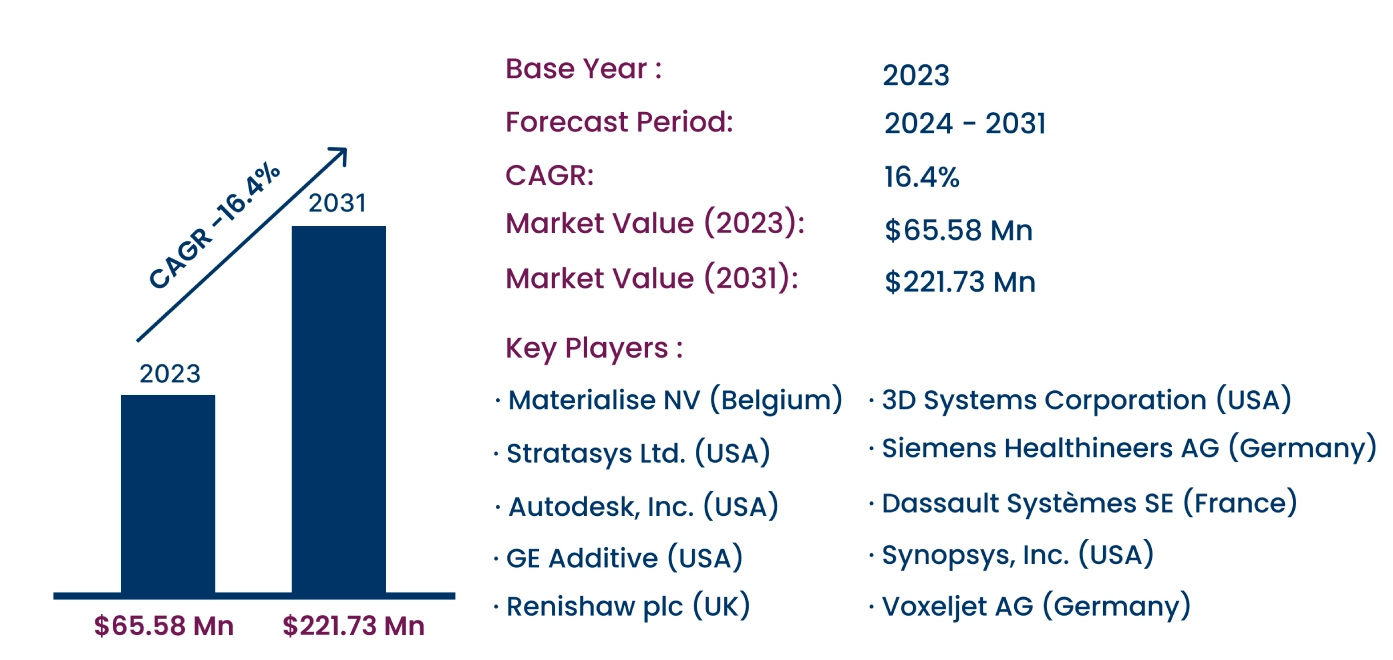

Global 3D Printing Medical Device Software Market to Reach USD 221.73 Million by 2031 | CAGR of 16.4%

Category : Healthcare | Published Date : Nov 2024 | Type : Press Release

3D Printing Medical Device Software Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the 3D Printing Medical Device Software Market was valued at USD 65.58 Million in 2023 and is projected to reach USD 221.73 Million by 2031, growing at a CAGR of 16.4% from 2024 to 2031. 3D printing medical device software enables the design, simulation, and manufacturing of customized medical devices, such as implants and prosthetics, leveraging additive manufacturing technologies. This software provides healthcare professionals with tools to create patient-specific devices, thereby improving surgical outcomes and enhancing healthcare efficiency.

The report comprises the 3D Printing Medical Device Software Market Share, Size & Industry Analysis, By Software Type (Integrated, Standalone), By Software Function (Printing, Analysis, Planning, Design, Visualization, Navigation), By Application (Medical Imaging, Dental, Surgery, Research, Physical Therapy, Aesthetic Medicine, Others), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Medical Device Manufacturers, Academic & Research Institutes, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on 3D Printing Medical Device Software Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profile, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

Increasing adoption of point-of-care manufacturing and growing use of bioprinting for regenerative medicine are driving market growth, while regulatory and compliance challenges present constraints.

Segmental Analysis :

By software type, the market is bifurcated into integrated and standalone software.

- Integrated software held the largest share in 2023, driven by its end-to-end capabilities, streamlining workflows for medical device manufacturers and healthcare providers.

- Standalone software is expected to register the fastest CAGR due to its specialized functionalities, appealing to smaller institutions and research facilities focused on specific applications.

By software function, the market is segmented into printing, analysis, planning, design, visualization, and navigation.

- Design software led the market in 2023, driven by the increasing demand for custom implants and precise models in surgeries.

- Planning software is anticipated to grow at the fastest rate, owing to its role in enhancing pre-surgical simulation and improving surgical precision.

By application, the market is segmented into medical imaging, dental, surgery, research, physical therapy, aesthetic medicine, and others.

- Surgery accounted for the largest share in 2023, driven by the demand for customized surgical planning models and implants.

- Research is expected to witness the fastest growth due to increased academic interest and R&D in bioprinting.

By end-user, the market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), medical device manufacturers, academic & research institutes, and others.

- Hospitals & clinics held the largest market share in 2023, leveraging 3D printing for personalized patient care.

- Medical device manufacturers are projected to grow at the fastest rate, as they increasingly utilize 3D printing to enhance production efficiency and customization.

Based on regions, the global market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

- North America dominated the market in 2023, supported by a robust healthcare infrastructure and high investment in medical innovation.

- Asia-Pacific is anticipated to grow at the highest CAGR, driven by expanding healthcare investments and technological advancements in 3D printing across emerging economies.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 221.73 Million |

| CAGR (2024-2031) | 16.4% |

| By Software Type | Integrated, Standalone |

| By Software Function | Printing, Analysis, Planning, Design, Visualization, Navigation |

| By Application | Medical Imaging, Dental, Surgery, Research, Physical Therapy, Aesthetic Medicine, Others |

| By End-User | Hospitals & Clinics, ASCs, Medical Device Manufacturers, Academic & Research Institutes, Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The 3D printing medical device software market is competitive, with leading companies focusing on technological advancements and strategic acquisitions.

List of prominent players in the 3D Printing Medical Device Software Industry:

- Materialise NV (Belgium)

- 3D Systems Corporation (USA)

- Stratasys Ltd. (USA)

- Autodesk, Inc. (USA)

- Siemens Healthineers AG (Germany)

- GE Additive (USA)

- Renishaw plc (UK)

- Dassault Systèmes SE (France)

- Synopsys, Inc. (USA)

- Voxeljet AG (Germany)

Recent Industry Developments :

- In October 2021, 3D Systems acquired Volumetric Biotechnologies, enhancing its expertise in tissue engineering.

- In May 2022, Organovo Holdings, Inc. launched a 3D tissue model for Crohn's disease, showcasing advancements in bioprinting applications.