Infrastructure Monitoring Market Size :

Infrastructure Monitoring Market Size is estimated to reach over USD 16.76 Billion by 2032 from a value of USD 9.66 Billion in 2024 and is projected to grow by USD 10.21 Billion in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

Infrastructure Monitoring Market Scope & Overview:

Infrastructure monitoring is used for facilitating structural management of assets that are being built or demolished, offering direct insight related to its behaviour or any effects on surrounding structures. It involves observing various aspects of the building and its surrounding environment to manage structural integrity, track progress, and mitigate risks. By integrating various technologies like IoT sensors, GIS, AI, machine learning, and digital twins, infrastructure monitoring in construction buildings provides comprehensive data and actionable insights. This leads to improved project oversight, enhanced safety, optimized resource utilization, and the creation of more resilient and sustainable infrastructures.

Infrastructure Monitoring Market Insights :

Infrastructure Monitoring Market Dynamics - (DRO) :

Key Drivers :

Emergence of infrastructure & application monitoring as a service is driving the infrastructure monitoring market expansion

The emergence of infrastructure & application monitoring as a service is revolutionizing how organizations manage their IT environments. This service model offers businesses the flexibility to monitor their infrastructure and applications without the need for extensive on-premises installations. By leveraging cloud-based platforms, companies can gain real-time insights into their systems, enabling them to detect and address potential issues swiftly. This approach not only decreases the burden on internal IT teams but also ensures that businesses can maintain high levels of performance and reliability. As organizations increasingly adopt digital transformation strategies, the demand for such services is expected to grow, providing a scalable and efficient solution for monitoring complex IT infrastructures.

- For instance, in January 2023, Siemens announced a partnership with Skyway to create vertiport infrastructure. This collaboration focused on providing sustainable electric power, establishing standardized charging methods, and studying energy requirements for these facilities.

Thus, according to the infrastructure monitoring market analysis, the emergence of infrastructure & application monitoring as a service is driving the infrastructure monitoring market growth.

Key Restraints :

Complexity of modern IT environments is affecting the infrastructure monitoring market demand

Organizations often struggle with integrating monitoring tools into their existing systems, leading to potential gaps in coverage and increased management costs. Furthermore, the rapid pace of technological advancements often leads to monitoring solutions becoming obsolete quickly, necessitating continuous investment in new technologies and upgrades. Further, many monitoring applications in construction require real-time data for immediate decision-making, such as detecting structural irregularities during lifting operations or responding to safety alerts, thereby increasing complexity. Thus, the aforementioned factors would further impact the infrastructure monitoring market size.

Future Opportunities :

Surge in cloud-based monitoring solutions is expected to drive the infrastructure monitoring market opportunities

Cloud-based monitoring solutions offer significant advantages due to their scalability, allowing organizations to oversee extensive IT infrastructures without the limitations of traditional on-premises hardware. Market analysis indicates that these solutions eliminate the need for substantial initial investments in hardware and reduce ongoing maintenance expenses. Businesses benefit from flexible, subscription-based pricing, paying only for the resources they use, which makes cloud-based monitoring a particularly cost-effective choice for smaller organizations with tight budgets. Furthermore, the accessibility of cloud-based monitoring solution enables users to manage it remotely from anywhere with an internet connection.

- For instance, Schneider Electric offers monitoring solutions for industrial operations, smart buildings, and electrical grids. Their EcoStruxure platform leverages IoT connectivity, cloud computing, and AI-powered analytics. This integrated approach helps organizations improve the efficiency and sustainability of their infrastructure management. Schneider Electric's solutions are widely used in sectors like data centers, utilities, and manufacturing to optimize energy use and operational workflows.

Thus, based on the above infrastructure monitoring market analysis, the surge in cloud-based monitoring solutions is expected to drive the infrastructure monitoring market opportunities and trends.

Infrastructure Monitoring Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 16.76 Billion |

| CAGR (2023-2030) | 6.4% |

| By Component | Hardware, Software, and Service |

| By Technology | Wired and Wireless |

| By Application | Corrosion Monitoring, Erosion Monitoring, Crack Detection, Damage Detection, Multimodal Sensing, Drought Monitoring, Strain Monitoring, Thermal Monitoring, Vibration Monitoring, and Others |

| By End-User | Aerospace and Defense, Manufacturing, Mining, Power Generation, Civil Infrastructure, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | ABB, Acellent Technologies, Inc., AVT Reliability Ltd., Bridge Diagnostics, Inc. (BDI), Dynatrace LLC, Campbell Scientific, Inc., Digitex Systems, Emerson Electric, General Electric, Honeywell, National Instruments, Parker Hannifin, Rockwell Automation, Siemens AG, Yokogawa Electric Corporation, Schaeffler AG |

Infrastructure Monitoring Market Segmental Analysis :

By Component :

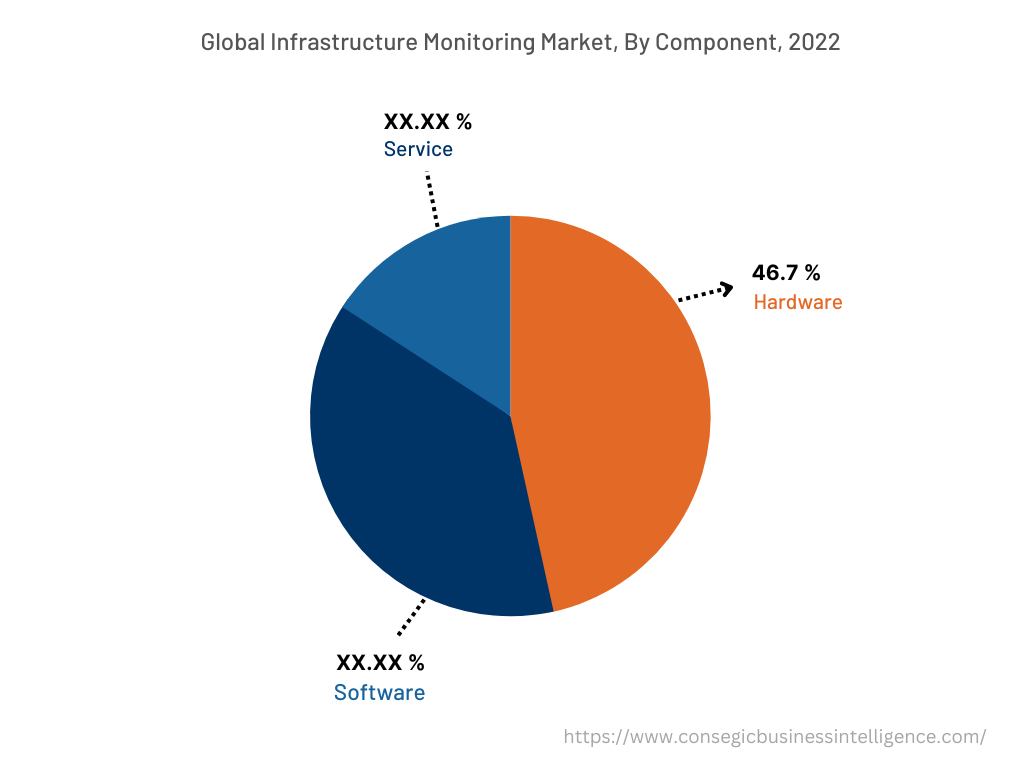

Based on component, the infrastructure monitoring market is segmented into hardware, software, and services.

Trends in the component:

- The integration of advanced technologies into infrastructure monitoring solutions is enhancing their capabilities significantly.

- The rising complexity of infrastructure projects and the need for specialized skills are driving the growth of the services segment.

The hardware segment accounted for the largest revenue share of 47.89% in the year 2024.

- The hardware segment primarily includes sensors, data acquisition systems, and other physical devices that capture real-time data from infrastructure elements. With advancements in sensor technologies, the hardware segment is expected to grow significantly.

- Innovations, including wireless sensors and energy-harvesting sensors, are making hardware more reliable and easier to install, contributing to market development.

- Many organizations are opting for physical monitoring devices, such as network probes and sensors, as they provide continuous oversight and data collection even when there are disruptions or outages in the main network. This ensures critical operational insights are maintained regardless of network connectivity issues.

- Thus, based on the above analysis, these factors are further driving the global

The services segment is anticipated to register the fastest CAGR during the forecast period.

- Services are critical for the successful deployment and operation of monitoring systems.

- Service providers offer expertise in system integration, ensuring that all components work seamlessly together.

- They also provide ongoing maintenance to ensure the system's reliability and accuracy.

- The rising complexity of infrastructure projects and the need for specialized skills are driving the development of the services segment.

- For instance, in July 2023, VMware, Inc. launched advanced cloud monitoring services designed to simplify the scaling and access of distributed cloud resources. These new cloud-based offerings are specifically aimed at improving proactive fault resolution.

- Thus, based on the above analysis, these factors are driving the infrastructure monitoring market demand.

By Technology :

Based on the technology, the market is segmented into wired and wireless.

Trends in the technology:

- There is a growing demand for high-speed data and connectivity, driven by widespread smartphone usage, rich media content, and the rollout of 5G networks.

- The proliferation of IoT devices and the growth of edge computing necessitate strong monitoring capabilities for these diverse and often remote endpoints. This includes monitoring device performance, security, and connectivity at the edge, ensuring seamless operation and data integrity.

- Thus, the above factors are expected to drive the infrastructure monitoring market share during the forecast period.

The wired segment accounted for the largest revenue in the year 2024.

- Wired technologies have been the traditional choice for infrastructure monitoring due to their reliability and high data transmission rates.

- These systems are often used in permanent installations where long-term monitoring is required, such as in bridges and dams.

- The escalating threat landscape, with increasingly sophisticated cyberattacks targeting network infrastructure, is driving the segment's development. This drives the need for monitoring solutions that offer real-time threat detection, behavioural analytics, and integrated security insights to protect wired networks.

- Thus, based on the above analysis, these factors would further drive the infrastructure monitoring market

The wireless segment is anticipated to register the fastest CAGR during the forecast period.

- Wireless technologies are gaining popularity due to their flexibility and ease of installation.

- Wireless sensors can be quickly deployed in various environments without the need for bulky cabling, making them ideal for temporary monitoring or in areas where wired solutions are impractical.

- The advancements in wireless communication technologies, such as LoRaWAN, Zigbee, and NB-IoT, have significantly improved the reliability and range of wireless monitoring systems. These advancements are making wireless solutions increasingly popular, particularly in urban areas where rapid deployment is essential.

- Consequently, based on the above analysis, these factors are anticipated to further drive the infrastructure monitoring market trends during the forecast period.

By Application :

Based on application, the market is segmented into corrosion monitoring, erosion monitoring, crack detection, damage detection, multimodal sensing, drought monitoring, strain monitoring, thermal monitoring, vibration monitoring, and others.

Trends in the application

- The increasing focus on smart buildings and sustainable construction practices is driving the adoption of advanced monitoring solutions in this application area.

- The rising need for ensuring the safety and efficiency of tunnels, particularly in urban areas with high traffic volumes, is driving the demand for specialized monitoring systems.

- These factors are anticipated to further drive the infrastructure monitoring market trends during the forecast period.

The vibration monitoring segment accounted for the largest revenue share in 2024, and it is anticipated to register the fastest CAGR during the forecast period.

- Vibration monitoring held the largest market share, driven by the increased use of vibration sensors. These sensors are installed to detect and analyze vibrations caused by external factors such as traffic, wind, or seismic activity.

- By continuously monitoring these vibrations, engineers can identify potential structural problems, assess the impact of external forces, and ensure the safety and lifespan of infrastructure.

- Vibration monitoring is widely used in industrial environments to evaluate the condition of machinery and equipment. Sensors are placed on rotating machinery like motors, pumps, turbines, and compressors. This enables the detection of unusual vibrations that might signal issues such as misalignment, imbalance, wear, or other mechanical defects.

- Thus, the aforementioned factors are driving the infrastructure monitoring market growth.

By End-User :

Based on end user, the market is segmented into aerospace and defense, manufacturing, mining, power generation, civil infrastructure, and others.

Trends in the end user:

- The focus on digital transformation and the increasing complexity of government IT infrastructures are expected to drive continued investment in monitoring solutions.

- The increasing focus on renewable energy sources, such as wind and solar, is driving the demand for specialized infrastructure monitoring solutions to ensure the reliability and efficiency of these installations.

The civil infrastructure segment accounted for the largest revenue share in the year 2024, and it is expected to register the highest CAGR during the forecast period.

- Civil infrastructure, which encompasses roads, bridges, tunnels, and buildings, is the largest end-user segment.

- The rising need for ensuring the safety and reliability of critical infrastructure is driving the adoption of monitoring systems in this sector.

- Moreover, governments and private entities are increasingly investing in monitoring solutions to prevent failures and extend the lifespan of their infrastructure assets.

- Further, the growing initiatives for smart cities are also contributing to the demand for advanced monitoring systems in the civil infrastructure sector.

- Thus, the rising developments associated with civil infrastructure are driving the global market.

By Region :

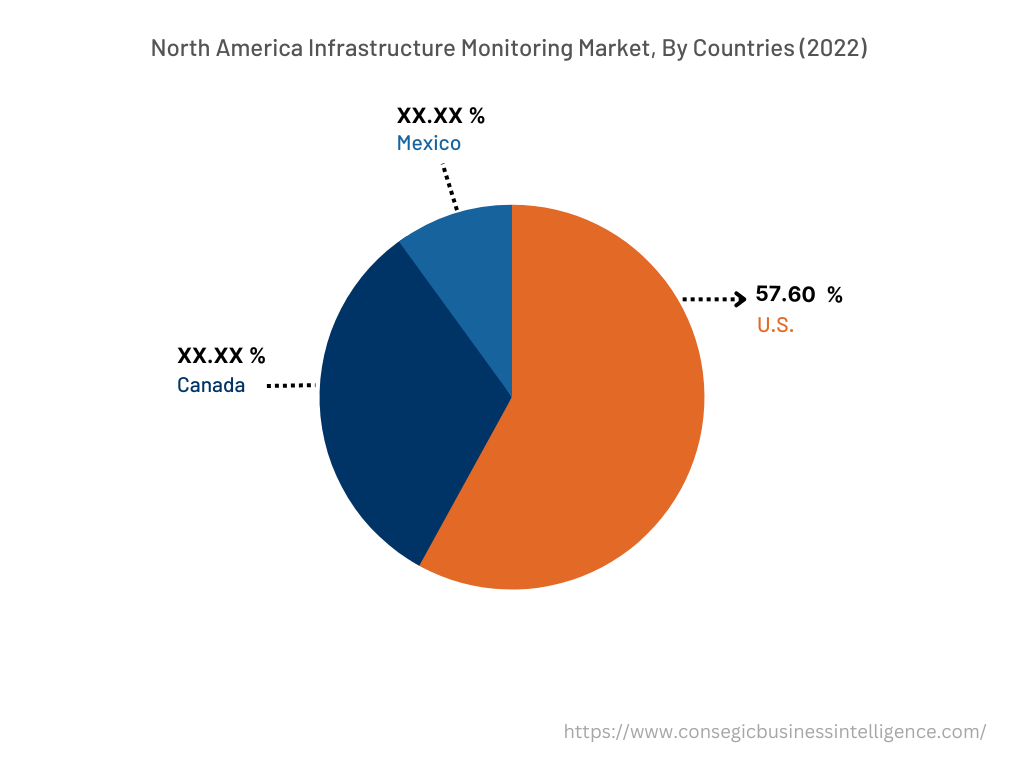

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific infrastructure monitoring market expansion is estimated to reach over USD 3.69 billion by 2032 from a value of USD 1.99 billion in 2024 and is projected to grow by USD 2.12 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 34.91%. The region is expected to witness the highest growth rate during the forecast period, driven by large-scale infrastructure projects and increasing awareness of the benefits of infrastructure monitoring systems. Rapid urbanization and industrialization in the region are creating a significant need for new infrastructure, which in turn requires robust monitoring solutions. Further, governments in these regions are increasingly focusing on infrastructure development and resilience, creating a favorable environment for market growth. These trends would further drive the regional market during the forecast period.

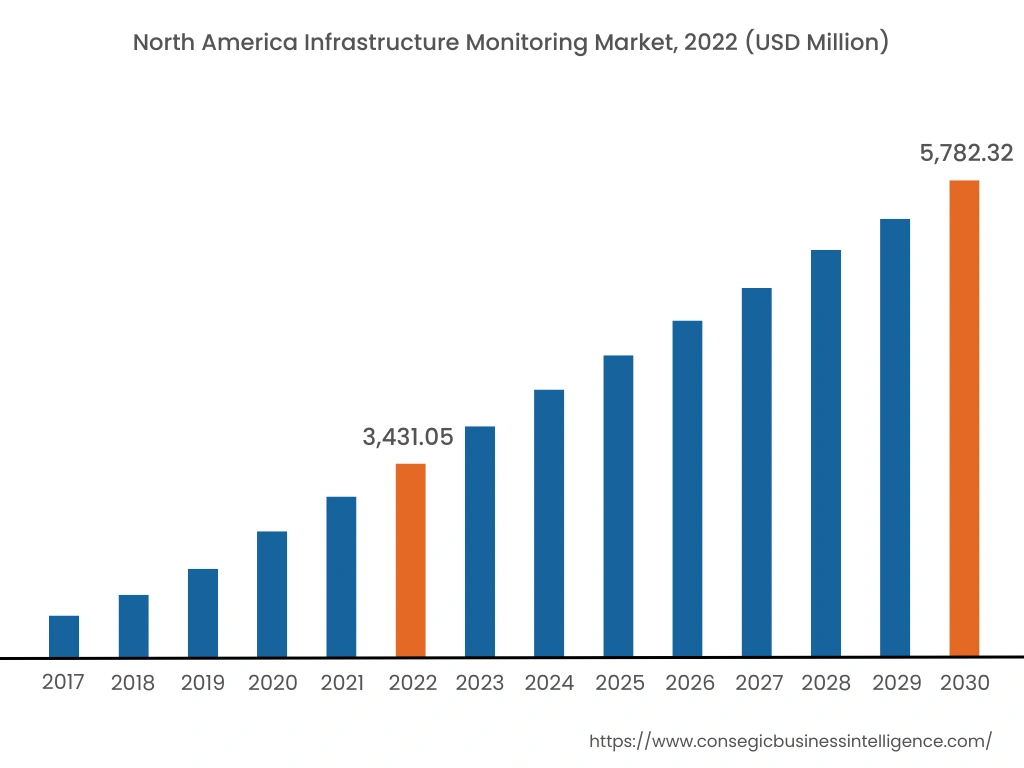

North America market is estimated to reach over USD 7.27 billion by 2032 from a value of USD 4.21 billion in 2024 and is projected to grow by USD 4.44 billion in 2025. North America has been one of the largest markets for advanced monitoring systems, primarily due to the early adoption of advanced technologies and high investments in infrastructure maintenance. The U.S. government and private entities are increasingly focusing on the safety and longevity of critical infrastructure, driving the need for advanced monitoring solutions. Further, the region's well-established technological ecosystem and the presence of major market players further support market growth. These factors and trends would further drive the industry in North America.

According to the analysis, the infrastructure monitoring industry in Europe is anticipated to witness significant development during the forecast period. The region's stringent regulatory standards and focus on smart city initiatives are further driving the adoption of monitoring systems. Latin America's significant investment in infrastructure development and ongoing maintenance efforts is a key driver for the increased adoption of monitoring technologies. This substantial financial commitment emphasizes the need to ensure the reliability, safety, and efficiency of vital infrastructure assets across the region. Further, the increasing urbanization and industrialization along with rising infrastructure development activities in the Middle East & African region contribute significantly to the market's growth. These factors would further drive the regional infrastructure monitoring market size.

- For instance, in April 2023, according to the World Nuclear Association, Asia leads the world in electricity generation from nuclear power plants. The continent currently has about 140 operable nuclear power reactors, with an additional 30-35 reactors under construction. The above factors are driving the market in the region.

Top Key Players & Market Share Insights:

The global infrastructure monitoring market is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the infrastructure monitoring industry include-

- Schneider Electric (France)

- Siemens AG (Germany)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- General Electric Company (U.S.)

- Emerson Electric Co. (U.S.)

- ABB Ltd. (Switzerland)

- Rockwell Automation, Inc. (U.S.)

Recent Industry Developments :

- In September 2022, ABB and Samotics entered a strategic partnership to extend ABB's condition monitoring services to strict and submersible environments.

- In February 2020, Dynatrace LLC introduced the next-generation all-in-one software intelligence platform for structure monitoring. The platform includes enhanced AI and cloud-based dynamic microservices to provide algorithms for improved infrastructure performance and reliability metrics.

Key Questions Answered in the Report

What is infrastructure monitoring? +

Infrastructure monitoring refers to the systematic process of observing and tracking the performance, availability, and health of an organization's IT infrastructure including servers, networks, databases, and other critical components.

What specific segmentation details are covered in the infrastructure monitoring market report, and how is the dominating segment impacting the market growth? +

The hardware component dominates the market as majority of the organizations rely on legacy systems and on-premises hardware for the IT infrastructure. The systems require hardware-based monitoring solutions to effectively track and manage the performance, thus contributing significantly in driving the growth of the hardware segment.

What specific segmentation details are covered in the infrastructure monitoring market report, and how is the fastest segment anticipated to impact the market growth? +

The power generation segment is anticipated to witness the fastest CAGR as infrastructure monitoring sensors monitor equipment namely turbines, generators, and boilers to detect anomalies and predict maintenance needs. Continuous monitoring helps to optimize plant performance, reduce downtime, and enhance operational efficiency.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period owing to the increasing investment by governments and private enterprises in transportation, energy, and construction projects, driving the demand for infrastructure monitoring solutions to ensure the safety and efficiency of the developments.