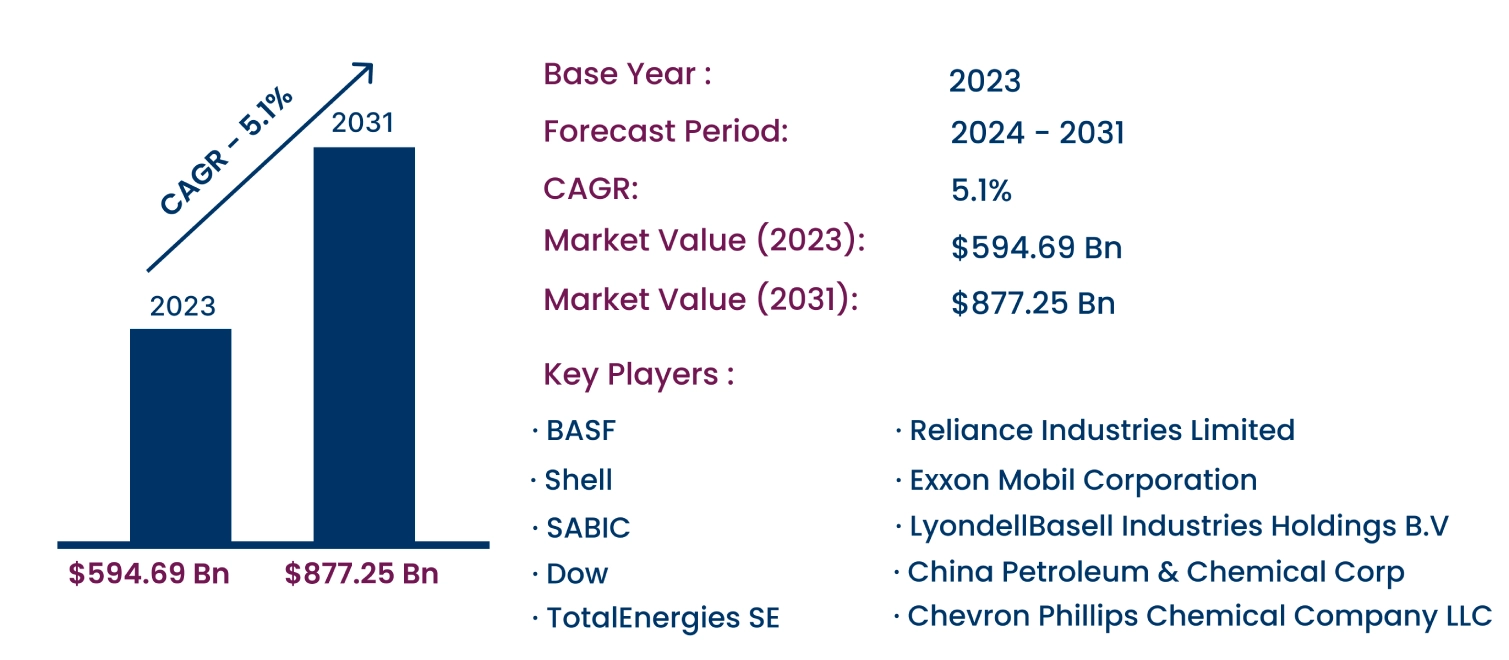

Global Petrochemicals Market to Reach USD 877.25 Billion by 2031 | CAGR of 5.1%

Category : Materials And Chemicals | Published Date : Nov 2024 | Type : Press Release

Petrochemicals Market Scope & Overview:

As per the Consegic Business Intelligence newly published report, the Petrochemicals Market was valued at USD 594.69 billion in 2023 and is projected to grow at a CAGR of 5.1%, reaching USD 877.25 billion by 2031. Petrochemicals are essential chemical compounds derived from petroleum and natural gas, playing a critical role across industries such as packaging, construction, automotive, and agriculture. These compounds, including ethylene, propylene, benzene, and toluene, serve as foundational elements in manufacturing polymers, adhesives, dyes, and coatings.

The report comprises the Petrochemicals Market Share, Size & Industry Analysis, based on Product Type (Ethylene, Propylene, C4 Stream, Benzene, Toluene, Xylene, Methanol, Others), Application (Polymers, Adhesives & Sealants, Dyes, Solvents, Paints & Coatings, Fertilizers, Surfactants, Others), End-Use Industry (Building and Construction, Packaging, Agriculture, Automotive, Electronics, Healthcare, Textile, Food and Beverage, Paper & Pulp, Consumer & Industrial Goods, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Petrochemicals Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The growth of the petrochemicals market is primarily driven by the rising demand for polymers across packaging, construction, and automotive sectors, coupled with advancements in lightweight materials. Additionally, the increasing focus on sustainable and bio-based petrochemical production presents significant growth opportunities for manufacturers, especially in developed regions emphasizing circular economy practices.

Segmental Analysis :

Based on product type, the market is segmented into Ethylene, Propylene, C4 Stream, Benzene, Toluene, Xylene, Methanol, and Others.

- The ethylene segment accounted for the largest market share in 2023, driven by its use as a raw material for polyethylene and other industrial chemicals essential in packaging, automotive, and construction.

- The C4 stream segment is projected to grow at the fastest CAGR, supported by its applications in producing synthetic rubber and fuel additives, especially for the growing automotive industry.

Based on application, the market is categorized into Polymers, Adhesives & Sealants, Dyes, Solvents, Paints & Coatings, Fertilizers, Surfactants, and Others.

- The polymers segment dominated the market in 2023, driven by demand for lightweight materials in packaging and construction.

- The adhesives & sealants segment is expected to grow at the fastest rate, fueled by rising applications in construction and automotive sectors.

Based on end-use industry, the market is segmented into Building and Construction, Packaging, Agriculture, Automotive, Electronics, Healthcare, Textile, Food and Beverage, Paper & Pulp, Consumer & Industrial Goods, and Others.

- The packaging segment held the largest market share of 28.11% in 2023, attributed to the high demand for durable and lightweight materials in the e-commerce and retail industries.

- The automotive segment is anticipated to grow at the fastest CAGR, driven by the adoption of lightweight materials to enhance vehicle fuel efficiency.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

- Asia-Pacific: Accounted for the highest market share of 40.11% in 2023, valued at USD 238.53 billion, driven by rapid industrialization and demand from automotive and construction sectors.

- North America: Expected to grow at the highest CAGR of 5.6%, supported by advancements in petrochemical technologies and increasing applications across multiple industries.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 877.25 Billion |

| CAGR (2024-2031) | 5.1% |

| Product Type | Ethylene, Propylene, C4 Stream, Benzene, Toluene, Xylene, Methanol, Others |

| Application | Polymers, Adhesives & Sealants, Dyes, Solvents, Paints & Coatings, Fertilizers, Surfactants, Others |

| End-Use Industry | Building and Construction, Packaging, Agriculture, Automotive, Electronics, Healthcare, Textile, Food and Beverage, Paper & Pulp, Consumer & Industrial Goods, Others |

| By Region | North America (U.S., Canada, Mexico), Europe (Germany, UK, France, Spain, Italy, Russia, BENELUX, Rest of Europe), APAC (China, Japan, India, South Korea, Australia, ASEAN, Rest of APAC), LATAM (Brazil, Argentina, Chile, Rest of LATAM), MEA (GCC, Turkey, South Africa, Rest of MEA) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Petrochemicals Industry:

- Reliance Industries Limited (India)

- BASF (Germany)

- Exxon Mobil Corporation (U.S.)

- Shell (United Kingdom)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- SABIC (Saudi Arabia)

- Dow (U.S.)

- China Petroleum & Chemical Corp (China)

- TotalEnergies SE (France)

- Chevron Phillips Chemical Company LLC (U.S.)

Recent Industry Developments:

- July 2024: KBR launched KCOTKleanSM, a suite of low and zero-carbon technologies aimed at decarbonizing the catalytic olefins process.

- March 2023: KBR introduced SCOREKlean, an ethylene process technology using hydrogen-fueled burners to achieve zero emissions from ethylene-cracking furnaces.

- July 2023: McDermott was awarded an EPCM contract for IOCL's Naphtha Cracker Expansion project to increase ethylene production by 20%.