EMS-ODM Market Size :

EMS-ODM Market size is estimated to reach over USD 1,164.62 Billion by 2031 from a value of USD 563.72 Billion in 2022 and is projected to grow by USD 599.43 Billion in 2023, growing at a CAGR of 8.7% from 2023 to 2031.

EMS-ODM Market Scope & Overview :

EMS (Electronics Manufacturing Service) refers to the term utilized for companies associated with designing, manufacturing, testing, distributing, and providing repair services for electronic components and assemblies for original equipment manufacturers. Meanwhile, ODM (Original Design Manufacturer) refers to companies that are responsible for designing and producing products that are marketed and sold under the name of the Original Equipment Manufacturer (OEM).

EMS-ODM Market Insights :

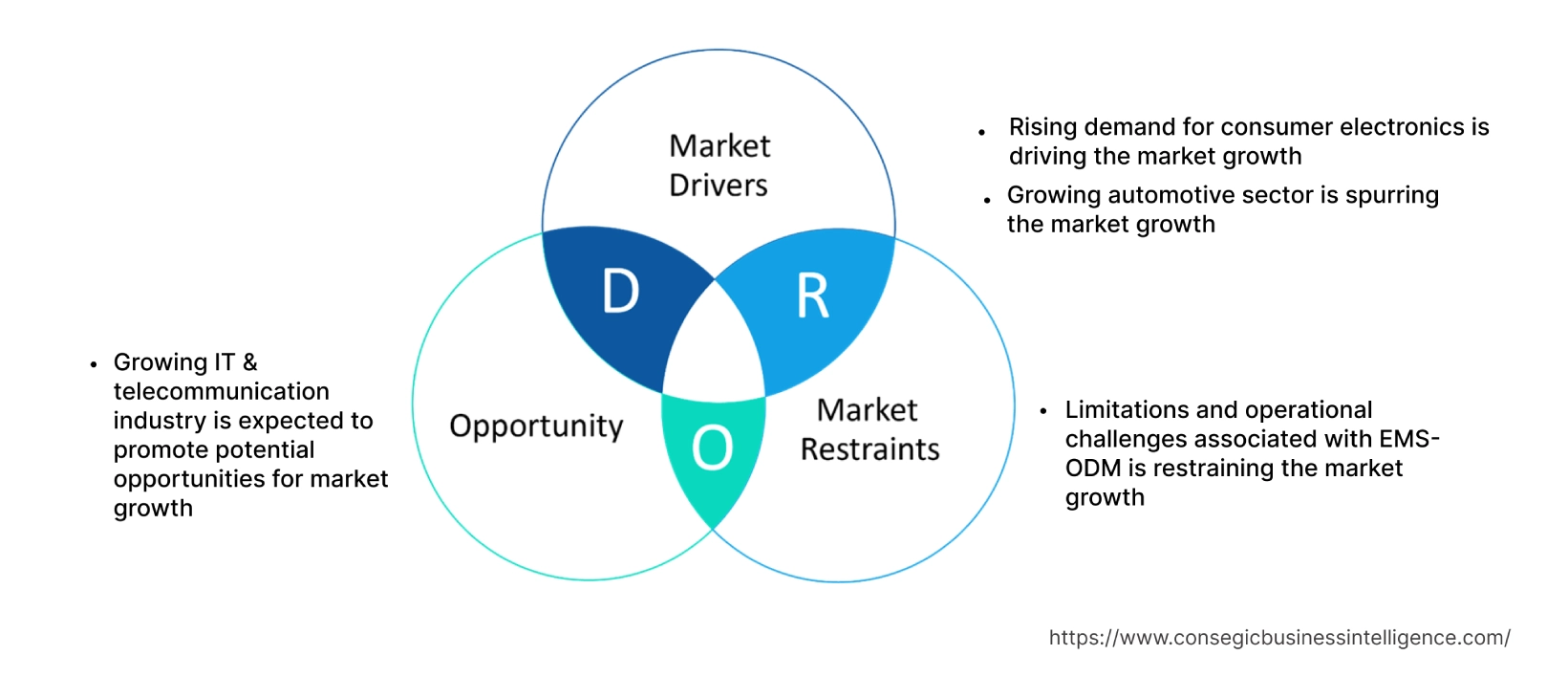

EMS-ODM Market Dynamics - (DRO) :

Key Drivers :

Rising demand for consumer electronics

Electronics Manufacturing Service (EMS) is primarily utilized for providing end-to-end services including materials procurement, smart manufacturing, testing, assembly, global logistics, and after-sales for clients involved in global consumer products including smartphones, wearables, computers, and others. Moreover, EMS services are often employed by consumer electronic brands for outsourcing manufacturing and reducing the cost of production. Moreover, the benefits of EMS including diversified business mode and end-to-end manufacturing capabilities are primary determinants for increasing its deployment by consumer electronic brands.

Factors including the growing adoption of laptops and other consumer devices, and advancement in consumer electronics including the adoption of IoT and AI are key prospects driving the expansion of the consumer electronics sector.

According to the Association of German Banks, the manufacturing, and sales of the electronics sector in Germany depicted a rise of 10% in 2021 as opposed to 2020. Further, according to the Brazilian Electrical and Electronics Industry Association (ABINEE), the value of the electrical and electronics sector in Brazil reached up to USD 42.2 billion in 2022, observing a rise of 8% as compared to USD 39.2 billion in 2021. Analysis of market trends concludes that the growth of the consumer electronics sector is driving the demand for EMS-ODM services, in turn proliferating the EMS-ODM market demand.

Growing automotive sector.

The automotive sector has stringent requirements in terms of operations and processes, quality, and on-time deliveries. EMS is often used in the automotive sector for offering various services ranging from design, engineering, and prototyping to new product innovation and mass production of automobile electronic components. Moreover, EMS covers the design, manufacturing, assembly, testing, and distribution of various automotive electronic systems including ADAS, power modules, infotainment systems, and other related systems.

Factors including the advancements in autonomous driving systems, and increasing production of automobiles are key prospects fostering the expansion of the automotive sector. For instance, according to the European Automobile Manufacturers Association, the production of passenger cars in the European Union reached 10.9 million in 2022, depicting an increase of 8.3% as compared to 2021.

Additionally, according to the International Organization of Motor Vehicle Manufacturers, the overall automotive production in North America reached 14,798,146 units in 2022, witnessing a rise of 10% from 13,467,065 units in 2021.

Analysis of market trends concludes that the expansion of the medical sector is increasing the adoption of electronics manufacturing services for various components of automobile electronics systems, in turn driving the proliferation of the EMS-ODM market growth.

Key Restraints :

Limitations and operational challenges.

The implementation of EMS-ODM services is associated with certain limitations and operational challenges, which is a key factor limiting market expansion.

For instance, the primary limitation associated with electronic manufacturing services includes decreased operating margins. Moreover, EMS firms are susceptible to risks associated with investment in operations and management of global manufacturing processes. Additionally, EMS companies must balance external and internal resources while remaining within international standards, which makes traceability and compliance issues an additional operational challenge.

Further, partnering with ODM (original design manufacturer) is also associated with certain limitations and operational challenges including reduced control over design and manufacturing processes, quality control issues, intellectual property concerns, cost overruns, and others. Hence, the above limitations and operational challenges associated with employing EDM-ODM services are restraining the proliferation of the EMS-ODM market demand.

Future Opportunities :

Growing IT & telecommunication industry.

The growth of the IT & telecommunication sector is expected to present potential opportunities for the growth of the EMS-ODM market. EMS is often used in the IT & telecommunication sector for printed circuit board assembly (PCBA), new product introduction, functional tests, product certification, sourcing, and other related functionalities associated with telecom devices. Moreover, electronics manufacturing services are used for the design, manufacturing, testing, and delivery of multiple telecom devices including RF-hardened and rugged devices, 4G/5G repeaters, fiber-optic devices, servers & storage equipment, and others.

Factors including the increasing deployment of 5G infrastructure, the growing need for high-speed communication, and cloud services are among the key prospects driving the expansion of the IT & telecommunication sector.

For instance, Telefonica deployed its 5G services to 1,400 municipalities in Spain in 2022, with the target of reaching 2,400 municipalities by the end of 2023, representing an incline of 71.4%. Analysis of market trends concludes that the proliferation of the IT & telecommunication sector is anticipated to increase the utilization of EMS for designing, manufacturing, testing, and delivery of several telecommunication devices, which will drive EMS-ODM market opportunities during the forecast period.

Global EMS-ODM Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 1,164.62 Billion |

| CAGR (2023-2031) | 8.7% |

| By Type | Electronic Manufacturing Service (EMS) and Original Design Manufacturer (ODM) |

| By Enterprise Size | Large Enterprise and Small & Medium Enterprise |

| By Application | Electronic Devices, Servers and Storage, Networking, Medical Instruments, and Others |

| By End-User | Consumer Electronics, IT & Telecommunication, Medical, Automotive, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Sanmina Corporation, Jabil Inc., Flex Engineering Services, UMC Electronics Co. Ltd., Zoliner Elektronik AG, Shenzhen Kaifa Technology Co. Ltd., Universal Scientific Industrial Co. Ltd., Kinpo Group, Foxconn Hon Hai Technology Group, Qisda Corporation |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

EMS-ODM Market Segmental Analysis :

By Type :

Based on the type, the market is bifurcated into electronic manufacturing service (EMS) and original design manufacturer (ODM). In 2022, the electronic manufacturing service (EMS) segment accounted for the highest EMS-ODM market share. Electronics manufacturing service (EMS) involves companies associated with designing, manufacturing, testing, distributing, and providing repair services for electronic components and assemblies for original equipment manufacturers. Moreover, the deployment of electronic manufacturing services offers several benefits including diversified business mode, end-to-end manufacturing capabilities, improved inventory management, reduced operational costs, lower production times, and others. The above benefits of electronic manufacturing services are further increasing the utilization in consumer electronics, IT & telecommunication, automotive, and other related industries.

For instance, Sanmina Corporation offers electronic manufacturing services including design & engineering, prototyping, testing, supply chain management, system manufacturing, and aftermarket services. Further, the company offers electronic manufacturing services for automotive, medical, IT & telecommunication, and other industrial sectors. Analysis of market trends concludes that the increasing prevalence of electronic manufacturing service providers for automotive, telecommunication, and other industrial sectors is a prime factor proliferating the development of the segment.

The original design manufacturer (ODM) segment is anticipated to register the fastest CAGR during the forecast period. ODM refers to companies that are responsible for designing and producing products that are marketed and sold under the name of the original equipment manufacturer (OEM). Additionally, partnering with an original design manufacturer offers a range of benefits including cost-effective production, higher expertise and experience, improved flexibility, reduced risk, along the ability to customize and adapt to various customer needs.

For instance, Qisda Corporation is an original design manufacturer serving several business sectors including consumer electronics, telecommunication, automotive, and medical among others. Thus, the rising prevalence of original design manufacturers serving multiple industrial sectors is a prime factor anticipated to drive the EMS-ODM market growth during the forecast period.

By Enterprise Size :

Based on the enterprise size, the market is segregated into large enterprises and small & medium enterprises. The large enterprise segment accounted for the largest revenue share in the year 2022 of the EMS-ODM market share. Large enterprises refer to companies that have above-average business operations, perform large operations, and have high economies of scale. Large enterprises primarily comprise a larger workforce, generate a high amount of revenue, and have a greater competitive capacity in comparison to small and medium enterprises. Moreover, large enterprises operating in the EMS-ODM sector often target national and international markets for the delivery of advanced design and manufacturing services.

For instance, Sanmina Corporation and Kinpo Group are a few of the large enterprises that offer a range of EMS and ODM services for consumer electronics, automotive, telecommunication, and other industrial sectors. Analysis of EMS-ODM market trends concludes that the prevalence of large enterprises operating in the EMS-ODM sector is a key factor driving the expansion of the segment.

Small & medium enterprise segment is expected to witness the fastest CAGR during the forecast period. Small and medium enterprises refer to companies that maintain revenues, workforce, and assets below a certain threshold. SMEs often account for the majority of the businesses that are operating across the world. SMEs are segregated from large enterprises because they operate differently with more simple operations.

For instance, Coconics is an India-based small & medium enterprise operating in the ODM sector. The company is responsible for manufacturing IT products in India. Thus, the rising development of small & medium enterprises operating in the EMS-ODM sector is projected to boost the proliferation of the EMS-ODM market trends during the forecast period.

By Application :

Based on the application, the market is classified into electronic devices, servers and storage, networking, medical instruments, and others. The electronic devices segment accounted for the largest revenue share in the year 2022. EMS services are often employed by electronic brands for outsourcing electronic manufacturing and reducing the cost of production. Moreover, EMS services are utilized for the design, manufacturing, testing, and assembly of a range of electronic products including smartphones, wearables, computers, and others.

For instance, Shenzhen Kaifa Technology Co. Ltd. is an EMS provider that offers electronic manufacturing services for electronic devices including smartphones, wearables, routers, ICT communications devices, and others. The EMS-ODM market analysis concluded that the increasing innovation associated with electronic manufacturing services for electronic device applications is a prime factor fostering the proliferation of the market.

The medical instruments segment is expected to witness the fastest CAGR during the forecast period. Electronic manufacturing services are employed by medical companies for design, manufacturing, and regulatory compliance, along with repair and refurbishment services for complex medical instruments including diagnostics & laboratory equipment, medical imaging systems, patient monitoring systems, and other medical devices.

For instance, Sanmina Corporation is an EDM provider that offers electronic manufacturing services for medical instrument manufacturing including ultrasound, CT scanners, MRI scanners, X-ray systems, and other medical equipment. Thus, the increasing utilization of electronic manufacturing services for application in medical instrument manufacturing is anticipated to boost the EMS-ODM market expansion during the forecast period.

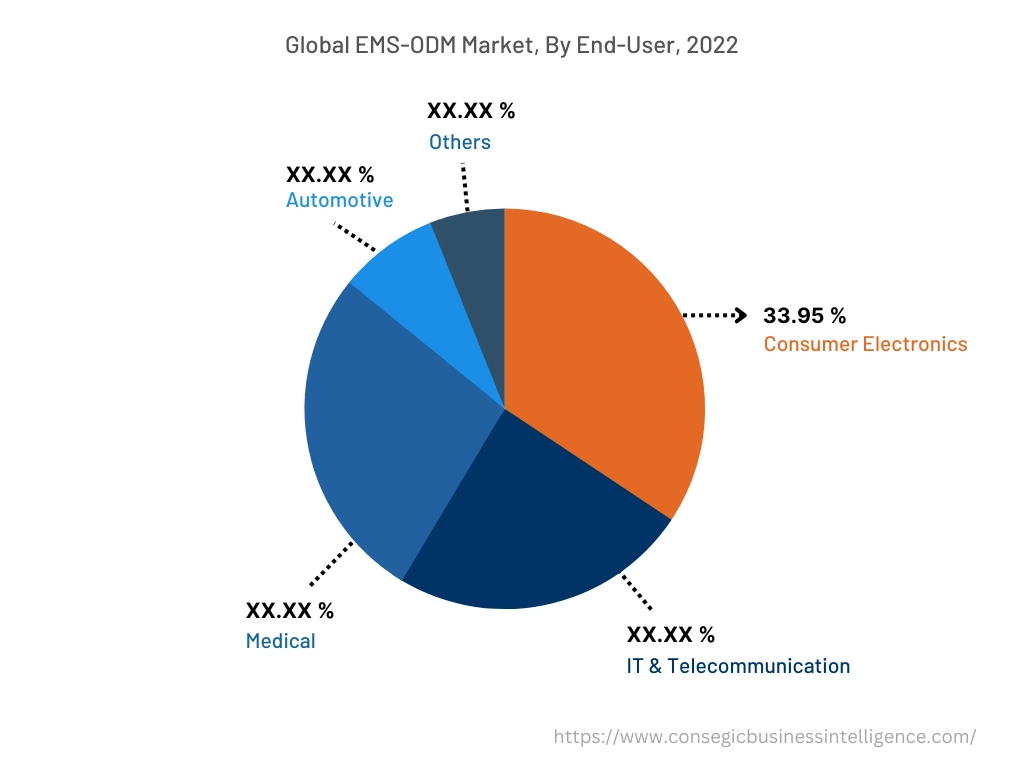

By End-User :

Based on the end-user, the market is segregated into consumer electronics, IT & telecommunication, medical, automotive, and others. The consumer electronics segment accounted for the largest revenue share of 33.95% in the year 2022. Factors including the growth in adoption of smartphones, and other consumer dev, and increasing demand for cost-efficient electronic devices are crucial aspects driving the expansion of the consumer electronics sector.

According to the GSM Association, the adoption of smartphones in Italy is projected to reach 81% by 2025, witnessing an increase from 77% in 2021. Additionally, according to Atradius, the consumer electronics sector in Spain observed a rise of 3.5% in 2021 in contrast to 2020. Thus, the growth in the consumer electronics sector is increasing the utilization of electronic manufacturing services for design, product.

The medical segment is expected to witness the fastest CAGR during the forecast period. The expansion of the medical segment is primarily driven by multiple factors including rising healthcare expenditure and increasing investments in the production of advanced medical devices among others.

For instance, Cyient Inc. offers a range of electronic manufacturing services including integrated design and production capabilities for medical device companies worldwide. Analysis of market trends concludes that the prevalence of EDM providers dedicated to offering a range of electronic manufacturing services for facilitating medical companies is a vital factor expected to drive EMS-ODM market expansion during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

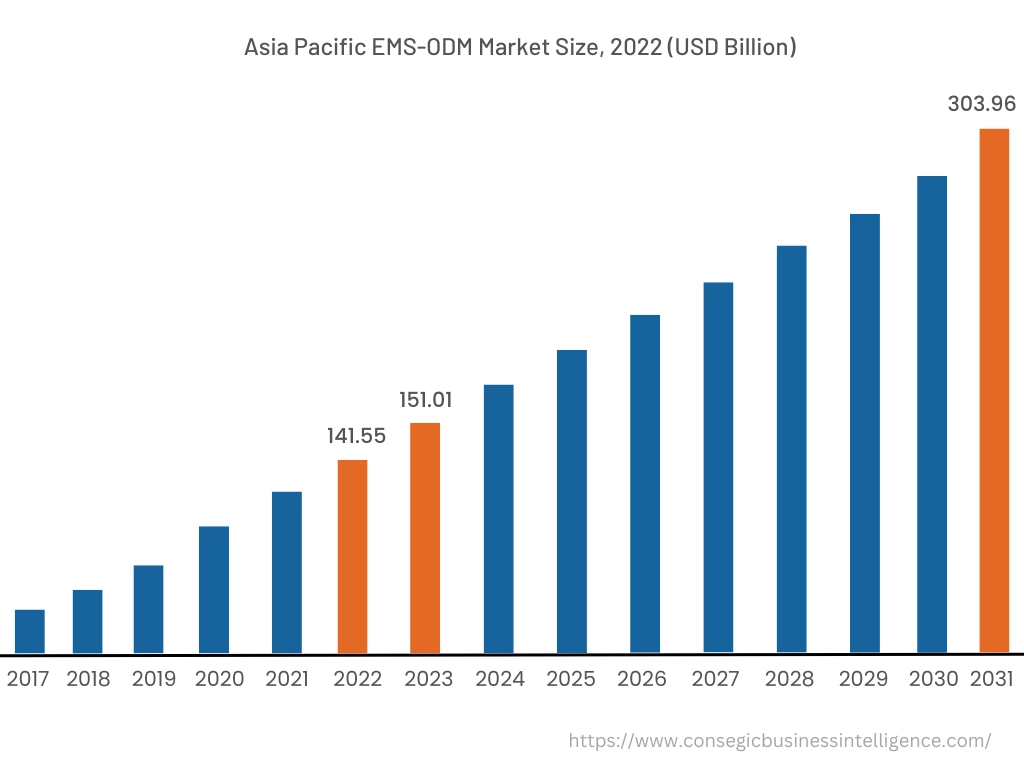

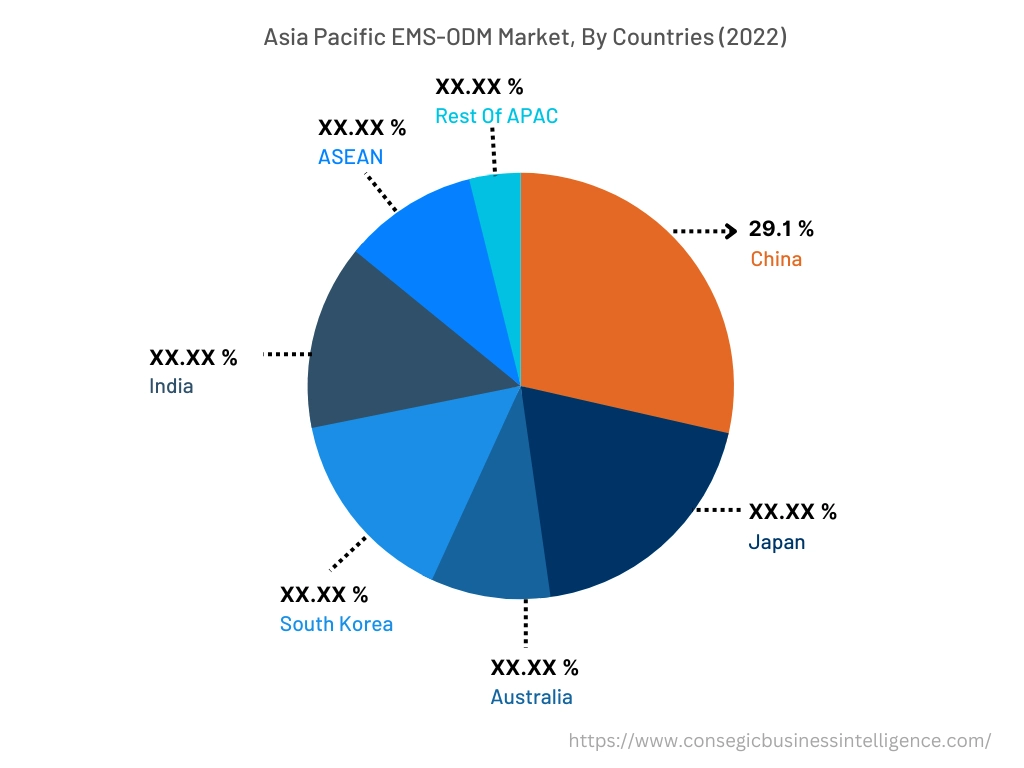

Asia-Pacific is expected to grow with the highest CAGR of 9.1% and is estimated to reach over USD 303.96 Billion by 2031 from a value of USD 141.55 Billion in 2022 and is projected to grow by USD 151.01 Billion in 2023. In addition, in the region, China accounted for the maximum revenue share of 29.1% in the same year.

The prevalence of a significant number of EMS-ODM providers in the Asia-Pacific region including UMC Electronics Co. Ltd., Shenzhen Kaifa Technology Co. Ltd., Universal Scientific Industrial Co. Ltd., Kinpo Group, Qisda Corporation, and others are contributing to market proliferation in the region. Moreover, as per the regional trends, the expansion of consumer electronics, automotive, IT & telecommunication, and other sectors is a vital factor driving the market demand for ODM and EMS services in the region.

For instance, according to the India Brand Equity Foundation, the consumer electronics sector in India was valued at USD 9.84 billion in 2021, while it is estimated to grow at a significant rate to reach USD 21.18 billion by 2025. The above factors are driving the utilization of electronic manufacturing services by consumer electronic brands for outsourcing electronic component manufacturing and reducing the cost of production, in turn driving EMS-ODM market opportunities in the Asia-Pacific region.

North America is expected to register a CAGR of 8.7% during the forecast period. The growing pace of industrialization is facilitating the development of the market in the North American region. Further, factors including the development of various industries including medical, automotive, and others are driving the market proliferation for the market in North America.

For instance, according to the International Trade Administration (ITA), the medical device sector in Canada was valued at USD 6.5 billion in 2022, with primary activities including research & development and manufacturing of medical diagnostic, and therapeutic devices. Thus, the growing medical sector in North America is expected to drive the adoption of EMS, thereby proliferating market expansion in the region during the forecast period.

Top Key Players & Market Share Insights:

The EMS-ODM market is highly competitive with major players' products in the national and international markets. The major companies operating in the EMS-ODM industry are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the EMS-ODM market. Key players in the EMS-ODM industry include-

- Sanmina Corporation

- Jabil Inc.

- Kinpo Group

- Foxconn Hon Hai Technology Group

- Qisda Corporation

- Flex Engineering Services

- UMC Electronics Co. Ltd.

- Zoliner Elektronik AG

- Shenzhen Kaifa Technology Co. Ltd.

- Universal Scientific Industrial Co. Ltd.

Recent Industry Developments :

- In March 2022, Sanmina Corporation entered into a joint venture agreement with Reliance Strategic Business Ventures Limited.

Key Questions Answered in the Report

What is EMS-ODM? +

EMS (electronics manufacturing service) involves companies associated with designing, manufacturing, testing, distributing, and providing repair services for electronic components and assemblies for original equipment manufacturers. ODM (original design manufacturer) refers to companies that are responsible for designing and producing products that are marketed and sold under the name of the original equipment manufacturer (OEM).

What specific segmentation details are covered in the EMS-ODM report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed electronics manufacturing service (EMS) as the dominating segment in the year 2022, owing to the increasing prevalence of significant number of EMS providers offering services in multiple industrial sectors such as consumer electronics, IT & telecommunication, automotive, and others.

What specific segmentation details are covered in the EMS-ODM market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed medical as the fastest-growing segment during the forecast period due to rising adoption of electronic manufacturing services by medical companies for production of complex medical equipment.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

North America is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as including medical, automotive, and others.