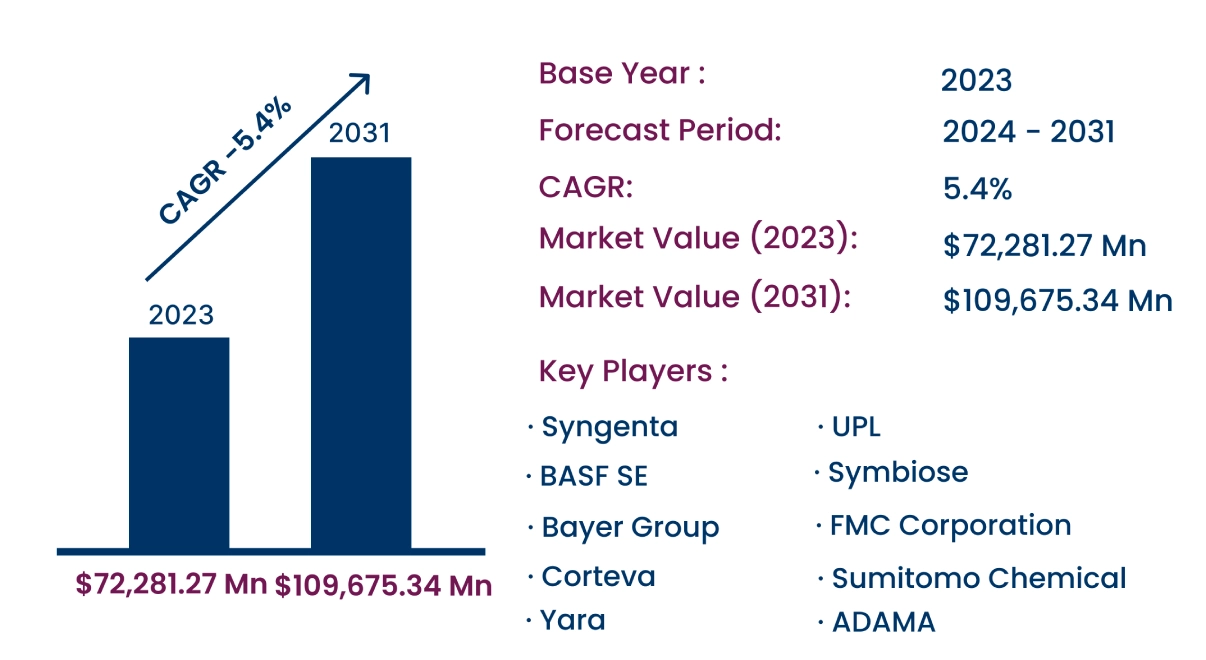

Global Crop Protection Chemicals Market to Reach USD 109,675.34 Million by 2031 | CAGR of 5.4%

Category : Agriculture & Animal Feed | Published Date : Dec 2024 | Type : Press Release

Crop Protection Chemicals Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Crop Protection Chemicals Market size was valued at USD 72,281.27 million in 2023 and is projected to grow at a CAGR of 5.4%, reaching USD 109,675.34 million by 2031. Crop protection chemicals are substances designed to prevent, kill, or repel pests, diseases, and weeds, safeguarding crop health and yield. These chemicals include herbicides, insecticides, and fungicides, developed in both powder and liquid forms for use across various crop types, including cereals & grains, oilseeds & pulses, and fruits & vegetables.

The report comprises the Crop Protection Chemicals Market Share, Size & Industry Analysis, based on Type (Herbicides, Insecticides, Fungicides, Others), Source (Synthetic, Biological), Form (Powder, Liquid, Others), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Crop Protection Chemicals Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The increasing prevalence of pest infestations and advancements in the mode of action of crop protection chemicals drive the market. However, stringent regulatory requirements pose challenges.

Segmental Analysis :

Based on type, the market is segmented into Herbicides, Insecticides, Fungicides, and Others.

- The herbicide segment accounted for the largest market share in 2023, driven by its effective control of weeds competing with crops for essential resources like nutrients and sunlight.

- The fungicides segment is projected to grow at the fastest CAGR, fueled by advancements in fungicidal formulations targeting fungal diseases like mildew and blight.

Based on the source, the market is bifurcated into Synthetic and Biological.

- The synthetic segment dominated the market in 2023, owing to its rapid action and extended protection, making it cost-effective for large-scale agricultural use.

- The biological segment is expected to grow at the fastest rate, supported by increased adoption of eco-friendly farming practices and the development of biopesticides.

Based on form, the market is categorized into Powder, Liquid, and Others.

- The liquid segment held the largest revenue share in 2023, driven by its precise application and compatibility with modern agricultural equipment.

- The powder segment is anticipated to witness significant growth, benefiting from its ease of storage and slow-release properties.

Based on crop type, the market is segmented into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others.

- The cereals & grains segment accounted for the largest share in 2023, supported by the high demand for staple crops like wheat, rice, and corn globally.

- The fruits & vegetables segment is expected to grow rapidly, driven by stringent food safety standards and increasing consumer preference for fresh produce.

Based on regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

- Asia-Pacific: Accounted for the largest market share in 2023, with significant contributions from China, due to its large agricultural sector and growing need for sustainable crop protection solutions.

- North America: Expected to grow at the fastest CAGR, driven by advanced agricultural technologies and increasing adoption of eco-friendly pest management practices.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 109,675.34 Million |

| CAGR (2024-2031) | 5.4% |

| Type | Herbicides, Insecticides, Fungicides, Others |

| Source | Synthetic, Biological |

| Form | Powder, Liquid, Others |

| Crop Type | Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Crop Protection Chemicals Industry:

- Syngenta (Switzerland)

- BASF SE (Germany)

- Bayer Group (Germany)

- Corteva (U.S.)

- Sumitomo Chemical (Japan)

- ADAMA (India)

- Yara (Norway)

- FMC Corporation (U.S.)

- Symbiose (Brazil)

- UPL (India)

Recent Industry Developments :

- September 2024: Simbiose Agro launched two biopesticides, FlyControl and FrontierControl, focusing on sustainable pest management.

- June 2024: Corteva Agriscience unveiled Resicore REV herbicide, enhancing corn weed control with pre- and post-emergence efficacy.

- July 2023: Insecticides (India) Limited introduced Mission, a new liquid insecticide for lepidopteran pest control across multiple crops.