Global Opioid Anesthetics Market to Reach USD 1,188.06 Million by 2031 | CAGR of 4.4%

Category : Healthcare | Published Date : Jun 2024 | Type : Press Release

Opioid Anesthetics Market Scope & Overview :

Opioid Anesthetics are drugs used with anesthesia to reduce the dosage, improve delivery, and enhance the effectiveness of anesthesia. Several types of opioid anesthetics include morphine, fentanyl, sufentanil, hydromorphone, buprenorphine, and tramadol.

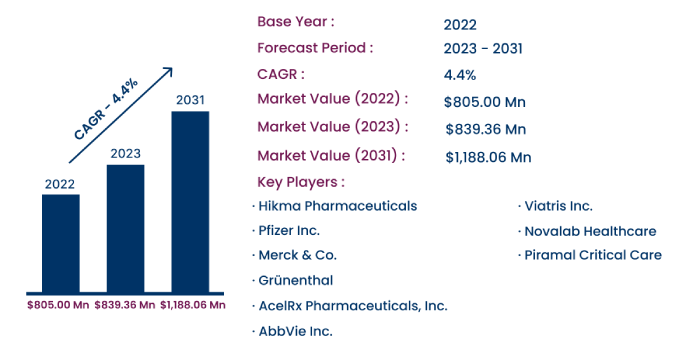

Consegic Business Intelligence analyzes that the Global Opioid Anesthetics Market size was valued at USD 805 Million in 2022, projected to grow by USD 839.36 Million in 2023, and is expected to register a CAGR of 4.4% to reach USD 1,188.06 Million by 2031.

This report comprises Opioid Anesthetics Market Share, Size & Industry Analysis, By Type (Oral and Injectable), By End-Users (Hospitals, Ambulatory Surgical Centers, Clinics, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa), and Forecast, 2023-2031.

This report contains detailed information on Opioid Anesthetics Market Opportunities, Trends, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profile, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

As per the report analysis, the rising use of assisting anesthetics in surgeries is driving the opioid anesthetics market growth. These drugs increase the duration of medicine's effectiveness. They also reduce immediate postoperative pain and agitation.

Segmental Analysis :

The Opioid Anesthetics Market is segmented into three major segments based on type, end-users, and region.

Based on type, the market is bifurcated into oral and injectable.

- In 2022, the injectable segment accounted for the highest market share and is also expected to witness the fastest CAGR from 2023 to 2031, as they can be administered within the body and improve patient safety.

Based on the end-users, the market is categorized into hospitals, ambulatory surgical centers, clinics, and others.

- The hospital segment held the highest 56.75% of the total market share due to its usage in surgeries and handling post-operative pain.

- The ambulatory surgical centers segment is anticipated to witness the fastest CAGR as they provide emergency same-day surgical care to avoid hospital admissions by providing instant diagnostics and preventive measures.

By region, the market is segregated into regions including North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- In 2022, the North American region accounted for the highest market share at 37.30% valued at USD 300.27 Million, of which the U.S. contributed 65.55% due to the rise in advanced healthcare facilities, and chronic diseases in the region. This region is also expected to register the fastest CAGR of 4.8% over the forecasted period.

| Report Attributes | Report Details |

| By Type | Oral and Injectable |

| By End-Users | Hospitals, Ambulatory Surgical Centers, Clinics, and Others |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. Additionally, this report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Opioid Anesthetics Industry :

- Hikma Pharmaceuticals

- Pfizer Inc.

- Merck & Co.

- Grünenthal

- AcelRx Pharmaceuticals, Inc.

- AbbVie Inc.

- Viatris Inc.

- Novalab Healthcare

- Piramal Critical Care

Recent Industry Developments :

- In December 2021, Hikma Pharmaceuticals launched a new Bupivacaine HCl Injection, USP with variants as 0.25%, 0.5%, and 0.75% in 10mL and 30mL doses.