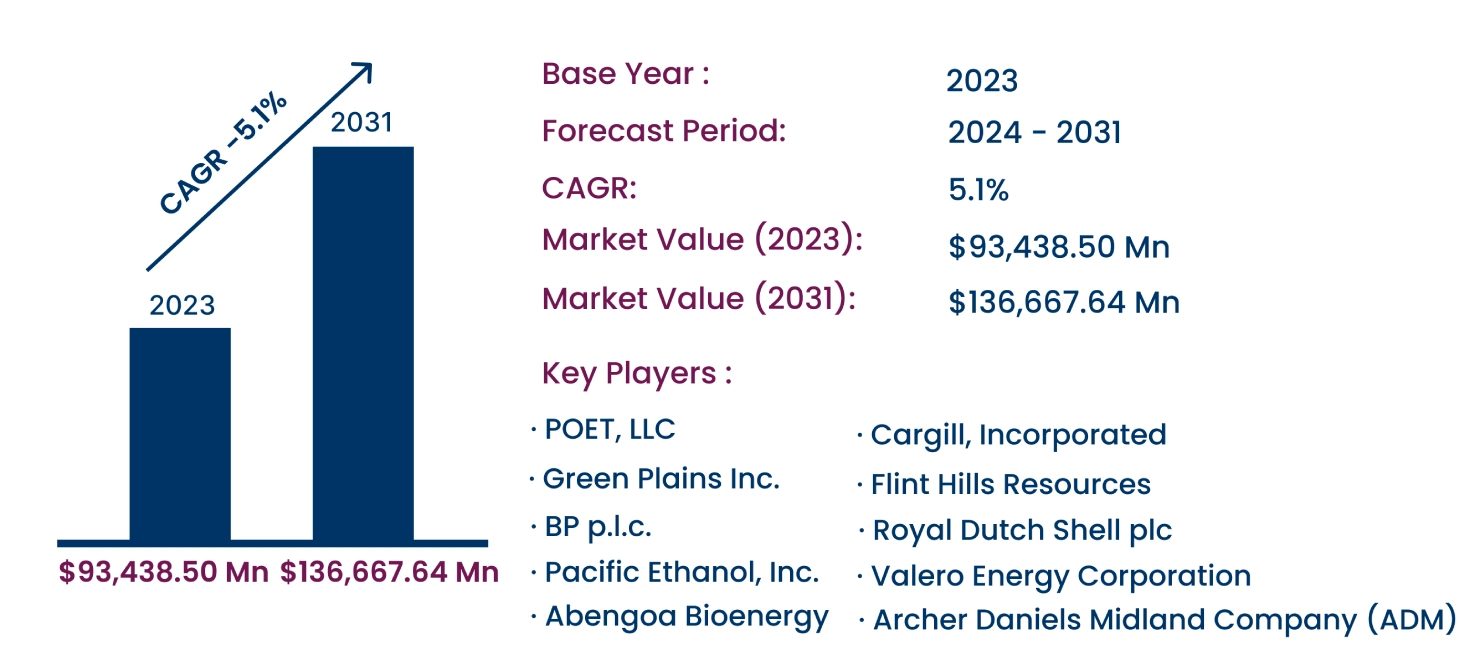

Global Ethanol Market to Reach USD 136.67 Billion by 2031 | CAGR of 5.1%

Category : Materials And Chemicals | Published Date : Nov 2024 | Type : Press Release

Ethanol Market Scope & Overview:

In the newly published report, Consegic Business Intelligence states that the Ethanol Market size was valued at USD 93.44 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to reach USD 136.67 billion by 2031. Ethanol is a renewable biofuel primarily derived from corn, sugarcane, and other biomass sources. It is extensively used as an additive in gasoline to increase octane levels and reduce carbon emissions, contributing to cleaner combustion. Ethanol also finds applications in industrial solvents, disinfectants, pharmaceuticals, and alcoholic beverages, offering biodegradability and compatibility with existing fuel infrastructure.

The report comprises the Ethanol Market Share, Size & Industry Analysis, based on Source (Corn-Based Ethanol, Sugarcane-Based Ethanol, Wheat-Based Ethanol, Barley-Based Ethanol, Cellulosic Ethanol, Others), Process (Biobased, Synthetic), Application (Biofuel, Industrial Solvents, Disinfectants & Sanitizers, Cosmetic Formulations, Chemical Intermediates), Grade (Fuel-Grade Ethanol, Industrial-Grade Ethanol, Food-Grade Ethanol, Pharmaceutical-Grade Ethanol), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Ethanol Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profiles, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

The rising adoption of ethanol as a sustainable fuel alternative, driven by regulatory mandates and environmental concerns, is accelerating market growth.

Segmental Analysis :

Based on sources, the ethanol market is segmented into Corn-Based Ethanol, Sugarcane-Based Ethanol, Wheat-Based Ethanol, Barley-Based Ethanol, Cellulosic Ethanol, and Others.

- The corn-based ethanol segment held the largest market share of 33.12% in 2023, attributed to its extensive use in biofuel production, particularly in North America. The U.S. leads in production due to its abundant corn supply and advanced fermentation technologies.

- The cellulosic ethanol segment is projected to grow at the fastest CAGR, driven by its environmental benefits, reduced reliance on food-based feedstocks, and strong government support for advanced biofuels.

Based on the process, the market is categorized into Biobased and Synthetic Ethanol.

- The biobased ethanol segment dominated the market in 2023, fueled by its widespread use in biofuel production through fermentation. Advancements in fermentation technologies, including genetically modified yeast, are further boosting this segment's efficiency.

- The synthetic ethanol segment is expected to register the fastest growth, driven by its high purity and increasing demand in industrial applications, particularly in pharmaceuticals and cosmetics.

Based on application, the market is segmented into Biofuel, Industrial Solvents, Disinfectants & Sanitizers, Cosmetic Formulations, and Chemical Intermediates.

- The biofuel segment accounted for the largest market share in 2023, driven by increasing ethanol-blended gasoline adoption to reduce emissions and enhance fuel efficiency. Government programs like the Renewable Fuel Standard (RFS) in the U.S. are key drivers for this segment.

- The disinfectants & sanitizers segment is projected to grow at the fastest rate, supported by heightened hygiene awareness and increased usage of ethanol-based antimicrobial products in healthcare and residential settings.

Based on grade, the market is segmented into Fuel-Grade Ethanol, Industrial-Grade Ethanol, Food-Grade Ethanol, and Pharmaceutical-Grade Ethanol.

- The fuel-grade ethanol segment led the market in 2023, propelled by its widespread adoption of gasoline blending programs aimed at reducing carbon emissions.

- The pharmaceutical-grade ethanol segment is expected to witness the fastest growth, driven by rising demand for high-purity ethanol in sanitizers, disinfectants, and pharmaceutical formulations.

Based on regions, the global market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America

- North America accounted for the largest share of 38.11% in 2023, led by the U.S., a major producer of corn-based ethanol. The region's demand is fueled by renewable fuel mandates and government support for ethanol blending in gasoline.

- Asia-Pacific is expected to register the highest CAGR of 5.7%, driven by increasing energy needs and government initiatives promoting ethanol production in countries like China and India.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 136.67 Billion |

| CAGR (2024-2031) | 5.1% |

| Source | Corn-based Ethanol, Sugarcane-Based Ethanol, Wheat-Based Ethanol, Barley-Based Ethanol, Cellulosic Ethanol, Others |

| Process | Biobased, Synthetic |

| Application | Biofuel, Industrial Solvents, Disinfectants & Sanitizers, Cosmetic Formulations, Chemical Intermediates |

| Grade | Fuel-Grade Ethanol, Industrial-Grade Ethanol, Food-Grade Ethanol, Pharmaceutical-Grade Ethanol |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The ethanol market features a competitive landscape dominated by leading producers and suppliers. Key players focus on product innovation, strategic collaborations, and R&D investments to expand their market presence. The competitive landscape encompasses companies like Archer Daniels Midland Company (USA), Valero Energy Corporation (USA), and POET, LLC (USA), who lead in ethanol production and distribution. Other prominent players such as BP p.l.c. (UK) and Royal Dutch Shell plc (Netherlands) have invested in advanced ethanol technologies to align with global sustainability goals. Companies are also expanding their capabilities in pharmaceutical-grade ethanol production to meet rising demand in healthcare.

List of prominent players in the Ethanol Industry:

- Archer Daniels Midland Company (ADM) (United States)

- Valero Energy Corporation (United States)

- POET, LLC (United States)

- Green Plains Inc. (United States)

- BP p.l.c. (United Kingdom)

- Royal Dutch Shell plc (Netherlands)

- Pacific Ethanol, Inc. (United States)

- Flint Hills Resources (United States)

- Abengoa Bioenergy (Spain)

- Cargill, Incorporated (United States)

Recent Industry Developments :

- April 2024: The U.S. EPA extended higher ethanol gasoline sales (E15) during the summer to address potential supply disruptions, allowing continued use of E15 blends traditionally restricted from June 1 to September 15.

- January 2024: BP announced plans to expand ethanol blending capacity in Brazil, aiming to meet the increasing demand for sustainable biofuels.

- October 2023: POET, LLC completed the expansion of its U.S. production facilities, increasing ethanol output by 25% to cater to growing biofuel demand.