Live IP Broadcast Equipment Market Size :

Live IP Broadcast Equipment Market Size is estimated to reach over USD 3,879.17 Million by 2031 from a value of USD 974.02 Million in 2022 and is projected to grow by USD 1,115.59 Million in 2023, growing at a CAGR of 16.9% from 2023 to 2031.

Live IP Broadcast Equipment Market Scope & Overview :

Live IP broadcast equipment refers to devices that are designed for the distribution of media in audio and video format from television, radio, and other means of telecasting. There are various types of equipment such as encoders, video servers, antennas, production switchers, and others. Moreover, it offers several benefits including high-quality streams, greater audience potential, a wide variety of content uses, ease of use and convenience, reliable content delivery, and a streamlined broadcasting experience among others. The aforementioned benefits are key determinants for increasing its utilization in broadcasting applications.

Live IP Broadcast Equipment Market Insights :

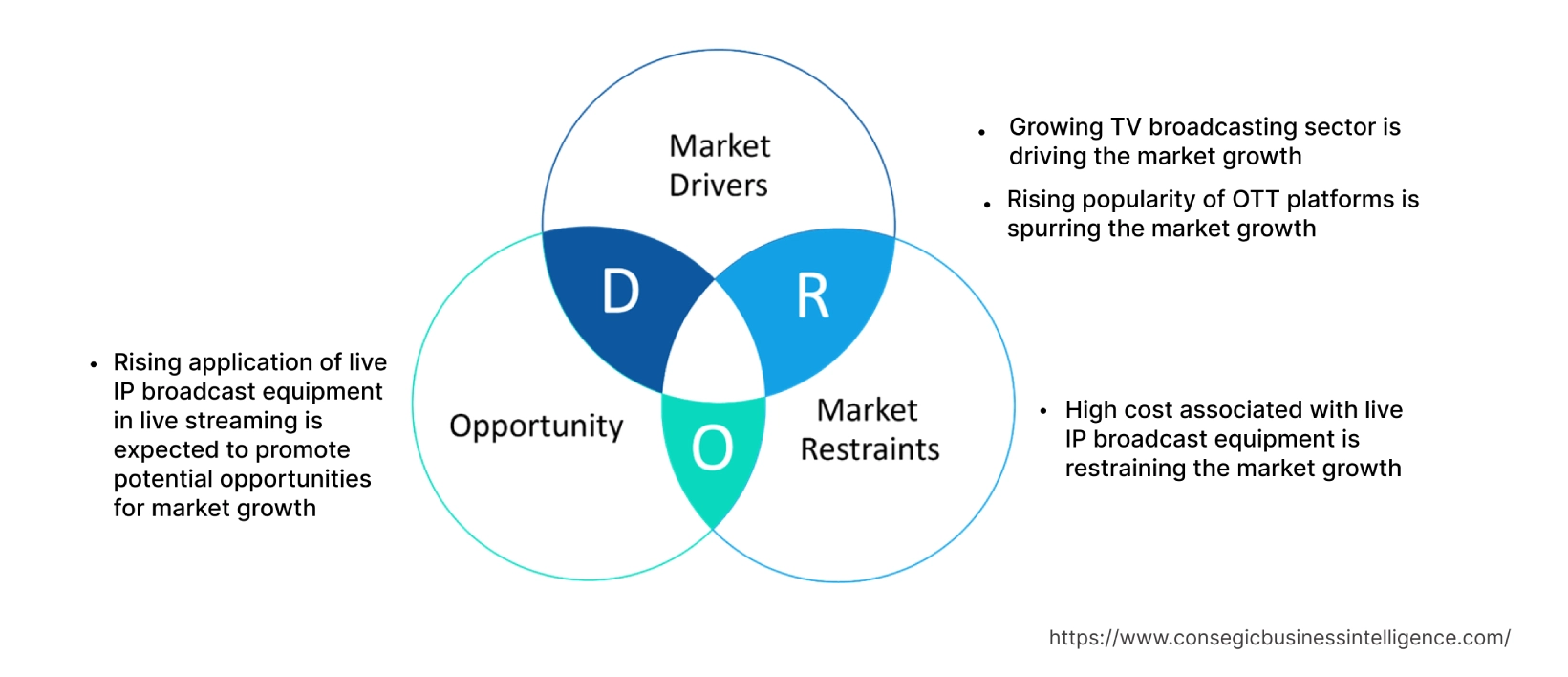

Live IP Broadcast Equipment Market Dynamics - (DRO) :

Key Drivers :

The growing TV broadcasting sector is driving market growth

Live IP broadcast equipment plays a significant role in creating a master output for television broadcasts or recordings. Equipment such as production switchers helps in generating several visual effects, ranging from simple mixes to elaborate effects. Moreover, equipment makes use of numerous input sources and applies desired effects to generate one or more outputs. It also enables TV broadcasters to add effects, overlays, and other visual enhancements to the program output. The above characteristics are increasing its adoption in TV broadcasting applications to perform necessary production operations for the efficient delivery of content.

Factors including the rising adoption of smart TV, increasing penetration of the internet, availability of a wide range of channels, and increasing popularity of audio and video broadcasting are crucial factors driving the TV broadcasting sector.

In December 2021, Fox Television Stations and Nexstar Media Group launched NextGen TV broadcasting in Los Angeles, United States. NextGen TV offers a wide range of audio and video options, along with other innovative capabilities including an improved live broadcast viewing experience for its users. Additionally, in 2022, Grupo Perfil, in collaboration with Grupo Cronica, launched a new open TV channel called Bravo TV.

Hence, the market analysis shows that the rising growth of the TV broadcasting sector along with the introduction of new TV channels is increasing the adoption of this equipment for effective delivery of content, in turn driving the live IP broadcast equipment market growth.

The rising popularity of OTT platforms is spurring the live IP broadcast equipment market

OTT (over-the-top) is a platform that provides television and film content over the Internet as per the requests and requirements of individual consumers. It is often utilized in OTT platforms for content optimization and delivery. It is used for encoding video content into a format that can be easily streamed over the Internet while maintaining a balance between file size and video quality.

Factors including the rapid progression of the media and entertainment sector, increasing penetration of smart devices including smart TVs and smartphones, along the growing trend of VOD (video-on-demand) content are primary determinants for driving the OTT platforms.

For instance, according to the Confederation of Indian Industry (CII), India witnessed around 70 to 80 million paid subscribers of OTT platforms in 2021, representing a significant increase from 14 million subscribers in 2018. Additionally, according to the European Audio-Visual Observatory, the VOD (video-on-demand) sector was valued at USD 13.2 billion in 2020, and its growth was mainly driven by the rapid shift in consumer preference towards content that is accessible at any time, any place, and any device.

Thus, the analysis shows that the rising trend of OTT platforms and growing consumer base is driving the utilization of live IP broadcasts for various applications including content optimization and efficient delivery of OTT media, in turn proliferating the live IP broadcast equipment market growth.

Key Restraints :

The high cost associated is restraining the market

The deployment of live IP broadcast equipment is often associated with high cost, which is a key factor constraining the market.

For instance, Ross Video Ltd, a North American manufacturer, offers a carbonite ultra-production switcher at a starting price of USD 10,900 per unit. Additionally, Panasonic Corporation offers an AV-UHS500 4K live video production switcher designed for broadcast applications for USD 21,000 per set, which is relatively very high.

Therefore, the analysis of market trends depicts that the high cost associated with the utilization is restraining the live IP broadcast equipment market demand.

Future Opportunities :

The rising application in live streaming is expected to promote potential opportunities for the market

The widespread adoption of social media and video-sharing platforms has resulted in a surge in the popularity of live streaming. Live streaming has become a new approach for individuals, businesses, and organizations to connect with their audience in real-time and is an effective way to engage with customers, fans, and followers. Live IP broadcast equipment plays a crucial role in live streaming by allowing producers to switch between multiple camera angles, graphics, and other elements in real time. It enables users to take several video inputs and direct the video output during live streaming. Moreover, it is also capable of adding effects and transitions and creating virtual sets or augmented reality experiences, which enhances the overall production quality of a live stream. The aforementioned features are increasing its utilization for live streaming.

Factors including the growing consumer shift towards digital content for learning and entertainment activities and increasing penetration of social media for content distribution are major factors driving the adoption of live streaming.

For instance, according to Restream, in 2020, around 54% of users live-streamed about gaming and esports while 17% of users live-streamed about entertainment, and 9% live-streamed about professional content. Therefore, the market trends analysis shows that an increase in global demand and consumption of live stream content is increasing the adoption of the equipment for the efficient optimization and delivery of live stream content through various digital platforms, in turn promoting live IP broadcast equipment market opportunities during the forecast period.

Global Live IP Broadcast Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 3,879.17 Million |

| CAGR (2023-2031) | 16.9% |

| By Type | Encoders, Video Servers, Antennas, Production Switchers, and Others |

| By Sales Channel | Online and Offline |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Ross Video Ltd., Harmonic Inc., Panasonic Corporation, Belden Inc., Cisco Systems Inc., Grass Valley, Evertz, Sony Corporation, Sencore, EVS Broadcast Equipment |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Live IP Broadcast Equipment Market Segmental Analysis :

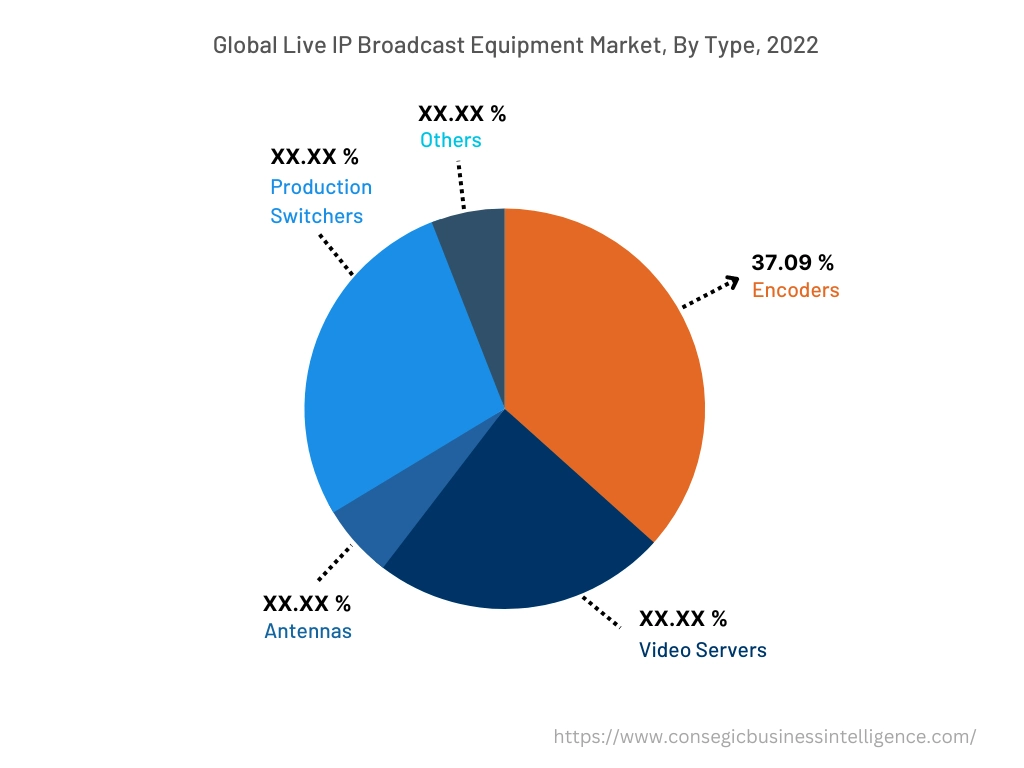

By Type :

Based on the type, the market is segmented into encoders, video servers, antennas, production switchers, and others. The encoders segment accounted for the largest revenue share of 37.09% of the live IP broadcast equipment market share in the year 2022. An encoder is a type of broadcast equipment that takes audio and video feed from video equipment, further encodes, compresses, and sends it to the cloud by utilizing a coding standard. The video content is further captured in the cloud for broadcast and viewed across a broad spectrum of devices and video resolutions. Moreover, they offer several benefits including high reliability, low latency, high-quality video encoding, versatility, multiple-resolution output, and others. The above benefits of encoders are further increasing the utilization in broadcasting applications.

For instance, in August 2022, Nanjing Magewell Electronics Co., Ltd announced the launch of its new model of live media encoders optimized for applications including live streaming, IP-based production, and others. The new encoder offers expanded features including SDI and HDMI input connectivity in a single unit, simultaneous multi-protocol streaming, 4K encoding and streaming from the HDMI input, higher streaming bitrates, and others. Therefore, the rising innovations associated with encoders are a prime factor proliferating the segment.

The production switcher segment is anticipated to register the fastest CAGR during the forecast period in the global live IP broadcast equipment market. A production switcher is a device that selects various incoming video signals from multiple sources such as cameras and feeds and directs the signals into a single output, including a video recorder, streaming device, or display device. Moreover, they offer various benefits including the generation of several visual effects, color signals, and seamless switching between multiple camera angles and graphics in real-time to offer enhanced content quality and delivery.

For instance, in February 2023, Blackmagic Design, launched its new range of production switchers, ATEM Television Studio HD8, which is integrated with broadcast features with excellent portability. The new range of production switchers includes broadcast-grade control panels combined with advanced features including streaming and recording. The production switchers are capable of recording all video inputs and connecting up to 8 remote cameras. The new production switchers also support talkback, live streaming, and optional internal storage. Thus, segmental trends analysis depicts that the increasing development of production switchers for utilization in media streaming and broadcasting applications is a vital factor expected to drive the live IP broadcast equipment market trends during the forecast period.

By Sales Channel :

Based on the sales channel, the market is segregated into online and offline. The online segment accounted for the largest revenue share in the year 2022 of the total live IP broadcast equipment market share. Online sales channel offers a method of distribution in which the manufacturers sell products through the company websites or any other third-party e-commerce websites that are available on the internet. Online distribution channels offer several benefits including easy access to the products, quicker comparison of multiple products and prices, faster buying process, and higher flexibility. The above benefits of online sales channels are key determinants for driving its utilization for the distribution of the equipment.

For instance, Ross Video Ltd is a manufacturer that provides various types of IP broadcast equipment such as encoders, video servers, and production switchers for online purchase through the company website along with multiple e-commerce websites including eBay, and others. Hence, analysis of segmental trends shows that the increasing availability of equipment in online sales channels, owing to its aforementioned benefits, is a prime factor fostering live IP broadcast equipment market demand.

The offline segment is expected to witness the fastest CAGR during the forecast period. Offline sales channel involves the distribution of equipment from manufacturers to the end-users indirectly through offline distributors including supermarkets/hypermarkets, specialty stores, and others. The growth of the offline segment is attributed to several factors including including a strong customer base, higher credibility, and ease of customization as per the target market among others.

For instance, Sony Corporation has opened several offline stores in multiple states across India including Uttar Pradesh, Madhya Pradesh, and others, as a part of the company's strategy to augment its retail presence in India. Hence, segmental trends analysis shows that the increasing development of offline stores is anticipated to boost the live IP broadcast equipment market trends during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

North America is estimated to reach over USD 1,517.14 Million by 2031 from a value of USD 380.94 Million in 2022 and is projected to grow by USD 436.31 Million in 2023. As per the live IP broadcast equipment market analysis, the North American region is primarily driven by its usage in the media and entertainment sector among others. The utilization of the equipment in the entertainment sector during content optimization and broadcasting is further promoting live IP broadcast equipment market expansion in the region.

For instance, according to the Motion Picture Association, the entertainment industry in the United States was valued at USD 32.3 billion in 2021, depicting a growth of 7% in comparison to 2020. Moreover, the digital entertainment sector in the U.S. accounted for 80% of the total output generated from the entertainment industry in 2021.

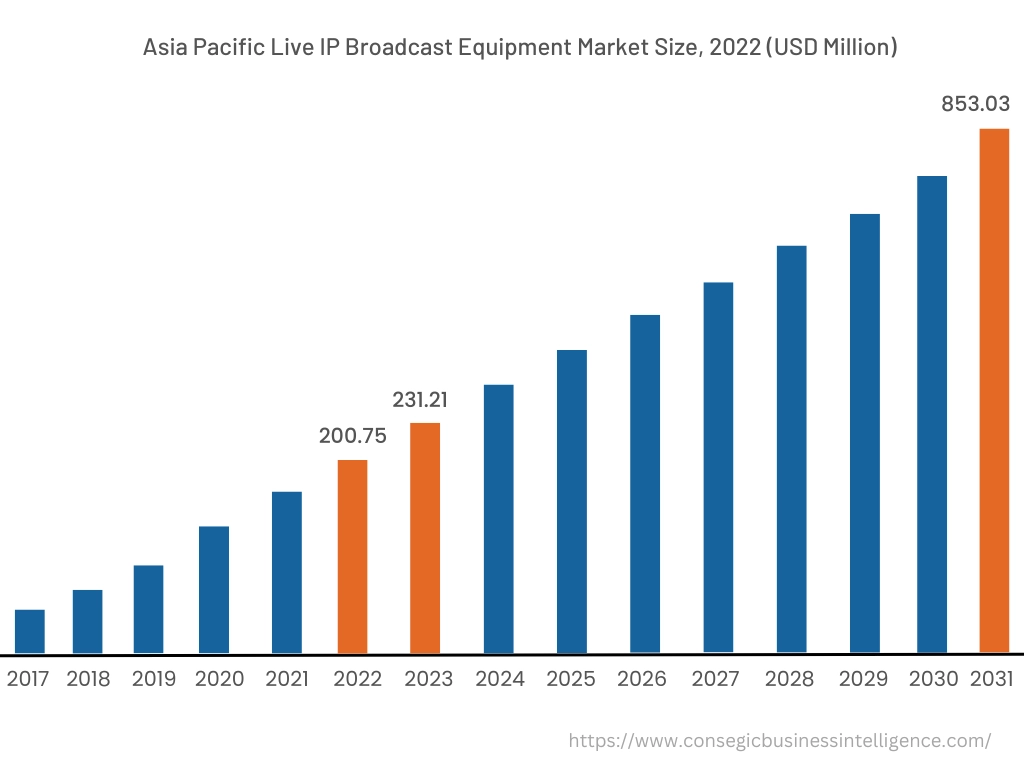

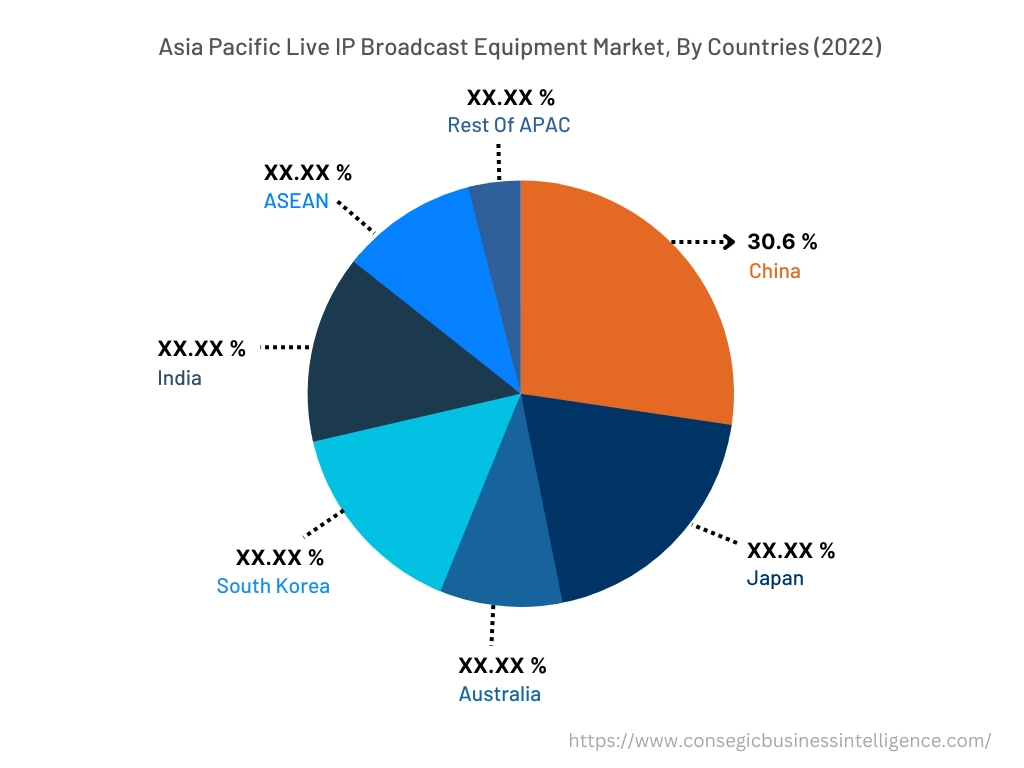

Asia-Pacific is expected to register the fastest CAGR of 17.7% and is estimated to reach over USD 853.03 Million by 2031 from a value of USD 200.75 Million in 2022 and is projected to grow by USD 231.21 Million in 2023. In addition, in the region, China accounted for the maximum revenue share of 26.5% in the same year. The rapid pace of development and digitalization of the media and entertainment sector is creating lucrative prospects for the growth of the market in the Asia-Pacific region. Moreover, factors including the rapid rise of OTT platforms, increasing developments related to TV broadcasting channels, and rising investments in the media & broadcasting sector are vital aspects fostering the live IP broadcast equipment market expansion in the region.

For instance, according to the India Brand Equity Foundation, foreign direct investment in the media and broadcasting sector in India was valued at USD 9.85 billion as of September 2022. Thus, rising investment in the media & broadcasting sector is projected to increase the adoption of the equipment in the Asia-Pacific region, thereby, contributing to live IP broadcast equipment market opportunities in the region during the forecast period.

Top Key Players & Market Share Insights:

The live IP broadcast equipment market is highly competitive with major players providing live IP broadcast equipment to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and sales channel launches to hold a strong position in the live IP broadcast equipment market. Key players in the live IP broadcast equipment industry include-

- Ross Video Ltd.

- Harmonic Inc.

- Sony Corporation

- Sencore

- EVS Broadcast Equipment

- Panasonic Corporation

- Belden Inc.

- Cisco Systems Inc.

- Grass Valley

- Evertz

Recent Industry Developments :

- In March 2021, Sony introduced XVS- G1, a production switcher that integrates Sony's switching technology, 4K and 1080p support, and a new video processing engine with a modern design. The production switcher is optimized for utilization in outside broadcast vehicles, small to mid-size studios, and fly-pack systems.

Key Questions Answered in the Report

What is live IP broadcast equipment? +

Live IP broadcast equipment refers to devices that are designed for distribution of media in audio and video format from television, radio, and other means of telecasting.

What specific segmentation details are covered in the live IP broadcast equipment report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed encoders as the dominating segment in the year 2022, owing to rising innovations associated with encoders for utilization in media streaming and broadcasting applications.

What specific segmentation details are covered in the live IP broadcast equipment market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by sales channel segment has witnessed offline as the fastest-growing segment during the forecast period due to rising development of hypermarkets/supermarkets, specialist stores, and other offline stores for distribution of live IP broadcast equipment.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid growth of OTT platforms, increasing developments related to TV broadcasting channels, and rising investments in media & broadcasting sector.