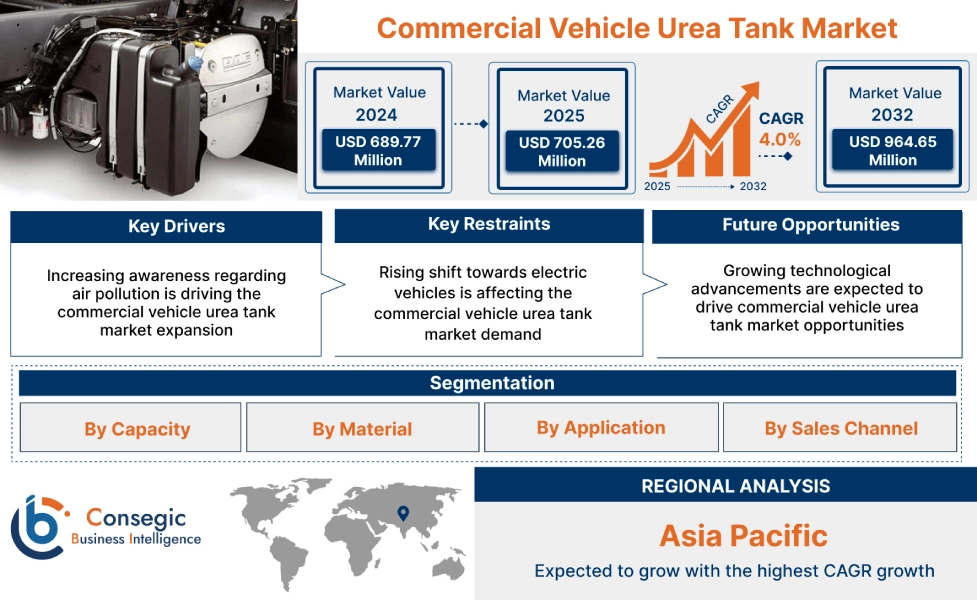

Commercial Vehicle Urea Tank Market Size:

Commercial Vehicle Urea Tank Market Size is estimated to reach over USD 964.65 Million by 2032 from a value of USD 689.77 Million in 2024 and is projected to grow by USD 705.26 Million in 2025, growing at a CAGR of 4.0% from 2025 to 2032.

Commercial Vehicle Urea Tank Market Scope & Overview:

A commercial vehicle urea tank is a container within a diesel-powered vehicle that stores the urea-based solution used in selective catalytic reduction (SCR) systems. These systems help reduce harmful emissions, particularly nitrogen oxides (NOx), by injecting the urea solution into the exhaust stream. Manufacturers are developing compact, lightweight, and efficient urea tank solutions that maximize space utilization, minimize weight, and enhance durability. Advanced features such as integrated heating systems, level sensors, and diagnostic capabilities optimize urea tank performance, ensuring reliable operation in diverse operating conditions and climates.

How is AI Transforming the Commercial Vehicle Urea Tank Market?

Artificial Intelligence is reshaping the commercial vehicle urea tank market by enhancing efficiency, emission control, and predictive maintenance. Urea tanks are essential for selective catalytic reduction (SCR) systems that reduce nitrogen oxide emissions, and AI optimizes their operation through intelligent monitoring and control. AI-driven sensors analyze engine performance, temperature, and urea consumption in real time to ensure precise dosing and minimize wastage. Predictive analytics help detect leaks, crystallization, or pump failures early, preventing system downtime. In manufacturing, AI improves design and production quality by simulating performance under varying conditions. As environmental regulations tighten globally, AI integration is enabling smarter, cleaner, and more reliable urea tank systems for next-generation commercial vehicles.

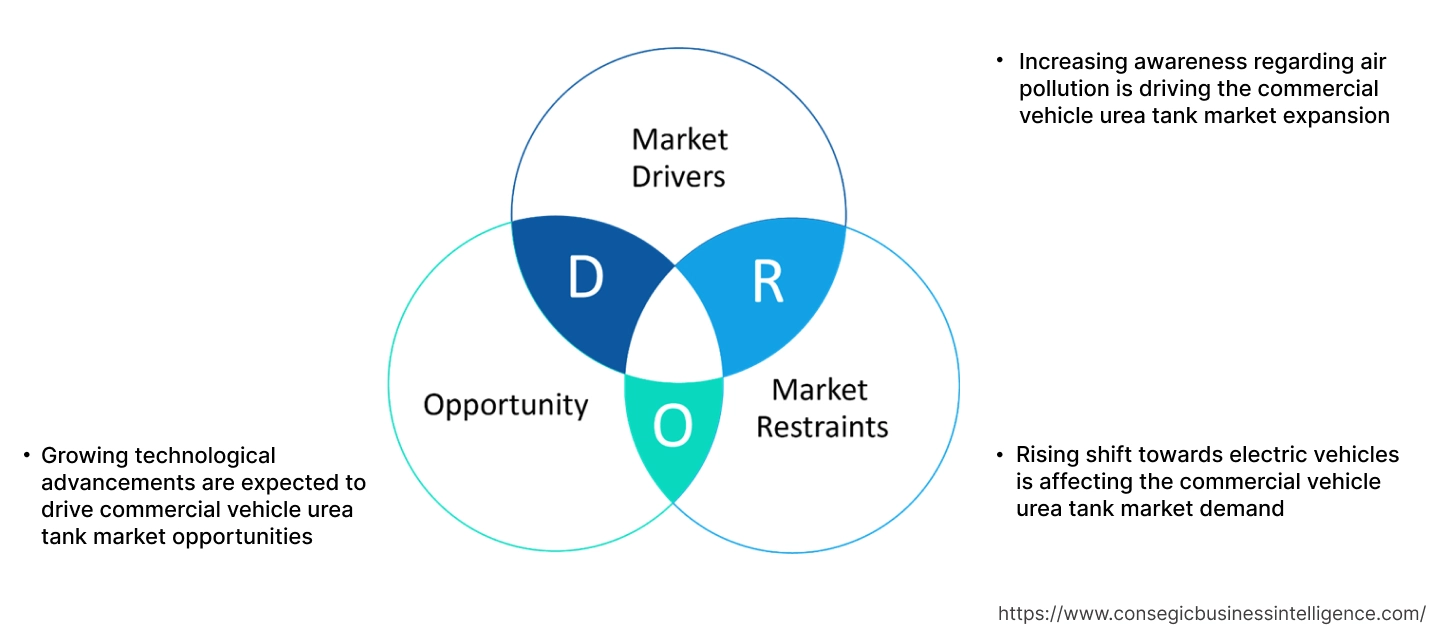

Commercial Vehicle Urea Tank Market Dynamics - (DRO) :

Key Drivers:

Increasing awareness regarding air pollution is driving the commercial vehicle urea tank market expansion

The increasing awareness regarding air pollution is transforming the global market. As concerns about environmental impact rise globally, governments, regulatory bodies, and consumers alike are placing greater emphasis on reducing harmful emissions from diesel engines. Diesel engines are known contributors to nitrogen oxide (NOx) emissions, which are detrimental to air quality and human health.

The growing awareness of air pollution is driving the adoption of urea tanks, particularly in regions with stringent emissions regulations. Urea tanks are used in conjunction with SCR technology, helps neutralize NOx emissions by converting them into harmless nitrogen and water vapor. This technology not only aids in meeting regulatory standards but also supports efforts to mitigate the environmental impact of diesel-powered vehicles and machinery across various sectors such as automotive, agriculture, construction, and mining.

- For instance, Azure Chemicals’s Selective Catalytic Reduction (SCR) system is an advanced technology designed to significantly reduce nitrogen oxide (NOx) emissions from diesel engines. It achieves this by injecting DEF, a urea-based solution, into the hot exhaust stream. This reaction converts the harmful NOx into harmless nitrogen gas and water vapor, which are then released into the atmosphere. The SCR system effectively lowers the levels of NOx emitted by diesel engines.

Thus, according to the commercial vehicle urea tank market analysis, the increasing awareness regarding air pollution is driving the commercial vehicle urea tank market size.

Key Restraints:

Rising shift towards electric vehicles is affecting the commercial vehicle urea tank market demand

As governments worldwide intensify efforts to combat climate change and reduce dependence on fossil fuels, there is a notable trend towards electrification in the automotive sector. Electric vehicles offer zero tailpipe emissions and are increasingly favored for their environmental benefits, contributing to improved air quality in urban areas. This transition towards EVs poses challenges for the commercial vehicle urea market. Further, the reduced reliance on diesel engines in electric vehicles could potentially limit the need for urea tanks in the long term, particularly in the commercial vehicle segment. Thus, the aforementioned factors would further impact the commercial vehicle urea tank market size.

Future Opportunities :

Growing technological advancements are expected to drive commercial vehicle urea tank market opportunities

The increasing adoption of high-density polyethylene (HDPE) and other advanced plastics offers significant weight reduction compared to traditional steel urea tanks. Further, tanks are being designed to be more compact to fit into the increasingly complex layouts of modern commercial vehicles , including smaller models. This optimizes space utilization without compromising efficiency. Moreover, advanced sensors are being integrated for accurate monitoring of urea levels, providing real-time data to the driver or fleet management systems. These sensors help prevent urea freezing in cold climates by enabling integrated heating systems to activate when needed.

- For instance, Yara International’s Adblue and SCR technology in passenger and commercial vehicles includes selective catalytic reduction systems in truck, van engines, and others, which use diesel exhaust fluids(DEFs) to prevent exhaust gases from being released into the atmosphere.

Thus, based on the above commercial vehicle urea tank market analysis, the growing technological advancements are expected to drive the commercial vehicle urea tank market opportunities.

Commercial Vehicle Urea Tank Market Segmental Analysis :

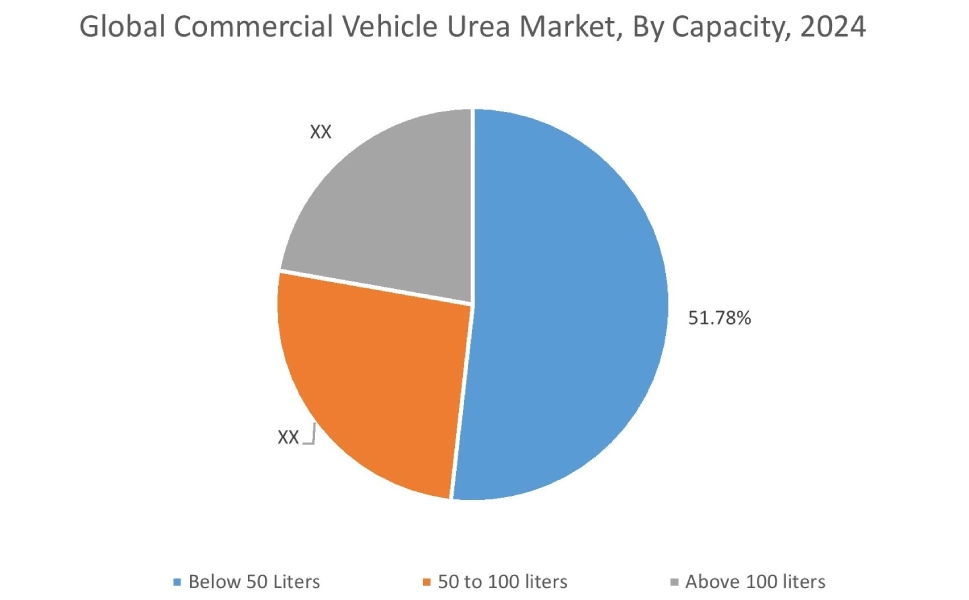

By Capacity:

Based on capacity, the market is segmented into below 50 liters, 50 to 100 liters, and above 100 liters.

Trends in the capacity:

- The stricter emission regulations, such as Euro VI, China VI, and Bharat Stage VI (BS-VI), often necessitate higher diesel exhaust fluid (DEF) consumption rates to achieve the required NOx reduction levels. This can lead to a need for larger commercial vehicle urea tanks to maintain practical operating ranges between refills.

- Vehicles designed for long-haul transportation or operation in remote areas where DEF refuelling infrastructure might be limited will require larger and medium tanks to ensure they can complete their journeys without interruptions.

- Thus, based on the above analysis, these factors are driving the commercial vehicle urea tank market demand.

The below 50 liters segment accounted for the largest revenue share of 51.78% in the year 2024.

- These smaller commercial vehicle urea tanks are widely used in light and medium-duty commercial vehicles such as delivery vans, pickup trucks, and city buses. These types of vehicles often operate within urban areas where their routes are shorter, and they have more frequent opportunities to refuel, making larger urea tanks unnecessary.

- The urea tanks under 50 liters are also driven by their affordable manufacturing, simpler integration into vehicle designs, and the benefit of reduced weight. This lighter weight helps improve fuel efficiency and lowers the overall cost of operating the vehicle.

- Furthermore, strict emission regulations like Euro VI, Bharat Stage VI, and China VI are encouraging fleet operators and vehicle manufacturers to use smaller SCR systems with these compact urea tanks. This allows them to meet environmental standards without adding significant weight to the vehicles or substantially increasing production costs.

- Thus, based on the above analysis, these factors are further driving the commercial vehicle urea tank market growth.

The 50 to 100 liters segment is anticipated to register the fastest CAGR during the forecast period.

- Vehicles in this category often operate on regional routes or within larger urban areas, requiring a sufficient urea capacity for extended operations without the excessive weight and space implications of larger tanks.

- The rapid urbanization and growing logistics and transportation industries are contributing to the increased need for medium commercial vehicles (MCVs), consequently driving the need for 50 to 100 liters urea tanks.

- There a growing trend towards integrating advanced level sensors in this capacity range to provide accurate real-time data to drivers and fleet management systems, optimizing urea usage, and preventing operational disruptions.

- Thus, based on the above analysis and developments, these factors are expected to drive the commercial vehicle urea tank market share during the forecast period.

By Material:

Based on the material, the market is segmented into stainless steel, plastic, and composite.

Trends in the material:

- As the need for lighter vehicles and more stringent emission standards continues, there is a growing interest in exploring and adopting advanced plastics and composite materials.

- There is an increasing emphasis on the environmental impact of vehicle components. This trend is pushing material manufacturers and tank designers to consider the recyclability and sustainability of the materials used in urea tanks.

The stainless steel segment accounted for the largest revenue share in the year 2024.

- Stainless steel offers excellent corrosion resistance, which is crucial for handling urea for commercial vehicles, a slightly corrosive solution. Certain grades of stainless steel are specifically designed to withstand urea environments.

- The need for metal urea tanks is driven by the increasing adoption of SCR technology in commercial vehicles, where robust emission control solutions are essential.

- Moreover, advancements in metal processing and fabrication techniques are enhancing the performance characteristics of these tanks, thereby expanding their applications in the commercial vehicle segment.

- Thus, based on the above analysis, these factors would further supplement the commercial vehicle urea tank market

The plastic segment is anticipated to register the fastest CAGR during the forecast period.

- Plastic moulding techniques allow greater design flexibility, enabling the creation of complex shapes that optimize space utilization within the vehicle chassis. This includes integrated features like mounting points and sensor housings.

- The increasing preference for lightweight materials in automotive manufacturing, driven by the need to improve fuel efficiency and reduce emissions, is a key factor supporting the development of plastic urea tanks.

- HDPE is significantly lighter, contributing directly to improved fuel efficiency and increased payload capacity, which are critical factors for commercial vehicle operators.

- For instance, Floteks manufactures its urea tanks using plastic materials that meet automotive industry standards. The company also integrates components like urea quality sensors and level indicators into the tanks, ensuring high quality through strict assembly and testing procedures. The company’s plastic tanks for commercial vehicles reduce the emission of harmful gases from exhaust diesel vehicles equipped with the SCR system.

- These factors would further drive the commercial vehicle urea tankmarket trends during the forecast period.

By Application:

Based on application, the market is segmented into light commercial vehicles (LCV), medium commercial vehicles (MCV), and heavy commercial vehicles (HCV).

Trends in the application:

- Manufacturers are developing advanced storage tanks and dispensing equipment that ensure the purity and integrity of urea throughout its lifecycle. These innovations are aimed at addressing challenges such as contamination and crystallization, which can impact the performance of the SCR system, while driving the segment development.

- The need for efficient and reliable emission control systems in commercial fleets is paramount, given their extensive operational demands and the increasing stringency of emission regulations.

The light commercial vehicles (LCV) segment accounted for the largest revenue share in the year 2024.

- Light commercial vehicles (LCVs) are a significant segment of the commercial vehicle urea tank market, encompassing a wide range of vehicles such as delivery vans, pickup trucks, and utility vehicles.

- These vehicles are typically employed for urban and regional transportation tasks, including last-mile delivery, parcel logistics, and service fleet operations.

- Urea tanks installed in LCVs are designed to accommodate lower engine displacements, reduced operating ranges, and space constraints inherent to light-duty vehicles.

- Manufacturers prioritize compact designs, lightweight materials, and space-efficient packaging to optimize urea tank integration into LCV platforms, ensuring compatibility with urban driving environments and maximizing cargo or passenger space.

- Moreover, LCV urea tanks are engineered for durability, reliability, and ease of maintenance, meeting the emissions reduction requirements of modern diesel engines while minimizing operational downtime and total cost of ownership for fleet operators.

- Thus, based on the above developments, these factors are driving the commercial vehicle urea tank market growth.

The heavy commercial vehicles (HCV) segment is anticipated to register the fastest CAGR during the forecast period.

- HCVs operate over longer distances, carry heavier payloads, and encounter diverse operating conditions, necessitating larger urea tanks with enhanced capacity, durability, and range.

- Urea tanks installed in HCVs are typically integrated into the vehicle chassis or mounted externally to maximize storage volume while ensuring ease of access for refilling and maintenance.

- Manufacturers prioritize robust construction, corrosion resistance, and integrated heating systems to prevent urea freezing and ensure reliable operation in cold climates or adverse weather conditions.

- Additionally, HCV urea tanks may feature advanced monitoring and diagnostic systems to track urea consumption, detect potential issues, and optimize urea injection strategies for maximum efficiency and emissions control.

- For instance, in March 2025, Hindustan Petroleum Corporation Ltd. (HPCL) announced the partnership with Tata Motors to launch genuine diesel exhaust fluid (DEF). This high-quality solution will drive ideal vehicle performance, boost drivetrain, and extend vehicle longevity.

- These factors are anticipated to further drive the commercial vehicle urea tank market trends during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into OEM and aftermarket.

Trends in the sales channel:

- The sales channel segment demonstrates the critical role of both OEMs and aftermarket providers in driving the growth and innovation of the vehicle urea tank market. As the market continues to evolve, the collaboration between these channels and manufacturers will be key to developing comprehensive solutions that address the diverse needs of the automotive industry, ranging from manufacturing to maintenance and beyond.

- The rise of e-commerce platforms is creating new prospects for aftermarket sales of urea tanks and related components, offering wider accessibility and competitive pricing.

The OEM segment accounted for the largest revenue in the year 2024.

- OEMs play a crucial role in the market, as they provide urea tanks that are integrated into vehicles during the manufacturing process.

- The presence of stringent emission norms is increasing the adoption of SCR systems in new commercial vehicles, in turn driving the growth of the OEM segment.

- Manufacturers are collaborating closely with OEMs to develop customized urea tank solutions that meet the specific requirements of different vehicle models and brands, thereby ensuring seamless integration and optimal performance.

- OEMs offer a wide range of urea tank options tailored to specific vehicle models, applications, and customer requirements, providing commercial vehicle operators with access to factory-backed warranties, technical support, and aftermarket services.

- Thus, based on the above factors are driving the global market growth.

The aftermarket segment is anticipated to register the fastest CAGR during the forecast period.

- As the global vehicle fleet ages, the demand for aftermarket urea tanks is expected to rise, driven by the need for replacements and upgrades to maintain emission compliance and operational efficiency.

- This segment benefits from the increasing awareness among vehicle owners and operators regarding the importance of maintaining emission control systems, which has led to a growing market for replacement parts and accessories.

- Additionally, the aftermarket segment offers prospects for innovation in terms of providing more durable and efficient tank solutions that can enhance the longevity and performance of vehicles.

- These factors are anticipated to further drive the market trends during the forecast period.

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

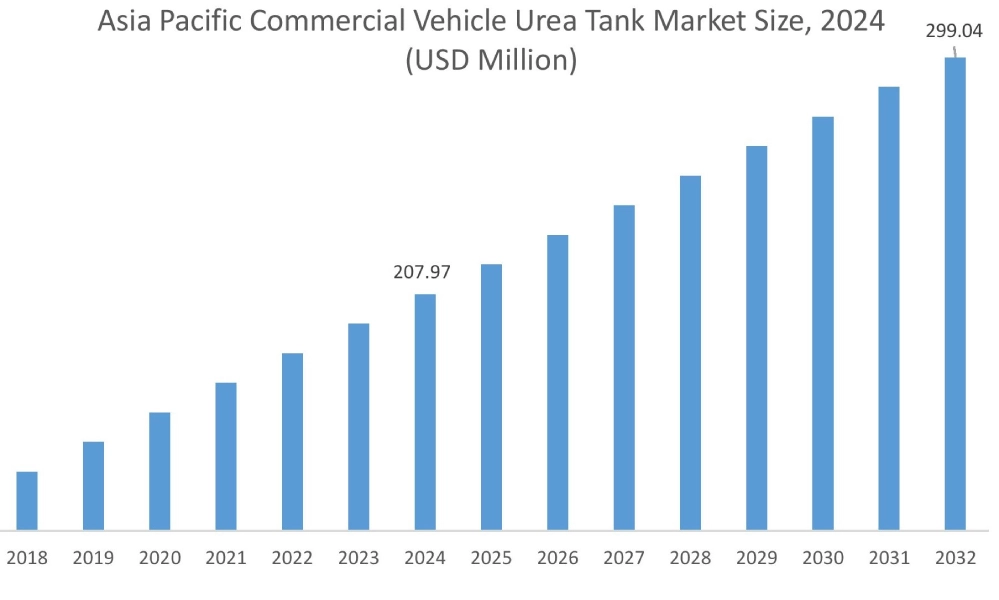

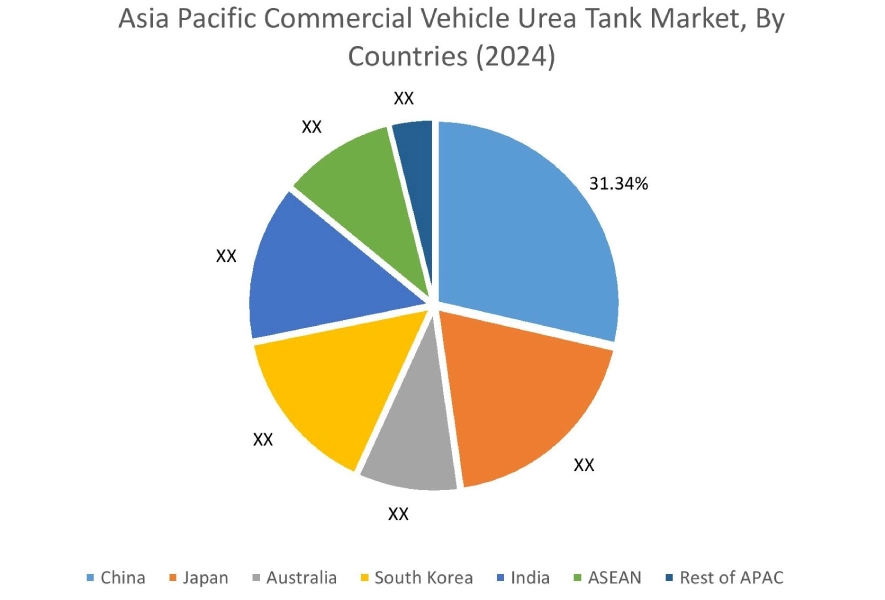

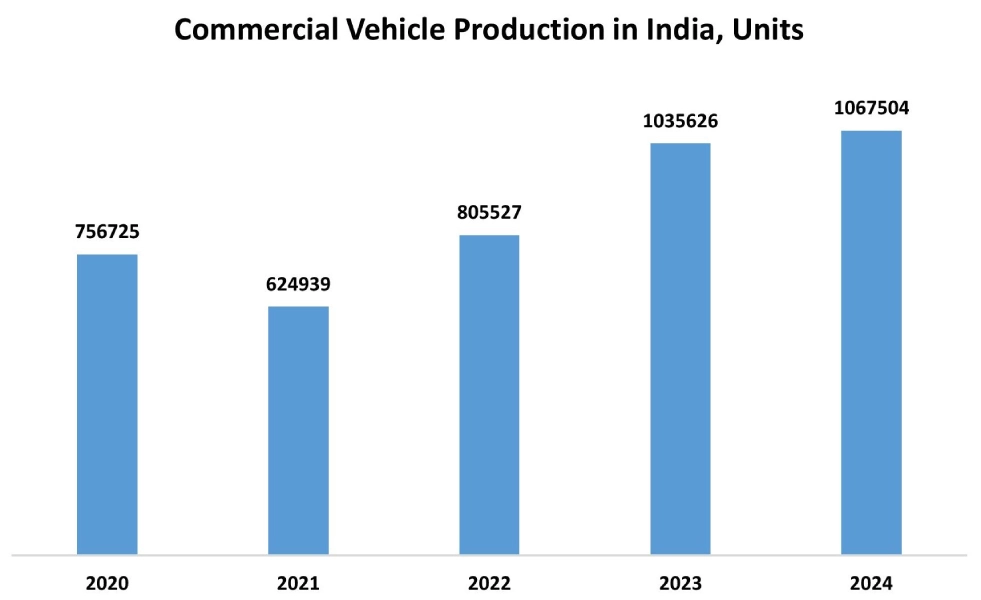

Asia Pacific commercial vehicle urea tank market expansion is estimated to reach over USD 299.04 million by 2032 from a value of USD 207.97 million in 2024 and is projected to grow by USD 213.14 million in 2025. Out of this, the China market accounted for the maximum revenue split of 31.34%. Asia-Pacific emerges as a key market fueled by rapid industrialization, urbanization, and infrastructure development across countries. In Asia-Pacific, commercial vehicle operators seek urea tank systems that offer reliability, durability, and efficiency in diverse operating conditions, including urban traffic congestion, long-distance transportation, and challenging terrain. Urea tank manufacturers in Asia-Pacific cater to the unique needs of commercial vehicle fleets in industries such as logistics, construction, mining, and agriculture, providing customized urea tank solutions optimized for local regulations, climate conditions, and operational requirements. These factors would further drive the regional commercial vehicle urea tank market during the forecast period.

- For instance, in December 2024, Tata Genuine Parts introduced the Tata DEF station, aiming at cleaner and greener transportation. Tata Genuine Parts' DEF Station ensures Tata vehicles have a reliable supply of diesel exhaust fluid, which helps them meet environmental regulations and reduce emissions, supporting greener transportation while maintaining vehicle performance.

North America market is estimated to reach over USD 327.98 million by 2032 from a value of USD 235.16 million in 2024 and is projected to grow by USD 240.39 million in 2025. In North America, the market is characterized by the strong presence of established automotive manufacturers and stringent environmental regulations. The U.S. and Canada are key contributors to the market, driven by regulations such as the Clean Air Act that mandate reductions in NOx emissions. The demand for urea tanks in this region is further driven by the growing use of SCR technology in both commercial and off-highway vehicles, which are integral to the logistics and mining industries. These factors are further driving the market in North America.

- For instance, in July 2024, Volvo Trucks North America introduced a new engine designed to meet the stringent Omnibus regulations set by the California Air Resources Board (CARB). These rules, applicable to model years 2024 through 2026, demand a significant reduction in emissions from heavy-duty on-road engines, specifically a 75% decrease in nitrogen oxide (NOx) and a 50% decrease in particulate matter (PM) as compared to the current U.S. Environmental Protection Agency (EPA) standards.

According to the analysis, the commercial vehicle urea tank industry in Europe is anticipated to witness significant development during the forecast period. The European Union's stringent emission norms, including Euro 6 standards, have made SCR systems a necessity for diesel vehicles, driving the demand for urea tanks. The region also consists of several leading automotive manufacturers who are at the forefront of adopting advanced emission control technologies. Additionally, countries in Latin America are witnessing substantial growth in commercial vehicle production. This growth is further supported by favorable government policies and incentives aimed at promoting the adoption of cleaner technologies, including SCR systems. Further, the Middle East & Africa region benefits from a well-established infrastructure for urea distribution, which supports the widespread adoption of SCR systems. The market is anticipated to grow steadily, with prospects arising from the ongoing push towards sustainable and eco-friendly vehicle technologies.

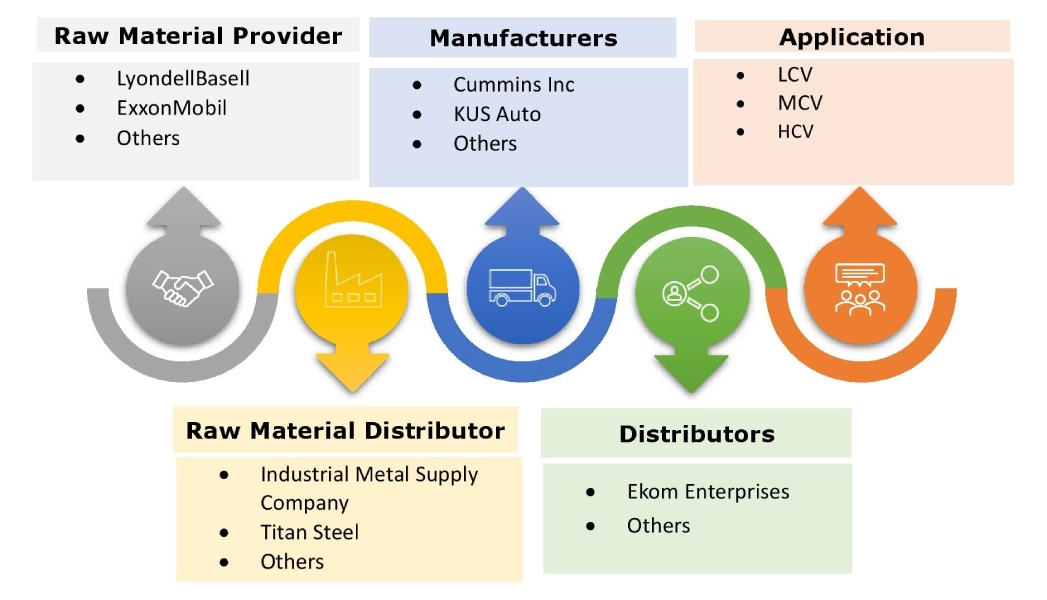

Top Key Players and Market Share Insights:

The global commercial vehicle urea tank market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the commercial vehicle urea tank industry include-

- Cummins Inc. (U.S.)

- Röchling Group (Germany)

- Yara International (Norway)

- Krampitz Tank System GmbH (Germany)

- SSI Technologies (U.S.)

- Elkamet Kunststofftechnik GmbH (Germany)

- KUS Auto (China)

- Elkhart Plastics Autoliv (Sweden)

- Hitachi Zosen (Japan)

- Robert Bosch (Germany)

Commercial Vehicle Urea Tank Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 964.65 Million |

| CAGR (2025-2032) | 4.0% |

| By Capacity |

|

| By Material |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Commercial Vehicle Urea Tank Market? +

Commercial Vehicle Urea Tank market size is estimated to reach over USD 964.65 Million by 2032 from a value of USD 689.77 Million in 2024 and is projected to grow by USD 705.26 Million in 2025, growing at a CAGR of 4.0% from 2025 to 2032.

Which is the fastest-growing region in the Commercial Vehicle Urea Tank Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Commercial Vehicle Urea Tank report? +

The Commercial Vehicle Urea Tank report includes specific segmentation details for capacity, material, application, sales channel, and region.

Who are the major players in the Commercial Vehicle Urea Tank Market? +

The key participants in the market are Cummins Inc. (U.S.), Elkamet Kunststofftechnik GmbH (Germany), KUS Auto (China), Elkhart Plastics Autoliv (Sweden), Hitachi Zosen (Japan), Robert Bosch (Germany), Röchling Group (Germany), Yara International (Norway), Krampitz Tank System GmbH (Germany), SSI Technologies (U.S.), and others.