Articulated Hauler Market Size:

Articulated Hauler Market size is estimated to reach over USD 18.07 Billion by 2032 from a value of USD 9.80 Billion in 2024 and is projected to grow by USD 10.40 Billion in 2025, growing at a CAGR of 7.9% from 2025 to 2032.

Articulated Hauler Market Scope & Overview:

An articulated hauler, also known as an articulated dump truck is a large, off-road vehicle built to carry heavy loads over rough or uneven ground. It has two separate sections—one at the front with the cab and engine, and one at the rear that holds the dump body. These two parts are connected by a hinge, allowing them to move independently. This flexible design helps the vehicle turn easily and stay stable on sloped or narrow paths, especially useful in construction sites, mines, and quarries.

These vehicles typically consist of a tractor unit with an enclosed cab and an engine, connected to a rear section that carries the dump body. The articulated steering system allows for tight turning, while the oscillating frame helps maintain ground contact over rugged terrain. Payload capacities vary by model, with some units equipped with all-wheel drive and traction control to handle wet or soft ground conditions.

Articulated dump truck configurations support continuous operation in sites where rigid-frame trucks may face mobility limitations. End-users include earthmoving contractors, quarry operators, and mining companies that require reliable hauling systems for challenging terrain.

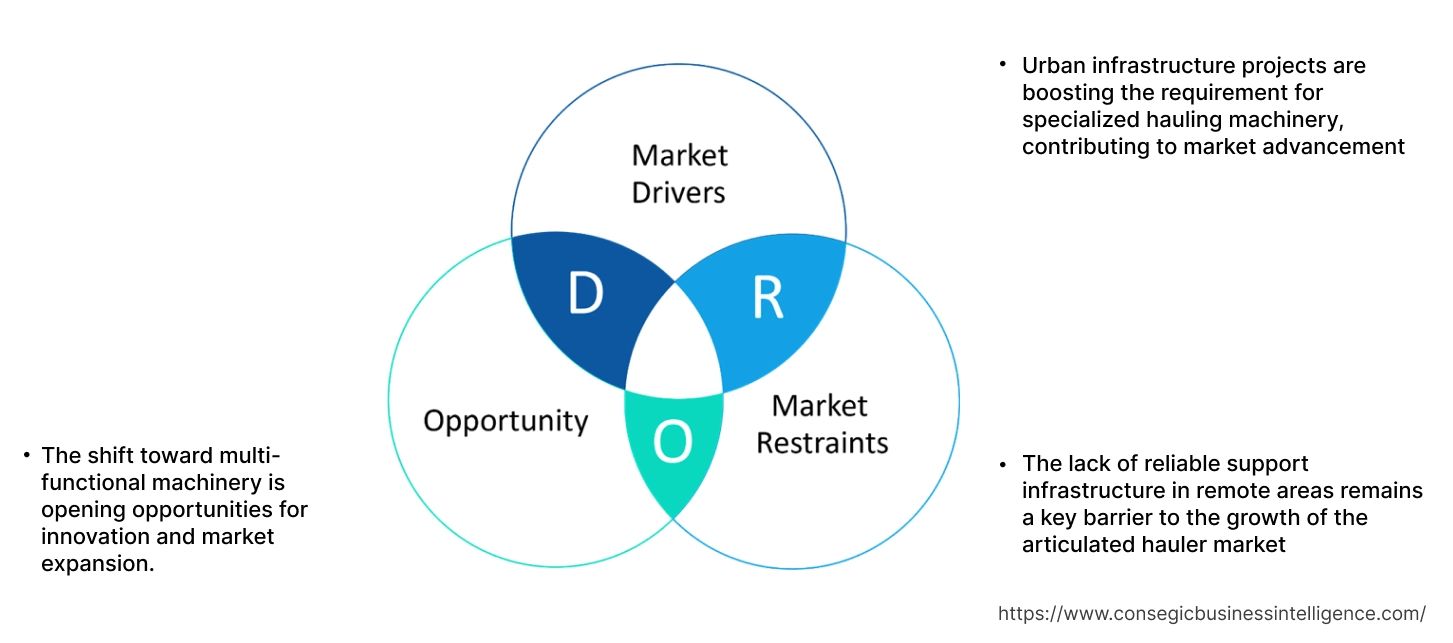

Articulated Hauler Market Dynamics - (DRO) :

Key Drivers:

Urban infrastructure projects are boosting the requirement for specialized hauling machinery, contributing to market advancement.

The rapid urbanization in both developed and emerging markets is driving the demand for specialized construction equipment that can handle the challenges of dense, space-constrained environments. In cities with growing residential and commercial developments, infrastructure projects such as road extensions, utilities installation, and building construction require machinery capable of navigating narrow and challenging spaces. Traditional rigid-frame vehicles often struggle in these environments, making articulated dump trucks an essential solution. These haulers provide the flexibility and maneuverability needed to transport heavy materials through tight spaces, enhancing efficiency on construction sites. With urban areas expanding rapidly and infrastructure needs increasing, the need for versatile hauling equipment that fits into these urban environments is growing. This shift towards urbanization is thus a key driver for the articulated hauler market, as more cities invest in complex construction projects where specialized equipment is essential for success.

Key Restraints:

The lack of reliable support infrastructure in remote areas remains a key barrier to the growth of the articulated hauler market.

In regions with limited infrastructure, accessing spare parts or trained technicians for repairs and maintenance becomes a hurdle. In the absence of established service networks, downtime caused by equipment failure can result in significant delays on job sites, ultimately impacting project timelines and costs. This issue is especially prevalent in developing countries or remote areas where access to service providers is limited. Without proper maintenance or access to technical support, the full potential of articulated dump trucks cannot be realized, making it difficult for businesses to operate efficiently. As a result, this lack of after-sales service and support in certain regions becomes a major restraint, limiting the widespread adoption of articulated haulers.

Future Opportunities :

The shift toward multi-functional machinery is opening opportunities for innovation and market expansion.

Contractors often seek equipment that can serve multiple purposes across different types of projects, from excavation to grading and material handling. Articulated dump truck, known for their adaptability, are increasingly being designed to perform these varied tasks, offering significant value in terms of versatility. The ability to use a single machine for multiple functions reduces the need for separate equipment, thereby cutting operational costs and increasing overall efficiency on job sites. This flexibility is particularly important in projects where time and space are limited, such as in urban construction or complex infrastructure development. As the construction sector moves toward more streamlined and cost-effective operations, the demand for multi-functional equipment, including articulated haulers, will continue to grow.

- For instance, in September 2024, Komatsu introduced the new HD465-10 and HD605-10 haul trucks designed to deliver enhanced multifunctional performance for mining and quarry applications. These next-generation rigid-frame trucks feature powerful EPA Tier 4 Final engines and advanced transmission systems that offer improved fuel efficiency, productivity, and operator comfort. Their multifunctional design supports varied hauling requirements while maintaining high reliability and low operating costs. With simplified maintenance and data-driven fleet management capabilities, these trucks represent Komatsu’s commitment to innovation, durability, and sustainability in heavy-duty material transport.

Manufacturers that innovate and enhance the capabilities of their machines to meet diverse needs will gain a competitive edge in the market, driving the global articulated hauler market opportunities.

Articulated Hauler Market Segmental Analysis :

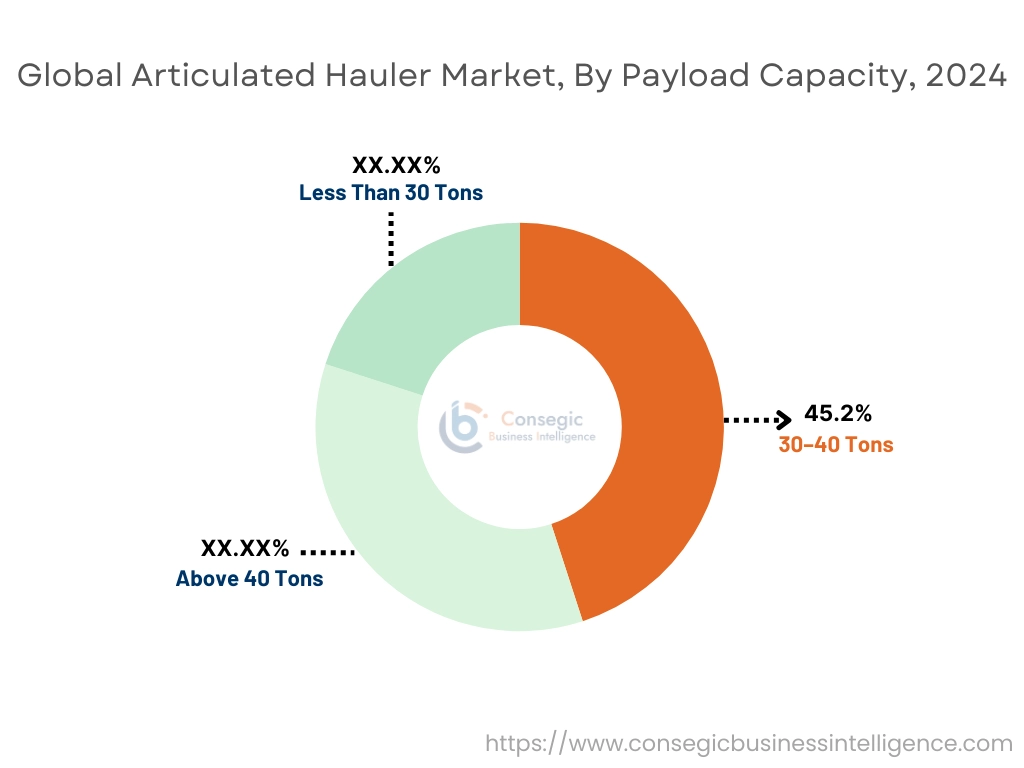

By Payload Capacity:

Based on Payload Capacity, the market is segmented into Less Than 30 Tons, 30–40 Tons, and Above 40 Tons.

The 30–40 Tons segment holds the largest revenue of the overall Articulated Hauler Market share of 45.2% in the year 2024.

- Articulated haulers in this range are widely used in general construction, quarrying, and infrastructure projects due to their optimal balance between payload capacity and maneuverability.

- OEMs offer multiple configurations in this category that are suitable for earthmoving, aggregate transport, and overburden removal on mid-sized job sites.

- These haulers provide cost-effective productivity for contractors who prioritize fuel efficiency and terrain adaptability.

- For instance, in April 2025, Volvo Construction Equipment (Volvo CE) unveiled the A30 Electric and A40 Electric, marking the world's first serial-produced battery-electric articulated haulers in their respective size classes. Announced at Bauma 2025, these models represent a significant advancement in sustainable construction machinery. The A30 Electric offers a 29-ton payload, while the A40 Electric provides a 39-ton payload, both delivering performance comparable to their diesel counterparts but with zero emissions.

- According to the articulated hauler market analysis, given its adaptability to general-purpose operations, the 30–40 tons segment accounts for the largest market share, fueling the articulated hauler market expansion.

The Above 40 Tons segment is expected to grow at the fastest CAGR during the forecast period.

- High-capacity haulers are increasingly adopted in large-scale mining, energy, and resource extraction operations, where efficiency per haul is critical.

- These machines offer superior traction, durability, and cycle productivity on rugged, high-load terrains, particularly in remote sites.

- OEMs are introducing advanced telematics, autonomous readiness, and low-emission engines in this category to meet the demands of industrial clients.

- With project scale and hauling efficiency becoming key procurement criteria, this segment is expected to grow, fueling the global articulated hauler market growth.

By Drive Type:

Based on drive type, the market is segmented into 4-Wheel Drive and 6-Wheel Drive.

The 6-Wheel Drive segment holds the largest revenue of the overall Articulated Hauler Market share in the year 2024 and is expected to grow at the fastest CAGR during the forecast period.

- 6-wheel drive articulated dump trucks offer enhanced traction, gradient handling, and stability on loose soil, rock, and slope-heavy job sites.

- These haulers are essential for off-road transport in applications such as open-pit mining, remote road building, and energy infrastructure.

- Fleet operators increasingly favor 6WD models for their load distribution, fuel economy under load, and reduced wear during prolonged operations.

- According to the articulated hauler market analysis, their superior performance, increased customer demand, and OEM focus, this segment is both the largest and fastest growing, significantly fueling the global articulated hauler market growth.

By End Use Industry:

Based on End-Use Industry, the market is segmented into Construction, Mining, Forestry, and Others.

The Construction segment holds the largest revenue share of the overall Articulated Hauler Market in the year 2024.

- Articulated haulers are critical in construction projects for transporting fill material, soil, and aggregate across uneven job sites.

- Mid-sized models are used extensively in road construction, residential grading, and bridge infrastructure for their maneuverability and dump cycle efficiency.

- As infrastructure spending increases globally, construction remains the most consistent user of articulated dump trucks across both public and private sectors.

- For instance, in January 2025, John Deere announced the launch of 460 P-Tier Autonomous Articulated Dump Truck (ADT), an autonomous solution for applications beyond agriculture into construction and quarry applications. The autonomous 460 P-Tier allows for driverless hauling, improving productivity, safety, and efficiency on large, repetitive haul routes. The system uses a combination of sensors, GPS, and intelligent software to navigate and operate the truck without manual intervention, making it ideal for controlled worksite environments.

- Thus, the versatility and continuous demand in construction work, significantly drives the global articulated hauler market trends.

The Mining segment is expected to grow at the fastest CAGR during the forecast period.

- Mining operations require high-capacity haulers with robust frames, durable drivetrains, and automated load control systems for continuous material transport.

- Surface mines, including coal, iron ore, and limestone operations, increasingly rely on articulated dump trucks for short-distance hauling and stockpile management.

- OEMs are integrating haul cycle analytics, tire pressure sensors, and remote diagnostics to meet the performance needs of mining companies.

- According to the market analysis, shifting trend towards high usage intensity and volume of machines deployed is significantly fueling the global articulated hauler market expansion.

Regional Analysis:

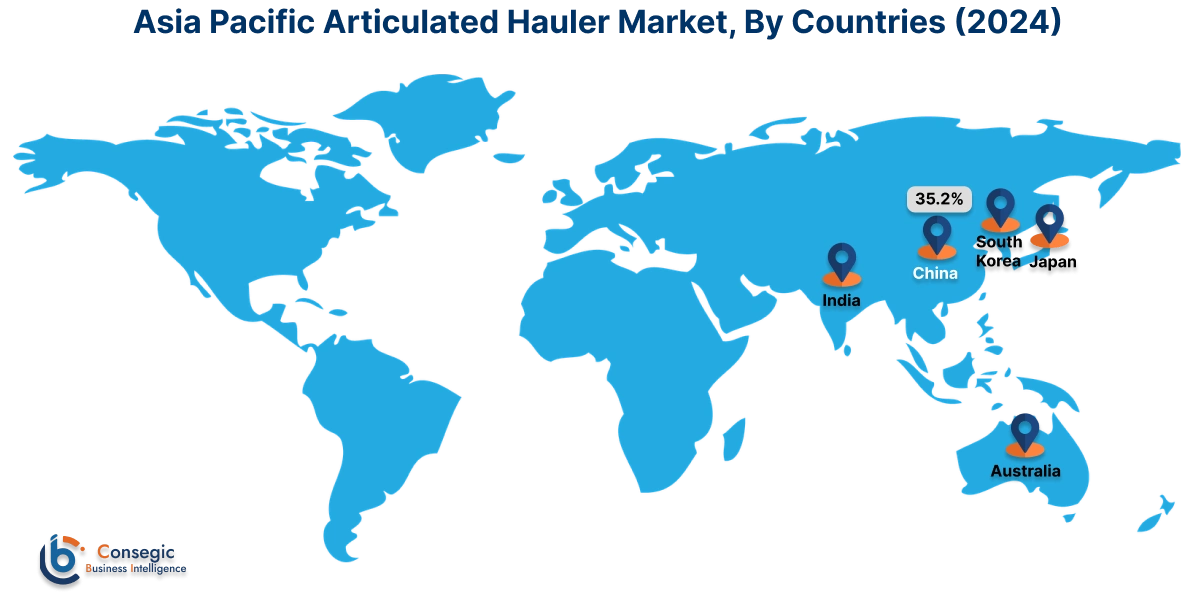

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

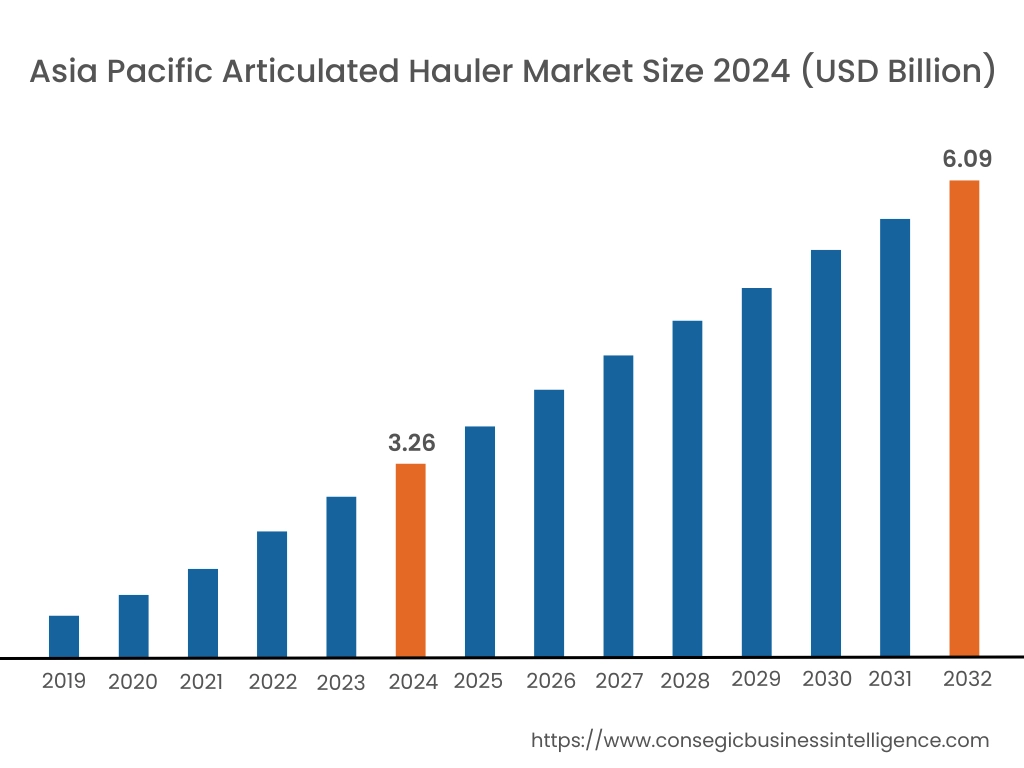

Asia Pacific region was valued at USD 3.26 Billion in 2024. Moreover, it is projected to grow by USD 3.47 Billion in 2025 and reach over USD 6.09 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.2%.

Rapid industrial and resource development initiatives are propelling the market growth in Asia-Pacific. China leads fleet scaling, and India follows with targeted fleet renewals in government-backed infrastructure and mining programs. One notable trend involves local OEMs customizing high-load-capacity machines for harsh terrain, while another trend highlights battery-electric pilot programs for articulated haul trucks unveiled by major OEMs.

- For instance, in February 2025, Volvo Construction Equipment (Volvo CE) introduced its New Generation Articulated Hauler range to the Asian market, featuring the A35, A40, and A45 models. These haulers are tailored to meet regional requirements, with Tier 2-compliant engines for Southeast Asia and Tier 4 Final/Stage V-compliant engines for Japan and Korea. The haulers also feature advanced connectivity options and are constructed using low-carbon emission steel, aligning with Volvo CE's commitment to sustainability and its goal of achieving net-zero greenhouse gas emissions by 2040.

Analysis of the market showed that government incentives for low-emission equipment and large-scale infrastructure plans are driving OEM engagement and fleet renewals, significantly boosting the articulated hauler market demand.

North America is estimated to reach over USD 5.31 Billion by 2032 from a value of USD 2.88 Billion in 2024 and is projected to grow by USD 3.06 Billion in 2025.

Infrastructure productivity and mining site performance requirements are fueling equipment upgrades in North America. The United States is the primary market, and Canada supports sizeable hauler fleets across its mining and infrastructure sectors. A significant trend involves integrating hydrographic survey planning with haul operations to optimize route profiles, while another trend highlights the reuse of sediments for shoreline and flood‐control applications.

- For instance, in October 2024, Rokbak and Terapro Construction entered into a distribution agreement to supply Rokbak's RA30 and RA40 models across Quebec and parts of Ontario. With an extensive network of 18 branches, Terapro is well-positioned to provide comprehensive sales and support services for these robust haulers, which are renowned for their durability and efficiency in challenging construction environments. The partnership aims to meet the growing need for high-performance hauling equipment in Eastern Canada,

Furthermore, analysis of the market showed that sustained public funding and strategic public–private partnerships are driving fleet modernization, significantly fueling the Articulated Hauler industry growth in this region.

Europe exhibits a strong presence in the market due to the robust infrastructure refurbishment programs and stringent emissions regulations. Germany is a leading adopter, and Sweden remains influential given the OEM’s home‐market leadership. Notable trends include adoption of low‐emission Stage V/Tier 4 compliant models showcased at expos and telematics‐driven fleet management systems improving uptime across project sites. Analysis of the market showed that EU funding programs and stringent environmental standards are significantly boosting the articulated hauler market in this region.

Across the Middle East and Africa, urban mega-projects and resource-driven developments are boosting market growth. The United Arab Emirates and Saudi Arabia are leading adopters of the latest articulated dump trucks. South Africa is also rolling out these machines for mining and infrastructure applications. The shifting trend towards factory-fitted telematics like CareTrack for payload and cycle monitoring and the regional uptake of on-board weighing and tire-pressure control systems fuel market growth. Analysis of the market showed that integrated dealership support networks and regulatory emphasis on operational efficiency have fueled the articulated hauler market in this region.

In Latin America, the robust mining and infrastructure projects underpin market momentum. Brazil drives adoption with extensive fleet operations, and Chile follows closely in deploying haulers for copper and aggregate transport. Additionally, the analysis of fleet performance metrics enables efficient operator training and maintenance scheduling and state-backed procurement schemes and OEM partnerships for electrification pilots are shaping regional hauler fleets, driving articulated hauler market growth in this region.

Top Key Players and Market Share Insights:

The Articulated Hauler Market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Articulated Hauler Market. Key players in the Articulated Hauler industry include -

- Caterpillar Inc. (USA)

- Volvo Construction Equipment (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Rokbak (UK)

- Epiroc AB (Sweden)

- Komatsu Ltd. (Japan)

- Deere & Company (USA)

- Bell Equipment (South Africa)

- Sandvik AB (Sweden)

- Liebherr Group (Switzerland)

Recent Industry Developments :

Product Launches:

- In March 2025, John Deere announced performance upgrades to its 410 P-Tier and 460 P-Tier articulated dump trucks, equipping them with new, more powerful engines and enhanced features to improve productivity, durability, and operator comfort. The upgraded models now include John Deere PowerTech 13.6L engines, delivering greater horsepower and torque for demanding hauling applications.

Articulated Hauler Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 18.07 Billion |

| CAGR (2025-2032) | 7.9% |

| By Payload Capacity |

|

| By Drive Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Articulated Hauler Market? +

Articulated Hauler Market size is estimated to reach over USD 18.07 Billion by 2032 from a value of USD 9.80 Billion in 2024 and is projected to grow by USD 10.40 Billion in 2025, growing at a CAGR of 7.9% from 2025 to 2032.

What specific segments are covered in the Articulated Hauler Market? +

The Articulated Hauler Market specific segments for Payload Capacity, Drive Type, End-Use Industry, and Region.

Which is the fastest-growing region in the Articulated Hauler Market? +

Asia pacific is the fastest growing region in the Articulated Hauler Market.

What are the major players in the Articulated Hauler Market? +

The key players in the Articulated Hauler Market are Caterpillar Inc. (USA), Volvo Construction Equipment (Sweden), Komatsu Ltd. (Japan), Deere & Company (USA), Bell Equipment (South Africa), Liebherr Group (Switzerland), Hitachi Construction Machinery Co., Ltd. (Japan), Rokbak (UK), Epiroc AB (Sweden), Sandvik AB (Sweden), and others.