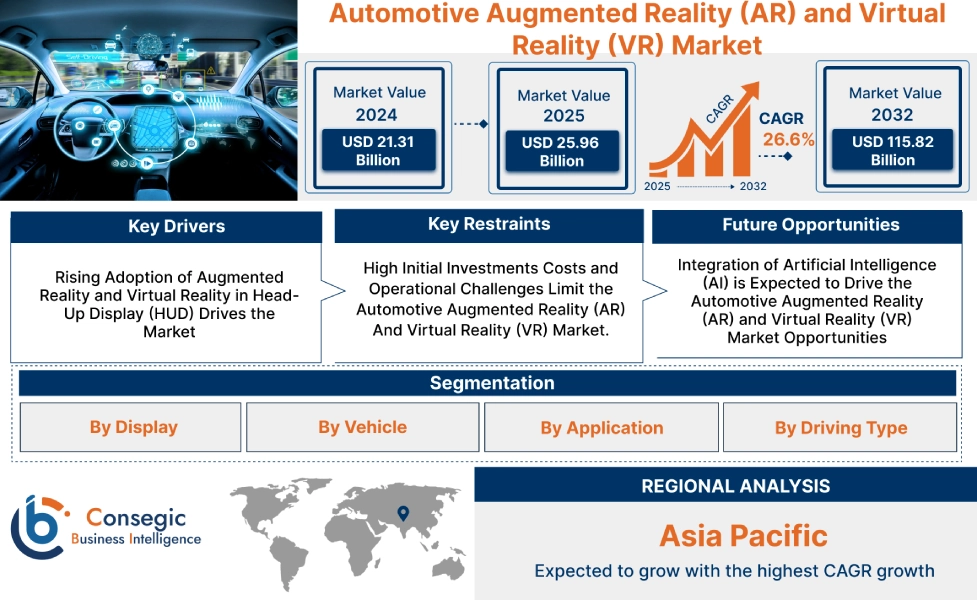

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Size:

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market size is estimated to reach over USD 115.82 Billion by 2032 from a value of USD 21.31 Billion in 2024 and is projected to grow by USD 25.96 Billion in 2025, growing at a CAGR of 26.6% from 2025 to 2032.

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Scope & Overview:

Augmented Reality (AR) refers to a technology that uses cameras and sensors to augment 3D objects onto displays on top of the user's environment for enhanced reality. Virtual Reality (VR) refers to a technology that uses sensors, input devices, and computer simulation to create a computer-generated environment in the user's peripheral vision. The automotive industry uses AR and VR technologies for HUDs, ADAS systems, assembly, and manufacturing phases of automobiles. Further, increasing focus on automation and integration of technologies to enhance a driver's experience has resulted in robust growth in the automotive AR and VR market.

How is AI Impacting the Automotive Augmented Reality (AR) and Virtual Reality (VR) Market?

AI is significantly advancing the automotive AR and VR market by making immersive technologies more intelligent, interactive, and practical. In design and manufacturing, AI enhances VR simulations, enabling engineers to visualize prototypes, test ergonomics, and optimize vehicle structures with greater precision. In sales and customer engagement, AI-powered AR applications allow buyers to virtually explore car features, customize models, and experience test drives in a digital environment. For driver assistance, AI integrates with AR head-up displays to project real-time navigation, hazard alerts, and performance data directly onto the windshield, improving safety and user experience. As automotive companies embrace digital transformation, AI-driven AR and VR are becoming essential tools across design, production, marketing, and in-vehicle applications.

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Dynamics - (DRO) :

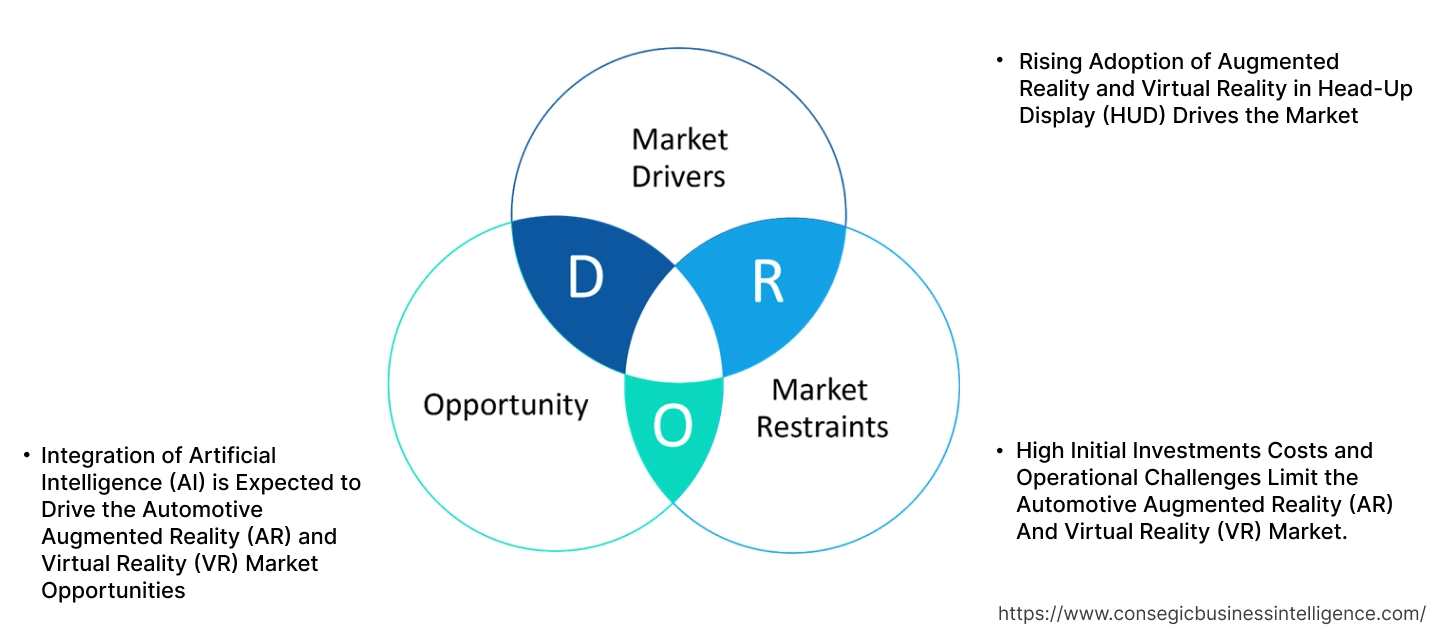

Key Drivers:

Rising Adoption of Augmented Reality and Virtual Reality in Head-Up Display (HUD) Drives the Market

Automotive augmented reality is being increasingly used in head-up displays of cars to display information in the driver’s vision to enhance the driving experience. The information displayed includes speed, warning signals, and other information related to the car’s performance. The AR HUD can be integrated with the windshield using a display like LCD, LED, and OLED, which can then display information. The HUD can also include a special type of film that can block incoming infrared light and visible wavelengths to enhance visibility and the life of the HUD components, driving the automotive augmented reality (AR) and virtual reality (VR) market size.

- For instance, Mercedes Benz for some of its models, like the 2022 C class, offers augmented reality navigation on the windshield using the HUD. The screen is layered between the windshield glass to achieve the display of navigation.

Additionally, many car companies are turning to virtual showrooms using virtual reality to showcase their cars instead of a physical showroom, which in turn drives the market. Hence, the growing adoption of AR HUDs and VR showrooms is driving the Automotive Augmented Reality (AR) and Virtual Reality (VR) market.

Key Restraints :

High Initial Investments Costs and Operational Challenges Limit the Automotive Augmented Reality (AR) And Virtual Reality (VR) Market.

The implementation of AR and virtual reality solutions is often associated with certain operational limitations and challenges, which are among the primary factors restraining the automotive augmented reality (AR) and virtual reality (VR) market growth. AR systems are often associated with high initial investment and implementation costs due to the technology used. Automotive companies may find it costly to implement AR and VR solutions due to the customization required to fit their needs in the production phase of a vehicle. Rendering 3D models on displays that accurately display vehicle parts or components in detail can be costly to implement due to the software costs and hardware costs. Moreover, employees need extensive training in both software and hardware to utilize AR and VR effectively during the design, assembly, and production phases. Also, companies looking to implement AR and VR will need to invest in employee training, which can restrain the adoption of automotive augmented reality (AR) and virtual reality (VR).

Future Opportunities :

Integration of Artificial Intelligence (AI) is Expected to Drive the Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Opportunities

Automotive Augmented Reality (AR) and Virtual Reality (VR) providers are frequently investing in the development of new technologies like Artificial Intelligence (AI) to ensure their safe and effective utilization in augmented reality and virtual reality. AI can be used to integrate information like threats on the road through HUDs, generating 3D models for vehicle components based on previous models, and training engineers working in different phases of production using personalized training programs to enhance learning.

- For instance, Transfr Inc.offers several virtual reality training options, including automotive training to simulate real-world problems virtually. Moreover, automotive VR training allows students to inspect automotive parts and perform repairs in a controlled and safe environment.

Thus, the rising integration of Artificial Intelligence (AI) is projected to drive the automotive augmented reality (AR) and virtual reality (VR) market opportunities during the forecast period.

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Segmental Analysis :

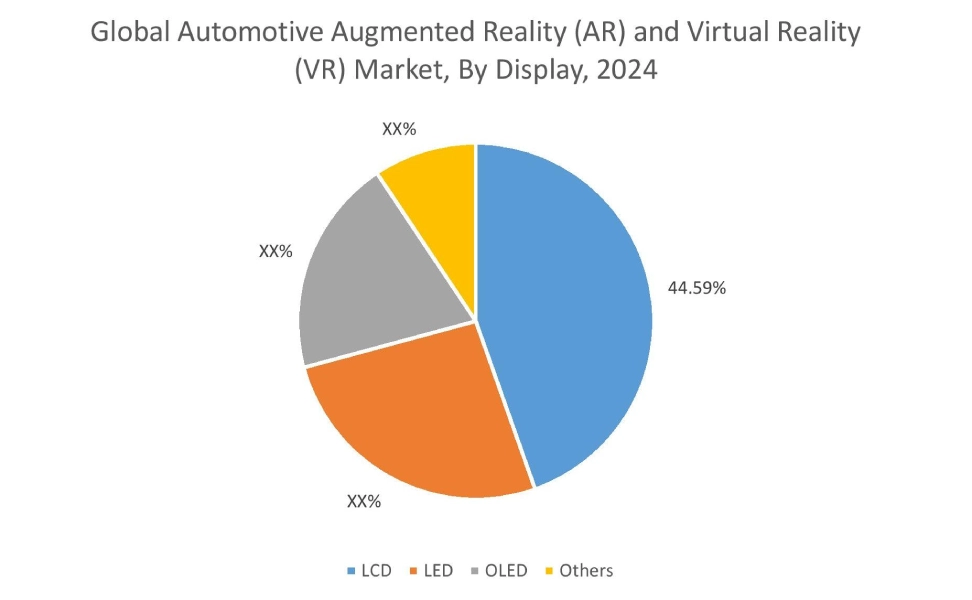

By Display:

Based on the display, the market is segmented into LCD, LED, OLED, and others.

Trends in the display:

- Increasing technological advancements associated with LCD displays to display warning information on windshields are driving the market.

- Rising utilization of LCD in VR headsets during prototyping of vehicle parts is driving the automotive augmented reality (AR) and virtual reality (VR) market share.

LCD segment accounted for the largest revenue share of 44.59% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Augmented reality can help overlay images on top of real environments for an immersive experience using LCD displays due to its cost-effectiveness and high resolution.

- Companies are investing in technologies to offer immersive experiences to drivers with the integration of LCD displays in the windshields and mirrors to achieve a photorealistic 3D effect.

- For instance, 3M offers a windshield HUD that uses a 3M Cold Mirror Film solution by placing it behind or directly in front of an LCD screen.

- Additionally, VR glasses or headwear consisting of LCD displays can be used to deliver information, like designing a component to make quick prototypes with the help holographic image on top of the environment, which is driving the automotive augmented reality (AR) and virtual reality (VR) market share.

- Thus, according to the automotive augmented reality (AR) and virtual reality (VR) market analysis, the rising advancements related to LCD displays are driving the automotive augmented reality (AR) and virtual reality (VR) market trends.

By Vehicle:

Based on the vehicle, the market is segmented into passenger vehicles and commercial vehicles.

Trends in vehicle:

- Rising trend towards the adoption of augmented reality and virtual reality in passenger cars for enhanced entertainment within the vehicle.

- Increasing integration of VR for driver training is driving the automotive augmented reality (AR) and virtual reality (VR) market.

Passenger vehicles accounted for the largest revenue share in the year 2024.

- Augmented reality in passenger cars offers passengers in the rear seat various infotainment options, including interactive information, entertainment, and gaming.

- Many companies today are digitalizing their showrooms using virtual reality technology, reducing their costs associated with traditional showrooms, as per the automotive augmented reality (AR) and virtual reality (VR) market analysis.

- For instance, Kia offers the option to view its car models virtually using virtual reality. The virtual reality option is ideal for consumers who prefer the comfort of using VR headsets without having to travel to the physical showroom.

- According to the analysis, increasing advancements associated with passenger car AR and VR solutions, including VR showrooms, are driving the automotive augmented reality (AR) and virtual reality (VR) market expansion.

Commercial vehicles is anticipated to register the fastest CAGR during the forecast period.

- Virtual Reality (VR) is increasingly used to create digital mockups of trucks in a virtual environment to test truck models.

- Moreover, AR solutions offer a wide range of benefits like part identification through the use of mobile apps, which is driving the automotive augmented reality (AR) and virtual reality (VR) market demand.

- For instance, in May 2023, Volvo launched an AR safety app, which allows users of the app to locate potentially dangerous components on their electric trucks as well as the steps required to make them safe.

- According to the automotive augmented and virtual reality market analysis, the increasing advancements related to commercial AR and VR solutions like part identification for safety are anticipated to boost the automotive augmented reality (AR) and virtual reality (VR) market trends during the forecast period.

By Application:

Based on the application, the market is segmented into ADAS visualization, design and prototyping, digital training, and others.

Trends in application:

- Increasing adoption of automotive augmented reality (AR) and virtual reality (VR) in quality control, designing, and prototyping due to the efficiency offered in vehicle manufacturing.

- Increasing investment in AR-integrated ADAS navigation is fueling market growth.

Advanced Driver Assistance Systems (ADAS) accounted for the largest revenue share in the year 2024.

- ADAS has transformed the automotive sector by making driving a safer experience through the inclusion of road sign information on the windshield.

- Traditional ADAS offers only signals or warnings in the form of sounds and vibrations. AR ADAS can transform this experience with the integration of visuals in the windshield.

- ADAS can be combined with Adaptive Cruise Control to maintain a safe distance between the vehicles in front of the driver by visualizing the distance on the windshield, which has increased the automotive augmented reality (AR) and virtual reality (VR) market demand.

- For instance, HARMAN offers an augmented reality platform that displays real-time intelligent overlays on the road. The platform also offers original equipment manufacturers to customize the offerings with respect to the ADAS using the Software Development Kit (SDK).

- Therefore, the increasing adoption of AR and VR solutions in ADAS due to better visualization of speed and distance is driving the automotive augmented reality (AR) and virtual reality (VR) market size.

Quality control accounted for the largest revenue share in the year 2024.

- AR and VR for quality control and inspection have seen robust growth due to the ability to ease the quality assurance process for manufacturers.

- Today, manufacturers can integrate AR and VR solutions in the production phase to maintain and inspect the quality of components and comply with regulatory standards.

- Moreover, employees and technicians can wear AR and VR glasses to find flaws in components by comparing the 3D model with the actual model, resulting in the automotive augmented reality (AR) and virtual reality (VR) market expansion.

- For instance, Novac Immerz offers custom solutions in AR and VR for quality control and inspection to ease the quality assurance process.

- Thus, the rising adoption of AR and VR for quality control due to quality testing of specific components is propelling the automotive augmented reality (AR) and virtual reality (VR) market during the forecast period.

By Driving Type:

Based on the driving type, the market is segmented into autonomous and non-autonomous.

Trends in the driving type:

- Increasing adoption of AR and VR solutions in non-autonomous driving cars for increased safety and immersive experience for end customers.

- There is a rising trend towards the utilization of AR and VR solutions in autonomous cars as the shift towards driverless cars continues.

Non-autonomous accounted for the largest revenue share in the year 2024.

- The growth of non-autonomous vehicles is attributed to the rising adoption of technology in non-autonomous cars to make cars smarter and more immersive through interactive entertainment options using AR and VR.

- Increasing adoption of AR and VR to overlay information and instructions for technicians in manufacturing to isolate faults in the production process is driving the market.

- Moreover, VR solutions for non-autonomous cars,like enhancing end customers’ experience, have increased the adoption of VR in non-autonomous vehicles.

- For instance, Aston Martin has explored VR solutions for dealer training to explain customization options to customers like paint colours and trim.

- Therefore, the increasing development of AR and VR solutions for utilization in non-autonomous vehicles is propelling the automotive augmented reality (AR) and virtual reality (VR) market growth.

Autonomous is anticipated to register the fastest CAGR during the forecast period.

- Virtual reality is being used increasingly in autonomous vehicles for training the system that operates the vehicle using virtual simulations of roads.

- Moreover, the utilization of AR and VR solutions in sensors like lidar for autonomous vehicles has made it easy to detect cars and other objects on the road effectively.

- For instance, Waymo uses lidar sensors in its vehicles, which are one of the most used sensors in augmented reality.

- Hence, the growing adoption of AR and VR in autonomous vehicles due to training of autonomous cars using simulations and detection of cars on the road is projected to increase the utilization of AR and VR solutions in automotive during the forecast period.

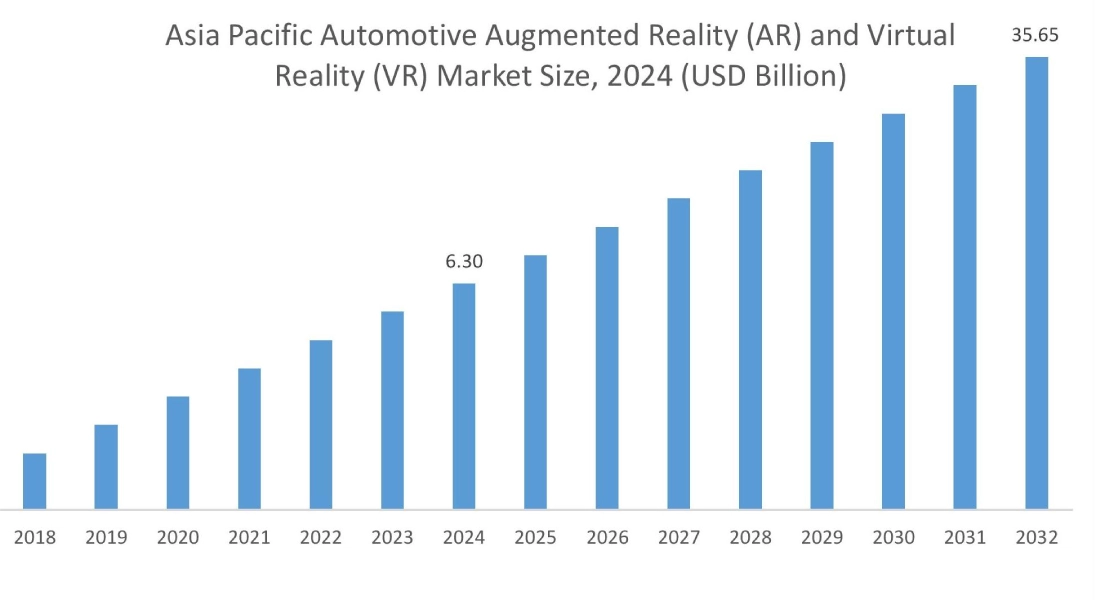

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

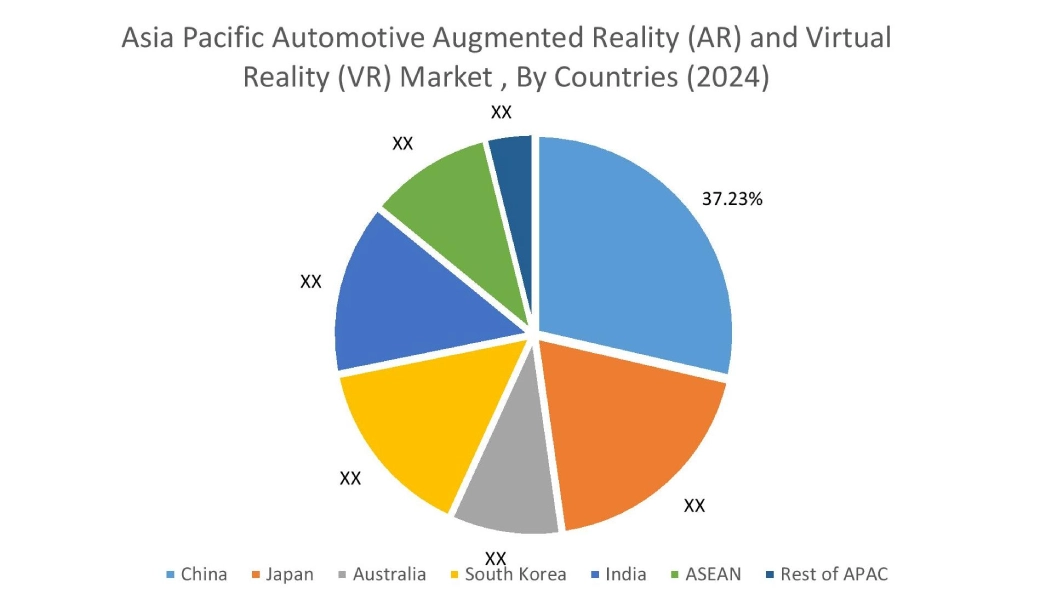

Asia Pacific region was valued at USD 6.30 Billion in 2024. Moreover, it is projected to grow by USD 7.70 Billion in 2025 and reach over USD 35.65 Billion by 2032. Out of this, China accounted for the maximum revenue of 37.23%. As per the automotive AR and VR market analysis, the adoption of AR and VR solutions in the Asia-Pacific region is primarily driven by the growing production of electric cars and rising investment in technology integrated into the cars.

- For instance, according to the UN Trade and Development, China manufactured 58% of the world’s electric vehicles in 2023. The growing production and technological advancements in electric cars are expected to drive the automotive AR and VR market.

North America is estimated to reach over USD 35.92 Billion by 2032 from a value of USD 6.63 Billion in 2024 and is projected to grow by USD 8.08 Billion in 2025. In North America, the growth of the automotive augmented reality (AR) and virtual reality (VR) industry is driven by the growing investments in autonomous cars and electric cars. Moreover, the increasing adoption of AR and VR solutions in the production of cars for streamlining operations by handling critical processes such as designing, training, and quality assurance is contributing to the automotive AR and VR market demand.

- For instance, Immerse offers VR training for assembly line operations during the production of cars. The company offers employee training through VR for complex tasks like engine installation and electrical repairs. The rise in software and solutions that utilize VR is driving the overall market.

Additionally, the regional analysis depicts that the growing ownership demand for electric vehicles is driving the automotive AR and VR market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to the increasing need to include AR technologies in head-up displays in cars. Middle East and African regions are expected to grow at a considerable rate due to factors such as an increase in technology investments and the rise in skilled workforce that can use AR and VR effectively in production.

Top Key Players & Market Share Insights:

The global Automotive Augmented Reality (AR) and Virtual Reality (VR) market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the Automotive Augmented Reality (AR) and Virtual Reality (VR) market. Key players in the automotive augmented reality (AR) and virtual reality (VR) industry include-

- Bosch GmbH(Germany)

- Fusion VR (India)

- Basemark Oy (Finland)

- Panasonic Automotive Systems Co., Ltd. (Japan)

- Dassault Systemes (France)

- ST Engineering Antycip(Singapore)

- Varjo (Finland)

- Vection Technologies (Australia)

- Magic Leap, Inc. (U.S.)

- Harman International (U.S.)

Recent Industry Developments :

Partnership:

- In March 2024, Unity Japan and Mazda Motor Corporation announced their partnership to utilize Unity’s expertise in real-time 3D rendering in Mazda vehicles to display information. The partnership aims to reduce the time the driver takes to recognize information, making the driving experience safer.

Product Launch:

- In March 2024, Valeo announced the launch of an extended reality in-car gaming experience that integrates the vehicle’s surroundings to offer an immersive gaming experience. The game uses the vehicle’s cameras, sensors, and AI algorithms to insert the car into a virtual environment.

Automotive Augmented Reality (AR) and Virtual Reality (VR) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 115.82 Billion |

| CAGR (2025-2032) | 26.6% |

| By Display |

|

| By Vehicle |

|

| By Application |

|

| By Driving Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Automotive Augmented Reality (AR) and Virtual Reality (VR) market? +

Automotive Augmented Reality (AR) and Virtual Reality (VR) market is estimated to reach over USD 115.82 Billion by 2032 from a value of USD 21.31 Billion in 2024 and is projected to grow by USD 25.96 Billion in 2025, growing at a CAGR of 26.6% from 2025 to 2032.

Which is the fastest-growing region in the Automotive Augmented Reality (AR) and Virtual Reality (VR) market? +

Asia-Pacific region is experiencing the most rapid growth in the Automotive Augmented Reality (AR) and Virtual Reality (VR) market.

What specific segmentation details are covered in the Automotive Augmented Reality (AR) and Virtual Reality (VR) report? +

The Automotive Augmented Reality (AR) and Virtual Reality (VR) report includes specific segmentation details for display, vehicle, application, driving type, and region.

Who are the major players in the Automotive Augmented Reality (AR) and Virtual Reality (VR) market? +

The key participants in the Automotive Augmented Reality (AR) and Virtual Reality (VR) market are Bosch GmbH (Germany), ST Engineering Antycip (Singapore), Varjo (Finland), Vection Technologies (Australia), Magic Leap, Inc. (U.S.), Harman International (U.S.), Fusion VR (India), Basemark Oy (Finland), Panasonic Automotive Systems Co., Ltd. (Japan), Dassault Systemes (France), and Others.