Eco-Friendly Plasticizers Market Size:

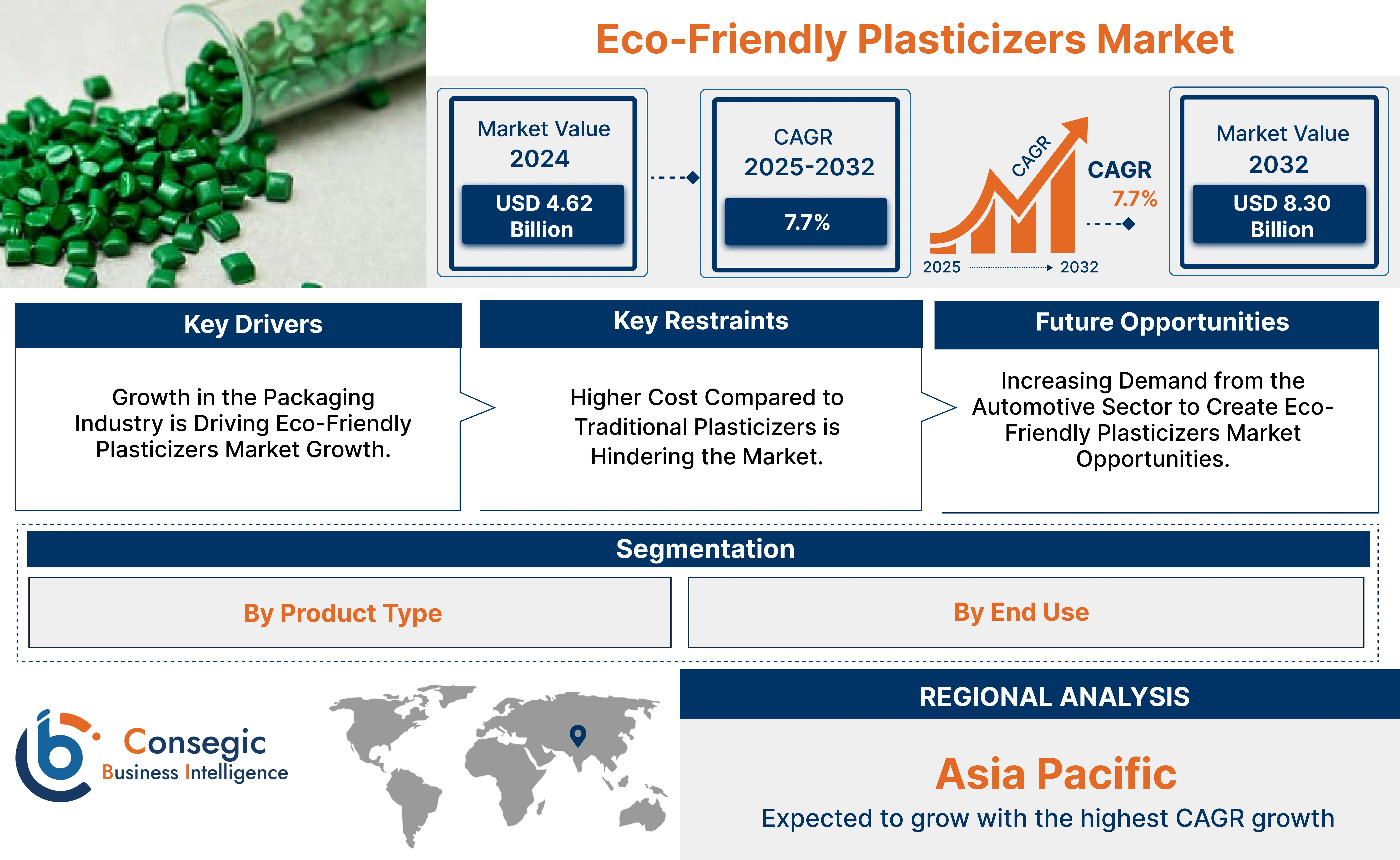

The Eco-Friendly Plasticizers Market size is growing with a CAGR of 7.7% during the forecast period (2025-2032), and the market is projected to be valued at USD 8.30 Billion by 2032 from USD 4.62 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 4.95 Billion.

Eco-Friendly Plasticizers Market Scope & Overview:

Eco-friendly plasticizers address the health and environmental concerns associated with traditional phthalate-based plasticizers. The market is driven by increasingly stringent global regulations and strong corporate sustainability commitments. There are two major categories known as bio-based plasticizers that are derived from renewable resources such as vegetable oils and citric acid and non-phthalate synthetic plasticizers, which are developed with improved safety profiles. These plasticizers offer a higher initial cost and performance differences compared to their conventional counterparts. Eco-friendly plasticizers offer distinct advantages such as reduced toxicity, lower environmental impact, and enhanced brand reputation, making them a suitable option for applications in packaging, automotive, consumer goods, and construction among other sectors as they focus for more sustainable solutions.

How AI is Impacting the Eco-Friendly Plasticizers Market?

AI is transforming the eco-friendly plasticizers market by accelerating the discovery and development of sustainable alternatives. Machine learning algorithms analyze vast datasets to predict material properties, enabling the design of novel bio-based plasticizers with desired performance characteristics, often surpassing traditional petroleum-based options. AI also optimizes production processes, reducing waste and energy consumption, and enhances recycling efforts through improved sorting and identification of plastic waste. This fosters a more circular economy and supports the shift towards non-toxic, biodegradable solutions, ultimately driving market growth for green plasticizers.

Eco-Friendly Plasticizers Market Dynamics - (DRO) :

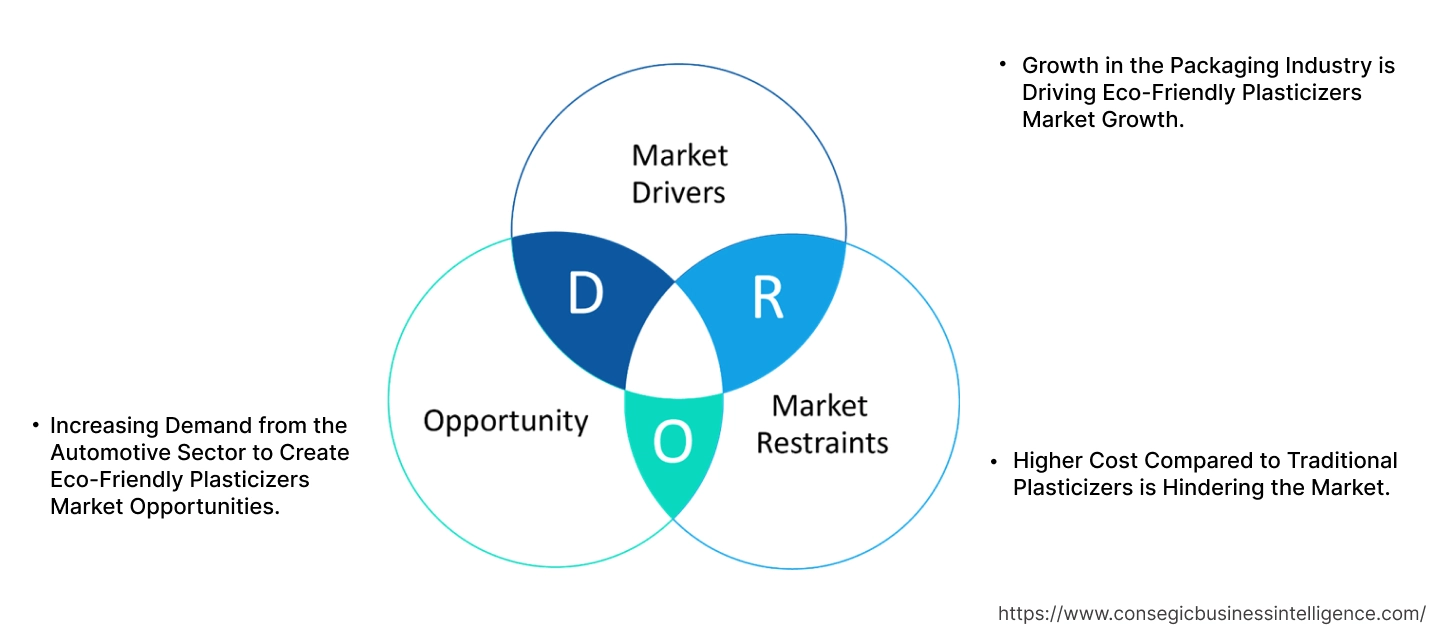

Key Drivers:

Growth in the Packaging Industry is Driving Eco-Friendly Plasticizers Market Growth.

The rise in stringent regulations restricting traditional phthalate plasticizers in food contact and sensitive applications along with a growing global consumer demand for safer, sustainable products, are forcing packaging manufacturers to adopt greener alternatives. This includes utilization of bio-based options such as epoxidized vegetable oils (ESBO), citrate esters, and high-performance non-phthalate synthetics such as DOTP. As the packaging sector continues to grow, its focus on sustainability is driving the market.

- For instance, according to the data published by the Smithers, the packaging market across the globe experienced a growth rate of more than 2% from 2019 – 2024.

Hence, due to the aforementioned factors, the growing packaging sector is driving eco-friendly plasticizers market growth.

Key Restraints:

Higher Cost Compared to Traditional Plasticizers is Hindering the Market.

The high cost of eco-friendly plasticizers as opposed to their traditional petroleum-derived counterparts, presents a barrier to their widespread adoption. This is due to the established economies of scale and mature manufacturing processes of conventional phthalates, making them considerably more cost-effective. Conversely, eco-friendly alternatives, particularly bio-based variants, involve complex production methods and reliance on potentially volatile agricultural feedstocks. In case of price-sensitive industries such as construction and packaging, the higher cost directly impacts the product's competitiveness. These aforementioned factors are contributing to hindrances in the eco-friendly plasticizers market expansion.

Future Opportunities :

Increasing Demand from the Automotive Sector to Create Eco-Friendly Plasticizers Market Opportunities.

Opportunities.

The growing demand of the automotive sector, particularly from electric vehicles, is driven by the sector’s need for lightweight materials to enhance fuel efficiency and EV range, along with the stringent regulations on interior air quality, leading to a shift towards non-toxic alternatives. Plasticizers of eco-friendly nature offer properties such as durability, flexibility, and low VOC emissions, making them a suitable option for diverse automotive components, from dashboards and seat covers to wires and cables, thus contributing to market revenue.

- For instance, according to the data published by ACEA, the European Union manufactured 12.2 million cars in 2023, marking an 11.6% increase compared to 2022 production figures.

Thus, as per analysis, the increasing demand from the automotive sector is expected to create eco-friendly plasticizers market opportunities.

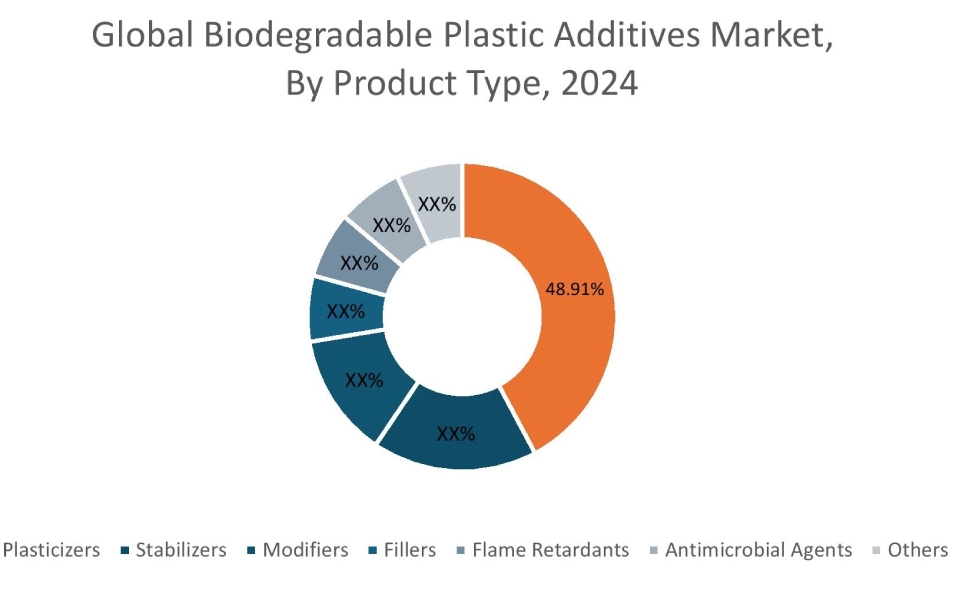

Eco-Friendly Plasticizers Market Segmental Analysis :

By Product Type:

Based on Product Type, the market is categorized into bio-based plasticizers and non-phthalate-free plasticizers.

Trends in Product Type:

- The increase in stringent regulations that promote sustainable and bio-based chemicals favoring the adoption of bio-based plasticizers serve as a key trend positively impacting the market.

The bio-based plasticizers segment accounted for the largest eco-friendly plasticizers market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- Bio-based plasticizers are dominating the market, driven by their superior environmental nature, as they are derived from renewable plant sources such as vegetable oils, citric acid, and succinic acid, offering lower toxicity, enhanced biodegradability, and a reduced carbon footprint.

- Additionally, the increase in global regulations promoting sustainable chemicals along with a growing consumer preference for green products across diverse sectors is contributing to rise in their adoption.

- Moreover, continuous technological advances contribute to improving their performance, making bio-based plasticizers increasingly competitive with synthetic alternatives.

- For instance, according to PwC, irrespective of concerns about the cost of living and inflationary pressures, consumers are showcasing a willingness to pay more for products that are sustainably produced or sourced, indicating an average premium acceptance of 9.7%.

- Thus, as per the market analysis, the bio-based plasticizers segment dominates the eco-friendly plasticizers market expansion and is expected to grow at the fastest CAGR over the forecast period.

By End Use:

Based on the End Use, the market is categorized into packaging, consumer goods, automotive & transportation, building & construction, and others.

Trends in the End Use

- Stringent regulations on food contact materials and medical packaging which increasingly restrict traditional phthalates are a key trend.

The packaging segment accounted for the largest eco-friendly plasticizers market share of 38.44% in 2024.

- The packaging sector holds prominence due to the strict regulations concerning food contact and medical packaging, which increasingly restrict traditional phthalates, thereby preferring low-toxicity eco-friendly options such as ESBO and citrates.

- Furthermore, the rise in consumer requirements for sustainable and safe packaging, along with the focus towards corporate sustainability goals, is driving the widespread adoption of these plasticizers in films, wraps, containers, and seals.

- Moreover, the need for materials that are flexible as well as safe for direct contact further contributes to the role of eco-friendly plasticizers further contributing to the segment’s revenue.

- Thus, based on market analysis, the packaging segment dominated the market share.

The automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period.

- The automotive & transportation segment revenue is driven by the sector’s need for lightweighting to enhance fuel efficiency along with the increase in stringent regulations on interior air quality.

- The rise in expansion of electric vehicles including marine electric vehicle is further contributing to the high adoption, as eco-friendly plasticizers become important for components such as battery casings and wiring.

- For instance, new IEA report indicates that global electric car sales are projected constitute over a quarter of worldwide car sales, and are on track to surpass a 40% market share by 2030.

- Moreover, automotive companies' strong focus towards sustainability trends and the need for materials that maintain durability and performance in harsh conditions are further supporting segmental revenue.

- Thus, based on market analysis, the automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period.

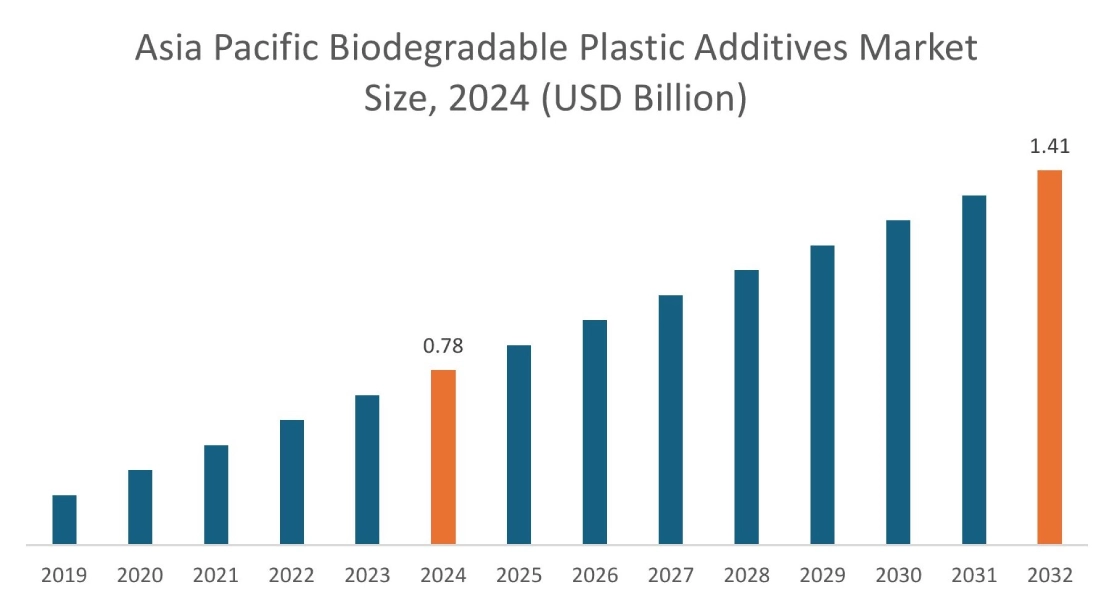

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

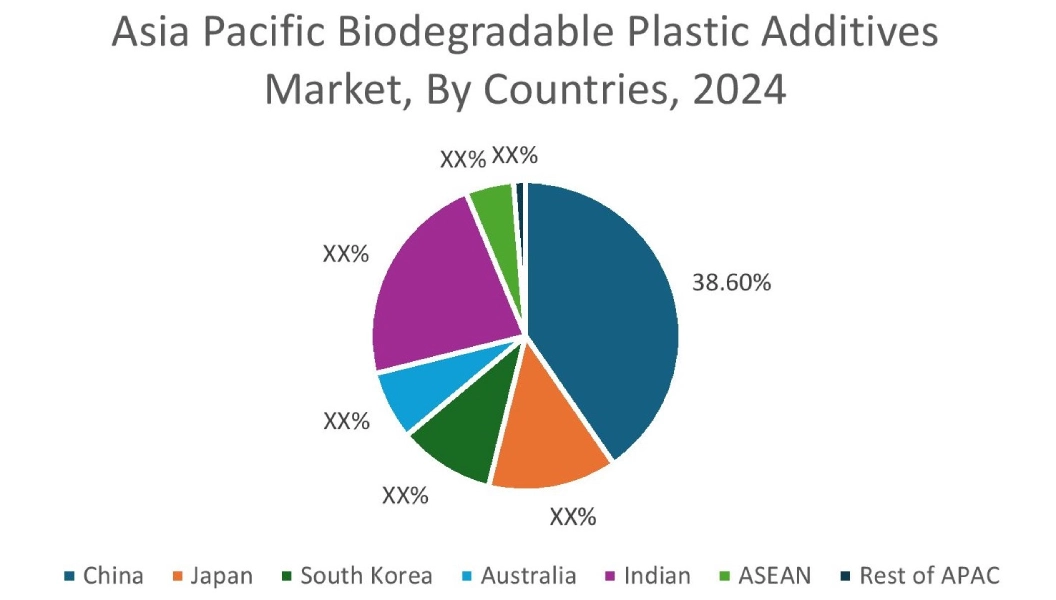

In 2024, Asia Pacific accounted for the highest market share at 41.98% and was valued at USD 1.94 Billion and is expected to reach USD 3.51 Billion in 2032. In Asia Pacific, China accounted for a market share of 38.60% during the base year of 2024. The growth of the packaging sector in the Asia Pacific region is a major catalyst for the eco-friendly plasticizers market demand due to the region's growing packaging sector along with the increase in stringent regulations on plastic waste and hazardous substances, particularly for food & beverage and medical packaging. Manufacturers are adopting safer alternatives such as ESBO and citrates.

- For instance, according to the packaging world, the total packaging for bottled water in China experienced a growth rate of 6.0% by 2023.

Thus, as per the eco-friendly plasticizers market analysis, these factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

In Europe, the eco-friendly plasticizers industry is experiencing the fastest growth with a CAGR of 10.1% over the forecast period owing well-established automotive sector across the region, driven by the region's stringent regulations such as REACH and evolving ELV directives, which necessitate the use of safer and more recyclable materials. Furthermore, Europe's circular economy goals along with the rapid growth of the electric vehicle market are contributing to the need for these sustainable plasticizers. This makes eco-friendly plasticizers important for various automotive components, as they enhance performance, and align with the sector’s environmental goals.

North America's eco-friendly plasticizers market analysis is driven by continuous advancements in production technologies. This includes R&D investments by leading chemical companies to develop more efficient synthesis ways for both bio-based and non-phthalate alternatives. The North American manufacturers are focused on improving the efficiency of bio-based plasticizer production through advanced extraction, purification, and enzymatic processes. These factors together are contributing to the eco-friendly plasticizers market demand in this region.

The increasing building & construction sector in the Middle East and Africa (MEA) presents a potential for the eco-friendly plasticizers market trend, driven by infrastructure development across the region, especially through projects in Saudi Arabia and the UAE. In addition to this, a growing focus towards green building practices and sustainability initiatives along with an increasing demand for durable, high-performance materials are driving the adoption of such plasticizers in the construction sector of the region driving eco-friendly plasticizers market trend.

The market in Latin America is defined by the development of new, high-performance bio-based plasticizers, driven by the region's abundant renewable feedstocks such as sugarcane, soybean, and castor oil. In addition to this, the growing domestic trend for eco-friendly products, increasing consumer environmental awareness, and government policies are promoting bio-based plasticizers for innovation. Furthermore, local R&D efforts and the potential to utilize the region’s existing biorefinery infrastructure offer lucrative opportunities for cost- bio-based plasticizers in the region.

Top Key Players and Market Share Insights:

The global eco-friendly plasticizers market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global eco-friendly plasticizers market. Key players in the eco-friendly plasticizers industry include

- BASF SE (Germany)

- The Dow Chemical Company (U.S.)

- Kraton Polymers (U.S.)

- Clariant International Ltd. (Switzerland)

- Evonik

- Industries AG (Germany)

- UPM-Kymmene Corporation (Finland)

- Aekyung Chemical Co. Ltd. (South Korea)

- Lanxess AG (Germany)

- Oxea GmbH (Germany)

Eco-Friendly Plasticizers Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.30 Billion |

| CAGR (2025-2032) | 7.7% |

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Eco-Friendly Plasticizers Market? +

In 2024, the Eco-Friendly Plasticizers Market is USD 4.62 Billion.

Which is the fastest-growing region in the Eco-Friendly Plasticizers Market? +

Europe is the fastest-growing region in the Eco-Friendly Plasticizers Market.

What specific segmentation details are covered in the Eco-Friendly Plasticizers Market? +

By Product Type and End Use segmentation details are covered in the Eco-Friendly Plasticizers Market.

Who are the major players in the Eco-Friendly Plasticizers Market? +

BASF SE (Germany), The Dow Chemical Company (U.S.), Evonik Industries AG (Germany), UPM-Kymmene Corporation (Finland), Aekyung Chemical Co. Ltd. (South Korea) are some of the major players in the market.