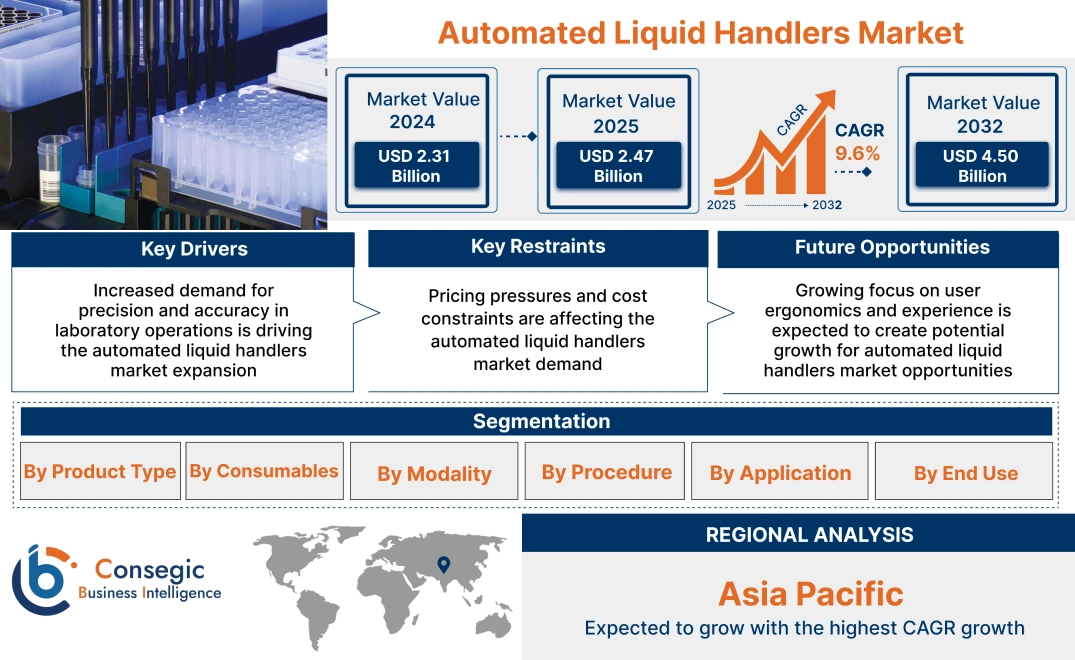

Automated Liquid Handlers Market Size:

Automated Liquid Handlers Market Size is estimated to reach over USD 4.50 Billion by 2032 from a value of USD 2.31 Billion in 2024 and is projected to grow by USD 2.47 Billion in 2025, growing at a CAGR of 9.6% from 2025 to 2032.

Automated Liquid Handlers Market Scope & Overview:

Automated liquid handlers are robotic systems that precisely and rapidly dispense, mix, and transfer liquids, automating tasks that were previously done manually in laboratories. Moreover, these systems are crucial for high-throughput applications, reducing human error, increasing productivity, and improving consistency in sample preparation. They are widely used in fields such as life sciences, drug discovery, and genomics.

How is AI Impacting the Automated Liquid Handlers Market?

AI is significantly impacting the automated liquid handlers market by enhancing precision, efficiency, and adaptability of liquid handling processes. AI and machine learning (ML) algorithms are being integrated into these systems to optimize pipetting, predict maintenance needs, and enable smart automation for faster and more accurate results. This leads to reduced human error, faster execution of complex tasks, and the ability to handle intricate samples. Also, automated liquid handlers are reshaping research workflows, enabling researchers to focus on data analysis and interpretation rather than manual liquid handling tasks.

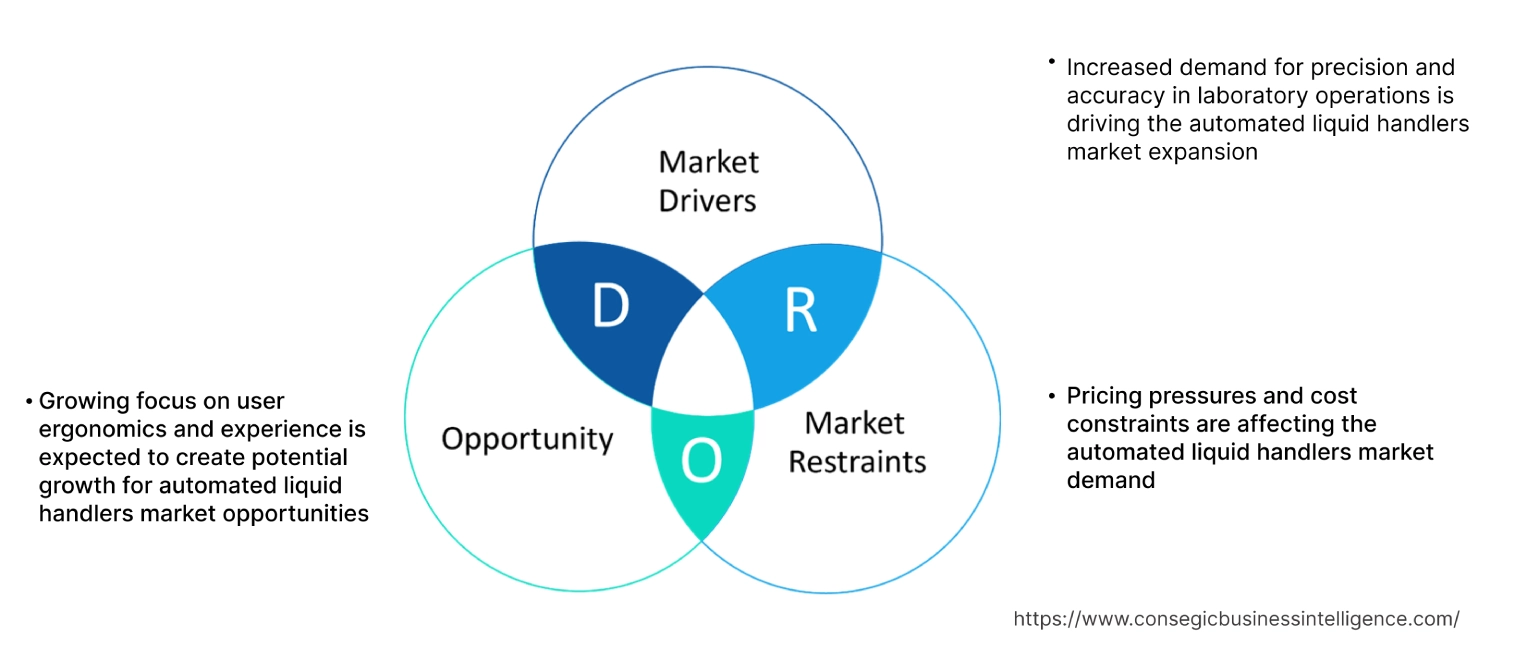

Automated Liquid Handlers Market Dynamics - (DRO) :

Key Drivers:

Increased demand for precision and accuracy in laboratory operations is driving the automated liquid handlers market expansion

Automated liquid handling technologies play a crucial role in enhancing accuracy and precision in laboratory procedures. By minimizing the potential for human error, these systems ensure dependable liquid transfers, a critical factor when even minor variations can impact experimental outcomes. It enables the processing to a greater number of samples in less time, leading to higher throughput. This capability is particularly vital for high-volume applications such as clinical drug discovery, ADME-Tox research, and large-scale studies. Further, the increasing pressure for efficiency in research and development is a major driving force behind the widespread adoption of automated liquid handling technologies, which can execute tasks with speed and precision.

- For instance, in June 2023, Agilent Technologies Inc. launched the InfinityLab GPC/SEC, a complete system designed for gel permeation chromatography and size exclusion chromatography. This new offering aims to empower labs with enhanced tools for separating and analyzing intricate mixtures by the dimension of their molecules. By incorporating this system, laboratories, particularly those focused on research demanding accurate molecular separation and analysis, can streamline an efficient approach for their liquid handling procedures.

Thus, according to the automated liquid handlers market analysis, the increased demand for precision and accuracy in laboratory operations is driving the automated liquid handlers market size.

Key Restraints:

Pricing pressures and cost constraints are affecting the automated liquid handlers market demand

Intense competition among market players and cost constraints experienced by laboratories present significant challenges for the development of the market. The pressure on pricing emerging from this competition necessitates a delicate balance for manufacturers. Further, pricing pressures inevitably impact profit margins, requiring manufacturers to carefully strategize their pricing models to maintain profitability while remaining attractive to customers. Moreover, cost constraints within laboratory budgets can restrict the purchasing decision for automated liquid handling systems.Thus, the aforementioned factors would further impact on the automated liquid handlers market size.

Future Opportunities :

Growing focus on user ergonomics and experience is expected to create potential growth for automated liquid handlers market opportunities

Manufacturers can distinguish their products through prioritizing user ergonomics and experience within the market. By emphasizing ergonomic designs, intuitive interfaces, and user-friendly features, manufacturers can enhance the usability and appeal of their liquid handlers. This approach aims to improve user comfort, alleviate operator fatigue, and streamline the overall user experience during laboratory procedures. As a result, such enhancements contribute to higher levels of product adoption and customer satisfaction among laboratory professionals.

Through a focus on ergonomic design, liquid handlers can be tailored to fit comfortably in the user's hand, reducing strain and discomfort during prolonged use. Additionally, intuitive interfaces and user-friendly features simplify operation, making it easier for users to navigate settings and perform tasks with precision and efficiency. These improvements not only enhance the usability of liquid handlers but also contribute to a positive user experience.

- For instance, in May 2023, Eppendorf announced the release of new generation epMotion automated liquid handler at the 2023 SLAS conference in U.S. The epMotion system delivers exceptional precision and accuracy when handling liquids and features an intuitive interface along with adaptable protocols to suit various needs. Its updated design has a space-saving shape and enhanced ergonomics, ensuring comfortable and efficient operation for users.

Thus, based on the above automated liquid handlers market analysis, the growing focus on user ergonomics and experience is expected to drive the automated liquid handlers market opportunities.

Automated Liquid Handlers Market Segmental Analysis :

By Product Type:

Based on product type, the automated liquid handlers market is segmented into benchtop workstation, standalone, multi-instrument system, and others.

Trends in the product type:

- The expansion of lab automation, coupled with the rising need for automated liquid handling systems that incorporate sensors and strict rules within major pharmaceutical companies emphasizing the maintenance of high precision, are contributing to the development of the segment.

- With the continuous evolution of technologies such as artificial intelligence and machine learning, these systems are becoming smarter and more efficient, further fueling their adoption.

- Thus, the above factors are driving the automated liquid handlers market demand.

The benchtop workstation segment accounted for the largest revenue share in the year 2024.

- Benchtop workstations are designed to perform complex liquid handling tasks, such as sample preparation, reagent mixing, and compound screening, with minimal human intervention.

- These compact and customizable workstations offer automated liquid handling capabilities tailored to individual applications, such as nucleic acid extraction, PCR setup, and sample dilution, in turn enhancing efficiency and throughput in small to mid-sized laboratories.

- For instance, in February 2022, SPT Labtech announced the launch of Apricot DC1, an automated liquid handling workstation, at SLAS 2022 International Conference and Exhibition in Boston, U.S. This launch unveils an innovative category of small and user-friendly automated pipettors. This makes it more financially feasible for numerous labs to simplify and automate their manual or semi-manual pipetting tasks across a diverse range of applications.

- Thus, based on the above analysis, these factors are further driving the automated liquid handlers market growth.

The multi-instrument system segment is anticipated to register the fastest CAGR during the forecast period.

- Multi-instrument automated liquid handling systems present a sophisticated solution for high-throughput laboratories and research facilities with diverse liquid handling needs.

- These integrated platforms combine multiple liquid handling instruments, such as pipetting robots, microplate washers, and plate readers, into a unified system, streamlining complex workflows and maximizing operational efficiency.

- The growing research spending in areas such as genomics, proteomics, and drug discovery fuels the need for multi-instrument liquid handling systems.

- Thus, based on the above analysis, these factors are expected to drive the automated liquid handlers market share during the forecast period.

By Consumables:

Trends in the consumables:

- There is a growing trend towards miniaturizing assays to reduce reagent consumption, lower costs, and increase throughput. The liquid handlers capable of handling small volumes are becoming increasingly important.

- The integration of automated liquid handlers with other automated systems like robotic arms for plate handling, automated storage systems, and analytical instruments is becoming more common, leading to fully automated workflows.

The reagent reservoirs segment accounted for the largest revenue share in the year 2024.

- As more labs adopt automated liquid handlers, the need for compatible and efficient reagent reservoirs naturally increases. This drives innovation in reservoir design for better integration and performance within automated workflows.

- The need for data integrity and reproducibility in pharmaceutical R&D and quality control (QC) requires high-quality, consistent consumables such as reagent reservoirs, which minimize the risk of contamination or errors during automated liquid handling.

- For instance, Hamilton’s 20 ml reagent reservoir are compatible with Hamilton 100 μL and 5 mL pipetting channels. They are self-standing, which includes barcodes for identification, and are offered in transparent or black versions.

- Thus, these factors would further supplement the automated liquid handlers market

The sealing consumables segment is anticipated to register the fastest CAGR during the forecast period.

- These consumables are designed for long-term storage or when plate contents should not be accessed again. They offer a strong and irreversible bond with the plate.

- In critical applications like diagnostics, drug discovery, and biobanking, maintaining the integrity and preventing contamination of samples is paramount. This fuels the need for high-quality sealing consumables that provide robust protection against evaporation, microbial contamination, and cross-contamination. Barcoded seals are also gaining traction for sample tracking and security.

- These factors are anticipated to further drive the automated liquid handlers market trends during the forecast period.

By Modality:

Based on modality, the market is segmented into fixed tip and disposable tip.

Trends in the modality:

- The development of workstations tailored to specific applications, such as high throughput screening, drug discovery, and diagnose testing is driving the need for advanced liquid handlers.

- Automation allows for faster sample preparation and higher throughput, which leads to increased productivity.

The disposable tip segment accounted for the largest revenue in the year 2024.

- The strong need to avoid sample mix-up, particularly in crucial areas like genomics and clinical testing, is boosting the need for single-use tips in automated liquid handling.

- The disposable tips also offer greater ease of use as compared to traditional pipettes that require regular upkeep and accuracy checks, further contributing to the development of the market.

- Thus, based on the above developments, these factors are driving the automated liquid handlers market growth.

The fixed tip segment is anticipated to register the fastest CAGR during the forecast period.

- In research, purified samples such as those used in RNA/DNA sequencing and PCR are often handled with fixed tips on automated equipment. These long, steel needles can access the bottom of deep containers, such as spinner tubes used in cell culture or NMR.

- Fixed tip is a budget-friendly option and requires a specific, straightforward process.

- Cleaning instruments with fixed tips are simple due to the liquid displacement method used. This washing step is vital to prevent carry-over contamination from previous samples.

- For instance, Danaher’s fix tip handlers are used in magnetic-bead-based extraction and cleanup processes, to enhance the reliability, consistency, and speed of extracting nucleic acids. This leads to higher quality samples, which are essential for downstream applications like next-generation sequencing (NGS), microarrays, and quantitative PCR (qPCR).

- These factors are anticipated to further drive the automated liquid handlers market trends during the forecast period.

By Procedure:

Based on procedure, the market is segmented into PCR setup, high-throughput screening, serial dilution, array printing, whole genome amplification, cell culture, and plate reformatting.

Trends in the procedure:

- As precision medicine continues to gain traction in clinical practice, the need for advanced liquid handling technologies capable of processing diverse sample types and supporting complex analytical workflows is expected to grow, thereby, driving the segment development.

- By automating labor-intensive and error-prone liquid handling tasks, these systems ensure the reproducibility and reliability of genomic data, laying the foundation for personalized treatment strategies tailored to each patient's unique genetic profile.

The PCR setup companies segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- PCR (polymerase chain reaction) setup is a critical procedure in molecular biology and genetics, involving the precise dispensing of PCR reagents, templates, and primers into reaction wells for PCR amplification.

- Governments and healthcare organizations globally have invested heavily in PCR-based testing infrastructure to manage and contain outbreaks. This increased the focus on disease surveillance, making PCR a necessary tool in the diagnostic sector.

- PCR technology has revolutionized molecular biology and diagnostics by enabling the amplification of DNA sequences, making it a significant tool in various applications including genotyping, gene expression analysis, and infectious disease detection.

- For instance, in November 2023, F. Hoffmann-La Roche Ltd launched the LightCycler PRO System, a next-generation qPCR system designed to meet the evolving clinical needs of molecular diagnostics.

- Thus, based on the above factors, these developments are driving the global market.

By Application:

Based on application, the market is segmented into drug discovery & development, biopharmaceutical production, cancer & genomic research, molecular biology & research, forensics, clinical & diagnostics, and others.

Trends in the application:

- As proteomics research grows and becomes more intricate, the need for advanced liquid handling solutions that can accommodate the needs of high-throughput and high-precision analyses is becoming increasingly apparent.

- The increasing prevalence of chronic and infectious diseases has led to a surge in diagnostic testing, thereby driving the adoption of liquid handling systems to improve the efficiency and reliability of laboratory processes. The integration of these systems with diagnostic instruments and data management tools is further enhancing their utility in clinical laboratories.

The drug discovery & development segment accounted for the largest revenue in the year 2024.

- The increasing intricacy and scale of drug development are key drivers of the segment growth.

- Automated liquid handling systems play a vital role in boosting the efficiency and accuracy of drug discovery. By streamlining the preparation and testing of various compounds, these technologies are crucial for tasks like high-throughput screening (HTS), optimizing initial drug candidates, and evaluating how drugs are processed by the body and their potential toxicity (ADME-Tox).

- Companies such as Thermo Fisher Scientific and Hamilton Company leverage these systems to accelerate the drug discovery pipeline and improve the overall effectiveness of research efforts.

- For instance, Thermo Fisher offers the Multidrop Combi reagent dispenser, which is used in several applications, such as drug discovery, genomic, proteomic, cell-based assays, and high-throughput screening.

- Thus, based on the above factors, these developments are driving the automated liquid handlers

The cancer & genomic research segment is anticipated to register the fastest CAGR during the forecast period.

- The growing focus on personalized medicine and genomic studies has created a need for automated tools that can effectively handle intricate, high-throughput experiments.

- Automated liquid handling systems are crucial for tasks such as genomic sequencing, gene expression analysis, and the identification of cancer biomarkers.

- These systems empower scientists to manage substantial amounts of genetic information efficiently, which is vital for advancing cancer research and developing personalized therapies.

- These factors are anticipated to further drive the global market during the forecast period.

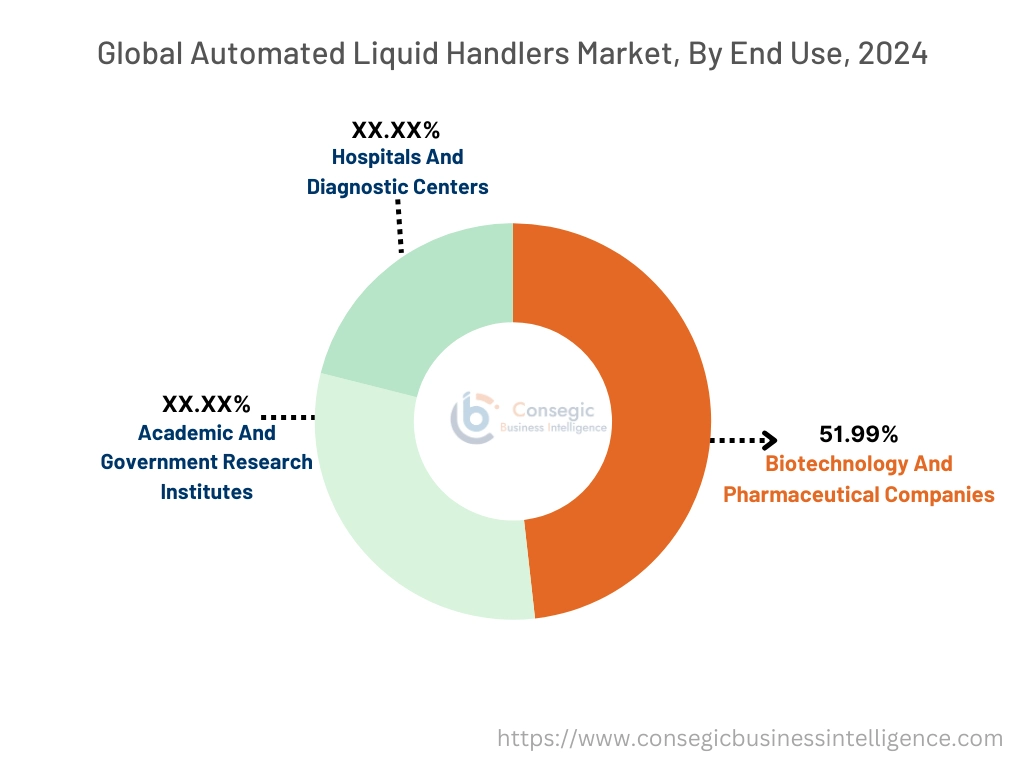

By End Use:

Based on end use, the market is segmented into biotechnology and pharmaceutical companies, academic and government research institutes, and hospitals and diagnostic centers.

Trends in the end use:

- The increasing volume of diagnostic tests due to rising health awareness, disease prevalence, and advancements in diagnostic technologies contribute to the growing need for automated liquid handlers.

- The increasing focus on precision medicine and personalized healthcare is creating new applications and need for sophisticated liquid handling systems that can handle diverse and complex samples

The biotechnology and pharmaceutical companies segment accounted for the largest revenue share of 51.99% in the year 2024.

- Biotechnology & pharmaceutical companies constitute a significant end-user segment within the market, encompassing a diverse array of organizations engaged in drug discovery, development, and manufacturing.

- These companies utilize automated liquid handling systems to expedite high-throughput screening, assay development, compound management, and other critical workflows essential to the drug discovery process.

- By automating liquid handling tasks, biotechnology and pharmaceutical companies can enhance efficiency, reproducibility, and data quality, ultimately accelerating the pace of drug discovery and development.

- Thus, the above factors are driving the global market trends.

The academic and government research institutes segment is anticipated to register the fastest CAGR during the forecast period.

- Academic & government research institutes represent key segment of end users in the automated liquid handling, comprising universities, research institutions, government agencies, and public health laboratories.

- These institutions utilize automated liquid handling systems to support a wide range of scientific research endeavours across diverse disciplines, including molecular biology, genetics, genomics, proteomics, pharmacology, and clinical diagnostics.

- By automating labour-intensive and error-prone liquid handling tasks, academic and government research institutes can improve research efficiency, reproducibility, and data integrity, while advancing an understanding of disease mechanisms, developing new therapies, and improving public health outcomes.

- These factors are anticipated to further drive the global market during the forecast period.

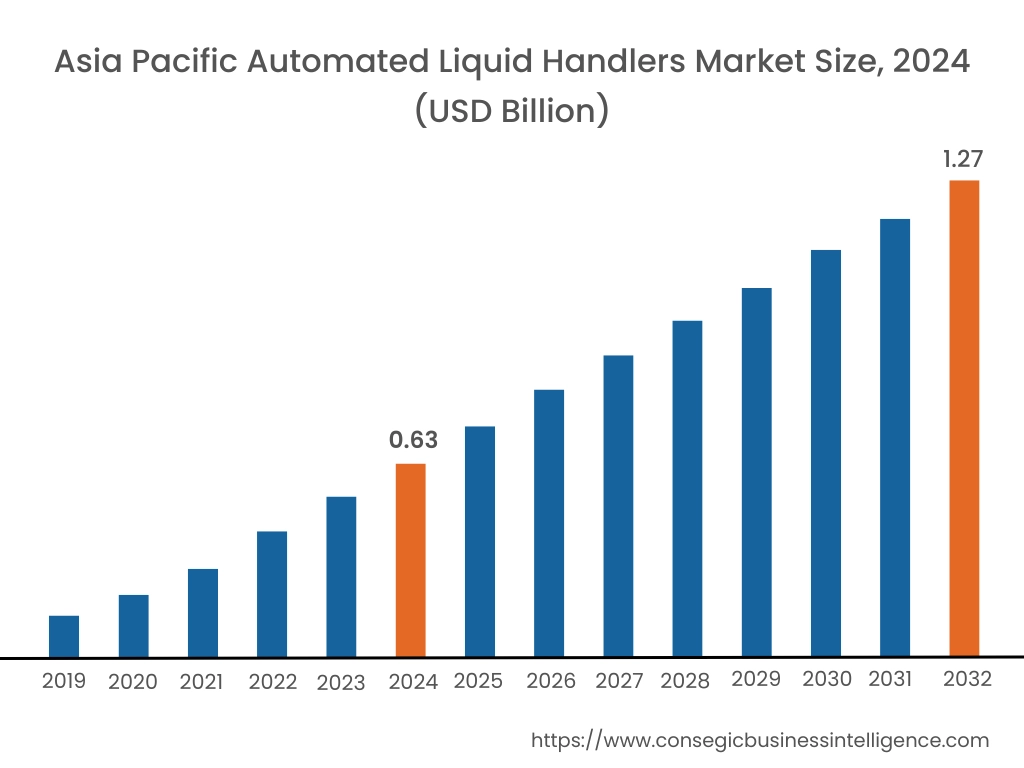

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

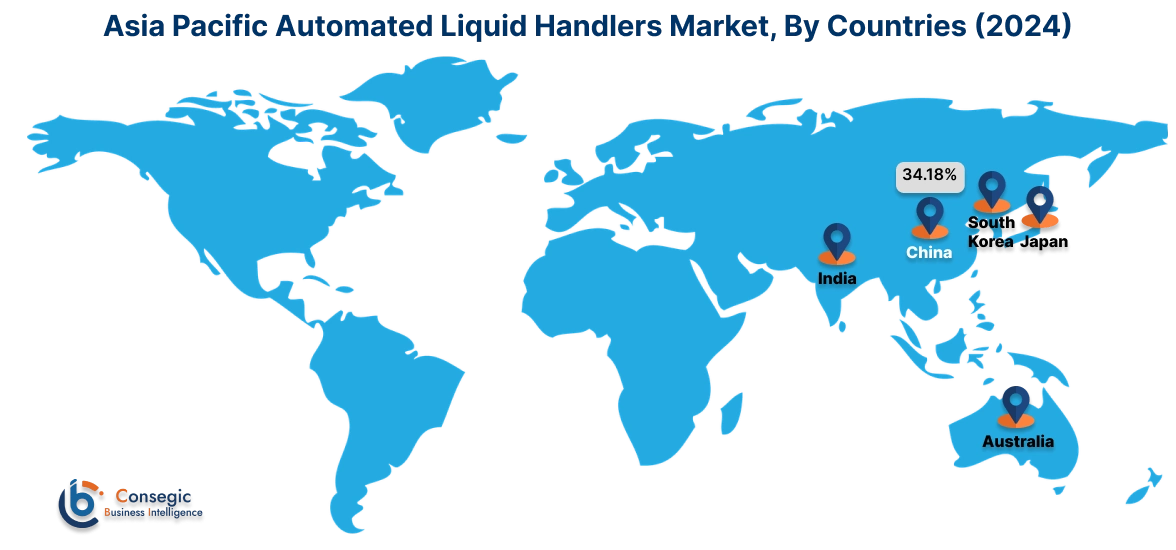

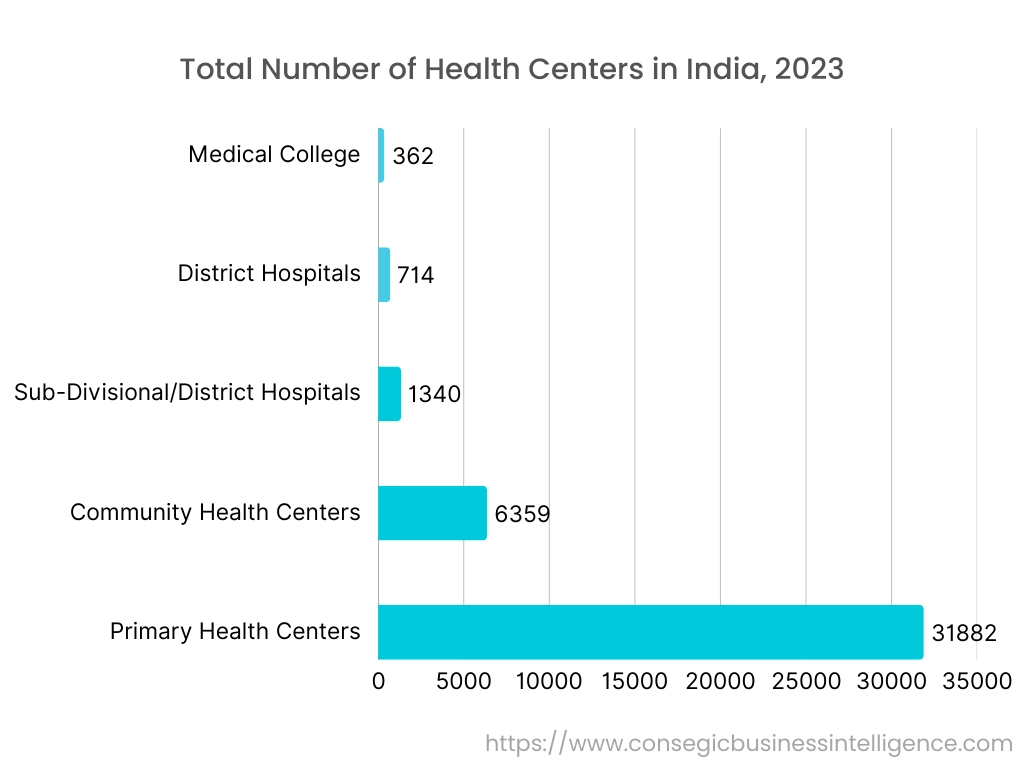

Asia Pacific automated liquid handlers market expansion is estimated to reach over USD 1.27 billion by 2032 from a value of USD 0.63 billion in 2024 and is projected to grow by USD 0.68 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 34.18%. The regional growth can be attributed to the increasing healthcare expenditure, rising research activities, and expanding pharmaceutical and biotechnology industry. Further, emerging economies such as China and India are significantly investing in healthcare infrastructure and research capabilities. Moreover, the growing frequency of chronic diseases and the need for advanced diagnostic solutions are further propelling the need for liquid handling systems in this region. These factors would further drive the regional automated liquid handlers market during the forecast period.

- For instance, in October 2024, SPT Labtech announced the partnership with ICE Bioscience, to launch a joint laboratory focused on intelligent drug screening and life sciences automation. SPT Labtech's firefly liquid handler will boost ICE Bioscience's global drug discovery research and development services, specifically for high-throughput screening (HTS) and assay development.

North America market is estimated to reach over USD 1.67 billion by 2032 from a value of USD 0.86 billion in 2024 and is projected to grow by USD 0.92 billion in 2025. North America stands as a prominent region within the global market, driven by strong investments in research and development, advanced laboratory infrastructure, and a strong presence of biotechnology and pharmaceutical companies. Further, the region's focus on innovation, coupled with favorable regulatory frameworks and government funding initiatives, fuels the adoption of automated liquid handling systems across various scientific research disciplines. These factors would further drive the market in North America.

- For instance, in February 2023, Agilent launched an optional on-deck thermal cycler for its Agilent Bravo next-generation sequencing liquid handling system. This add-on allows the Bravo to perform thermal cycling automatically, which is useful for end-point PCR, next-generation sequencing, and cell-based applications.

According to the analysis, the automated liquid handlers industry in Europe is anticipated to witness significant development during the forecast period. Countries in the region are leading contributors to the market in this region, with numerous pharmaceutical and biotechnology companies driving the demand for advanced liquid handling systems. Further, the region's focus on innovation and research excellence, combined with government support for scientific research, are expected to sustain market growth during the forecast period. Additionally, the growth of Latin America can be attributed to the expanding life sciences industry, rising investments in research and development, and growing demand for precision medicine and personalized healthcare solutions. Further, the Middle East & Africa region is experiencing growth due to government efforts focused on improving healthcare infrastructure and fostering advancements in both drug development and genomic research.

Top Key Players and Market Share Insights:

The global automated liquid handlers market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the automated liquid handlers industry include-

- Thermo Fisher Scientific, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Aurora Biomed, Inc. (Canada)

- AUTOGEN, INC. (U.S.)

- Eppendorf AG (Germany)

- Danaher Corporation (U.S.)

- Hamilton Company (Germany)

- Hudson Robotics (U.S.)

- Lonza Group AG (Switzerland)

- PerkinElmer, Inc. (U.S.)

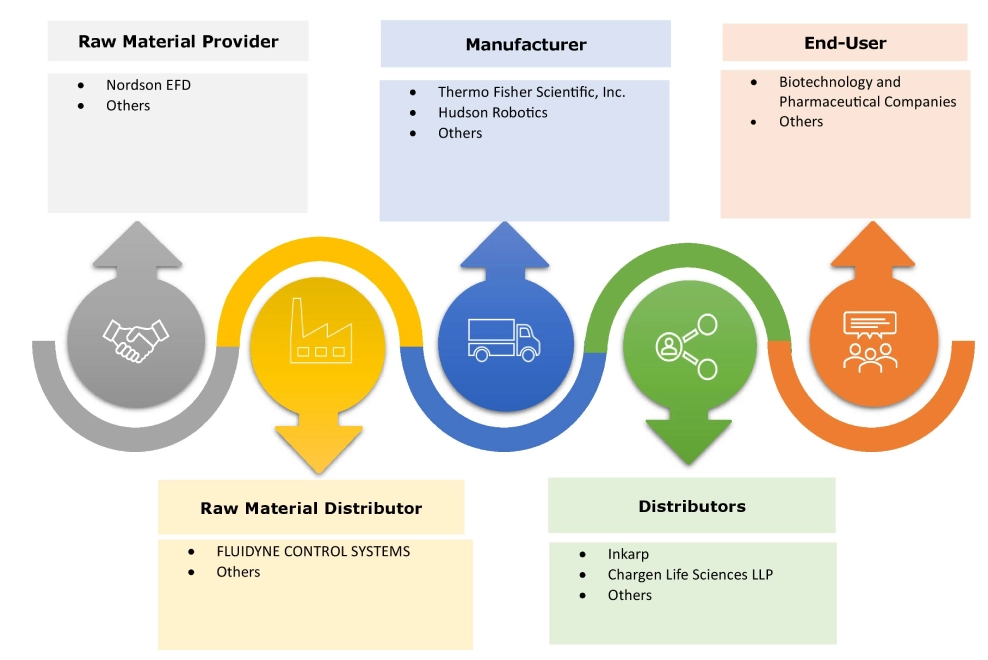

Automated Liquid Handlers Market Ecosystem:

Recent Industry Developments :

Product Launch:

- In February 2022, Festo unveiled its Modular Gantry Robot platform at SLAS 2022, aiming to streamline the development of automated liquid handling systems for labs. This open-source and adaptable solution leverages high-quality components, empowering equipment designers to rapidly create tailored setups while minimizing the need for extensive mechanical and electrical engineering efforts.

Automated Liquid Handlers Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.50 Billion |

| CAGR (2025-2032) | 9.6% |

| By Product Type |

|

| By Consumables |

|

| By Modality |

|

| By Procedure |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Automated Liquid Handlers Market? +

Automated Liquid Handlers market size is estimated to reach over USD 4.50 Billion by 2032 from a value of USD 2.31 Billion in 2024 and is projected to grow by USD 2.47 Billion in 2025, growing at a CAGR of 9.6% from 2025 to 2032.

Which is the fastest-growing region in the Automated Liquid Handlers Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Automated Liquid Handlers report? +

The automated liquid handlers report includes specific segmentation details for product type, consumables, modality, procedure, application, end use, and region.

Who are the major players in the Automated Liquid Handlers Market? +

The key participants in the market are Thermo Fisher Scientific, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Aurora Biomed, Inc. (Canada), AUTOGEN, INC. (U.S.), Eppendorf AG (Germany), Danaher Corporation (U.S.), Hamilton Company (Germany), Hudson Robotics (U.S.), Lonza Group AG (Switzerland), PerkinElmer, Inc. (U.S.), and others.