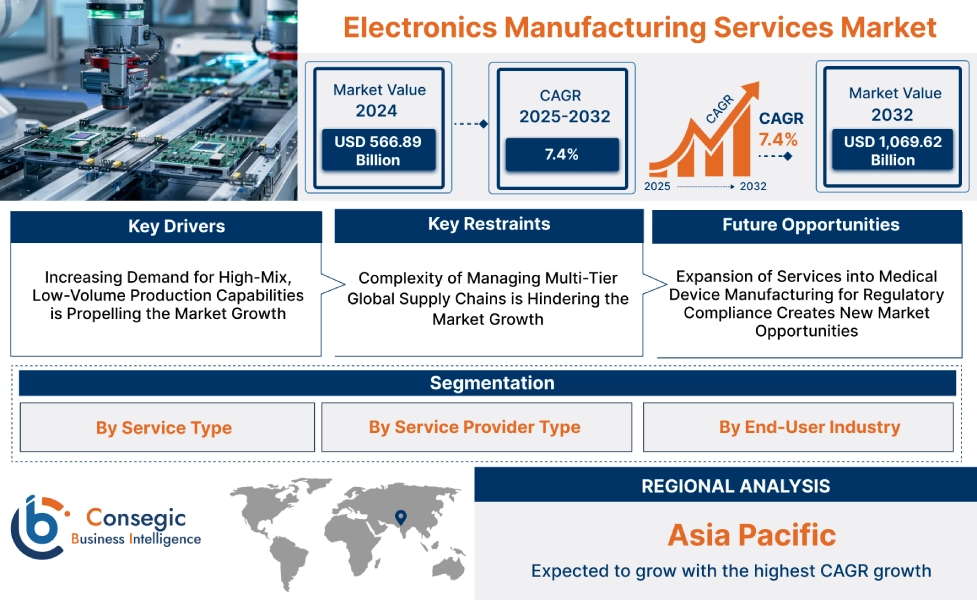

Electronics Manufacturing Services Market Size:

Electronics Manufacturing Services Market is estimated to reach over USD 1,030.40 Billion by 2032 from a value of USD 606.87 Billion in 2024 and is projected to grow by USD 635.70 Billion in 2025, growing at a CAGR of 6.2% from 2025 to 2032.

Electronics Manufacturing Services Market Scope & Overview:

The electronics manufacturing services (EMS) market involves companies associated with designing, manufacturing, testing, distributing, and providing repair services for electronic components and assemblies for original equipment manufacturers. The EMS providers are responsible for all aspects of the production process including sourcing raw materials and components, designing and testing of products, along with assembling and delivering the finished products. Additionally, EMS services are utilized in various industries including consumer electronics, IT & telecommunication, medical, automotive, and other industrial sectors.

How is AI Transforming The Electronics Manufacturing Services Market?

The integration of AI is considerably transforming the electronics manufacturing services market. AI incorporation helps in improving efficiency, quality, and design through applications such as predictive maintenance, automated quality control, supply chain optimization, and generative design, among others. Moreover, AI-powered systems are also used for improving production speed, lowering waste, along with facilitating faster adaptation to market changes, which in turn helps in driving cost savings and making factories smarter and more competitive.

In addition, AI-powered systems are being increasingly used for inspecting products on the assembly line for flaws with high accuracy, which in turn ensures consistent quality and decreased errors. Hence, the above factors are expected to positively impact the market in the upcoming years.

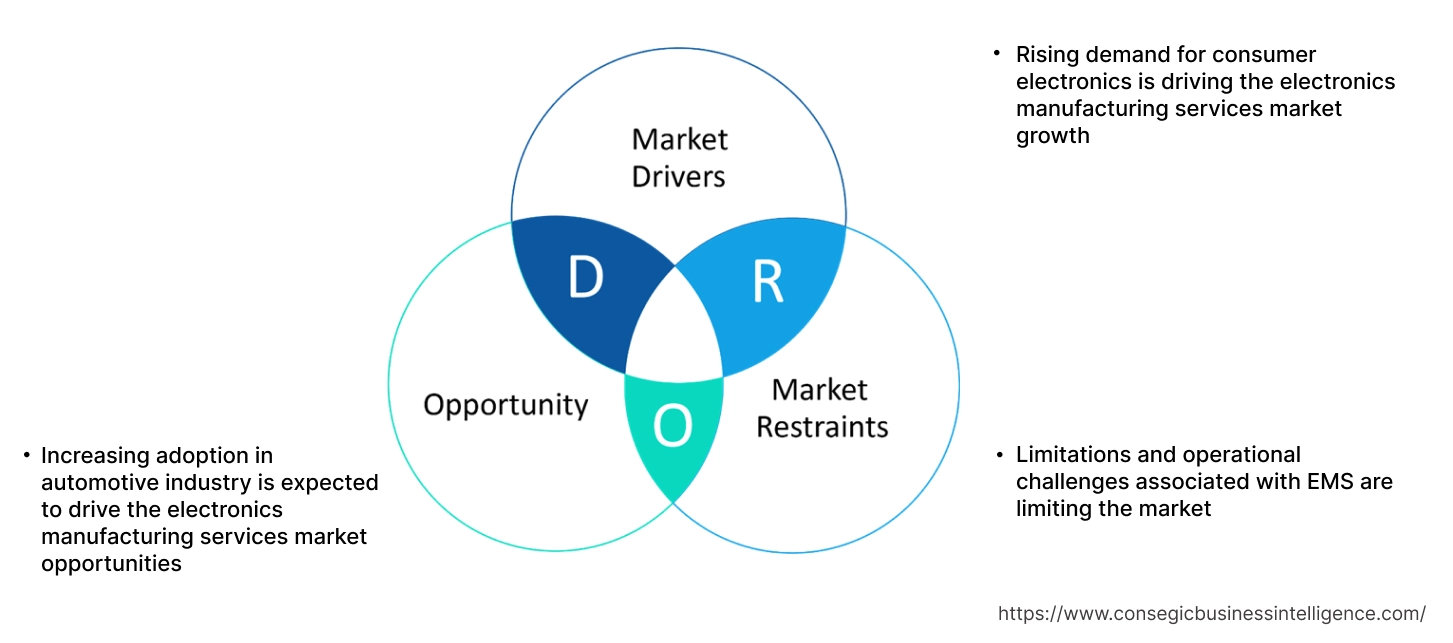

Electronics Manufacturing Services Market Dynamics - (DRO) :

Key Drivers:

Rising demand for consumer electronics is driving the electronics manufacturing services market growth

Electronics manufacturing services are primarily utilized for providing end-to-end services, including materials procurement, smart manufacturing, testing, assembly, global logistics, and after-sales support for clients involved in global consumer products, including smartphones, wearables, computers, and others. Moreover, EMS are often employed by consumer electronics brands for outsourcing electronic manufacturing and reducing the cost of production. Additionally, the benefits of EMS including diversified business mode and end-to-end manufacturing capabilities are primary determinants for increasing its deployment by consumer electronic brands.

Factors including the growing penetration of laptops, smartphones, and other consumer devices, progressions in consumer electronics including IoT and AI, increasing need for cost-efficient electronic devices are key prospects driving the consumer electronics sector.

- For instance, according to the German Electrical and Electronic Manufacturers’ Association (ZVEI), the electronics production in Germany witnessed an annual growth rate of around 3% in 2024. Additionally, the electronics sector in Germany was valued at USD 263.77 billion in 2023, witnessing a growth of 6% from USD 248.32 billion in 2022.

Therefore, the growing consumer electronics sector is increasing the need for EMS to provide end-to-end manufacturing services, thereby driving the electronics manufacturing services market size.

Key Restraints :

Limitations and operational challenges associated with EMS are limiting the market

The implementation of electronics manufacturing services is associated with certain limitations and operational challenges, which are among the key factors limiting the market. For instance, the primary limitation associated with electronic manufacturing services includes decreased operating margins. Intense global competition and continuous pressure from Original Equipment Manufacturers (OEMs) to lower costs are resulting in narrow profit margins for EMS providers. Moreover, EMS firms are vulnerable to risks related to investment in operations and management of global manufacturing processes. In addition, EMS companies must balance external and internal resources while remaining within international standards, which in turn makes traceability and compliance issues an additional operational challenge.

Furthermore, partnering with EMS providers is also linked with several other limitations and operational challenges, including reduced control over design and manufacturing processes, intellectual property concerns, quality control issues, cost overruns, and others. Hence, the above limitations and operational challenges associated with using electronic manufacturing services are hindering overall market growth.

Future Opportunities :

Increasing adoption in automotive industry is expected to drive the electronics manufacturing services market opportunities

The increasing adoption of electric electronics manufacturing services in automotive sector, particularly for vehicle manufacturing, presents significant opportunities for the market. The automotive sector has stringent requirements in terms of operations and processes, quality, and on-time deliveries. EMS is often used in the automotive sector for offering various services ranging from design, engineering and prototyping to new product innovation and mass production of automobile electronic components. Moreover, EMS covers design, manufacturing, assembly, testing, and distribution of various automotive electronic systems, including ADAS, power modules, infotainment systems, and other related systems.

Factors including the advancements in autonomous driving systems, growing adoption of electric vehicles, along with increasing vehicle production are among the key prospects driving the adoption of EMS in automotive sector.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total passenger car production worldwide reached up to 68,020,265 units in 2023, representing an increase of nearly 11% from 61,553,361 units in 2022.

Thus, the aforementioned factors are projected to drive the electronics manufacturing services market opportunities.

Electronics Manufacturing Services Market Segmental Analysis :

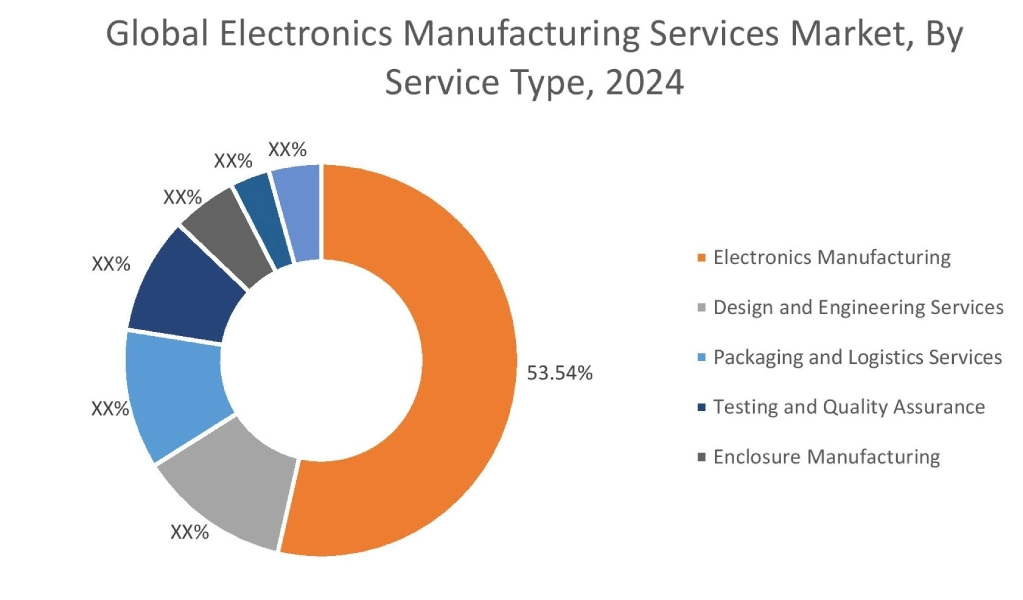

By Service Type:

Based on the service type, the market is segmented into electronics manufacturing, design and engineering services, packaging and logistics services, testing and quality assurance, enclosure manufacturing, pre-compliance & certification service, and others.

Trends in the Service Type:

- Increasing implementation of advanced tracking technologies such as blockchain to provide real-time product traceability and enhance security against counterfeiting, is expected to drive the electronics manufacturing services market trends.

- There is increasing use of Artificial Intelligence and Machine Vision systems for automated optical inspection (AOI) to detect microscopic defects and anomalies with greater accuracy which is expected to drive electronics manufacturing services market size.

Electronics manufacturing accounted for the largest revenue share of 53.54% in the year 2024.

- There's a growing trend of adoption of AI, IoT sensors, and robotics for real-time monitoring, predictive maintenance, and autonomous assembly, which drives the electronics manufacturing services market share.

- Further, there is increasing use of complex packaging technologies like System-in-Package (SiP) and Advanced Packaging to integrate more components into smaller, denser modules.

- Furthermore, shift towards using eco-friendly/RoHS-compliant materials, adopting energy-efficient production methods, and prioritizing the circular economy to meet stricter global sustainability regulations, drives the electronics manufacturing services market trends.

- For instance, in June 2022, Flex Ltd. announced the extension of its regional strategic automotive manufacturing hub in Jalisco, Mexico. The expansion was aimed at enabling the development and production of next-gen mobility solutions, including electric vehicles and autonomous driving technologies.

- Thus, as per electronics manufacturing services market analysis, green manufacturing, Industry 4.0 & smart factories, and advanced miniaturization are driving the market.

Design and engineering services is anticipated to register the fastest CAGR during the forecast period.

- There's an emerging trend towards use of digital twins and simulation software to test and validate product performance and manufacturing processes which in turn drives the electronics manufacturing services market share.

- Further, there is a growing demand for EMS providers who possess specific design IP and certification expertise in complex, high-reliability sectors like automotive and medical which in turn drives the electronics manufacturing services market demand.

- Therefore, based on analysis, specialized expertise and virtual prototyping are anticipated to boost the market during the forecast period.

By Business Model:

Based on the business model, the market is segmented into contract manufacturing, original design manufacturing, and turnkey manufacturing.

Trends in the Business Model:

- There is increasing adoption of services that span the entire product life, including managing product redesigns, which in turn drives the electronics manufacturing services market demand.

- Shifting away from solely chasing high-volume consumer electronics toward handling a larger variety of products in smaller batches drives the electronics manufacturing services market growth.

Contract manufacturing accounted for the largest revenue share in the year 2024.

- Contract manufacturers are expanding their in-house capabilities beyond PCB assembly to include specialized areas like plastic injection molding, complex sheet metal fabrication, and highly technical testing which in turn drives the market.

- Further, there is growing implementation of advanced Manufacturing Execution Systems (MES) and integration of ERP systems with factory floor data in turn driving the electronics manufacturing services industry.

- Furthermore, there is rising use of advanced analytics and long-term supply agreements to better manage component volatility, ensuring stable sourcing and pricing power for critical components like microcontrollers and power management ICs.

- Thus, as per electronics manufacturing services market analysis, focus on vertical integration, digitalization of operations, and supplier risk management are driving the market.

Original Design Manufacturing is anticipated to register the fastest CAGR during the forecast period.

- ODMs are developing proprietary IP in niche, high-growth areas such as specialized AI server hardware, automotive modules, and sophisticated 5G enterprise network equipment.

- Further, manufacturers are investing heavily in robust legal frameworks and secure design environments to protect the proprietary IP which propels the electronics manufacturing services market expansion.

- Therefore, based on analysis, IP protection and licensing and specialization in emerging tech are anticipated to boost the growth of the market during the forecast period.

By End-User:

Based on the end user, the market is segmented into aerospace and defense, automotive, consumer electronics, healthcare, industrial automation, IT and telecom, and others.

Trends in the End User:

- High-volume assembly of complex, modular server racks, cloud computing hardware, and advanced cooling systems for massive data centers drives the electronics manufacturing services market expansion.

- There's an increasing proliferation of connected & wearable devices and high-end imaging & diagnostics which subsequently propels the electronics manufacturing services market.

Consumer Electronics accounted for the largest revenue share in the year 2024 and is anticipated to register a significant CAGR during the forecast period.

- There is constant demand for ultra-small, high-density assemblies using System-in-Package (SiP) and advanced packaging to integrate multiple functions into small form factors.

- Further, there's increasing focus on designing products for repairability, using recycled plastics/metals, and managing end-of-life to comply with expanding global environmental regulations.

- Furthermore, increasing focus on high-volume production of low-cost, connected IoT devices and sensors drives the market.

- Thus, based on analysis, miniaturization and SiP, sustainable and circular design, and IoT proliferation are driving the market.

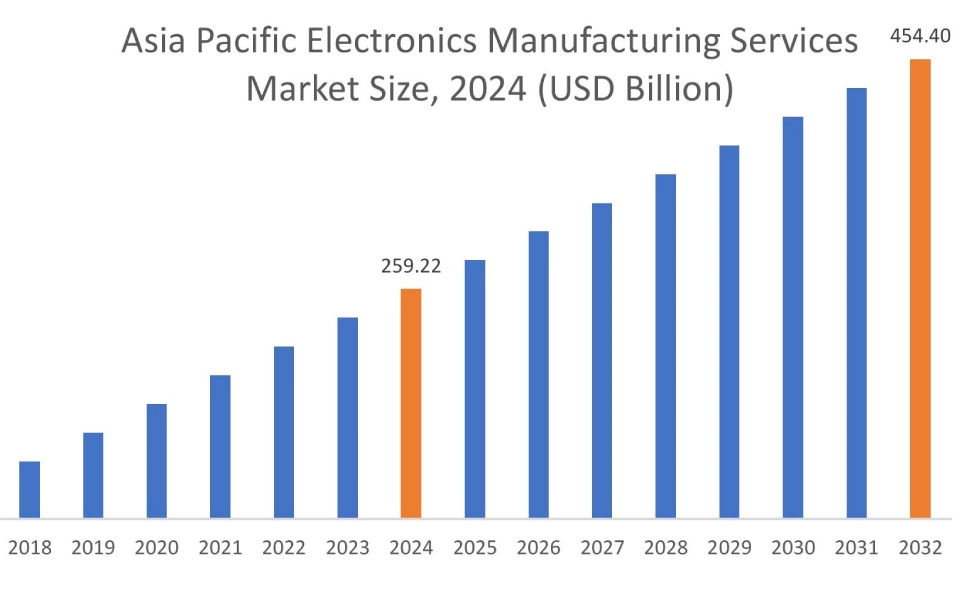

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

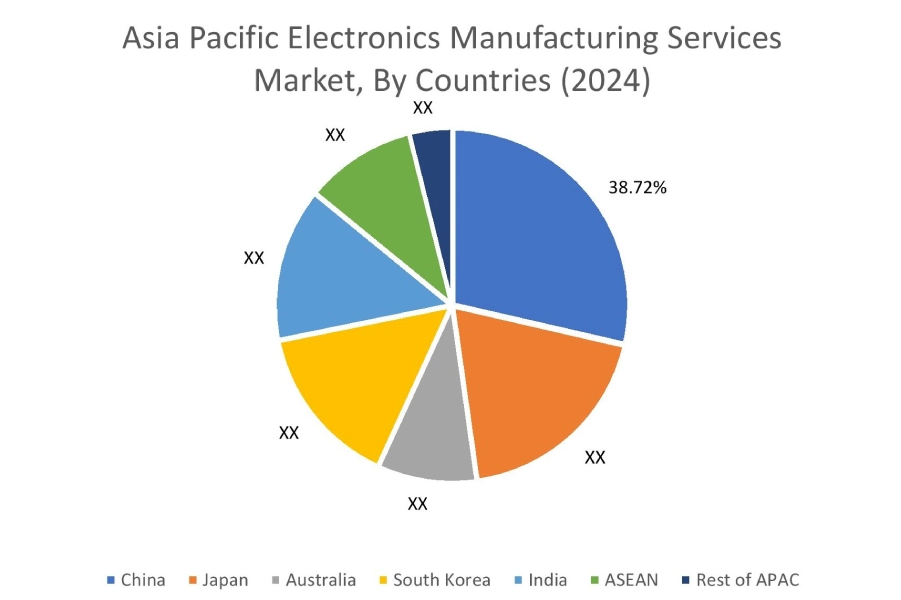

Asia Pacific region was valued at USD 259.22 Billion in 2024. Moreover, it is projected to grow by USD 272.26 Billion in 2025 and reach over USD 454.40 Billion by 2032. Out of this, China accounted for the maximum revenue share of 38.72%. The market for electronics manufacturing services in the Asia Pacific region is mainly driven by the growth of consumer electronics, automotive, IT & telecommunication, and other sectors, along with the prevalence of significant number of EMS providers in the region.

- For instance, according to the FDI Invest India, the appliances and consumer electronics sector in India was valued at USD 9.84 billion in 2021, and it is estimated to grow at a significant rate to reach USD 21.18 billion by the end of 2025. The above factors are propelling the market in the Asia Pacific region.

North America is estimated to reach over USD 256.57 Billion by 2032 from a value of USD 152.84 Billion in 2024 and is projected to grow by USD 159.95 Billion in 2025. The North American market is primarily driven rising production of automobiles and increasing adoption of electric vehicles (EVs) in the region. Moreover, growing healthcare, telecommunication, and other industries and rising need for advanced electronic systems in industrial sectors are key factors driving the market in the North American region.

- For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), the overall automobile production including passenger cars and commercial vehicles in the United States reached 10.61 million in 2023, representing an increase of nearly 6% in contrast to 10.06 million in 2022. The aforementioned factors are boosting the market in the North American region.

The regional trends analysis depicts that factors including the rising adoption of industrial automation, growing production of medical devices, increasing development of automotive manufacturing facilities, and rising adoption of electronic manufacturing services by industrial manufacturers are driving the market in the European region. Additionally, factors driving the market in Latin America, Middle East, and African regions include the growing consumer electronics sector, significant production of automobiles, and rising adoption of electric vehicles, among others.

Top Key Players & Market Share Insights:

The global electronics manufacturing services market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the electronics manufacturing services industry. Key players in the global electronics manufacturing services market include-

- Pegatron Corporation (Taiwan)

- Plexus Corp. (U.S.)

- Fabrinet (Cayman Islands)

- COMPAL Inc. (Taiwan)

- Sanmina Corporation (U.S.)

- WISTRON CORPORATION (Taiwan)

- Foxconn (Taiwan)

- FLEX LTD (U.S.)

- Jabil Inc. (U.S.)

- Celestica Inc. (Canada)

Recent Industry Developments :

Acquisition

- In May, 2024, Flex Ltd. announced the acquisition of FreeFlow, a company specializing in asset disposition and digital circular economy tracking. This acquisition aims to enhance Flex's reverse logistics and circular economy services, allowing customers to sell surplus and returned inventory while promoting sustainability through second-life products.

- In January, 2024, the Competition Commission of India (CCI) officially approved the acquisition of 100% of the equity share capital of Wistron Infocomm Manufacturing (India) Private Limited by Tata Electronics Private Limited. The acquisition involves Tata Electronics, that manufactures smartphone enclosures, taking full control of the Wistron plant, which is an existing Electronic Manufacturing Services (EMS) facility engaged in the contract manufacturing of smartphones for a major global brand.

Electronics Manufacturing Services Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 1,030.40 Billion |

| CAGR (2025-2032) | 6.2% |

| By Service Type |

|

| By Business Model |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the electronics manufacturing services market? +

The electronics manufacturing services market is estimated to reach over USD 1,030.40 Billion by 2032 from a value of USD 606.87 Billion in 2024 and is projected to grow by USD 635.70 Billion in 2025, growing at a CAGR of 6.2% from 2025 to 2032.

What specific segmentation details are covered in the electronics manufacturing services report? +

The electronics manufacturing services report includes specific segmentation details for service type, business model, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the electronics manufacturing services market, original design manufacturing is the fastest growing segment during the forecast period.

What are the key trends in the electronics manufacturing services market? +

The electronics manufacturing services market is being shaped by several key trends including rapid adoption of Industry 4.0 technologies like AI and smart automation, and booming demand from high-growth end-use sectors such as Electric Vehicles (EVs), 5G infrastructure, and advanced medical devices.

Who are the major players in the Electronics Manufacturing Services market? +

The key participants in the Electronics Manufacturing Services market are Pegatron Corporation (Taiwan), WISTRON CORPORATION (Taiwan), Foxconn (Taiwan), FLEX LTD (U.S.), Jabil Inc. (U.S.), Celestica Inc. (Canada), Plexus Corp. (U.S.), Fabrinet (Cayman Islands), COMPAL Inc. (Taiwan), Sanmina Corporation (U.S.), and others.