Thermal Interface Materials Market Size:

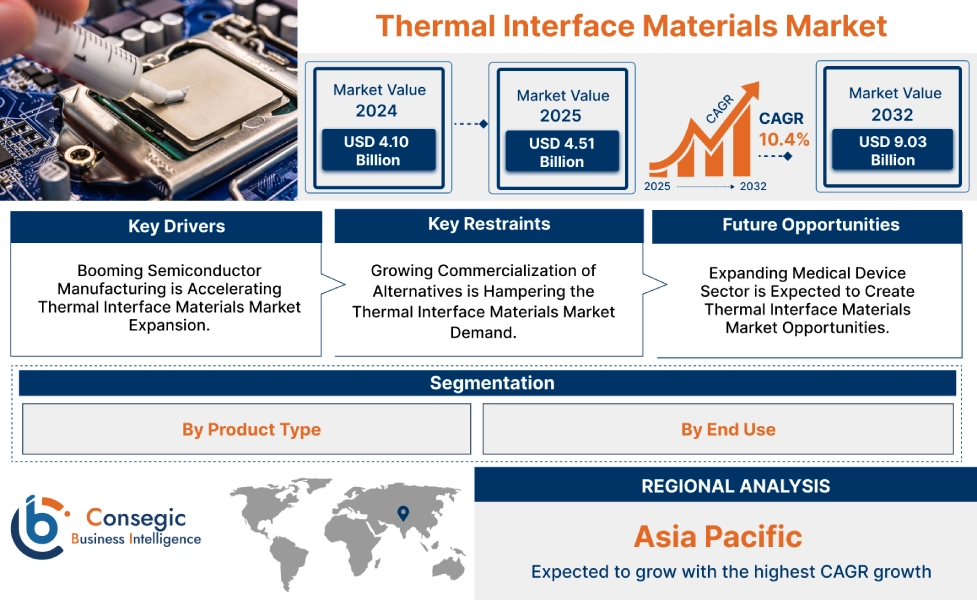

Thermal Interface Materials Market size is growing with a CAGR of 10.4% during the forecast period (2025-2032), and the market is projected to be valued at USD 9.03 Billion by 2032 from USD 4.10 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 4.51 Billion.

Thermal Interface Materials Market Scope & Overview:

Thermal interface materials (TIMs) are substances designed to improve heat transfer between two solid surfaces, typically a heat-generating component and a heat-dissipating device. They fill microscopic air gaps and surface imperfections that act as thermal insulators. They are manufactured by incorporating thermally conductive filler particles into a polymer matrix. This composite mixture is then processed into various forms such as pastes, gels, pads, tapes, or phase change materials through processes like compounding, mixing, coating, or molding. Key properties include high thermal, low thermal resistance, and excellent conformability to irregular surfaces, among others.

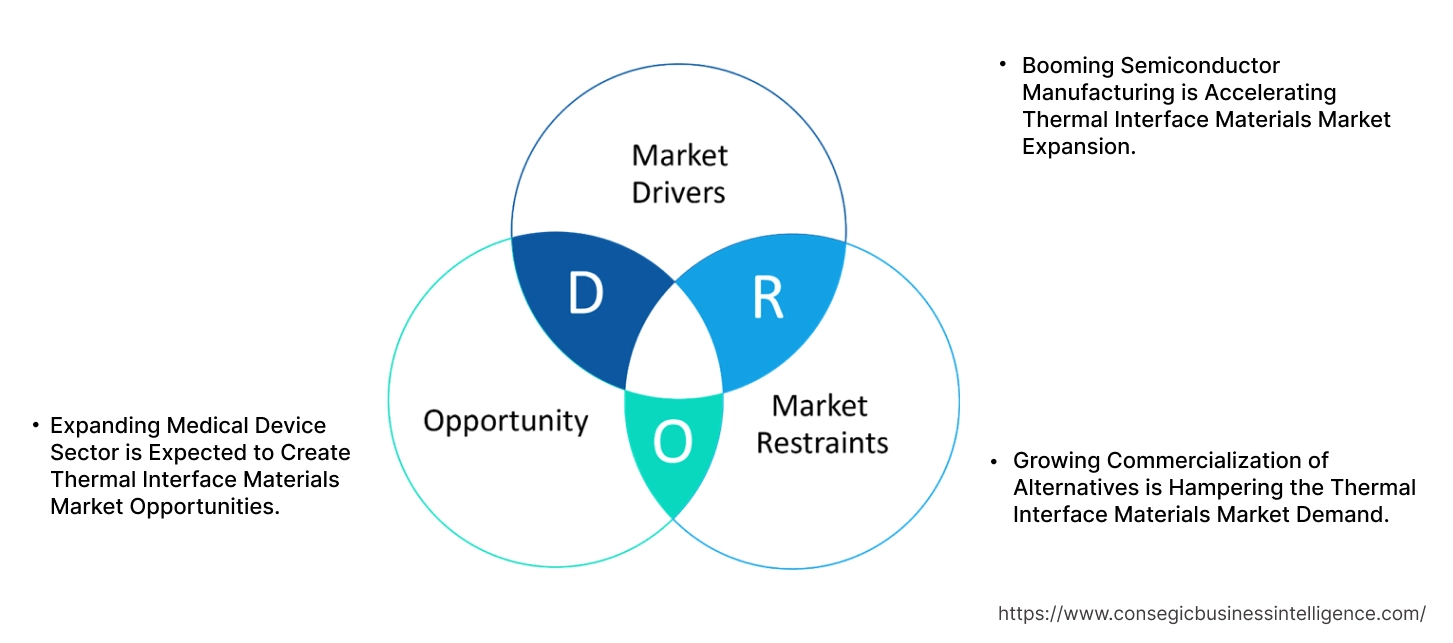

Thermal Interface Materials Market Dynamics - (DRO) :

Key Drivers:

Booming Semiconductor Manufacturing is Accelerating Thermal Interface Materials Market Expansion.

Thermal interface materials are critical in the semiconductor sector, directly impacting device performance and longevity. Their primary benefit is maximizing heat dissipation from increasingly compact and powerful semiconductor chips to their cooling solutions. By filling microscopic air gaps between the chip and heatsink, they significantly reduce thermal resistance, preventing localized hotspots and ensuring efficient heat transfer. This leads to improved device performance by allowing chips to operate at optimal temperatures without throttling, extended component lifespan by minimizing thermal stress, and enhanced reliability for critical electronics. Increasing demand across various sectors, such as AI and autonomous vehicles, is driving semiconductor manufacturing, thereby requiring these materials for multiple applications.

For instance,

- According to the United States International Trade Commission, Taiwan's semiconductor industry output between 2018 and 2022 grew at a CAGR of 17.04%, thus positively impacting thermal interface materials market trends.

Overall, the booming semiconductor manufacturing is significantly boosting the thermal interface materials market expansion.

Key Restraints:

Growing Commercialization of Alternatives is Hampering the Thermal Interface Materials Market Demand.

The market faces hurdles from the substitutes available in the market. For instance, Liquid cooling systems utilize a circulating liquid to absorb and transport heat away from components. This involves cold plates, pumps, and radiators. They offer superior heat dissipation capacity for very high-power components such as high-end CPUs/GPUs in gaming PCs or data center servers. It allows for denser component packaging and is quieter than air cooling due to fewer high-speed fans. Moreover, vapor chambers and heat pipes are sealed, evacuated structures containing a small amount of working fluid. Heat causes the fluid to vaporize, moving to cooler areas where it condenses, releasing heat, and then returns as liquid. They provide highly efficient heat spreading over a larger area with very low thermal resistance. Hence, the growing commercialization of substitutes is hampering the thermal interface materials market demand.

Future Opportunities :

Expanding Medical Device Sector is Expected to Create Thermal Interface Materials Market Opportunities.

Thermal interface materials are crucial in medical devices, where precise temperature control and reliability are paramount. They prevent delicate components from overheating, ensuring accurate readings and consistent performance in diagnostic equipment such as MRI and CT scanners. For implantable devices such as pacemakers, these materials help dissipate heat safely away from the patient's skin, preventing thermal injury. They also contribute to extending the lifespan of expensive medical instruments and enabling the miniaturization of devices by allowing more efficient heat management in confined spaces, enhancing patient comfort, and improving clinical outcomes. Increasing demand for healthcare services has led to sector increase, hence positively influencing thermal interface materials market trends.

For instance,

- According to the International Trade Administration, the medical device industry of China is expected to grow at a CAGR of 8.3% from 2021 to 2026, creating potential for the market.

Overall, the expanding medical device sector is expected to increase the thermal interface materials market opportunities.

Thermal Interface Materials Market Segmental Analysis :

By Product Type:

Based on product type, the market is categorized into thermal greases & pastes, thermal tapes & films, phase change materials, thermal adhesives, gap fillers, and others.

Trends in Product Type:

- There is a growing trend of manufacturers increasingly favoring dispensable forms due to their ability to achieve very thin bonds and excellent conformability to irregular surfaces.

- A trend towards combining different material types, such as carbon fillers with silicone matrix, to leverage synergistic benefits such as enhanced thermal conductivity and improved reliability.

The thermal greases & pastes segment accounted for the largest market share in 2024

- These are currently the dominant product types. Their dominance stems from their excellent conformability to surface irregularities, low thermal resistance at thin bond line thicknesses, and relatively low cost.

- Additionally, they offer good electrical insulation, high temperature resistance, and their non-curing property allows for easy rework, making maintenance more convenient.

- They are widely used across various applications, from consumer electronics (like CPUs in PCs) to power modules, due to their ease of application and effective performance in many scenarios. The growing need for consumer electronics is driving the segmental share.

- For instance, according to Canalys, the PC market across the globe, with combined shipments of desktops, notebooks, and workstations, increased by 5.0% in 2024 when compared to the previous year.

- Overall, as per the market analysis, the aforementioned factors are driving a segment in the market.

The phase change materials segment is expected to grow at the fastest CAGR over the forecast period.

- Phase change materials (PCMs) are an emerging and growing segment in the market. They offer the advantage of being solid at room temperature, making them easy to handle and apply.

- Key properties include a defined phase change temperature at which they transition, high latent heat of fusion, and low thermal resistance in their softened state. They also exhibit excellent wetting characteristics when heated.

- They also provide consistent performance across temperature fluctuations, improving long-term device stability and lifespan.

- They are increasingly being adopted in high-performance computing, LEDs, and certain automotive applications where consistent performance over temperature cycles is critical and pump-out issues of traditional greases are a concern. All these benefits are driving their increased utilization.

- Overall, as per the market analysis, the aforementioned factors will drive phase change material segment in the thermal interface materials market growth.

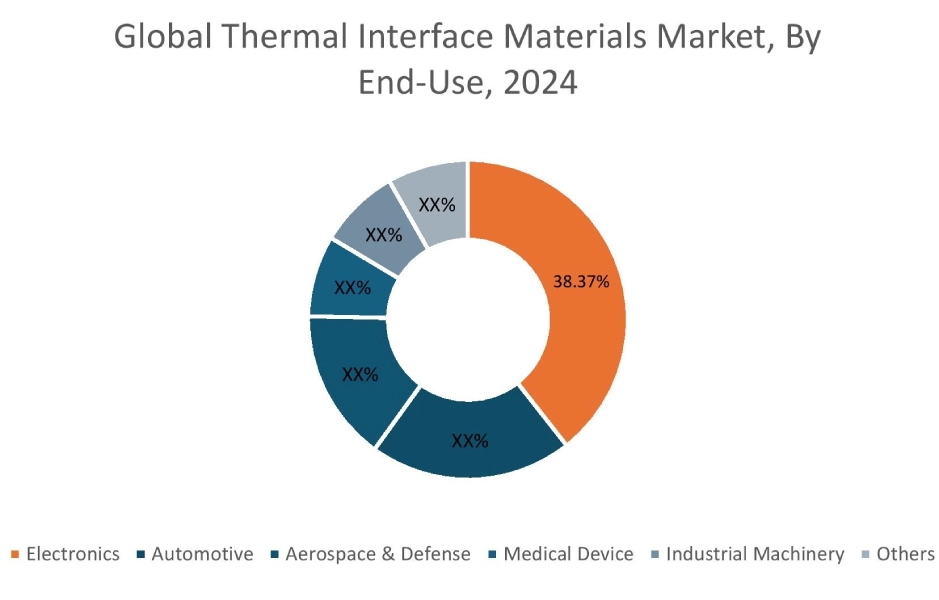

By End Use:

Based on end-use, the market is categorized into electronics, automotive, aerospace & defense, medical device, industrial machinery, and others.

Trends in the End-Use

- The growing trend of miniaturization in consumer devices is driving a continuous need for more efficient TIMs.

- Usage of TIMs for lightweight thermal solutions in avionics, radar systems, and defense electronics is also a rising trend.

The electronics segment accounted for the largest market share of 38.37% in 2024.

- The electronics sector is dominating the market due to the relentless pursuit of miniaturization and higher performance in electronic devices.

- Modern CPUs, GPUs, memory modules, and other semiconductor components are becoming increasingly compact while simultaneously generating more heat.

- This rise in power density necessitates highly efficient thermal management to prevent overheating, which leads to performance throttling, reduced lifespan, and even catastrophic device failure.

- TIMs are indispensable in filling microscopic air gaps between these heat-generating chips and their cooling solutions, ensuring maximum heat transfer.

- The massive production volumes of consumer electronics, such as smartphones, laptops, gaming consoles and others, data center servers, and networking equipment solidify electronics leading share in the market.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the thermal interface materials industry.

The medical device segment is expected to grow at the fastest CAGR over the forecast period.

- The medical device sector is an emerging and rapidly growing end-use for the market. Modern diagnostic equipment, such as MRI, CT scanners, surgical tools, and wearable/implantable devices, generates heat.

- Thermal interface materials are essential to dissipate this heat effectively, ensuring the accuracy of measurements, preventing overheating of sensitive components, and, critically, protecting patients from thermal injury when devices are in direct contact with skin or tissue.

- Rising chronic disease rates and the increasing adoption of new technologies have led to sector growth, thus driving the need for these materials.

- For instance, according to the MedTech Europe report, the medical device market of Europe has grown at a CAGR of 5.7% in the last ten years and is expected to grow more than that in the coming years.

- Thus, according to market analysis, the aforementioned factors will drive the segment in the thermal interface materials market growth.

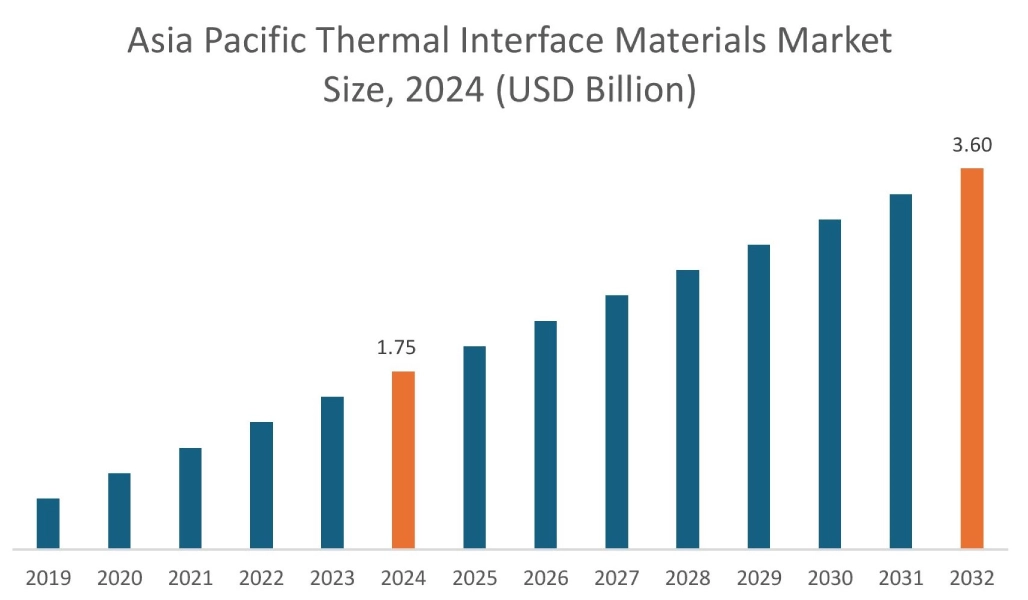

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

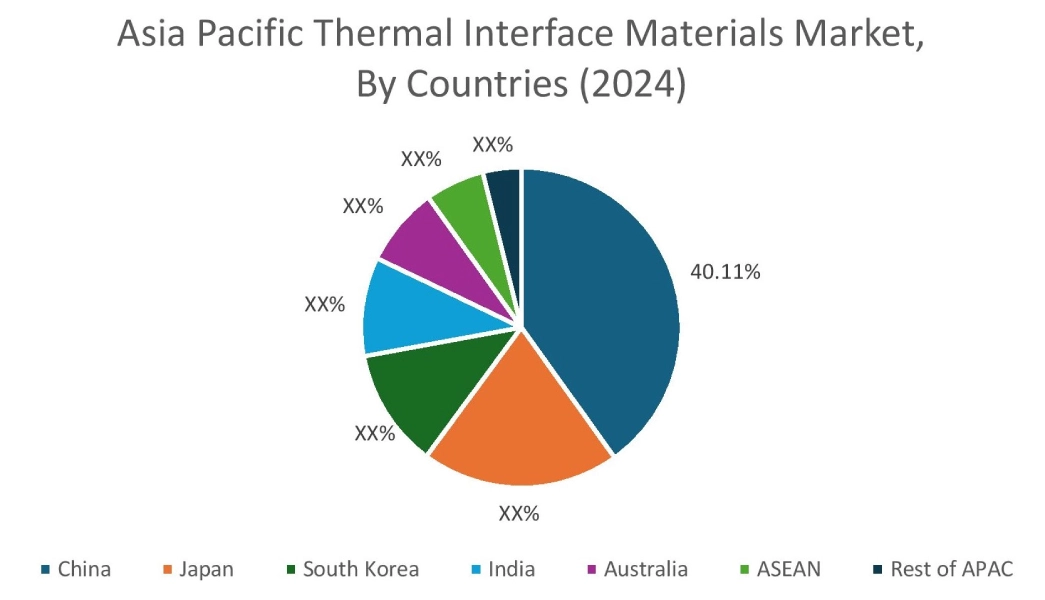

In 2024, Asia Pacific accounted for the highest thermal interface materials market share at 42.78% and was valued at USD 1.75 Billion and is expected to reach USD 3.60 Billion in 2032. In Asia Pacific, China accounted for the thermal interface materials market share of 40.11% during the base year of 2024. The region is a hub for electronics production. This surge is driven by increasing urbanization, rising disposable incomes, and the widespread adoption of smart devices, 5G technology, and IoT. Countries such as India, China, Japan, and South Korea lead the market.

For instance,

- According to the Semiconductor Association, China's expanded wafer capacity represented 26% of the global increase in 2022.

Thermal interface materials are essential to efficiently dissipate this heat, ensuring optimal performance, preventing thermal damage, and extending the lifespan of the vast volume of electronic products manufactured across APAC. Overall, the growing electronics manufacturing is driving the market in the region.

In Europe, the thermal interface materials market is experiencing the fastest growth with a CAGR of 12.3% over the forecast period. The region is a significant player in electric vehicle adoption and manufacturing. This is driven by ambitious decarbonization targets and supportive policies. EVs, whether battery electric (BEVs) or plug-in hybrids (PHEVs), contain numerous heat-generating components like battery packs, inverters, converters, and electric motors. Thermal interface materials are indispensable for efficiently managing the immense heat generated by these components, preventing overheating, ensuring optimal performance, and extending the lifespan of the entire EV powertrain. This focus on thermal management is critical for improving range, enabling faster charging, and enhancing overall EV safety and reliability for the European market.

North America’s thermal interface materials market analysis indicates that several key trends are contributing to its growth in the region. The medical device sector is rapidly evolving in the region. This is driven by continuous technological innovation, an aging population, and increasing demand for advanced healthcare solutions. Interface materials for thermal management ensure that sensitive components operate within optimal temperature ranges, preventing overheating that could compromise accuracy, reliability, or patient safety. The benefits include enhanced device performance, extended product lifespan for expensive equipment, and, crucially, maintaining patient comfort and safety by preventing thermal discomfort or injury from heat-generating wearables or implantable.

Middle East and Africa (MEA) thermal interface materials market analysis indicates that there is robust growth in the industrial machinery sector in the region. This is driven by diversification efforts away from oil and gas, increased investments in manufacturing, and infrastructure development. Interface materials used for thermal management are crucial here to ensure the reliable and efficient operation of power electronics, motors, and control systems within this machinery. The benefits include preventing costly downtime due to overheating, extending the lifespan of expensive industrial equipment, and maintaining operational efficiency even in harsh environmental conditions common in the MEA region.

Latin America's region creates potential for the market. The aerospace and defense sector are showing growth due to increasing regional security needs, modernization efforts, and investments in local manufacturing capabilities. This expansion directly translates to a rising need for high-performance interface materials for thermal management. In aerospace applications such as avionics, radar systems, and flight control units, and in defense applications such as missiles, communication systems, and ruggedized computing, these materials are essential to dissipate heat efficiently from these critical electronics, ensuring their uninterrupted performance, reliability, and precision in demanding environments.

Top Key Players and Market Share Insights:

The Thermal Interface Materials market is highly competitive, with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Thermal Interface Materials market. Key players in the Thermal Interface Materials industry include-

- Honeywell International Inc (United States)

- Momentive Performance Materials Inc. (United States)

- Parker Hannifin Corporation (United States)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Panasonic Corporation (Japan)

- Henkel AG & Co. KGaA (Germany)

- Dow, Inc. (United States)

- Laird Performance Materials (United States)

- 3M (United States)

- Indium Corporation (United States)

Recent Industry Developments :

Product Launch:

- In 2023, Bostik and Polytec PT launched a new range of thermal conductive adhesives (TCA) aimed at improving battery design in electric vehicles. This new range, including the XPU TCA 202, addresses the critical need for effective thermal management in advanced battery systems, particularly cell-to-pack (CTP) designs.

Thermal Interface Materials Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 9.03 Billion |

| CAGR (2025-2032) | 10.4% |

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Thermal Interface Materials market? +

In 2024, the Thermal Interface Materials market is USD 4.10 Billion.

Which is the fastest-growing region in the Thermal Interface Materials market? +

Europe is the fastest-growing region in the Thermal Interface Materials market.

What specific segmentation details are covered in the Thermal Interface Materials market? +

Product Type and End-Use segmentation details are covered in the Thermal Interface Materials market.

Who are the major players in the Thermal Interface Materials market? +

Honeywell International Inc (United States), Henkel AG & Co. KGaA (Germany), Dow, Inc. (United States), Laird Performance Materials (United States), and 3M (United States) are some major players in the market.