Electronic Expansion Valve Market Size :

Electronic Expansion Valve Market is estimated to reach over USD 1,279.12 Million by 2030 from a value of USD 673.72 Million in 2022, growing at a CAGR of 8.6% from 2023 to 2030.

Electronic Expansion Valve Market Scope & Overview:

Electronic expansion valves are a type of expansion valve designed for controlling the flow of refrigerant that enters a direct expansion evaporator. The flow of refrigerants are controlled as response to signals directed by an electronic controller. The electronic expansion valves enable more efficient and accurate operation of the refrigeration systems. The valves offer a range of benefits including ease of installation, precise control, fast and accurate response to load change, and energy savings among others. The aforementioned benefits of electronic expansion valves are key determinants for increasing its deployment in the automotive, residential, commercial, and industrial sectors.

Electronic Expansion Valve Market Insights :

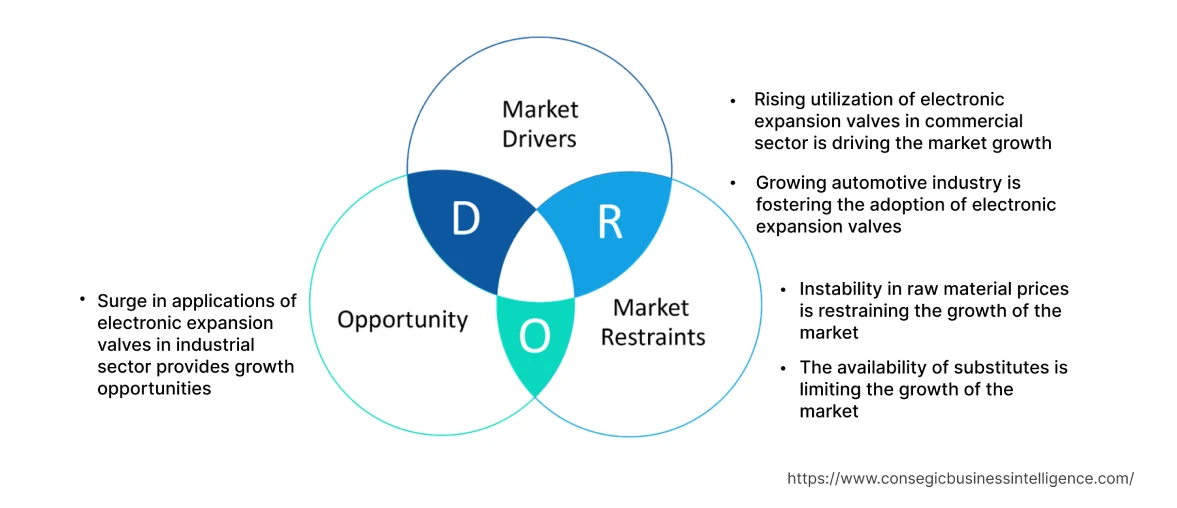

Electronic Expansion Valve Market Dynamics - (DRO) :

Key Drivers :

Rising utilization of electronic expansion valves in commercial sector is driving the market growth

Electronic expansion valves are primarily utilized in the commercial sector including offices, hotels, airports, hospitals, restaurants, educational institutes, and others for heat pumps and air conditioning applications. Moreover, the ability of electronic expansion valves to precisely control the flow of refrigerant into the evaporator system makes it ideal for utilization in air conditioners and heat pumps installed in commercial buildings.

Factors including the growing pace of urbanization, increasing construction of commercial buildings, and rising installation of air conditioning systems in commercial spaces are major factors driving the adoption of electronic expansion valves.

For instance, in June 2021, Securonix Inc. opened a new commercial office space in Tokyo, Japan with the motive of expanding presence in the Asia-Pacific region. Thus, the rising development of new commercial spaces is driving the adoption of electronic expansion valves for utilization in air conditioning systems and heat pumps installed in commercial buildings, in turn driving the growth of the market.

Growing automotive industry is fostering the adoption of electronic expansion valves

Electronic expansion valves are used in the automotive industry, particularly for applications in automobile HVAC (heating, ventilation, and air conditioning) to ensure thermal comfort in vehicles. Moreover, electronic expansion valve helps in controlling the drop in pressure in the car AC system required for the evaporation of the refrigerant and generation of cold air.

Factors including increasing automobile production and rising installation of HVAC systems in automobiles are among the key factors driving the market growth of electronic expansion valves.

According to the International Organization of Motor Vehicle Manufacturers, the total automobile production in the European region reached 13,801,210 units in 2022, depicting an increase of 5% from 13,129,583 units in 2021. Hence, the growing automotive industry is fueling the adoption of electronic expansion valves for application in automobile HVAC systems and heat pumps, thereby proliferating the growth of the market.

Key Restraints :

Instability in raw material prices is restraining the growth of the market

A The overall cost of electronic expansion valves is primarily dependent on the cost of production, followed by the cost of raw materials including steel, copper, brass, and others. As a result, fluctuations in the prices of raw materials impact the overall cost of electronic expansion valves, which is a prime factor restricting the growth of the market.

For instance, according to MEPS International Ltd., the average price of steel in North America reached approximately USD 1,548 per ton in May 2022, witnessing an increase of 23.2% in comparison to February 2022. Additionally, steel prices declined to USD 848 per ton by October 2022. Further, according to the Knoema Corporation, the average price of copper reached approximately USD 10,512 per metric ton in May 2021, demonstrating a significant growth of over 100% in comparison to March 2020. Hence, the instability in prices of raw materials including steel, copper, and others that are used in the production of electronic expansion valves is restraining the growth of the market.

The availability of substitutes is limiting the growth of the market

Electronic expansion valves have various substitutes including thermal expansion valves, mechanical valves, and others. Comparatively, the substitutes have similar performance, properties, and applications, with respect to electronic expansion valves, which is a key factor restricting the market growth. For instance, thermal expansion valves act as an ideal alternative to electronic expansion valves for applications including heat pumps and air conditioning systems. Therefore, the availability of various substitutes for electronic expansion valves is limiting the growth of the market.

Future Opportunities :

Surge in applications of electronic expansion valves in industrial sector provides growth opportunities

Electronic expansion valves are widely utilized in the industrial sector for application in HVAC systems to provide cooling and ventilation to larger facilities including food processing, pharmaceutical production, chemical processing, and others. Electronic expansion valves are crucial in maintaining suitable temperature conditions to ensure safety of the industrial products and prevent energy wastage by optimizing the temperature regulation process.

Factors including the rapid pace of industrialization and rising investments in the expansion of industrial manufacturing facilities are driving the growth of the industrial sector. For instance, in June 2022, KeyPlants AB, a Swedish company launched a portable on-demand (POD) facility for pharmaceutical companies. The POD facility includes clean rooms and fabrication units and enables pharmaceutical companies to reduce the time required to set up new production, speed up the development process, and increase production flexibility.

Therefore, the rising development of industrial facilities is anticipated to increase the application of electronic expansion valves for regulating cool temperatures within industrial facilities, further providing opportunities for market growth during the forecast period.

Electronic Expansion Valve Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,279.12 Million |

| CAGR (2023-2030) | 8.6% |

| By Material | Stainless Steel, Copper, Brass, and Others |

| By End-User | Automotive, Residential, Commercial, and Industrial |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Sanhua, Danfoss, CAREL INDUSTRIES S.p.A., PARKER HANNIFIN CORP, SAGINOMIYA SEISAKUSHO, INC., Zhejiang DUNAN Artificial Environment co., LTD, Emerson Electric Co., Siemens, FUJIKOKI CORPORATION, Castel S.r.l. |

Electronic Expansion Valve Market Segmental Analysis :

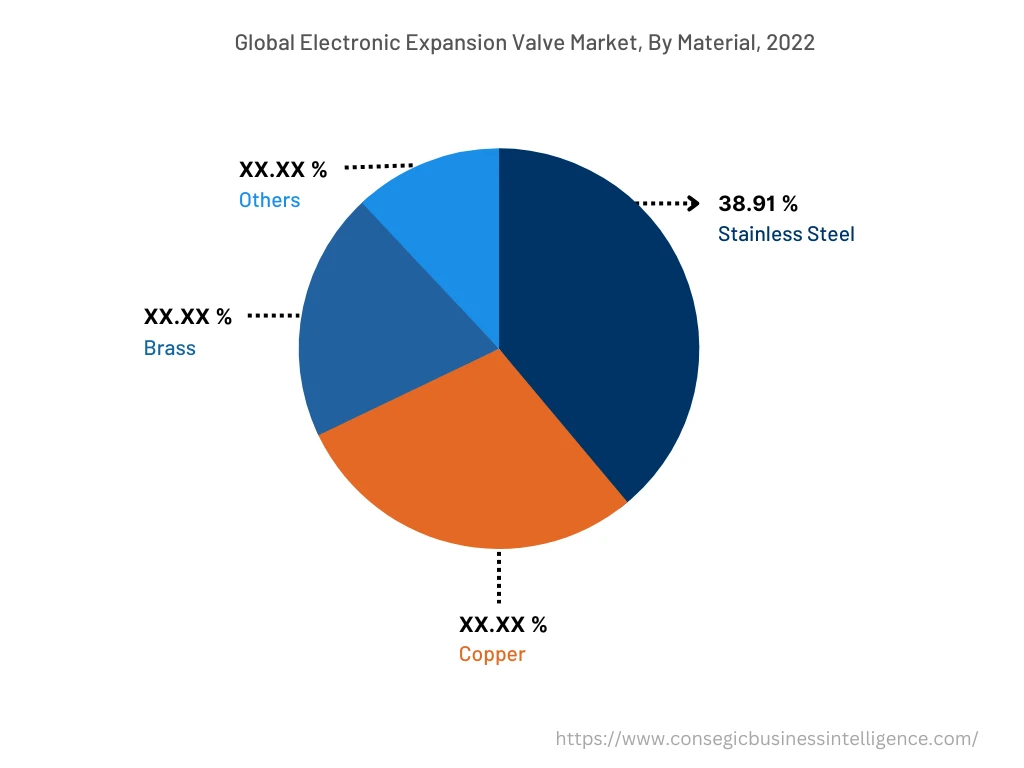

By Material :

Based on the material, the market is bifurcated into stainless steel, copper, brass, and others. The stainless steel segment accounted for the largest revenue share of 38.91% in the year 2022. Stainless steel electronic expansion valves are characterized with various benefits including higher impact resistance, high strength, and durability. Moreover, electronic expansion valves composed of stainless steel offer excellent resistance to high and low temperatures, high resistance to corrosion and other deposits or residues, along with the capability to endure heavy usage. The above benefits of stainless steel electronic expansion valves are increasing its utilization in automotive and industrial sectors among others.

According to the China Association of Automobile Manufacturers, the total production of passenger cars in China reached up to 2.39 million units in January-August 2022, witnessing a YoY growth of 38.3%. Hence, the growth of automotive sector is among the key factors driving the application of stainless steel electronic expansion valves in automobile heat pumps and air conditioning systems, in turn contributing to the growth of the market.

The copper segment is anticipated to register fastest CAGR growth during the forecast period. Copper is mainly used as an electronic expansion valve material, attributing to its high electrical conductivity, heat resistance, and corrosion resistance properties. In addition, copper also offers a range of benefits including high malleability, ductility, and others, which are prime determinants increasing its utilization in electronic expansion valves. Further, copper electronic expansion valves are mainly utilized for air conditioning applications in commercial and industrial sectors among others.

In October 2022, Binance Holdings Ltd., a global company launched two new commercial offices in Sao Paulo and Rio de Janeiro city of Brazil, intending to expand presence in the Latin American region. Therefore, the expansion of new commercial spaces is driving the adoption of copper electronic expansion valves for deployment in air conditioning systems and heat pumps installed in commercial buildings, thereby, driving the market growth during the forecast period.

By End-User :

Based on the end-user, the market is segregated into automotive, residential, commercial, and industrial. Commercial segment accounted for the largest revenue share in the year 2022. Factors including the significant investments in commercial construction and increasing utilization of electronic expansion valves for air conditioning applications in commercial buildings are major factors driving the growth of the commercial segment.

According to CoreLogic Inc., the sales of commercial property in the U.S. witnessed substantial growth in 2021. The sales of commercial properties including offices, retail, hotel, and others increased by 16% during the second quarter of 2021 as compared to 2019. Hence, the growing commercial sector is driving the demand for electronic expansion valves in heat pumps and air conditioning systems installed in commercial buildings. The above factors are further driving the growth of the market.

Further, the automotive segment is expected to witness the fastest CAGR growth during the forecast period. The growth of the automotive segment is attributed to several factors including the rising automobile production and growing adoption of electric vehicles.

According to the OICA (International Organization of Motor Vehicle Manufacturers), the total automobile production worldwide reached 85.02 million in 2022, witnessing an increase of 6% in comparison to 2021. Hence, the rising automotive production is driving the adoption of electronic expansion valves for utilization in automotive air conditioning systems to optimize temperature control within automobiles, in turn fostering market growth during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share of 34.21% in 2022, registering a CAGR of 8.8% during the forecast period (2023-2030). The adoption of electronic expansion valves in the North American region is primarily driven by its usage in the automotive and commercial sectors among others. The deployment of electronic expansion valves in commercial sectors including offices, educational institutions, hotels, and others to precisely control the flow of refrigerants in air conditioning systems installed in commercial buildings is a major factor for market growth in the region.

Additionally, the rising automotive production in the region is driving the market demand for electronic expansion valves for utilization in automobile HVAC and heat pumps. For instance, according to OICA (International Organization of Motor Vehicle Manufacturer), the total automobile production in Canada reached 12,28,735 units in 2022, depicting an increase of 10% in comparison to 2021. The above factors are further anticipated to drive the market demand in North America during the forecast period.

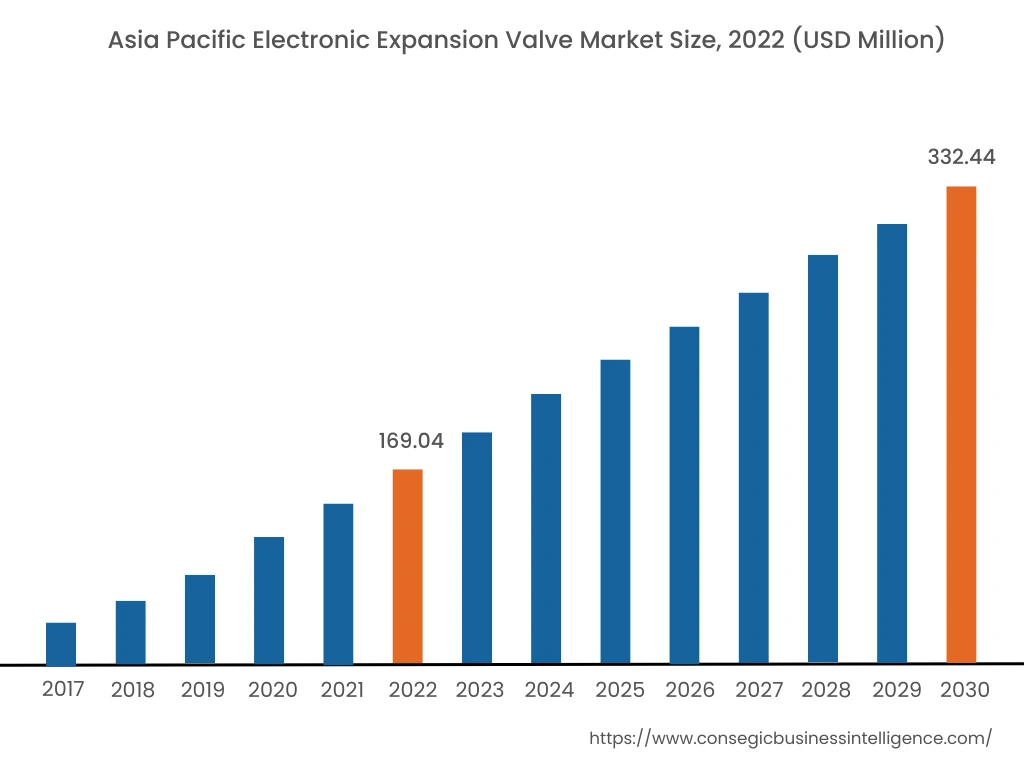

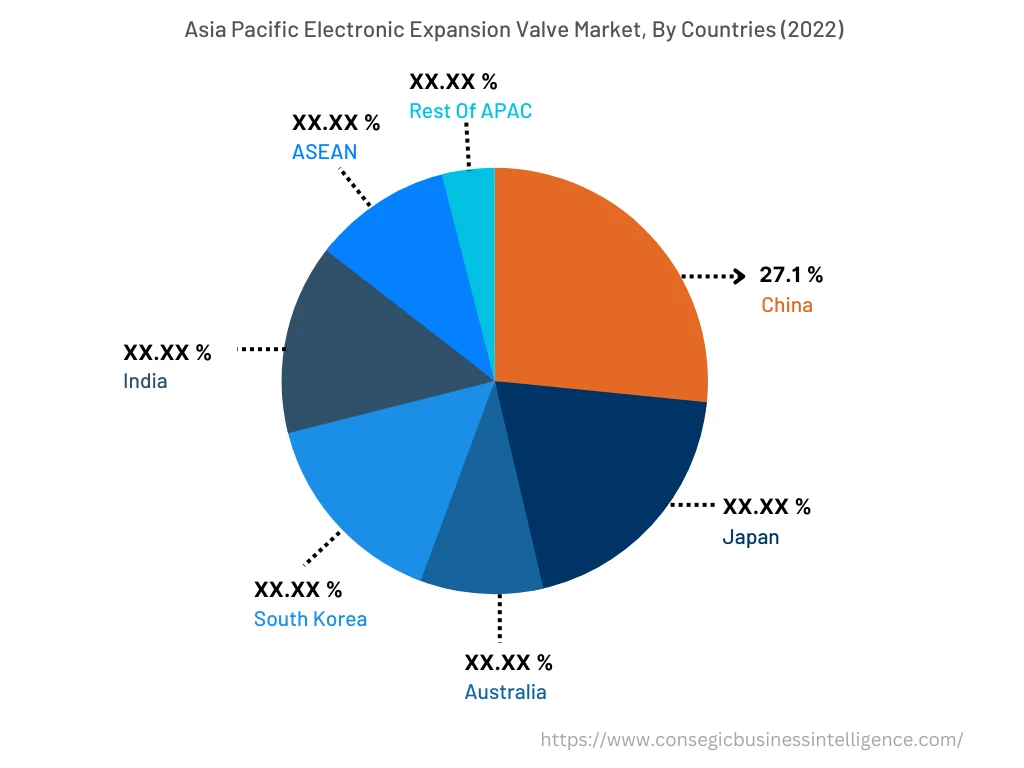

Asia-Pacific accounted for USD 169.04 million in 2022 and is expected to reach USD 332.44 million by 2030. Further the market witnessed a CAGR of 9.1% during the forecast period (2023-2030). In addition, in the region, the China accounted for the maximum revenue share of 27.1% in 2022. The rapid pace of industrialization and development is fostering lucrative opportunities for market growth in the region. Moreover, the growing building & construction activities and the rising automobile production is stimulating market growth for electronic expansion valves in the Asia-Pacific region.

For instance, according to the Building and Construction Authority of Singapore, the total construction demand including residential, commercial, and industrial buildings in Singapore is estimated to reach between USD 27 billion to USD 32 billion by the end of 2023, depicting a significant growth in comparison to 2020. Hence, the growing residential, commercial, and industrial construction in the region is expected to drive market growth in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights:

The electronic expansion valve market is highly competitive with major players providing electronic expansion valves to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in electronic expansion valve market. Key players in the electronic expansion valve market include -

- Sanhua

- Danfoss

- CAREL INDUSTRIES S.p.A.

- PARKER HANNIFIN CORP

- SAGINOMIYA SEISAKUSHO, INC.

- Zhejiang DUNAN Artificial Environment co., LTD

- Emerson Electric Co.

- Siemens

- FUJIKOKI CORPORATION

- Castel S.r.l.

Recent Industry Developments :

- In March 2022, Danfoss launched an electronic expansion valve that is designed to enhance efficiency in heat pumps and IT cooling. The electronic expansion valve offers high accuracy, energy efficiency, and performance.

Key Questions Answered in the Report

What is electronic expansion valve? +

Electronic expansion valve is a type of expansion valve designed for controlling the flow of refrigerant that enters a direct expansion evaporator as response to signals directed by an electronic controller.

What specific segmentation details are covered in the electronic expansion valve report, and how is the dominating segment impacting the market growth? +

The report consists of segments including material and end-user. Each segment has key dominating sub-segment being driven by the industry trends and market dynamics. For instance, by material segment has witnessed stainless steel as the dominating segment in the year 2022, owing to its increasing utilization in automotive and industrial sectors among others.

What specific segmentation details are covered in the electronic expansion valve market report, and how is the fastest segment anticipated to impact the market growth? +

By end-user segment, automotive segment witnessed as the fastest-growing segment during the forecast period due to the rising adoption of electronic expansion valves in automobile air conditioning systems and heat pumps.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and rising building and construction activities.