Urban Farming Market Size:

Consegic Business Intelligence analyzes that the urban farming market size is growing with a CAGR of 5.8% during the forecast period (2024-2031). The market accounted for USD 135.42 Billion in 2023 and USD 140.87 Billion in 2024, and the market is projected to be valued at USD 212.72 Billion by 2031.

Urban Farming Market Scope & Overview:

Urban farming is the practice of cultivating crops, livestock, or types of food in an urban environment. It takes many forms, from small backyard gardens to large rooftop farms. Urban farmers use a variety of techniques to grow food in limited spaces, such as container gardening, vertical farming, and vertical farming. Several benefits are provided by this farming such as increased access to fresh healthy food, reduced food insecurity, improved environmental quality, and community building among others. As per the analysis, this movement is driven by various factors, including rising food costs, concerns about the environmental impact of industrial agriculture, and a desire for fresher, more local food. By growing their food, urban farmers gain control over what they eat, reduce their carbon footprint, and connect with the natural world right in their neighborhoods.

Urban Farming Market Insights:

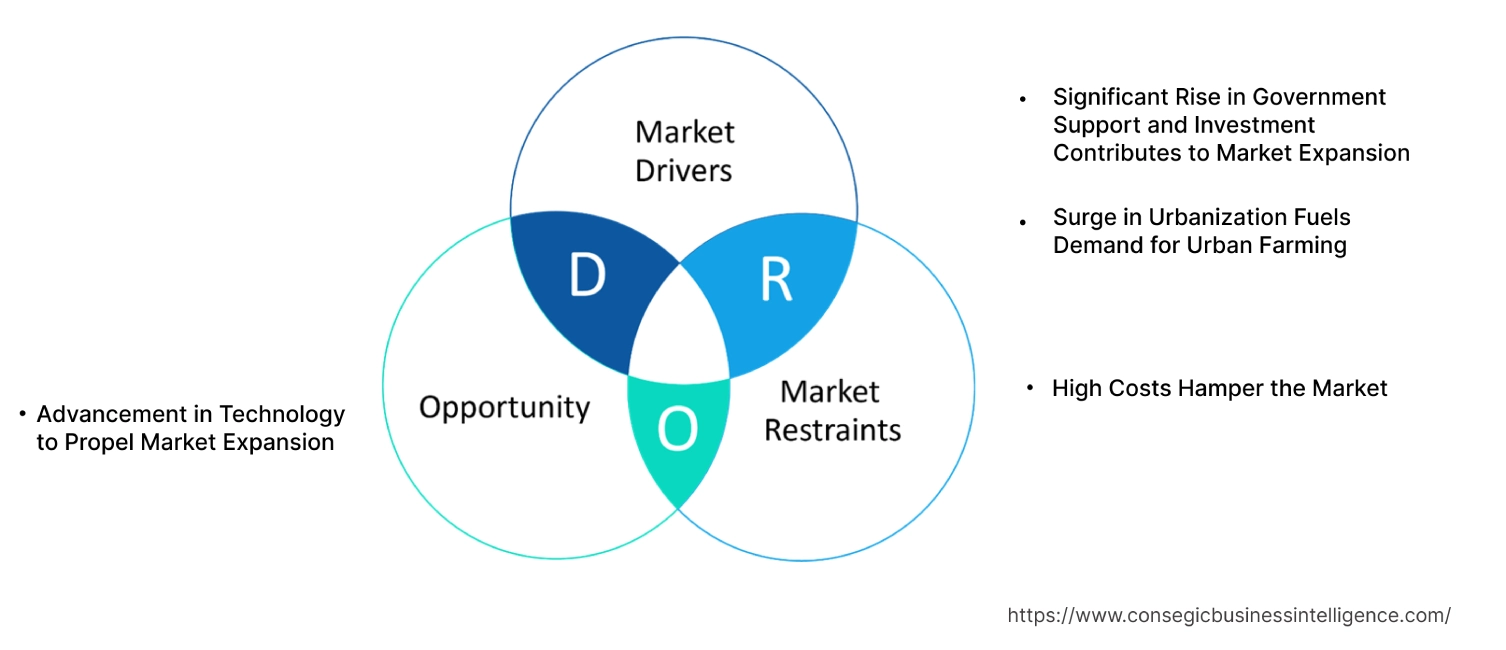

Urban Farming Market Dynamics - (DRO) :

Key Drivers:

Significant Rise in Government Support and Investment Contributes to Market Expansion

The rising population, urbanization, and food scarcity issues are creating the adoption of modern farming solutions. Based on the analysis, growing awareness of farming benefits is leading to government initiatives and funding programs supporting urban farm development, research, and education, further stimulating urban farming market growth. These investments encourage healthy food, and economic development, provide employment and on-the-job training, expand community greenspaces, foster community collaboration, build climate and disaster-resilient communities, and are an essential part of a resilient diversified food system.

- For instance, in March 2022, the Delhi government launched a campaign for the promotion of urban farming in Delhi. Through this campaign, the Delhi government hopes to encourage community and garden farming for optimum utilization of spaces in concrete houses and buildings and also provide ward-level action plans for the implementation of this farming. The Delhi government also plans to increase high-quality food production and reduce the usage of chemicals and pesticides. Moreover, it has also planned for the Delhi Environment Protection Committee (DEPC) to increase the awareness and adoption of this farming. The DEPC aims to provide education, training, and solutions concerning this farming.

Thus, the rising government support and initiatives are propelling the expansion of the market.

Surge in Urbanization Fuels Demand for Urban Farming

The significant rise in urbanization is causing the expansion of the cities. This in turn results in land scarcity for traditional farming practices. As cities expand, access to land for traditional farming shrinks. This leads to an increase in food prices and concerns about supply chain disruptions. Owing to this people are looking for ways to grow their food or source it locally. Urban farming utilizes small spaces like rooftops, balconies, and vacant lots, maximizing land use within urban environments and contributing to city greening initiatives. Moreover, it offers greater control over food quality and reduces reliance on external systems, contributing to food security and affordability.

- For instance, according to the report published by NITI Aayog Asian Development Bank in May 2022, the number of inhabitants in Indian cities is estimated to have increased almost fourfold between 1970 and 2018, from 109 Billion to 460 Billion.

Consequently, the increasing urbanization is driving the spectacular expansion of the market.

Key Restraints :

High Costs Hamper the Market

The ongoing operational costs of this type of farming are substantial. Factors like energy-intensive lighting, climate control, nutrient delivery systems, and labor costs significantly impact the profitability of farming ventures. The need to maintain optimal growing conditions and ensure consistent crop yields further adds to the financial burden.

- For instance, according to the report titled URBAN AGRICULTURE TOOL KIT published by the United States Department of Agriculture, the total start-up cost for an urban farm ranges from USD 189,050 to USD 207,790.

Overall, as this industry continues to evolve, the high cost of entry and maintenance are hampering the market.

Future Opportunities :

Advancement in Technology to Propel Market Expansion

The demand for more advanced solutions for food sources has motivated the need for farming. As per the analysis, technological advances such as the Internet of Things, robotics, and AI are expected to propel the efficiency of farming. These revolutionize urban agriculture by automating tasks, optimizing resource use, and providing real-time insights for data-driven decision-making. As these technologies advance and become more affordable, they hold immense potential for addressing food security challenges in cities.

- For instance, in December 2023, China unveiled to world's first AI-powered vertical farm with 20 floors, Developed by the Institute of Urban Agriculture under the Chinese Academy of Agricultural Sciences. China has unveiled its first domestically developed unmanned vertical plant factory in Chengdu, Sichuan Province.

Thus, the aforementioned factors create potential urban farming market opportunities and trends.

Urban Farming Market Segmental Analysis :

By Growth Medium:

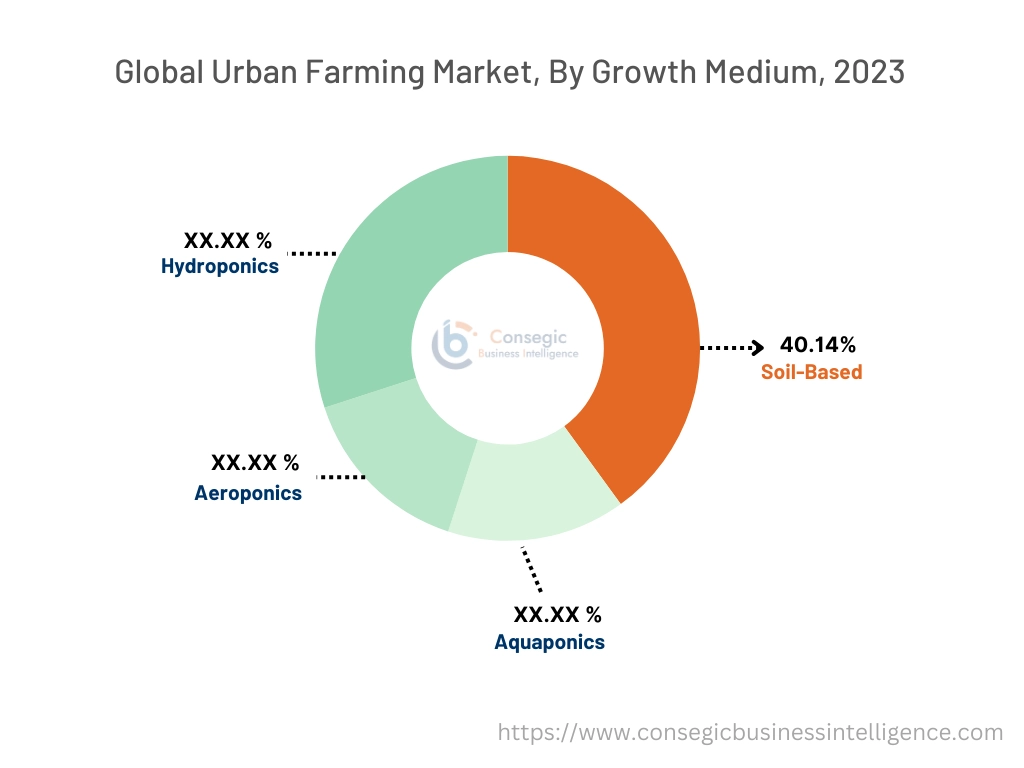

Based on the growth medium, the market is categorized into aeroponics, aquaponics, hydroponics, and soil-based.

Trends in the Growth Medium:

- Advances in automation and data analytics are enhancing hydroponic systems, enabling real-time monitoring and optimized growing conditions, which improve overall productivity and reduce labor needs.

- There is a growing trend in aquaponics for educational purposes and community-based projects, emphasizing local food production and environmental stewardship.

In 2023, the soil-based segment accounted for the highest market share of 40.14% in the urban farming market.

- Soil-based growth of plants is the traditional method of plant production. Soil fosters a complex web of microbial life, and beneficial insects creating a mini-ecosystem that promotes plant health and nutrient recycling.

- It offers several advantages over other techniques such as natural ecosystems, a wide variety of crops, nutrient buffering, and water conservation.

- Additionally, soil supports a diverse range of plants that might not thrive in soil-less systems.

- As per the analysis, owing to these benefits this soil-based medium is intensively adopted by urban farmers for the plants in spaces such as balconies, rooftop gardens, home gardens, community gardens, and commercial farms as well.

- Moreover, as per the analysis, various initiatives are being introduced by the companies to promote soil-based medium pushing the expansion of the segment.

- For instance, in October 2022, Soil Organic, an indoor farming startup that sells fresh organic culinary herbs, secured USD 125 Billion to expand soil-based vertical farming across the US to expand its national footprint.

- Consequently, this expansion is contributing to the phenomenal expansion of the segment.

The hydroponics segment is expected to hold the fastest CAGR over the forecast period.

- Hydroponics is a method of cultivating plants that does not involve the use of soil.

- This technique has gained significant traction in recent times, owing to its low maintenance cost, ease of installation and implementation, and high crop yield.

- Additionally, the method's environmental friendliness, space-saving attributes, and water conservation benefits have further contributed to its popularity.

- Furthermore, based on the analysis, the reduced usage of pesticides, high yield of nutrient-rich produce, and faster crop growth rate associated with hydroponics have significantly boosted the adoption of this technique, resulting in a remarkable expansion of the segment.

By Farm Type:

Based on the farm type segment, the market is categorized into community farms, commercial farms, community gardens, home gardens, and others.

Trends in the Farm Type:

- Vertical farming is gaining popularity and possessing a potential trend, particularly in urban areas, as it allows for high-density food production in limited spaces.

- Regenerative agriculture is farming causes potential trends as this approach focuses on rebuilding soil health and biodiversity.

In 2023, the commercial farms segment accounted for the highest market revenue share in the overall e and it is also expected to hold the fastest CAGR over the forecast period.

- Commercial farms are agricultural businesses that specialize in producing large quantities of farm products for sale.

- These farms aim to optimize their operations for maximum efficiency and cost-effectiveness.

- Commercial urban farms, on the other hand, tend to be much larger and more mechanized than subsistence farms. They often focus on specific crops or livestock products, allowing them to become highly specialized and efficient in their production processes.

- To achieve their goals, commercial farms often employ intensive yet sustainable techniques such as hydroponics and aquaponics.

- These innovative methods allow them to maximize yields within limited areas while minimizing waste and reducing environmental impact.

- Thus, these factors are propelling the expansion of the segment.

By Farming Type:

Based on the farming type segment, the market is bifurcated into indoor and outdoor.

Trends in the Farming Type:

- Indoor farming is experiencing significant expansion, influenced by the need for sustainable food production methods that can operate independently of external weather conditions.

In 2023, the outdoor segment accounted for the highest market share in the overall urban farming market.

- As per the urban farming market analysis, outdoor farming is a conventional method of cultivating crops without relying on a controlled environment.

- This technique involves nurturing plants in an open-air environment, where they are exposed to natural elements such as sunlight, water, and CO2.

- Typically, a soil-based production system is adopted for outdoor farming, which allows the plants to grow and thrive in their natural habitat.

- This traditional practice of farming is widely practiced by home gardens, community gardens, and farms, as well as commercial farms.

- Outdoor farming offers several benefits such as reduced energy consumption, lower production costs, and healthier, more sustainable crops.

The indoor segment is expected to hold the fastest CAGR over the forecast period.

- Indoor farming involves the growing the plants in a controlled environment, typically within a building or greenhouse.

- Both types of production systems including soil-based and soil-less methods are adopted for indoor farming.

- Indoor farming doesn't rely on sunlight instead it uses artificial lighting, such as LED lights to provide optimal spectrum and intensity for plant growth.

- Precise control over temperature, humidity, and CO2 levels is a prominent benefit provided by indoor farming.

- Additionally, plants grown through indoor farming are less susceptible to pests and disease, further protecting the plants and minimizing the utilization of pesticides.

- Furthermore, indoor farming enables the production of food year-round, regardless of the climate outside.

- For instance, on May 18, 2023, Plenty today announced the opening of the Plenty Compton Farm, the world's most technologically advanced indoor vertical farm, designed to grow up to 4.5 Billion pounds of leafy greens annually in a single city block in Compton, California. The farm is made possible by dozens of Plenty's patent assets, including the company's unique 3D vertical architecture that drives its industry-leading yield of up to 350 times the yield per acre of a conventional farm.

- Thus, the aforementioned factors are influencing the expansion of the segment.

By Crop Type :

Based on the crop type segment, the market is bifurcated into food crops and non-food crops.

Trends in the Crop Type:

- Growing farming of ornamental plants is trending as it is utilized for beautification and landscaping in urban settings.

- Aromatic herbs such as basil and mint are popular in urban gardens for culinary uses.

In 2023, the food crops segment accounted for the highest market share in the overall urban farming market, and it is also expected to hold the fastest CAGR over the forecast period.

- Food crops involve the group of crops utilized for food consumption. Rising population and urbanization are potential factors that are leading to food scarcity, further creating a greater demand for food crops.

- Additionally, government investments to motivate and support urban agriculture are expected to promote the production of food crops.

- For instance, in July 2023, The U.S. Department of Agriculture (USDA) announced the investment of USD 7.4 Billion in 25 selected grants that support urban agriculture and innovative production. The grant is provided to selected recipients, including community gardens and nonprofit farms, to increase food production and access in economically distressed communities. These grants build on USD 40 Billion in projects funded since 2020 and are part of USDA's broad support for urban agriculture through its Office of Urban Agriculture and Innovative Production (OUAIP).

- Thus, the significant expenditure by the government for urban agriculture is expected to propel the segment expansion.

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

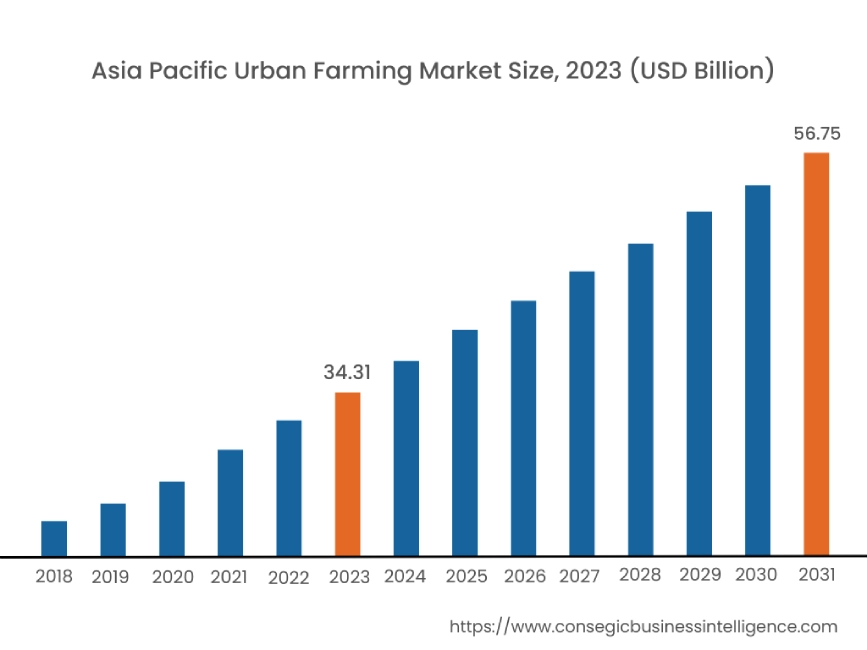

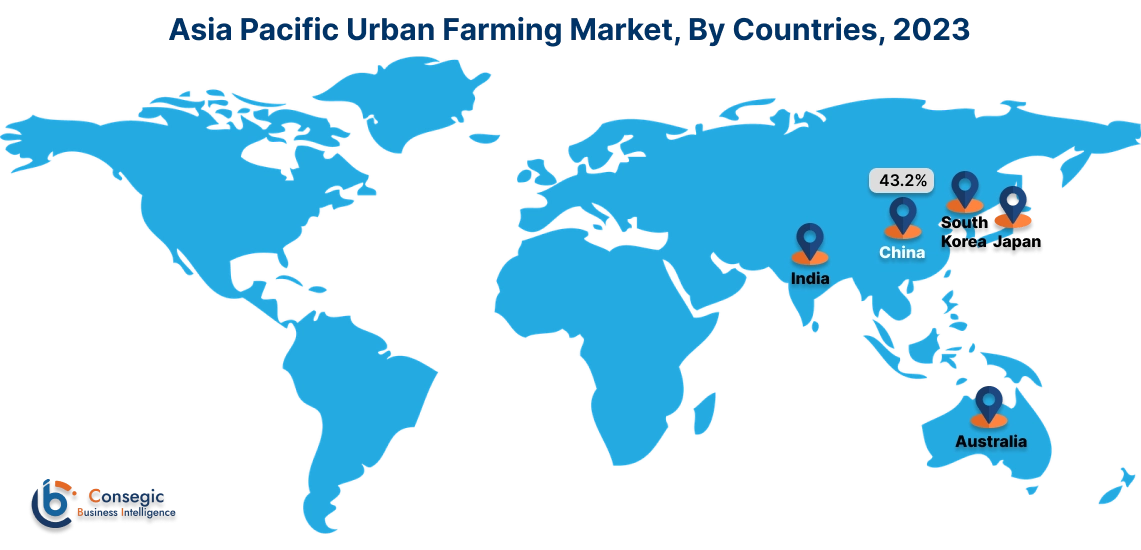

The Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 6.5% during 2024-2031. In Asia Pacific, China accounted for a major market revenue of 43.2% in 2023. Factors such as high population and rising urbanization in the region leading to the increased demand for urban farming practices are expected to fuel the market expansion in the Asia Pacific region. Additionally, consumers in Asia-Pacific are increasingly interested in fresh, local, and sustainable food, driving the demand for urban-grown produce. Moreover, the increasing urbanization across the region is expected to contribute to the astonishing expansion of the urban farming market. All these above-mentioned factors are collectively driving the urban farming market demand in the Asia Pacific region and creating lucrative opportunities and urban farming market trends in the Asia Pacific region.

The Asia Pacific region is emerging as a significant growth for Urban Farming Market, fueled by rapid urbanization, economic development, and increasing investments in smart infrastructure along with technological developments in security. Countries including China, Japan, and India are leading the adoption of access control service solutions in residential and commercial premises.

North America accounted for the highest urban farming market share valued at USD 48.06 Billion in 2023 and it is expected to reach USD 75.73 Billion in 2031.

The significant expansion of the urban farming market across the North American region is attributed to factors such as high urbanization and awareness among consumers regarding urban farming practices. Moreover, the significant support by the government for urban farming is driving market expansion across the region.

- For instance, in October 2022, the U.S. Department of Agriculture (USDA) is investing USD 14.2 Billion in 52 grants that support urban agriculture and innovative production. This investment, which includes American Rescue Plan Act funds, will allow grant recipients to expand access to nutritious foods, foster community engagement, increase awareness of climate change and mitigate the effects within urban areas, provide jobs, educate communities about farming, and expand green spaces.

Europe is anticipated to witness substantial growth that is backed by the increasing adoption of technologies in the farming sector. Companies invest in innovative technologies to cater to the surging demand for urban farming across the region.

The Middle East, Africa, and Latin America are expected to grow at a considerable rate due to increasing investments in types of farming in countries like Brazil, and UAE, among others.

Top Key Players & Market Share Insights:

The global urban farming market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The urban farming industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the market include-

- AeroFarms (U.S)

- Vertical Harvest (U.S)

- BUFCO (Canada)

- iFarm(UK)

- Urban Health Farms(Netherlands)

- Gotham Greens(U.S)

- BABYLON MICRO-FARMS (U.S)

- Brooklyn Grange Farm(U.S)

- MicroHabitat (Canada)

- Farm Urban(UK)

- VerticalField(Isreal)

Recent Industry Developments :

Merger & Acquisitions:

- In April 2024, xFarm Technologies, revealed its acquisition of Spain's Greenfield Technologies and France's SpaceSense, a move aimed at bolstering its capabilities in regenerative agriculture and geospatial AI. This initiative is part of xFarm's strategy to strengthen its presence across Europe, supporting daily operations on 340,000 farms spanning four Billion hectares.

- In June 2023, Vertical Harvest, a community-oriented indoor farming company, and Bedrock, the nation's premier city builder, based in Detroit announced plans to explore the development of Vertical Harvest Detroit. Situated within Detroit's Milwaukee Junction neighborhood, the proposed 60,000-square-foot structure would stand 74 feet tall and feature a 205,000-square-foot growing canopy that utilizes hydroponic, vertical, and controlled environmental agricultural practices. An estimated 2.2 Billion pounds of fresh vegetables, including Lettuces, Petite Greens, Microgreens, and Herbs would be produced year-round.

Urban Farming Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 212.72 Billion |

| CAGR (2024-2031) | 5.8% |

| By Growth Medium |

|

| By Farm Type |

|

| By Farming Type |

|

| By Crop Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the urban farming market? +

In 2023, the urban farming was USD 135.42 Billion.

Which is the fastest-growing region in the urban farming market? +

Asia Pacific is the fastest-growing region in the urban farming market.

What specific segmentation details are covered in the urban farming market? +

Growth medium, Farm Type, Farming Type, and Crop Type are the segmentation details covered in the urban farming market.

Who are the major players in the urban farming market? +

AeroFarms(U.S), Vertical Harvest(U.S), BABYLON MICRO-FARMS(U.S), Brooklyn Grange Farm(U.S), BUFCO(Canada), MicroHabitat(Canada), iFarm(UK), Farm Urban(UK), Urban Health Farms(Netherlands), Gotham Greens(U.S), VerticalField(Isreal) and many more.