Anti-Reflective Glass Market Introduction :

Consegic Business Intelligence analyzes that the Global Anti-Reflective Glass Market size is growing with a CAGR of 7.2% during the forecast period (2023-2030), and the market is projected to be valued at USD 5,709.05 Million by 2030 from USD 3,282.55 Million in 2022.

Anti-Reflective Glass Market Definition & Overview :

Anti-reflective(AR) glass has a thin and transparent coating used to minimize the reflection and offer high-light transmission. The glass is commonly known as AR coating glass or non-reflective glass. The anti-reflection coating is applied on a single surface or two surfaces of glass to reduce the reflectivity of the surface to allow more light to pass through the glass to improve clarity and visibility.

Furthermore, the glasses are widely used in high-end places or technical instruments, such as museum showcases, luxury showrooms, jewelry display cabinets, high-end display windows or cabinets, airports, picture frames, and optical devices and equipment, among others.

Anti-Reflective Glass Market Insights :

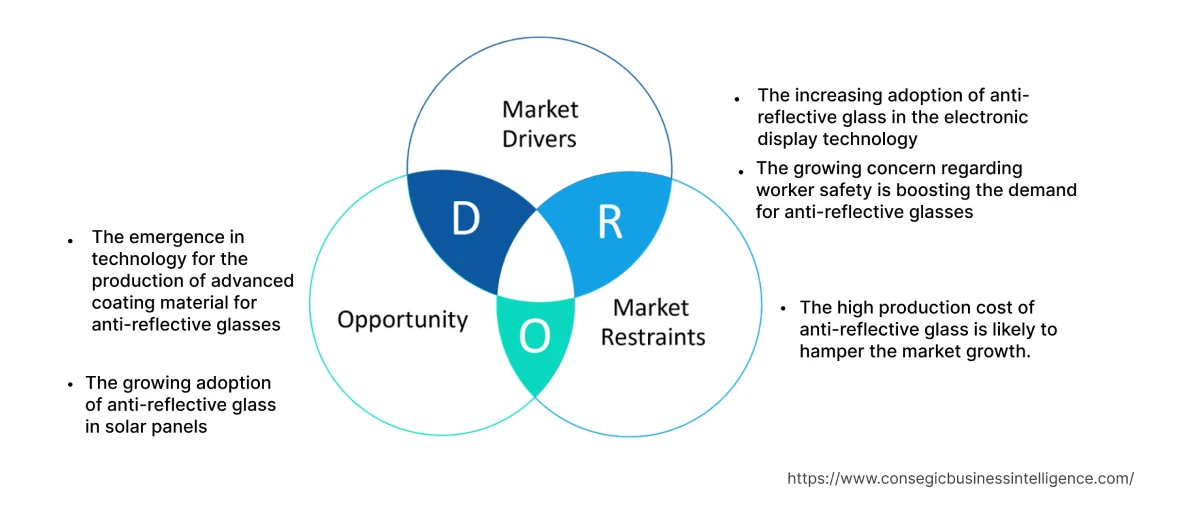

Anti-Reflective Glass Market Dynamics - (DRO) :

Key Drivers :

Increasing adoption in the electronic display technology

Anti-reflective glass enhances the visibility and clarity of displays in various electronic gadgets such as smartphones, LCDs, and laptops by minimizing reflections and glare. The increasing requirement for high-quality displays that provide better visibility, and reduced glare is contributing to the increasing demand for them in the electronic industry. They are mainly used for display devices such as LCD TVs, laptops, touch screen devices, picture frame glass, and other electronics to enhance the transmission rate and reduce the reflectivity to provide better visibility. Analysis of market trends concludes that key players are engaging in research and development activities for the launch of new products to cater to the growing demand for high-quality electronic display screens.

For instance, AGC Inc., a world-leading manufacturer of glass, chemicals, and high-tech materials, introduced the launch of anti-glare (AG) glass for 4K high-definition displays. The new AG glass decreases sparkle by 30% and further suppresses light reflection. The product is launched to be used in notebook PCs and other devices equipped with 4K HD displays. Hence, the introduction of such types of new and innovative products is increasing the anti-reflective glass market demand.

The growing concern regarding worker safety

Safety eyewear is crucial to ensure that employees have optimum vision while working. Anti-reflective glasses are employed to ensure workers' safety by reducing glare and reflection that cause eye strain, headaches, and fatigue. They help workers remain alert and focused on the task, thereby, reducing the risk of injuries and accidents Further,. Anti-reflective (AR) coatings are applied to glasses to minimize bright reflections that inhibit vision. The coating is also known as anti-glare coatings or AR coatings.

For instance, Honeywell launched the Uvex Avatar OTG safety eyewear to avoid eye injuries and offer safety to workers. The glass has an anti-scratch and anti-reflective coating that offers improved visibility and minimizes eye strain. The Uvex Avatar OTG safety eyewear has an adjustable nosepiece, and insulated wire-core temples for safety in dielectric use. Analysis of market trends concludes that the introduction of of the glasses to ensure workers' safety is a key driver boosting the anti-reflective glass market demand.

Key Restraints :

The high production cost

Anti-reflective glass is more expensive compared to standard glass. The cost of manufacturing anti-reflective coatings along with the specialized processes involved in their production contribute to the higher price. Its production requires specialized equipment and techniques such as vacuum deposition or sputtering which involves complex machinery and expertise. These additional processes add up to higher production costs.

Additionally, the glass is more susceptible to scratches and damage as compared to standard glass. Thus, the need for careful handling, cleaning, and maintenance act as a barrier in their adoption particularly in heavy traffic areas such as showrooms, airports, and others. Hence, the aforementioned factors are collectively responsible for hindering the growth of the anti-reflective glass market.

Future Opportunities :

The emergence in technology for the production of advanced coating material

Anti-reflective glass is more susceptible to scratches and damage as compared to standard glass and the production of its coating material is also high. Hence, the ongoing advancement in coating materials presents an opportunity for the development of the glasses with improved performance, durability, cost-effectiveness, enhanced scratch resistance, and reduced production cost.

For instance, Essilor, a French-based ophthalmic optics company, introduced the Crizal Sapphire HR, a new anti-reflective coating manufactured from new Crizal high resistance technology offering 70% more scratch-resistance, 20% improved thermal resistance, and increased durability. Analysis of market trends concludes that the advancement in technology to develop enhanced coating material is emerging as one of many anti-reflective glass market opportunities that will drive market expansion in the coming years.

The growing adoption in solar panels

The adoption of anti-reflective coatings on the surface of solar panels to reduce the reflection of incident sunlight is expected to present potential opportunities for the growth of the market in the coming years.

The advancement in technology enables the key players to develop innovative AR coating system that is likely to improve the efficiency of solar panels and reduce the cleaning of panels.

For instance, Pellucere developed MoreSun coating based on research conducted by Oregon State University with the assistance of the National Science Foundation and the Oregon Nanoscience and Microtechnologies Institute (ONAMI). MoreSun is a coating and application system that adds anti-reflective and anti-soiling silica coating to any solar panel. This coating enhances energy generation and minimizes the cleaning of solar panels and further offers advanced light transitivity and high capacity of absorption.

Hence, the introduction of such types of innovative AR glass for usage in the solar energy sector is expected to increase the growth of the anti-reflective glass market.

Anti-Reflective Glass Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 5,709.05 Million |

| CAGR (2023-2030) | 7.2% |

| By Type | One-Sided and Two-Sided |

| By Application | Architectural Windows, Electronic display, Eyewear, Solar Panels, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | 3M Company, Saint-Gobain S.A., Guardian Industries Corporation, Abrisa Technologies, Schott AG, EuropeTec AG, Essilor International, JMT Glass, AGC Glass Europe, and General Glass International |

Anti-Reflective Glass Market Segmental Analysis :

Based on the Type :

The type segment is classified into one-sided and two-sided. In 2022, the one-sided segment accounted for the highest anti-reflective glass market share. One-sided AR glass improved light transmission and reduced reflection from a single side of the glass, making it suitable for applications where one-sided glare reduction is sufficient. Analysis of anti-reflective glass market trends concludes that the wide employment of such type of glass in electronic displays such as optical lenses, camera lenses, LCD, and smartphones, among others is contributing to the dominance of the segment.

However, the two-sided segment is expected to grow at the fastest CAGR over the forecast period owing to the superior optical performance of the segment in reducing reflections from both sides of the glass surfaces. Examination of market trends concludes that the two-sided AR glass is commonly used in applications where maximum clarity and minimal reflections are crucial such as architectural windows, solar panels, museum showcases, and high-end optics.

For instance, Saint-Gobain introduced Vision-Lite low-reflective coated glass. The low-reflective coating is on both sides of the glass. The glass is widely used in display cabinets in museums, as a protective screen for paintings, television studios, and others. The anti-reflective glass market analysis concluded that the expanding applications of two-sided AR glass due to the increasing requirement for superior optical glass quality is expected to accelerate the growth of the segment.

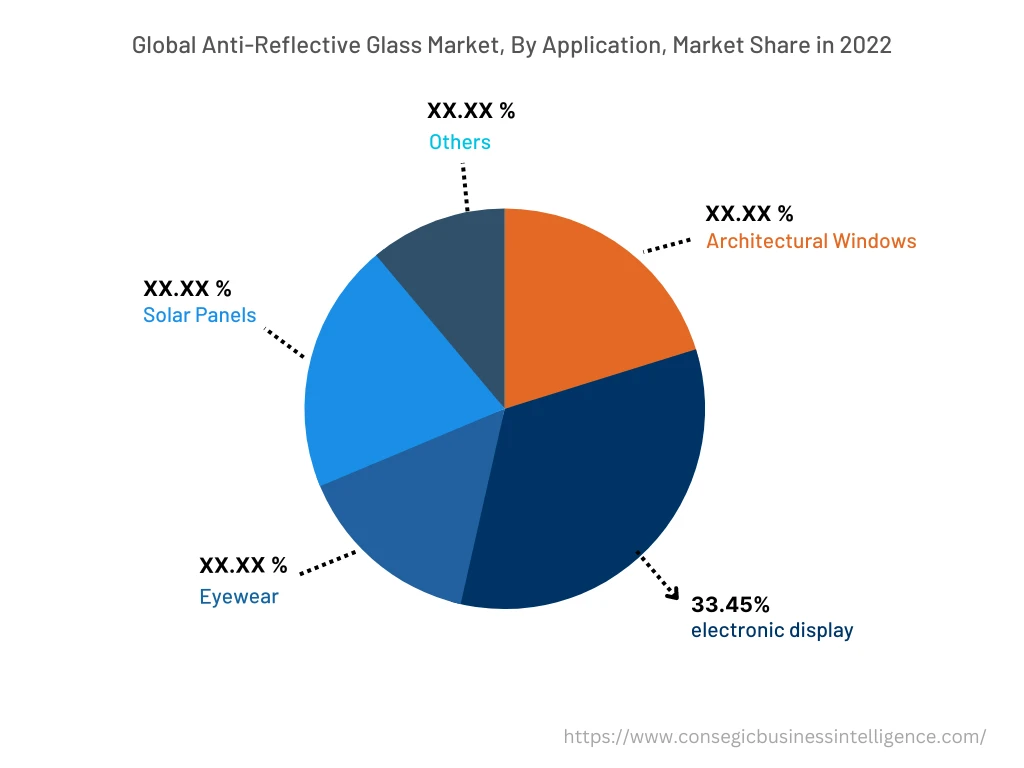

Based on the Application :

The application segment is categorized into architectural windows, electronic displays, eyewear, solar panels, and others. In 2022, the electronic display segment accounted for the highest anti-reflective glass market share of 33.45% in the market owing to the increasing demand for high-quality displays that offer vibrant colors, sharp images, and excellent visibility.

For instance, JMTGLASS, headquartered in India, introduced double side TO1 AR glass type widely deployed in LCD TV, LED, and electronic products to improve display screen brightness and reduce energy consumption. Examination of market trends concludes that the introduction of such types of advanced anti-reflective glasses for various applications in electronic display is contributing to the anti-reflective glass market growth.

However, the solar panels segment is expected to witness the fastest CAGR over the forecast period owing to the increasing deployment of anti-reflective coatings on the surface of solar panels to reduce the reflection of sunlight which further helps in generating electricity or heat.

Analysis of anti-reflective glass market trends concludes that the growing demand for renewable energy sources such as solar panels for various applications including generating electricity is expected to increase the adoption of anti-reflective glass over the forecast period.

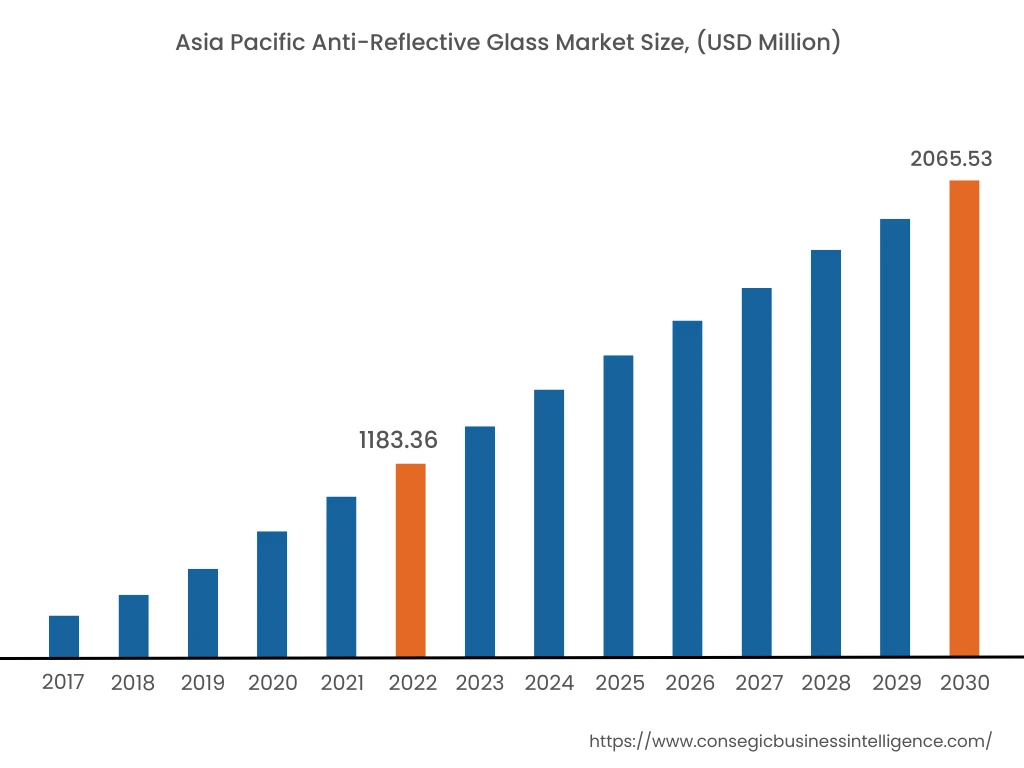

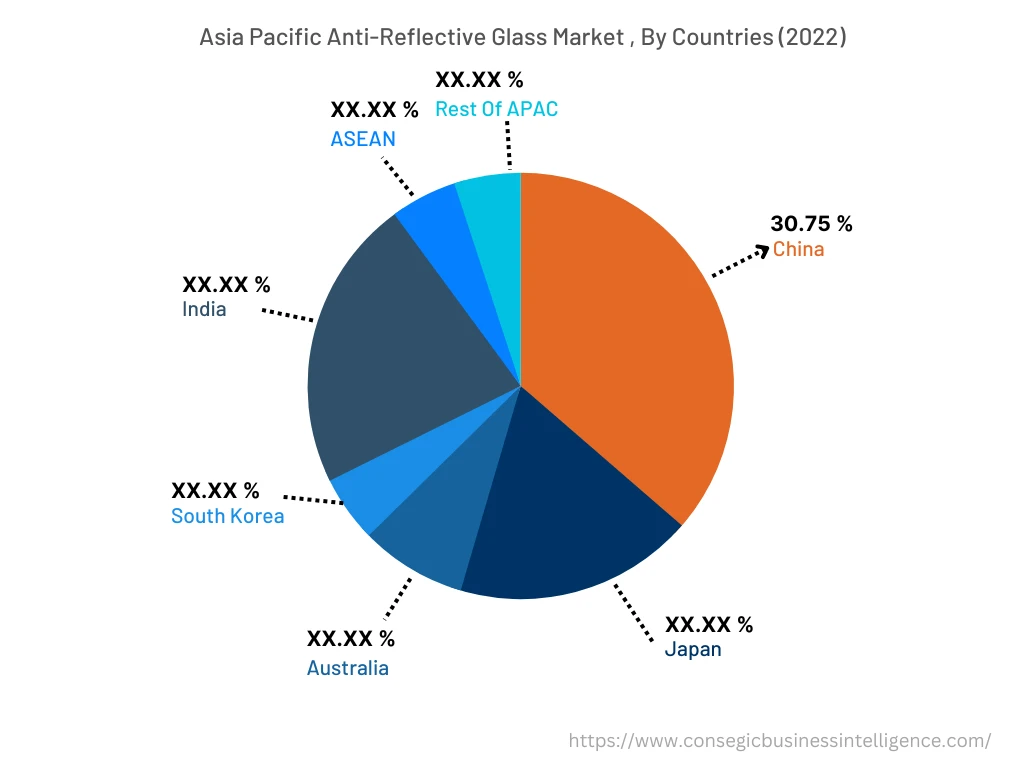

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, Asia Pacific accounted for the highest market share at 36.05% and was valued at USD 1,183.36 million, and is expected to reach USD 2,065.53 million in 2030. In Asia Pacific, China accounted for the highest market share of 30.75% during the base year of 2022 owing to the increasing adoption of solar power to meet the growing energy demands and to reduce carbon emissions.

For instance, as per the Ministry of New and Renewable Energy in India, the government has taken various steps to promote renewable energy in the country such as the declaration of trajectory for Renewable Purchase Obligation (RPO) and setting up of ultra-mega renewable energy parks.

The anti-reflective glass market analysis concluded that such government initiatives and investment to promote the adoption of renewable energy is driving the growth for the market in the region.

However, North America is expected to register the fastest CAGR of 8.1% in the market during the forecast period. Examination of market trends concludes that the growing electronics industry in the region particularly U.S. due to rising requirement for high-display quality gadgets including tablets, smartphones, and laptops is expected to boost the anti-reflective glass market growth in the region.

Top Key Players & Market Share Insights :

The anti-reflective glass market is highly competitive, with several large players and numerous small and medium-sized enterprises. The major companies operating in the anti-reflective glass industry have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- 3M Company

- Saint-Gobain S.A.

- JMT Glass

- AGC Glass Europe

- General Glass International

- Guardian Industries Corporation

- Guardian Industries Corporation

- Schott AG

- EuropeTec AG

- Essilor International

Recent Industry Developments :

- In September 2022, Guardian Glass introduced Clarity Neutral, an anti-reflective neutral-looking glass to cater to the increasing requirement for higher transparency, neutral-looking glass for architectural projects and applications such as retail storefronts, digital signage, and museum displays.

- In June 2022, Saint-Gobain announced the launch of a new highly reflective glass, MIRASTAR REFLECT with a high level of opacity and reflection and 0.1% light transmission and 55% light reflection.

- In December 2022, AGC developed anti-glare glass catered for 4K high-definition displays. The brand new product aims to reduce the presence of sparkle caused by optical factors by a significant percentage of 30% while also simultaneously suppressing the reflection of light. The product is supposed to be utilized in notebook PCs and other electrical devices.

Key Questions Answered in the Report

What was the market size of the anti-reflective glass market in 2022? +

In 2022, the market size of the anti-reflective glass market was USD 3,282.55 million.

What will be the potential market valuation for the anti-reflective glass market industry by 2030? +

In 2030, the market size of the anti-reflective glass market will be expected to reach USD 5,709.05 million.

What are the key factors driving the growth of the anti-reflective glass market? +

The increasing adoption of anti-reflective glass in electronic display technology and the growing concern regarding worker safety are the key factors driving the growth of the anti-reflective glass market.

What is the dominating segment in the anti-reflective glass market by application? +

In 2022, the electronic display segment accounted for the highest market share of 33.45% in the overall anti-reflective glass market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the anti-reflective glass market's growth in the coming years? +

North America is expected to grow at the fastest CAGR of 8.1% in the market during the forecast period.