Online Banking Market Introduction :

Online Banking Market size is estimated to reach over USD 48,820.39 Million by 2031 from a value of USD 16,819.81 Million in 2023, growing at a CAGR of 14.2% from 2024 to 2031.

Online Banking Market Definition & Overview:

Online banking, also known as Internet banking, refers to an electronic payment system that enables users to conduct financial transactions through the Internet. It provides users with a range of services that are traditionally available through a local bank branch including transfers, deposits, and online bill payments. Moreover, based on the analysis, it offers a range of benefits including quick fund transfer, 24/7 availability, ease of operations, activity tracking, increased convenience, and others. The above benefits of banking are key determinants for increasing its utilization for corporate banking, retail banking, and investment banking among others.

How is AI Impacting the Online Banking Market?

AI is reshaping online banking by enhancing security, personalizing customer experiences, and streamlining operations. AI-powered fraud detection systems analyze real-time transaction patterns to identify and prevent illicit activities with unprecedented accuracy, minimizing financial losses. Furthermore, AI-driven chatbots and virtual assistants provide 24/7 instant support, handling routine queries and offering tailored financial advice, significantly improving customer satisfaction and engagement. Internally, AI optimizes credit scoring and loan approvals by analyzing vast datasets, leading to faster and more inclusive lending decisions. It also automates compliance processes like KYC and AML, reducing manual errors and operational costs.

Global Online Banking Market Insights :

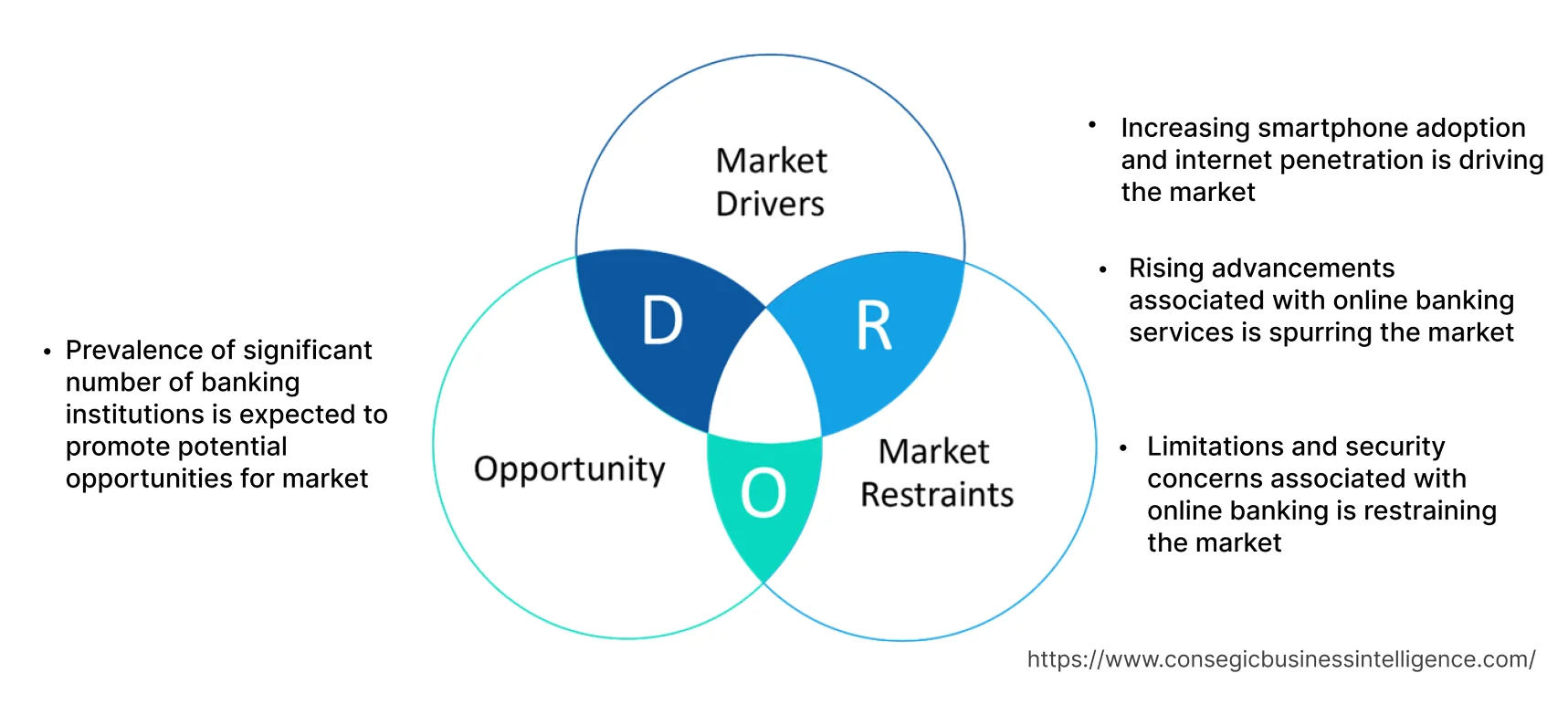

Online Banking Market Dynamics - (DRO) :

Key Drivers :

Increasing smartphone adoption and internet penetration is driving the market

The rising number of smartphone users worldwide and increasing penetration of internet has led to a significant increase in demand for online banking market. Moreover, several banks offer real-time payment options, features of bill payments, routine banking activities, and others, through online mobile banking applications. As a result, the rising adoption of smartphones and increasing internet penetration is driving the online banking market demand.

Moreover, as per the analysis, factors including increasing pace of digitalization in banking sector, growing smartphone users, and rising internet penetration are key determinants for driving the adoption of banking services.

For instance, according to GSM Association, smartphone adoption in the European region is estimated to reach 83% by 2025, demonstrating an increase from 79% in 2021. Additionally, smartphone adoption in Asia-Pacific region is expected to increase up to 84% by 2025, signifying a rise from 74% in 2021.

Further, according to International Telecommunication Union, approximately 5.3 billion individuals worldwide use internet as of 2022, representing 66% of the world's population while depicting a growth rate of 6.1% over 2021.

Hence, the rising adoption of smartphones and increasing internet penetration is driving the adoption of these banking for real-time payment options, routine these banking activities, and others, thereby, fostering the market trends and opportunities.

Rising advancements associated with online banking services is spurring the market

A broad range of banks and financial institutions are undergoing digital transformation to provide a range of these banking services to meet the growing consumer demand for internet banking. Hence, banking institutions are launching internet banking services with updated features and advancements.

For instance, in July 2023, Citi Bank launched its new CitiDirect commercial banking platform that is particularly designed to address the needs of Citi commercial bank clients. CitiDirect commercial banking platform integrates Citi's global products and services into a single digital platform, while providing customers with a consolidated view of their banking relationship across loans, cash, trade, servicing and other assets.

Additionally, as per the analysis in October 2023, ICICI Bank launched iFinance, which enables users to obtain a consolidated view of their savings and current accounts in one place. ICICI users can access the one-view dashboard on ICICI Bank's mobile banking and online banking platforms. Therefore, rising advancements associated with banking services trends are stimulating the demand of the market.

Key Restraints :

Limitations and security concerns associated with online banking is restraining the market

The implementation of banking is usually associated with certain limitations and security concerns, which are primary factors limiting the market.

For instance, online banking platforms are highly prone to frequent service disruptions and technical issues as it significantly relies on the internet. An unstable internet connection can hinder the user's ability to access accounts online. Similarly, as per the analysis, users cannot access online banking platforms if bank's servers crash or become momentarily inaccessible due to planned site maintenance.

Additionally, these banking platforms are usually associated with deposit restrictions. Individuals, particularly enterprises, often face challenges to make significant online deposits due to daily or monthly mobile deposit restrictions.

Further, these banking platforms are susceptible to concerns associated with identity theft and security. The possibilities of unauthorized access to users banking account through hacked login credentials generates security concerns among banking users. Therefore, the aforementioned limitations and security concerns associated with these banking are constricting the online banking market trends.

Future Opportunities :

Prevalence of significant number of banking institutions is expected to promote potential opportunities for market

The prevalence of significant number of banking institutions is anticipated to present potential opportunities for the growth of the online banking market. Banks are among the primary providers of banking services and trends. Most of the banking firms offer a range of banking services including transactional services, informational services, and communicative services to its customers.

Factors including rising digitalization of banking sector, prevalence of substantial number of banking firms, and availability of a broad range of digital banking services are providing lucrative aspects for the market.

For instance, according to Federal Deposit Insurance Corporation (FDIC), United States comprised of approximately 4,136 commercial banks along with 69,905 total branches across the country as of 2022.

Additionally, according to the European Union, there are approximately 5,441 banks operating in EU region, among which Germany accounted for 28% of the total number of banks in EU, followed by Poland with 11%, Austria and Italy with 9% each, and the rest in other EU member states. Hence, as per the analysis, the prevalence of significant number of banking firms is increasing the provision of these banking services, in turn promoting online banking market opportunities and online banking market trends for market during the forecast period.

Online Banking Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 (USD Million) | USD 48,820.39 Million |

| CAGR (2023-2031) | 14.2% |

| By Service Type | Informational Services, Transactional Services, and Communicative Services |

| By Banking Type | Corporate Banking, Retail Banking, and Investment Banking |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Fiserv Inc., EdgeVerve Systems Limited, Capital Banking Solutions, CGI Inc., Oracle Corporation, ACI Worldwide, Temenos Headquarters SA, Broadridge Financial Solutions Inc., Finastra, Sopra Banking Software |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Online Banking Market Segmental Analysis :

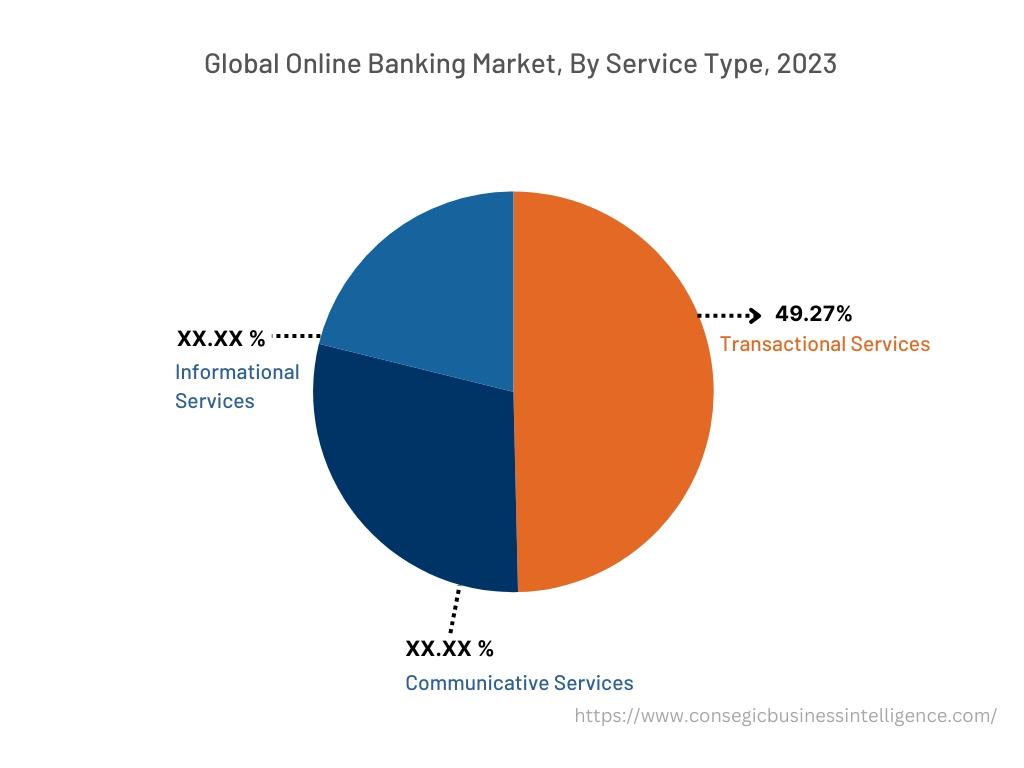

Based on the Service Type :

Based on the service type, the market is bifurcated into informational services, transactional services, and communicative services, and others. The transactional services segment accounted for the largest revenue share of 49.27% in the year 2023. Transactional services deal with all the money-based or payment transactions. It enables users to conduct money-based transactions such as fund transfers, utility bill payments, creating term deposits, credit card bill payments, and investing in market securities.

For instance, Fiserv Inc., is a provider of these banking that offers transactional services in its portfolio. The company offers digital payment solutions to deliver innovative real-time payment options that grow revenue, manage costs and mitigate risks. Thus, based on the analysis, the increasing advancements associated with online transactional services are among the prime factors driving the segment.

The communicative services segment is anticipated to register fastest CAGR during the forecast period. Communicative services enable users to perform simple, communicative functions such as applying for several services including loans or raising queries regarding account balances. Communicative services enables communication between the bank and customer through virtual chat bots. The chat bots are equipped with general information and redirects users to the customer care department if required. Communicative services also enable users to make inquiries associated with fund transfers, minimum balance requirements, types of bank accounts and cards provided, and others.

For instance, ICICI Bank offers iPal Chatbot, which is a multi-channel bot that is developed to support users banking queries. The iPal chatbot can be accessed on multiple channels such as these banking and iMobile app. Therefore, rising progressions associated with communicative services for improved banking experience is anticipated to boost the growth of the segment during the forecast period.

Based on the Banking Type :

Based on the banking type, the market is segregated into corporate banking, retail banking, and investment banking. The retail banking segment accounted for the largest online banking market share in the year 2023. Online retail banking includes banking services such as funds transfers, account opening, loans, bank card application, and others, integrated in a branchless, online method. Moreover, online retail banking offers several benefits including increased convenience, faster customer acquisition, faster rollout of new products and services, enhanced customer experience, and others.

For instance, PNB bank offers online retail banking in its service portfolio. PNB online retail banking provides secure and convenient access to user's accounts, fund transfer service, online opening and modification of fixed deposits, card-related services, and various other services. Hence, the prevalence of significant number of banking/financial institutions providing online retail banking solutions is driving the market.

Corporate banking segment is expected to witness significant CAGR during the forecast period. Online corporate banking refers to a self-service banking system that is backed by network technologies for fulfilling the diversified demands of corporate customers. Online corporate banking offers several financial services to its corporate customers including account management, payment, cash management, group wealth management, salary distribution, investment and wealth management, and others.

For instance, Finastra is a banking solution provider that offers corporate digital banking platform for delivery of a unified and consistent banking for corporate customers. The online corporate banking platform offers a range of services including trade and supply chain finance, cash and liquidity management, treasury services, and others. Thus, the increasing development associated with online corporate banking solutions is expected to boost the market during the forecast period.

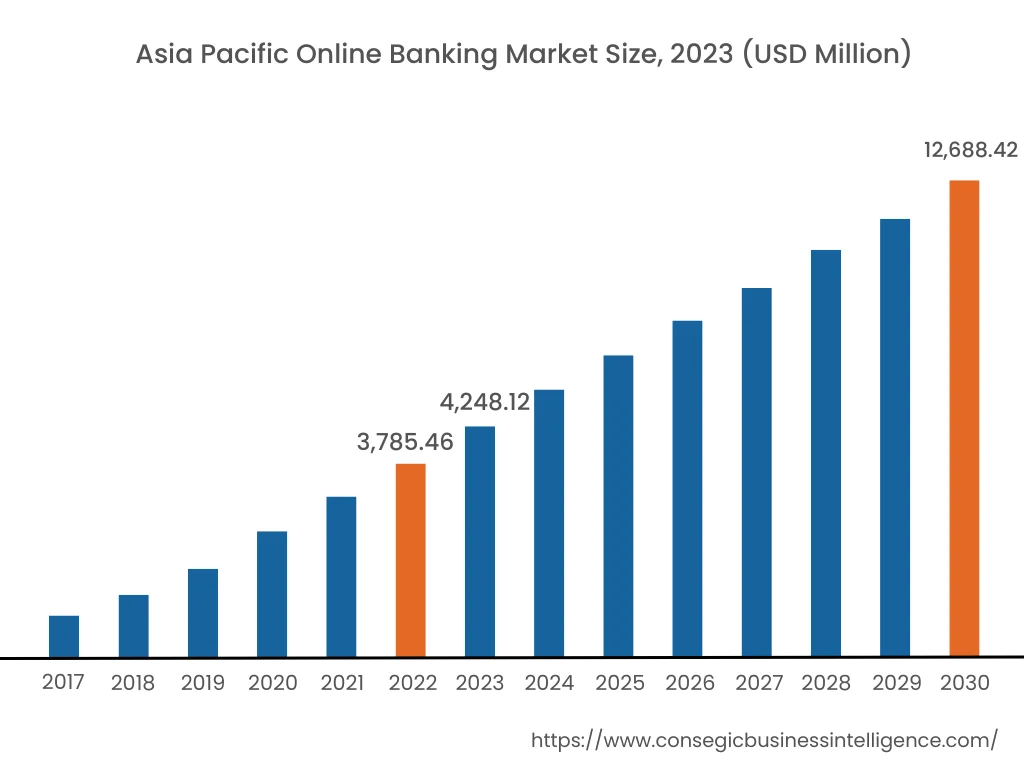

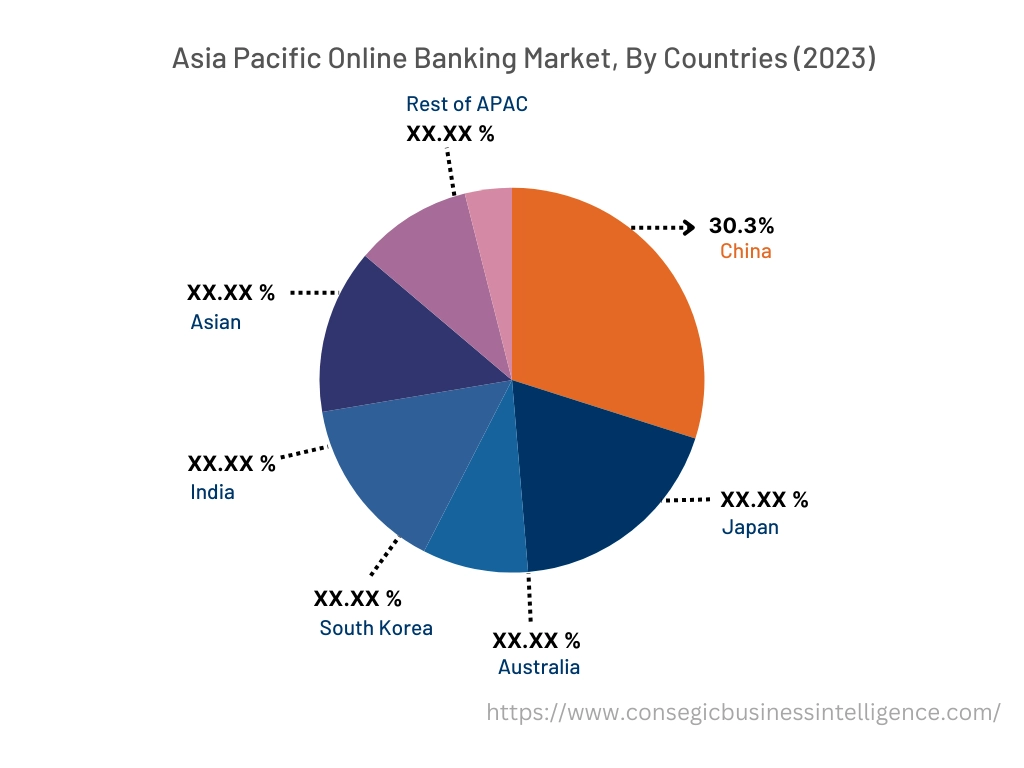

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific accounted for the revenue share of USD 4,248.12 Million in 2023 and is expected to reach USD 12,688.42 Million by 2031, registering a CAGR of 14.7% during the forecast period. In addition, in the region, the China accounted for the maximum revenue share of 30.3% in the same year.

The growing pace of digitalization and development is providing lucrative growth prospects for the market in the region. In addition, factors including the presence of substantial number of banking/financial institutions, along with rising popularity of digital payments and online fund transfer are driving the online banking market trends in the Asia-Pacific region.

For instance, according to Invest India, there are approximately 123,000 bank branches across India as of March 2022. Banks are among the primary providers of these banking services that offer transactional services, informational services, and communicative services to its customers. Therefore, the growth of banking/financial institutions is projected to boost the market growth in the Asia-Pacific region during the forecast period.

North America is expected to register CAGR of 14.4% during the forecast period. The market in North America is primarily driven by the prevalence of significant number of players that offer these banking solutions in the region including Fiserv Inc., CGI Inc., ACI Worldwide, Broadridge Financial Solutions Inc., and others.

Moreover, the increasing expansion of banking firms has been a prevalent factor for market growth in the region.

For instance, in July 2022, Citi Bank launched its Citi Commercial Bank in Canada, with the aim of expanding its presence in the North American region. Citi Commercial Bank delivers a broad range of institutional products and solutions including a banking platform in its portfolio. Thus, as per the online banking market analysis, the above factors are proliferating the online banking market growth and trends in North America.

Top Key Players & Market Share Insights :

The global online banking market is highly competitive with major players providing the online banking industry to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and software type launches to hold a strong position in online banking market. Key players in the online banking market include-

- Fiserv Inc.

- EdgeVerve Systems Limited

- CGI Inc.

- Oracle Corporation

- ACI Worldwide

- Capital Banking Solutions

- Temenos Headquarters SA

- Broadridge Financial Solutions Inc.

- Finastra

- Sopra Banking Software

Recent Industry Developments :

- In April 2022, Fiserv Inc. completed the acquisition of Finxact. The acquisition aims at accelerating the ability for fintechs and financial institutions to deliver digital banking experiences to its customers.

Key Questions Answered in the Report

What is online banking? +

Online banking, also known as internet banking, refers to an electronic payment system that enables users to conduct financial transactions through the Internet.

What specific segmentation details are covered in the online banking report, and how is the dominating segment impacting the market growth? +

For instance, by service type segment has witnessed transactional services as the dominating segment in the year 2023, owing to the increasing adoption of online bill payments, fund transfers, and others.

What specific segmentation details are covered in the online banking market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by banking type segment has witnessed corporate banking as the fastest-growing segment during the forecast period due to increasing advancements associated with online corporate banking solutions for fulfilling the diversified demands of corporate customers.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2024-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rising pace of digitalization, presence of substantial number of banking/financial institutions, along with rising popularity of digital payments and online fund transfer among others.