3D Printing Medical Device Software Market Size:

3D Printing Medical Device Software Market size is estimated to reach over USD 251.33 Million by 2032 from a value of USD 74.79 Million in 2024 and is projected to grow by USD 85.69 Million in 2025, growing at a CAGR of 16.4 % from 2025 to 2032.

3D Printing Medical Device Software Market Scope & Overview:

3D printing medical device software enables the design, simulation, and production of medical devices using additive manufacturing technologies. These software solutions are essential for creating customized medical devices such as implants, prosthetics, and surgical instruments, offering high precision and efficiency. By leveraging advanced features like computer-aided design (CAD) and simulation tools, these systems allow healthcare professionals and manufacturers to develop patient-specific solutions that meet exact clinical needs. The software plays a critical role in improving the accuracy and customization of medical devices, which is particularly important in fields such as orthopedics, dentistry, and cardiovascular treatments. Hospitals, research institutions, and medical device manufacturers are the primary end-users.

3D Printing Medical Device Software Market Dynamics - (DRO) :

Key Drivers:

Growing Demand for Point-of-Care Manufacturing in Hospitals Boosts the Market

One of the most significant drivers in the 3D printing medical device software market growth is the rising adoption of point-of-care (POC) manufacturing within hospitals and clinical settings. Healthcare providers are increasingly investing in 3D printing infrastructure to produce custom implants, surgical guides, and prosthetics on-site, tailored to individual patients' needs. This shift is driven by the need for rapid prototyping and reduced lead times in critical surgical interventions. The flexibility of 3D printing software allows hospitals to quickly design and produce medical devices based on patient-specific data, improving surgical outcomes and reducing dependency on external suppliers. For instance, in orthopedic surgeries, 3D-printed guides and implants customized in real-time can significantly enhance the precision of the procedure, minimize surgery duration, and reduce complications. The ability to manage the full design and production process in-house gives hospitals a competitive edge, streamlining workflows, cutting costs, and improving patient care delivery. This rising trend is fueling demand for advanced software solutions that enable seamless integration of imaging data, design customization, and real-time production capabilities.

Key Restraints :

Regulatory and Compliance Challenges in Medical 3D Printing Limits the Market

A critical restraint in the 3D printing medical device software market demand is the complex regulatory landscape governing the design and production of 3D-printed medical devices. As these devices often involve patient-specific customization, meeting stringent regulatory standards becomes challenging. Regulatory bodies, such as the U.S. FDA and the European Medicines Agency (EMA), have yet to fully standardize protocols for the validation and certification of patient-specific 3D-printed devices. Compliance with ISO standards, such as ISO 10993 for biological evaluation, and ISO 13485 for medical device quality management systems, adds to the complexity. Moreover, ensuring traceability of design modifications and quality control at each stage of production is difficult when producing custom devices in hospital or clinical settings. This often requires extensive documentation and adherence to strict validation processes, which can delay production timelines and increase costs. Manufacturers face ongoing challenges in developing software solutions that can seamlessly incorporate these regulatory requirements, ensuring that 3D-printed medical devices are safe, reliable, and meet global compliance standards.

Future Opportunities :

Rising Use of 3D Printing Software for Bioprinting Applications Creates New Opportunities

A significant 3D printing medical device software market opportunity market lies in the growing application of bioprinting—the 3D printing of biological tissues and structures. This emerging field involves the use of specialized software that integrates biological data, cell types, and growth factors to design and produce tissue-like structures for regenerative medicine and organ transplantation research. Bioprinting software must be capable of handling the intricate layers of biological materials while ensuring cell viability and structural integrity during the printing process. As research into bio-printed tissues advances, the need for sophisticated software platforms that can simulate biological environments and optimize cell scaffolding is expected to grow. For example, software solutions that enable the design of biocompatible implants or the production of tissue scaffolds for skin regeneration and bone repair are gaining traction in both clinical research and experimental treatments. This trend opens up new avenues for software developers to innovate in bioprinting technology, addressing the growing demand for regenerative medicine solutions and expanding the scope of 3D printing in healthcare.

3D Printing Medical Device Software Market Segmental Analysis :

By Software Type:

Based on software type, the market is bifurcated into integrated and standalone software.

The integrated software segment accounted for the largest revenue of the total 3D printing medical device software market share in 2024.

- Integrated software solutions offer end-to-end capabilities that encompass the entire workflow, from design to production, within a single platform.

- This comprehensive functionality is highly valued by hospitals, clinics, and medical device manufacturers that require seamless integration of various stages such as modeling, simulation, and printing.

- Integrated systems streamline operations, reduce errors, and improve collaboration across teams.

- As healthcare institutions and manufacturers increasingly adopt 3D printing for surgical planning, custom implants, and prosthetics, integrated software is becoming the preferred choice due to its efficiency and ability to handle complex workflows.

- Thus, the segmental trends analysis depicts that integrated software leads the market as it provides a unified platform for managing all stages of the 3D printing workflow, appealing to institutions seeking operational efficiency and accuracy in medical device manufacturing and surgical planning, boosting the 3D printing medical device software market demand.

The standalone software segment is anticipated to register the fastest CAGR during the forecast period.

- Standalone software provides specialized functionalities for specific tasks such as designing, printing, or analysis, allowing users to choose and implement the exact capabilities they need.

- This flexibility is particularly attractive to research institutes and smaller healthcare facilities that may not require comprehensive solutions but need focused tools for specific applications.

- The growing demand for customization and advancements in niche 3D printing applications are driving the rapid adoption of standalone solutions, especially in research and development settings.

- Hence, the analysis shows that standalone software is expected to grow rapidly due to its flexibility and appeal to organizations with specific needs, particularly in research and smaller-scale medical device applications, proliferating the 3D printing medical device software market trends.

By Software Function:

Based on software function, the market is segmented into printing, analysis, planning, design, visualization, and navigation.

The design function accounted for the largest revenue of the overall 3D printing medical device software market share in 2024.

- Design software is a critical component of the 3D printing process, allowing for the creation of highly precise and customizable models of medical devices, implants, and prosthetics.

- The healthcare sector increasingly relies on 3D design tools for developing patient-specific devices, particularly in orthopedic, dental, and reconstructive surgeries.

- Advanced design software offers intuitive interfaces and sophisticated features that enable the development of intricate and personalized medical devices.

- The growing focus on personalized medicine and custom implants continues to drive the segment.

- Thus, design software leads the market as healthcare institutions prioritize patient-specific solutions, with advanced tools facilitating the development of highly customized medical devices, driving the 3D printing medical device software market growth.

The planning function is anticipated to register the fastest CAGR during the forecast period.

- Planning software is becoming increasingly important in surgical applications, enabling surgeons to simulate procedures, assess potential risks, and optimize surgical approaches before actual operations.

- The ability to visualize patient anatomy and accurately plan complex surgeries, such as craniofacial or orthopedic procedures, is a major driver of this segment.

- Planning software enhances precision and reduces intraoperative errors, making it a valuable tool for improving patient outcomes in surgery.

- With the rising adoption of 3D printing in surgical planning, this segment is expected to experience significant development.

- Therefore, the segmental analysis portrays that planning software is set to grow rapidly as the demand for pre-surgical simulation and risk assessment increases, driven by its ability to enhance precision in complex surgeries, boosting the 3D printing medical device software market trends.

By Application:

Based on application, the market is segmented into medical imaging, dental, surgery, research, physical therapy, aesthetic medicine, and others.

The surgery segment accounted for the largest revenue share of the global 3D printing medical device software market in 2024.

- 3D printing software for surgical applications is essential for creating detailed, patient-specific models that aid in surgical planning and the production of custom implants.

- Surgeons use these models to better understand complex anatomies and practice procedures before performing them, reducing risks and improving patient outcomes.

- The increasing use of 3D printing in surgeries such as orthopedics, neurosurgery, and maxillofacial surgeries, where precise implants and preoperative planning are critical, is driving the segment.

- This segment is particularly influenced by the growing trend toward personalized surgery and the need for custom implants that fit a patient's unique anatomy.

- Thus, as per the segmental trends the surgery segment dominates the market due to the increasing adoption of 3D printing for pre-surgical planning and the production of patient-specific implants, which significantly improve surgical outcomes, boosting the 3D printing medical device software market expansion.

The research segment is anticipated to register the fastest CAGR during the forecast period.

- Research applications of 3D printing in healthcare are growing as academic and research institutions explore new ways to leverage 3D printing for medical innovations.

- Research institutes are increasingly using 3D printing software to develop new medical devices, explore bioprinting applications, and create prototypes for experimental treatments.

- The flexibility and customization offered by 3D printing technology allow researchers to experiment with new materials and designs, leading to rapid advancements in the medical field.

- As 3D printing continues to evolve, the research segment is expected to grow significantly, driven by ongoing innovation in medical device development and regenerative medicine.

- Therefore, the research segment is expected to grow rapidly as academic institutions and research organizations continue to push the boundaries of 3D printing technology, creating the 3D printing medical device software market opportunities.

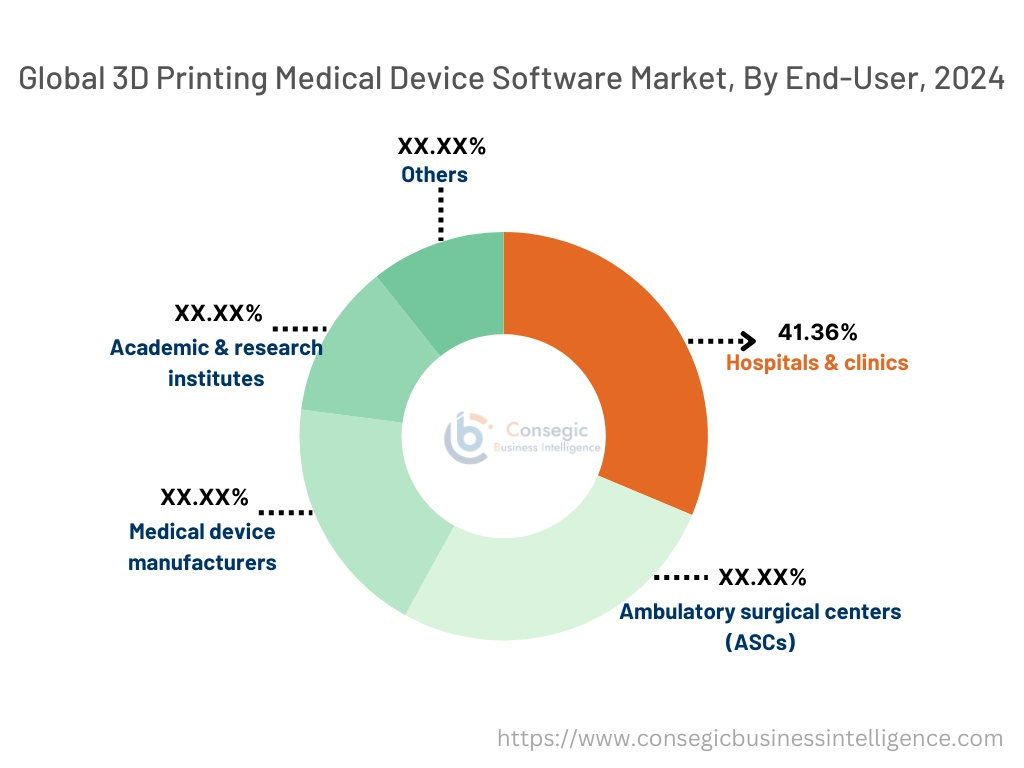

By End-User:

Based on end-user, the market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), medical device manufacturers, academic & research institutes, and others.

The hospitals & clinics segment accounted for the largest revenue share of 41.36% in 2024.

- Hospitals and clinics are the primary users of 3D printing medical device software, particularly for applications such as surgical planning, custom prosthetics, and medical imaging.

- These healthcare providers use 3D printing to enhance precision in surgeries and improve patient-specific care.

- The ability to create models and implants tailored to individual patients has made 3D printing a crucial tool in modern healthcare settings.

- As more hospitals integrate 3D printing into their surgical workflows and adopt advanced software for planning and design, this segment continues to dominate the market.

- Thus, the hospitals and clinics lead the market, driven by the increasing use of 3D printing for patient-specific implants and surgical planning, which improves both precision and patient outcomes, driving the 3D printing medical device software market expansion.

The medical device manufacturers segment is anticipated to register the fastest CAGR during the forecast period.

- Medical device manufacturers are leveraging 3D printing software to streamline the production of custom medical devices, including implants, prosthetics, and surgical instruments.

- The ability to design, prototype, and produce devices quickly and accurately using 3D printing technology offers a significant advantage in terms of time-to-market and cost reduction.

- Manufacturers are increasingly adopting 3D printing software to meet the growing demand for personalized medical devices and to improve the efficiency of their production processes.

- This trend is expected to accelerate as more manufacturers turn to 3D printing for device innovation and customization.

- As per the 3D printing medical device software market analysis, medical device manufacturers are expected to grow rapidly as they adopt 3D printing software to enhance customization, and streamline production.

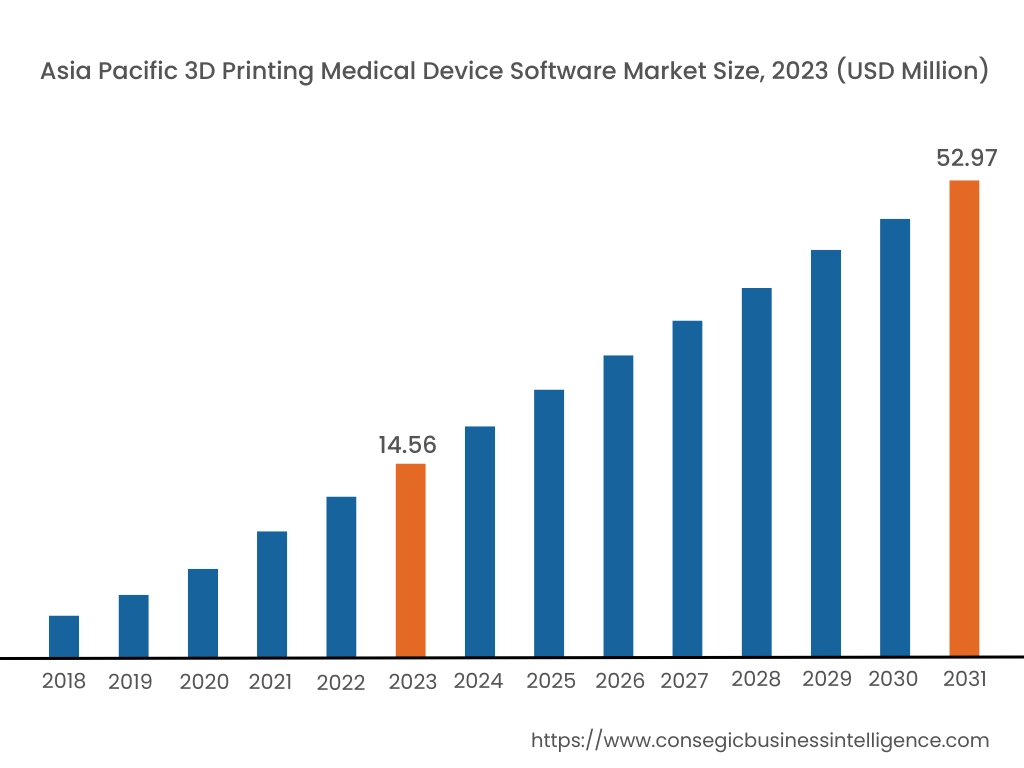

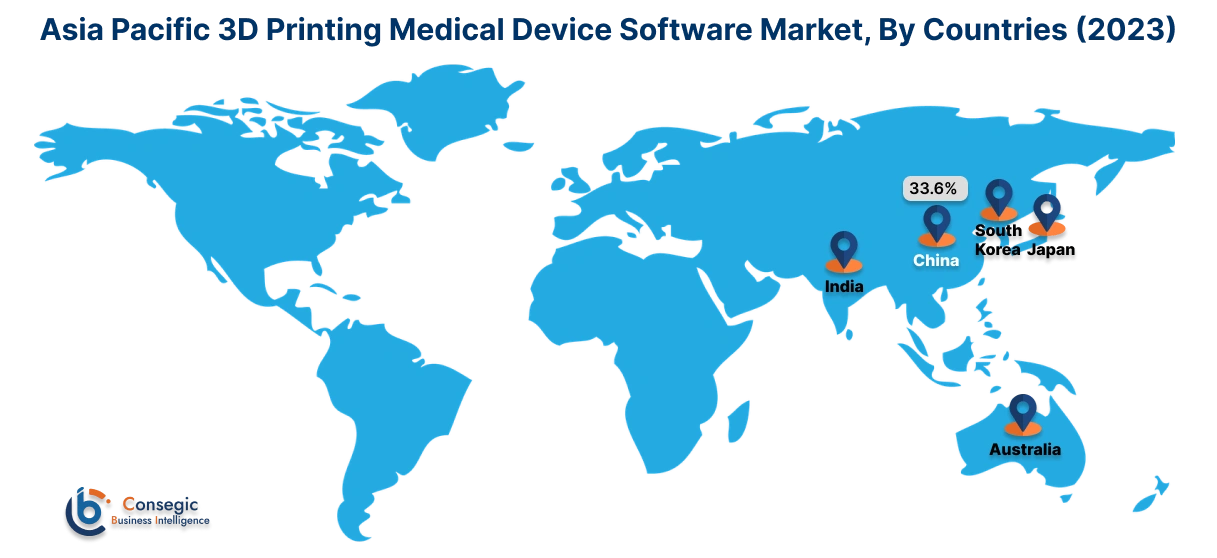

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 76.53 Million in 2024. Moreover, it is projected to grow by USD 25.31 Million in 2025 and reach over USD 22.03 Million by 2032. Out of this, China accounted for 33.6% of the total market share. Asia-Pacific is the fastest-growing market, driven by increasing healthcare investments and technological advancements in countries such as China, Japan, and India. The rising prevalence of chronic diseases and the need for personalized medical treatments are fueling the adoption of 3D printing software in medical device manufacturing. Government initiatives supporting digital healthcare transformation and the expansion of healthcare infrastructure further contribute to the market. However, challenges such as limited awareness and high costs of advanced software solutions may impede market expansion.

North America region leads the market, propelled by substantial investments in healthcare innovation and a strong presence of key industry players. The U.S. dominates due to its advanced healthcare infrastructure and early adoption of 3D printing technologies for medical device manufacturing. The demand for customized medical solutions and the integration of sophisticated software for precise modeling and simulation are key growth drivers. However, high initial costs and stringent regulatory requirements may pose challenges to market expansion.

Europe holds a significant share of the market, with countries like Germany, the UK, and France at the forefront. The region benefits from strong research and development activities and supportive government initiatives promoting the adoption of advanced medical technologies. The focus on patient-specific medical devices and the integration of 3D printing software in surgical planning and prosthetics are notable trends. Nonetheless, variations in regulatory frameworks across countries and the need for skilled professionals may hinder rapid growth.

The regional trends analysis shows that the market in the Middle East & Africa region is gradually expanding, with growing investments in healthcare infrastructure and an increasing focus on adopting advanced medical technologies. Countries like the UAE and South Africa are witnessing a rise in the adoption of 3D printing software for medical applications, particularly in orthopedics and dental care. However, limited access to advanced technologies and a shortage of skilled professionals may restrict market growth.

As per the 3D printing medical device software market analysis, Latin America is an emerging market, with countries such as Brazil and Mexico showing potential growth. The increasing burden of chronic diseases and the need for cost-effective medical solutions are driving the adoption of 3D printing software in the medical sector. Government initiatives aimed at improving healthcare services and the growing presence of local manufacturers adopting 3D printing technologies are contributing to market growth. However, economic instability and inadequate healthcare infrastructure in certain areas may pose challenges to market expansion.

Top Key Players & Market Share Insights:

The 3D printing medical device software market is highly competitive with major players providing treatments to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global 3D printing medical device software market. Key players in the 3D printing medical device software industry include -

- Materialise NV (Belgium)

- 3D Systems Corporation (USA)

- Stratasys Ltd. (USA)

- Autodesk, Inc. (USA)

- Siemens Healthineers AG (Germany)

- GE Additive (USA)

- Renishaw plc (UK)

- Dassault Systèmes SE (France)

- Synopsys, Inc. (USA)

- Voxeljet AG (Germany)

Recent Industry Developments :

Mergers and Acquisitions:

- In October 2021, 3D Systems, Inc. announced the acquisition of Volumetric Biotechnologies to enhance its biological expertise and capabilities in tissue engineering.

Product Launches:

- In May 2022, Organovo Holdings, Inc. unveiled a 3D tissue model for Crohn's disease, showcasing the advanced role of 3D printing medical device software in developing complex tissue structures.

3D Printing Medical Device Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 251.33 Million |

| CAGR (2025-2032) | 16.4% |

| By Software Type |

|

| By Software Function |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 3D Printing Medical Device Software Market? +

3D Printing Medical Device Software Market size is estimated to reach over USD 251.33 Million by 2032 from a value of USD 74.79 Million in 2024 and is projected to grow by USD 85.69 Million in 2025, growing at a CAGR of 16.4 % from 2025 to 2032.

What will be the potential market valuation for the 3D Printing Medical Device Software by 2032? +

In 2032, the market size of 3D Printing Medical Device Software is expected to reach USD 251.33 million.

What are the segments covered in the 3D Printing Medical Device Software market report? +

Their software type, software, function, applications, and end-user industries are the segments covered in this report.

Who are the major players in the 3D Printing Medical Device Software market? +

Materialise NV (Belgium), 3D Systems Corporation (USA), Stratasys Ltd. (USA), Autodesk, Inc. (USA), Siemens Healthineers AG (Germany), GE Additive (USA), Renishaw plc (UK), Dassault Systèmes SE (France), Synopsys, Inc. (USA), Voxeljet AG (Germany) are the major players in the 3D Printing Medical Device Software market.