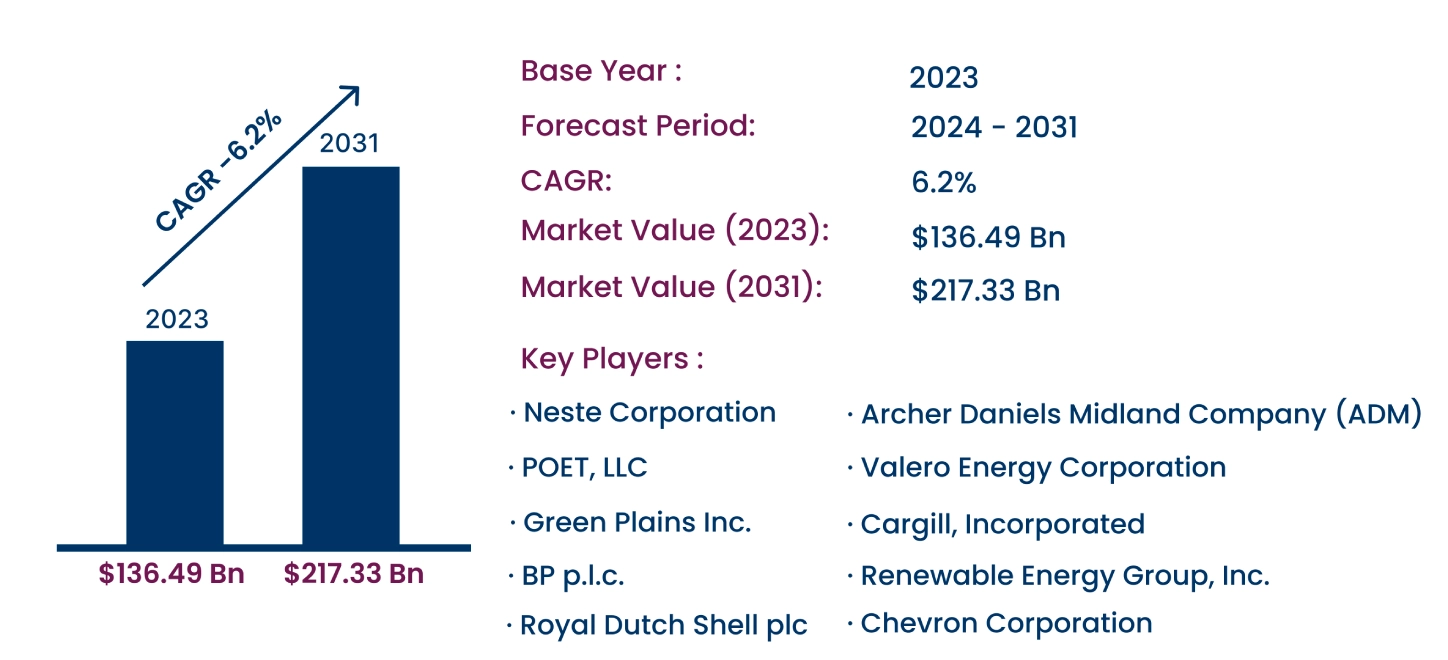

Global Biofuels Market to Reach USD 217.33 Billion by 2031, Growing at a CAGR of 6.2%

Category : Energy and Power | Published Date : Nov 2024 | Type : Press Release

Biofuels Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Biofuels Market was valued at USD 136.49 Billion in 2023 and is projected to reach USD 217.33 Billion by 2031, expanding at a CAGR of 6.2% from 2024 to 2031. Biofuels are renewable energy sources produced from biological materials such as plants, agricultural waste, and algae. The primary types of biofuels include ethanol, biodiesel, and biogas, widely utilized as alternatives to traditional fossil fuels. The market benefits from biofuels' reduced carbon footprint, renewability, and compatibility with existing fuel infrastructure, making them key components in the transition towards sustainable energy solutions. The major end-use industries include automotive, aviation, and power generation, driven by the increasing adoption of cleaner and renewable energy sources.

The report comprises the Biofuels Market Share, Size & Industry Analysis, By Fuel Type (Biodiesel, Ethanol, Bioethanol, Propanol, Butanol, Methanol, Biogas, and Others), By Feedstock (First-Generation, Second-Generation, Third-Generation, Fourth-Generation), By Form (Solid, Liquid, Gaseous), By Application (Lubricants, Cleaning Oil, Engine Fuel, Solvents, Others), By End-User Industry (Automotive, Aviation, Energy & Power, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024–2031.

The report contains detailed information on Biofuels Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profile, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

Increasing demand for renewable energy sources and government incentives promoting biofuel production are key drivers propelling market growth. However, high production costs and limited feedstock supply pose significant challenges.

Segmental Analysis :

By Fuel Type, the market is segmented into Biodiesel, Ethanol, Bioethanol, Propanol, Butanol, Methanol, Biogas, and Others.

- Ethanol accounted for the largest market share in 2023, driven by its widespread use as a gasoline additive to enhance octane levels and reduce emissions, especially in the U.S. and Brazil.

- Biodiesel is expected to register the fastest CAGR during the forecast period, favored for its compatibility with existing diesel engines and its role in regulatory blending mandates across North America and Europe.

By Feedstock, the segments include First-Generation, Second-Generation, Third-Generation, and Fourth-Generation Feedstocks.

- First-generation feedstocks held the largest share in 2023, driven by established agricultural supply chains for corn, sugarcane, and soybeans, despite concerns over food versus fuel debates.

- Second-generation feedstocks are projected to grow at the fastest rate, owing to their sustainability and reduced impact on food supplies, supported by advancements in biofuel production technologies.

By Form, the market segments are Solid, Liquid, and Gaseous Biofuels.

- Liquid Biofuels led the market in 2023, driven by their extensive use in transportation due to ease of handling and compatibility with existing infrastructure.

- Gaseous Biofuels, including biogas, are anticipated to register the highest growth, supported by increased adoption in power generation and heating applications.

By Application, the segments include Lubricants, Cleaning Oil, Engine Fuel, Solvents, and Others.

- Engine Fuel dominated the application segment, primarily in the transportation sector, due to the strong demand for ethanol and biodiesel as renewable fuel alternatives.

- Lubricants are expected to experience rapid growth, benefiting from their biodegradability and lower environmental impact in industrial applications.

In the end-user industry, the segments include automotive, aviation, energy & power, and others.

- Automotive held the largest share in 2023, with widespread use of ethanol and biodiesel to reduce greenhouse gas emissions and enhance fuel efficiency.

- Aviation is projected to register the fastest CAGR, driven by the adoption of sustainable aviation fuels (SAFs) aimed at achieving decarbonization targets.

Based on regions, the global market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

- North America led the market in 2023, valued at USD 53.30 Billion, driven by strong government mandates and the Renewable Fuel Standard (RFS).

- Asia-Pacific is forecasted to grow at the highest CAGR of 6.8%, supported by increasing demand for alternative energy sources and government policies promoting biofuel adoption.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 217.33 Billion |

| CAGR (2024-2031) | 6.2% |

| By Fuel Type | Biodiesel, Ethanol, Bioethanol, Propanol, Butanol, Methanol, Biogas, Others |

| By Feedstock | First-Generation, Second-Generation, Third-Generation, Fourth-Generation |

| By Form | Solid, Liquid, Gaseous |

| By Application | Lubricants, Cleaning Oil, Engine Fuel, Solvents, Others |

| By End-User Industry | Automotive, Aviation, Energy & Power, Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape of the Biofuels Market is characterized by significant industry players focusing on research, product innovation, and strategic partnerships. The analysis highlights leading companies and emerging players, assessing their strengths and growth strategies. This section includes detailed profiles of major market players, providing insights into their recent activities and market positioning.

List of prominent players in the Biofuels Industry:

- Archer Daniels Midland Company (ADM) (United States)

- Valero Energy Corporation (United States)

- Neste Corporation (Finland)

- Cargill, Incorporated (United States)

- POET, LLC (United States)

- Green Plains Inc. (United States)

- Renewable Energy Group, Inc. (United States)

- BP p.l.c. (United Kingdom)

- Royal Dutch Shell plc (Netherlands)

- Chevron Corporation (United States)

Recent Industry Developments :

- August 2024: Indonesia announced the launch of B40 biodiesel, increasing the palm oil content to 40% as part of its strategy to enhance renewable energy use.

- July 2023: Shell partnered with Green Plains Inc. to integrate advanced technologies, optimizing biofuel production and efficiency.

- January 2022: ExxonMobil acquired a stake in Biojet AS, aiming to produce biofuels from forestry waste, marking a significant move into renewable energy.