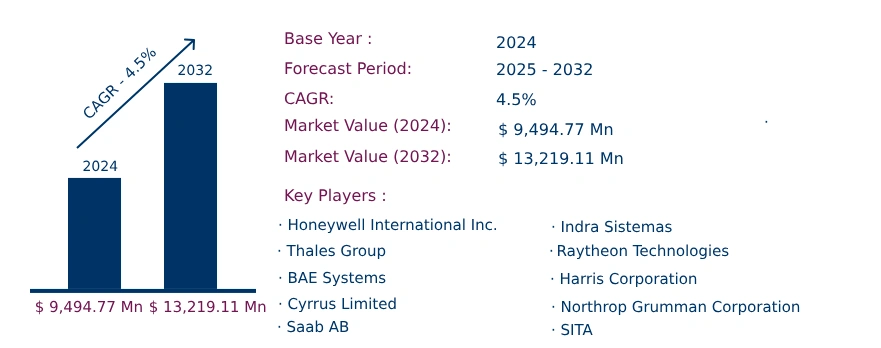

Global Air Traffic Control Equipment Market to Reach USD 13,219.11 Million by 2032 | CAGR of 4.5%

Category : Aerospace and Defence | Published Date : Jan 2025 | Type : Press Release

Air Traffic Control Equipment Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Air Traffic Control Equipment Market is projected to grow from USD 9,494.77 million in 2024 to USD 13,219.11 million by 2032, at a CAGR of 4.5% during the forecast period. Air traffic control equipment comprises radar systems, flight data displays, communication networks, automated surveillance-broadcast (ADS-B) systems, meteorological sensors, and other essential systems used for efficient air traffic management.

This equipment enhances air traffic safety, improves navigation, facilitates real-time communication between pilots and controllers, and manages airspace congestion. Air traffic control systems are crucial for tracking aircraft movement, ensuring seamless communication, and optimizing flight operations in commercial and military aviation.

The report comprises the Air Traffic Control Equipment Market Share, Size & Industry Analysis, based on Equipment (Radar Systems, Flight Data Displays, Communication Networks, Automated Surveillance-Broadcast (ADS-B) Systems, Meteorological Sensors, Others), Application (Navigation, Surveillance, Others), End-User (Military, Commercial), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2025-2032.

The report contains detailed information on Air Traffic Control Equipment Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The increasing demand for advanced air traffic management solutions is fueling market expansion, driven by growing global air traffic and the need for improved safety measures. Additionally, advancements in surveillance, radar, and navigation systems present new opportunities for optimizing air traffic control operations.

Segmental Analysis :

Based on equipment, the market is segmented into radar systems, flight data displays, communication networks, automated surveillance-broadcast (ADS-B) systems, meteorological sensors, and others.

- The radar systems segment accounted for the largest revenue share in 2024, attributed to its critical role in monitoring and managing aircraft movement by tracking speed, location, and altitude. The integration of secondary surveillance radar (SSR) technology enhances detection accuracy and air traffic control efficiency.

- The automated surveillance-broadcast (ADS-B) systems segment is anticipated to witness the highest CAGR, driven by its ability to enhance real-time aircraft tracking, reduce reliance on traditional radar systems, and improve situational awareness for air traffic controllers.

Based on application, the market is segmented into navigation, surveillance, and others.

- The navigation segment held the largest revenue share of 42.11% in 2024, as air traffic control systems play a crucial role in managing aircraft take-offs, landings, and flight routes. These systems enhance airspace efficiency, collision avoidance, and communication between pilots and controllers.

- The surveillance segment is expected to grow at the fastest CAGR, fueled by increasing investments in airspace safety, improved aircraft tracking technologies, and the integration of ADS-B systems and surveillance radars.

Based on end-user, the market is segmented into military and commercial.

- The commercial segment dominated the market in 2024, driven by expanding airport infrastructure, rising passenger air traffic, and growing investments in modernizing air traffic control systems for commercial aviation.

- The military segment is projected to experience significant growth, owing to the adoption of advanced air traffic control solutions in military bases, defense airports, and air force operations to ensure secure and efficient airspace management.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

- Asia-Pacific led the market in 2024, valued at USD 2,397.94 million, with China accounting for 33.4% of regional revenue. The region is experiencing strong growth due to increasing commercial airport construction, rising air travel demand, and government investments in aviation infrastructure.

- North America is expected to reach USD 4,667.67 million by 2032, supported by significant military aviation investments, rising air defense budgets, and modernization of air traffic control systems in the U.S. and Canada.

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 13,219.11 Million |

| CAGR (2025-2032) | 4.5% |

| Equipment | Radar Systems, Flight Data Displays, Communication Networks, Automated Surveillance-Broadcast (ADS-B) Systems, Meteorological Sensors, Others |

| Application | Navigation, Surveillance, Others |

| End-User | Military, Commercial |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Air Traffic Control Equipment Industry:

- Honeywell International Inc. (US)

- Thales Group (France)

- BAE Systems (US)

- Cyrrus Limited (UK)

- Saab AB (Sweden)

- Indra Sistemas (Spain)

- Raytheon Technologies (US)

- Harris Corporation (US)

- Northrop Grumman Corporation (US)

- SITA (Switzerland)

Recent Industry Developments :

- March 2024: Thales launched TopSky, an upgraded air traffic control system with advanced safety features and seamless air traffic management operations.

- November 2024: Saab partnered with ST Engineering and Thales to modernize Singapore’s Air Traffic Management (ATM) infrastructure, improving efficiency and safety.

- November 2024: Indra acquired Global ATS and Micro Nav from the Quadrant Group to enhance ATC simulator and training solutions for air traffic controllers.