Industrial Gases Market Size:

Industrial Gases Market Size is estimated to reach over USD 168.92 Billion by 2032 from a value of USD 108.29 Billion in 2024 and is projected to grow by USD 113.06 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Industrial Gases Market Scope & Overview:

Industrial gases are commercially manufactured gases used in various industries for a wide range of applications. These gases, such as oxygen, nitrogen, carbon dioxide, and others, are crucial for processes such as manufacturing, energy production, healthcare, and food processing sectors among others. Additionally, in manufacturing sector, these gases are essential for processes such as metal fabrication, welding, and heat treatment, where they provide inert atmospheres, facilitate combustion, and enhance material properties.

How is AI Transforming the Industrial Gases Market?

There is an emerging use of AI in industrial gases market, particularly in applications involving automation and process optimization during its manufacturing process. AI is being used to enhance the efficiency, sustainability, and cost-effectiveness of industrial gases production.

Additionally, AI-powered systems can monitor and analyze product quality in real-time, ensuring consistency and adherence to standards. Further, AI-powered solutions are being adopted for various applications, including predictive maintenance, production and supply chain optimization, along with environmental monitoring, among others. Thus, the factors are expected to drive the market growth in upcoming years.

Industrial Gases Market Dynamics - (DRO) :

Key Drivers:

Growing healthcare sector is driving the global market

Industrial gases such as oxygen, nitrogen, helium, carbon dioxide, and others play crucial roles in various medical applications that are critical to patient care and medical device manufacturing. Further, population growth and aging demographics, coupled with advancements in medical technology, drive the need for respiratory therapies, diagnostic imaging, and medical device manufacturing. As medical procedures become increasingly sophisticated, the reliance on these gases continues to grow. In addition, the development of minimally invasive surgeries and endoscopic procedures necessitates the use of carbon dioxide for insufflation and tissue dissection.

- For instance, in October 2024, Linde India commenced the operations of new air separation units in Ludhiana, India, to boost industrial gas supply in Northern India. This move aims to meet the increasing need for vital gases such as medical oxygen, industrial oxygen, nitrogen, and argon, which are essential for industries including healthcare and pharmaceuticals.

Thus, according to the market analysis, the growing healthcare sector is driving the industrial gases market size.

Key Restraints :

Growing market competition intensity is affecting the industrial gases market demand

The global market is characterized by high competition intensity due to the presence of numerous players ranging from large multinational corporations to smaller regional suppliers. This competition drives companies to innovate and differentiate their products and services, often focusing on improving the purity, efficiency, and reliability of oxygen supply.

Further, intense competition also leads to price pressures, compelling companies to optimize their production processes and supply chains to remain cost-competitive. The need to comply with stringent regulatory standards and meet customer needs for high-quality industrial products adds additional complexity to the market landscape. Thus, the above analysis depicts that the aforementioned factors would further impact the industrial gases market size.

Future Opportunities :

Growing adoption of gases in electronics sector is expected to drive industrial gases market opportunities

The electronics sector stands as a pivotal segment within the global industrial gas market, fostering significant demand for various gases essential in its manufacturing processes. These gases play multipurpose roles in electronics manufacturing, ranging from providing inert atmospheres for semiconductor fabrication to enabling precise etching and deposition processes essential in microchip production.

Further, the advent of emerging technologies like the Internet of Things (IoT), artificial intelligence (AI), and 5G networks are driving rapid innovation and growth in the consumer electronics sector, further fueling the demand for gases. As electronic devices become increasingly sophisticated and miniaturized, the need for precise and controlled manufacturing environments supplied by gases continues to grow.

- For instance, in February 2025, Merck announced the partnership with Linde, to build semiconductor plant in India. The company’s semiconductor manufacturing relies on a vast array of materials with 150 different chemicals and more than 30 gases and minerals. These materials are vital for creating reliable and safe chips and for driving innovation. They are essential for key steps in chip production, including precisely removing material adding impurities to alter electrical properties ensuring cleanliness, and building up extremely pure layers on silicon wafers.

Thus, based on the above industrial gases market analysis, the growing adoption of industrial gases in electronics sector is expected to drive industrial gases market opportunities.

Industrial Gases Market Segmental Analysis :

By Gas Type:

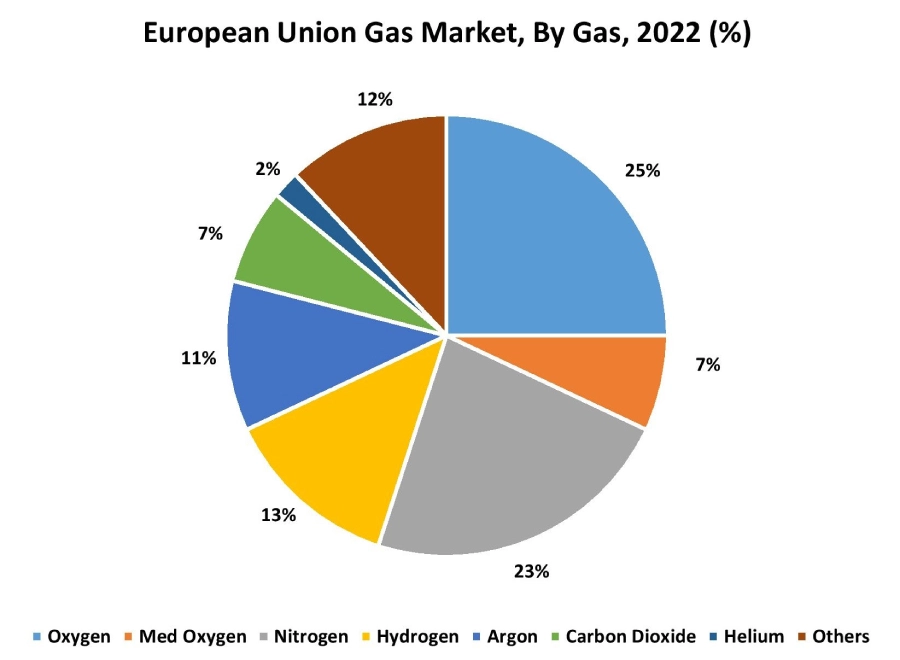

Based on gas type, the market is segmented into oxygen, nitrogen, hydrogen, carbon dioxide, argon, helium, acetylene, and others.

Industrial gases like oxygen, nitrogen, hydrogen, carbon dioxide, argon, helium, and acetylene are essential for numerous industries, including manufacturing, healthcare, and food production. Oxygen is crucial for respiration, welding, cutting, and various chemical processes. Nitrogen is used in inert gas blankets, chemical synthesis, food packaging, and as a carrier gas in chromatography. Hydrogen is a fuel source for fuel cells, used in refining petroleum, and as a protective gas in heat treatment. Carbon Dioxide is used in carbonated beverages, food preservation (cryogenics), fire suppression, and as a shielding gas in welding. Moreover, argon is an inert gas used as a shielding gas in arc welding and other high-temperature applications, as well as in the electronics industry. Helium is used as a buoyancy gas in balloons, as a cooling agent in cryogenics, and as a carrier gas in chromatography. Acetylene is a high-energy fuel gas commonly used for welding, cutting, and torch work.

Trends in the gas type:

- As countries invest in developing their electronics manufacturing capabilities to reduce dependence on imports and boost technological advancements, the need for on-site gases is expected to surge. This inclination is supported by governmental initiatives and policies aimed at promoting domestic electronics production.

- The increasing emphasis on environmental sustainability and energy efficiency is driving the market.

The nitrogen segment accounted for the largest revenue share of 24.56% in the year 2024.

Nitrogen is the key gas type driving the market, primarily due to its applications in the electronics and food & beverage industries. Further, nitrogen gas is widely used for packaging and preserving food items, preventing oxidation, and extending their shelf life. The rising global consumer demand for fresh and long-lasting food products has escalated the use of nitrogen gas, particularly in modified atmosphere packaging (MAP) technologies. This is further propelled by the increasing awareness regarding food safety and quality, encouraging food producers to adopt advanced packaging solutions that leverage the benefits of nitrogen gas.

- For instance, in February 2024, Air Liquide invested more than 50 million euros (USD 56.88 million) in two key locations to boost its supply of high-purity nitrogen to GlobalFoundries (GF).

Thus, based on the above industrial gases market analysis, these factors are further driving the industrial gases market growth.

The hydrogen segment is anticipated to register the fastest CAGR during the forecast period.

The segment growth can be attributed to the increasing need for clean energy solutions and the pivotal role of hydrogen gas in enabling the transition to a low-carbon economy. As countries worldwide strive to reduce carbon emissions and meet international climate goals, hydrogen gas emerges as a critical energy carrier, while offering a versatile and sustainable alternative to fossil fuels. Further, governments and organizations across the globe are actively promoting hydrogen as a clean energy source due to its potential to decarbonize various sectors, including transportation, power generation, and industrial activities.

- For instance, in April 2025, the Dutch government has approved a Euro 2.8 billion (USD 3.2 billion) initiative called the Green Growth Package to promote hydrogen energy. Additionally, Euro 662 million (USD 753.09 million) has been allocated to increase the use of hydrogen in various industrial applications, in turn stimulating the need for gases.

Thus, based on the above analysis, these factors are expected to drive the industrial gases market share during the forecast period.

By Production & Delivery Method:

Based on production & delivery method, the market is segmented into on-site production, bulk & cylinder delivery, and merchant liquid delivery.

On-site production allows for generating gases including oxygen, nitrogen, and argon at the facility itself, potentially saving costs and ensuring a consistent supply. Bulk and cylinder delivery provide a more traditional route, with gases transported in large tanks or cylinders to the customer's location. Merchant liquid delivery involves delivering liquid gases, often in cryogenic tankers, to storage tanks at the customer's site.

Trends in the production and delivery method:

- The continuous advancements in gas generation technologies and the development of hybrid systems combining multiple methods further enhance the capabilities and efficiency of production and delivery solutions.

- The integration of digital technologies, IoT sensors, and advanced control systems in industrial gas plants and distribution networks is improving operational efficiency, safety, and remote monitoring capabilities for production and delivery of gases.

The bulk & cylinder delivery segment accounted for the largest revenue in the year 2024.

This method involves supplying smaller quantities of compressed or liquefied gases in individual cylinders of varying sizes. Cylinders are transported to the customer's site via trucks. This is suitable for lower-volume users, applications requiring portability, or gases that are not needed in large continuous quantities. Industries with high gas consumption, such as steel manufacturing, chemical processing, and large-scale food processing, are driving the need for bulk delivery. Further, bulk delivery streamlines gas supply management, improving overall efficiency and reducing operational costs. Thus, based on the above analysis, these factors would further supplement the global market share.

The on-site production segment is anticipated to register the fastest CAGR during the forecast period.

With the rising prevalence of chronic diseases and the growing aging population, the need for medical-grade gases is expected to increase substantially. Additionally, the COVID-19 pandemic has highlighted the importance of a reliable supply of medical oxygen, creating prospects for investments in on-site gas generation systems in healthcare facilities. Moreover, hydrogen plays a crucial role in fuel cell technology and other sustainable energy solutions. The increasing investments in hydrogen infrastructure and the development of hydrogen-based energy systems present significant growth opportunities for on-site hydrogen generation technologies.

- For instance, Air Products on-site gas generation offers tailored solutions by producing hydrogen, oxygen, nitrogen, and argon with precise purity, pressure, and flow rates directly at the users’ facility.

These developments are anticipated to further drive the industrial gases market trends during the forecast period.

By Application:

Based on application, the market is segmented into air separation, coolant, carbonation, cutting & welding, cryogenic, and others.

Industrial gases like nitrogen, oxygen, carbon dioxide, and argon are crucial in various industrial applications. Air separation plants extract gases like nitrogen, oxygen, and argon from the atmosphere, using methods like cryogenic distillation and pressure swing adsorption. Moreover, gases are used as coolants, especially in cryogenics where they help to achieve extremely low temperatures for research, storage, and industrial processes. These gases enable various welding techniques and metal cutting processes in industries like manufacturing, construction, and automotive. Cryogenics involves achieving extremely low temperatures, and gases like nitrogen, helium, and argon are used to cool materials and substances to these temperatures.

Trends in the application:

- The development of cryogenic distillation, pressure swing adsorption, and membrane separation technologies have transformed the sector, allowing to produce ultra-pure gases required in both conventional and emerging applications.

- As the need for high-quality glass products increases, particularly in sectors such as construction and automotive, the integration of advanced gas technologies is becoming essential. Thus, based on the above analysis, these factors are anticipated to further drive the industrial gases market trends during the forecast period.

The cryogenic segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

Cryogenic technology is widely used for the production of high-purity gases such as oxygen, nitrogen, and argon. This technology involves the liquefaction of air and subsequent distillation to separate the different gases based on their boiling points. Moreover, cryogenic air separation units (ASUs) are commonly employed in large-scale industrial applications, providing a reliable and efficient supply of high-purity gases.

- For instance, in October 2024, Linde Engineering announced partnership with NEXTCHEM, to supply their carbon capture technology, HISCORP, for Ghasha and ADNOC's Hail industrial project. This gas development for industrial project aims for net-zero emissions and will play a crucial role by efficiently capturing and purifying 1.5 million tonnes of CO₂ annually for sequestration.

Therefore, based on the above analysis, these factors are driving the industrial gases market growth.

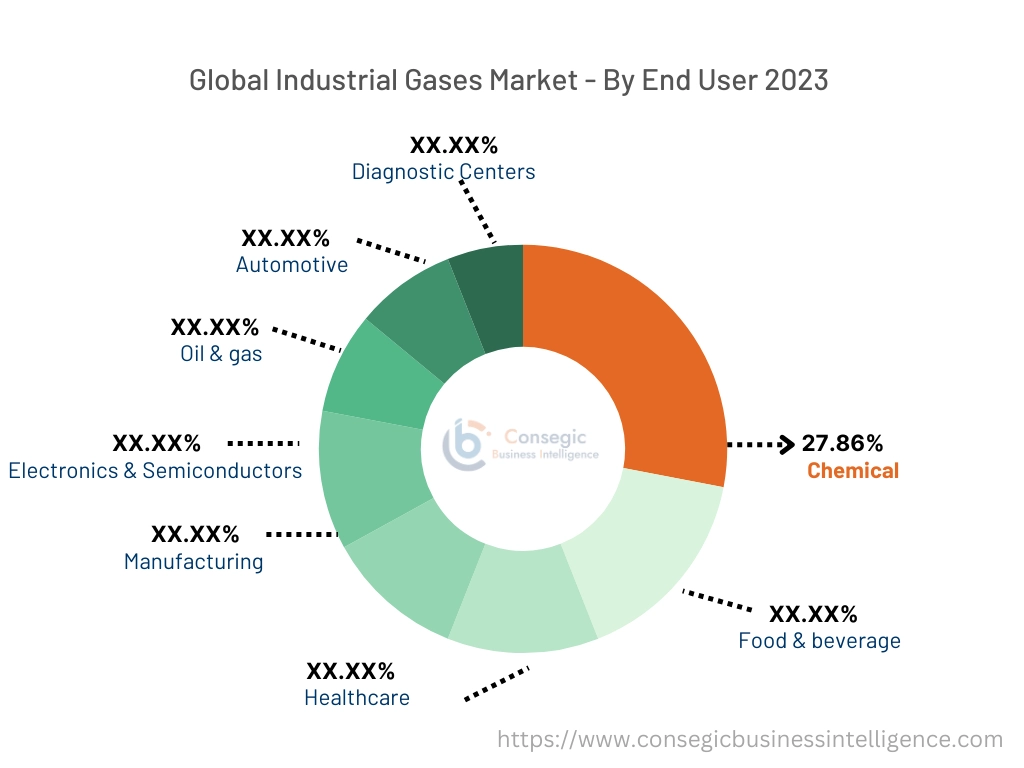

By End-User:

Based on end user, the market is segmented into healthcare, food & beverage, chemical, manufacturing, electronics & semiconductors, oil & gas, automotive, and others.

Industrial gases play critical roles in various processes, from medical procedures to manufacturing and chemical synthesis. In healthcare, these gases are used in respiratory therapy, scans, cryotherapy, and medical treatments. In food and beverage, these gases are used in carbonation of beverages and as a fire extinguisher. In chemical sector, they are primarily used in chemical synthesis and processes. In electronics and semiconductors, these are used in cleaning and inert gas blanketing in semiconductor manufacturing. Additionally, these gases are also used in metal manufacturing, energy generation, and various other applications.

Trends in the end user:

- The growing need for metal products in construction, automotive, and aerospace industries drives the adoption of on-site gas generation systems in metal manufacturing & fabrication facilities.

- The continuous advancements in electronics technology and the increasing production of electronic devices drive the need for on-site gas generation systems, ensuring a consistent supply of high-purity gases required for precision manufacturing processes.

- Therefore, the aforementioned factors are driving the industrial gases market demand.

The chemical segment accounted for the largest revenue share in the year 2024.

The chemical sector is a major segment of industrial gas applications, utilizing them in various processes such as synthesis, refining, and production of different chemicals. Further, the need for on-site gas generation systems in chemical plants is driven by the need for a consistent and reliable supply of high-purity gases to ensure optimal production efficiency and product quality.

- For instance, in March 2023, Air Liquide announced the development of an industrialized ammonia (NH3) in the port of Antwerp, Belgium. The chemical plant has the facility to transform NH3 into hydrogen, with an improved carbon footprint and innovative technology.

Hence, the above factors are further driving the global market trends.

The healthcare segment is anticipated to register the fastest CAGR during the forecast period.

Governments worldwide are investing in medical research, coupled with the efforts of medical institutes and pharmaceutical companies to develop COVID-19 vaccines and treatments, in turn fueling the need for industrial nitrogen in the healthcare sector. These gases are essential for respiratory therapy, anesthesia, and monitoring of patients. The COVID-19 pandemic has emphasized the critical importance of a reliable supply of medical oxygen in healthcare facilities, leading to heightened investments in gas generation systems to enhance preparedness and response capabilities.

- For instance, HORIBA provide wide range of gas analyzers, such as continuous impurities monitor in oxygen, nitrogen, and carbon dioxide, and other gases, to resolve issues in industrial and medical gas manufacturing.

The above factors are anticipated to further drive the industrial gases market expansion during the forecast period.

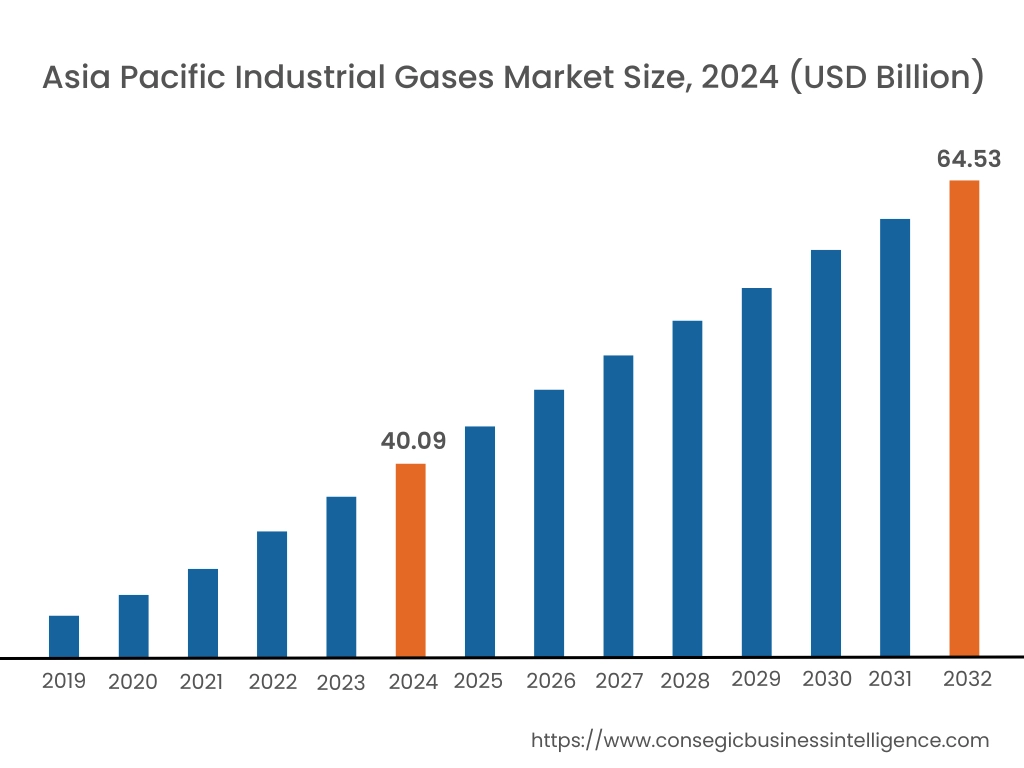

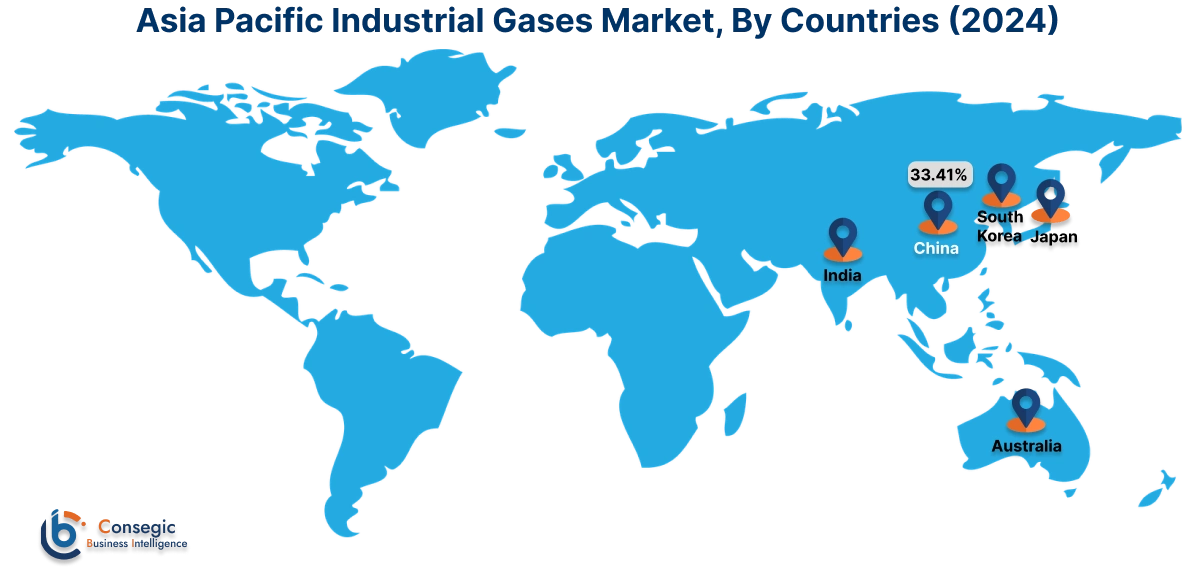

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific industrial gases market expansion is estimated to reach over USD 64.53 billion by 2032 from a value of USD 40.09 billion in 2024 and is projected to grow by USD 41.96 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 33.41%. The region serves a wide array of industries, including manufacturing, healthcare, electronics, and chemicals. Further, recognizing the importance of sustainability, companies in the region are increasingly investing in technologies aimed at lowering carbon emissions throughout gas production and distribution. This involves improvements in energy-efficient cryogenic distillation and the incorporation of renewable energy sources like solar and wind power in production plants. These efforts not only support global climate objectives but also meet the growing need for eco-conscious solutions within region’s industrial landscape. These factors would further drive regional industrial gases market share during the forecast period.

- For instance, in October 2023, Linde signed an agreement with Indian Oil to supply gases for industrial applications to Panipat oil refinery. Linde's subsidiaries will construct, possess, and manage significant new on-site plants to provide hydrogen, nitrogen, and compressed dry air for Indian Oil's operations. These new facilities will support the large-scale, multi-billion-dollar expansion of the Panipat refinery, while increasing its capacity from 15 to 25 million metric tons annually.

North America market is estimated to reach over USD 46.96 billion by 2032 from a value of USD 30.28 billion in 2024 and is projected to grow by USD 31.60 billion in 2025. North America is a key region in the global market, characterized by a mature industrial sector and advanced healthcare infrastructure. The United States, being a major player in the chemical and electronics industries, generates significant need for high-purity gases. Additionally, the region's focus on clean energy solutions, including hydrogen-based technologies, drives the adoption of on-site gas generation systems. Moreover, the market in North America is expected to grow steadily, supported by technological advancements and increasing investments in sustainable energy.

- For instance, in June 2024, Air Liquide opened its biggest liquid hydrogen production and distribution hub in North Las Vegas, Nevada. This large-scale facility will generate 30 tonnes of liquid hydrogen, to meet the increasing need in the clean transportation sector.

Additionally, according to the industrial gases industry analysis, the industrial gases industry in Europe is expected to witness significant development during the forecast period. The region's stringent regulatory standards and emphasis on sustainability drive the adoption of advanced gas technologies. Further, the growing electronics manufacturing sector, coupled with the increasing demand for medical-grade gases, supports the market growth in Europe.

Additionally, there is a growing emphasis on sustainable practices in Latin America, leading to increased use of gases for industrial applications in environmentally friendly processes. This includes the development and adoption of green hydrogen production technologies like electrolysis using renewable energy sources along with carbon capture, utilization, and storage (CCUS) initiatives where gases like nitrogen and CO2 are used.

Further, the strong presence and ongoing development of the oil & gas and petrochemical industries in the Middle East & Africa are major trends driving the demand for gases for industrial applications, such as hydrogen, nitrogen, and oxygen, which are crucial in refining processes, enhanced oil recovery (EOR), and various other applications.

Top Key Players & Market Share Insights:

The global industrial gases market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global industrial gases market. Key players in the industrial gases industry include-

- Air Liquide (France)

- Linde plc (Ireland)

- SIAD Group (Italy)

- Matheson Tri-Gas, Inc. (U.S.)

- Praxair, Inc. (U.S.)

- Air Products and Chemicals, Inc. (U.S.)

- Taiyo Nippon Sanso Corporation (Japan)

- Messer Group GmbH (Germany)

- Iwatani Corporation (Japan)

- Gulf Cryo (Kuwait)

Recent Industry Developments :

Partnership:

- In May 2024, Linde signed an agreement with H2 Green Steel, to supply industrial gases for large-scale manufacturing. Linde will supply nitrogen, argon, and oxygen to steel plant, and employ cutting-edge methods to slash carbon emissions by as much as 95% compared to conventional steel production.

Industrial Gases Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 168.92 Billion |

| CAGR (2024-2031) | 5.1% |

| By Gas Type |

|

| By Production & Delivery Method |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Industrial Gases Market? +

Industrial Gases Market Size is estimated to reach over USD 168.92 Billion by 2032 from a value of USD 108.29 Billion in 2024 and is projected to grow by USD 113.06 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Which is the fastest-growing region in the Industrial Gases Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Industrial Gases report? +

The mobility as a service report includes specific segmentation details for gas type, product & delivery method, application, end user, and region.

Who are the major players in the Industrial Gases Market? +

The key participants in the market are Air Liquide (France), Linde plc (Ireland), Air Products and Chemicals, Inc. (U.S.), Taiyo Nippon Sanso Corporation (Japan), Messer Group GmbH (Germany), Iwatani Corporation (Japan), Gulf Cryo (Kuwait), SIAD Group (Italy), Matheson Tri-Gas, Inc. (U.S.), Praxair, Inc. (U.S.), and others.

What are the major challenges in the industrial gases market? +

Challenges include high production and transportation costs, strict environmental regulations, and geopolitical risks affecting supply chains.