Industrial Food Cutting Machines Market Introduction :

Industrial Food Cutting Machines Market size is estimated to reach over USD 3,672.93 Million by 2032 from a value of USD 2,437.40 Million in 2024 and is projected to grow by USD 2,522.18 Million in 2025, growing at a CAGR of 5.30% from 2025 to 2032.

Industrial Food Cutting Machines Market Definition & Overview :

An industrial food cutting machines are equipment used to process large quantities of food items effectively and efficiently. Food cutting machines are widely used for slicing food into appropriate shapes in large scale food industries. Fruits and vegetables, fish, meat, and seafood among others are sliced into strips and cubes according to the requirements using these machines including food dicers, food shredders, food slicers, and more. These machines are widely used for their hygienic and easy to clean operations. The goods processed by these machines are shipped to various places like grocery stores and restaurants for consumer consumption. These machines are used to make sure that processed food has consistent portioning and sizing, which results in maintenance of uniform quality and quality of processed food item.

Industrial Food Cutting Machines Market Insights :

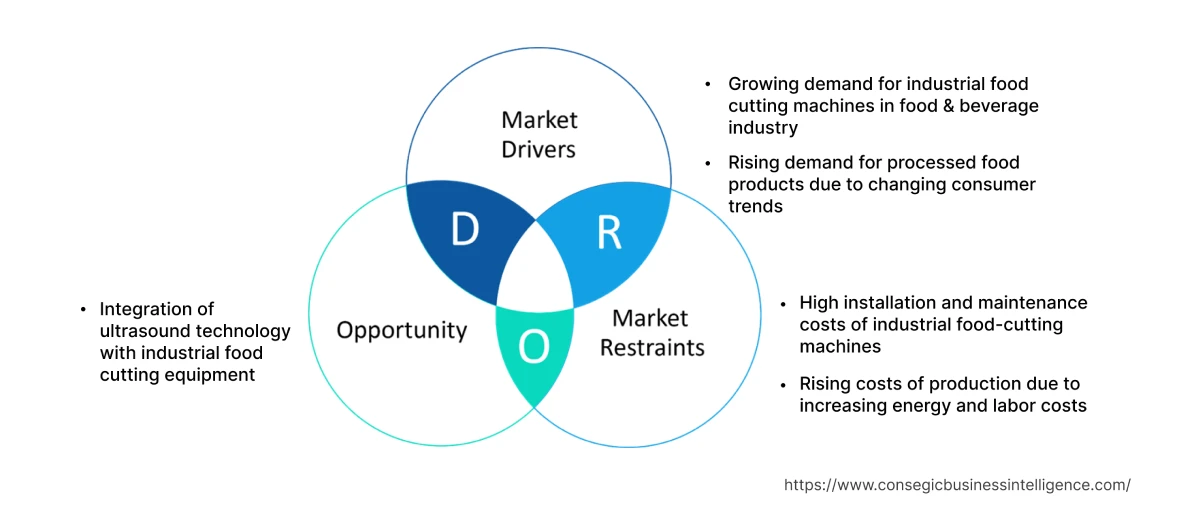

Industrial Food Cutting Machines Market Dynamics - (DRO)

Key Drivers :

Growing food & beverage industry Fuels the Market Growth

Industrial food cutting machines are widely used in the food beverage sector for diverse range of applications including slicing, chopping, crumbling, grating, shredding, mixing, and dicing among others. The food cutting machines tend to process large amounts of food items cleanly and quickly. Additionally, these machines are easy-to-clean and hygienic, this in turn is driving the adoption of the machines in the food & beverage sector. Moreover, the surge in trend towards automation is another key factor that is positively impacting the adoption of food cutting machines to ensure efficient and fast manufacturing processes. Analysis of market trends concludes that several companies are manufacturing food cutting machines specifically for processing fruits and vegetables in industries. For instance, in February 2023, KRONEN launched the KUJ HC-220 slice, cube & strip cutting machine equipped with capability of processing maximum 8,000 kg fruits and vegetables in one hour. Therefore, owing to the factors mentioned above, the growing food and beverages setor is driving the industrial food cutting machines market demand.

Rising demand for industrial cutting machines from meat processing industry Drives the Market Development

The industrial food cutting machines are used in the meat processing industry mainly for cutting meat into strips, slices, shredding, and other applications. Additionally, the food cutting machines are widely used to mince the meat into small portions for stuffing it and preparing frozen meat products including sausages, salamis, and others. For instance, SAMYANG KOREA manufactures SFH-350, a high-speed frozen meat cutter specifically designed for use in the meat processing sector. Analysis of market trends concludes that rising global meat consumption is considered to be one of the key factors that is boosting the industrial food cutting machines market demand. According to the Food & Agriculture Organization (FAO) it is estimated that by 2050 the production of animal products will be driven greatly by income and population growth. For instance, in March 2023 Nantsune launched GNS-350 Pegasus meat slicer with a 350MM feeding tank width.

Key Restraint :

High installation and maintenance costs of industrial food-cutting machines Hampers the Market Demand

The major factor restraining the growth of industrial food cutting machines is high capital expenditure required to invest in them including food dicers, grinders, and slicers. Moreover, a high level of maintenance is also required to check the efficient functioning of these machines. Additionally, the growing requirement for skilled labor to operate food cutting machines further adds to the cost of these machines, thereby restraining the adoption of the machines in small and mid-ranged industries.

Future Opportunities :

Integration of ultrasound technology with industrial food cutting equipment Opens New Doors

The integration of ultrasonic technology with industrial food cutting equipment is expected to present significant opportunities for market growth during the forecast period. The integration of ultrasonic technology with food cutting equipment is expected to provide clean, high-quality, and frictionless cutting without changing the texture and consistency of food products. Moreover, ultrasonic cutting blades consists of a low friction cutting surface that inhibits food from sticking to the blades. Thus, the incorporation of ultrasonic technology into these machines lowers down its downtime, hence emerging as one of many industrial food cutting machines market opportunities that drive market expansion during the forecast period.

Industrial Food Cutting Machines Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 3,672.93 Million |

| CAGR (2025-2032) | 5.3% |

| Based on the Product Type | Food Dicers, Food Milling, Food Shredders, Food Slicers, and Others |

| Based on the Technology | Automatic and Semi-automatic |

| Based on the Application | Fish, Fruits and Vegetables, Meat, Seafood, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Brunner-Anliker AG, Buhler AG, Cheersonic, Dadaux, Deville Technologies, EMURA Food Cutter Machine Co. Ltd, Illinois Tool Works Inc., Jaymech Food Machines Ltd., Marel TREIF GmbH, Urschel Laboratories Inc., Weber Maschinenbau GmbH |

Industrial Food Cutting Machines Market Segmental Analysis :

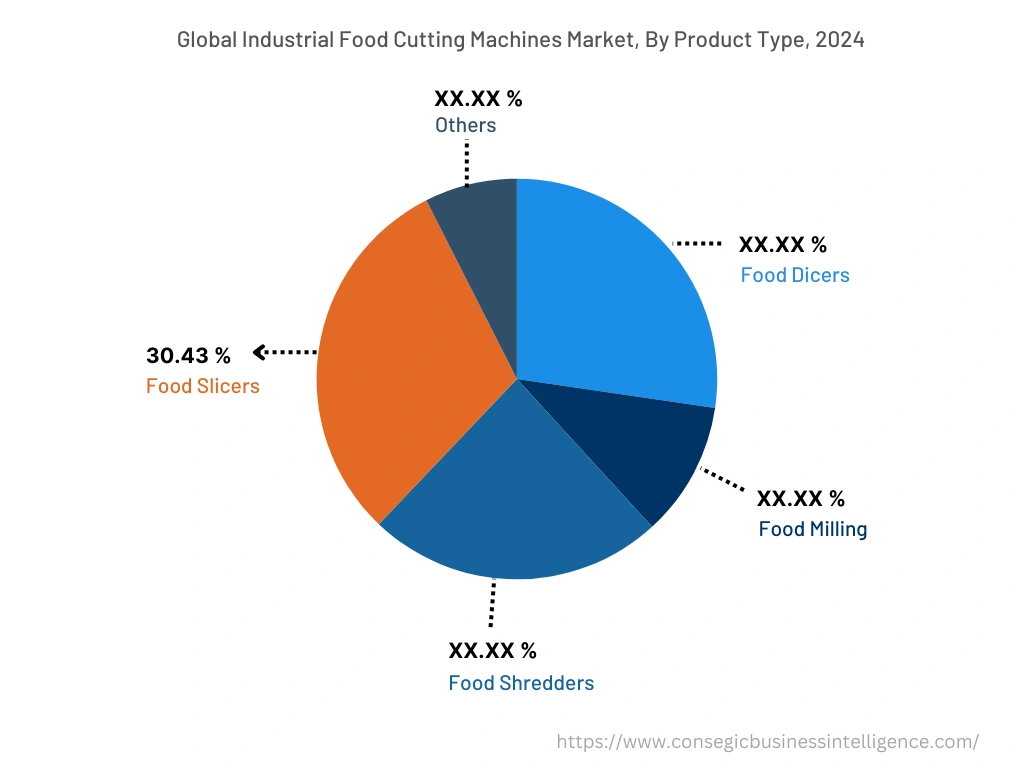

Based on the Product Type :

Based on the product type, the market is segregated into food dicers, food milling, food shredders, food slicers, and others. The food slicers segment accounted for the largest revenue share of 30.43% in the year 2024. Food and beverage firms are increasingly using food slicers to ensure product uniformity. Examination of market trends conclude that food slicers allow users to provide portion-controlled slicing by setting the slice thickness in order to yield uniform portions. Thus, food slicers are well-suited to obtain uniform slices of vegetables for grilling or garnishing. For instance, in November 2021, Hobart launched two new food slicers called Centerline by Hobart Edge10 (10-inch knife) and Edge14 (14-inch knife featuring 12 and 13-inch knives to obtain a large number of uniform slices. Therefore, the utilization of food slicers to enhance the quality of the food products is driving the industrial food cutting machines market growth.

Food dicers segment is anticipated to register fastest CAGR growth during the forecast period. The food dicers play a crucial role in speeding up the process of food production on an industrial scale. Moreover, the utilization of dicers in food and beverage sector reduces the dependence on human-staff, thereby contributing to the cost-efficiency of food production process. The industrial food cutting machines market analysis concluded that increasing necessity for fast-food delivery services in quick-service restaurants is expected to fuel the expansion of market during the forecast period.

Based on the Technology :

Based on the technology, the market is bifurcated into automatic and semi-automatic. In 2024, the semi-automatic segment accounted for the highest industrial food cutting machines market share. The semi-automatic machines allow users to speed up the process of food preparation along with satisfying customers by providing their desired food products. Analysis of market trends concludes that several benefits associated with the semi-automatic food cutting machines including increased efficiency, accuracy, and cost efficiency are driving the adoption of the machines across the food and beverage sector.

The automatic food cutting machines are anticipated to witness fastest CAGR growth during the forecast period. Automatic vegetable cutting machine offers uniform slice thickness, high cutting efficiency, good cutting quality, low energy consumption, and safety in vegetable processing plants. For instance, in February 2021, Grote Company, Inc. launched an automatic industrial slicer to increase the performance and sanitation while decreasing the total cost of food processing process. The industrial food cutting machines market analysis concluded that the ability of automatic food cutting machines to provide ease and convenience to the users is anticipated to positively impact the market growth.

Based on the Application :

Based on the application, the market is bifurcated into fish, fruits and vegetables, meat, seafood, and others. In 2024, the fruits and vegetables segment accounted for the highest industrial food cutting machines market share. These machines are used for grinding, cutting, and chopping of different types of vegetables, grains, fruits and other food products. The machines enable high performance, efficiency and are customized as per the requirements of the clients. Fruits and vegetable cutting machines comprises of a wide range of interchangeable slices, dices, blades, grates, granulates that cuts vegetables and fruits accurately and quickly without altering the natural qualities of the fruits, vegetables or any products. For instance, in February 2023, KRONEN GmbH launched an industrial food cutter called KUJ HC-220 to process fruits, vegetables, and other food products with high capacity. Therefore, the deployment of these machines in large scale food industries is contributing to industrial food cutting machines market growth.

The meat cutter segment is expected to emerge as the fastest-growing segment during the forecast period. Examination of market trends conclude that meat cutting machines are deployed in large food industries to provide accurate cutting, convenient cleaning, luxurious shape, and reliable food quality. A commercial meat cutting machine helps business to save time and money as well as reduce food wastage, thereby increasing the efficiency of the food production process. As a result, meat cutting machines are suitable for restaurants, butcher shops, canteens, and fresh meat cutter machines for meat processing applications.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2024 valued at USD 808.51 million and is projected to grow at a CAGR of 5.5% during the forecast period. The increasing demand for packaged and processed food products is driving the proliferation of the industrial food cutting machines market in the region. Assessment of market trends suggest that quick service restaurants (QSR), canteens, and fast-food centers are increasingly deploying food cutting machines to meet the growing demand. The industrial food cutting machines market analysis concluded that factors including increasing adoption of technology in processing, food preferences, convenience, and food safety among others are driving the market expansion of the market.

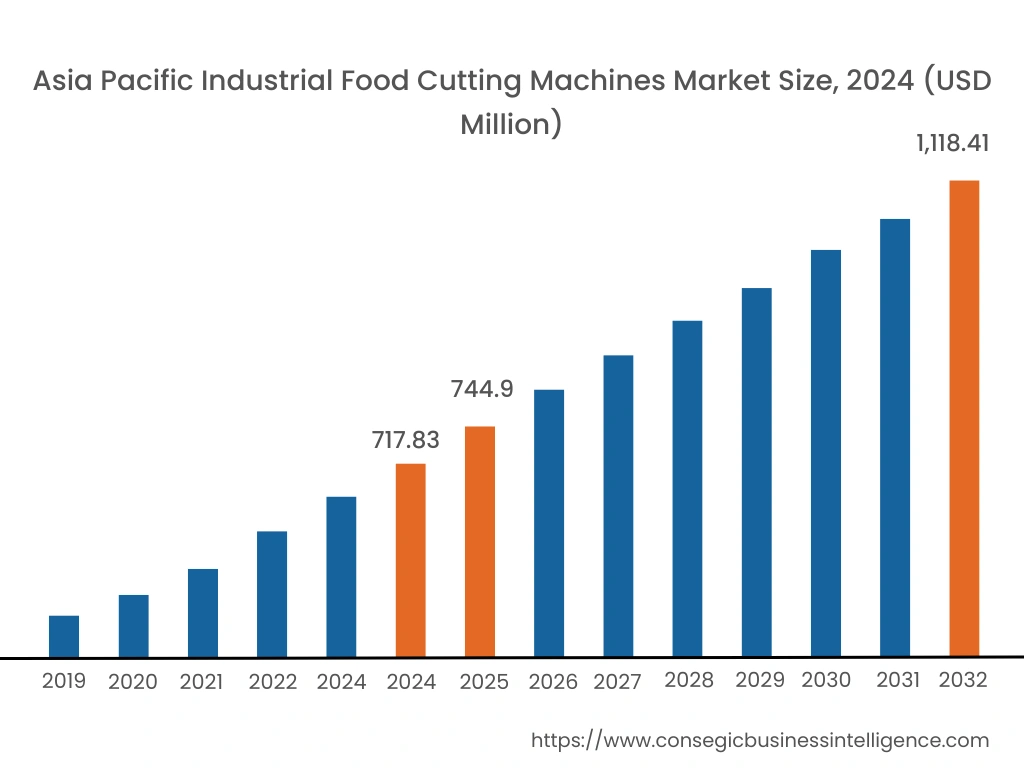

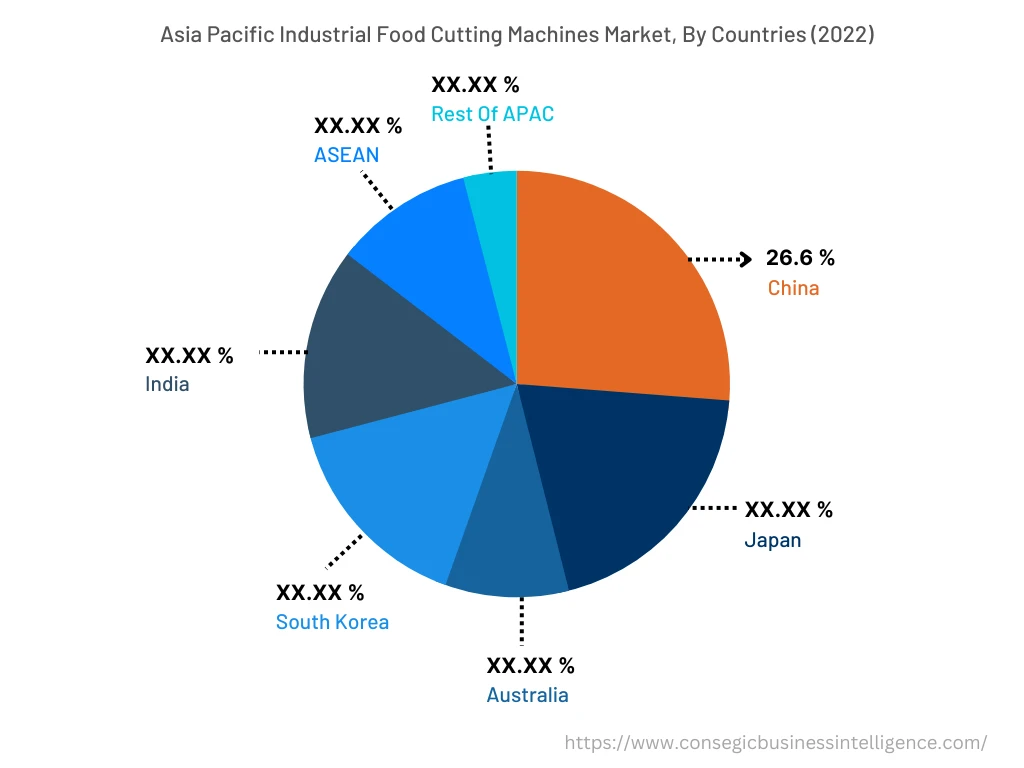

The Asia-Pacific region is anticipated to witness the fastest CAGR of 5.6% during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 26.6% in the same year. Presence of large number of food companies in the food & beverage sector including Nissin Foods Holdings, Lee Kum Kee, Amul, and Foods & Inns among others is considered to fuel the adoption of industrial food cutting machines in the region during the forecast period. Analysis of industrial food cutting machines market trends concludes that the growing income in emerging economies of Asia Pacific is leading to the increased demand for processed food which in turn is anticipated to increase demand for industrial food cutting machines.

Top Key Players & Market Share Insights :

The industrial food cutting machines market is highly competitive due to the presence of a large number of key players operating in the market. The report analyses detailed profiles of the major companies operating in industrial food cutting machines industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the expansion of the market. Key players in the robotic process automation market include-

- Brunner-Anliker AG

- Buhler AG

- Marel TREIF GmbH

- Urschel Laboratories Inc.

- Weber Maschinenbau GmbH

- Cheersonic

- Dadaux

- Deville Technologies

- EMURA Food Cutter Machine Co. Ltd.

- Illinois Tool Works Inc.

- Jaymech Food Machines Ltd.

Recent Industry Developments :

- In May 2021, GEA Group Aktiengesellschaft introduced new industrial slicer called GEA OptiSlicer 6000 to slice meat and cheese products.

- In May 2020, ANDRITZ introduced new ADuro product line of recycling shredders for primary and secondary shredding, fine granulation of food products.

Key Questions Answered in the Report

What is Industrial Food Cutting Machines? +

Industrial food cutting machines are the equipment that are used to process plant and animal products into edible food products. Industrial food cutting machines are deployed in large scale industries that aids in preparation of pre-cooked food by slicing it into appropriate shapes and sizes.

What specific segmentation details are covered in the Industrial Food Cutting Machines market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including Component, Operation, Enterprise Size, and End-User. Each segment has key dominating sub-segment being driven by the industry trends and market dynamics. For instance, by type segment has witnessed food slicers as the dominating segment in the year 2024 due to the increasing demand for uniformity in food production process.

What specific segmentation details are covered in the industrial food cutting machines market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including Type, Technology, and Application. Each segment is projected to have the fastest-growing sub-segment being fuelled by industry trends and drivers. For instance, by application segment has witnessed meat cutter as the fastest-growing segment due to its ability to save time and money, thereby increasing the efficiency of meat processing.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

The Asia-Pacific region is anticipated to witness fastest CAGR growth during the forecast period due to the increasing demand for packaged food products as a result of changing consumers lifestyles.