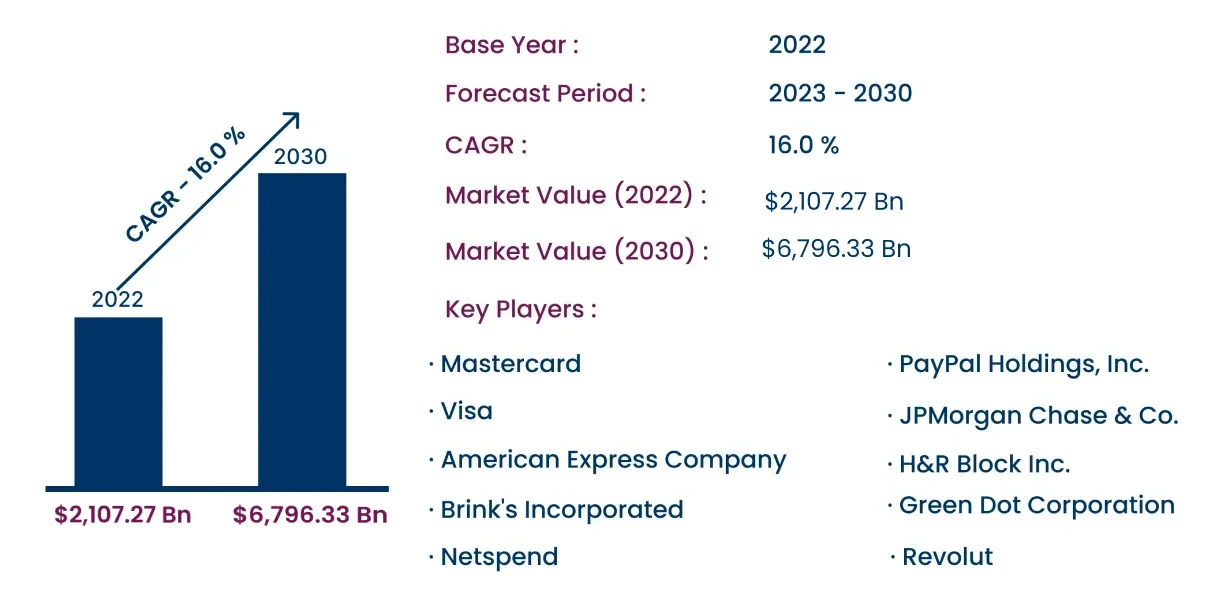

Global Prepaid Card Market growing at a CAGR of 16.0 % from 2023 to 2030

Category : IT And Telecommunications | Published Date : May 2023 | Type : Press Release

Key Market Overview

The prepaid card market is expected to reach USD 6,796.33 Billion by 2030. The market, which was valued at USD 2,109.27 Billion in 2022, is predicted to grow at a compound annual growth rate of 16.0% during the period 2023-2030.

The report highlights the increasing adoption of prepaid cards in different sectors including financial, corporate, and retail among others. Consegic Business Intelligence study also provides insights into the market's competitive landscape, market segmentation, regional outlook, and emerging technologies in the market.

Global Prepaid Card Market By Overview

The report analyses significant segments such as card type, usage, end-user, and region, to identify emerging trends and potential opportunities. The open loop segment is expected to grow during the forecast period owing convenience & flexibility offered to the user. Additionally, the open loop prepaid card offers several advantages including wider acceptance, cash withdrawal from ATMs, and international transactions among others.

Get Free SampleMarket Dynamics

Driver:

- Flexibility and convenience in payment is driving the demand for prepaid card.

- Growing trends of online shopping is driving the market growth

Restraints:

- The fee structure of the cards limits the market growth.

Market Segmentation:

| Report Attributes | Report Details |

| By Card Type | Closed Loop and Open Loop |

| By Usage | General Purpose Card, Gift Cards, Government Benefit Card, Incentive Card, and Others |

| By End-User | Retail, Government Institutions, Corporate Institutions, Financial Institutions, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Competitive Landscape :

As per the study, the market is dominated by certain major companies such as Mastercard, Visa, PayPal Holdings, Inc, and American Express Company that have a strong market position in current market circumstances. Further, the Prepaid Card market is expected to witness significant growth in coming years owing to the advancements in technology and increasing adoption of the cashless transactions. The market players compete for a firm market position through mergers and acquisitions, product innovations, and business strategies. Thus, evolving research and developments in the Prepaid Card market are expected to help market players adopt innovative ways of product creation to cater to the growing needs of various end-use industries.

- Mastercard

- PayPal Holdings, Inc.

- Visa

- American Express Company

- JPMorgan Chase & Co.

- H&R Block Inc.

- Banco Bilbao Vizcaya Argentaria S.A

- Brink's Incorporated

- Green Dot Corporation

- Netspend

- Revolut