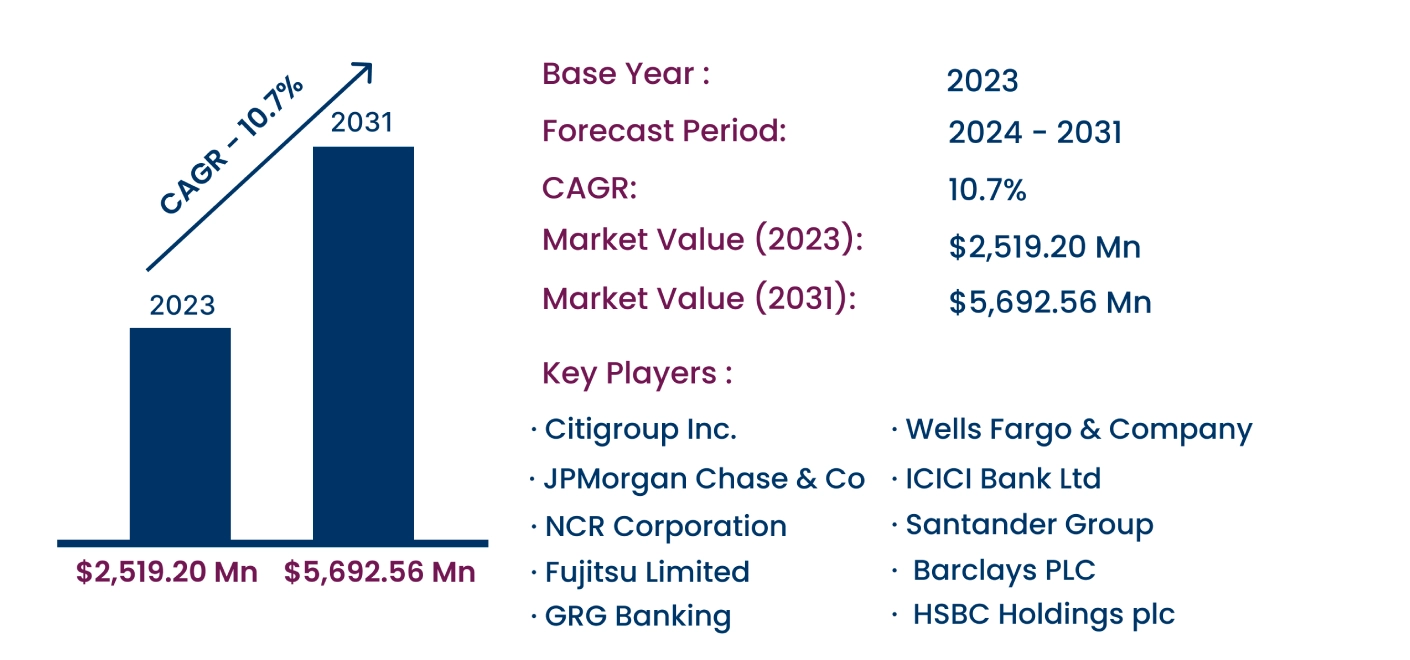

Global Cardless ATM Market to Reach USD 5,692.56 Million by 2031 | CAGR of 10.7%

Category : IT And Telecommunications | Published Date : Nov 2024 | Type : Press Release

Cardless ATM Market Scope & Overview:

As per the Consegic Business Intelligence newly published report, the Cardless ATM Market size was valued at USD 2,519.20 million in 2023 and is projected to grow at a CAGR of 10.7%, reaching USD 5,692.56 million by 2031. Cardless ATMs provide a seamless and secure way for customers to conduct transactions without a physical card. They utilize advanced technologies such as QR codes, Near-Field Communication (NFC), and biometric authentication, enabling users to withdraw cash or perform banking operations via mobile applications. This innovation not only enhances convenience but also mitigates risks associated with card skimming and fraud, addressing the evolving preferences of digital-savvy consumers.

The report comprises the Cardless ATM Market Share, Size & Industry Analysis, based on Technology (QR Code-Based, NFC, Biometric Authentication, Mobile App-Based), Type (On-Site ATM, Off-Site ATM, Others), Application (Personal Banking, Corporate Banking, Retail Payments, Others), End-User (Banks & Financial Institutions, Independent ATM Deployers (IADs), Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Cardless ATM Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

Increasing adoption of mobile banking and rising consumer preference for contactless payment methods are driving market growth.

Segmental Analysis :

Based on technology, the market is segmented into QR Code-Based, NFC, Biometric Authentication, and Mobile App-Based.

- The QR Code-Based segment accounted for the largest share in 2023, driven by its simplicity, compatibility with mobile banking apps, and minimal need for ATM hardware upgrades.

- The NFC segment is expected to grow at the fastest rate during the forecast period, owing to its secure, fast, and user-friendly transaction process, supported by rising adoption of NFC-enabled smartphones and contactless payment trends.

Based on type, the market is segmented into On-Site ATM, Off-Site ATM, and Others.

- The On-Site ATM segment held the largest share in 2023, attributed to its enhanced security features and availability within bank premises. These ATMs cater to customers seeking secure and comprehensive banking services.

- The Off-Site ATM segment is projected to grow at the fastest CAGR, supported by its 24/7 accessibility and strategic placement in high-traffic locations such as malls and airports.

Based on application, the market is segmented into Personal Banking, Corporate Banking, Retail Payments, and Others.

- The Personal Banking segment accounted for the largest market share in 2023, driven by consumer preference for secure, card-free transactions facilitated by mobile banking apps.

- The Retail Payments segment is anticipated to grow at the fastest rate, supported by increasing adoption of digital wallets and mobile payment platforms for secure and contactless retail transactions.

Based on end-user, the market is segmented into Banks & Financial Institutions, Independent ATM Deployers (IADs), and Others.

- The Banks & Financial Institutions segment dominated the market in 2023, driven by their extensive ATM networks and commitment to enhancing customer convenience through cardless solutions.

- The Independent ATM Deployers (IADs) segment is projected to grow rapidly, fueled by their agility in deploying advanced cardless ATM technologies in high-footfall locations.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

- Asia-Pacific: Accounted for the largest market share in 2023, driven by increasing digital adoption, mobile banking usage, and financial inclusion efforts in countries like China and India.

- North America: Expected to grow at the fastest CAGR, supported by robust adoption of mobile banking and widespread deployment of cardless ATM solutions by major banks in the U.S.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 5,692.56 Million |

| CAGR (2024-2031) | 10.7% |

| Technology | QR Code-Based, NFC, Biometric Authentication, Mobile App-Based |

| Type | On-Site ATM, Off-Site ATM, Others |

| Application | Personal Banking, Corporate Banking, Retail Payments, Others |

| End-User | Banks & Financial Institutions, Independent ATM Deployers (IADs), Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The cardless ATM market is highly competitive, with key players focusing on technological advancements and partnerships to expand their market presence. Major companies include Citigroup Inc. and JPMorgan Chase & Co., which are driving innovation through integration of advanced technologies.

List of prominent players in the Cardless ATM Industry:

- Citigroup Inc. (USA)

- JPMorgan Chase & Co. (USA)

- Wells Fargo & Company (USA)

- NCR Corporation (USA)

- Fujitsu Limited (Japan)

- GRG Banking (China)

- ICICI Bank Ltd. (India)

- Santander Group (Spain)

- Barclays PLC (UK)

- HSBC Holdings plc (UK)

Recent Industry Developments :

- June 2023: Bank of Baroda launched an Integrated Cardless Cash Withdrawal (ICCW) feature, enabling customers to use UPI for secure cardless transactions at ATMs.

- January 2023: Fidelity Bank introduced a cardless ATM withdrawal service, allowing customers to securely access funds via mobile-generated secure codes, enhancing convenience and security.