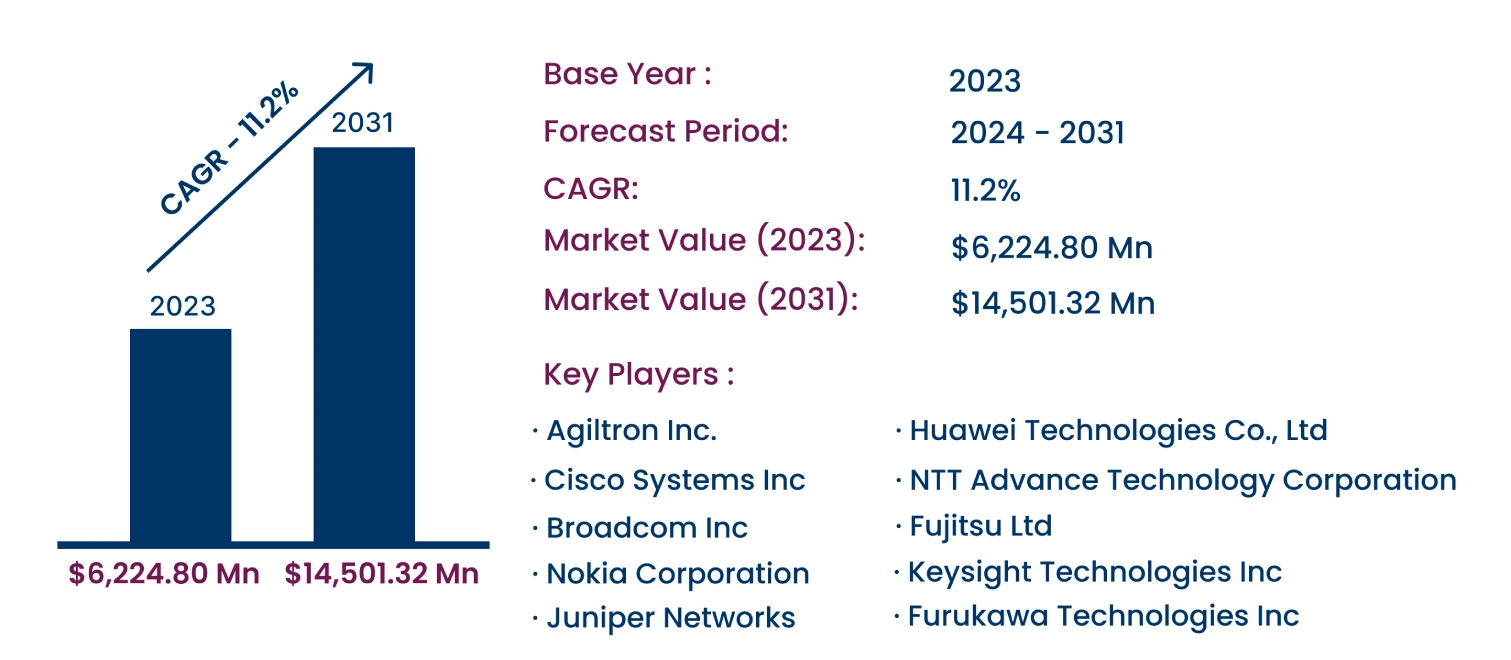

Global Optical Switches Market to Reach USD 14,501.32 Million by 2031 | CAGR of 11.2%

Category : Semiconductor And Electronics | Published Date : Nov 2024 | Type : Press Release

Optical Switches Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Optical Switches Market size was valued at USD 6,224.80 million in 2023 and is projected to grow at a CAGR of 11.2%, reaching USD 14,501.32 million by 2031. Optical switches are pivotal components in communication networks, designed to route light-based data signals efficiently. They feature high speed, low latency, and energy-efficient functionalities, which make them indispensable for data centers, telecommunications, and IT networks.

The report comprises the Optical Switches Market Share, Size & Industry Analysis, based on Type (All-Optic Switch, Electro-Optic Switch, Acoustic-Optic Switch, MEMS Optical Switch, Magneto Optical Switch, Mechanical Optical Switch, Matrix Optical Switch, Others), Enterprise Size (Small and Medium Enterprises, Large Enterprises), Application (Switching Function, Network Monitoring, Multiplexing, Testing, Optical Cross-Connection, Others), End-Use (IT and Telecom, Manufacturing, Retail, BFSI, Military and Defense, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Optical Switches Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The rising demand for high-bandwidth networks and advancements in 5G and IoT infrastructure are key drivers propelling market growth.

Segmental Analysis :

Based on type, the market is segmented into All-Optic Switch, Electro-Optic Switch, Acoustic-Optic Switch, MEMS Optical Switch, Magneto Optical Switch, Mechanical Optical Switch, Matrix Optical Switch, and Others.

- The electro-optic switch segment held the largest market share in 2023, driven by its high-speed bandwidth and low-latency capabilities essential for telecommunication and data center applications.

- The MEMS optical switch segment is projected to register the fastest CAGR, supported by advancements in miniaturization and automation technologies for IoT and 5G applications.

Based on enterprise size, the market is segmented into Small and Medium Enterprises and Large Enterprises.

- The large enterprise segment dominated the market in 2023, fueled by increasing data center expansion to support advanced technologies like 5G and AI.

- The small and medium enterprise segment is expected to grow rapidly, driven by the adoption of cost-effective and scalable optical switching solutions for enhanced connectivity.

Based on application, the market is segmented into Switching Function, Network Monitoring, Multiplexing, Testing, Optical Cross-Connection, and Others.

- The testing segment accounted for the largest revenue share in 2023, driven by the rising demand for quality control in optical fiber networks.

- The multiplexing segment is anticipated to grow significantly due to its role in optimizing network efficiency in high-capacity telecom applications.

Based on end-use, the market is segmented into IT and Telecom, Manufacturing, Retail, BFSI, Military and Defense, and Others.

- The IT and telecom segment held the largest market share in 2023, driven by the proliferation of 5G networks and cloud computing.

- The segment is also projected to grow at the fastest rate, supported by increasing adoption of IoT-enabled smart devices requiring seamless connectivity.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

- Asia-Pacific: Held the largest market share in 2023, led by China, with a revenue share of 31.2%, driven by rising investments in telecommunications and data centers.

- North America: Expected to grow significantly, supported by advancements in cloud networking and rising demand for high-speed bandwidth solutions.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 14,501.32 Million |

| CAGR (2024-2031) | 11.2%/td> |

| Type | All-Optic Switch, Electro-Optic Switch, Acoustic-Optic Switch, MEMS Optical Switch, Magneto Optical Switch, Mechanical Optical Switch, Matrix Optical Switch, Others |

| Enterprise Size | Small and Medium Enterprises, Large Enterprises |

| Application | Switching Function, Network Monitoring, Multiplexing, Testing, Optical Cross-Connection, Others |

| End-Use | IT and Telecom, Manufacturing, Retail, BFSI, Military and Defense, Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Optical Switches Industry:

- Huawei Technologies Co., Ltd. (China)

- NTT Advance Technology Corporation (Tokyo)

- Agiltron Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Fujitsu Ltd. (Japan)

- Nokia Corporation (Finland)

- Keysight Technologies Inc. (U.S.)

- Furukawa Technologies Inc. (Japan)

- Juniper Networks (U.S.)

Recent Industry Developments :

- March 2024: Coherent Corp launched a new optical circuit switch designed to reduce electrical switches in data centers, optimizing costs.

- June 2024: Nokia acquired Infinera to scale optical network solutions and enhance in-house technology capabilities in North America, valued at USD 2.3 million.

- October 2024: Celestial AI acquired a silicon photonics portfolio to advance optical switch technologies.