Bio-polypropylene Market Size:

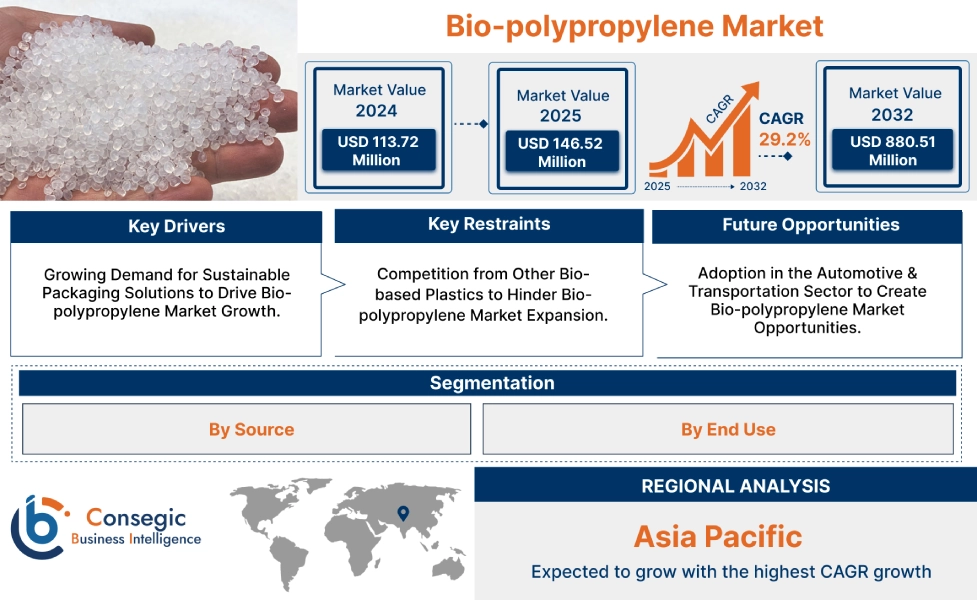

The Bio-polypropylene Market size is growing with a CAGR of 29.2% during the forecast period (2025-2032), and the market is projected to be valued at USD 880.51 Million by 2032 from USD 113.72 Million in 2024. Additionally, the market value for 2025 is attributed to USD 146.52 Million.

Bio-polypropylene Market Scope & Overview:

Bio-polypropylene (Bio-PP) is an advanced thermoplastic polymer that serves as a sustainable alternative to conventional polypropylene, which is traditionally derived from fossil fuels. This innovative material is produced from renewable biological resources, such as various plant materials, agricultural residues, corn, and sugarcane. By utilizing these bio-based feedstocks, biobased polypropylene significantly reduces reliance on petroleum resources and contributes to a lower carbon footprint during its production phase. This compound maintains comparable mechanical properties to its traditional counterpart, including durability, lightweight characteristics, and chemical resistance, allowing for its integration into existing manufacturing processes and a wide range of applications.

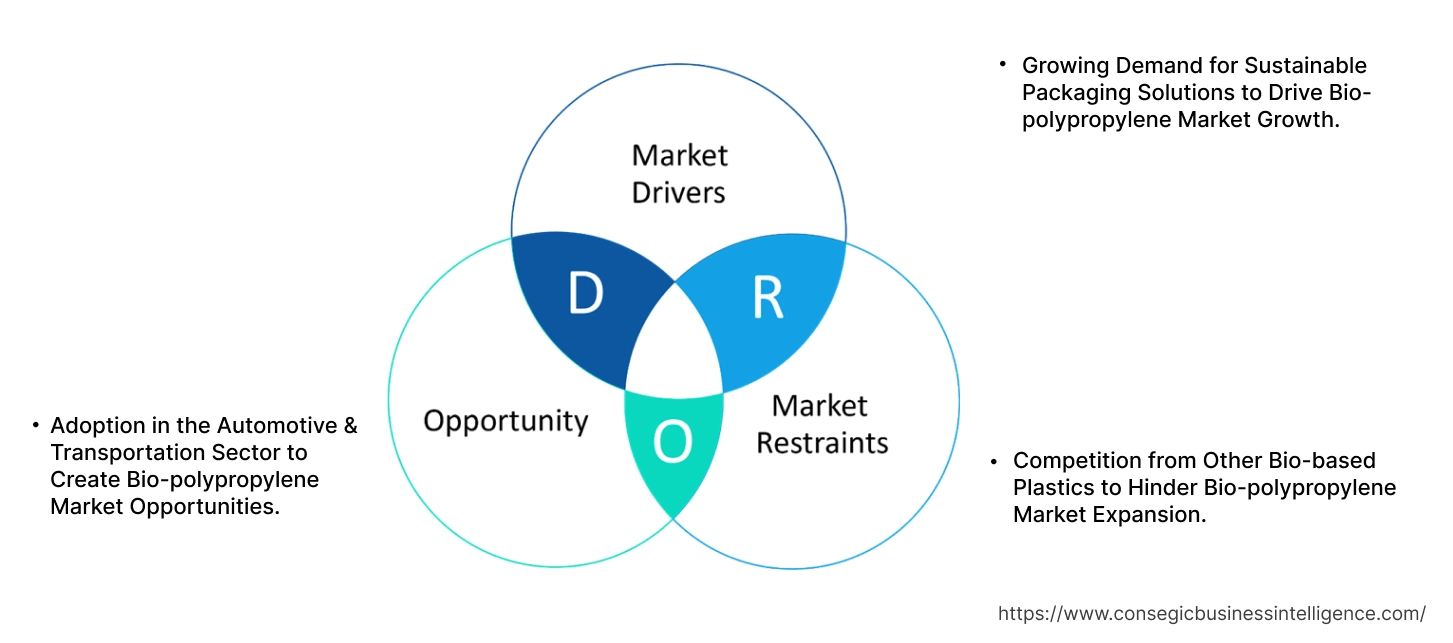

Bio-polypropylene Market Dynamics - (DRO) :

Key Drivers:

Growing Demand for Sustainable Packaging Solutions to Drive Bio-polypropylene Market Growth.

As consumer awareness regarding plastic pollution and environmental impact rises, various sectors are actively seeking eco-friendly alternatives to conventional plastics. Bio-polypropylene, which is derived from renewable sources, offers comparable mechanical properties to traditional polypropylene, including durability and barrier protection, while significantly reducing carbon footprint acts as an alternative to conventional plastic. This makes it a suitable choice for brands aiming to meet stringent sustainability goals and satisfy the growing consumer preference for greener packaging which benefits market revenue.

- For instance, in 2023, Bonnysa and ITC collaborated to launch a new lid for Bonnysa's grated tomato, featuring biocircular polypropylene derived from organic waste, a sustainable initiative that reduces the packaging's carbon footprint by offsetting emissions through plant-based carbon capture and rapid crop regeneration.

Thus, as per the analysis, the growing market for this material in the packaging sector is fueling significant bio-polypropylene market growth.

Key Restraints:

Competition from Other Bio-based Plastics to Hinder Bio-polypropylene Market Expansion.

Wide availability of alternatives poses as significant competition to bio-polypropylene market demand, impeding market growth. Polymers such bio-based Polyethylene Terephthalate (bio-PET) amongst others, provide specific performance advantages and more competitive pricing for certain applications. These alternatives are readily available in the market and sometimes produced at lower costs, presenting a viable substitute for sectors seeking to transition away from fossil-based materials. This existing competition among various sustainable plastic options diverts investment and market share away from biobased polypropylene. This availability and growing commercialization of substitutes create a competitive landscape and support players to adopt alternatives. As a result, the above-mentioned factors are limiting the bio-polypropylene market expansion.

Future Opportunities :

Adoption in the Automotive & Transportation Sector to Create Bio-polypropylene Market Opportunities.

As the global automotive sector, particularly the rapidly expanding electric vehicle segment, prioritizes sustainability and lightweighting, wherein biobased polypropylene offers a compelling solution. Its comparable performance to conventional polypropylene, coupled with a reduced carbon footprint, makes it suitable for components such as interior parts, dashboards, door panels, battery casings, and even select exterior elements. This shift allows automakers to meet stringent emissions regulations, improve fuel efficiency, extend EV range, and cater to growing consumer demand for more environmentally friendly vehicles, thereby directly driving the market forward.

- For instance, in 2025, the Council of the European Union has adopted a new end-of-life vehicles (ELV) regulation aiming to boost circular design and the use of recycled materials, including plastics like bio-polypropylene, across Europe's automotive sector.

Henceforth, adoption of biobased polypropylene in automotive and transportation is creating lucrative bio-polypropylene market opportunities over the forecast period.

Bio-polypropylene Market Segmental Analysis :

By Source:

Based on source, the market is categorized into sugarcane, starch, biomass, edible & non-edible oils, and others.

Trends in Source:

- A trend towards improving the efficiency of the process related to the conversion of sugarcane-derived ethanol into bio-propylene to reduce production costs is growing.

- A strong trend towards utilizing used cooking oils and other non-edible waste oils to minimize competition with food sources and maximize greenhouse gas reduction is rising.

The Sugarcane segment accounted for the largest Bio-polypropylene market share in 2024.

- Sugarcane stands as a widely used feedstock in the production of bio-polypropylene primarily due to the existence of a well-established infrastructure that efficiently converts sugarcane's sucrose into ethanol which is crucial precursor for propylene.

- This robust supply chain, particularly prevalent in major sugarcane-producing regions, supports sugarcane's dominant share within the bio-based polypropylene feedstock market.

- Its prominence is further supported by fermentation technologies involved in this conversion process, offering both a competitive cost base and a consistently reliable supply of the raw material.

- Thus, as per the bio-polypropylene market analysis, the sugarcane segment is dominating the bio-polypropylene market demand.

Edible & Non-edible Oils segment is expected to grow at the fastest CAGR over the forecast period.

- The edible and non-edible oils segment encompasses a diverse range of lipid-based feedstocks, including both virgin vegetable oils alongside increasingly important waste streams such as used cooking oils (UCO).

- These oils are processed through hydrotreating to yield bio-naphtha or directly converted into bio-propylene, serving as base monomers for compound production.

- Used cooking oil is gaining significant adoption as a feedstock due to its waste-derived nature, which offers substantial potential for reducing greenhouse gas emissions compared to fossil-based alternatives.

- For instance, in 2024, Braskem launched WENEW, an innovative bio-circular polypropylene (PP) derived from used cooking oil, representing a significant focus on replacing fossil fuels and promoting a more sustainable economy within the restaurant and snack food sectors.

- Overall, considering the aforementioned factors the edible & non-edible oils segment is expected to grow over the forecast period.

By End Use:

Based on end use, the market is categorized into packaging, automotive & transportation, consumer goods, textile, medical & healthcare, and others.

Trends in the End Use:

- There's a growing trend of designing packaging entirely from biobased polypropylene to facilitate easier recycling within existing PP streams and reduce material complexity.

- Driven by stringent food contact regulations and consumer demand, biobased polypropylene is seeing greater use in food wraps, rigid containers, and caps for enhanced sustainability.

The Packaging segment accounted for the largest Bio-polypropylene market share of 39.63% in 2024.

- This segment is the largest consumer of biobased polypropylene encompassing a broad spectrum of applications from flexible films for food wraps and pouches to rigid containers, bottles, and caps.

- Biobased polypropylene is suitable for these uses due to its inherent barrier properties, lightweight nature, and adaptability to various processing techniques such as film extrusion and injection molding.

- The segment's significant growth is primarily fueled by the growing emphasis on eco-friendly packaging solutions from both consumers and increasingly stringent regulatory bodies, presenting material as a direct and highly effective sustainable alternative to conventional polypropylene packaging.

- For instance, in 2021, PACCOR partnered with Orkla to produce 100% biobased polypropylene packaging products, derived from renewable resources and following the ISCC certified mass balance principle, with testing initiated in 2021 at its Finnish production site and further certification at its German facility, all aimed at accelerating decarbonization efforts.

- Thus, as per the aforementioned factors, the packaging segment is dominating market growth.

The Automotive segment is expected to grow at the fastest CAGR over the forecast period.

- Bio-polypropylene is increasingly integrated into various vehicle components, including interior parts such as dashboards, door panels, and seat elements, as well as exterior applications such as bumpers and body panels among others.

- The high value placed on this material is due to its inherent lightweight nature, exceptional durability, and resistance to chemicals.

- The escalating global production of electric vehicles coupled with increasingly stringent regulations concerning fuel efficiency and emissions, is a primary driver for the need for lightweight, sustainable materials such as biobased polypropylene as it directly contributes to reducing overall vehicle weight and carbon footprint.

- Thus, based on the market analysis, automotive is the fastest growing segment.

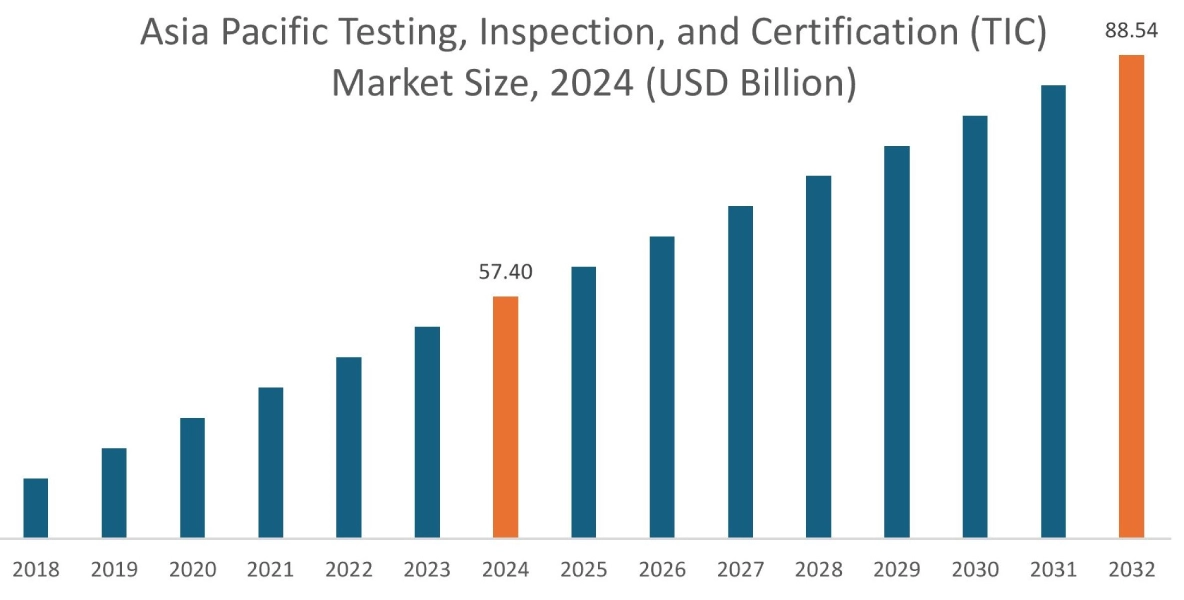

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

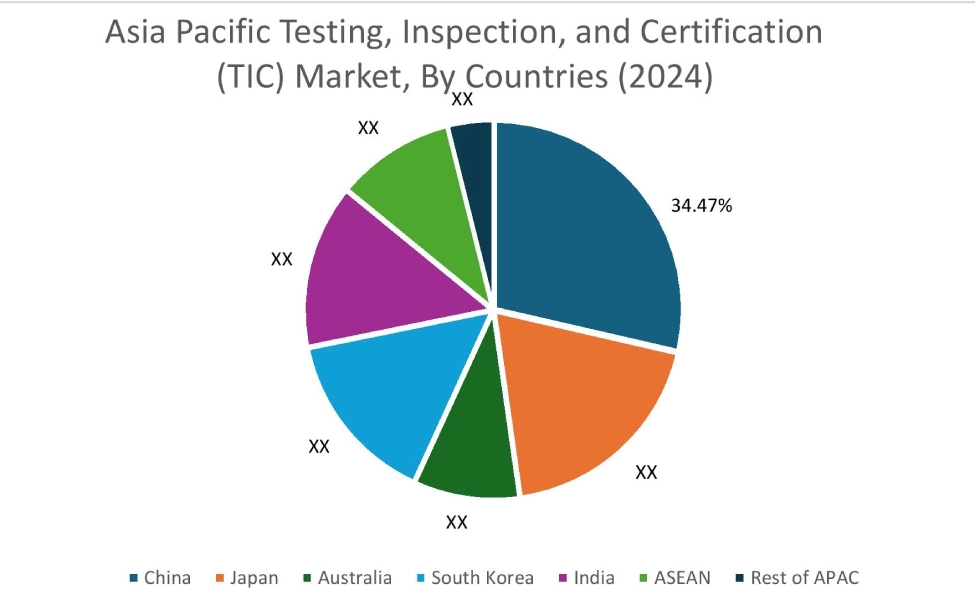

In 2024, Asia Pacific accounted for the highest market share at 41.49% and was valued at USD 47.18 Million and is expected to reach USD 306.92 Million in 2032. In Asia Pacific, the China accounted for a market share of 39.31% during the base year of 2024. The upwards trajectory of regional share is primarily driven by growing manufacturing base that spans plastics, automotive, and consumer goods sectors, creating a large industrial requirement for sustainable materials. Furthermore, increasing awareness of environmental issues coupled with growing government support for sustainable practices are collectively accelerating the adoption of bio-polypropylene across diverse sectors throughout the Asia Pacific region. The region also sees increasing adoption in the automotive sector, particularly for electric vehicles.

- For instance, the Ministry of Heavy Industries, India introduced the PM E-DRIVE Scheme in 2024, allocating USD 1.28 billion to accelerate the growth of India's Electric Vehicle (EV) ecosystem. This initiative aims to foster electric mobility nationwide and reduce the country's dependence on fossil fuels.

Thus, as per analysis, these factors collectively position Asia Pacific as a key region for the market.

In Europe, the bio-polypropylene industry is experiencing the fastest growth with a CAGR of 34.3% over the forecast period owing to its stringent environmental regulations and robust initiatives championing circular economy models. European policies and evolving consumer requirements strongly support sustainable and circular solutions, consequently compelling sectors across the continent to integrate bio-based polymers into their product lines. Furthermore, the region's growing automotive sector, with its commitment to lightweighting vehicles and substantially reducing emissions, serves as a crucial driver for the increasing adoption of Bio-PP in various vehicle components. Collectively these factors fuel European bio-polypropylene market analysis.

North American market is characterized by high consumer environmental awareness and a strong emphasis on sustainability, which translates into significant demand for eco-friendly products. This necessity is further amplified by continuous technological advancements in bio-based materials. Consequently, there's a growing adoption of Bio-PP within key sectors, notably automotive and packaging where lightweight materials and sustainable packaging solutions are increasingly prioritized. Complementing this need is a rising trend of investments in developing and scaling up bio-based polymer production capabilities within North America, ensuring a robust supply to meet the expanding market needs. Hence, as per analysis, these factors collectively present a positive impact on the regional bio-polypropylene market trends.

The market in Latin America is defined by the region's increasing focus on sustainable development and the implementation of environmental regulations. Brazil stands out as a key player in this market, leveraging its abundant sugarcane resources as a crucial feedstock for bio-based polymers, including Bio-PP. Major producers like Braskem are active in this region, utilizing these renewable resources to produce sustainable plastics. Furthermore, the expanding packaging and automotive sectors across Latin America, coupled with a rising environmental consciousness among consumers and manufacturers, will further propel bio-polypropylene market trends.

The market in Middle East and Africa is characterized by substantial government investments aimed at diversifying economies and actively promoting sustainable industrial practices in countries like Saudi Arabia and the UAE. These nations are spearheading new projects and initiatives that specifically prioritize the incorporation of sustainable materials, consequently leading to an increasing demand for Bio-PP in sectors such as packaging and various industrial applications. Additionally, rising environmental awareness and growing foreign investments in green technologies present promising future opportunities for market expansion across the broader MEA region.

Top Key Players and Market Share Insights:

The Global Bio-polypropylene Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Bio-polypropylene market. Key players in the Bio-polypropylene industry include

- Braskem (Brazil)

- LyondellBasell Industries Holdings B.V. (U.S.)

- FKuR Kunststoff GmbH (Germany)

- Mitsui Chemicals, Inc. (Japan)

- Borealis (Austria)

- SABIC (Saudi Arabia)

Bio-polypropylene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 880.51 Million |

| CAGR (2025-2032) | 29.2% |

| By Source |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Bio-polypropylene market? +

In 2024, the Bio-polypropylene market is USD 113.72 Million.

Which is the fastest-growing region in the Bio-polypropylene market? +

Europe is the fastest-growing region in the Bio-polypropylene market.

What specific segmentation details are covered in the Bio-polypropylene market? +

By Source and End Use segmentation details are covered in the Bio-polypropylene market.

Who are the major players in the Bio-polypropylene market? +

Braskem (Brazil), LyondellBasell Industries Holdings B.V. (U.S.), Mitsui Chemicals, Inc. (Japan) are some of the major players in the market.