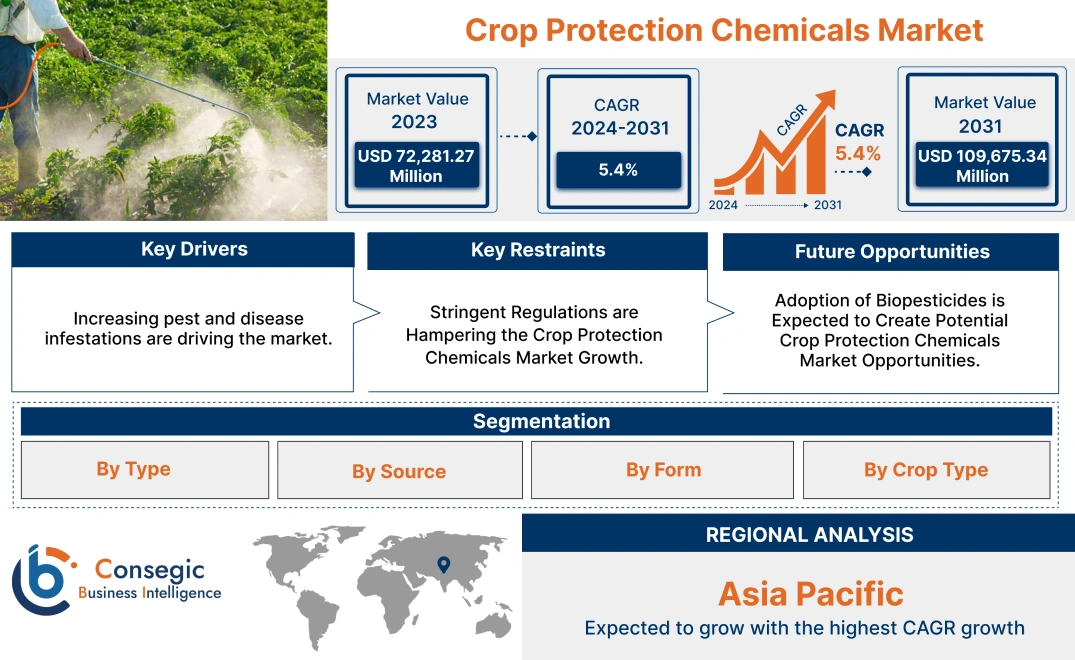

Crop Protection Chemicals Market Size:

Crop Protection Chemicals Market size is estimated to reach over USD 1,10,105.77 Million by 2032 from a value of USD 74,278.95 Million in 2024 and is projected to grow by USD 76,732.94 Million in 2025, growing at a CAGR of 5.40% from 2025 to 2032.

Crop Protection Chemicals Market Scope & Overview:

Crop protection chemicals are substances used to kill, repel, or prevent pests, diseases, and weeds that pose a threat to damaging crops. These chemicals encompass a wide range of categories, including herbicides, insecticides, and fungicides, which serve various functions in controlling unwanted plant growth, killing pests such as insects and mites, and preventing fungal diseases that infect plants, produced by thorough research and development of synthesis techniques.

These chemicals improve crop yield and food security, often include inert ingredients like safeners, synergists, and wetting agents, manufactured to improve crop uptake, decrease sublimation, and enhance residual performance. Enhanced soil protection by disrupting the lifecycles of weeds, fungi, and insects mitigates their threats to the crop yield and quality.

Crop protection chemicals are significant for their use in commercial and farming techniques, including foliar sprays, soil treatments, and seed treatments. They are extensively used by farmers, agri businesses, and commercial farms.

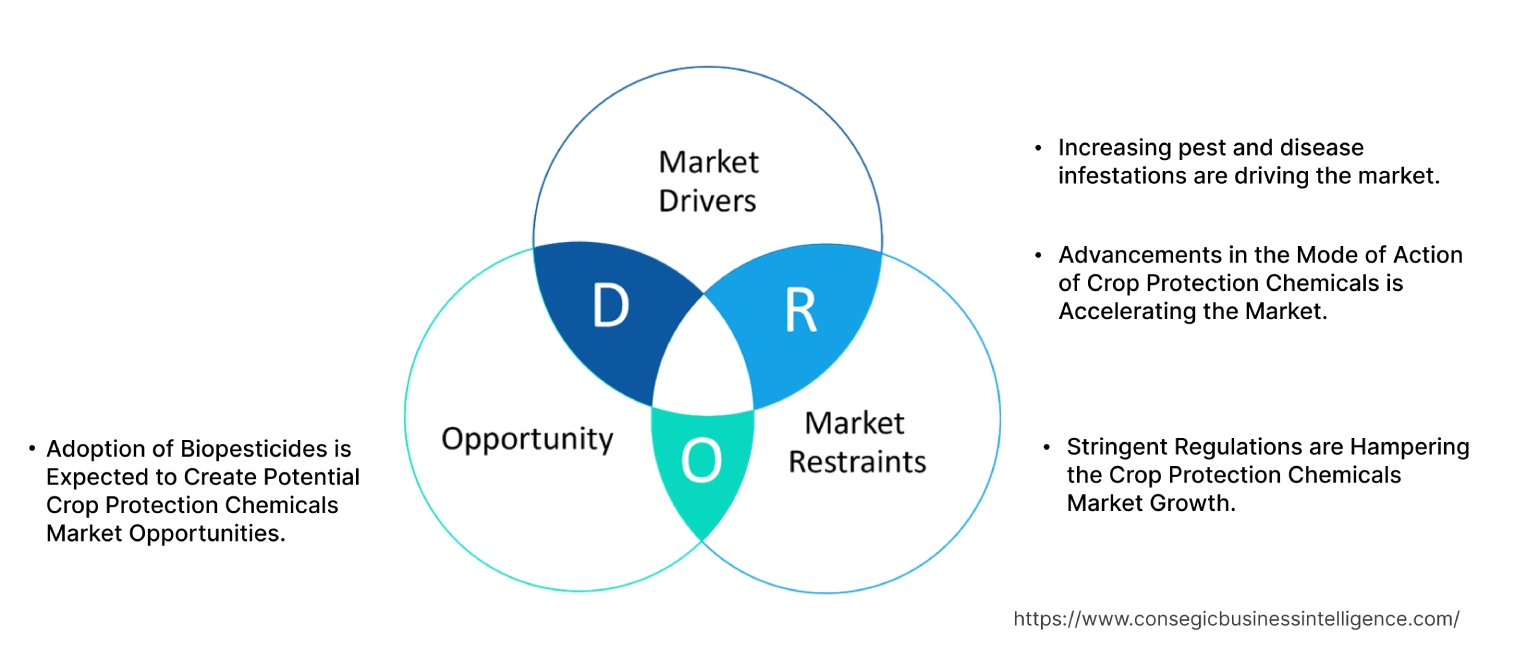

Crop Protection Chemicals Market Dynamics - (DRO) :

Key Drivers:

Increasing Pest Infestations and Unwanted Weeds are Contributing to Market Progress.

Pests and insects cause major damage to crops, reducing the overall crop yield and quality. This has a massive impact in conditions of food scarcity and drought. Similarly, weed-induced crop yield loss happens when the entire crop land is covered with unwanted plants or weeds. These plants grow quickly, covering the whole field in a few days, competing with the crops for resources, inviting pests and diseases, and hindering harvesting. Crop protection chemicals play a crucial role in controlling pest infestations and unwanted weed development. These chemicals attack the specific biochemical processes in the insects or weeds, ultimately killing or attenuating them. Herbicides particularly target weeds by disturbing their growth cycles through multiple pathways, whereas insecticides are mainly designed to control insect infestations by targeting their nervous systems and interfering with their reproduction. Growing damages and increasing awareness about their significance, farmers and commercial agri-businesses are adopting these formulations, contributing to the global market development.

Key Restraints :

Reliance on Petrochemical Derivatives Causes Vulnerability in Supply Chains is Restricting Market Expansion.

The most widely acquired source of these chemicals is petrochemical-derived intermediaries sourced from countries with high petroleum resources. Supply of these chemicals may be restricted due to various factors such as geopolitical instabilities, trade limitations, and disturbances in the energy market. The limited source locations of these chemicals make the task more complicated and result in high cost fluctuations. Moreover, specialized chemicals like chlorinated hydrocarbons and aromatic compounds have limited production hubs, leading to logistics disruptions. This results in delays to the overall delivery time for the chemicals, adding to the increased production costs, potentially limiting flexibility in sourcing strategies, and hindering the overall market development.

Future Opportunities :

The Growing Adoption of AI and Drone Technology is Opening New Growth Avenues.

The world is witnessing the rapid development of artificial intelligence and cutting-edge technologies such as drones, especially for monitoring crops. Adopting AI-powered precision agriculture techniques for crop protection and monitoring is revolutionizing the development of highly specialized crop protection solutions. Rather than relying on conventional spraying practices, precision agriculture uses satellite images, connected sensors, and drone-assisted monitoring for identifying and locating pest or fungal outbreaks and weed management. This helps farmers to target specific regions of application, reducing excess chemical runoff and improving efficiency. Innovations are fueled by drone technology, AI-driven automation, like driverless tractors and smart irrigation, and precision farming, present valuable global Crop Protection Chemicals market opportunities.

Crop Protection Chemicals Market Segmental Analysis :

By Type:

Based on Type, the market is segmented into Herbicides, Insecticides, Fungicides, and Others.

Trends in the Type:

- Growing adoption of multi-site fungicides to address rising fungal proliferations in tropical regions and greenhouse crops.

- Insecticides with targeted delivery pathways with RNA interference, and biocontrol methods to disrupt the virulence of insects.

- Adding safeners to herbicides for application in row plants, inducing a larger chemical load without harming the plant.

The Herbicides segment holds the largest revenue of the overall Crop Protection Chemicals Market share in the year 2024.

- This segment dominates owing to the increased use in row crops like wheat, soybean, and maize, where the weed infestation may compete for the crop essentials, depleting resources, impacting yield, and input efficiency.

- The growing innovations in selective herbicides targeting invasive species of weeds without affecting the main crop, decreasing the toxic effects on the plant.

- Programs to manage crop resistance and weed varieties that are tolerant to herbicides have come up to support repeated and rotational use of these weed-killing agents.

- According to the Crop Protection Chemicals market, the push towards reliance on chemical weed control over the manual alternatives, particularly for large-scale applications, has dominated the segment, fueling the global Crop Protection Chemicals market growth.

The Fungicides segment is expected to grow at the fastest CAGR during the forecast period.

- Fungicides have grown significantly, especially in crops with high commercial value like fruits and exotic vegetables, where fungal infections can destroy the entire plantation in just a few days.

- Fungal development is common in regions with a high humidity index, like tropical regions of spaces with controlled environments, facilitating repeated applicability.

- The sector is advancing with the inclusion of systemic fungicides that both safeguard and boost plant immunity, offering both preventive and remedial capabilities.

- With the increasing requirements for fungicides and growing technological advancements in spraying technologies that detect fungal infections at early stages, the global Crop Protection Chemicals market is progressing.

By Source:

Based on Source, the market is segmented into Synthetic and Biological.

Trends in the Source:

- Hybrid chemical formulations with both biological and synthetic components to balance the efficiency and environmental impact.

- Innovations in biological sources, shifting towards fermentation-based actives, to improve scalability, consistency, and precise delivery.

The Synthetic segment holds the largest revenue of the overall Crop Protection Chemicals Market share in the year 2024.

- The synthetic chemicals dominate the market owing to their accuracy, efficiency, and efficacy, with a broad spectrum of actions to control pest and weed infestations.

- These synthetic chemicals provide consistent performance throughout different climatic conditions and soil structures, making them an integral segment of the chemicals for crop protection applications.

- The increasing research and development activities going on to synthesize more selective and residue-minimized synthetic options have created significant opportunities to reduce the environmental impact.

- Thus, synthetic chemicals offer effective and efficient pest control solutions, driving the overall segment analysis in the crop protection chemicals market trends.

The Biological segment is expected to grow at the fastest CAGR during the forecast period.

- Biological crop protection chemicals, also known as biopesticides, are derived from natural sources such as animals, plants, bacteria, and certain minerals.

- They offer a more environmentally friendly and sustainable approach to pest and disease control by disrupting the life cycle of pests or by inducing plant defense mechanisms.

- These biological compounds also coordinate well with organic farming and integrated pest management (IPM) programs, making them compatible with a wide variety of applications.

- The increasing requirement for sustainable and eco-friendly agricultural practices is driving the demand for biological chemicals for crop protection, driving the Crop Protection Chemicals market expansion.

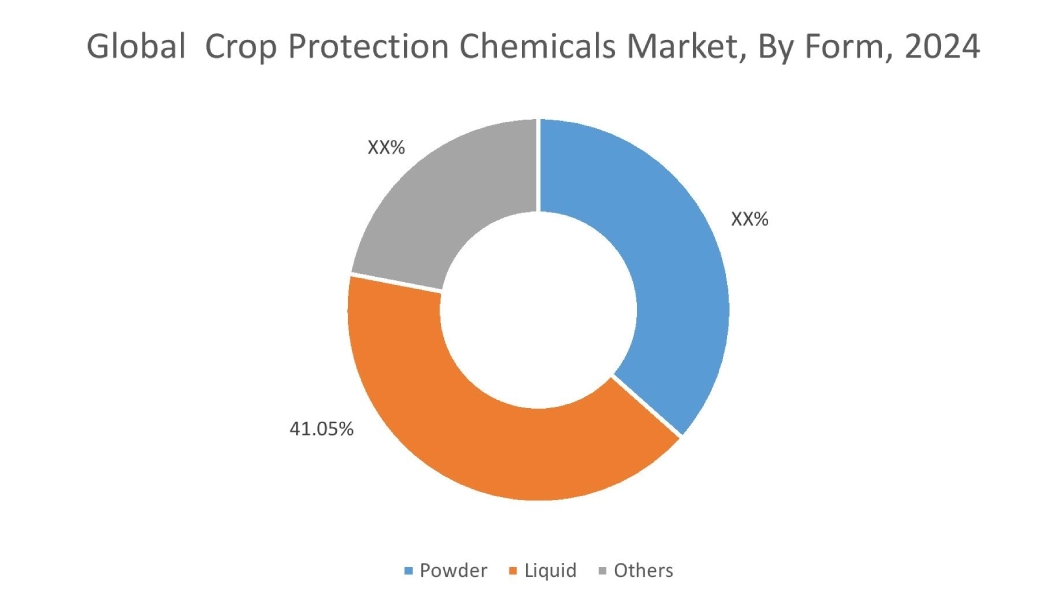

By Form:

Based on Form, the market is segmented into Powder, Liquid, and Others.

Trends in the form:

- The use of encapsulated liquid technologies for enabling controlled release to improve field stability.

- Innovations in water-soluble films and sachets for single-use precision, reducing errors and risks of contamination.

The Liquid segment holds the largest revenue of the overall Crop Protection Chemicals Market share of 41.05% in the year 2024 and is expected to grow at the fastest CAGR during the forecast period.

- Liquid formulations of crop protection chemicals include suspension solutions, emulsifiable concentrates, microencapsulated suspensions, and aerosols.

- They are applied using various methods, including compressed air sprayers, foggers, soil injectors, aircraft, low-pressure boom sprayers, high-pressure sprayers, and ultra-low-volume sprayers.

- Additionally, as precision agriculture becomes increasingly used, liquid application is better adapted to variable-rate application systems, which are GPS-controlled and digitally calibrated.

- Thus, due to their ease of application and handling, precision, rapid action, compatibility with modern equipment, and reduced dust exposure, liquid formulations are the largest and fastest segment, contributing to the largest market share, significantly driving the global Crop Protection Chemicals market trends.

By Application:

Based on Application, the market is segmented into Foliar Spray, Soil Treatment, Seed Treatment, and Others.

Trends in the Application:

- Advancements in foliar sprays with AI-driven drones, ensuring impactful delivery across various regions with the help of satellite imaging and detection of crop stress in real-time.

- Microbes and fungicides are applied to seeds packaged together at the point of purchase, incorporating initial protection into commercial seed systems.

The Foliar Spray segment holds the largest revenue of the overall Crop Protection Chemicals Market in the year 2024.

- Foliar spray can be defined as a device popular for its fast action and direct delivery mechanism, enabling it to immediately absorb into the surface of the leaves during the peak crop stress phases.

- This spraying method is highly compatible with drone applications, mainly in the large-scale farming regions.

- It provides flexibility in timing and dosage for farmers to have the ability to modify treatments according to up-to-date pest monitoring or weather data, particularly in precision farming systems.

- According to the Crop Protection Chemicals market analysis, the targeted delivery of chemicals, covering large farming areas and real-time data surveillance, makes this segment the largest, significantly fueling the market development.

The Seed Treatment segment is expected to grow at the fastest CAGR during the forecast period.

- Seed treatment provides prevention of soil-borne fungi, insects, or some bacteria at an early stage of the crop and helps decrease the chances of future infestations.

- Additionally, this treatment experiences increased proliferation of crops owing to its preventive nature and reduced surface runoff.

- Advances in biopolymer coatings, biological agents, and multi-functional seed dressings are expanding the range of threats that can be neutralized before germination, improving overall plant establishment.

- The shifting consumer preferences to preventive measures offered by seed treatment, enhancing the efficiency for farmers by reducing the need to repeatedly apply insecticides, boosts requirements for this segment, driving the Crop Protection Chemicals market growth.

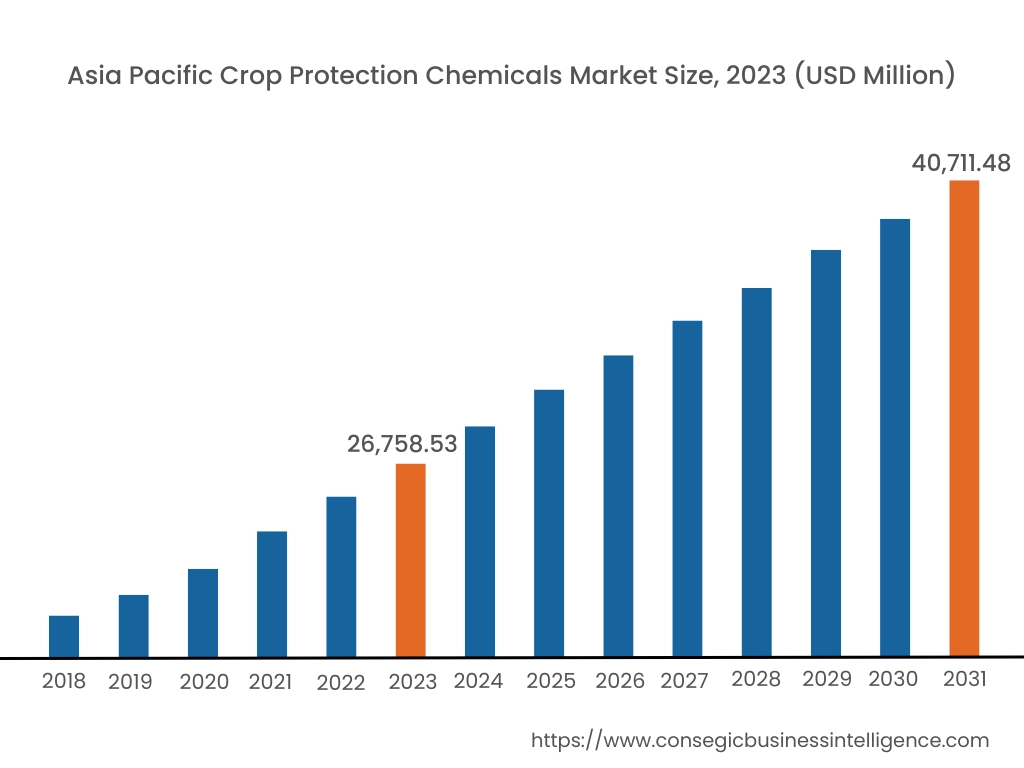

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 24,391.76 Million in 2024. Moreover, it is projected to grow by USD 25,264.23 Million in 2025 and reach over USD 37,303.84 Million by 2032. Out of this, China accounted for the maximum revenue share of 30.85%.

In Asia Pacific, the market is a mature one, driven by its rich agricultural sector and increasing demand for food and resources. Countries such as China and India are large agricultural economies with immense production of several crop types, such as grains & cereals and fruits & vegetables, making them significant consumers of these chemicals. Additionally, the volatile climatic conditions and varied agricultural practices create a diverse range of pest and disease challenges, propelling the demand for various chemicals for crop protection.

- For instance, in March 2025, Coromandel International Limited, India’s largest agri-business, announced the strategic acquisition of a majority stake in NACL Industries Limited, a robust crop protection firm with a strong formulation business. Coromandel has decided to acquire 53% shares in NACL Industries, at a consideration of Rs 820 Crores. This acquisition will place Coromandel at a leading position in the Indian Crop Protection industry with foundational support from the formulation business.

Moreover, a growing focus on sustainable and integrated pest management practices across the region propels market development. Market analysis shows that the combination of the aforementioned factors is driving substantial growth in the Asia Pacific crop protection chemicals market demand.

North America is estimated to reach over USD 31,996.74 Million by 2032 from a value of USD 21,454.39 Million in 2024 and is projected to grow by USD 22,174.47 Million in 2025.

North America experiences a shift due to the rapid integration of precision agriculture and automation in large-scale farming applications. Countries like the United States and Canada follow advancements in the agricultural industries. Mexico is also depicting a steady alignment with standardizing crop protection practices. Key trends include the rising adoption of variable-rate application systems, encapsulated formulations in micro-environments, and innovations in genetically modified crop varieties that are tolerant to herbicides.

- For instance, in April 2025, Vive Crop Protection expanded its label for AZteroid FC 390 in Canada. This new addition to their product range enables efficient disease control for a wide variety of crops such as radishes, sugarbeets, and many more high-value root vegetables. This versatile product aims to allow every Canadian farmer to have an easy and hassle-free solution to disease control, application efficiency, and crop quality across large farm areas.

Furthermore, market analysis depicts that technological advancements driven by innovations in product delivery and chemicals’ efficiency significantly drive the Crop Protection Chemicals industry opportunities in this region.

Europe witnesses steady market development due to the strong emphasis on sustainable agriculture. The region has a diverse agricultural landscape, including arable crops, horticulture, and specialty crops. Additionally, the European Union has implemented strict regulations to minimize the environmental impact of synthetic pesticides. This has driven the development of more sustainable and environmentally friendly crop protection solutions, such as biological control agents, biopesticides, and integrated pest management strategies. Moreover, the European Union's focus on reducing pesticide residues in food has led to the development of low-toxicity and highly specific chemicals used for crop protection. Notable trends include the paradigm shift towards biological alternatives, the adoption of increased pest management, and precision spraying techniques have bolstered the growth of the market. Market analysis shows that the region’s well-regulated, technology-driven, and consumer and policy-driven sustainability goals have boosted the Crop Protection Chemicals market.

The Middle East and Africa region presents a complex and diverse landscape for these chemicals. While some countries, particularly in the Middle East, have advanced agricultural practices and rely heavily on chemical pesticides, other regions in Africa face challenges such as food insecurity and limited access to modern agricultural technologies. One of the major challenges in this region is the increasing prevalence of pests and diseases, driven by factors such as climate change, globalization, and the emergence of resistant strains. To combat these challenges, farmers in the region rely on a variety of chemicals, including insecticides, fungicides, and herbicides. As the region's economies develop, there is an increasing demand for food, which drives the need for effective crop protection solutions. Notable trends include introducing chemical fertilizers to crops through irrigation in water-scarce regions and using powder-based chemicals for logistical convenience to propel market progress. The market analysis showed that the development of farming infrastructure and targeted policy support by the government bodies are fueling the Crop Protection Chemicals market in this region.

Latin America provides a dynamic agricultural landscape, characterized by diverse crops and climatic conditions. Countries such as Brazil and Argentina are major agricultural producers, cultivating crops such as soybeans, corn, and sugarcane. The region's favorable climate and vast arable land make it a suitable environment for agriculture, driving the requirement for effective crop protection solutions. Key trends contributing to the Latin American market growth, like the increasing pest and disease pressure, driven by climate change and growing resistance of pests, necessitate the use of advanced crop protection solutions. Additionally, the rising consumer demand for high-quality, pesticide-free food is encouraging farmers to adopt IPM strategies, including the use of pesticides. Market analysis showed that the Government initiatives to promote agricultural productivity and food security are further stimulating the crop protection chemicals market demand in this region.

Top Key Players & Market Share Insights:

The Crop Protection Chemicals Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Crop Protection Chemicals Market. Key players in the Crop Protection Chemicals industry include -

- Symbiose (Brazil)

- UPL (India)

- Bayer Group (Germany)

- Corteva (U.S.)

- Sumitomo Chemical (Japan)

Recent Industry Developments :

Mergers and Acquisitions:

- In January 2025, Crystal Crop Protection Limited acquired the assets of Ethoxysulfuron, a significant active ingredient from Bayer AG. This is a significant step towards Crystal’s leadership in the rice herbicide market, reinforcing their presence across countries of Asia, South Asia, and Southeast Asia.

Crop Protection Chemicals Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 1,10,105.77 Million |

| CAGR (2024-2031) | 5.40% |

| By Type |

|

| By Source |

|

| By Form |

|

| By Crop Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Crop Protection Chemicals Market? +

Crop Protection Chemicals Market size is estimated to reach over USD 1,10,105.77 Million by 2032 from a value of USD 74,278.95 Million in 2024 and is projected to grow by USD 76,732.94 Million in 2025, growing at a CAGR of 5.40% from 2025 to 2032.

What specific segments are covered in the Crop Protection Chemicals Market? +

The Crop Protection Chemicals Market is specifically segmented by Type, Source, Form, Application, and Region.

Which is the fastest-growing region in the Crop Protection Chemicals Market? +

Asia Pacific is the fastest-growing region in the Crop Protection Chemicals Market.

What are the major players in the Crop Protection Chemicals Market? +

The key players in the Crop Protection Chemicals Market are Syngenta (Switzerland), BASF SE (Germany), FMC Corporation (US), Symbiose (Brazil), UPL (India), Bayer Group (Germany), Corteva (US), Sumitomo Chemical (Japan), ADAMA (India), Yara (Norway), and others.