Testing, Inspection, and Certification (TIC) Market Size:

Testing, Inspection, and Certification (TIC) Market size is estimated to reach over USD 368.91 Billion by 2032 from a value of USD 252.89 Billion in 2024 and is projected to grow by USD 260.42 Billion in 2025, growing at a CAGR of 4.4% from 2025 to 2032.

Testing, Inspection, and Certification (TIC) Market Scope & Overview:

Testing, inspection, and certification (TIC) refers to the process of ensuring the safety, integrity, and quality of various types of goods and services across several industries. Moreover, TIC provides conformity assessment in emerging areas such as operational efficacy, research & development (R&D), and others. Moreover, TIC has several applications across numerous sectors such as automotive, healthcare, oil & gas, and others, which are further driving the testing, inspection, and certification (TIC) market.

How is AI Transforming the Testing, Inspection, and Certification (TIC) Market?

The use of AI is emerging in testing, inspection, and certification (TIC) market, specifically for AI enhancing efficiency, accuracy, and automation across various TIC processes. This includes areas such as predictive analytics for defect detection, automated visual inspections, and streamlining compliance processes.

In addition, AI algorithms can analyze vast datasets from testing and inspection processes to identify patterns, predict failures, and assess risks in a much faster and efficient manner. Furthermore, AI-powered computer vision systems offer improved visual inspections, detecting defects, anomalies, and deviations in products and infrastructure with greater speed and accuracy as compared to manual testing and inspection. Consequently, the above factors are expected to positively impact the market growth in upcoming years.

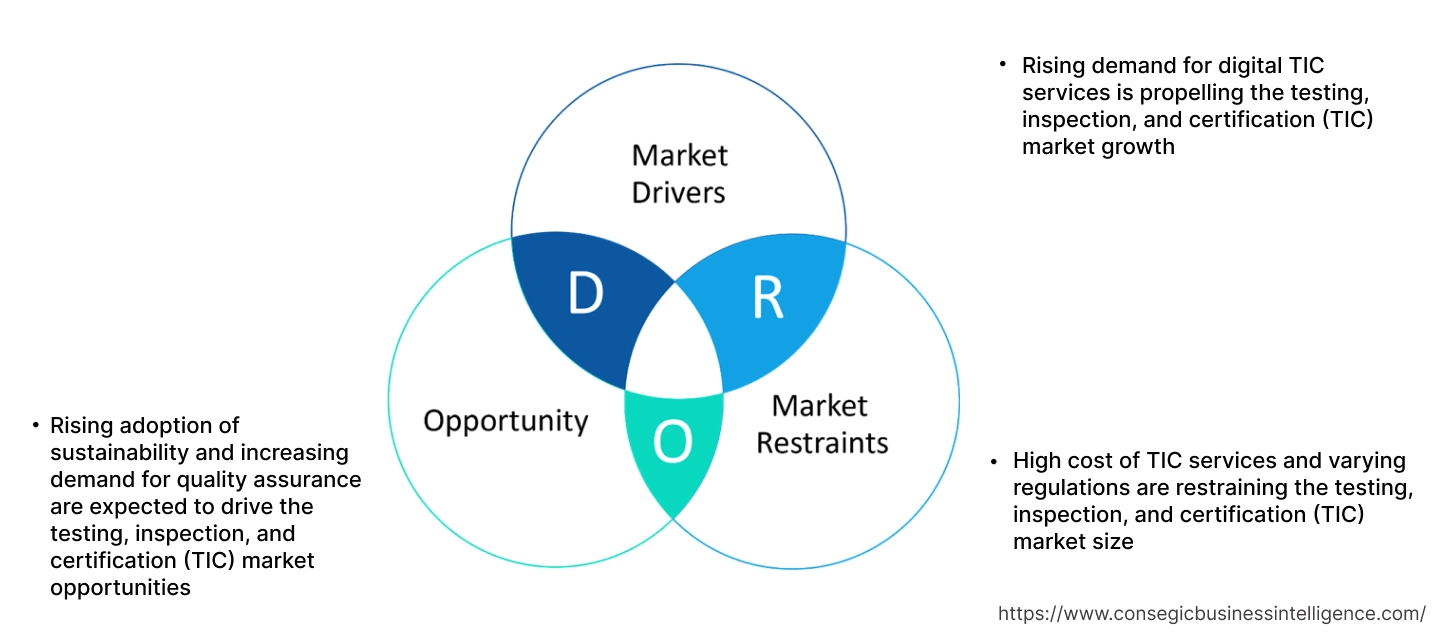

Testing, Inspection, and Certification (TIC) Market Dynamics - (DRO) :

Key Drivers:

Rising demand for digital TIC services is propelling the testing, inspection, and certification (TIC) market growth

Digital TIC services refer to the integration of digital technologies to enhance the traditional TIC process. This service utilizes advanced technologies such as the internet of things (IoT), artificial intelligence, and cloud computing for data collection, remote testing and inspection, and others. Moreover, digital inspection methods enable remote inspections and predictive analytics while reducing the need for on-site presence.

- For instance, Boston Consulting Group offers services related to TIC, specifically within their technology, media, and telecommunications practice.

Thus, the increasing adoption of digital TIC services is propelling the testing, inspection, and certification (TIC) market expansion.

Key Restraints:

High cost of TIC services and varying regulations are restraining the testing, inspection, and certification (TIC) market size

TIC process includes several specialized personnel and rigorous testing procedures, which makes TIC services expensive, particularly for small and medium enterprises. Moreover, the prevalence of varying regulations across multiple regions worldwide can lead to increased complexity and high costs, which further impact the market growth.

Additionally, TIC services also need to comply with varying regulations across numerous industries, which further adds to operational costs and investment in specialized expertise. Therefore, the aforementioned factors are hindering the market growth.

Future Opportunities :

Rising adoption of sustainability and increasing demand for quality assurance are expected to drive the testing, inspection, and certification (TIC) market opportunities

TIC services enhance sustainability by ensuring products and processes meet regulatory compliance, in turn validating environmental, social, and governance claims. Moreover, TIC providers play a crucial role in verifying the sustainability of supply chains by ensuring the ethical sourcing of raw materials. Additionally, it also helps companies facilitate the adoption of innovative solutions for environmental challenges associated with various types of industries such as automotive, healthcare, oil and gas, and others.

- For instance, Intertek Group provides TIC services, ranging from testing, analysis, to assurance and certification, which help industries meet environmental, social, and governance requirements.

Therefore, rising adoption of sustainability and increasing need for quality assurance are projected to boost the testing, inspection, and certification (TIC) market opportunities during the forecast period.

Testing, Inspection, and Certification (TIC) Market Segmental Analysis :

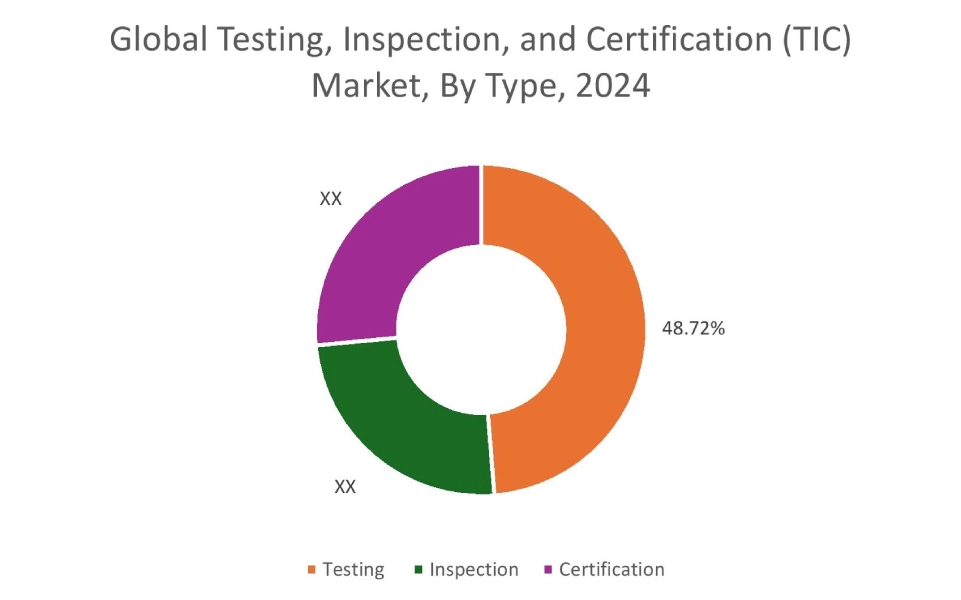

By Type:

Based on type, the market is segmented into testing, inspection, and certification (TIC)

Trends in the type:

- There is a rising trend towards the adoption of advanced technologies such as AI-driven inspections, which is further driving the market.

- Increasing trend in adoption of certification services to ensure that products and systems meet established standards for safety, quality, and performance is driving the testing, inspection, and certification (TIC) market growth.

Testing segment accounted for the largest revenue share of 48.72% in the overall testing, inspection, and certification (TIC) market share in 2024.

- Testing services are vital for ensuring the safety, quality, and compliance of products and systems across several industries.

- Moreover, testing involves several processes such as quality assurance, safety validation, risk mitigation, verification and compliance, and others.

- For instance, CWM International offers testing services to verify physical, chemical, and performance-related properties of products, materials, and services to ensure safety and high quality.

- Hence, the rising adoption of testing services is driving the testing, inspection and certification (TIC) market growth.

Certification segment is anticipated to register a substantial CAGR growth during the forecast period.

- In TIC, certification plays an essential role in verifying that products and systems meet established standards for safety, quality, and performance.

- Moreover, TIC certifications build confidence among consumers, assuring them that the product or services they purchase meet the established standard of quality and safety.

- For instance, in December 2024, Amazon approved Certified Laboratories as a TIC organization for its ophthalmic and skin-lightening products. Moreover, using certification of Amazon-approved TIC ensures the product meets the required standards.

- Hence, the above factors are projected to drive the testing, inspection, and certification (TIC) market size during the forecast period.

By Sourcing Type:

Based on sourcing type, the market is segmented into in-house and outsourced.

Trends in the sourcing type:

- Increasing adoption of outsourced sourcing type due to factors such as increased cost savings, access to expertise, and others.

- Factors including rising need for quality control, increased regulatory requirements, and improved product quality are driving the segment development.

The outsourced segment accounted for the largest revenue share in the overall market in 2024, and it is anticipated to register a significant CAGR growth during the forecast period.

- In TIC, outsourcing involves contracting with other providers to carry out TIC-related activities, which include ensuring products, systems, and processes meet specified standards and regulations.

- Moreover, outsourcing offers a wide range of benefits, including cost savings, access to expertise, ease of navigating regulations, and others.

- Additionally, there are three types of outsourcing, such as onshore outsourcing, offshore outsourcing, and near-shore outsourcing, to ensure compliance with various regulations and standards.

- For instance, Applus+, a provider of testing and certification, offers outsourcing services to various sectors, including automotive, energy, and others. Moreover, they also outsource for calibration, GMP production, and project management, specifically in TIC projects.

- Therefore, the rising adoption of outsourcing services for TIC is projected to drive the testing, inspection, and certification (TIC) market trends during the forecast period.

By End User:

Based on end user, the market is segmented into automotive, healthcare, oil & gas, aerospace, construction, food & beverage, chemical, and others.

Trends in the end user:

- Increasing adoption of TIC services in the automotive industry for ensuring quality control and improved vehicle performance is driving the testing, inspection, and certification (TIC) market trends.

- Factors such as IoT-enabled testing, enhanced remote testing, and improved efficiency are driving the adoption of TIC services in the healthcare sector.

Automotive segment accounted for a substantial revenue in the overall testing, inspection, and certification (TIC) market share in 2024.

- In automotive sector, a wide range of tests are conducted, including crash tests, harshness tests, noise and vibration tests, and others to ensure vehicles’ performance.

- Moreover, inspection involves visual and functional checks to identify any potential issues and ensure regulatory compliance.

- In addition, certification bodies in the automotive industry ensure that the processes are reliable and meet the international standards according to the International Organization for Standardization.

- Therefore, according to the market analysis, the above factors are driving the testing, inspection, and certification (TIC) market.

The healthcare segment is anticipated to register the fastest CAGR growth during the forecast period.

- In healthcare sector, TIC involves a wide range of services that are designed to ensure consistent quality standards throughout the healthcare product lifecycle.

- Moreover, TIC services also ensure the safety, efficacy, and quality of medical devices, pharmaceuticals, as well as healthcare facilities.

- These services involve rigorous TIC processes to verify regulatory compliance and standards for companies.

- For instance, PwC offers a wide range of TIC services for the healthcare sector. These services are focused on compliance with regulations, standards, and enhanced practices.

- Hence, according to the testing, inspection, and certification (TIC) market analysis, the above factors are projected to boost the testing, inspection, and certification (TIC) market during the forecast period.

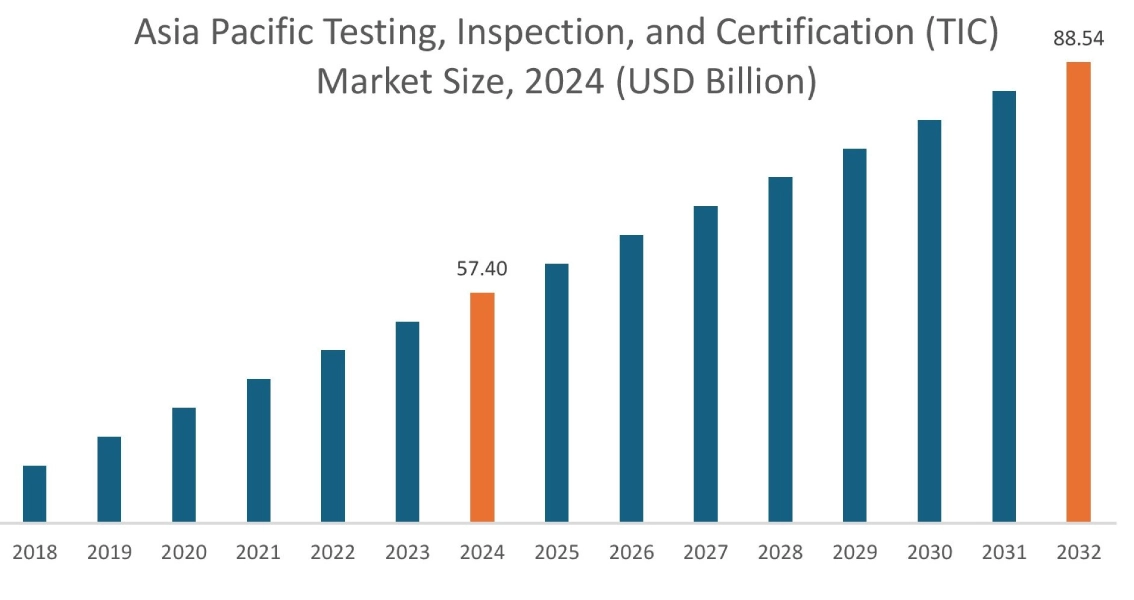

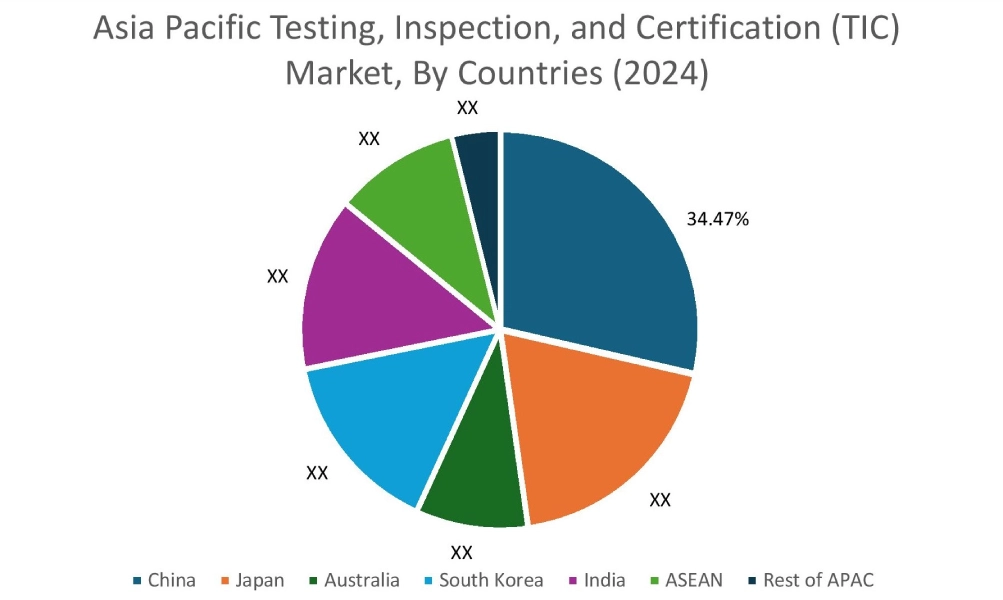

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 57.40 Billion in 2024. Moreover, it is projected to grow by USD 59.39 Billion in 2025 and reach over USD 88.54 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.47%. As per the testing, inspection, and certification (TIC) market analysis, the adoption of TIC services in the Asia-Pacific region is primarily driven by the rising adoption for sustainability in automotive, healthcare, oil and gas, and other sectors in the region. Additionally, the rising adoption of technologies such as AI-driven testing & inspection, along with increasing trend of outsourcing TIC services, are further accelerating the testing, inspection, and certification (TIC) market expansion.

- For instance, in November 2022, the Bureau of Indian Standards and the National Standards Body of India signed a memorandum of understanding (MoU) with the testing, inspection, and certification (TIC) Council of India. Moreover, this MoU is focused on promoting the implementation of standards and ensuring quality in laboratories.

Europe is estimated to reach over USD 128.75 Billion by 2032 from a value of USD 89.53 Billion in 2024 and is projected to grow by USD 92.09 Billion in 2025. In Europe, factors including rising progressions in AI-driven inspections and increasing need to meet regulatory requirements in automotive, healthcare, aerospace, and other sectors to ensure improved efficiency and quality are contributing to the testing, inspection, and certification (TIC) market demand in the region.

- For instance, Mistras Group offers testing, inspection, and certification (TIC) services. Moreover, the company also offers a wide range of TIC solutions, including traditional and advanced non-destructive testing.

Additionally, the regional analysis depicts that the increasing adoption of IoT-enabled testing, rising adoption of sustainability, and increasing developments associated with the automotive, healthcare, and aerospace industries are driving the testing, inspection, and certification (TIC) market demand in North America. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as significant investments in automotive, oil & gas, construction, and other industrial sectors, increasing technological advancements, and growing need for enhanced quality control, among others.

Top Key Players and Market Share Insights:

The global testing, inspection, and certification (TIC) market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the testing, inspection, and certification (TIC) industry. Key players in the testing, inspection, and certification (TIC) industry include-

- Mistras Group (U.S.)

- SGS SA (Switzerland)

- Applus (Spain)

- Element Materials Technology (UK)

- DEKRA (Germany)

- Eurofins Scientific (Luxembourg)

- Bureau Veritas (France)

- ALS (Australia)

- DNV GL (Norway)

- Intertek Group plc (UK)

Recent Industry Developments :

Product Launch:

- In January 2025, SGS announced the launch of NATURE Services, an initiative within its IMPACT NOW initiative, which is focused on providing testing, inspection, and certification (TIC) services to adopt sustainability.

Testing, Inspection, and Certification (TIC) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 368.91 Billion |

| CAGR (2025-2032) | 4.4% |

| By Type |

|

| By Sourcing Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the testing, inspection, and certification (TIC) market? +

The testing, inspection, and certification (TIC) market was valued at USD 252.89 Billion in 2024 and is projected to grow to USD 368.91 Billion by 2032.

Which is the fastest-growing region in the testing, inspection, and certification (TIC) market? +

Asia-Pacific is the region experiencing the most rapid growth in the testing, inspection, and certification (TIC) market.

What specific segmentation details are covered in the testing, inspection, and certification (TIC) report? +

The testing, inspection, and certification (TIC) report includes specific segmentation details for type, sourcing type, end user, and region.

Who are the major players in the testing, inspection, and certification (TIC) market? +

The key participants in the testing, inspection, and certification (TIC) market are Mistras Group (U.S.), SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Bureau Veritas (France), ALS (Australia), DNV GL (Norway), Intertek Group plc (UK), Applus (Spain), Element Materials Technology (UK), DEKRA (Germany), and others.