5G NTN Market Size:

5G NTN Market size is estimated to reach over USD 96.64 Billion by 2032 from a value of USD 7.12 Billion in 2024 and is projected to grow by USD 9.72 Billion in 2025, growing at a CAGR of 33.3% from 2025 to 2032.

5G NTN Market Scope & Overview:

5G NTN (non-terrestrial network) refers to the integration of satellite and other non-terrestrial technologies with 5G cellular networks. This enables 5G services to extend beyond the reach of traditional terrestrial towers, which helps in providing coverage in remote areas, disaster-stricken regions, and at sea. 5G non-terrestrial network leverages 3GPP standards, allowing smartphones and other 5G devices to connect directly to satellites, along with offering services such as emergency communication, location data, and others. Moreover, 5G non-terrestrial network provides several benefits including extended coverage and connectivity to remote and underserved areas, in turn contributing to enhanced global reach, improved resilience, and support for emerging technologies such as internet of things (IoT) and others.

How is AI Transforming the 5G NTN Market?

AI is playing a vital role in advancing the global 5G Non-Terrestrial Network (NTN) market by improving network intelligence, efficiency, and adaptability. It enables real-time decision-making for dynamic resource allocation, beamforming, and traffic management across satellite and aerial platforms. AI helps address challenges like signal delays, link variability, and mobility in non-terrestrial environments, ensuring more stable and low-latency communication. It also supports predictive maintenance, optimizing satellite operations and reducing downtime. AI-powered digital twins and network slicing further enhance service quality by simulating and managing network behavior under various conditions. As demand for global connectivity grows, especially in remote and underserved areas, AI is key to making 5G NTN solutions more scalable and effective.

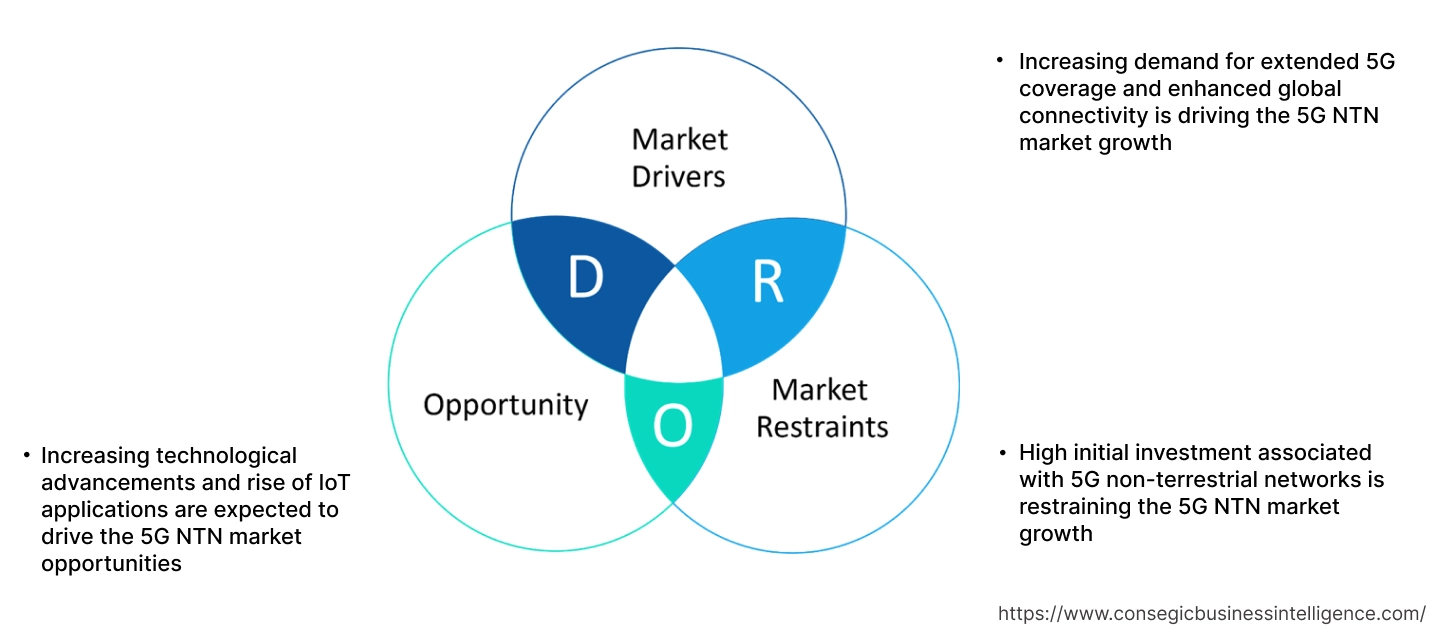

5G NTN Market Dynamics - (DRO) :

Key Drivers:

Increasing demand for extended 5G coverage and enhanced global connectivity is driving the 5G NTN market growth

5G non-terrestrial network solutions offer extended 5G coverage to areas where traditional terrestrial networks are unavailable or insufficient, such as rural areas, oceans, and remote locations. This is particularly crucial for areas with rugged terrain or low population density. Moreover, 5G non-terrestrial networks, which integrate satellite and potentially high-altitude platform station (HAPS) technologies with traditional 5G terrestrial networks, offer a solution to extend 5G reach and capacity, thereby fulfilling the need for global connectivity. Additionally, the rising 5G deployments along with the ability of 5G non-terrestrial networks to provide seamless global connectivity are crucial for various industries and applications, including IoT devices, maritime operations, aviation, and defense, which is further driving the market.

- For instance, in July 2025, Anritsuannounced completion of verification and provision for 3GPP RAN5 Rel-17 NR NTN (non-terrestrial network) test cases on the company’s 5G NR (new radio) mobile device test platform. This development allows 5G devices to seamlessly connect to satellites by utilizing same protocols as terrestrial base stations, in turn driving lucrative prospects for extended global 5G coverage beyond traditional terrestrial network

Thus, according to the analysis, the increasing demand for extended 5G coverage and enhanced global connectivity is propelling the 5G NTN market size.

Key Restraints :

High initial investment associated with 5G non-terrestrial networks is restraining the 5G NTN market growth

High initial investment associated with 5G non-terrestrial networks is among the primary factors limiting the market growth. The upfront costs associated with 5G non-terrestrial networks, including costs of equipment, hardware, software, and others along with integrating them into existing systems can be considerably high, which often leads to financial barriers, specifically for smaller businesses or businesses operating on tighter budgets.

Additionally, integrating components from different vendors and ensuring seamless interoperability can be complex and time-consuming, which often requires specialized expertise, potentially leading to increased integration costs. Thus, the aforementioned factors are hindering the 5G NTN market expansion.

Future Opportunities :

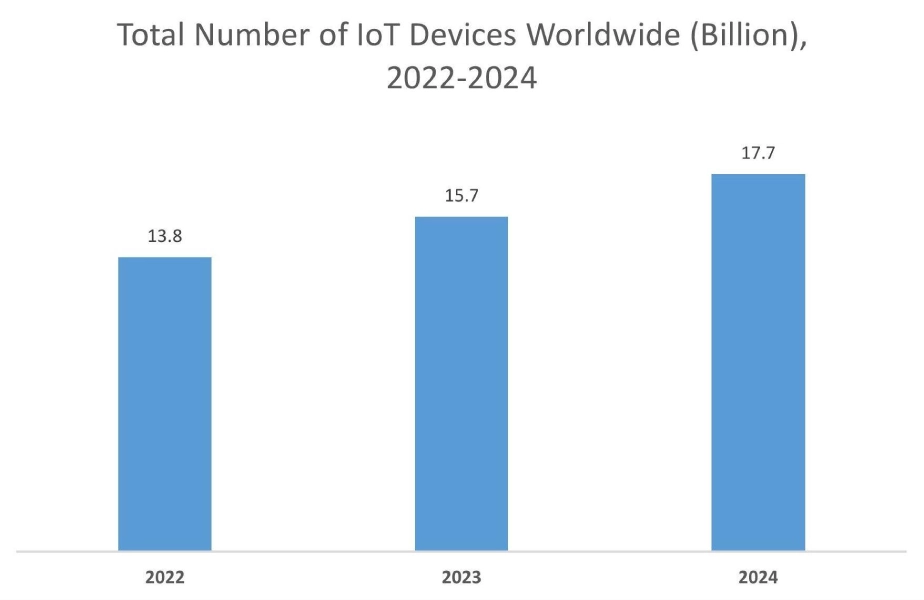

Increasing technological advancements and rise of IoT applications are expected to drive the 5G NTN market opportunities

5G non-terrestrial network is crucial for supporting the expanding ecosystem of IoT devices across various industries, including industrial automation, healthcare, transportation, smart cities, and others. 5G non-terrestrial network offers the potential for global coverage, including remote and underserved areas where traditional terrestrial networks struggle to reach. This is crucial for IoT applications that require seamless connectivity, regardless of location. Moreover, 5G non-terrestrial networks provide high-speed data transmission and low latency, which are required in several IoT applications such as real-time monitoring systems and autonomous vehicles, among others. In addition, 5G non-terrestrial network can handle high volumes of connected devices, making it suitable for large-scale IoT deployments in smart cities, industrial automation, and other sectors.

- For instance, the total number of IoT devices worldwide reached 17.7 billion in 2024, witnessing a substantial increase from 15.7 billion in 2023 and 13.8 billion in 2022, respectively.

Thus, the increasing technological advancements and rise of IoT applications are expected to boost the 5G NTN market opportunities during the forecast period.

5G NTN Market Segmental Analysis :

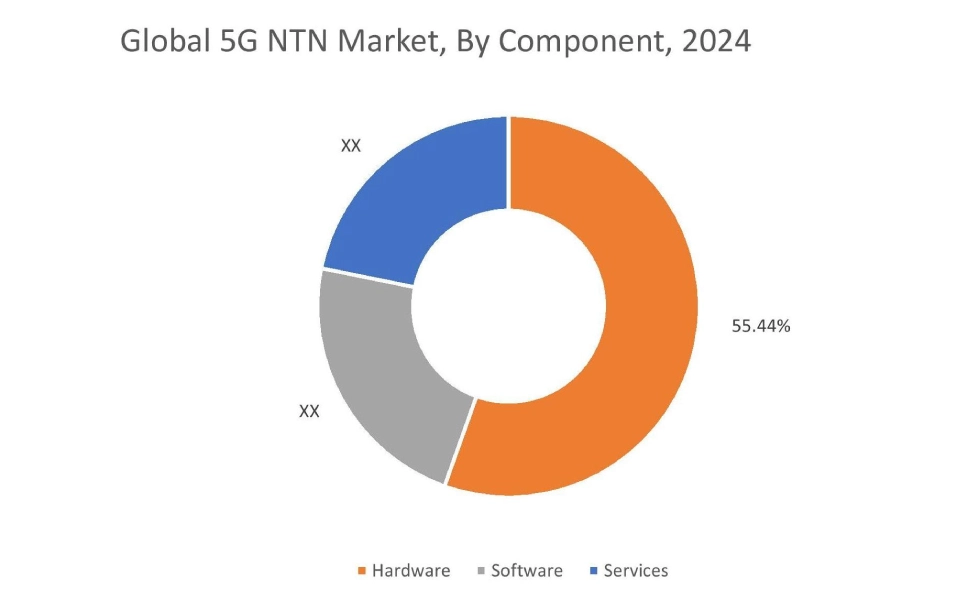

By Component:

Based on component, the market is segmented into hardware, software, and services.

Trends in the component:

- Rising technological advancements associated with 5G non-terrestrial networks hardware components, such as antennas, ground stations, satellites, user terminals, and others, are driving the market.

- Increasing trend in adoption of 5G non-terrestrial network software to enable 5G new radio communication over satellite and other non-terrestrial networks and facilitate seamless connectivity is boosting the market.

Hardware segment accounted for the largest revenue share of 55.44% in the overall 5G NTN market share in 2024.

- The hardware segment primarily includes satellites, user terminals, antennas, ground stations, and other related equipment.

- Satellites are the backbone of 5G non-terrestrial networks, providing communication links between ground stations and user terminals.Antennas are essential for both satellite and ground stations for facilitating signal transmission and reception.

- Moreover, ground stations refer to facilities that manage the satellite network and connect it to the terrestrial 5G network, acting as gateways for communication.

- For instance, Quectel offers an external 5G/NTN antenna in its product offerings, which is capable of covering 5G NR Sub-6GHz frequency bands, and it is also compatible with NTN bands. The antenna features high efficiency and gain to ensure high-speed data transmission.

- Consequently, the rising advancements associated with hardware components and equipment used in 5G non-terrestrial networks is further propelling 5G NTN market trends.

The software segment is anticipated to register a significant CAGR during the forecast period.

- 5G non-terrestrial network software refers to a specialized software that enables 5G NR (new radio) communication over satellite and other non-terrestrial networks.

- 5G non-terrestrial network software extends 5G capabilities to include support for satellites while addressing the distinct challenges of long propagation delays and Doppler shifts that are typically prevalent in satellite communication.

- For instance, Gatecom Satcom offers 5G NTN NB-IoT UE software in its solution offerings.The software is specifically developed for terminal manufacturers that want to develop and manufacture 5G NTN capable terminals based on an SDR hardware platform.

- Therefore, according to the market analysis, the rising advancements related to 5G non-terrestrial network software are projected to boost the 5G NTN market size during the forecast period.

By Platform:

Based on platform, the market is segmented into satellites, high-altitude platforms (HAPs), and unmanned aerial systems (UAS).

Trends in the platform:

- Increasing trend in utilization of various satellite platforms for extending 5G coverage to areas that cannot be served by traditional terrestrial networks is driving the market growth.

- There is a rising trend towards the adoption of high-altitude platforms for offering flexible and cost-effective solutions for expanding 5G coverage, particularly in underserved areas.

The satellites segment accounted for a significant revenue share in the 5G NTN market share in 2024, and it is anticipated to register a substantial CAGR during the forecast period.

- 5G non-terrestrial networks utilize various satellite platforms, including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO) satellites for extending 5G coverage to areas that cannot be served by traditional terrestrial networks.

- LEO satellites orbit closer to Earth, offering lower latency and higher data rates, making them suitable for real-time applications and areas with high user density.

- Moreover, MEO satellites are positioned between LEO and GEO, and provide a balance of coverage and latency, making them suitable for a wide range of applications.

- Additionally, GEO satellites orbit at a fixed point above the equator, providing broad coverage. It is suitable for broadcasting and serving remote, fixed locations.

- For instance, in February 2025, MediaTek, Airbus Defence and Space, and Eutelsat Group conducted its first successful trial of 5G-advanced NR non-terrestrial network (NTN) technology over OneWeb low Earth orbit (LEO) satellites. The tests aim at supporting the deployment of the 5G-advanced NR NTN standard, in turn contributing to upcoming satellite and terrestrial interoperability within a large network ecosystem.

- Consequently, the aforementioned factors are further driving the 5G NTN market trends.

By End Use:

Based on end use, the market is segmented into aerospace & defense, maritime, automotive, government, and others.

Trends in the end use:

- Factors including the growing urban air mobility and rising need for reliable and high-speed internet and communication services in aircraft during flight operations are key trends driving the market growth.

- Rising trend in adoption of 5G NTN in the maritime sectorfor supporting various maritime applications, ranging from basic ship-to-shore communication to complex navigation and remote monitoring systems.

The aerospace & defense segment accounted for the largest revenue share in the overall market in 2024.

- 5G non-terrestrial networks are primarily used in the aerospace & defense sector for providing enhanced connectivity, particularly in remote and challenging environments.

- It enables high-speed, low-latency communication for various applications, including autonomous vehicles, drones, and real-time intelligence gathering, which plays a critical role in modern defense strategies.

- Moreover, 5G non-terrestrial networks also improve connectivity for aircraft systems, satellite networks, and ground infrastructure, which enable faster data exchange and reduced latency.

- Additionally, 5G non-terrestrial networks ensure connectivity in remote areas, oceans, and conflict zones, which are vital for global military operations.

- For instance, according to the International Air Transport Association (IATA), the global air passenger traffic gained significant momentum and witnessed an increase of 36.9% in 2023 in comparison to 2022.

- According to the 5G NTN market analysis, the growing aerospace & defense sector and rising urban air mobility are driving the market growth.

The maritime segment is anticipated to register a significant CAGR during the forecast period.

- 5G non-terrestrial networks are used in the maritime industry for providing enhanced connectivity for ships, offshore platforms, and port operations.

- It combines 5G's high bandwidth and low latency with the broad coverage of satellite networks, particularly LEO (Low Earth Orbit) satellites, to offer seamless and reliable communication even in remote ocean areas.

- Additionally, 5G non-terrestrial networks provide high-speed internet access, enabling real-time data transmission for various maritime applications, including navigation, crew communication, and remote monitoring, among others.

- Therefore, the above factors are expected to drive the adoption of 5G non-terrestrial network solutions in maritime sector, in turn driving market growth during the forecast period.

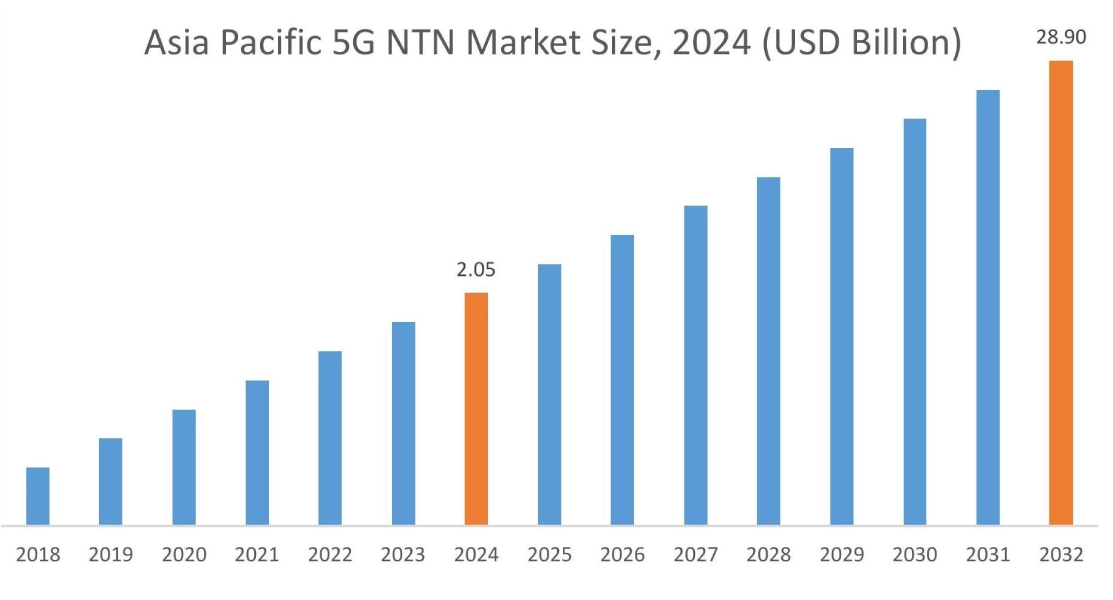

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

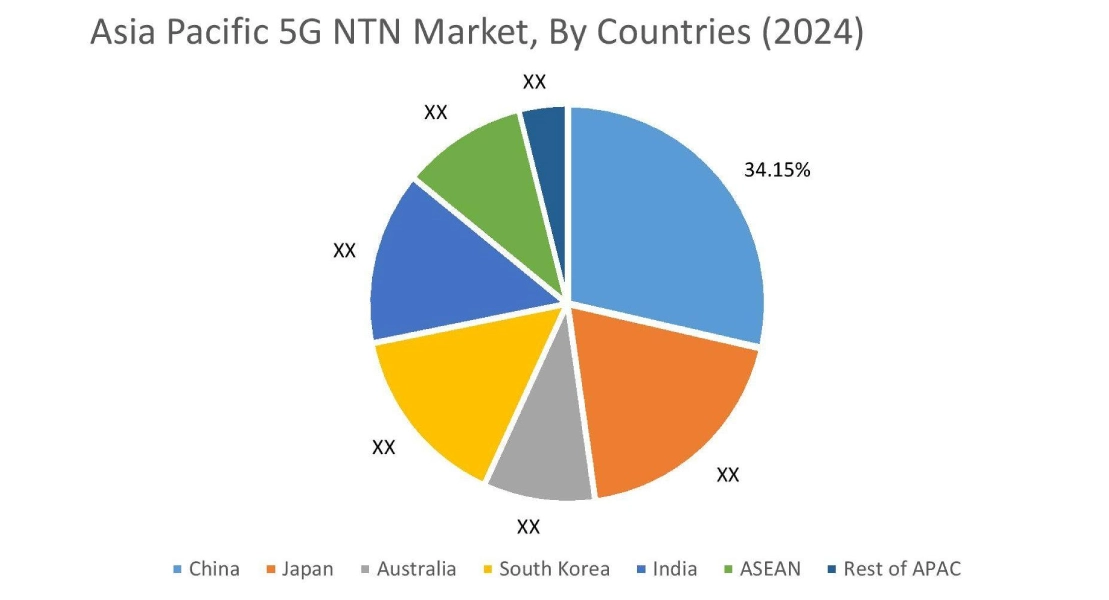

Asia Pacific region was valued at USD 2.05 Billion in 2024. Moreover, it is projected to grow by USD 2.80 Billion in 2025 and reach over USD 28.90 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.15%. As per the 5G NTN market analysis, the adoption of 5G non-terrestrial networks in the Asia-Pacific region is primarily driven by growing maritime, defense, and government sectors, among others. Additionally, the favorable government measures for smart city development and rising proliferation of IoT devices are further accelerating the 5G NTN market expansion.

- For instance, the Government of India allocated approximately USD 70.6 billion to the Ministry of Defense, as part of its Union Budget 2022-23. Thus, the aforementioned factors are anticipated to drive market demand in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 32.28 Billion by 2032 from a value of USD 2.39 Billion in 2024 and is projected to grow by USD 3.26 Billion in 2025. In North America, the growth of the 5G NTN industry is driven by growing investments in the aerospace & defense sector, rising advancements in autonomous vehicles, and others. Moreover, the increasing need for advanced connectivity and 5G coverage in aerospace & defense applications is contributing to the 5G NTN market demand.

- For instance, Boeing, a North American aerospace company, delivered 136 commercial aircraft during the second quarter of 2023, witnessing an increase of 4.6% as compared to first quarter of 2023. The above factors are further propelling the market in North America.

Additionally, as per the regional analysis, factors including the growing demand for high-speed and extended connectivity along with increasing need for reliable network solutions in areas lacking traditional terrestrial infrastructure are driving the 5G NTN market demand in Europe. Further, as per the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as the increasing need for reliable internet and communication services and expanded coverage, particularly in remote areas, among others.

Top Key Players & Market Share Insights:

The global 5G NTN market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the 5G NTN market. Key players in the 5G NTN industry include-

- Anritsu(Japan)

- Rohde & Schwarz(Germany)

- Intelsat (USA)

- Nokia (Finland)

- ZTE Corporation (China)

- Omnispace LLC (USA)

- Gilat Satellite Networks(Isreal)

- Keysight Technologies (USA)

- Gatehouse Satcom A/S (Denmark)

- Mavenir (USA)

- VIAVI Solutions Inc. (USA)

Recent Industry Developments :

Partnerships & Collaborations:

- In March 2024, Omnispace partnered with MTN, a mobile network operator based in Africa, for developing and deploying satellite IoT and 5G NTN services in their markets.

- In March 2024, Rohde & Schwarz collaborated with MediaTek for demonstrating a 5G NTN (non-terrestrial network) new radio connection based on the newest 3GPP release 17 specifications.

- In March 2022, Omnispace and Nelco Limited announced a strategic partnership, with the aim of allowing and distributing 5G non-terrestrial network (NTN) and direct-to-device satellite services. The partnership effort aims at expanding the reach of 5G by utilizing satellite communication throughout India and South Asia.

5G NTN Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 96.64 Billion |

| CAGR (2025-2032) | 33.3% |

| By Component |

|

| By Platform |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the 5G NTN market? +

The 5G NTN market was valued at USD 7.12 Billion in 2024 and is projected to grow to USD 96.64 Billion by 2032.

Which is the fastest-growing region in the 5G NTN market? +

Asia-Pacific is the region experiencing the most rapid growth in the 5G NTN market.

What specific segmentation details are covered in the 5G NTN report? +

The 5G NTN report includes specific segmentation details for component, platform, end use, and region.

Who are the major players in the 5G NTN market? +

The key participants in the 5G NTN market are Anritsu (Japan), Rohde & Schwarz (Germany), Gilat Satellite Networks (Isreal), Keysight Technologies (USA), Gatehouse Satcom A/S (Denmark), Mavenir (USA), VIAVI Solutions Inc. (USA), Intelsat (USA), Nokia (Finland), ZTE Corporation (China), Omnispace LLC (USA), and others.