Automotive Electric Vacuum Pump (EVP) Market Size :

Automotive Electric Vacuum Pump (EVP) Market is estimated to reach over USD 3,794.83 Million by 2030 from a value of USD 1,756.13 Million in 2022, growing at a CAGR of 10.3% from 2023 to 2030.

Automotive Electric Vacuum Pump (EVP) Industry Definition & Overview:

An automotive electric vacuum pump (EVP) is referred to as a type of vacuum pump that is powered by electricity and is employed in various automotive applications to generate vacuum pressure to power the brakes. Additionally, the automotive vacuum pump is also responsible for increasing the lifespan of an engine by keeping the oil clean for a longer period. Furthermore, automotive vacuum pumps remove the air from the engine by generating a vacuum that is utilized for various brake applications.

Automotive Electric Vacuum Pump (EVP) Market Insights :

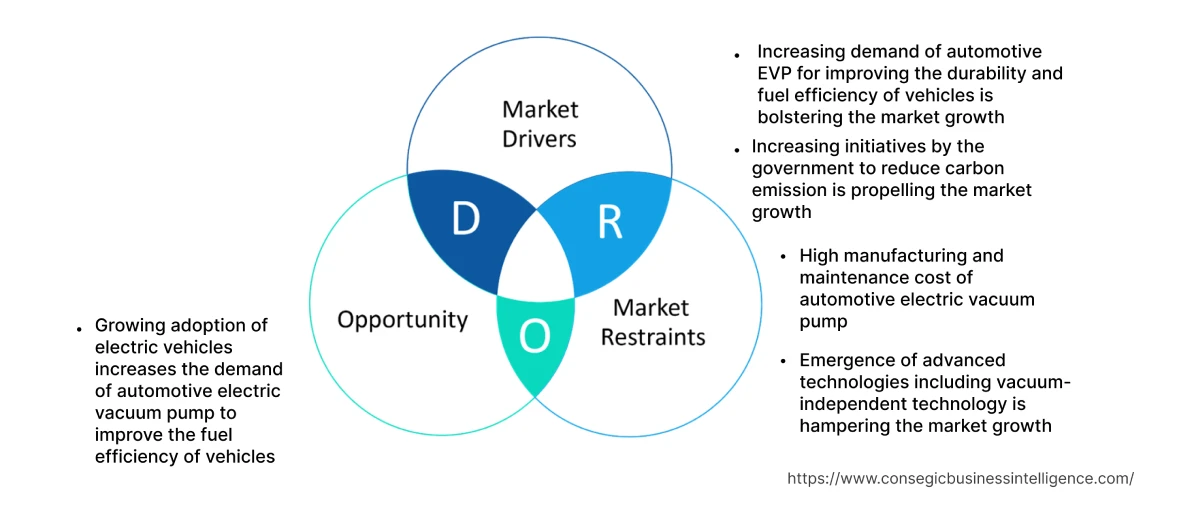

Automotive Electric Vacuum Pump (EVP) Market Dynamics - (DRO) :

Key Drivers :

Increasing demand for automotive EVP to improve the durability and fuel efficiency of vehicles is bolstering the market.

The ability of automotive electric vacuum pumps to offer enhanced fuel efficiency and durability of vehicles serves as the key factor responsible for driving the market. Automotive EVP automatically switches on and off, averting excessive energy consumption by mechanical pumps. Additionally, electric vacuum pumps are also responsible for enhancing the motor life of the vehicle by reducing the load on the engine lubrication system, thus contributing significantly to driving the market. Furthermore, the capability of automotive electric vacuum pumps to avert improper braking, reduce CO2 emissions, and result in improved fuel efficiency is also accelerating the automotive electric vacuum pump (EVP) market expansion.

- For instance, in May 2022, Atlas Copco introduced the GHS 1402-2002 VSD automotive electric vacuum pump to offer improved vacuum performance, with a 15% lesser carbon footprint, and enhanced lifespan of the engine.

The pump comprises of advanced magnetic motor that ensures higher efficiency at all speeds in comparison to the classic motors, hence contributing notably to spurring the automotive electric vacuum pump (EVP) market growth.

Increasing initiatives by the government to reduce carbon emissions are propelling the market.

Governments worldwide are implementing stringent emission standards to reduce carbon emissions and promote sustainable transportation. Automotive electric vacuum pumps play a crucial role in improving the efficiency of vehicles by reducing parasitic losses and optimizing engine performance. The vacuum pumps are responsible for enhancing fuel efficiency coupled with meeting the requirement of net-zero emissions goals. Subsequently, the increasing initiatives by the government to reduce carbon emissions, particularly carbon dioxide, serve as the major factor responsible for boosting the automotive electric vacuum pump (EVP) market opportunities.

- For instance, in November 2022, the Government of Canada invested approximately USD 58 Million in 24 projects to achieve Canada's goal to meet net-zero greenhouse gas emissions by 2050.

Thus, the market analysis shows that the project is initiated to reduce the emission of greenhouse gases including carbon dioxide, methane, and nitrous oxide, thus contributing remarkably to accelerating the market.

Key Restraints :

High manufacturing and maintenance cost of automotive electric vacuum pump

The cost of production and maintenance of automotive electric vacuum pumps is expensive which prevents small companies from entering the market. In addition, the manufacturing cost of the components including pressure regulator, fuel level unit, armature, and reservoir deployed in automotive electric vacuum pumps is also high. Moreover, the analysis of market trends portrays that the vacuum-free braking system accounts for almost 50% of the total production cost of the electric vacuum pump, thus impeding the automotive electric vacuum pump (EVP) market demand.

The emergence of advanced technologies including vacuum-independent technology is hampering the market.

Rapid advancements in mechanical pumps including the integration of vacuum-independent technology in the brake system of vehicles are hindering the market. Vacuum-independent pumps are designed to reduce greenhouse gas emissions in comparison to vacuum-dependent pumps, thus restraining the growth of the market. Additionally, the increasing adoption of vacuum-independent pumps in automated driving functions and automatic emergency braking offers enhanced performance as compared to electric vacuum pumps negatively impacting the market. Consequently, the ability of vacuum-independent electric pumps to offer improved performance and reduced carbon emission is impeding the market.

- For instance, in October 2018, ZF Friedrichshafen AG launched an Integrated Brake Control (IBC) system with vacuum-independent technology to offer an enhanced performance of Chevrolet Silverado.

Thus, the analysis of market trends depicts that the system is developed to reduce greenhouse gas emissions resulting in enhanced fuel economy, thereby hampering the automotive electric vacuum pump (EVP) market growth.

Future Opportunities :

The growing adoption of electric vehicles increases the demand for automotive electric vacuum pumps to improve the fuel efficiency of vehicles.

The increasing adoption of advanced automotive EVP in electric vehicles to enhance vehicle performance by achieving a high degree of vacuum pressure within a short period is expected to create opportunities. Additionally, the EVPs designed for electric vehicles are equipped with a low air-borne noise emissions system and structure-borne noise insulation system to reduce undesirable noise. Moreover, the ability of automotive electric vacuum pumps to allow electric vehicles to operate in drifting mode resulting in additional fuel savings due to reduced drivetrain resistance is also propelling the market. Consequently, with the increasing number of electric vehicles the demand for automotive EVP is also expected to increase, hence creating potential automotive electric vacuum pump (EVP) market opportunities.

- For instance, in April 2023, according to the International Energy Agency (IEA), more than 10 million electric cars were sold worldwide in 2022, and the sales are projected to grow by 35% in 2023 accounting for 14 million.

Thus, the market trends analysis shows that an increase in sales of electric cars is anticipated to create lucrative opportunities during the forecasted period.

Automotive Electric Vacuum Pump (EVP) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 3,794.83 Million |

| CAGR (2023-2030) | 10.3% |

| By Type | Diaphragm Type, Leaf Type, and Swing Piston Type |

| By Vehicle Type | Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles |

| By Sales Channel | OEM and Aftermarket |

| By Application | Brake and Engine |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Atlas Copco AB, Continental AG, Hella GmBH & Co. KGaA, Mikuni Corp., Rheinmetall Automotive AG, Robert Bosch GmbH, Tuopu Group, VERDER India Pumps Pvt Ltd, Youngshin Precision Co., Ltd., ZF Friedrichshafen AG |

Automotive Electric Vacuum Pump (EVP) Market Segmental Analysis :

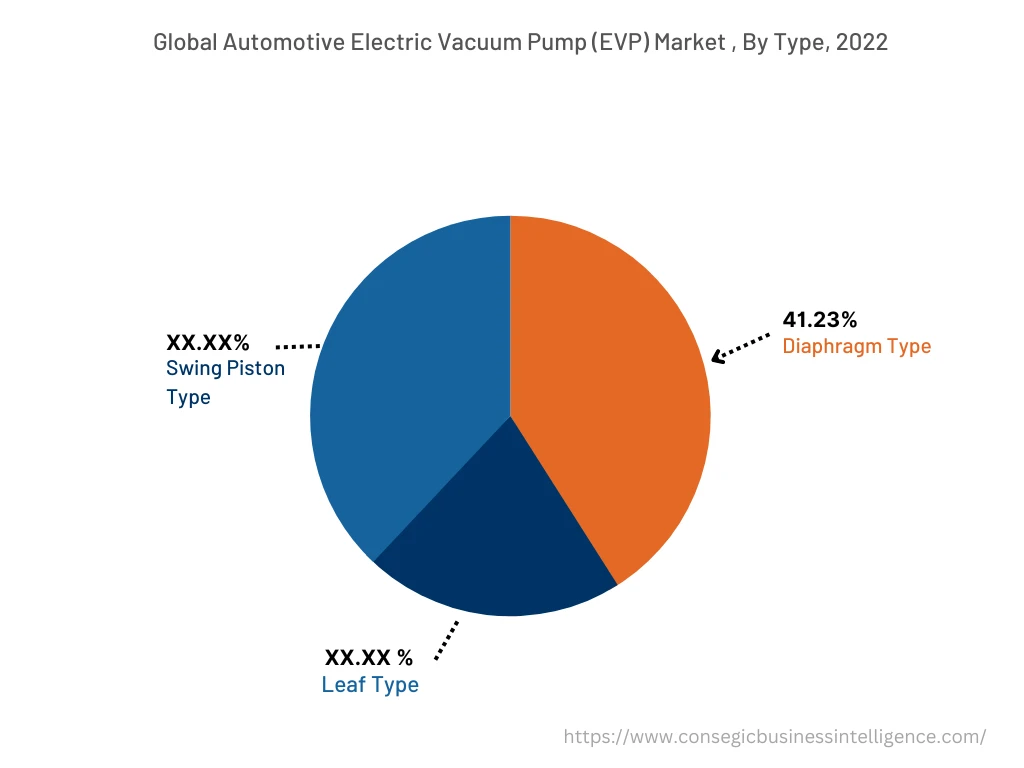

Based on the Type :

The type segment is trifurcated into diaphragm type, leaf type, and swing piston type.

The diaphragm pump accounted for the largest market share of 41.23% in 2022 as diaphragm pumps are capable of generating a deep vacuum quickly and with low vibrations. Additionally, diaphragm pumps operate via a horizontal fluid flow path that provides an energy-efficient and less friction-loss fluid path. The frictionless fluid path results in low energy costs, reduced maintenance, and increased longevity of the vehicle. Additionally, diaphragm pumps reduce carbon emissions more efficiently in comparison to other pumps, further driving the adoption of diaphragm pumps.

- For instance, in April 2022, Verderair introduced an e-PURE electrically driven double diaphragm pump. The product is designed with a reduced number of flow bends to enhance the fluid flow resulting in optimal fluid speed and the highest energy efficiency.

Swing piston automotive electric vacuum pumps are projected to register the fastest CAGR owing to their high efficiency. The swing piston provides strong vacuum power while consuming less energy compared to other types of pumps. The high efficiency leads to reduced energy consumption and improved vehicle efficiency aligned with the growing demand for more eco-friendly and energy-efficient vehicles. Additionally, swing piston pumps are more compact in comparison to other types of pumps, further driving the market. Moreover, swing piston pumps are known for their robustness and reliability in handling a wide range of operating conditions, thus contributing notably to propelling the automotive electric vacuum pump (EVP) market trends during the forecast period.

Based on the Vehicle Type :

The vehicle type segment is trifurcated into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Passenger cars accounted for the largest revenue of the total automotive electric vacuum pump (EVP) market share in 2022 and are also predicted to register the fastest CAGR during the forecast period as passenger cars prioritize performance, comfort, and convenience features. Electric vacuum pumps play a crucial role in enhancing vehicle performance by providing vacuum to systems including power brakes and emission control systems. Furthermore, passenger cars represent the largest segment of the automotive industry in terms of sales volume. Consequently, the accessibility of automotive electric vacuum pumps at an affordable price leads to the expansion of the customer base and results in increased sales volumes thus, driving the market.

- For instance, according to the India Brand Equity Foundation (IBEF), the Indian passenger car market was sized at USD 32.70 Million in 2021 and is expected to reach a value of USD 54.84 Million by 2027, by witnessing a CAGR of over 9% between 2022-27.

Thus, the segmental trend analysis shows that the growth in sales of passenger vehicles is expected to increase the demand for electric vacuum pumps in passenger cars in the upcoming years.

Based on the Sales Channel :

The sales channel segment is bifurcated into OEM and aftermarket.

The OEM segment accounted for the largest revenue of the overall automotive electric vacuum pump (EVP) market share in the year 2022 as OEMs have established strong relationships with consumers over the years, hence gaining a significant advantage in the market. Also, OEMs have invested heavily in building brand recognition, to establish a loyal customer base and manufacturers tend to purchase an electric vacuum pump from a reputable OEM compared to an unknown brand. Furthermore, OEMs offer a wide range of vacuum pumps at affordable price points creating a large consumer base, thus contributing significantly to propelling the automotive electric vacuum pump (EVP) market expansion.

The aftermarket segment is expected to witness the fastest CAGR during the forecast period. Aftermarket electric vacuum pump products cater to various needs of the consumers including customization, upgradation, and replacement of existing mechanical vacuum pumps. Additionally, the lifecycle of a vehicle extends beyond the initial warranty period offered by original equipment manufacturers. After the expiration of the warranty period, vehicle owners turn to aftermarkets for affordable and reliable vehicle parts including electric vacuum pumps, thus driving the market.

- For instance, in April 2023, ZF Aftermarket expanded its spare parts portfolio for electric cars by introducing the Electronic Brake Booster (EBB).

Thus, the analysis of segmental trends depicts that the system is developed to enhance the driver assistance and braking system in vehicles, hence contributing remarkably to propelling the automotive electric vacuum pump (EVP) market trends.

Based on the Application :

The application segment is bifurcated into brake and engine.

Brake accounted for the largest market share in 2022 and is also predicted to witness the fastest CAGR during the forecast period owing to the increasing adoption of vacuum pumps in braking systems. Automotive EVPs are critical in providing vacuum assistance for power brakes to enhance braking performance and ensure efficient and consistent braking force. Moreover, the advancements in technology including the emergence of advanced software that increases the efficiency of automatic emergency braking are further contributing to accelerating the automotive electric vacuum pump (EVP) market expansion.

- For instance, in January 2021, ZF Friedrichshafen AG introduced ZF brake control system ID.3 and ID.4 with an optimized software interface to improve the efficiency of the system.

The ZF brake control system is installed in compact cars SUVs to even light commercial vehicles (LCVs), thus contributing remarkably to promoting the automotive electric vacuum pump (EVP) market demand.

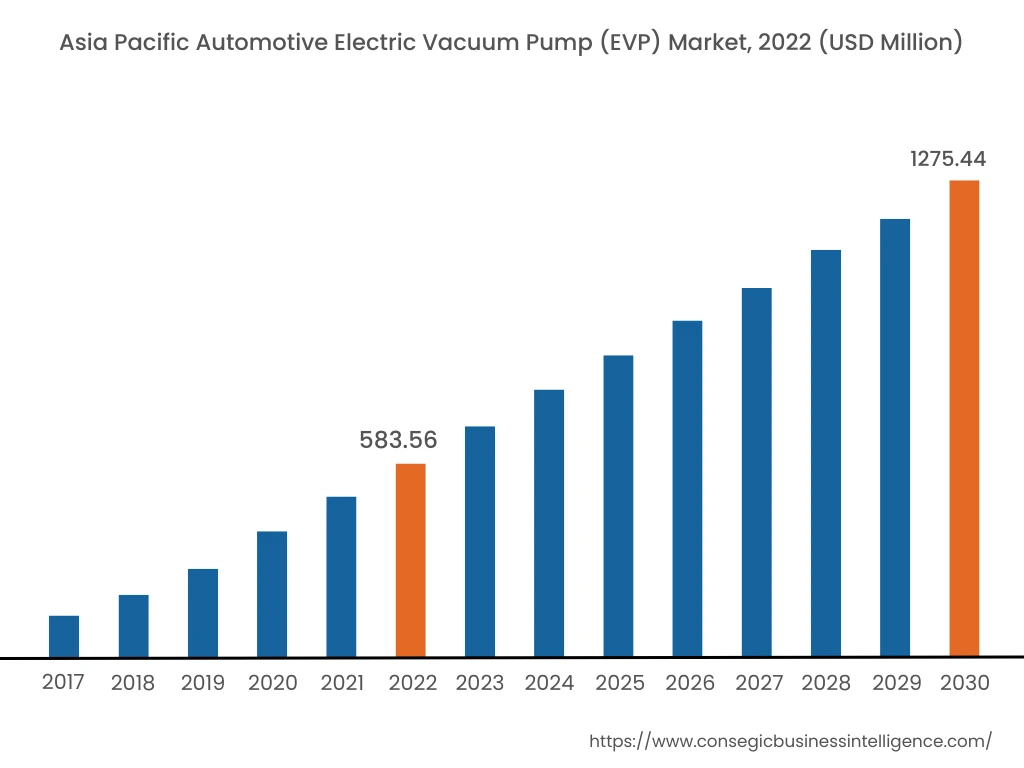

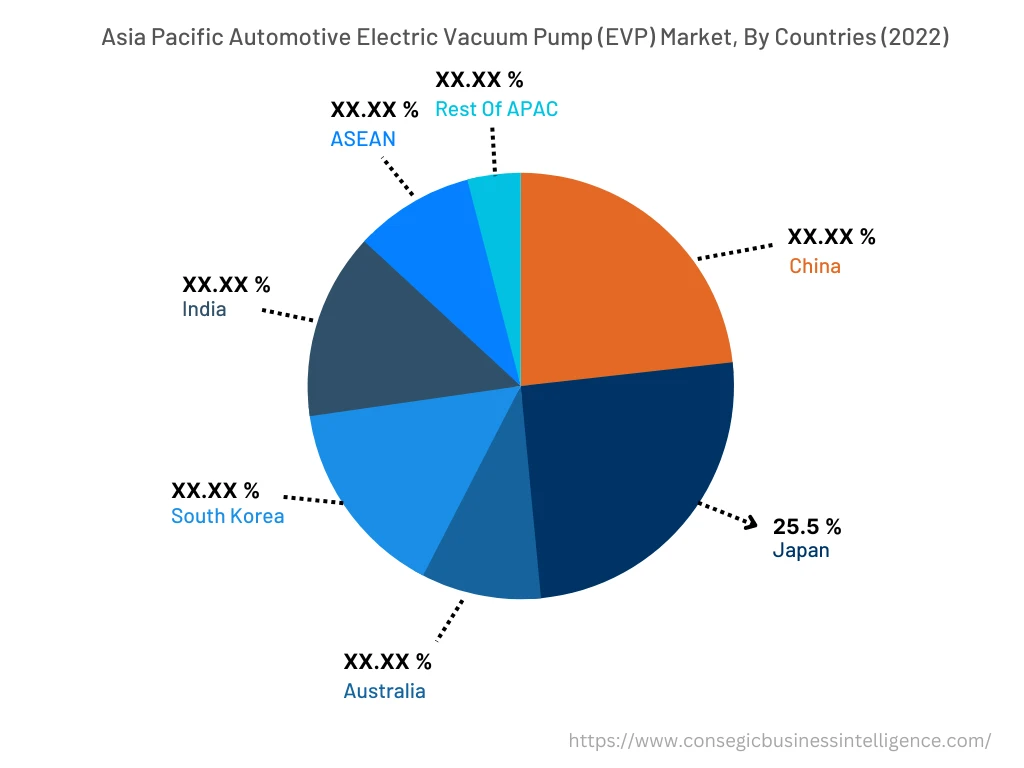

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific accounted for the largest revenue share of USD 583.56 Million in the year 2022 in the market. In addition, in the region, Japan accounted for the maximum revenue share of 25.5%% in the year 2022 owing to the expanding automotive industry that increases the demand for electric vacuum pumps to improve the efficiency of engines. Additionally, as per the automotive electric vacuum pump (EVP) market analysis, automotive manufacturers are implementing advanced technologies to reduce carbon emissions further contributing to accelerating the market. Moreover, the region encompasses various original equipment manufacturers (OEMs) who have established a loyal customer base that contributes significantly to promoting the growth of the automotive industry including the market. Moreover, the surge in the sales of cars in Asia Pacific countries also increases the demand for electric vacuum pumps to offer improved efficiency and performance of the engine.

- For instance, in January 2022, according to the China Association of Automobile Manufacturers (CAAM), the sales of sport SUVs were highest in China in 2021, reaching 10 million units. In the same year, 9.9 million Senda and approximately 1.1 million multi-purpose vehicles (MPV) were also sold in China.

In conclusion, car sales in China reached approximately 26.1 million vehicles in 2021, thus contributing significantly to the driving market.

The regional trends analysis shows that Europe is anticipated to witness the fastest CAGR of 10.7% during the forecast period in the market. The growth is credited to the early adoption of advanced technologies to reduce carbon emissions and improve the fuel efficiency of vehicles. Moreover, the presence of key players in the region including Robert Bosch GmbH and Continental AG constantly apply innovations and invest heavily in research and development to launch advanced products. The players also apply strategic decisions through mergers and acquisitions to strengthen the market position, thus contributing notably to accelerating the market growth.

Top Key Players & Market Share Insights:

The landscape of the global automotive electric vacuum pump (EVP) market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the market. Major players in the automotive electric vacuum pump (EVP) industry include -

- Atlas Copco AB

- Continental AG

- VERDER India Pumps Pvt Ltd

- Youngshin Precision Co., Ltd.

- ZF Friedrichshafen AG

- Hella GmBH & Co. KGaA

- Mikuni Corp.

- Rheinmetall Automotive AG

- Robert Bosch GmbH

- Tuopu Group

Recent Industry Developments :

- In April 2023, Atlas Copco completed the acquisition of Trillium US Inc. to expand its portfolio in the electric vacuum pumps market. The acquisition is considered a strategic decision by Atlas Copco to strengthen its position in the North American market.

Key Questions Answered in the Report

What is Automotive Electric Vacuum Pump (EVP)? +

An automotive electric vacuum pump (EVP) is referred to as a vacuum pump that is powered by electricity and is employed in various automotive applications to provide vacuum pressure to power brake boosters and other components.

What specific segmentation details are covered in the Automotive Electric Vacuum Pump (EVP) market report, and how is the dominating segment impacting the market growth? +

In the type segment, diaphragm pumps accounted for the largest market share in 2022 as diaphragm pumps operate via a horizontal fluid flow path that provides a more energy-efficient and less friction-loss fluid path. The frictionless fluid path results in low energy costs, reduced maintenance, and increased longevity of the vehicle.

What specific segmentation details are covered in the Automotive Electric Vacuum Pump (EVP) market report, and how is the fastest segment anticipated to impact the market growth? +

In the sales channel, the aftermarket is expected to witness the fastest CAGR as aftermarket electric vacuum pump products cater to various needs of the consumers including customization, upgradation, and replacement of existing mechanical vacuum pumps.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Europe is anticipated to witness the fastest CAGR during the forecast period due to the expanding automotive sector which increases the demand of electric vacuum pumps to improve the efficiency of engines.