Biofuels Market Size:

Biofuels Market Size is estimated to reach over USD 245.29 Billion by 2032 from a value of USD 142.91 Billion in 2024 and is projected to grow by USD 150.41 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Biofuels Market Scope & Overview:

Biofuels are derived from renewable organic materials such as crops, agricultural residues, and waste, which offer a better alternative to traditional fossil fuels due to their lower carbon footprint and potential for reducing greenhouse gas emissions. The need for biofuels is being significantly bolstered by the rising environmental concerns and increasing pressure from international bodies to reduce carbon footprints. Governments around the globe are implementing favorable policies and subsidies to promote the production and use of these fuels.

How is AI Impacting the Biofuels Market?

AI is significantly impacting the biofuels market by optimizing every stage of the production process. Machine learning algorithms analyze vast datasets on feedstock properties, climate, and soil conditions to identify the most efficient and sustainable sources. In the lab, AI accelerates research and development by simulating complex chemical reactions, predicting outcomes, and identifying optimal conditions for converting biomass into fuel, reducing the need for costly and time-consuming physical experiments. AI also plays a crucial role in real-time process control and predictive maintenance within production facilities, maximizing yield, minimizing waste, and ensuring consistent product quality while reducing energy consumption.

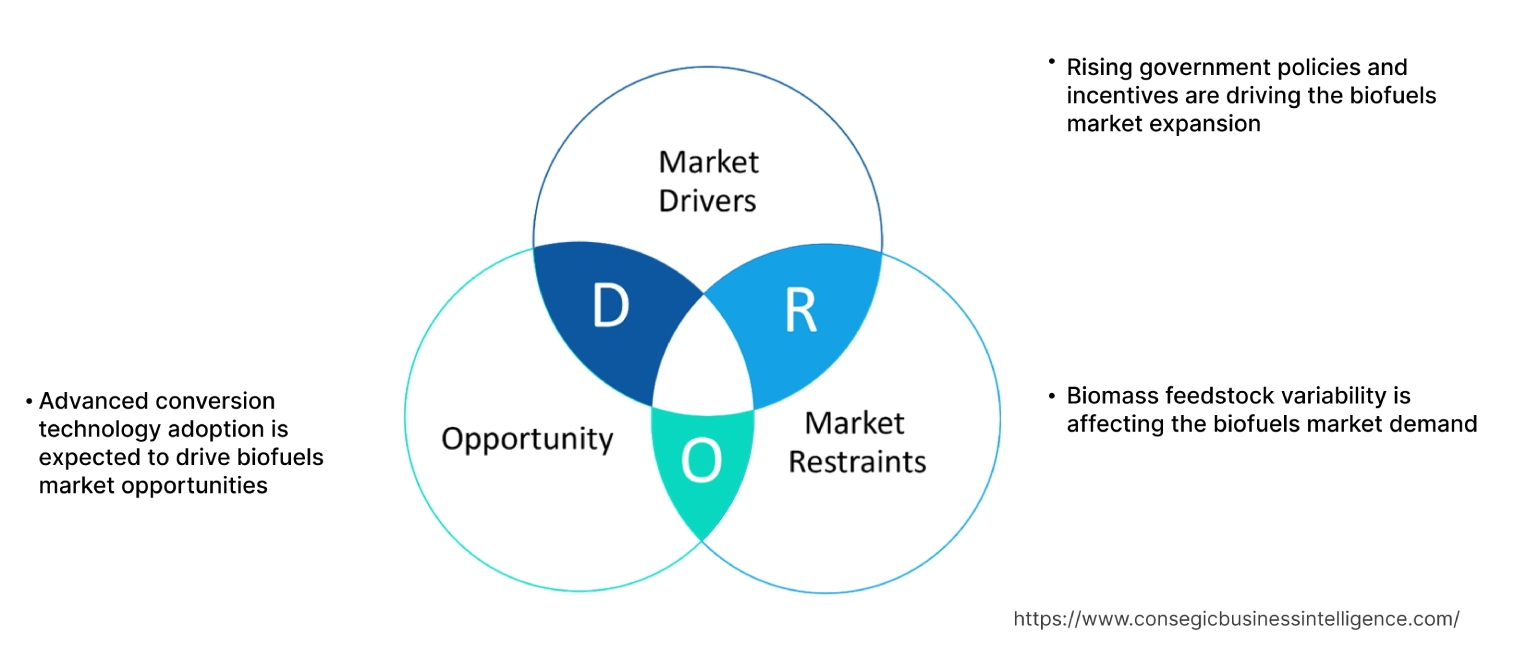

Biofuels Market Dynamics - (DRO) :

Key Drivers:

Rising government policies and incentives are driving the biofuels market expansion

Government policies and incentives are boosting the biofuel market. Governments around the world are implementing various mandates and incentives to encourage the adoption of next-generation fuels. For instance, the Renewable Energy Directive (RED) in the European Union and the Renewable Fuel Standard (RFS) in the United States have set specific targets for biofuel consumption. These policies not only boost the need for fuels but also attract significant investments in research and development, leading to technological advancements and cost reductions.

Further, government mandates and incentives are encouraging the adoption of sustainable fuels in transportation and distribution networks. This growth not only supports the sustainable fuels sector but also promotes technological advancements in vehicle engineering to accommodate and optimize biofuel use. With ongoing advancements in engine technology and fuel efficiency, biofuel-powered vehicles are expected to play a crucial role in achieving sustainable mobility and reducing carbon footprints globally.

Thus, the rising government policies and incentives for sustainable fuels are driving the biofuels market size.

Key Restraints :

Biomass feedstock variability is affecting the biofuels market demand

Biomass sources such as agricultural residues, energy crops, forestry residues, and municipal solid waste vary in availability, quality, and composition depending on geographical location, climate conditions, and agricultural practices. This variability can impact biofuel production processes, requiring flexibility and adaptation in feedstock selection and processing technologies.

Furthermore, technological challenges related to the scalability and cost-effectiveness of advanced biofuel production processes remain significant barriers to market development. Additionally, the emergence of alternative energy sources, such as electric and hydrogen fuel technologies in automotive sector, presents stiff competition, as these solutions are increasingly seen as viable pathways to achieving low-carbon economies. Thus, the above analysis depicts that the aforementioned factors would further impact the biofuels market size.

Future Opportunities :

Advanced conversion technology adoption is expected to drive biofuels market opportunities

Advanced conversion technologies play a pivotal role in advancing the sustainable fuel sector by improving the efficiency and sustainability of biofuel production processes. These technologies encompass biochemical and thermochemical conversion methods such as enzymatic hydrolysis, fermentation, pyrolysis, gasification, and catalytic upgrading. Further, advanced conversion technologies can increase biofuel yields, optimize energy efficiency, and reduce greenhouse gas emissions throughout the production lifecycle. Moreover, continued research and development investments are crucial for scaling up these technologies and integrating them into commercial biofuel production processes.

- For instance, in December 2024, IIT Guwahati researchers have developed a biological method to convert CO2 and methane into biofuels using methanotrophic bacteria. This method is more sustainable and energy efficient than chemical methods. Further, the method also reduces emissions by up to 87%.

Thus, based on the above biofuels market analysis, the adoption of advanced conversion technology is expected to drive biofuels market opportunities and trends.

Biofuels Market Segmental Analysis :

By Fuel Type:

Based on fuel type, the market is segmented into biodiesel, ethanol, bioethanol, propanol, butanol, methanol, biogas, and others.

The growth in demand for ethanol segment is due to its use as a fuel additive to reduce emissions and enhance engine performance, thereby meeting the sustainability goals. Furthermore, Bioethanol segment is driven by rising need in transportation and power sector due to its renewable nature and improved production efficiency.

Trends in the fuel type:

- The growing shift focus of several countries towards the use of renewable sources for electricity generation is driving the need for biogas and other fuels.

- The push towards reducing vehicular emissions and enhancing energy security continues to drive demand for bioethanol.

The ethanol segment accounted for the largest revenue share of 22.56% in the year 2024.

The use of ethanol as a fuel additive to reduce greenhouse gas emissions and improve engine performance is driving its demand. Ethanol, being a renewable biofuel, has emerged as an eco-friendly alternative to traditional fossil fuels. It contributes to lower greenhouse gas emissions, thus, aligning with the global sustainable development goals. Additionally, advancements in ethanol production technologies have further bolstered their adoption, making the production process more efficient and cost-effective. Thus, based on the above biofuels market analysis, these factors are further driving the biofuels market growth and trends.

The bioethanol segment is anticipated to register the fastest CAGR during the forecast period.

The fluctuating prices of crude oil have prompted many industries, particularly transportation and power generation, to seek alternative fuel. Bioethanol serves as viable alternatives due to their cost-effectiveness and renewable nature. Moreover, advancements in production technologies, such as genetic engineering and enzymatic hydrolysis, have enhanced the efficiency of biofuel production, making them more competitive with traditional fossil fuels. Thus, based on the above analysis, these factors are expected to drive the biofuels market share during the forecast period.

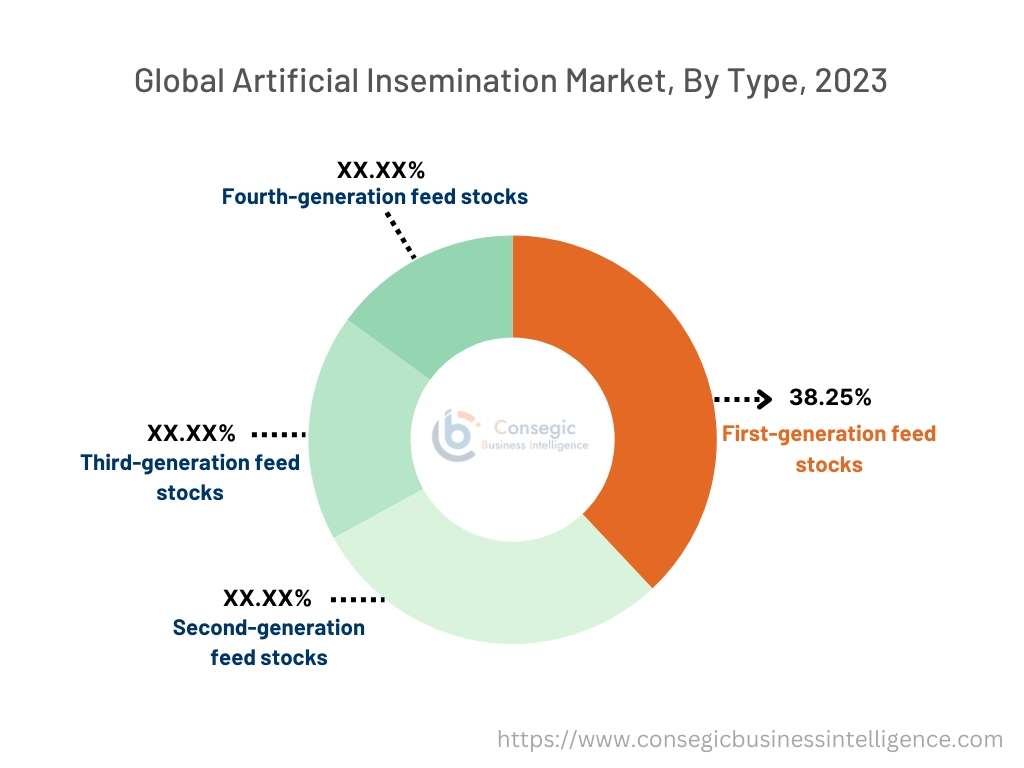

By Feedstock:

Based on feedstock, the market is segmented into first-generation, second, generation, third-generation, and fourth-generation.

The increasing demand for first generation segment is due to its widespread use of use of food-based crops like corn, sugarcane, and vegetable oils in ethanol and biodiesel production. Additionally, second generation feedstocks fuel the demand supported by the growing sustainable energy sector. These feedstocks also help in reducing carbon emissions, which in turn meet sustainability goals.

Trends in the feedstock:

- The technology to convert lignocellulosic biomass into sustainable fuels is advancing, though challenges remain in terms of cost-effectiveness and scalability. Efforts in research and development are focused on overcoming these hurdles, which are creating new prospects for developments in the global biofuels market.

- As the global market continues to evolve, strategic feedstock sourcing and diversification will be essential to mitigate risks associated with these external factors. The above factors would further drive the market.

The first-generation segment accounted for the largest revenue in the year 2024.

First-generation fuels are also known as conventional fuels, which are produced from food crops such as sugarcane vegetable oils, and corn. These fuels include ethanol and biodiesel and have been the primary focus of biofuel production for several decades. Moreover, the increasing adoption of first-generation bio fuels in sectors such as aviation and maritime signifies a growing push to lower carbon emissions within these industries. This trend suggests a move towards greater environmental sustainability and enhanced operational efficiency for first-generation bio fuels. Thus, based on the above analysis, these factors would further drive the global market.

The second-generation segment is anticipated to register the fastest CAGR during the forecast period.

Second generation fuels are emerging as a pivotal innovation in sustainable energy sector. This shift not only alleviates the food-versus-fuel debate but also enhances the sustainability profile of fuels by utilizing waste resources. The production of second-generation fuels involves advanced technologies such as enzymatic hydrolysis and gasification, which are constantly being refined to improve efficiency and reduce costs. As these technologies mature, second-generation fuels are expected to play a crucial role in reducing carbon emissions and diversifying energy sources, particularly in regions with abundant biomass resources. These developments are anticipated to further drive the biofuels market trends during the forecast period.

By Form:

Based on form, the market is segmented into solid, liquid, and gaseous.

The rise in demand for liquid segment is due to need to reduce greenhouse emissions and dependency on the fossil fuels. Coupled with government policies and the volatility of crude oil prices further strengthens the liquid segment demand.

Trends in the form:

- As fossil fuel prices continue to fluctuate, these fuels provide a more stable and predictable alternative. This stability can be particularly beneficial for economies that are heavily reliant on imported fossil fuels.

- The economic benefits of domestic biofuel production, such as job creation in the agricultural and manufacturing sectors, further supports the market growth. Thus, based on the above analysis, these factors are anticipated to further drive the biofuels market trends during the forecast period.

The liquid segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

The need for liquid fuels is driven primarily by the increasing need to reduce greenhouse gas emissions and dependency on fossil fuels, as well as government policies supporting renewable energy sources. Moreover, the increasing volatility of crude oil prices is driving the liquid fuels segment. As fossil fuel prices continue to fluctuate, these fuels provide a more stable and predictable alternative. This stability can be particularly beneficial for economies that are heavily reliant on imported fossil fuels. Therefore, based on the above analysis, these factors are driving the biofuels market growth.

By Application:

Based on application, the market is segmented into lubricants, cleaning oil, engine fuel, solvents, and others.

The applications of biofuels spread across different sectors, primarily due to its benefits like reduced emissions and increased efficiency. The demand for engine fuel segment is driven by increasing consumer awareness of climate change and pollution. The rise in need for lubricant segment is fueled by increasing environmental concerns and regulatory pressure for sustainable alternatives for petroleum-based lubricants.

Trends in the application:

- The use of bio fuels for heat generation offers several benefits, including reduced emissions, increased energy efficiency, and the potential for utilizing local feedstock.

- The use of biodiesel in heating oil blends and the development of bioethanol fireplaces are illustrations of how sustainable fuels are being incorporated into heat generation solutions. This diversification into heating is part of a broader strategy to expand fuel applications beyond traditional domains, making them a versatile component in the global energy blend.

The engine fuel segment accounted for the largest revenue share in the year 2024.

With the increasing awareness of climate change and pollution, consumers are more inclined towards adopting vehicles and machinery powered by alternative fuels. This rising need is pushing manufacturers to diversify their product portfolios to include alternative fuel engines. Additionally, businesses are recognizing the long-term benefits of adopting sustainable practices, such as cost savings from improved fuel efficiency and the potential to attract environmentally conscious customers. Hence, the above factors are further driving the global market.

The lubricant segment is anticipated to register the fastest CAGR during the forecast period.

The bio-lubricant market is experiencing a surge due to growing environmental concerns and the stringent regulations put forth by various governments to reduce carbon emissions and environmental pollution. Bio-lubricants, derived from renewable resources, offer a sustainable alternative to traditional petroleum-based lubricants. They are biodegradable, non-toxic, and possess superior lubricating properties, making them increasingly popular across various industries.

- For instance, in November 2022, Shell announced the acquisition of Environmentally Considerate Lubricants (ECLs) business of the PANOLIN Group. With this acquisition, Shell offers a wide variety of bio-lubricants, to meet customer needs across a range of applications in 100 countries.

These factors are anticipated to further drive the biofuels market during the forecast period.

By End-User:

Based on end user, the market is segmented into automotive, aviation, energy & power, and others.

The automotive segment is driven by increasing investments in fuel infrastructure and stringent environment regulations, encouraging shift towards bio-based alternatives. Furthermore, the aviation segment is further fueled by advancements in production technologies like HEFA and FT processes, and growing collaboration between aviation companies and research institutions.

Trends in the end user:

- Industrial facilities are increasingly adopting fuels to reduce their carbon emissions and enhance their energy efficiency. The use of sustainable fuels in industrial processes supports the transition to a circular economy by promoting the use of renewable feedstock and reducing reliance on fossil resources.

- Transportation remains the largest application sector for sustainable fuels, driven by the global push to decarbonize the transport industry. Bio fuels such as bioethanol and biodiesel are extensively used as blends with traditional fuels in vehicles to reduce carbon emissions.

The automotive segment accounted for the largest revenue in the year 2024.

Governments and international organizations are increasingly enforcing policies aimed at reducing carbon footprints, promoting the adoption of cleaner energy sources. This regulatory pressure is pushing automakers and automotive fuel producers towards bio fuels as a more sustainable alternative to traditional fossil fuels. Further, the development of dedicated fuel pumps, blending facilities, and storage tanks can enhance the availability and accessibility of sustainable fuels. Moreover, public and private investments in infrastructure projects can create a robust supply chain, ensuring a steady and reliable supply of fuels to consumers. Therefore, the aforementioned factors are driving the biofuels market demand.

The aviation segment is anticipated to register the fastest CAGR during the forecast period.

The innovations in technologies, such as hydro processed esters and fatty acids (HEFA) and fischer-tropsch (FT) processes, are enhancing the efficiency and feasibility of fuel production. These technological developments are reducing production costs and improving the energy yield of aviation bio fuels, making them more competitive with traditional jet fuels.

Moreover, collaborations between research institutions and aviation companies are leading to breakthroughs in biofuel development, which are essential for achieving the scale required for commercial viability. As technology continues to evolve, the cost-effectiveness and performance of aviation bio fuels are expected to improve, driving their adoption across the aviation sector. Thus, the above factors are anticipated to drive the market during the forecast period.

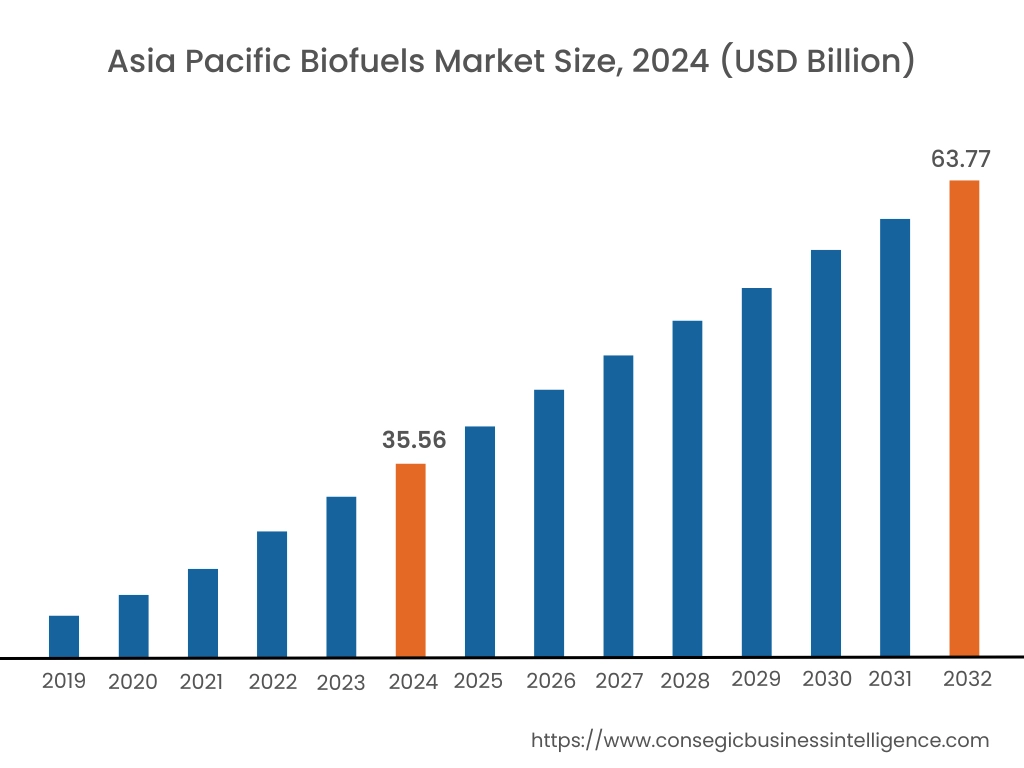

Regional Analysis:

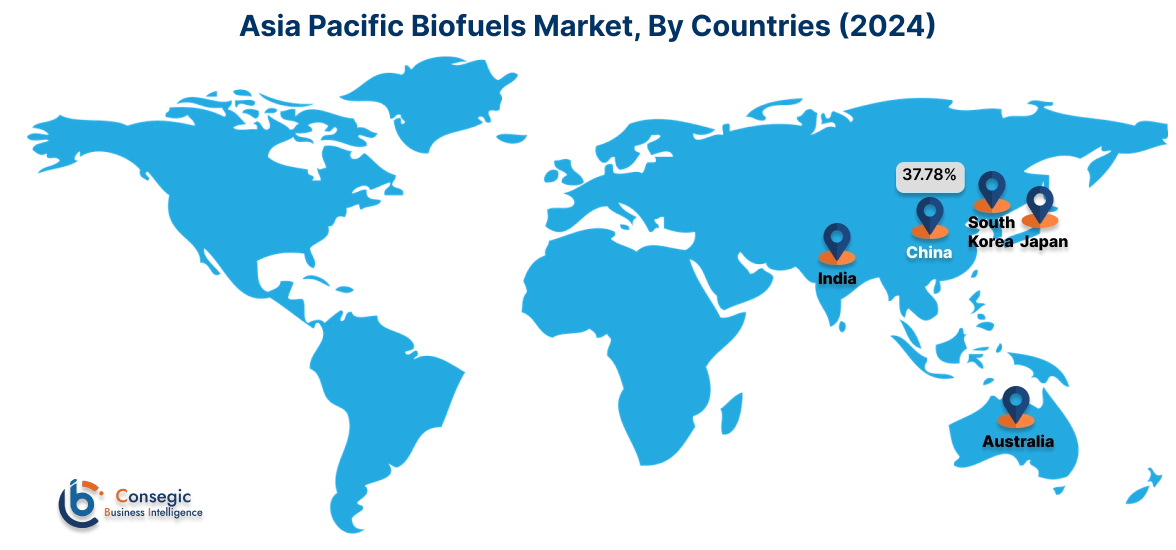

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific biofuels market expansion is estimated to reach over USD 63.77 billion by 2032 from a value of USD 35.56 billion in 2024 and is projected to grow by USD 37.57 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 37.78%. Asia Pacific is expected to exhibit the highest growth rate in the market, driven by rapid industrialization, urbanization, and increasing energy demands. Countries in the region are investing heavily in renewable energy sources, to address their growing energy needs and environmental concerns. Further, the region's abundant agricultural resources provide a solid foundation for biofuel production, with ongoing efforts to improve feedstock availability and production efficiency. Government initiatives to support biofuel adoption, coupled with technological advancements, are expected to enhance the region's market presence, contributing significantly to global biofuel production and consumption. These factors would further drive regional biofuels market share during the forecast period.

- For instance, in February 2025, NYK Line conducted the first biofuel test run on its coal carrier for Tohoku Electric Power. The aim was to reduce greenhouse gas emissions and continue to focus on advancing next-generation fuels, while contributing decarbonization in marine sector.

North America market is estimated to reach over USD 79.23 billion by 2032 from a value of USD 46.34 billion in 2024 and is projected to grow by USD 48.76 billion in 2025. North America, particularly the United States, is a significant market for next generation fuels, driven by strong policy frameworks and substantial investments in research and development. The U.S. Renewable Fuel Standard mandates the inclusion of next-generation fuels in the transportation fuel mix, promoting their adoption. Additionally, government grants and subsidies support biofuel projects, encouraging investments in the sector. Moreover, the presence of major next-generation and sustainable fuel companies and research institutions further drives the regional market growth.

- For instance, in October 2022, American Airlines announced a partnership with Gevo, to purchase 500 million gallons of sustainable aviation fuel (SAF). With this new agreement, American Airlines announced purchasing over 620 million gallons of low-carbon fuels in total. The above factors are driving the biofuels industry in North America.

Additionally, according to the analysis, the biofuels industry in Europe is expected to witness significant development during the forecast period. The region's strong focus on sustainability and emissions reduction drives biofuel adoption, particularly in the transport sector. Additionally, countries in Latin American region are prominent biofuel producers and consumers, with advanced biofuel technologies gaining traction. The region's emphasis on second and third-generation fuels from non-food biomass aligns with its sustainability goals, in turn leading to development of innovative fuel solutions. Further, the availability of abundant feedstock, favorable climatic conditions, and government policies promoting renewable energy are driving the growth of the biofuels market in the Middle East & Africa region.

Top Key Players & Market Share Insights:

The global biofuels market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global biofuels market. Key players in the biofuels industry include-

- Archer Daniels Midland Company (ADM) (U.S.)

- Valero Energy Corporation (U.S.)

- Royal Dutch Shell plc (Netherlands)

- BP p.l.c. (U.K.)

- Chevron Corporation (U.S.)

- Neste Corporation (Finland)

- Cargill, Incorporated (U.S.)

- POET, LLC (U.S.)

- Green Plains Inc. (U.S.)

- Renewable Energy Group, Inc. (U.S.)

Biofuels Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 245.29 Billion |

| CAGR (2024-2031) | 6.3% |

| By Fuel Type |

|

| By FeedStock |

|

| By Form |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Who are the major players in the Biofuels Market? +

The key participants in the market are Archer Daniels Midland Company (ADM) (U.S.), Valero Energy Corporation (U.S.), Neste Corporation (Finland), Cargill, Incorporated (U.S.), POET, LLC (U.S.), Green Plains Inc. (U.S.), Renewable Energy Group, Inc. (U.S.), BP p.l.c. (U.K.), Royal Dutch Shell plc (Netherlands), Chevron Corporation (U.S.), and others.

How big is the Biofuels Market? +

Biofuels Market Size is estimated to reach over USD 245.29 Billion by 2032 from a value of USD 142.91 Billion in 2024 and is projected to grow by USD 150.41 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Which is the fastest-growing region in the Biofuels Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Biofuels report? +

The biofuels report includes specific segmentation details for fuel type, feedstock, form, application, end user, and region.