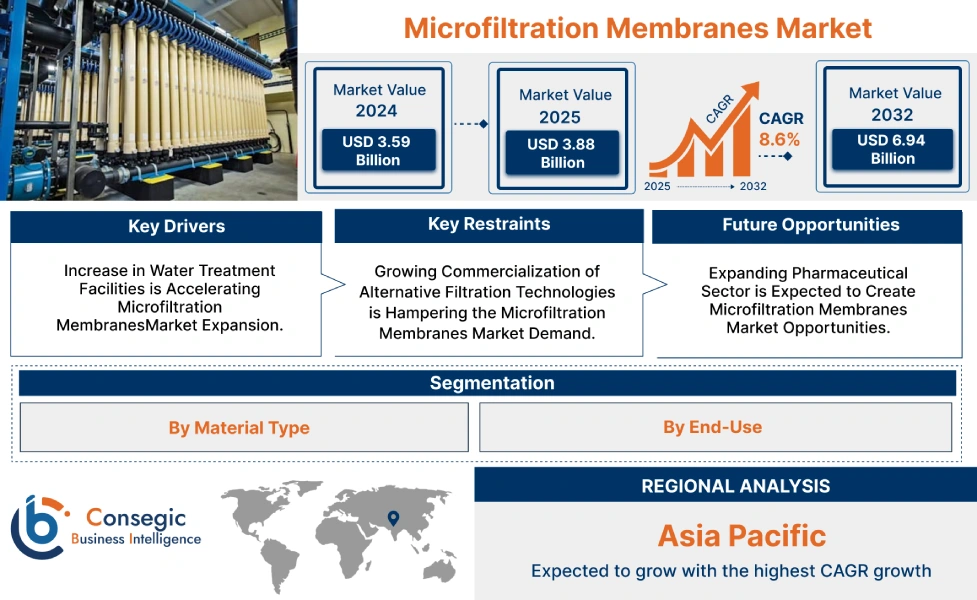

Microfiltration Membranes Market Size:

Microfiltration Membranes Market size is growing with a CAGR of 8.6% during the forecast period (2025-2032), and the market is projected to be valued at USD 6.94 Billion by 2032 from USD 3.59 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 3.88 Billion.

Microfiltration Membranes Market Scope & Overview:

Microfiltration (MF) membranes are porous barriers (0.1-10 µm) for pressure-driven removal of suspended solids, particulates, and bacteria from liquids or gases. They are made from organic polymers (via phase inversion, stretching, or track etching) and inorganic materials (ceramic, metallic). Key properties include material-dependent chemical/thermal resistance, hydrophilicity/hydrophobicity for specific applications, and high flux for efficient flow. These membranes are widely used across diverse industries such as in water treatment for clarification and pre-filtration; in food & beverage for clarification and microbial removal; in pharmaceuticals for sterile filtration and purification; and in chemical & petrochemical for solids separation and solvent clarification.

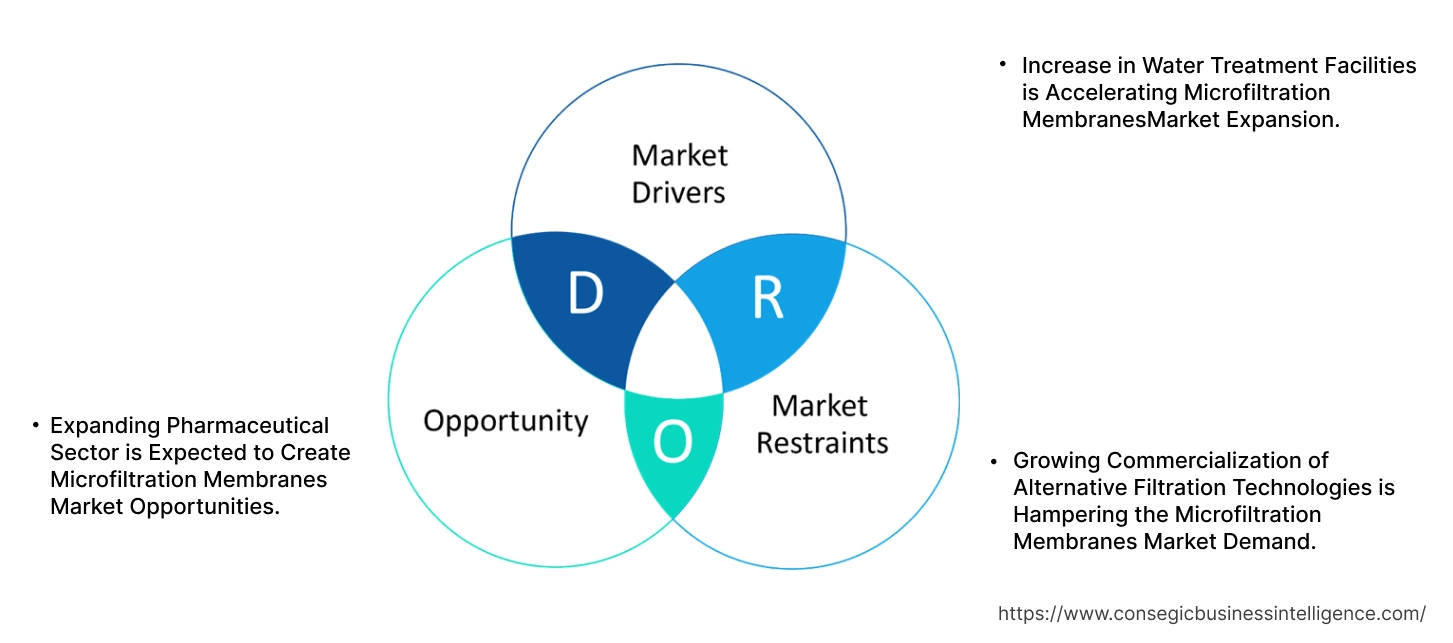

Microfiltration Membranes Market Dynamics - (DRO) :

Key Drivers:

Increase in Water Treatment Facilities is Accelerating Microfiltration Membranes Market Expansion.

Microfiltration membranes are crucial in water treatment for removing suspended solids, bacteria, and larger particles. They act as a physical barrier, clarifying water and serving as a vital pre-treatment step for more advanced purification methods such as reverse osmosis. This ensures safer drinking water and helps in industrial wastewater reuse. Growing global population and urbanization are increasing the demand for potable water and wastewater treatment. Escalating water scarcity from depletion and pollution necessitates advanced purification. Moreover, stricter environmental regulations compel industries to invest in treatment. Heightened awareness of waterborne diseases and expanded industrial water use also have led to an increase in water treatment facilities, hence requiring these membranes for multiple applications.

For instance,

- According to the U.S. EPA, in 2022, the U.S. saw an increase in the number of publicly owned treatment works (POTWs), with a total of over 17,500 facilities, which is a rise from over 16,000 POTWs in 2012, thus positively impacting microfiltration membranes market trends.

Overall, the increase in water treatment facilities is significantly boosting the microfiltration membranes market expansion.

Key Restraints:

Growing Commercialization of Alternative Filtration Technologies is Hampering the Microfiltration Membranes Market Demand.

The market faces hurdles from the substitutes available in the market. For instance, rapid sand filters and slow sand filters are highly economical, simple to operate and maintain, and utilize readily available materials. They are very effective at removing suspended solids, turbidity, and larger particulates from water. They also contribute to the biological removal of some pathogens and are widely used as a primary and secondary treatment step in municipal and industrial water plants. Moreover, dissolved air flotation is highly effective at removing lighter suspended solids, fats, oils, and greases (FOG). Additionally, coagulation & flocculation followed by the sedimentation process are highly effective at destabilizing and clumping very fine suspended particles and colloids that are too small to be removed by simple filtration. It significantly reduces turbidity and organic matter, improving the efficiency of subsequent filtration or disinfection steps, and is generally cost-effective for large volumes of water with high suspended solids. Hence, the growing commercialization of alternative filtration technologies is hampering the microfiltration membranes market demand.

Future Opportunities :

Expanding Pharmaceutical Sector is Expected to Create Microfiltration Membranes Market Opportunities.

Microfiltration membranes are indispensable in the pharmaceutical sector due to their ability to ensure product purity and safety. They are primarily used for cold sterilization of heat-sensitive drug solutions, effectively removing bacteria, fungi, and other microorganisms without compromising drug efficacy. They also play a critical role in cell harvesting and clarification of fermentation broths, separating target products from cellular debris. Additionally, they serve as a pre-filtration step for more advanced purification processes such as ultrafiltration and chromatography, ensuring cleaner streams and protecting downstream equipment. An aging population and increasing prevalence of chronic diseases have led to sector growth, hence positively influencing microfiltration membranes market trends.

For instance,

- According to IBEF, the Indian pharmaceutical industry is expected to grow at a CAGR of 10% from 2023 to 2030, creating the potential for the market.

Overall, the expanding pharmaceutical sector is expected to increase the microfiltration membranes market opportunities.

Microfiltration Membranes Market Segmental Analysis :

By Material Type:

Based on material type, the market is categorized into organic and inorganic.

Trends in Material Type:

- There is a growing trend towards developing new polymeric microfiltration membranes such as modified PVDF with improved chemical resistance and higher mechanical strength.

- The usage of organic material membranes in industrial wastewater and chemical processing due to their superior thermal stability is also a rising trend.

The organic segment accounted for the largest market share in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- Organic MF membranes are generally, polymeric membranes that are less expensive to produce than inorganic (ceramic/metallic) membranes, leading to lower upfront capital and replacement costs.

- Polymers offer flexibility in manufacturing processes such as phase inversion, allowing for diverse membrane configurations (flat sheet, hollow fiber, spiral wound) and tunable pore structures.

- Moreover, these polymers provide a broad spectrum of chemical resistances, making them suitable for various industrial and biological applications.

- Additionally, many polymeric membranes possess sufficient mechanical strength for typical operating pressures in microfiltration.

- The technology for producing organic polymeric membranes is well-established, contributing to their widespread usage in industries such as water treatment, chemical, and food & beverage among others. Growth in these industries is driving the segmental share.

- For instance, according to HART Design, American cheese production rose to 5.57 billion pounds, in 2021, which is an increase of 4.3% compared to the previous year, hence requiring organic membrane for removing bacteria from cheese.

- Overall, as per the market analysis, the aforementioned factors are driving a segment in the microfiltration membranes market growth.

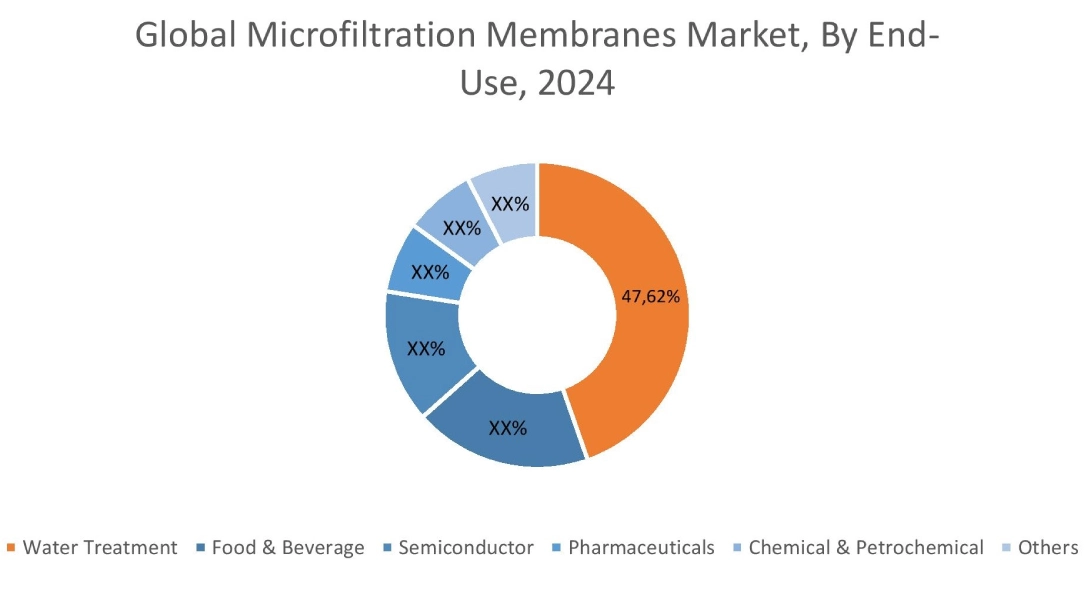

By End Use:

Based on end-use, the market is categorized into water treatment, food & beverage, semiconductor, pharmaceuticals, chemical & petrochemical, and others.

Trends in the End-Use

- There is a growing trend towards using MF membranes for treating wastewater for reuse (industrial, irrigation) and in modular, decentralized systems for smaller communities.

- A trend toward more robust and chemically resistant MF membranes for treating aggressive process streams, recovering valuable catalysts, and handling challenging industrial wastewater.

The water treatment segment accounted for the largest market share of 47.62% in 2024.

- Microfiltration membranes modern water treatment excels at physically removing suspended solids, turbidity, bacteria, algae, and protozoa from water sources such as lakes, rivers, and even wastewater.

- They are used as a pre-treatment step for more advanced membrane processes such as ultrafiltration (UF) or reverse osmosis (RO), protecting these sensitive downstream membranes from fouling by larger particles.

- This extends the lifespan and efficiency of the entire system. They are also vital for producing potable (drinking) water, providing a robust barrier against microbial contaminants.

- Replacing aging infrastructure and expanding capacity to meet growing demand is leading the new water treatment facilities, hence driving the segmental share.

- For instance, in 2024, the Tofino District of Canada officially opened its Wastewater Treatment Plant, marking the end of decades of discharging untreated sewage into the ocean.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the microfiltration membranes industry.

The pharmaceuticals segment is expected to grow at the fastest CAGR over the forecast period.

- MF membranes are vital for removing bacteria, yeasts, and other microorganisms from heat-sensitive pharmaceutical liquids (such as injectables, ophthalmic solutions, and some drug formulations).

- They act as an essential pre-filter for more sensitive downstream processes such as chromatography, protecting these costly systems from fouling by larger particles and extending their lifespan.

- Moreover, they efficiently separate desired proteins or therapeutic molecules from cell cultures (e.g., bacteria, yeast, or mammalian cells) and cellular debris after fermentation.

- All these benefits contribute to a cleaner product stream for further purification. Growth in the pharmaceutical industry is further driving this segment.

- Thus, according to market analysis, the aforementioned factors will drive the segment in the microfiltration membranes market growth.

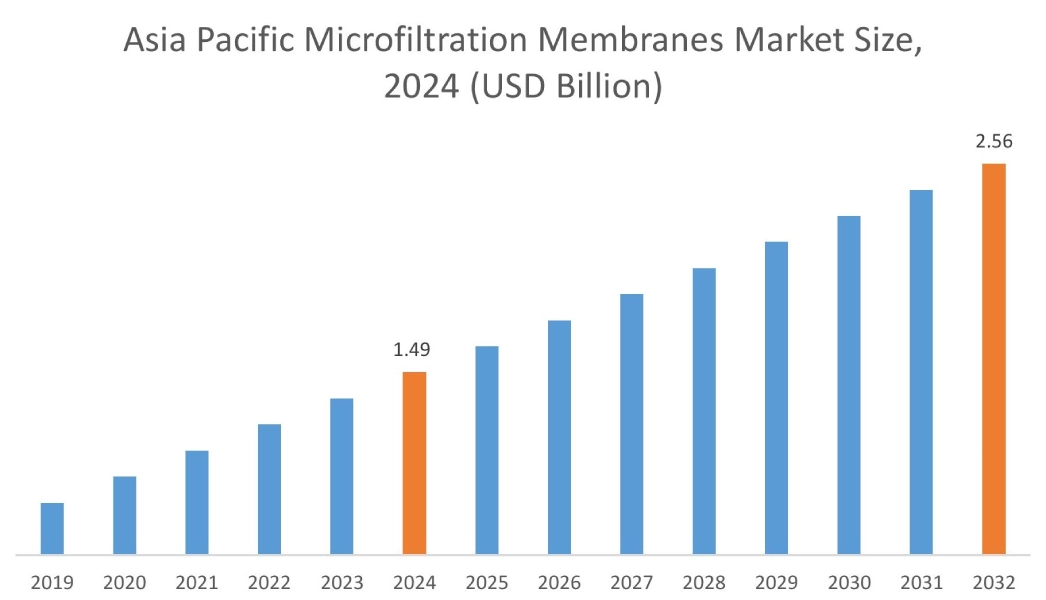

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

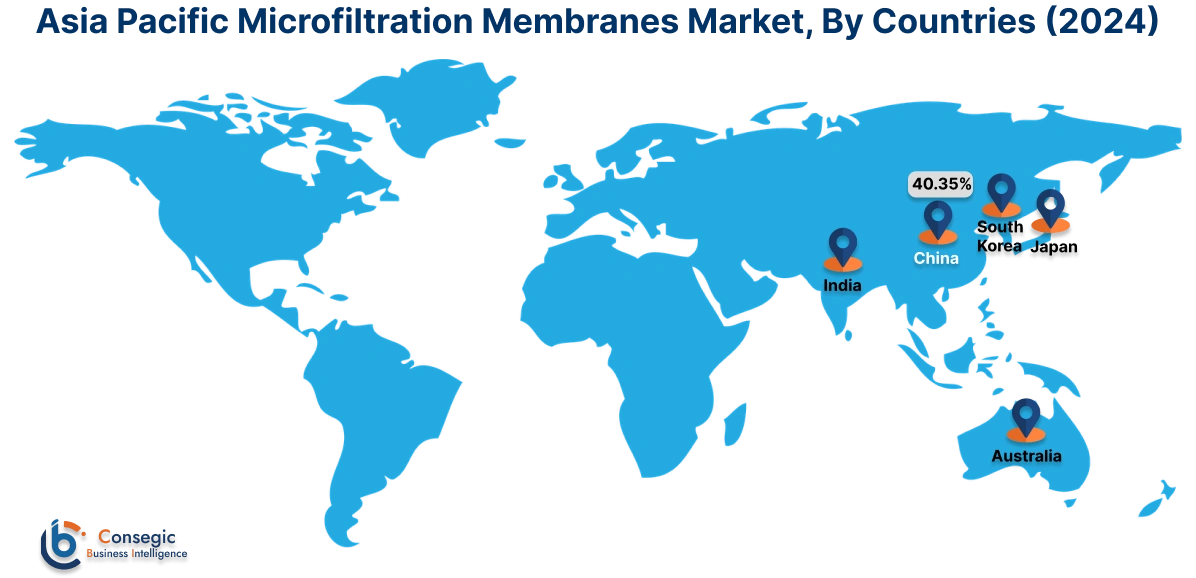

In 2024, Asia Pacific accounted for the highest microfiltration membranes market share at 41.56% and was valued at USD 1.49 Billion and is expected to reach USD 2.56 Billion in 2032. In Asia Pacific, the China accounted for the microfiltration membranes market share of 40.35% during the base year of 2024. The region is experiencing a surge in water treatment facilities. This is driven by rapid industrialization, urbanization, and increasing water scarcity. Countries such as India, South Korea, and China are leading the market.

For instance,

- In 2024, Thermax inaugurated a new, state-of-the-art manufacturing facility in Pune, India focused on water and wastewater treatment.

Microfiltration membranes are crucial in these new and upgraded facilities, serving as an effective pre-treatment step to remove suspended solids, bacteria, and turbidity, protecting downstream technologies like RO. They are also directly used for producing safe drinking water and enabling water reuse in industries and municipalities, addressing the escalating demand for clean water across the region. Overall, as per the market analysis, the increasing number of water treatment facilities is driving the market in the region.

In Europe, the microfiltration membranes market is experiencing the fastest growth with a CAGR of 11.4% over the forecast period. The semiconductor sector is experiencing rapid growth in the region. Semiconductor manufacturing demands ultrapure water (UPW) at various stages to prevent contamination that could damage sensitive microchips. MF membranes are indispensable for achieving this extreme purity. They are used to filter processing liquids such as etchants, plating solutions, and cleaning solvents, ensuring the removal of sub-micron particles, colloids, and microbes. This precision filtration is critical for preventing defects, enhancing yield, and maintaining the stringent quality standards required for advanced semiconductor fabrication in Europe.

North America’s microfiltration membranes market analysis indicates that several key trends are contributing to its growth in the region. There is an expanding food & beverage sector. This is fueled by increasing consumer demand for high-quality, safe, and self-stable products, alongside stringent food safety regulations. Microfiltration membranes are widely adopted for clarification, sterilization, and concentration in processes such as dairy (e.g., milk clarification, bacterial removal from cheese whey), juice processing (removing pulp and microbes), and beer/wine production (clarifying and removing yeast/bacteria). Their ability to achieve precise separation without heat ensures product integrity, enhances taste, and extends shelf life.

Middle East and Africa (MEA) microfiltration membranes market analysis indicates that chemical & petrochemical industries are rapidly evolving. These industries require efficient separation and purification processes, dealing with the challenging processing of liquids. MF systems are used for separating solids from liquids and clarifying solvents. They are particularly valuable for removing suspended particles, oils, and other contaminants from complex chemical and petrochemical effluents, supporting sustainable operations and regulatory compliance in the growing MEA industrial landscape.

Latin America's region creates potential for the market, as it is increasingly driven by technological advancements in membrane materials and module designs. Countries are investing in upgrading outdated water infrastructure and addressing water scarcity. Innovations in polymeric membranes (e.g., enhanced chemical resistance, and anti-fouling properties) and ceramic membranes (e.g., higher temperature and chemical stability) are making MF systems more efficient and robust. These advancements lead to improved flux, longer membrane lifespan, and reduced operational costs.

Top Key Players and Market Share Insights:

The Microfiltration Membranes market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Microfiltration Membranes market. Key players in The Microfiltration Membranes industry include-

- Synder Filtration, Inc. (United States)

- L. Gore & Associates, Inc. (United States)

- Merck KGaA (Germany)

- Trojan Technologies (Canada)

- Pentair Plc. (United Kingdom)

- DuPont Water Solutions (United States)

- Veolia (France)

- Pall Corporation (United States)

- Lenntech B.V. (Netherlands)

- Kovalus Separation Solutions (United States)

Microfiltration Membranes Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 6.94 Billion |

| CAGR (2025-2032) | 8.6% |

| By Material Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Microfiltration Membranes market? +

In 2024, the Microfiltration Membranes market is USD 3.59 Billion.

Which is the fastest-growing region in the Microfiltration Membranes market? +

Europe is the fastest-growing region in the Microfiltration Membranes market.

What specific segmentation details are covered in the Microfiltration Membranes market? +

Material Type and End-Use segmentation details are covered in the Microfiltration Membranes market.

Who are the major players in the Microfiltration Membranes market? +

Synder Filtration, Inc. (United States), W. L. Gore & Associates, Inc. (United States), DuPont Water Solutions (United States), Veolia (France), and Pall Corporation (United States) are some major players in the market.