Mutual Fund Assets Market Size:

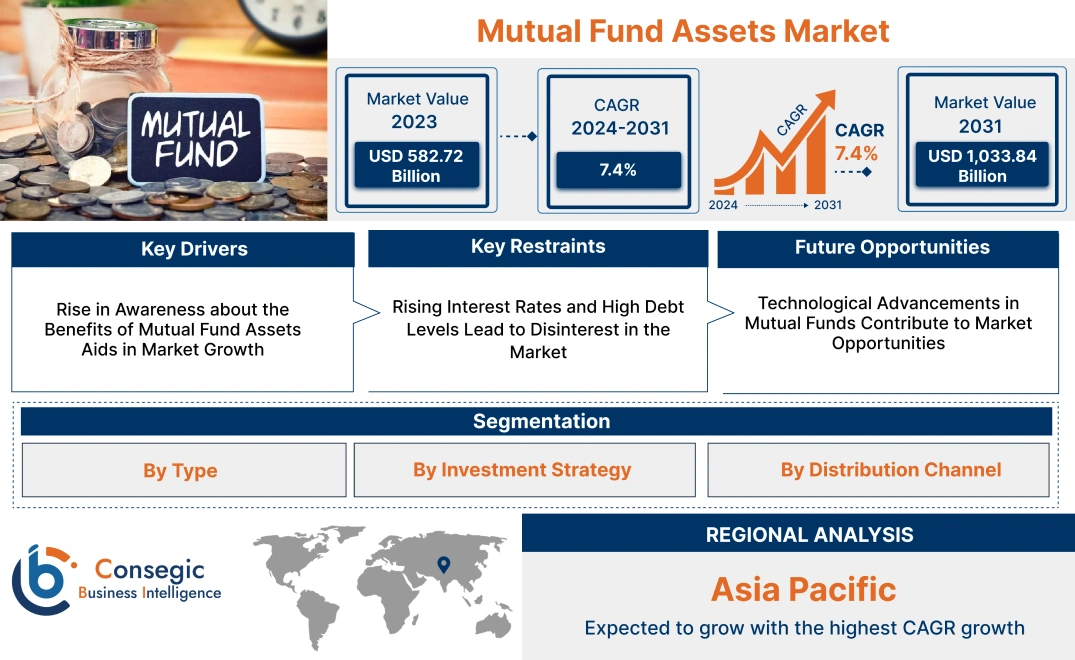

Mutual Fund Assets Market size is growing with a CAGR of 7.4% during the forecast period (2024-2031). The market accounted for USD 582.72 Billion in 2023 and is projected to grow by USD 617.33 Billion in 2024 and the market is estimated to reach over USD 1,033.84 Billion by 2031.

Mutual Fund Assets Market Scope & Overview:

Mutual fund assets are the total market value of all securities within a mutual fund portfolio. The total value of securities held within a mutual fund is represented by its assets. These funds invest in a diverse range of stocks, bonds, and other financial instruments by investing the money of several investors. The market value of these securities affects the Assets under management (AUM). The performance of the funds affects the investor's returns because changes in the portfolio gain or losses have an immediate effect on the fund's net asset value (NAV). Individuals easily access a portfolio with varied investments, which is managed by qualified fund managers through mutual funds potential capital growth, dividend or interest income, and professional fund management experience are all advantageous to investors. Mutual fund assets can also be traded with ease, giving investors liquidity to buy or trade shares at the current NAV. Observing the mutual fund assets helps investors evaluate the size, popularity, and general opportunities of the fund.

Mutual Fund Assets Market Dynamics - (DRO) :

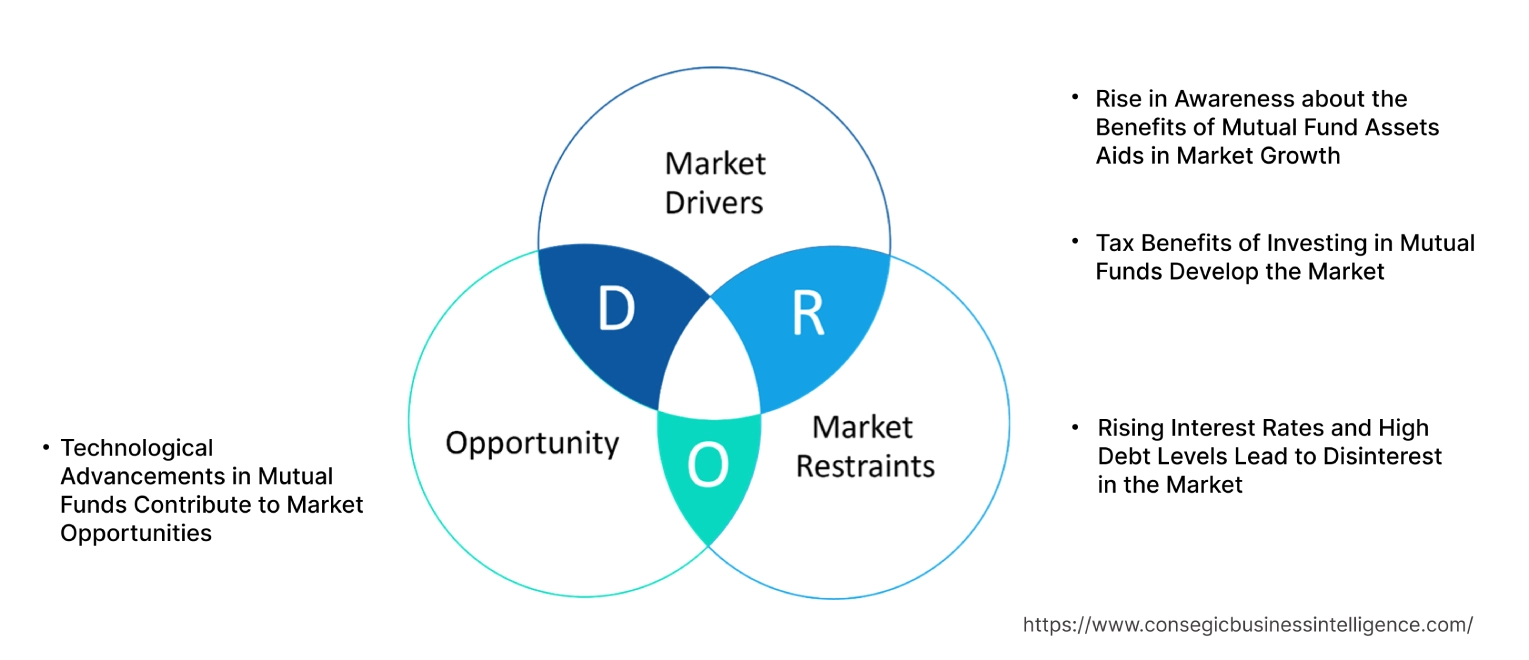

Key Drivers:

Rise in Awareness about the Benefits of Mutual Fund Assets Aids in Market Growth

The rise in awareness regarding the benefits of various mutual funds is encouraging people to invest in various mutual fund schemes. The role of educational initiatives, various online resources, and financial education initiatives have been essential in providing investors with information regarding the benefits of mutual funds. With the availability of various awareness programs, people realize mutual funds are an easy and well-managed way to engage in the financial markets as they learn more about investing options.

The purpose of application programs is to increase public awareness of the benefits of various mutual fund assets by providing an extensive collection of interactive tools and educational resources. To understand the principles of mutual funds, users can easily access content such as articles, videos, and tutorials through the internet. Various mutual fund providers are taking initiatives to create awareness about mutual fund benefits through newsletters, tutorials, and videos.

- For instance, IDFC mutual funds, in August 2023, released an investor awareness film on Youtube. The film mentions about the various investors and their approach towards investing.

Thus, the increasing awareness about mutual funds is boosting the mutual fund assets market growth.

Tax Benefits of Investing in Mutual Funds Develop the Market

The market for mutual fund assets is driven primarily by tax benefits since investors want to maximize returns while minimizing their tax obligations. A significant benefit is the possibility of advantageous capital gain tax treatment, especially for long-term investments, which presents investors with a more tax-efficient approach than direct stock holding. The divided treatment of mutual funds also offers tax benefits, with some distributions being eligible for reduced tax rates.

The use of tax advantage accounts such as 401(K) and IRAs, where investment in mutual funds grows tax-free or tax-deferred, adds even more appeal. To reduce the number of taxable events in the fund's portfolio, fund managers frequently implement tax-efficient strategies. Furthermore, the natural diversity found in mutual funds potentially helps to balance out capital gains and losses. Thus, the various tax benefits available by investing in various mutual funds are propelling the mutual fund assets market expansion.

Key Restraints :

Rising Interest Rates and High Debt Levels Lead to Disinterest in the Market

High levels of existing debt and rising interest rates present challenges for the mutual fund assets market. Consumer's cost of borrowing from various banks and organizations goes up with interest rates, making mutual funds more costly. This may discourage people from looking for further financial assistance, which could result in a decline in the number of people opting for mutual loans. The high levels of debt cause more difficulty and make it harder for borrowers to qualify for new mutual fund assets. Furthermore, borrowers may experience more financial stress as a result of the combination of rising interest rates and high debt, thus lenders might become less willing to give credit to people who are already heavily in debt, which would lower the number of mutual funds.

In addition, the increased interest rates may result in higher borrowing costs for equity funds that use leverage, which could have an impact on returns and profitability. Increased interest rates on both new and current mutual funds may put pressure on household finances and make it harder for borrowers to fulfill their financial commitments. This, therefore, leads to a rise in failing to repay loans, putting lenders and borrowers at risk. Thus, the rising interest and high debt levels are restraining the mutual fund assets market demand.

Future Opportunities :

Technological Advancements in Mutual Funds Contribute to Market Opportunities

Significant technological advancements in mutual funds have completely changed the financial landing. With new features for managing accounts and conducting transactions, mobile banking apps have given users access to a new level of flexibility. By using facial and fingerprint recognition, biometric authentication improves security and accelerates user verification. Decentralized and secure alternatives to centralized digital transactions are introduced by blockchain technologies and cryptocurrencies such as Bitcoin. Machine learning (ML) and artificial intelligence (AI) are essential for risk assessment, fraud detection, and customized facilities for customers.

Customer service is guaranteed to be prompt and effective because of the integration of chatbox and virtual assistants. By allowing safe data sharing between financial organizations outside developers, an open banking application program interface encourages innovations. Near-field communications and QR Codes are the technologies that enable contactless payments to improve both transaction speed and hygiene. Scalable and affordable solutions are offered by cloud computing and ongoing security strengthens defenses against changing cyber threats. Various advancements are observed in ATMs for cardless and cashless transactions.

- For instance, according to the India Brand Equity Foundation, in September 2023, Hitachi Payments collaborated with NPCI to launch India's first-ever UPI-ATM. The concept is to provide cash even in rural areas without the need for a physical card.

Thus, as per the market trends analysis, the aforementioned technological advancements are boosting the mutual fund assets market opportunities.

Mutual Fund Assets Market Segmental Analysis :

By Type:

By type, the market is categorized into stock fund/ equity fund, bond fund, index fund, balanced fund, money market fund, hybrid fund, and others.

In 2023, the equity fund segment accounted for the largest revenue of the total mutual fund assets market share and is expected to hold the fastest CAGR over the forecast period.

- Equity fund is a kind of mutual fund that makes its principal investments in stocks or other equities which are ownership stakes in publicly traded corporations

- An equity fund's objective is to create appreciation by taking part in these business expansions.

- By spreading risk among a wide range of stocks from different market capitalizations, industries, and sectors, equity funds provide investors with diversification.

- Equity funds come in a variety of forms such as growth funds, value funds, and income and dividend funds emphasizing generating consistent income from dividend-paying stocks.

- Expert fund managers actively manage equity funds, choosing which stock to buy and sell based on in-depth research on companies, the market, and economic trends.

- They have a high degree of fluctuation even though they can yield higher returns than more cautious investments.

- According to the Indian Brand Equity Foundation, in 2023, reported that Private Equity-Venture Capital (PE-VC) funds invested USD 6 billion in India-based companies during the quarter that ended September 2023. 1,261 deals were recorded of more than USD 46 billion of Private Equity (PE) – Venture Capitalist (VC) investments in 2022.

- Thus, the rising adoption of equity funds is boosting mutual fund assets market demand.

By Investment Strategy:

The investment strategy segment is categorized into equity strategy, fixed income strategy, multi-asset/balanced strategy, sustainable strategy, market timing strategy, buy and hold strategy, and others.

The Equity strategy accounted for the largest revenue share of the total mutual fund assets market share in 2023.

- The mutual funds equity strategy is a detailed plan outlining how the fund will purchase stocks in order to meet its goals.

- Clearly defining the investment objective, whether it be income generation, capital appreciation, or a balanced approach is the initial step in the strategy.

- Furthermore, the strategy defines the investment style of the fund, indicating whether it will prioritize growth value.

- The strategy is further shaped by decisions about geographic emphasis, sector and market capitalization focus, and active vs passive management.

- In November 2023, HSBC Asset Management announced the sixth vintage of the Vision Private Equity strategy.

- Thus, as per the mutual fund assets market analysis, the benefits provided by equity funds are boosting the mutual fund assets market growth.

The multi-asset/balanced strategy segment is anticipated to register the fastest CAGR during the forecast period.

- To balance risk and return, a multi-asset strategy entails investing across a variety of asset classes.

- This strategy includes a variety of investment types, including stocks, bonds, real estate, and commodities, in an effort to create a well-balanced portfolio.

- By increasing diversification, the strategy aims to lessen the negative effect of poor results in one class on the portfolio. Assets strategies aim to provide more stability and consistency in performance by combining a variety of assets with distant risk-return profiles.

- In January 2024, Bandhan Mutual Fund launched the Bandhan Multi Asset Allocation Fund, which is an open-ended scheme that enables investment across diverse asset classes including Indian equities and various international equities among others.

- Thus, as per the segmental trends analysis, as a balanced strategy provides fewer risk options, it is expected to boost the mutual fund assets market trends in the upcoming years.

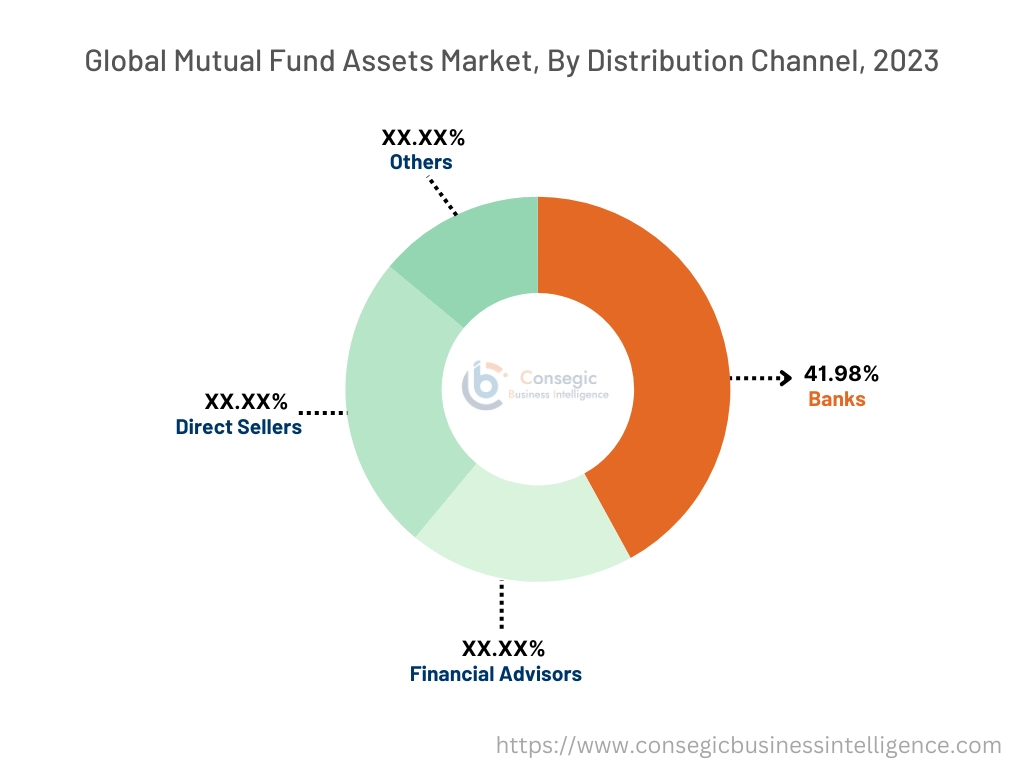

By Distribution Channel:

The end-user industry segment is categorized into banks, financial advisors, direct sellers, and others.

The bank's segment accounted for the largest revenue share of 41.98% in the year 2023.

- Banks are essential to the distribution of assets in mutual funds because they serve as middlemen and make investment easier for investors.

- Banks provide investors with a convenient platform to find, buy, and manage mutual fund holdings through their vast branch networks.

- They act as a channel for distribution, offering clients a selection of mutual fund choices that are tailored to satisfy various investment requirements.

- In January 2024, SBI Mutual Fund announced the launch of the SBI Nifty50 Equal Weight Index Fund, an open-ended index fund scheme that seeks to generate returns that, before expenses, correspond to the total return of the securities as represented by the underlying index - the NIFTY50 Equal Weight index, subject to tracking error.

- Thus, the segmental trends analysis depicts that the adoption of banks for mutual funds is boosting mutual fund assets market expansion.

The direct seller segment is anticipated to register the fastest CAGR during the forecast period.

- A platform or organization that allows investors to buy mutual fund assets directly from the assets management company, avoiding more conventional middlemen such as brokers or distributors, is known as a direct mutual fund seller.

- Online platforms are frequently offered by direct sellers, enabling investors to easily research, choose, and purchase mutual funds.

- In 2024, CRED acquired Kuvera which is an online wealth management platform. This acquisition helps to improve the distribution of mutual funds and enhance the company's portfolio.

- Thus, the market trends analysis depicts that the aforementioned factors are boosting the mutual fund assets market trends.

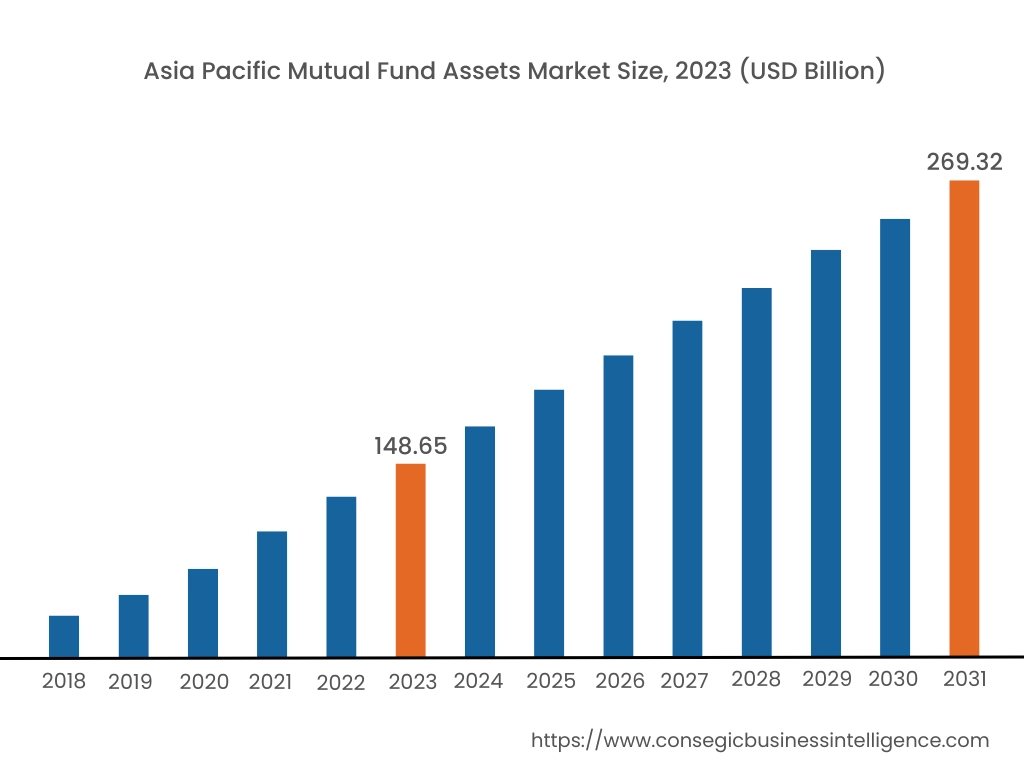

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

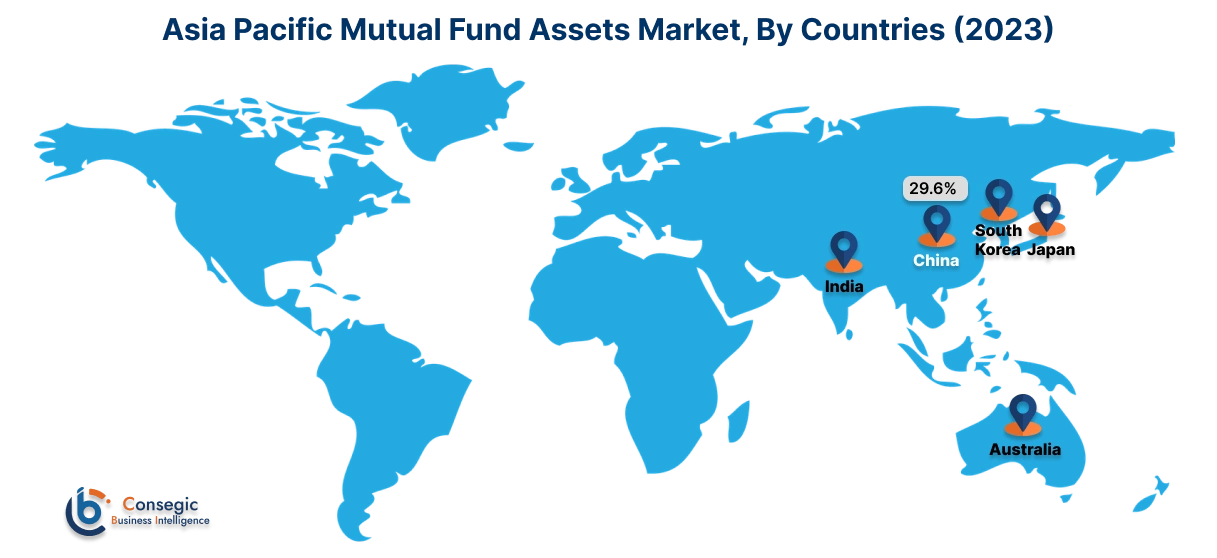

Asia Pacific region was valued at USD 148.65 Billion in 2023. Moreover, it is projected to grow by USD 157.75 Billion in 2024 and reach over USD 269.32 Billion by 2031. Out of this, China accounted for the maximum revenue share of 29.6%. The mutual fund assets market analysis shows that numerous factors such as strong economic development, rising income levels, and growing public awareness of investment opportunities are driving the market demand. The growth of these industries across the Asia Pacific is expected to influence the market demand over the estimated period.

In 2023, North America accounted for the highest market share at 33.7% valued at USD 196.23 Billion in 2023, it is expected to reach USD 350.99 Billion in 2031. The mutual fund industry in the region such as America and Canada is well-established and mature. Robust financial infrastructure, a wide range of investment options, and an individual investment culture are some factors contributing to North America's growth.

- According to the UN Environment program: finance initiative, stated that UNEP FI carries out its activities in North America through the North American Working Group in Canada and the United States. The Group is working to advance the adoption and integration of sustainability in the financial industry in North America through working with signatory members to address region-specific sustainability issues.

The mutual fund assets market in Latin America is growing steadily, driven by increasing investor awareness and favorable regulatory reforms. Brazil and Mexico lead the region, offering a variety of funds. However, market volatility and economic instability in some countries pose challenges to sustained growth. The market in the Middle East & Africa is nascent but expanding, with the UAE, Saudi Arabia, and South Africa driving the demand. Sharia-compliant funds are gaining traction. Limited investor education and underdeveloped financial markets hinder broader adoption. Europe's mutual fund assets market is mature, led by countries like the UK, Germany, and France. ESG-focused funds and passive investing are key trends. Regulatory changes like MiFID II ensure transparency, while geopolitical uncertainties and market fragmentation present challenges.

Top Key Players & Market Share Insights:

The mutual fund assets market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global mutual fund assets market. Key players in the mutual fund assets industry include-

- The Vanguard Group, Inc. (US)

- FMR LLC (US)

- SLGI Asset Management Inc. ,(Sun Life Assurance Company of Canada)(Canada)

- JPMorgan Chase & Co.(U.S.)

- BlackRock, Inc(U.S.)

- T. Rowe Price(U.S.)

- Capital Group (USA)

- Invesco Mutual Fund (USA)

- Aditya Birla Capital Ltd(India)

- Royal Bank of Canada(Canada)

- HDFC Mutual Funds(India)

- UTI Mutual fund(India)

Recent Industry Developments :

Product Launches:

- In January 2024, Old Bridge Mutual Fund has recently introduced its first equity-ended scheme. It is an open-ended scheme that allows investing in a maximum of 30 stocks.

- In May 2024, Bajaj Finserv Mutual Fund introduced the Bajaj Finserv Asset Allocation Fund, which is an open-ended scheme that invests in equity and equity-related instruments, and other debt derivatives.

- In June 2024, Mirae Asset Mutual Fund introduced Mirae Assets Nifty EV and New Age Automotive introduced an open-ended scheme replicating/tracking Nifty EV. It is India's first Exchange Traded Fund (ETF) that mainly focuses on Electric Vehicles. The investment aims to offer investors long-term capital appreciation.

- In August 2024, Union Mutual Fund introduced an open-ended hybrid scheme that aims to achieve long-term capital appreciation, by normally investing in a wide portfolio that usually includes components such as money market instruments, and gold and silver efts among others.

Mutual Fund Assets Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 1,033.84 Billion |

| CAGR (2024-2031) | 7.4% |

| By Type |

|

| By Investment Strategy |

|

| By Distribution channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What was the market size of the Mutual fund assets market in 2023? +

In 2023, the market size of Mutual fund assets was USD 612.32 Billion.

What will be the potential market valuation for the Mutual fund assets market by 2031? +

In 2031, the market size of Mutual fund assets will be expected to reach USD 1,246.22 Billion.

What are the key factors driving the growth of the Mutual fund assets market? +

Rise in awareness about the benefits of mutual funds.

What is the dominating segment in the Mutual fund assets market for type industry? +

In 2023, the equity fund segment accounted for the highest market share of in the overall Mutual fund assets market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Mutual fund assets market? +

North America accounted for the highest market share in the overall Mutual fund assets market.