Truck Mounted Crane Market Size :

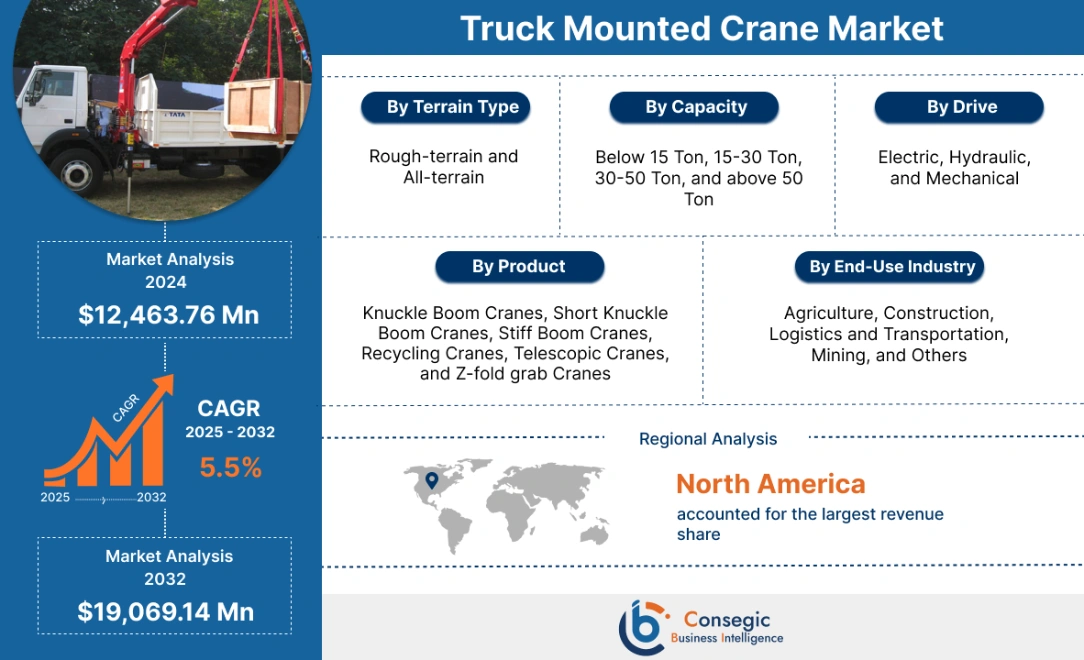

Truck Mounted Crane Market size is estimated to reach over USD 19,069.14 Million by 2032 from a value of USD 12,463.76 Million in 2024 and is projected to grow by USD 12,922.20 Million in 2025, growing at a CAGR of 5.50% from 2025 to 2032.

Truck Mounted Crane Market Scope & Overview:

Truck mounted crane, also termed a truck loader crane refers to a truck with a crane attached at the rear end to unload and load the goods from the truck's deck. They are widely used for cargo handling, construction, and electric line maintenance to offer better flexibility in comparison to conventional immobile cranes.

Truck Mounted Crane Market Insights :

Truck Mounted Crane Market Dynamics - (DRO) :

Key Drivers :

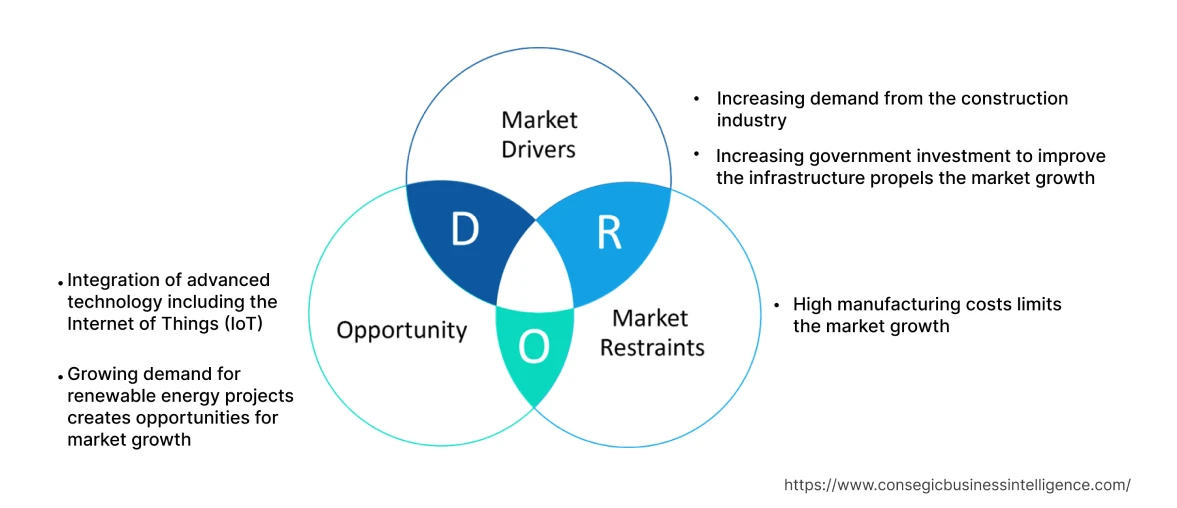

Increasing demand for truck mounted cranes in the construction industry creates market development

The rising need for these cranes to handle industrial equipment quickly and efficiently is promoting the market. Additionally, advancements in technology including the adoption of safety eye control to provide improved safety to construction workers further accelerate the market trends. For instance, in April 2022, TADANO launched TM-ZX1200 Truck Loader Cranes with an improved lifting capacity to meet the growing needs of the construction industry. The crane features "Safety Eyes" to offer improved vision and control to the operator of the crane thus, contributing considerably to the market. Thus, technological advancements coupled with the increasing need from the construction industry to handle goods more effectively are contributing significantly to propelling the truck mounted crane market growth.

Increasing government investment to improve the infrastructure propels market trends

The increasing investments by the government to enhance the infrastructure lead to the increased need for these cranes to effectively handle industrial equipment. For instance, the government in Vietnam has launched a Socio-Economic Development Plan to improve the industrial infrastructure in Vietnam. Further, the Indonesian government has also launched the Indonesian National Medium-term Development Plan to reduce forest deforestation and improve infrastructure. Furthermore, in April 2022, the UK government announced to invest GBP 6.1 million in the Transport Decarbonization Plan for the decarbonization of buildings across the UK.

Thus, the increasing government investment globally in heavy construction projects is resulting in the increased truck mounted cranes market demand.

Key Restraints :

High manufacturing costs limit the market

The high cost of production of these cranes serves as the major restraint for the global truck mounted crane market. The cranes are manufactured using high-strength low-alloy steel (HSLA) which is expensive in comparison to carbon steel, thus limiting the market. In addition, the manufacturing of these cranes requires intricate design and engineering to ensure stability while lifting high loads. Further, the development of components including hydraulic systems, control mechanisms, and telescopic booms requires significant investment in research and development. Thus, the high cost of designing, research & development, and manufacturing results in limiting the market trends.

Future Opportunities :

Integration of advanced technology including the Internet of Things (IoT) aid in market growth

The development of autonomous cranes, telematics systems, and data analytics is expected to increase the efficiency, safety, and productivity of these cranes. Additionally, IoT also enables remote monitoring through an app-based system that allows operators the ability to view real-time crane information, exchange data, and receive alerts. For instance, in June 2022, Manitowoc introduced POTAIN CONNECT and GROVE digital solutions to enable remote monitoring, servicing, and management of cranes leading to improved performance and sustainability. Subsequently, the integration of the Internet of Things with cranes to gain real-time insights is predicted to create truck mounted crane market opportunities.

Growing demand for renewable energy projects creates opportunities for the market

The shift towards renewable energy sources such as wind and solar power is projected to drive the market trends. These cranes are employed to minimize downtime and maximize operational time, thus resulting in improved efficiency. Additionally, the integration of the WINDCRANE data logger with these cranes precisely measures wind turbulence, average wind speed, and wind gusts further promoting the market trends. In conclusion, the increasing need for renewable energy projects is predicted to create global truck mounted crane market opportunities.

Truck Mounted Crane Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 19,069.14 Million |

| CAGR (2025-2032 ) | 5.5% |

| By Product | Knuckle Boom Cranes, Short Knuckle Boom Cranes, Stiff Boom Cranes, Recycling Cranes, Telescopic Cranes, and Z-fold grab Cranes |

| By Terrain Type | Rough-terrain and All-terrain |

| By Drive | Electric, Hydraulic, and Mechanical |

| By Capacity | Below 15 Ton, 15-30 Ton, 30-50 Ton, and above 50 Ton |

| By End-Use Industry | Agriculture, Construction, Logistics and Transportation, Mining, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Bocker Maschinenwerke, Hiab (Cargotec Corporation), Elliott Equipment Company, Furukawa UNIC, Tadano Ltd., IMT, KATO WORKS, Liebherr, Liugong Machinery, Manitex International, Manitowoc |

Truck Mounted Crane Market Segmental Analysis :

By Product :

The product segment is classified into knuckle boom cranes, short knuckle boom cranes, stiff boom cranes, recycling cranes, telescopic cranes, and Z-fold grab cranes. Knuckle boom cranes accounted for the largest market in 2024 owing to the ability of cranes to offer improved flexibility, versatility, and durability. Additionally, knuckle boom cranes are highly maneuverable and are equipped with an electro-hydraulic system that enables silent and emission-free operation. Consequently, the aforementioned factors are primarily responsible for driving the growth of the knuckle boom cranes segment. For instance, in March 2023, Wagenborg Nedlift introduced 92TM PALFINGER PK92002SH, a knuckle boom crane to expand the company's portfolio in the market. The product is equipped with an electrohydraulic powerpack system and operates at a range of 360°, thus contributing considerably to the knuckle boom crane segment.

Stiff boom cranes are projected to witness the fastest CAGR during the forecast period in the truck mounted crane market during the forecast period. As per the analysis, the growth is attributed to the increasing applications of cranes in various industries including construction, utility, and energy. In addition, stiff boom cranes offer a fast and flexible method for handling, loading, and unloading goods. Moreover, the cranes are resistant to corrosion and are made of highly durable materials, namely high strength low alloy (HSLA) steels that further accelerate the market growth. Thus, the aforementioned factors including corrosion resistance, high durability, and increasing adoption in various end-use industries are projected to drive the market in upcoming years.

By Terrain Type :

The terrain type segment is bifurcated into rough-terrain and all-terrain. All-terrain cranes accounted for the largest market in 2024 of the total truck mounted crane market share, owing to the increasing adoption of all-terrain cranes during the installation of oil and gas pipelines, lifting of heavy concrete buildings, and heavy haulage. In addition, these cranes offer enhanced flexibility by utilizing hydraulically powered telescopic booms to lift heavy loads. Moreover, these cranes are highly maneuverable in handling different types of surfaces including gravel, sand, dirt, grass, and asphalt. Thus, analysis depicts that the aforementioned factors including improved flexibility, maneuverability, and increasing use in remote construction are contributing significantly to accelerating the all-terrain segment.

The rough-terrain segment is anticipated to register the fastest CAGR during the forecast period in the truck mounted crane market. This is attributed to the ability of rough-terrain cranes to provide low axle weight and narrow transport width offering maximum lifting capacities. In addition, rough-terrain cranes also offer rugged durability, low-cost servicing, and maximum torque further driving the growth of the market. Moreover, rough-terrain cranes are designed with a fuel monitoring system to prevent fuel wastage and a positive control system to meter the number of hydraulic pumps discharged during crane operation. In conclusion, the abovementioned reasons are collectively responsible for driving the rough-terrain segment during the forecast period. For instance, in March 2023, TADANO launched GT1200XL-2 and GT-800XL-2, rough-terrain cranes in the United States and Canada. The crane provides low axle weight and narrow transport width along with a fuel monitoring system, hence contributing considerably to boosting the market.

By Drive :

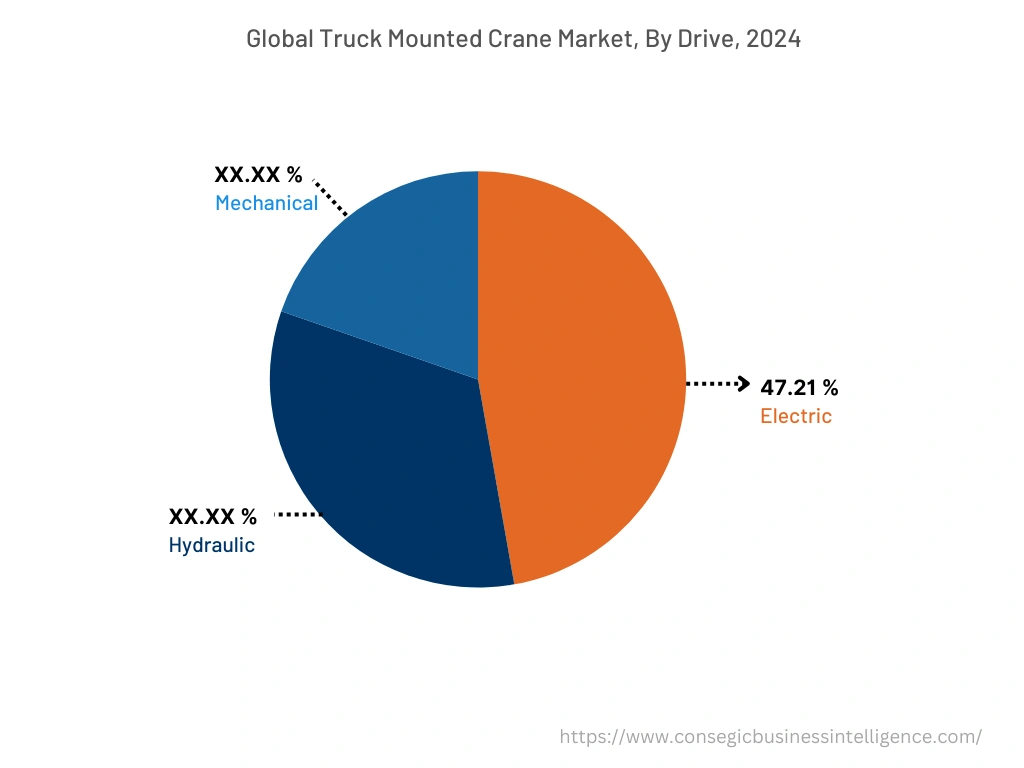

The drive segment is trifurcated into electric, hydraulic, and mechanical. Electric truck mounted cranes accounted for the largest market share of 47.21% in 2024 owing to the advancements in technology to offer emission-free and longer battery life. The incorporation of an emission-free system enables the operator to work in an environment free from exhaust fumes. In addition, the electrical drive reduces energy costs by up to 90% in comparison to diesel alternatives, further promoting the growth of the market. Consequently, analysis portrays that the ability of these cranes to provide emission-free longer battery life at an affordable price serves as the key driver for the truck mounted crane market. For instance, in October 2022, Hiab launched HIAB ePTO 44, an electrically driven crane with second-generation technology. The product is designed with emission-free control and improved battery life, thus contributing considerably to promoting the truck mounted crane market.

Hydraulic cranes are predicted to witness the fastest CAGR in the truck mounted crane market during the forecast period. This is attributed to the ability of hydraulic cranes to generate large amounts of power and maneuver heavy loads, eliminating the need for gears and pulleys. In addition, they are lightweight and easy to maintain in comparison to conventional cranes which in turn further accelerates the market. Moreover, analysis shows that they are gaining applications in many industrial settings for shipping containers, steel beams, concrete, and metal frames. Subsequently, the increasing adoption of these cranes in various industries and the ability to generate large amounts of power is expected to drive the hydraulic truck mounted crane market demand.

By Capacity :

The capacity segment is categorized into below 15 Ton, 15-30 Ton, 30-50 Ton, and above 50 Ton. The 15-30 ton capacity cranes accounted for the largest market share in 2024 as mid-capacity cranes are more portable and offer flexibility by rotating at 3600. Additionally, the cranes also provide enhanced stability and mobility in rough and narrow areas promoting the market. Moreover, mid-capacity cranes are extensively used in the transportation, construction, and logistics industries for loading and unloading goods. Furthermore, the integration of advanced technology including the Safety Eyes System to monitor the momentum during work is also propelling the market. Consequently, the emergence of advanced technologies and the ability of 15-30-ton capacity cranes to offer improved flexibility, stability, and mobility is driving the market growth. For instance, in January 2023, TADANO launched the TM-ZX1205HRS crane with a 12-ton capacity for the construction, transportation, and logistics industry. The crane is equipped with the advanced Safety Eyes System to monitor the work momentum, hence promoting the truck mounted crane market trends.

The 30–to 50-ton capacity crane is anticipated to witness the fastest CAGR in upcoming years in the truck mounted crane market. According to the truck mounted crane market analysis, a growing need for high-capacity cranes for various projects associated with metro systems, roads, waterways, trains, and refineries. Additionally, manufacturers are also implementing innovations to improve the performance and maneuverability of high-capacity truck mounted cranes by integrating advanced engines with low carbon emissions. Thus, the aforementioned factors are collectively contributing to fueling the market during the forecast period.

By End-Use Industry :

The end-use industry is divided into agriculture, construction, logistics and transportation, mining, and others. The construction industry accounted for the largest market share in 2024 owing to the ability of cranes to show improved performance at low maintenance along with reducing carbon emissions. Additionally, these cranes are designed to deliver strength to support the heaviest loads, reducing side oscillations, and thus improving the overall precision. Moreover, the emergence of advanced software to remotely monitor the crane performance to simplify maintenance planning and enhance uptime is driving the truck mounted crane market. Consequently, analysis shows that the aforementioned factors including software advancements, reducing carbon emissions, and high strength serve as the primary factors for these cranes in the construction industry. For instance, in February 2021, Hiab introduced EFFER 1000 to deliver improved performance with reduced emissions in the construction sector. The product encompasses an advanced Progress 2.0 control system to remotely monitor performance, thereby contributing to propelling the market.

The transportation industry is anticipated to witness the fastest CAGR in upcoming years. This is attributed to the increasing adoption of these cranes in the transportation industry to load and unload goods from one place to another. Additionally, the ability of truck mounted cranes to offer portability, ease of use, and sturdiness is increasing the adoption of truck mounted cranes in the transportation industry. Moreover, the development of advanced cranes to reduce downtime costs and improve productivity further promotes the growth of the market. In conclusion, the above-mentioned factors including improved portability, reduced downtime costs, and improved productivity are expected to fuel the demand for these cranes during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2024 valued at USD 4,134.33 Million and is projected to grow at a CAGR of 5.20% during the forecast period. This is attributed to the increasing need for truck mounted cranes in various industries including transportation and logistics. Additionally, the growing market trend in the region is also accredited to the early adoption of advanced technologies to facilitate real-time monitoring of the cranes by the operator. Moreover, the report analysis shows that the presence of key players in the region constantly applies innovations to launch advanced products to gain a competitive edge and also strengthen the market position. Consequently, the rising demand for these cranes from various industries and the presence of key manufacturers serve as the primary factors responsible for accelerating the truck mounted crane market trends in the region. For instance, in March 2023, Manitex International, Inc. launched the TC850 Series truck mounted crane to provide improved relative stiffness in long-reach applications. The crane is designed to meet the growing needs of various end-use industries, thus contributing considerably to propelling the market trends in the region.

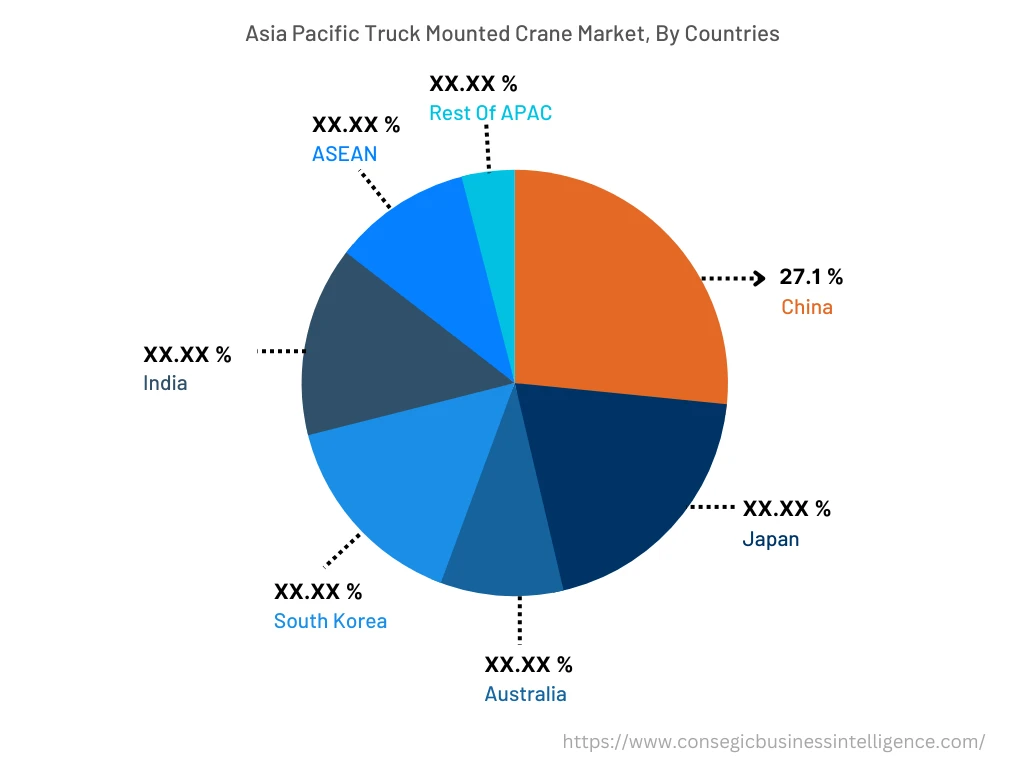

Asia Pacific is predicted to register the fastest CAGR of 5.9% in the truck mounted crane market during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 27.1% in the year 2024. This is endorsed by the expanding construction industry in countries including India and China owing to the easy availability of raw materials. Subsequently, the expansion of the construction industry raises the demand for these cranes for loading and unloading goods. Additionally, these cranes are also required for easy handling of construction equipment which is expected to further drive the market in Asia-Pacific countries.

Top Key Players & Market Share Insights:

The landscape of the Truck Mounted Crane Market is highly competitive. The key players in the market are adopting strategies for acquisitions mergers, and product innovations to stay competitive in the market. Following are the major market players that comprise the latest truck mounted crane industry concentration –

- Bocker Maschinenwerke

- Hiab (Cargotec Corporation)

- Elliott Equipment Company

- Furukawa UNIC

- Tadano Ltd.

- IMT

- KATO WORKS

- Liebherr

- Liugong Machinery

- Manitex International

- Manitowoc

Recent Industry Developments :

- In April 2023, Hiab received an order for the supply of highly durable, safe, and reliable MOFFETT truck mounted cranes for approximately USD 14.6 Million to the U.S.

- In November 2021, Hiab launched a 110-tonne meter (tm) truck mounted crane IQ.1188 HIPRO. The product is equipped with an advanced control system to remotely access the performance of the crane and also lower fuel consumption.

Key Questions Answered in the Report

What is a truck-mounted crane? +

A truck-mounted crane also termed as truck loader crane refers to a truck with a crane attached at the rear end to unload and load the goods from the truck’s deck.

What specific segmentation details are covered in the truck-mounted crane market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including product, terrain type, drive, capacity, and end-user. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the product segment has witnessed knuckle boom cranes as the dominating segment in the year 2024. The growth is endorsed by the ability of cranes to offer improved flexibility, versatility, and durability.

What specific segmentation details are covered in the truck mounted crane market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including product, terrain type, drive, capacity, and end-user. Each segment is projected to have the fastest-growing sub-segment fuelled by industry trends and drivers. For instance, in the terrain type segment, rough terrain is anticipated to witness the fastest CAGR growth during the forecast period. The growth is attributed to the ability of rough-terrain cranes to provide low axle weight and narrow transport width offering maximum lifting capacities.

What specific segmentation details are covered in the truck-mounted crane market report, and how does each dominating segment is influencing the demand globally? +

As aforementioned, each dominating segment is influencing the demand globally due to growing industrial needs. Moreover, fluctuation in demand being witnessed from different sectors is responsible for driving the truck-mounted crane market.