5G Device Testing Market Size:

5G Device Testing Market size is estimated to reach over USD 2,846.00 Million by 2032 from a value of USD 1,588.71 Million in 2024 and is projected to grow by USD 1,680.50 Million in 2025, growing at a CAGR of 7.60% from 2025 to 2032.

5G Device Testing Market Scope & Overview:

5G device testing refers to the process of evaluating and validating the performance, functionality, and security of devices and networks that operate on the fifth generation of network technology. It features higher frequency bands, massive MIMO (Multiple Input, Multiple Output), and ultra-low latency to ensure standardized performance along with security. Additionally, the security testing in 5G involves identifying vulnerabilities, ensuring that data encryption is robust and that devices and networks can withstand attacks. Moreover, by thoroughly testing devices and networks, manufacturers and service providers can guarantee that their 5G products deliver the expected performance, reliability, and security. The aforementioned features of 5G device testing are major determinants for increasing their deployment in healthcare, automotive, IT telecommunications, and other industries.

5G Device Testing Market Insights:

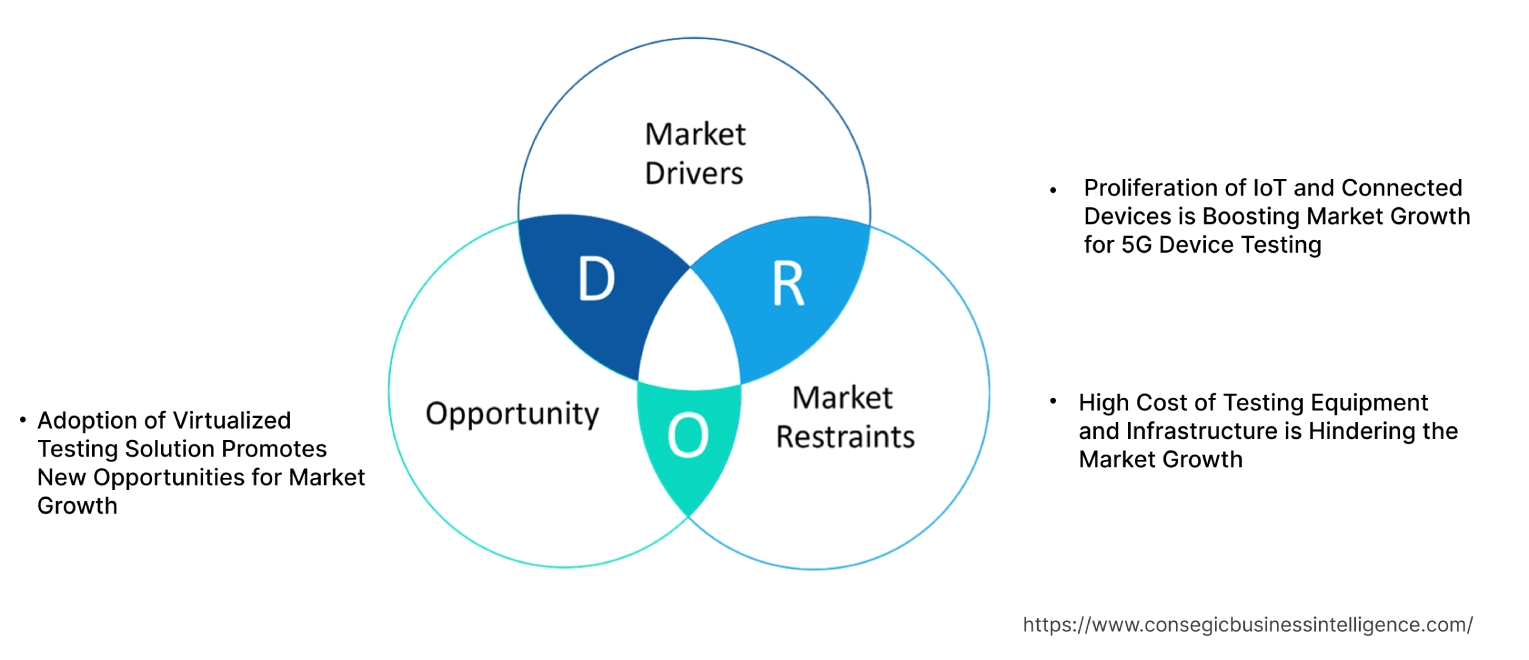

5G Device Testing Market Dynamics - (DRO) :

Key Drivers:

Proliferation of IoT and Connected Devices is Boosting Market Growth for 5G Device Testing

The rising demand for devices for seamless communication and real-time data exchange facilitates the need for 5G networks. These devices, from smart home systems and wearable technology to industrial sensors and autonomous vehicles, all rely on 5G's advanced features. Testing ensures that these devices operate efficiently within the 5G ecosystem, leveraging the network's high speed, low latency, and enhanced reliability to deliver standardized performance. Additionally, as IoT devices continue to expand into various sectors, including healthcare, agriculture, manufacturing, and smart cities, each sector has unique requirements that must be met to ensure successful deployment. Moreover, factors of growth include ultra-reliable, low-latent communication, robust connectivity to monitor and control, and prevention of potential failures across various industries to ensure high performance.

- In May 2021, Qualcomm Technologies launched the Qualcomm 315 5G IoT Modem-RF System purposely built for Internet of Things (IoT) modem solution. It is designed to bring 5G connectivity to the IoT devices by featuring power efficiency, and compact design. This makes it ideal for IoT applications that require reliable, high-speed connectivity while operating under low consumption.

Therefore, the proliferation of IoT devices with reliability and robust connectivity is boosting the 5G device testing market growth.

Key Restraints :

High Cost of Testing Equipment and Infrastructure is Hindering the Market Growth

The transition to 5G involves the adoption of advanced technologies and testing methodologies, which often require specialized and expensive equipment. Testing 5G devices involves high-precision RF (radio frequency) analyzers, network emulators, and other sophisticated tools designed to handle the complexities of 5G technology including millimeter-wave frequencies and massive MIMO (Multiple Input, Multiple Output) configurations. Moreover, the initial investment for acquiring and maintaining this testing infrastructure can be substantial, posing a barrier for smaller companies or startups. These high costs can limit their ability to compete effectively in the market, as they may struggle to afford the necessary tools and resources for thorough testing. Furthermore, the complexity of 5G technology requires continuous updates and calibration of testing equipment to ensure accurate results. This ongoing need for investment in cutting-edge technology and training can be a significant financial strain. Hence, the high cost of testing equipment and infrastructure limits the 5G device testing market.

Future Opportunities :

Adoption of Virtualized Testing Solution Promotes New Opportunities for Market Growth

Virtualized testing solution is a software-based approach to testing that uses virtualization technologies to create simulated environments for testing various components, systems, or networks. These solutions provide a scalable and flexible approach, enabling businesses to access a range of testing environments and network conditions on demand without the need for substantial investment in physical infrastructure. Additionally, by leveraging cloud resources, companies can avoid the high costs associated with purchasing, maintaining, and upgrading specialized testing equipment. Moreover, it facilitates reliability and interoperability in the testing of devices in various network conditions and scenarios including manufacturers, service providers, and network configuration.

- In October 2023, Viavi Solutions Inc. launched NITRO Wireless catering to equipment manufacturers, service providers, and system integrators. This solution is an interoperability test platform with cloud, intelligence, automation, and digital twin technology. Moreover, it enables Network Integrated Test, Real-Time Analytics and Optimization (NITRO) platforms to provide advanced virtualized solutions.

Consequently, virtualized testing solutions represent a significant opportunity in the 5G device testing market share due to the transformative impact of cloud computing.

5G Device Testing Market Segmental Analysis :

By Type:

Based on type the market is trifurcated into hardware testing, software testing, and services.

Trends in the type:

- The demand for managed testing services is increasing, as companies seek to outsource their testing needs to specialized providers. These services offer expertise in 5G testing, access to advanced tools, and comprehensive support, allowing companies to focus on their core competencies.

- Software testing is increasingly incorporating automation and AI-driven tools to enhance testing efficiency and accuracy. Automated testing scripts and AI analytics help in identifying bugs, performance issues, and vulnerabilities more effectively, reducing the time and cost of testing.

The hardware testing segment accounted for the largest revenue share of 55.29% in 2024.

- 5G devices are complex and require extensive hardware testing to ensure they meet the stringent performance and compliance standards.

- The need for high-frequency signal analyzers, network simulators, and other advanced testing equipment is substantial, making hardware testing a critical focus area.

- Additionally, advancements in infrastructure for 5G networks and devices further boost the growth of hardware testing. Ensuring that hardware components perform reliably under real-world conditions is essential for the successful deployment of 5G technology.

- In August 2023, Rohde & Schwarz and MediaTek collaborated to validate MediaTek's 5G RedCap test platform with R&S CMX500 OBT wireless communications tester. This platform enables a range of 5G standalone hardware including industrial sensors for 5G smart factories, logistics, edge-AI, and always-connected wearables. This launch highlights the ongoing advancements in hardware testing technologies to address the complexities of 5G network validation.

- Therefore, hardware testing ensures performance reliability in the devices, fueling the 5G device testing market demand.

The software testing segment is anticipated to register the fastest CAGR during the forecast period.

- Software testing is the process of evaluating and verifying a software application or system's performance.

- The primary goals of software testing are to identify any bugs, errors, or defects in the software, ensure that it meets specified requirements, and validate that it functions seamlessly.

- Additionally, this process involves different level testing including testing individual components or modules, integration testing, system testing, and acceptance testing to ensure the software meets the standardized requirements.

- In March 2022, Keysight Technologies, Inc. unveiled 5G new radio test cases for device and module validation. It utilizes Keysight's S8707A RF/RRM Carrier Acceptance Toolset (RCAT) which is incorporated in the company's suite of 5G network emulation solutions. This test case provides comprehensive validation for software platforms to meet specified requirements.

- Hence, validation of software so that it meets the requirements and performance is boosting the 5G device testing market trend.

By Equipment:

Based on equipment the market is segmented into oscilloscopes, signal generators, spectrum analyzers, and network analyzers.

Trends in the Equipment:

- Modern oscilloscopes are increasingly equipped with advanced signal analysis capabilities, including high-resolution sampling, real-time waveform analysis, and enhanced trigger features.

- There is a growing integration of signal generators with automated testing systems and software. This trend facilitates automated testing processes, reducing manual intervention and improving testing efficiency and consistency for 5G devices.

The spectrum analyzers accounted for the largest revenue share in the year 2024.

- Spectrum analyzer is an electronic test instrument used to measure and visualize the frequency spectrum of electric signals.

- It is widely used in fields including telecommunication, electronics, and audio engineering for analysis of amplitude of various frequency components.

- These are essential tools for tasks including turning transmitters, testing the performance of wireless communication systems, and diagnosing issues in radio frequency circuits.

- In May 2021, EXFO Inc. launched a 5GPro Spectrum Analyzer designed to help network operators and service providers efficiently manage the increasing and diverse radio frequency (RF). It offers advanced features for real-time spectrum analysis, enabling operators to detect, identify, and resolve interference issues quickly and accurately.

- Consequently, diagnosis of the issues in radio frequency by spectrum analyzers is driving the 5G device testing market.

The network analyzer is anticipated to register the fastest CAGR during the forecast period.

- Network analyzer also known as vector network analyzer (VAN), is a specialized electronic instrument used to measure the electrical properties of networks, particularly in the RF and microwave frequency.

- It is primarily used to test and characterize components including antennas, cables, filters, and amplifiers by analyzing frequency.

- In August 2022, Anritsu expanded its VectorStar vector network analyzer (VNA) family by incorporating capabilities of spectrum analysis. It is a high-performance tool designed to enhance the precision and reliability of RF and microwave measurements.

- Thus, comprehensive testing capabilities of network analyzers are proliferating the 5G device testing market.

By Device Type:

Based on device type the market is segmented into smartphones, IoT devices, connected vehicles, laptops, tablets, wearables, routers and modems, drones, and others.

Trends in the Device Type:

- Connected vehicles are increasingly relying on 5G for real-time data transmission and safety features to ensure low latency and high reliability to support autonomous driving and advanced driver assistance systems (ADAS).

- Testing for real-time data syncing and communication is becoming crucial as wearables increasingly rely on 5G for health monitoring and other real-time applications.

The smartphones accounted for the largest revenue share in the year 2024.

- Smartphones are the primary and most used devices among consumers as they enable them to experience 5G network technology.

- The demand for 5G-enabled smartphones is high, driving significant focus on testing these devices to ensure they meet performance and reliability standards.

- Moreover, modern smartphones incorporate a range of advanced features that leverage 5G capabilities, including high-speed internet, enhanced streaming, and improved connectivity.

- In September 2022, Apple launched the iPhone 14 series with advanced 5G capabilities. Rigorous testing was conducted to ensure that the devices met high-performance standards for speed, connectivity, and network efficiency, reflecting the significant focus on 5G testing for smartphones.

- Thus, the driving need for 5G-enabled smartphones for improved connectivity is propelling the 5G device testing market.

The IoT devices are anticipated to register the fastest CAGR during the forecast period.

- IoT devices are proliferating across various industries, leading to a trend towards scalability and connectivity testing, ensuring these devices handle large connections and data throughput required by 5G networks.

- These devices require reliable and high-speed communication for real-time data processing and remote operations.

- In June 2022, Anritsu collaborated with Tech Mahindra and launched the IoT Experience Lab. This collaboration aimed at providing solutions to evaluate IoT 5G device performance under various network conditions and ensuring compatibility with diverse IoT applications.

- Hence, the widespread adoption of 5G networks among the IoT drives the need for 5G device testing market opportunities.

By End-User:

Based on end users the market is segmented into telecommunication, manufacturers, healthcare, automotive, government, and others.

Trends in the End-User:

- With the rise of connected and autonomous vehicles, the automotive industry increasingly relies on 5G testing to ensure the safety, reliability, and real-time data processing capabilities of vehicle communication systems.

- The healthcare sector uses 5G testing for applications including telemedicine, remote surgery, and real-time patient monitoring, where low latency and high reliability are crucial.

Telecommunication accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Telecom operators are at the forefront of ensuring that 5G networks meet the necessary performance, coverage, and reliability standards.

- The robust infrastructure for the success of 5G, extensive testing is required at every stage of network development, from initial deployment to ongoing optimization and troubleshooting.

- Additionally, telecom companies are heavily investing in labs to test their 5G solutions to ensure their network supports high-speed, low latency, and massive connectivity requirements.

- In April 2022, Nokia launched a Private 5G Open Lab to support its growing portfolio of 5G solutions. The lab focuses on end-to-end testing of private 5G networks, ensuring interoperability, security, and performance across different 5G use cases.

- Therefore, the increasing rollout of the 5G network necessitates network operators to test and ensure the performance, fueling the 5G device testing market.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 467.89 Million in 2024. Moreover, it is projected to grow by USD 496.32 Million in 2025 and reach over USD 866.61 Million by 2032. Out of this, China accounted for the maximum revenue share of 25.5%. The Asia-Pacific region, countries including China, Japan, South Korea, and India, is rapidly advancing in the 5G device testing market. The region's expansive telecom infrastructure, growing population, and increasing demand for advanced connectivity drive the adoption of 5G device testing technologies. Additionally, the adoption of virtual and cloud-based testing environments is growing, enabling software testing to be conducted in scalable and flexible settings. This trend allows for comprehensive testing across various network conditions and configurations without the need for extensive physical infrastructure.

- In January 2022, Anritsu (Japan) launched Interference Waveform Pattern for 5G NR Receiver Test MX371055A and LTE Receiver Test MX371054A software. This facilitates efficient interference evaluation tests necessitated by radio frequency compliance tests.

North America is estimated to reach over USD 922.39 Million by 2032 from a value of USD 526.99 Million in 2024 and is projected to grow by USD 556.37 Million in 2025. According to 5G device testing market analysis, North America particularly the United States and Canada, stands out as a leading force. The region's early adoption of 5G technology and substantial investments in infrastructure have set it apart. The region's strong technological foundation and high demand for 5G services underscore its pivotal role in the global 5G device testing market.

- In August 2023, Qualcomm (US) and BT group joined forces to launch 5G lab facilities to test and validate the 5G network for fast deployment and commercialization. This collaboration aimed at 5G testing to ensure safety, reliability, and real-time data processing capabilities.

Europe is a significant player in the 5G device testing arena, with countries including Germany, the UK, and France leading the charge. The region's emphasis on regulatory compliance and its commitment to technological advancement are key factors driving the 5G device testing market. With substantial investments in 5G infrastructure and a focus on high-quality testing, Europe remains a crucial region for the industry.

Latin America is on the rise in the 5G device testing market, with Brazil and Mexico beginning to make strides in 5G infrastructure investment. While the region is still catching up compared to others, the growing interest in 5G technology presents promising growth.

The Middle East and Africa are gradually becoming important players in the 5G device testing market. Countries including UAE and South Africa are advancing their 5G initiatives, driven by investments in telecom infrastructure and smart city projects.

Top Key Players & Market Share Insights:

The 5G device testing market is highly competitive with major players providing standardized performance to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the 5G device testing market. Key players in the 5G device testing industry include-

- Keysight Technologies (USA)

- Rohde & Schwarz (Germany)

- VIAVI Solutions (USA)

- Anritsu (Japan)

- National Instruments (USA)

- Ixia (USA)

- NI (National Instruments) (USA)

- Tessolve (India)

- Spirent Communications (UK)

- Qualcomm (USA)

- EXFO (Canada)

- Testonica Lab (Ukraine)

- Aemulus Holdings (Malaysia)

- LitePoint (USA)

Recent Industry Developments :

Product Launches:

- In June 2024, Rohde & Schwarz introduced new network test equipment that includes high-frequency signal analyzers and testing platforms tailored for 5G devices. This launch highlights the ongoing investment in hardware testing technologies to address the complexities of 5G network validation.

- In February 2023, Keysight Technologies launched E7515R a virtualized testing platform specifically designed for 5G devices. This platform allows manufacturers to test their devices in virtualized environments that simulate real-world network conditions. By leveraging cloud resources, the solution provides scalability and flexibility, enabling companies to perform extensive testing without investing in costly on-premises infrastructure.

Collaborations:

- In February 2024, Cisco and Telus collaborated to introduce 5G capabilities to cater to IoT use cases across various industries. This collaboration aimed at providing a 5 G-connected car to enhance and automate user experience by providing 5G drive testing. This launch enables the OEM to leverage TELUS' high-performance wireless network to introduce 5 G-enabled telematics.

- In February 2024, Anritsu and ECSite joined forces to demonstrate edge edge-aloud software makes device testing efficient and cost-effective. This end-to-end cloud-based SaaS platform automates the testing process.

- In September 2023, Qualcomm Technologies in partnership with Samsung announced that they have completed simultaneous 5G 2x uplink and 4x downlink carrier aggregation (CA) for FDD spectrum for the upcoming 5G performance and flexibility. This test was completed by utilizing a mobile phone test device featuring the Snapdragon X75 5G Modem-RF System and Samsung's 5G dual-band and tri-band radios supporting advanced carrier aggregation technology.

Announcement:

- In November 2023, Nokia announced the completion of interoperability tests of the 5G Standalone (SA) Packet Core's User Plane Function (UPF) in the Sylva open-source cloud software environment. The motive of the test was to facilitate an open-source cloud software framework, catering to telecommunication and edge requirements.

5G Device Testing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,846.00 Million |

| CAGR (2025-2032) | 7.6% |

| By Type |

|

| By Equipment |

|

| By Device Type |

|

| By Synthesis Method |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Which region will lead the 5G device testing market? +

Asia Pacific is anticipated to register the fastest CAGR during the forecast period due to the region's expansive telecom infrastructure, growing population, and increasing demand for advanced connectivity driving the adoption of 5G device testing technologies.

How big is the 5G device testing market? +

5G Device Testing Market size is estimated to reach over USD 2,846.00 Million by 2032 from a value of USD 1,588.71 Million in 2024 and is projected to grow by USD 1,680.50 Million in 2025, growing at a CAGR of 7.60% from 2025 to 2032.

What is the key market trend? +

Software testing is increasingly incorporating automation and AI-driven tools to enhance testing efficiency and accuracy. Automated testing scripts and AI analytics help in identifying bugs, performance issues, and vulnerabilities more effectively, reducing the time and cost of testing.

What is the 5G device testing market? +

5G device testing refers to the process of evaluating and validating the performance, functionality, and security of devices and networks that operate on the fifth generation of network technology. It features higher frequency bands, massive MIMO (Multiple Input, Multiple Output), and ultra-low latency to ensure standardized performance along with security.