Neobanking Market Size:

Neobanking Market size is estimated to reach over USD 2,431.75 Billion by 2031 from a value of USD 107.61 Billion in 2023 and is projected to grow by USD 156.97 Billion in 2024, growing at a CAGR of 47.7% from 2024 to 2031.

Neobanking Market Scope & Overview:

Neobanks are online platforms, designed for digital-only banking purposes. They enable customers to open bank accounts, without the hassle of visiting the physical banks. They offer multiple benefits, such as customizing banking offerings based on personal needs, zero or low maintenance, minimum balance, ease of use, and faster response, to meet the demands of the new generation. The features range from easy access to funds, enhanced services based on customer data, easy creation of bank accounts, and provide technology-driven banking services. Startups, SMEs, MSMEs, freelancers, and individual consumers are among the primary users of these banking services.

How is AI Transforming the Neobanking Market?

AI transforms the neobanking market by enhancing personalization, improving operational efficiency, strengthening fraud detection and security, enabling 24/7 customer support via chatbots, and facilitating smarter credit scoring and investment guidance. Also, AI analyzes vast amounts of data to understand individual spending patterns and financial goals, enabling neobanks to deliver personalized savings plans, investment portfolios, and loan offers. Additionally, AI automates routine tasks, from account opening to loan processing, increasing efficiency and reducing operational costs. Further, AI algorithms can automate complex processes like credit evaluation and risk assessment, leading to faster and more informed decisions. AI helps implement advanced security measures for user authentication, such as facial recognition and behavioral analysis, to secure account access.

Neobanking Market Insights:

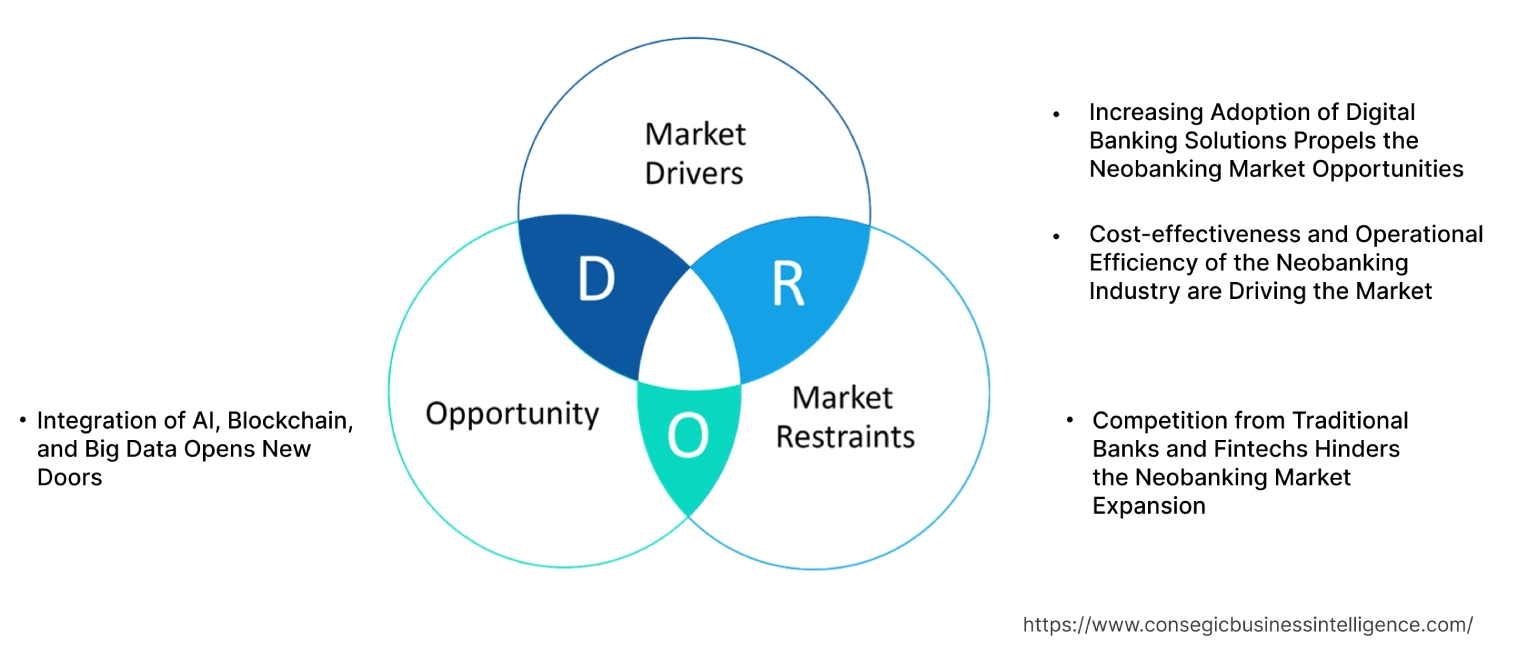

Neobanking Market Dynamics - (DRO) :

Key Drivers:

Increasing Adoption of Digital Banking Solutions Propels the Neobanking Market Opportunities

Digital banking paves the way for end-to-end digitalization of banking services. They utilize web-based and AI-enabled technologies to automate the process requiring human interference when comes to baking processes. With the recent technological advances, new-age consumers are seen to be more inclined towards online platforms, especially in terms of banking. Neobanks meet these demands by providing modern-age solutions that are online.

Moreover, these banks encompass user-centric models, analyzing user behavior and the need to provide personalized solutions. Along with that, the interface is designed in a manner that is easy to use and appeals to the customer visually.

- For instance, Nu Pagamentos in December 2023, highlights the company's inclusion goal through technology. Nu's banking model which is 100% digital, managed to reach 90% of municipalities in Columbia in over 2 years. Their innovative credit card model, allowed almost 30% of customers to use credit cards for the first time.

As per the neobanking market analysis, the advancement in technology and ease of access to baking services accelerates the neobanking market growth.

Cost-effectiveness and Operational Efficiency of the Neobanking Industry are Driving the Market

Neobanks majorly rely on web-based and cloud-based services which significantly reduces the maintenance cost, as well as the risk of hardware failure. The move towards AI integration, to automate the internal banking processes adds to the streamlining of operations and cost-cutting.

Additionally, routine tasks, such as onboarding customers, monitoring transactions, etc., which require minimal effort, can be automated to reduce human intervention and ensure error-free operations. Personalization of these services, by analyzing transaction history and spending habits can also significantly peak customer interest and reduce operational cost.

- For instance, in October 2023, Revolut launched Revolut 10, targeting primary accounts. This allows users to manage their money efficiently, introducing tools to invest and explore savings in just one tap.

As per the neobanking market analysis, the zero reliance on hardware and automation of tasks allows the neo-banking market to be cost-effective and ensure operational efficiency.

Key Restraints :

Competition from Traditional Banks and Fintechs Hinders the Neobanking Market Expansion

Even though, Neobanks provides customers with ample benefits, fintechs and traditional banks are still preferred by a majority of people due to the solidified customer trust and years of utilizing their services. Traditional banks provide more security as they are regulated by government bodies, along with that they also provide additional services like locker facilities and cash withdrawal through ATM.

Additionally, fintech encompasses a broad range of services, including payment processing, lending, insurance, and financial planning, which exceeds the offerings provided by neobanks, which solely focuses on digital banking. Therefore, these innovations and customer trust in traditional banking and fintech hamper the neobanking market growth.

Future Opportunities :

Integration of AI, Blockchain, and Big Data Opens New Doors

With the new innovations in AI and blockchain technologies, banking services have also started implementing these in their services. Neobanks utilize blockchain technologies in order to decentralize the assets of the consumers and this technology is called "neo blockchain". They allow users to make a digital presence with personalized identities.

Moreover, with the integration of AI, these banks can customize the services and harness big data to provide users with improved services. Technologies such as chatbots allow the user to get faster and enhanced solutions based on their queries.

- For instance, Hawk offers users an AIML technology to monitor online transactions, fraud detection, and payment screening. This provides ease of use, better financial solutions, and secure transactions.

As per the analysis, AI, blockchain, and big data are driving the neobanking market opportunities.

Neobanking Market Segmental Analysis :

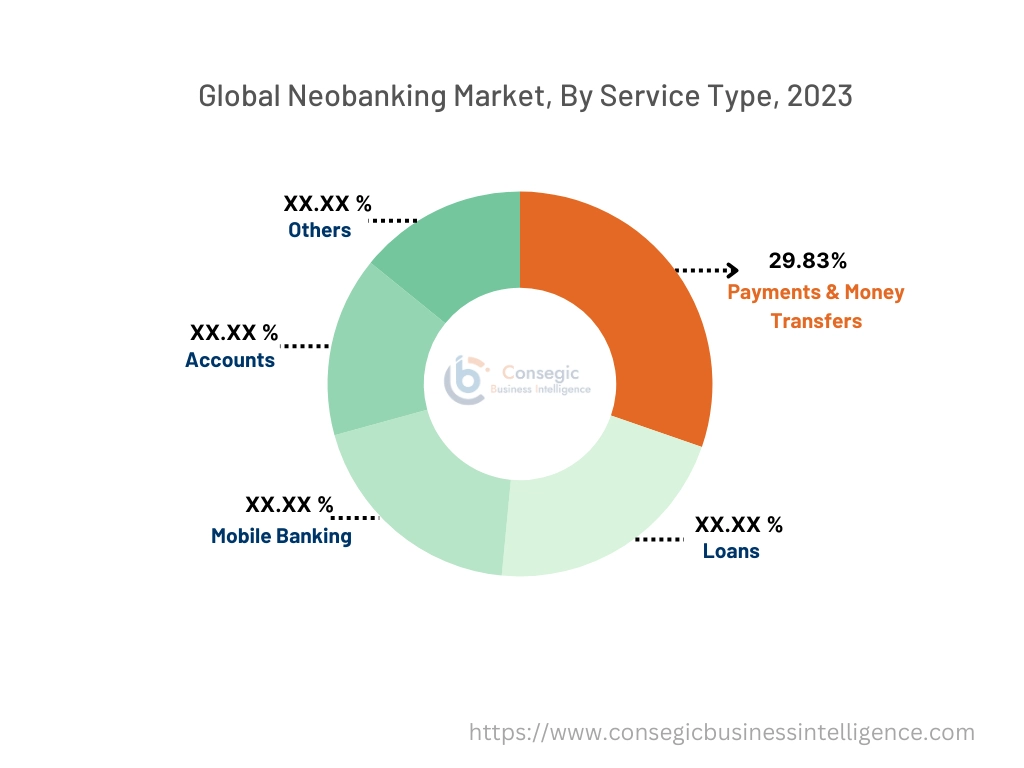

By Service Type:

Based on service type, the market is segmented into payments & money transfers, loans, mobile banking, accounts, and others.

Trends in the Service Type:

- Mobile banking services make it easier for users to utilize banking services using their screens with just one click. These services include QR Payments, setting transaction limits, and investing in funds.

- The ease of access has made transactions seamless, allowing users to transfer money across the world without having to pay any additional charges.

The payments & money transfers segment accounted for the largest revenue of 29.83% of the neobanking market share in 2023.

- Since payments & money transactions are the basis of neobanking, all transactions including international and national are extremely fast.

- Instant payment methods and fund transfers make the process of transferring money seamless and attractive to consumers.

- Moreover, other than providing biometric authentication and muti-layered encryption, neobanks can handle transactions that are large in volume.

- In September 2022, Revolut introduced an instant card transfer feature that allows users to transfer money from their bank account directly to their relative's or friends' cards using just the card number. Users don't need to worry about account details, exchange rates, or currency conversion while transferring money.

- Therefore, the rising requirements for instant transfers and ease of access further accelerate the neobanking market demand.

The loans segment is anticipated to register the fastest CAGR during the forecast period.

- Neobanks provide multiple categories of consumers ranging from individual and startup loans, as well as a few underbanked communities.

- They require photo ID, Aadhaar card, and other documents to perform online verification of identity and ensure secure bank transfer.

- The AI-powered credit assessment systems of these banks have made the process of analyzing customer data and financial history much faster, thereby resulting in more accurate and rapid lending decisions.

- For instance, N26 Credit provides instant quotes directly within the N26 app for loans between €1,000 and €50,000. Consumers don't have to go through the hassle of physically signing documents; they can complete the paperwork digitally.

- As per the market analysis, AI-enabled processes and the requirement for seamless approvals and transfers drive the neobanking market trends.

By Application:

Based on application, the market is bifurcated into personal and enterprise applications.

Trends in the Application:

- Neobanks allow enterprises to utilize several services ranging from tracking expenses, invoicing, and integration with business platforms making financial operations much more efficient.

The personal segment accounted for the largest revenue share of the global neobanking market in 2023.

- Neobanks provides multiple features including tools for budgeting finances, dashboards specifically designed for financial wellness, and notifications indicating real-time spending. These features make banking much easier and more accessible for the end-users.

- Moreover, new-age consumers, including Generation Z and millennials, find the no-fee or zero-fee deposit feature appealing. The personalization of services based on baking needs adds to the allure.

- For instance, in 2022, Monzo introduced a new feature called "targets" in trends. This feature allows the users to set monthly spending targets for multiple categories, as well as schedule payments based on those targets, making budgeting easier for individuals.

- As per the analysis, the personal segment drives the neobanking market demand, due the technological advances and low-cost deposits.

The enterprise segment is anticipated to register the fastest CAGR during the forecast period.

- Enterprises are continuously looking for cost-effective banking solutions, as well as scalable in nature.

- Neobanks with their increasing focus on services like processing payments in bulk, invoicing, and tracking the overall cash flow positions them to meet the growing requirements.

- Moreover, the increasing focus of Fintechs towards neobanking services for small businesses, creates more opportunities, along with tailored solutions in order to enhance business operations.

- In May 2021, Sage and Tide entered into a partnership, to provide a banking and accounting product that solves the complex process of setting up and handling banking operations for startups or small businesses.

- In conclusion, the rising requirements for affordable enterprise banking services are driving the rapid development of the enterprise segment in the market.

By Account Type:

Based on the account type, the market is bifurcated into savings and business accounts.

Trends in the Account Type:

- The new and secure integrated APIs and SDKs make the banking user journey much more seamless.

- The rising trend in AI-enabled features such as financial forecasting helps businesses, maintain their financial operations.

The savings account segment accounted for the largest revenue share of the neobanking market share in 2023.

- In terms of saving accounts, neobanks provide much higher rates of interest compared to traditional banks.

- They offer multiple features such as low-cost deposit, zero minimum balance, and tools to manage savings, which significantly appeal to the users, especially the new-age generation.

- These accounts provide customized recommendations based on the user spending habits, utilizing AI-driven features.

- For instance, the "automatic savings" feature built-in with the chime saving account, allows users to save money without the hassle of tracking it manually. This feature rounds up the money spent and transfers that amount from the checking account to the savings account.

- In conclusion, the surge in the neobanking accounts for the increasing demand for saving accounts among the younger generation.

The business account segment is anticipated to register the fastest CAGR during the forecast period.

- The rising trend in business towards customized financial solutions, based on the business needs and goals making financial operations and management much easier. Neobanks with their flexible features cater to these needs at an affordable rate.

- The services offered include processing payroll in a single tap, without any additional steps, dashboards that provide various business insights, and access to a dedicated marketplace.

- For instance, Bunq's business account offers various features, including budgeting tools, contactless payments, AutoVat, and easy sharing of the account with co-directors. These features allow businesses to operate seamlessly, reducing the hassle of managing financial operations.

- In conclusion, the demand for personalized and informed banking solutions drives the neobanking market trends.

Neobanking Market Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

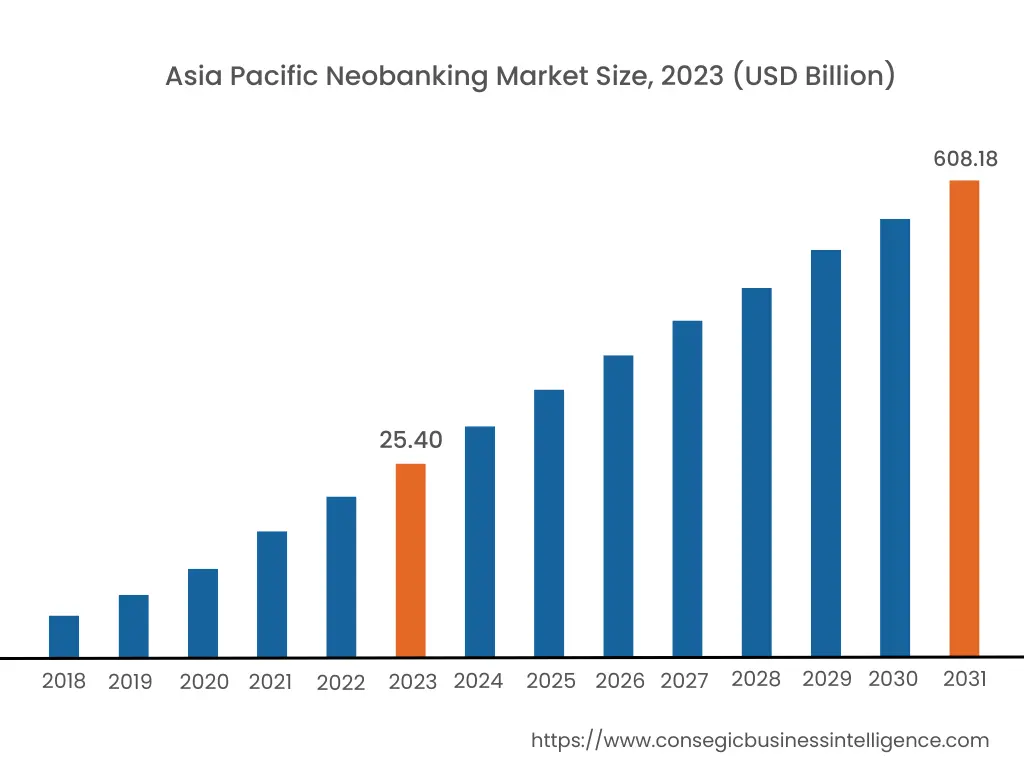

Asia Pacific region was valued at USD 25.40 Billion in 2023. Moreover, it is projected to grow by USD 37.24 Billion in 2024 and reach over USD 608.18 Billion by 2031. Out of this, China accounted for the maximum revenue share of 31.8%.

This is driven by the demand for easy-to-use banking services and informed financial solutions. Additionally, countries like Japan, China, and India are increasingly inclined toward these services due to the rising prevalence of advanced banking solutions among the youth, further accelerating neobanking market expansion in the region.

- In 2021, YouTrip, an Asian neo-bank, raised US$30 million in Series A funding to expand its B2B offerings. They will also expand their offerings to wider Southeast Asia, improving its overall profile by allowing cross-border payments.

North America is estimated to reach over USD 841.63 Billion by 2031 from a value of USD 38.06 Billion in 2023 and is projected to grow by USD 55.42 Billion in 2024. This market growth is driven by the increasing shift towards AI-driven solutions provided by the neobanks, which further makes banking easier and accessible for everyone. Additionally, the region's increasing investment in fintech companies further drives the market.

- In 2022, Winden an American fintech startup secured $5.3M in seed funding, in order to support the expansion of financial operations.

The analysis shows that the increasing number of fintech partnerships and the adoption of innovative and advanced technologies are driving the growth of the market in Europe. Additionally, the surge in the adoption of cashless transactions and regulatory support by the government contributes to this growth.

Over the years, the Middle East, Africa, and Latin America are expected to experience significant growth. This growth can be attributed to the increasing shift toward online banking services and the adoption of cashless payment technologies. Moreover, the growth in financial literacy and the adoption of mobile banking options bolsters neobanking market expansion.

Top Key Players & Market Share Insights:

The neobanking market is highly competitive with major players providing neobanking to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the industry. Key players in the neobanking industry include -

- Starling Bank (UK)

- Movencorp Newco Inc. (US)

- Chime Financial, Inc. (U.S.)

- N26 AG (Germany)

- Upgrade, Inc. (U.S.)

- Revolut Ltd (U.K.)

- Atom Bank (U.K.)

- PRETA S.A.S. (France)

- Nu Pagamentos S.A (Brazil)

- Social Finance, LLC (U.S.)

- Varo Bank, N.A. (U.K.)

- Monzo Bank Limited (U.K.)

- Banco Bilbao Vizcaya (U.S)

Recent Industry Developments :

Product Launches:

- In July 2024, a digital bank Neo was launched by bank Audi in Lebanon. The services range from dual-currency bank accounts to physical and virtual debit cards, bill payment management tools, and QR code-enabled transfers.

- In September 2023, MSMEs, will provide a platform to perform various operations such as bulk payment, transaction tracking, auto reconciliation, etc.

Mergers and Acquisitions:

- In March 2024, neobank Novus was acquired by Paynetics, aiming to expand ESG goals and hence enhance the ecosystem throughout Europe.

- In May 2023, neobank Kinly was acquired by Greenwood. This acquisition aims to serve the underserved communities and expand the services to cater to their needs.

Product Enhancements:

- In June 2024, the neobank Bunq partnered with Mastercard and Nvidia, aiming to enhance the user banking journey and address the issue of fraudulent activities.

Neobanking Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 2,431.75 Billion |

| CAGR (2024-2031) | 47.7% |

| By Service Type |

|

| By Application |

|

| By Account Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Neobanking Market? +

Neobanking Market size is estimated to reach over USD 2,431.75 Billion by 2031 from a value of USD 107.61 Billion in 2023 and is projected to grow by USD 156.97 Billion in 2024, growing at a CAGR of 47.7% from 2024 to 2031.

What specific segmentation details are covered in the neobanking market report? +

The neobanking market report includes specific segmentation details for the service type, application, account type, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the service type segment, the loans segment is the fastest-growing segment during the forecast period due to the requirement for seamless approvals and transfers.

Who are the major players in the neobanking market? +

The key participants in the neobanking market are Starling Bank (U.K.), Chime Financial, Inc. (U.S.), N26 AG (Germany), Movencorp Newco Inc. (U.S), Upgrade, Inc. (U.S.), Nu Pagamentos S.A (Brazil), Social Finance, LLC (U.S.), Varo Bank, N.A. (U.K.), Monzo Bank Limited (U.K.), PRETA S.A.S. (France), Revolut Ltd (U.K.), Atom bank (U.K.), Banco Bilbao Vizcaya (U.S.)