Digital Insurance Platform Market Size:

Digital Insurance Platform Market size is estimated to reach over USD 383.21 Billion by 2032 from a value of USD 131.21 Billion in 2024 and is projected to grow by USD 149.42 Billion in 2025, growing at a CAGR of 12.5% from 2025 to 2032.

Digital Insurance Platform Market Scope & Overview:

Digital insurance platform includes life insurance products and services that are offered, managed, and processed digitally. Moreover, insurance platforms have a set of amendments like a customer-first approach, omnichannel presence, insurance tech ecosystem, and coverage plans for customers who need little coverage. Digital insurance offers a wide range of benefits like enhanced customer experience, improved employee efficiency, low code capacities, and others. In addition, digital insurance reduces operational costs through accelerated product launches and efficient use of artificial intelligence and predictive analytics. Thus, the above benefits are driving the digital insurance platform market.

Digital Insurance Platform Market Dynamics - (DRO) :

Key Drivers:

Increasing demand for digital payment ecosystem is driving the digital insurance platform market size

Digital payments are transactions done through electronic processes, typically through the Internet or mobile networks from one account to another. Moreover, digital payments offer faster, more secure, and convenient transaction methods by streamlining insurance processes. Additionally, digital platforms allow policyholders to pay premiums and manage policies online by eliminating the need for physical visits.

- For instance, in March 2025, ACI Worldwide and Ingo Payments introduced a partnership that aims at expansion of the digital disbursement capabilities. Moreover, digital payment accelerates disbursements by ensuring customers receive funds easily, which ensures efficient and timely insurance claim pay-outs.

Hence, as per the digital insurance platform market analysis, the above factors are driving the digital insurance platform market size.

Key Restraints:

Data privacy, cyber security concerns, and regulatory compliance are hindering the digital insurance platform market growth

Data privacy and cyber security concerns are few of the limiting factors associated with insurance platforms. Moreover, the increasing frequency of cyberattacks and growing volume of sensitive data handled by insurance platforms are restricting the digital insurance platform market growth.

Additionally, regulatory compliance such as the Information Technology Act requires organizations to implement cybersecurity solutions, which are usually costly and complex. Hence, data privacy, cyber security concerns, and regulatory compliance are further hindering the digital insurance platform market expansion.

Future Opportunities :

Integration of artificial intelligence (AI), predictive analysis, and machine learning are expected to drive the digital insurance platform market opportunities

Integration of AI in insurance platforms is designed to handle the complexities of large organizations while maintaining the highest level of security and compliance. In insurance platforms, automated workflows help to significantly enhance and improve overall user experience. Moreover, predictive analytics helps personalize user experience and forecast demand by identifying potential customer churn and preventing fraudulent activities such as unauthorized transactions.

- For instance, Salesforce offers digital insurance platforms integrated with generative AI to enhance customer engagement by streamlining business tasks.

Hence, the integration of AI, predictive analytics, and machine learning is projected to boost the digital insurance platform market opportunities during the forecast period.

Digital Insurance Platform Market Segmental Analysis :

By Component:

Based on component, the market is segmented into policy administration, product administration, claims management, and others.

Trends in the component:

- Increasing trend in adoption of claims management due to the rise in automation and increased utilization of AI is driving the market.

- There is a rising trend toward the utilization of policy administration, attributed to their several processes including agenda setting, policy formulation, and others.

Policy administration segment accounted for the largest revenue in the overall digital insurance platform market share in 2024.

- Policy administration is a software used by insurers to manage the entire life cycle of policy and it seamlessly integrates with various systems, ensuring a cohesive flow.

- Moreover, core functions of policy administration consist of several components like new business, customer management, billing, and others.

- Additionally, policy administration systems provide reporting and analytical capabilities to evaluate and risk eligibility and automate underwriting decisions.

- For instance, Xoraila offers its policy management software to a wide range of industries like healthcare, financial services and banking, energy and utility, manufacturing, and others.

- According to the market analysis, the rising growth of policy administration in insurance platform is driving the digital insurance platform market trends.

Claims management segment is anticipated to register the fastest CAGR growth during the forecast period.

- In insurance platforms, claims management involves advanced technology to streamline and automate the entire claim process like initial reporting, settlements, and others.

- Moreover, integrating claim management systems with business systems like policy management, billing systems, and others helps in creating a streamlined workflow, connecting different parts of the process.

- For instance, in February 2025, Capital Rx unveiled healthcare’s first unified pharmacy and medical claims processing platform called Judi Health.

- Therefore, the above factors are expected to propel the market during the forecast period.

By Deployment:

Based on deployment, the market is segmented into cloud and on-premise.

Trends in the deployment:

- Rising trend in adoption of cloud deployment, driven by factors such as enhanced API frameworks, scalable features and functionalities, and others.

- Factors including enhanced customer experience by providing self-service portals, combined with improved data security and privacy are driving the cloud deployment segment.

- In insurance platform, cloud-based deployment offers scalability, cost-efficiency and increased flexibility, which allows seamless integration with advanced technologies.

- Moreover, cloud-based insurance platforms enable insurers to access real-time data and gain valuable insights into customer behavior leading to better decision-making.

- For instance, in July 2021, AI launched INFRD, an API insurance cloud platform, to modernize operational processes, enhance claims processes, and reduce risk and fraud in the insurance industry.

- Thus, rising advancements associated with cloud-based insurance platforms are driving the market.

By Application:

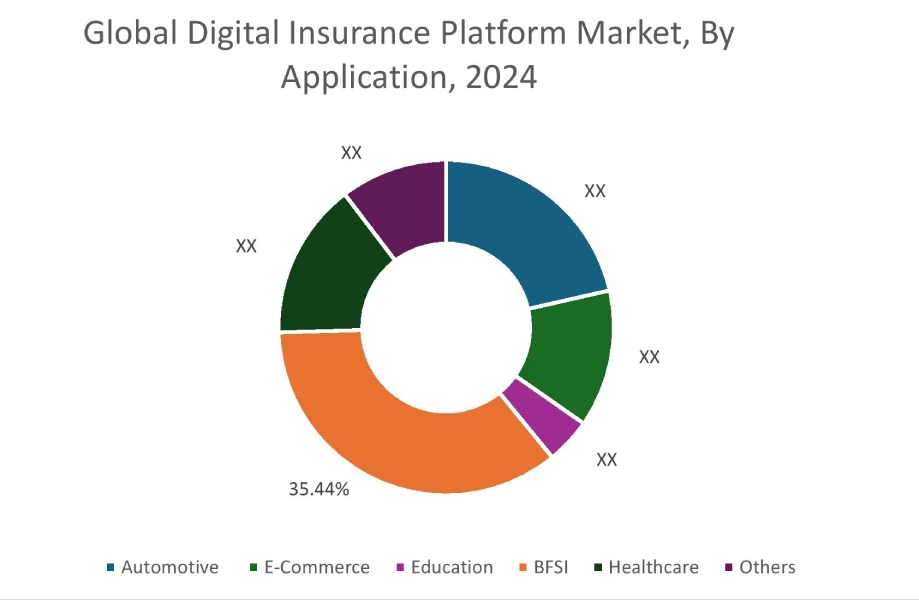

Based on application, the market is segmented into automotive, e-commerce, education, BFSI, healthcare, and others.

Trends in the application:

- Factors including, integration of AI features, enhanced claim processing, and others are driving the digital insurance platform market trends.

BFSI segment accounted for the largest revenue share of 35.44% in the overall digital insurance platform market share in 2024.

- In BFSI sector, digital insurance provides a wide range of benefits such as improved security features, fraud detection, improved claims processing & management, and others,

- Moreover, insurance companies offer an AI assistant that instantly replies to customer queries to provide quotes, renew policies, and even initiate the claims process.

- For instance, Decerto built a comprehensive lead management platform for life insurance sector of Warta, a leading player in the insurance market. Moreover, lead management platform is often used in conjunction with digital platforms to help streamline the process.

- Therefore, the rising adoption of digital insurance in BFSI sector is further driving the market growth.

Healthcare segment is anticipated to register fastest CAGR growth during the forecast period.

- In the healthcare sector, digital insurance provides a wide range of features like policy comparison, online purchasing plans, and payment processes, all through a user-friendly interface.

- Moreover, these platforms aim to enhance efficiency by reducing costs and streamlining processes for improved customer satisfaction.

- For instance, Oracle offers a digital insurance platform for the healthcare industry to help automate new provider contract models by simplifying enrolments, premium billing, and claims adjunctions.

- Therefore, the rising adoption for insurance platforms in the healthcare sector is expected to drive the digital insurance platform market during the forecast period.

Regional Analysis:

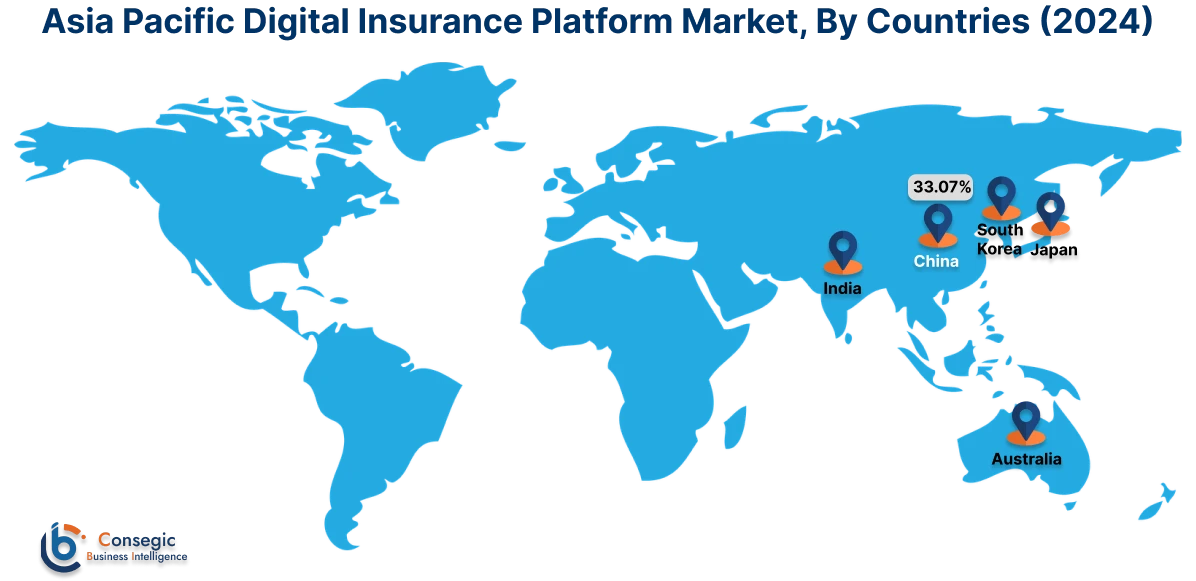

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

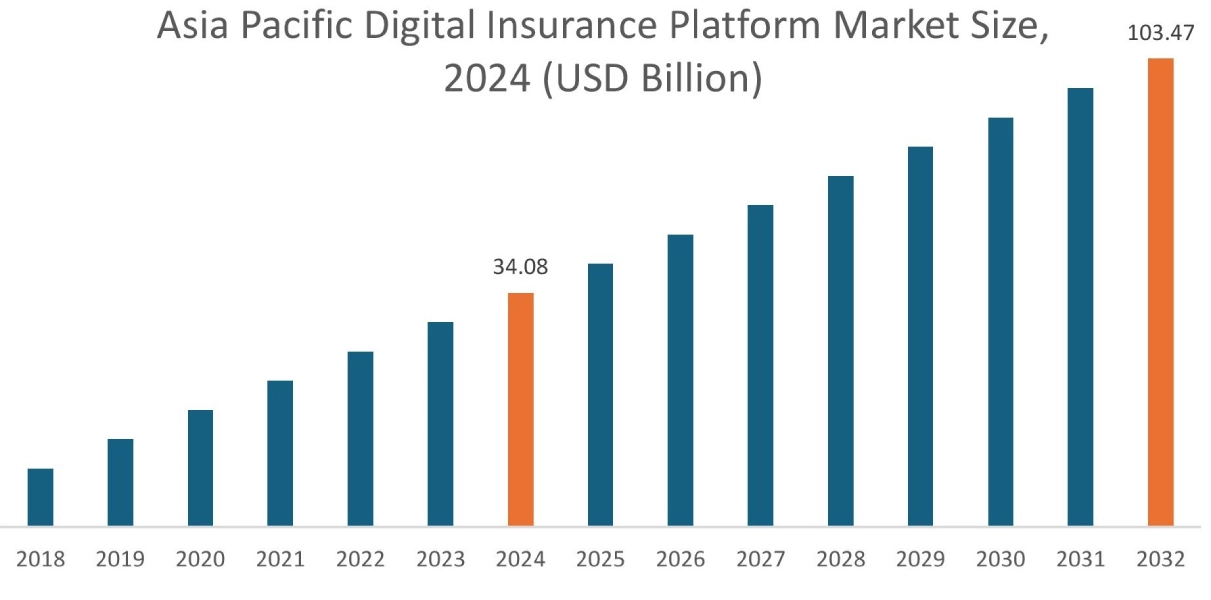

Asia Pacific region was valued at USD 34.08 Billion in 2024. Moreover, it is projected to grow by USD 38.94 Billion in 2025 and reach over USD 103.47 Billion by 2032. Out of this, China accounted for the maximum revenue share of 33.07%. As per the digital insurance platform market analysis, the adoption of insurance platform in the Asia-Pacific region is primarily driven increasing need for reliable insurance solutions in healthcare, automotive, and other sectors in the region. Additionally, the rising advancements in policy administration software and growing integration in cloud-based digital insurance are further accelerating the digital insurance platform market expansion.

- For instance, One Shield, an India-based insurance company, offers a digital platform for a wide range of insurance services like policy and billing, claims, reporting, and others.

North America is estimated to reach over USD 136.50 Billion by 2032 from a value of USD 46.71 Billion in 2024 and is projected to grow by USD 53.20 Billion in 2025. In North America, the adoption of digital insurance platform is driven by increasing adoption of claims management in healthcare sector and rising adoption of cloud-based digital insurance in the region. Similarly, rising developments associated with banking, finance, and insurance firms are contributing to the digital insurance platform market demand.

- For instance, in April 2024, Cogitate announced that ARU, a specialty property insurance company, launched a farm, ranch, and rural estate insurance program on their Cogitates Digital Edge Platform.

Additionally, the regional analysis depicts that the rising AI integration and growing adoption of digital insurance platforms in healthcare and BFSI sectors, due to its improved service efficiency and increased sales agent productivity, is driving the digital insurance platform market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as significant investments in BFSI firms, increasing online renewals for insurance policies, and others.

Top Key Players and Market Share Insights:

The global digital insurance platform market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the digital insurance platform industry. Key players in the digital insurance platform industry include –

- Acko General Insurance (India)

- Zipari Inc. (U.S.)

- Sureify Labs, Inc. (U.S.)

- Hyperexponential (U.K.)

- Prima Solutions (France)

- Salesforce, Inc. (U.S.)

- Cogitate (U.S.)

- Ensuredit (India)

- Oneshield (India)

- Majesco, Inc. (U.S.)

Recent Industry Developments :

Partnerships & Collaborations:

- In June 2025, Generali and Citi collaborated with Bindo Labs to unveil a new digital solution for insurance premium payments. Moreover, this initiative enables Generali to accept policy holder’s payments through more than 20 digital payment methods.

Digital Insurance Platform Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 383.21 Billion |

| CAGR (2025-2032) | 12.5% |

| By Component |

|

| By Deployment |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Who are the major players in the digital insurance platform market? +

The key participants in the digital insurance platform market are Acko General Insurance (India), Zipari Inc. (U.S.), Salesforce, Inc. (U.S.), Cogitate (U.S.), Ensuredit (India), Oneshield (India), Majesco, Inc. (U.S.), Sureify Labs, Inc. (U.S.), Hyperexponential (U.K.), Prima Solutions (France) and Others.

What specific segmentation details are covered in the digital insurance platform report? +

The digital insurance platform report includes specific segmentation details for component, deployment, application, and region.

Which is the fastest-growing region in the digital insurance platform market? +

Asia-Pacific is the region experiencing the most rapid growth in the digital insurance platform market.

How big is the digital insurance platform market? +

The digital insurance platform market was valued at USD 131.21 Billion in 2024 and is projected to grow to USD 383.21 Billion by 2032.