Opioid Anesthetics Market Size :

Consegic Business Intelligence analyzes that the Opioid Anesthetics Market size is estimated to reach over USD 1,204.93 Million by 2032 from a value of USD 856.47 Million in 2024 and is projected to grow by USD 878.55 Million in 2025, growing at a CAGR of 4.40% from 2025 to 2032.

Opioid Anesthetics Market Scope & Overview:

Opioid anesthetics are drugs that are used in conjunction with local and general anesthesia to enhance the effectiveness of the anesthesia, improve its delivery, and reduce the required dosage. These drugs are administered perineurally along with local anesthetics to extend the duration of anesthesia without increasing the risk of adverse effects. Opioids are widely used in the practice of anesthesia, as primary anesthetics, for pre-anesthetic medication, supplementation of general anesthetic agents. The efficient use of opioid anesthetics is done by careful titration of dose as per the individual patient's response to the drug and noxious stimulation. A wide range of anesthetics such as morphine, fentanyl, sufentanyl, hydromorphone, buprenorphine, and tramadol are commonly used for this purpose.

Opioid Anesthetics Market Insights :

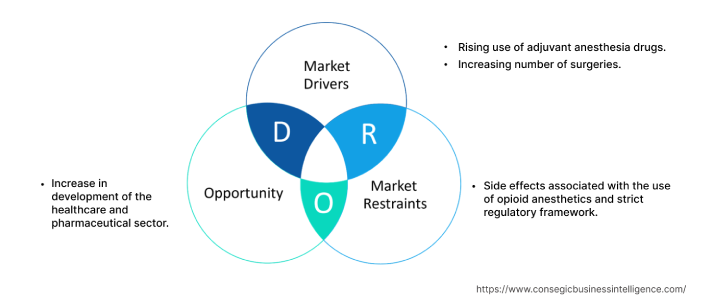

Opioid Anesthetics Market Dynamics - (DRO) :

Key Drivers :

Rising use of adjuvant anesthesia drugs is Driving the Market Growth.

Adjuvants are medications that are administered together with local or general anesthetics to increase their effectiveness, improve delivery, or decrease the required dosage. These medications work together with local anesthetics to enhance the duration and quality of anesthesia in regional techniques. Over time, the range of local anesthetic adjuvants has expanded from classical opioids to a wide variety of drugs with varying mechanisms of action, all aimed at improving the aesthetic experience. These drugs are used for better management of pain and anesthesia during surgeries. Additionally, the rise in surgeries is propelling the use of adjuvant anesthesia drugs. For instance, according to the data published on NCBI on July 29, 2020, globally, a staggering 310 million major surgeries are performed each year; around 40 to 50 million in the USA and 20 million in Europe. Thus, as per the analysis of market trends, the aforementioned reasons drive the opioid anesthetics market growth.

Increasing number of surgeries Fuels the Market Progress.

The rise in the number of surgeries is fuelling the demand for opioid anesthetics. They are used in combination with local and general anesthetic drugs to increase the effectiveness of the drug and prevent pain during surgical procedures like dental surgeries, cardiac surgeries, cosmetic surgeries, breast cancer biopsies, bone fractures, knee replacement, and cataract removal. These anesthetics are widely used as pre-anesthesia medications, adjuvant anesthetic medications, and post-operation medications. They are especially vital in treating pain and as anesthesia adjuncts or primary anesthetic agents during surgery and postoperatively. Additionally, the rising number of surgeries is boosting the opioid anesthetics market growth. For instance, according to the report published by the American Society of Plastic Surgeons in September 2023, cosmetic surgery procedures have grown by 19% in 2022 compared to 2019. Furthermore, in June 2021, a Canadian Health Information Institute report showed that 55,300 hip replacements and 55,285 knee replacements were performed in Canada during 2020-2021. Hence, the market trends analysis shows that the aforementioned reasons drive the opioid anesthetics market demand.

Key Restraints :

Side effects associated with the use and strict regulatory framework Hampers the Market Development.

Opioids are a key tool in anesthesia and surgical pain management. However, opioids come with a range of potential side effects, including respiratory depression, exacerbation of obstructive sleep apnea, post-operative nausea, vomiting, ileus, hyperalgesia (increased sensitivity to pain), drowsiness, delirium, hypotension, urinary retention, and risk of tolerance. These side effects can range from mild to severe depending upon the resistance and acceptance capacity of person to person. According to the report published by the Centers for Disease Control and Prevention in December 2022, the rate of drug overdose deaths involving synthetic opioids other than methadone increased by 22% in 2021. Moreover, approval of opioid-based drugs requires a strict regulatory framework and guidelines by the regulatory agencies which further extends the approval time for opioid-based anesthetic drugs. Thus, the market analysis shows that the complex regulatory processes along with the side effects of opioid drugs significantly hamper the opioid anesthetic market demand.

Future Opportunities :

Increase in development of the healthcare and pharmaceutical industry Creates New Growth Avenues.

The prevalence of chronic disorders is rising globally. There is a significant growth observed in the pharmaceutical and healthcare sectors post-COVID-19 pandemic. Additionally, advancement in the healthcare infrastructure and government initiatives for better management of health is expected to fuel the opioid anesthetics market for surgical treatment. For instance, according to the data published by the India Brand Equity Foundation in August 2023, in the Union Budget 2023-24, the Indian government allocated USD 10.76 billion to the Ministry of Health and Family Welfare (MoHFW). Moreover, the analysis of market trends depicts that the increasing number of hospitals in developing countries is expected to potentially fuel the opioid anesthetics market opportunities. For instance, according to the report by Investment Information and Credit Rating Agency, in August 2023, the hospital industry is driving a robust revenue growth of 8-10% in FY24, with an operating profit margin of 22-23%. This will boost the distribution of cancer drugs in the hospital pharmacies.

Opioid Anesthetics Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2031 | USD 1,204.93 Million |

| CAGR (2025-2032) | 4.4% |

| By Type | Oral and Injectables |

| By End-users | Hospitals, Ambulatory Surgical Centers, Clinics, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Hikma Pharmaceuticals, Pfizer Inc., Merck & Co., Grünenthal, AcelRx Pharmaceuticals, Inc., AbbVie Inc., Viatris Inc., Novalab Healthcare, Piramal Critical Care |

Opioid Anesthetics Market Segmental Analysis :

By Type :

The type segment is categorized into oral and injectables. In 2024, the injectable segment accounted for the highest market share in the global opioid anesthetics market, and it is expected to grow at the fastest CAGR in the overall opioid anesthetics market. Several injectable anesthetics are typically administered intravenously, transdermally, and subcutaneously in the body during surgical operations. Most of the anesthetic drugs are available in injectable form, leading to the dominance of this segment. Additionally, Intravenous administration of drugs increases the bioavailability of the drug and improves patient safety. Thus, segmental trends analysis portrays that the advantages related to injectable drugs are driving the opioid anesthetics market opportunities.

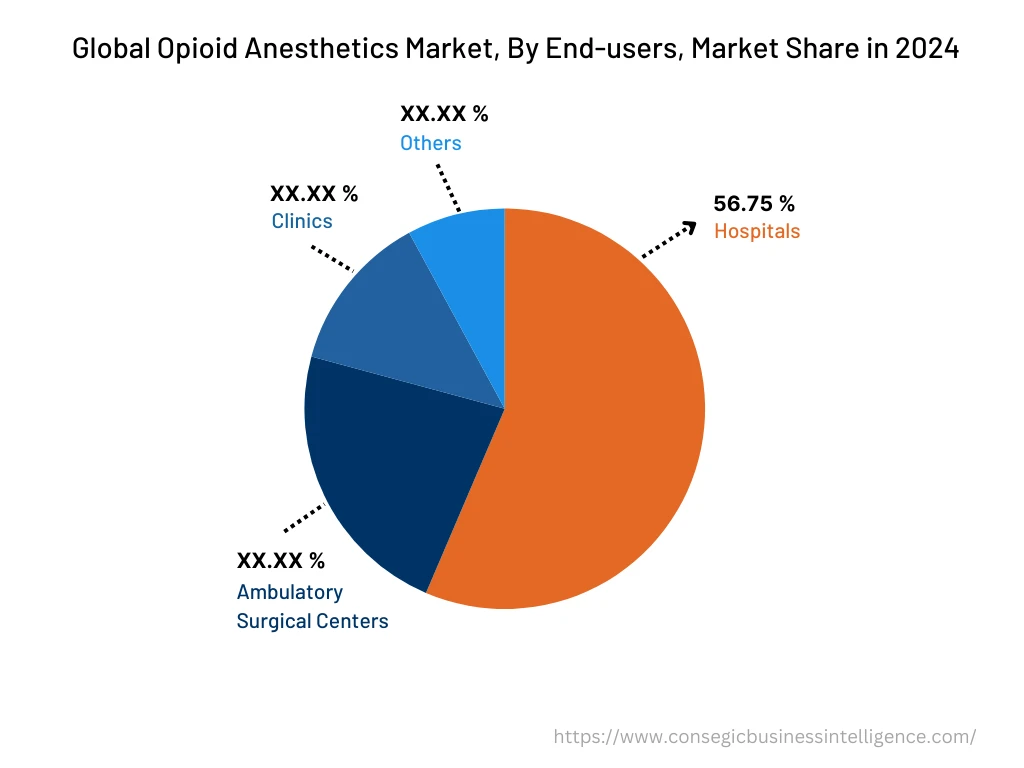

By End-User :

The end-users segment is categorized into hospitals, ambulatory surgical centers, clinics, and others. In 2024, the hospital segment accounted for the highest market share of 56.75% in the overall opioid anesthetics market share. Hospitals are outfitted with a comprehensive suite of healthcare facilities, encompassing an array of medical instruments, devices, diagnostic laboratories, and pharmacies that are essential for surgical procedures. These facilities are designed to provide patients with optimal care and support throughout the surgical process. The healthcare professionals who operate surgeries are highly trained and skilled in their respective areas of expertise, ensuring that patients receive the utmost care and attention from start to finish. Moreover, the rise in the hospital sector is significantly driving the opioid anesthetics market trends. For instance, according to the report by Investment Information and Credit Rating Agency, in August 2023, the hospital sector is driving a robust revenue growth of 8-10% in FY24, with an operating profit margin of 22-23%. Thus, the analysis of market trends shows that the aforementioned drive the opioid anesthetics market demand.

However, the ambulatory surgical centers segment is expected to grow at the fastest CAGR in the overall opioid anesthetics market. Ambulatory surgery centers, or ASCs, are modern healthcare facilities focused on providing same-day emergency surgical care, including diagnostic and preventive procedures, avoiding hospital admissions. Moreover, the surgical solutions provided by ambulatory surgical centers are cost-effective. Hence, the analysis of segment trends shows that it is expected to bring lucrative growth in the ambulatory surgical center's segment, thus, in turn, driving the opioid anesthetics market trends.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

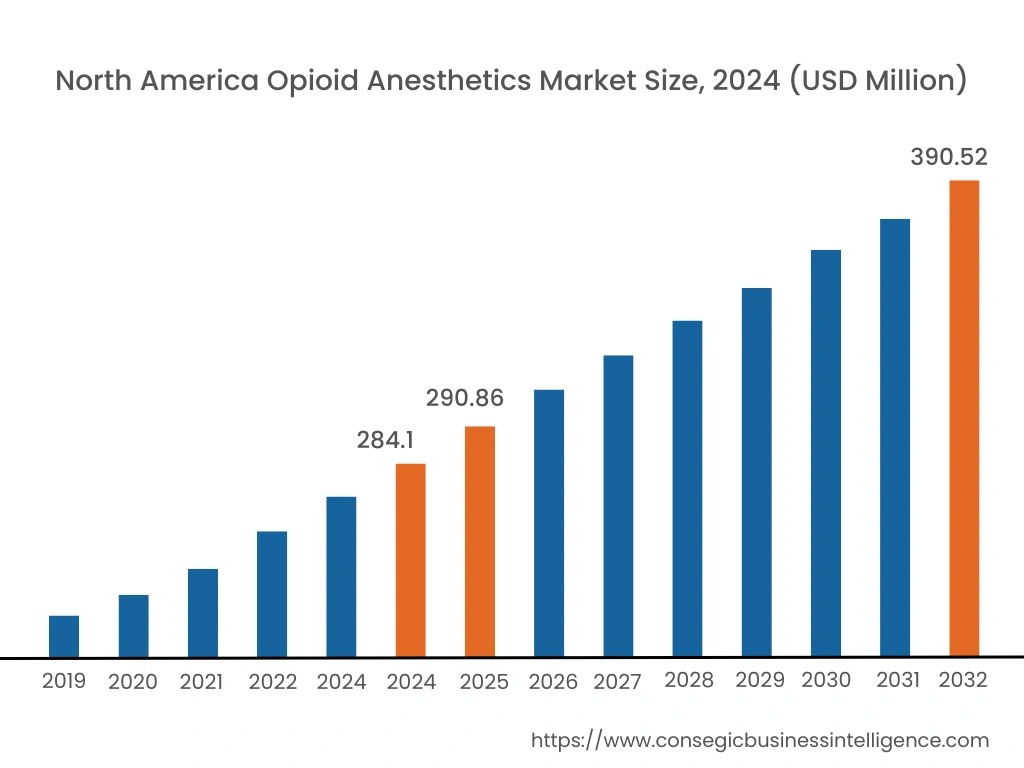

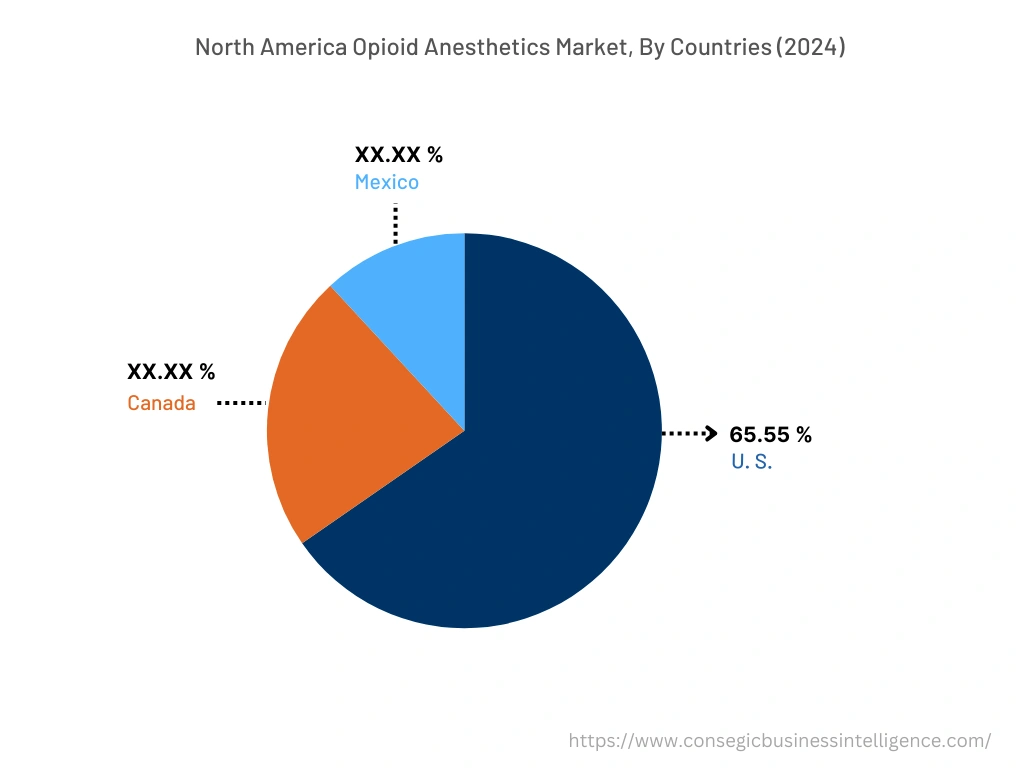

North America is estimated to reach over USD 390.52 Million by 2032 from a value of USD 284.1 Million in 2024 and is projected to grow by USD 290.86 Million in 2025. It is also the fastest-growing region across the globe, growing with a CAGR of 4.8% over the forecast period. In the North American region, the U.S. accounted for the highest market share of 65.55% during the base year 2024. As per the opioid anesthetics market analysis this is owing to the increasing geriatric population, advanced healthcare facilities and services, increase in chronic disorders surgeries, and significant growth in the pharmaceutical and healthcare industry. Additionally, the growing demand for pharmaceutical research and development is substantially driving the opioid anesthetics market expansion in the region. For instance, according to the report by the National Center for Science and Engineering Statistics in September 2023, in financial year (FY) 2022, the 42 federally funded research and development centers (FFRDCs) in the United States spent USD 26.5 billion on research and development (R&D). This was a 6.4% increase from the previous year.

In the Asia-Pacific region, the opioid anesthetics market is primarily driven by the growing demand for advanced healthcare infrastructure and surgical procedures. Countries such as Japan, China, and India are witnessing significant expansion in medical facilities, contributing to increased usage of opioid anesthetics for pain management. However, challenges such as regulatory scrutiny and rising concerns over addiction are affecting market dynamics. Despite these obstacles, the ongoing development of healthcare systems, along with the rise in chronic diseases and surgeries, is expected to drive steady growth in the region's opioid anesthetics market.

Top Key Players & Market Share Insights:

The opioid anesthetics market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The opioid anesthetics market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the opioid anesthetics industry include-

- Hikma Pharmaceuticals

- Pfizer Inc.

- Viatris Inc.

- Novalab Healthcare

- Piramal Critical Care

- Merck & Co.

- Grünenthal

- AcelRx Pharmaceuticals, Inc.

- AbbVie Inc.

Recent Industry Developments :

- In December 2021, Hikma Pharmaceuticals PLC (Hikma), the multinational pharmaceutical company, launched a new product Bupivacaine HCl Injection, USP through its US affiliate, Hikma Pharmaceuticals USA Inc. The company has launched 0.25%, 0.5% and 0.75% in 10mL and 30mL doses.

Key Questions Answered in the Report

What was the market size of the opioid anesthetics market in 2024? +

In 2024, the market size of opioid anesthetics was USD 856.47 million.

What will be the potential market valuation for the Opioid Anesthetics market by 2032? +

In 2032, the market size of opioid anesthetics will be expected to reach USD 1,204.93 million.

What are the key factors driving the growth of the opioid anesthetics market? +

Rising use of adjuvant anesthesia drugs is propelling the opioid anesthetics market growth.

What is the dominating segment in the opioid anesthetics market by end-users? +

In 2024, the hospitals segment accounted for the highest market share of 56.75% in the overall Opioid Anesthetics market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the opioid anesthetics market's growth in the coming years? +

North America is expected to be the fastest-growing region in the market during the forecast period.