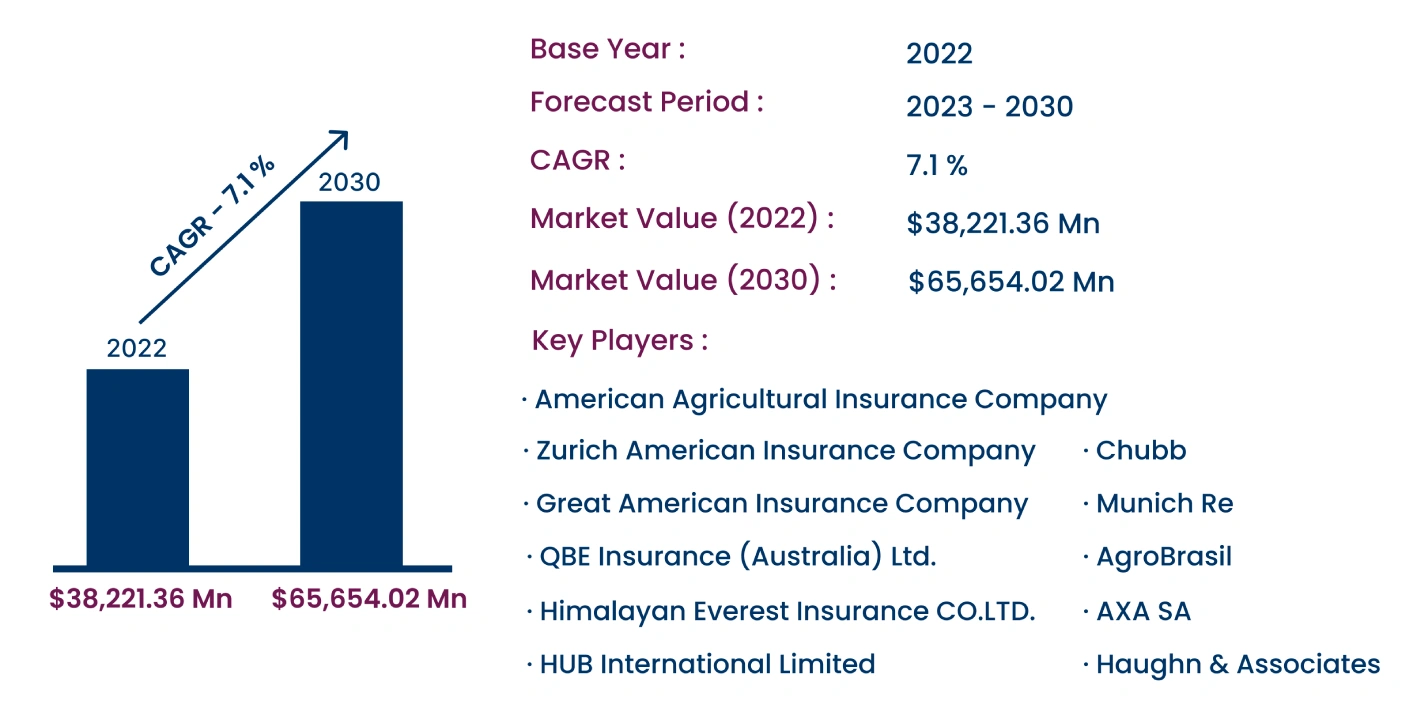

Global Agricultural Insurance Market Size to Reach USD 65,654.02 Million By 2030 | CAGR of 7.1%

Category : Agriculture & Animal Feed | Published Date : Jun 2024 | Type : Press Release | Author : Swapnil Bakshetty

Agricultural Insurance Market Scope & Overview :

Agricultural Insurance is a type of insurance that covers agriculture-related losses. It compensates farmers for losses due to loss of livestock or income, climatic change, crop failure due to insects and pests, and machinery failure, among others.

Consegic Business Intelligence analyzes that the Global Agricultural Insurance Market size was valued at USD 38,221.36 Million in 2022 and is expected to register a CAGR of 7.1% to reach USD 65,654.02 Million by 2030.

This report comprises Agricultural Insurance Market Share, Size & Industry Analysis, By Type (Crop Insurance (Multi-Peril Crop Insurance, Named Peril Insurance, and Index-Based Insurance), Livestock Insurance, Machinery Insurance, and Others), By Providers (Banks, Insurance Companies, Brokers/Agents, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa), and Forecast, 2023-2030.

This report contains detailed information on Agricultural Insurance Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profile, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The agricultural insurance market is growing due to the increase in adverse climate conditions and the rising awareness among farmers about the importance and benefits of insurance. The advancement in farming technology has led to higher costs and maintenance, increasing the demand for agriculture insurance.

Segmental Analysis :

The Agricultural Insurance Market is trifurcated based on type, provider, and region.

Based on type, the market is divided into crop insurance (multi-peril crop insurance, named-peril insurance, and index-based insurance), livestock insurance, machinery insurance, and others.

- In 2022, the crop insurance segment accounted for the highest market share of 38.50% and is also expected to witness the fastest CAGR from 2023 to 2030.

- The crop insurance segment is further divided into multi-peril crop insurance, named-peril insurance, and index-based insurance. Out of which the multi-peril crop insurance held the highest market share while index-based insurance is anticipated to register the fastest CAGR over the forecasted years.

Based on provider, the market is categorized into banks, insurance companies, brokers/agents, and others

- Insurance companies dominated the market share in 2022 due to their expertise in risk assessment, underwriting, and claims management.

- The bank segment is predicted to grow at the fastest CAGR from 2023 to 2030, due to their premium financial services, including paying premiums in installments.

By region, the market is segregated into regions including North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- In 2022, the North American region contributed the highest market share of 36.15% valued at USD 13,817.02 Million and is expected to reach USD 23,884.93 million in 2030.

- Over the forecasted period, the Asia-Pacific region is expected to grow at the fastest CAGR of 8.1% due to agricultural dependency for livelihood and rising awareness about insurance benefits.

| Report Attributes | Report Details |

| By Type | Crop Insurance (Multi-Peril Crop Insurance, Named Peril Insurance, and Index-Based Insurance), Livestock Insurance, Machinery Insurance, and Others |

| By Provider | Banks, Insurance Companies, Brokers/Agents, and Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. Additionally, this report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Agricultural Insurance Industry :

- Great American Insurance Company

- Chubb

- QBE Insurance (Australia) Ltd.

- Himalayan Everest Insurance CO.LTD.

- Agriculture Insurance Company of India Limited

- Munich Re

- Zurich American Insurance Company

- Asian Development Bank

- HUB International Limited

- AXA SA

- American Agricultural Insurance Company

- AgroBrasil

- Haughn & Associates

Recent Industry Developments :

- American Financial Group, Inc. (AFG) completed the purchase of Crop Risk Services (CRS) from American International Group, Inc. (AIG), in July 2023.

- In March 2023, Hub International acquired AG Direct Hail Insurance Ltd., a crop hail insurance provider.