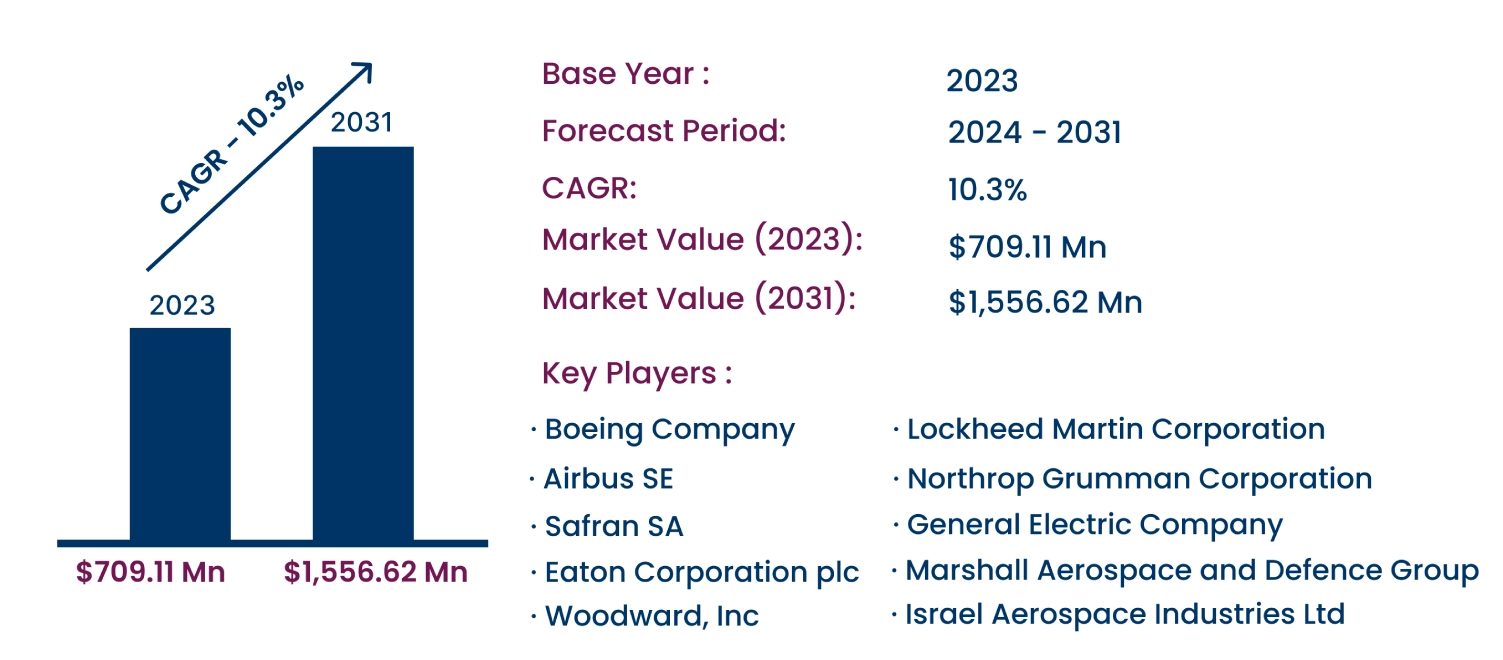

Global Aerial Refueling Systems Market to Reach USD 1,556.62 Million by 2031 | CAGR of 10.3%

Category : Aerospace and Defence | Published Date : Nov 2024 | Type : Press Release

Aerial Refueling Systems Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Aerial Refueling Systems Market size was valued at USD 709.11 million in 2023 and is projected to grow at a CAGR of 10.3%, reaching USD 1,556.62 million by 2031. Aerial refueling systems are advanced mechanisms designed to transfer fuel between aircraft mid-flight, significantly enhancing operational range and endurance. These systems are pivotal in military aviation, ensuring extended mission capabilities and strategic flexibility.

The report comprises the Aerial Refueling Systems Market Share, Size & Industry Analysis, based on Type (Probe and Drogue, Boom and Receptacle, Flying Boom, Autonomous Systems), Component (Refueling Pods, Refueling Probes, Fuel Tanks, Hoses, Pumps, Valves), Aircraft Type (Fixed-Wing, Rotary-Wing, Unmanned Aerial Vehicles (UAVs)), Application (Military Aviation, Commercial Aviation, UAV Operations), End-User (Defense Forces, Commercial Airlines, UAV Operators), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Aerial Refueling Systems Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

Rising investments in military modernization programs and advancements in UAV refueling systems are driving market growth, while high operational costs remain a challenge.

Segmental Analysis :

Based on type, the market is segmented into Probe and Drogue, Boom and Receptacle, Flying Boom, and Autonomous Systems.

- The probe and drogue segment held the largest market share in 2023, attributed to its flexibility in refueling multiple aircraft simultaneously and compatibility with fixed-wing and rotary-wing aircraft.

- The autonomous systems segment is projected to grow at the fastest rate during the forecast period, driven by advancements in AI-based refueling technologies for UAVs and high-risk military operations.

Based on component, the market is segmented into Refueling Pods, Refueling Probes, Fuel Tanks, Hoses, Pumps, and Valves.

- The refueling pods segment accounted for the largest share in 2023, supported by their efficiency in challenging flight conditions and modular designs enabling retrofitting across various aircraft.

- The data management systems segment is anticipated to grow rapidly, fueled by the adoption of advanced analytics for mission planning and optimization.

Based on aircraft type, the market is divided into Fixed-Wing, Rotary-Wing, and Unmanned Aerial Vehicles (UAVs).

- The fixed-wing segment dominated the market in 2023, owing to its widespread use in military operations requiring extended range and endurance.

- The UAV segment is expected to register the fastest growth, driven by advancements in lightweight refueling systems for high-altitude, long-endurance drones.

Based on application, the market is segmented into Military Aviation, Commercial Aviation, and UAV Operations.

- The military aviation segment held the largest share in 2023, supported by increasing geopolitical tensions and the need for extended combat and reconnaissance missions.

- The UAV operations segment is projected to grow significantly, driven by the increasing adoption of drones for surveillance, logistics, and disaster response.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

- Asia-Pacific: Held the largest market share in 2023, led by China’s dominance with a 28.3% revenue share, driven by investments in defense procurement and advanced refueling technologies.

- North America: Expected to grow significantly, fueled by the U.S. Air Force's modernization programs and the deployment of advanced tanker aircraft like the KC-46 Pegasus.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 1,556.62 Million |

| CAGR (2024-2031) | 10.3% |

| Type | Probe and Drogue, Boom and Receptacle, Flying Boom, Autonomous Systems |

| Component | Refueling Pods, Refueling Probes, Fuel Tanks, Hoses, Pumps, Valves |

| Aircraft Type | Fixed-Wing, Rotary-Wing, Unmanned Aerial Vehicles (UAVs) |

| Application | Military Aviation, Commercial Aviation, UAV Operations |

| End-User | Defense Forces, Commercial Airlines, UAV Operators |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Aerial Refueling Systems Industry:

- Boeing Company (USA)

- Airbus SE (Netherlands)

- Lockheed Martin Corporation (USA)

- Northrop Grumman Corporation (USA)

- General Electric Company (USA)

- Safran SA (France)

- Eaton Corporation plc (Ireland)

- Marshall Aerospace and Defence Group (UK)

- Woodward, Inc. (USA)

- Israel Aerospace Industries Ltd. (Israel)

Recent Industry Developments :

- October 2024: The 9th Air Force introduced next-generation refueling capabilities, enhancing operational efficiency for extended air missions.

- September 2024: Legionnaire International secured a $3.19 million AFWERX contract to advance aviation repair solutions for military applications.