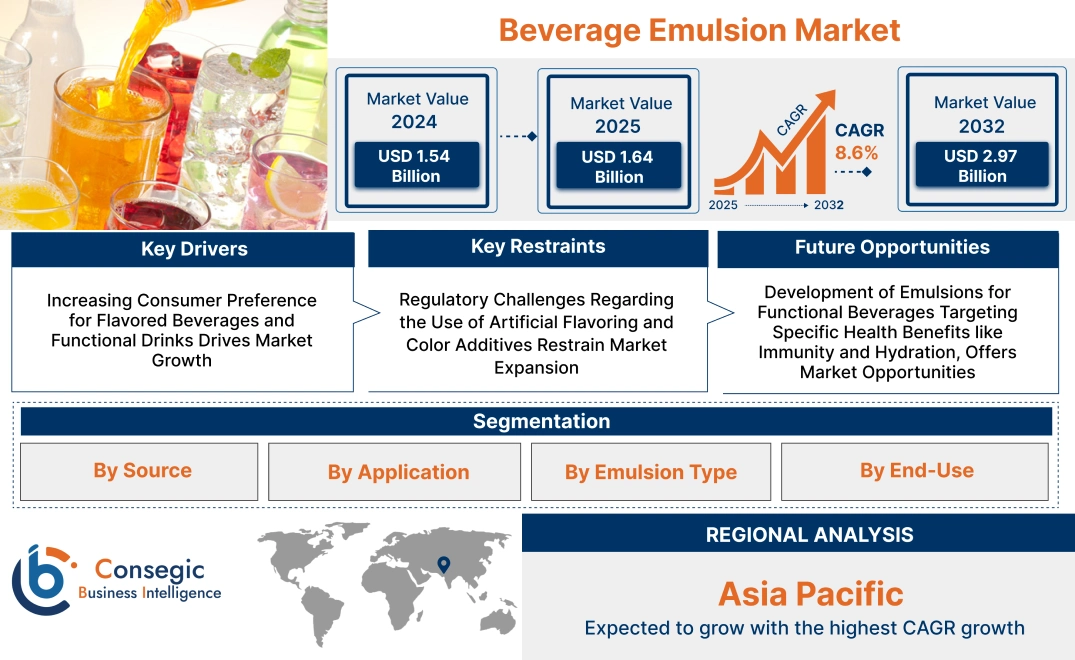

Beverage Emulsion Market Size:

Beverage Emulsion Market size is estimated to reach over USD 2.97 Billion by 2032 from a value of USD 1.54 Billion in 2024 and is projected to grow by USD 1.64 Billion in 2025, growing at a CAGR of 8.6% from 2025 to 2032.

Beverage Emulsion Market Scope & Overview:

Beverage emulsion refers to a stable mixture of two immiscible liquids, typically oil and water, used to deliver flavor, color, nutrients, or functional additives uniformly within drinks. It is a critical formulation component for products like carbonated soft drinks, energy beverages, flavored waters, and fortified juices.

Formulated using emulsifiers, stabilizers, weighting agents, and homogenization techniques, they ensure consistent texture, appearance, and taste throughout a product’s shelf life. They are engineered to resist separation, maintain clarity or cloudiness as desired, and enable even dispersion of active ingredients.

Beverage emulsion systems enhance product appeal, optimize ingredient delivery, and support clean-label formulations by reducing the need for synthetic additives. Their versatility allows manufacturers to innovate across a broad range of beverage categories. By maintaining product stability under various storage and transportation conditions, emulsions contribute significantly to improving consumer experience and brand differentiation in the competitive beverage sector.

How is AI Impacting the Beverage Emulsion Market?

AI is impacting the beverage emulsion market by accelerating product innovation and optimizing formulation. Using machine learning, companies can analyze vast datasets to predict which ingredient combinations will create stable emulsions with the desired flavor, mouthfeel, and visual appeal, significantly reducing R&D time. AI-powered sensors and real-time monitoring in production lines ensure consistent emulsion quality by automatically adjusting parameters to maintain optimal droplet size and stability. This improves efficiency, minimizes waste, and helps manufacturers create complex formulations for functional or fortified beverages with better bioavailability, all while meeting consumer demands for clean-label and natural ingredients.

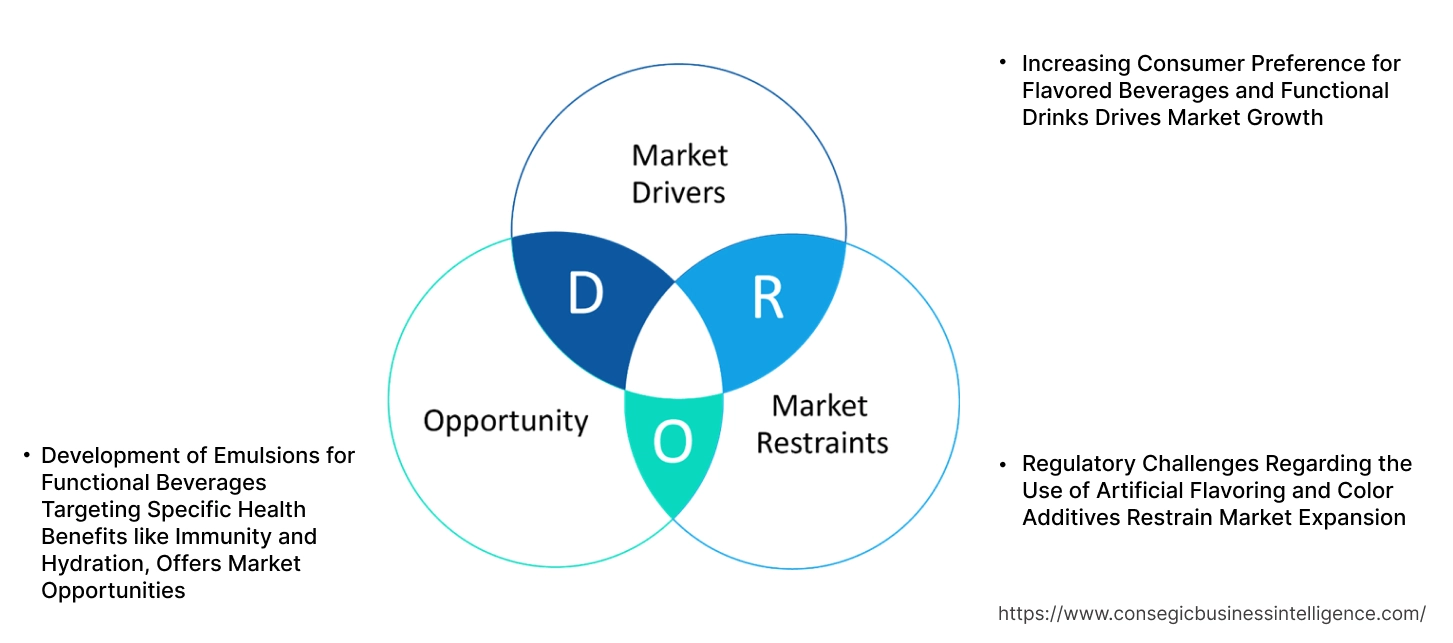

Beverage Emulsion Market Dynamics - (DRO) :

Key Drivers:

Increasing Consumer Preference for Flavored Beverages and Functional Drinks Drives Market Growth

Consumers are increasingly seeking beverages that not only quench thirst but also offer enhanced flavors and functional benefits. Flavored drinks, such as fruit juices, flavored water, and energy drinks, are gaining popularity, driving the demand for beverage emulsions that deliver consistent, stable flavors and textures. Additionally, the rise of functional beverages, which include added vitamins, minerals, and probiotics, further propels this trend. These emulsions are essential in ensuring that ingredients like oils, vitamins, and flavoring agents are properly mixed and evenly distributed. As consumers focus on both taste and health benefits, the need for emulsions that enhance flavor profiles and maintain stability is rising. The growing popularity of these beverages, combined with consumer interest in healthier options, is driving beverage emulsion market expansion as beverage manufacturers increasingly rely on emulsions for their formulation needs.

Key Restraints:

Regulatory Challenges Regarding the Use of Artificial Flavoring and Color Additives Restrain Market Expansion

While the need for flavored and colored beverages is growing, the use of artificial additives, including flavoring agents and colorants, faces increasing scrutiny from regulatory bodies worldwide. Stricter regulations and consumer concerns regarding artificial ingredients are forcing beverage manufacturers to explore natural alternatives or limit the use of synthetic chemicals in their products. The challenge lies in balancing flavor enhancement and aesthetic appeal with natural and clean-label formulations. In many regions, such as the European Union and North America, governments have enforced stringent laws regarding the use of artificial additives, placing additional burdens on manufacturers to comply with health and safety standards. As demand for clean-label products rises, these regulatory challenges present significant hurdles for the beverage emulsion market growth, especially in the development and acceptance of products using artificial flavoring and coloring agents.

Future Opportunities :

Development of Emulsions for Functional Beverages Targeting Specific Health Benefits like Immunity and Hydration, Offers Market Opportunities

The shift toward functional beverages that provide specific health benefits, such as immunity boosting, hydration, and energy enhancement, presents significant development potential for manufacturers. Emulsions play a key role in stabilizing bioactive ingredients, vitamins, and minerals that are incorporated into these beverages, ensuring their proper dispersion and bioavailability. With an increasing consumer focus on health and wellness, beverage companies are exploring innovative formulations that cater to specific needs, such as immune support or hydration. Additionally, demand for beverages with added health benefits, such as collagen for skin health and plant-based proteins, is increasing. As these trends continue, the beverage emulsion market is witnessing an influx of opportunities to develop specialized emulsions that align with consumer health trends. The expansion of functional beverage offerings targeting specific health needs is driving beverage emulsion market opportunities.

Beverage Emulsion Market Segmental Analysis :

By Source:

Based on the source, the market is segmented into xanthan gum, pectin, carboxymethyl cellulose, carrageenan, gum arabic, modified starch, and gellan gum.

The xanthan gum segment accounted for the largest revenue share in 2024.

- Xanthan gum is widely used as a thickening and stabilizing agent in beverage emulsions, offering excellent viscosity and suspension properties.

- It is commonly used in the non-alcoholic beverage sector for maintaining texture and consistency in products like fruit juices, smoothies, and soft drinks.

- The widespread adoption of xanthan gum is driven by its ability to create stable emulsions in beverages, ensuring uniform distribution of flavor and texture.

- As per beverage emulsion market analysis, xanthan gum remains dominant due to its versatile functionality and consistent performance in beverage formulations.

The gum arabic segment is expected to experience the fastest CAGR during the forecast period.

- Gum arabic is known for its ability to enhance flavor release and improve mouthfeel in beverages, making it popular in both alcoholic and non-alcoholic beverages.

- It is used extensively in the production of soft drinks and functional beverages, especially in flavor and cloud emulsions.

- The rising trend toward natural and organic products in the beverage industry is fueling the development of the gum arabic segment.

- According to market trends, the gum arabic segment is accelerating the beverage emulsion market demand due to its eco-friendly, natural composition and its growing application in premium beverage products.

By Application:

Based on application, the market is divided into alcoholic beverages and non-alcoholic beverages.

The non-alcoholic beverage segment held the largest beverage emulsion market share in 2024.

- Non-alcoholic beverages such as fruit juices, flavored waters, energy drinks, and soft drinks extensively use emulsions for enhancing flavor, texture, and stability.

- The growing preference for healthy, refreshing, and low-calorie beverages is driving its requirement to improve taste and consistency.

- The increasing consumption of health-conscious drinks, including functional beverages and sports drinks, is contributing significantly to the growth of this segment.

- As per beverage emulsion market trends, the non-alcoholic beverage sector remains the leading application due to the rising shift towards wellness-focused and low-sugar drinks.

The alcoholic beverage segment is projected to witness the fastest CAGR during the forecast period.

- Beverage emulsions in alcoholic drinks, including beer, wine, and spirits, are used to enhance mouthfeel, stability, and flavor delivery.

- The rising trend of premium and craft beverages, which often incorporate unique emulsions for better texture and flavor complexity, is contributing to this segment's growth.

- Alcoholic beverage manufacturers are also using emulsions to stabilize hazy drinks and to ensure even mixing of ingredients in flavored liquors.

- According to market analysis, the alcoholic beverage segment is driving beverage emulsion market expansion, due to the increasing innovation in beverage formulations and consumer preference for quality and unique drinking experiences.

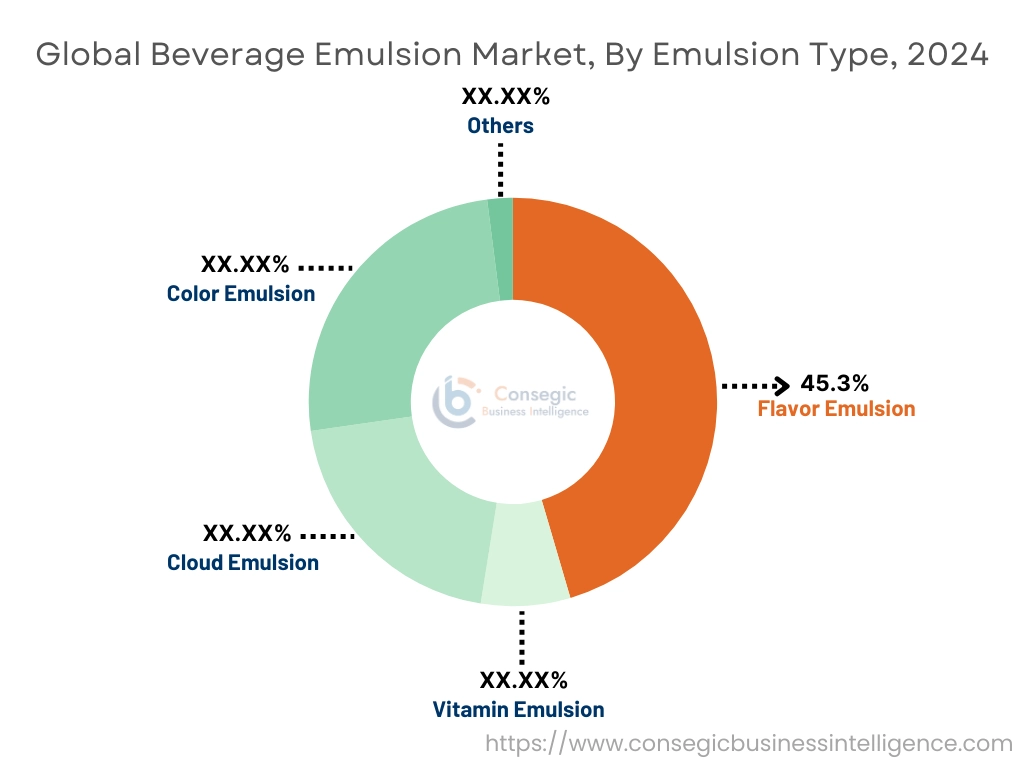

By Emulsion Type:

Based on emulsion type, the market is segmented into color emulsion, flavor emulsion, vitamin emulsion, cloud emulsion, and others.

The flavor emulsion segment held the largest beverage emulsion market share of 45.3% in 2024.

- Flavor emulsions are used extensively in both alcoholic and non-alcoholic beverages to ensure consistent, long-lasting flavor delivery throughout the drink.

- These emulsions play a critical role in balancing sweetness and enhancing taste profiles, particularly in beverages like flavored waters, sodas, and energy drinks.

- The increasing consumer preference for flavored beverages that offer natural, bold, and unique flavor experiences is driving the need for flavor emulsions.

- As per beverage emulsion market analysis, the flavor emulsion segment continues to dominate due to its critical role in ensuring high-quality flavor experiences in a wide range of beverages.

The cloud emulsion segment is projected to witness the fastest CAGR.

- Cloud emulsions are used in beverages to provide a creamy, cloudy appearance, commonly seen in drinks like fruit juices and lemonades.

- The increasing trend toward premium and natural beverage formulations is driving the necessity for cloud emulsions to enhance the visual appeal and texture of drinks.

- Cloud emulsions also contribute to the mouthfeel and aesthetic quality of beverages, which is becoming increasingly important in consumer preferences.

- Hence, the cloud emulsion segment is expected to bolster the beverage emulsion market demand, as consumers seek more visually appealing and innovative products.

By End-Use Industry:

Based on end-use industry, the beverage emulsion market is segmented into food & beverage, pharmaceuticals, personal care, nutraceuticals, and others.

The food & beverage segment accounted for the largest revenue share in 2024.

- The food and beverage industry is the primary consumer of beverage emulsions, with applications spanning soft drinks, fruit juices, energy drinks, and alcoholic beverages.

- The need for clean-label ingredients, natural products, and healthier alternatives has significantly influenced its growth in this sector.

- The increasing interest in plant-based and functional beverages has also expanded the use of emulsions for texture, flavor, and appearance in these new categories.

- As per beverage emulsion market growth, the food and beverage industry continues to be the dominant end-use sector, supported by ongoing product innovation and increasing health-consciousness among consumers.

The nutraceuticals segment is expected to experience the fastest CAGR.

- Nutraceuticals, which include functional beverages and supplements, require emulsions to improve the bioavailability of active ingredients such as vitamins, minerals, and herbal extracts.

- With the growing consumer interest in health and wellness, the nutraceuticals segment is expanding rapidly, particularly in beverages aimed at improving health and offering functional benefits.

- The ability of emulsions to stabilize and effectively incorporate nutrients into beverages is driving their increasing use in this sector.

- According to beverage emulsion market trends, the nutraceuticals segment is gaining traction as more consumers look for drinks that deliver health benefits along with taste.

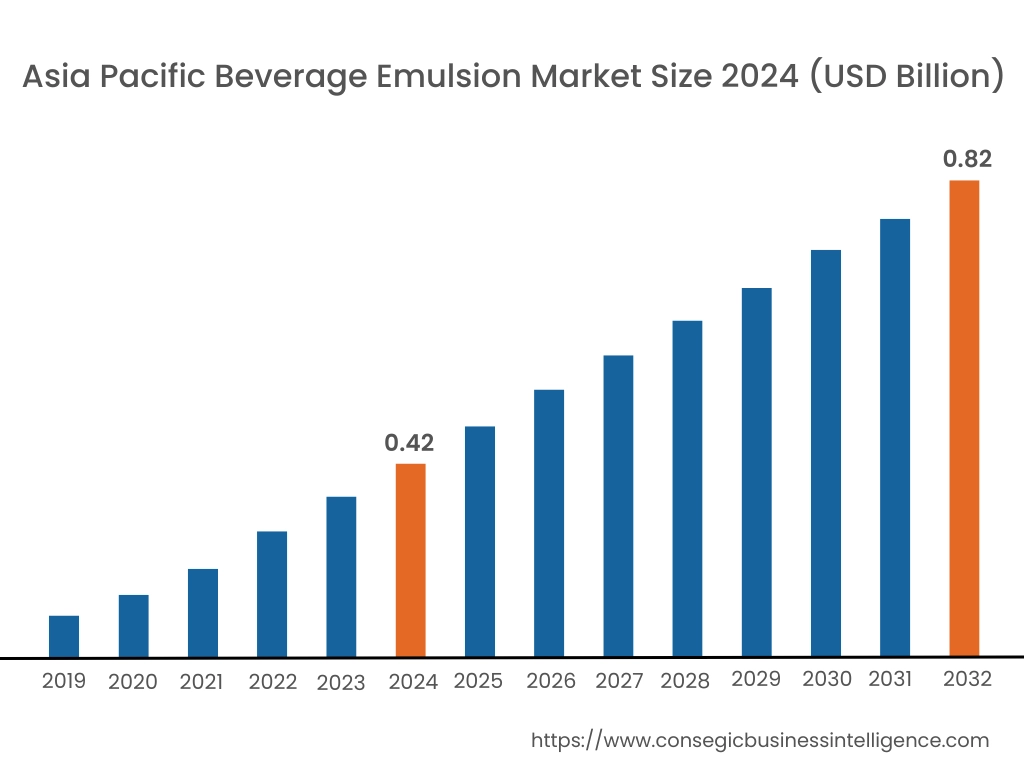

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 0.42 Billion in 2024. Moreover, it is projected to grow by USD 0.45 Billion in 2025 and reach over USD 0.82 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.7%. Asia-Pacific is witnessing rapid growth in the beverage emulsion industry, fueled by the booming non-alcoholic beverage sector and growing health-conscious consumer base. In China, India, Japan, and Southeast Asia, beverage manufacturers are integrating emulsions into new product launches across categories such as fortified juices, ready-to-drink teas, and functional energy drinks. Market analysis shows strong interest in emulsions that deliver long-term stability for high-acid and high-protein formulations. Growth is further supported by the expanding middle-class population, urbanization, and the rising popularity of beverages enhanced with vitamins, minerals, and herbal extracts requiring stable dispersion in liquid matrices.

North America is estimated to reach over USD 0.99 Billion by 2032 from a value of USD 0.51 Billion in 2024 and is projected to grow by USD 0.55 Billion in 2025. North America remains a significant market for beverage emulsions, with the United States and Canada leading demand across functional beverages, flavored waters, and carbonated soft drinks. Market analysis indicates that clean-label formulations and natural ingredient sourcing are becoming major priorities for beverage brands. Growth in this region is supported by consumer preferences for vitamin-fortified beverages, natural flavor emulsions, and visually vibrant drinks. Companies are investing in emulsions that provide high stability without synthetic additives, fueling innovation across both mainstream and niche beverage categories. There is also a rising requirement for emulsions that perform well in low-sugar and plant-based drink formulations.

Europe represents a sophisticated and regulation-driven beverage emulsion market where compliance with stringent food safety and clean-label standards is necessary. Countries such as Germany, France, and the United Kingdom are leading adopters, particularly in the production of flavored waters, premium energy drinks, and botanical-infused beverages. Market analysis highlights growing demand for emulsions based on plant-derived emulsifiers and reduced reliance on traditional stabilizers. The market opportunity in Europe is driven by rising consumer awareness of functional ingredients, evolving wellness trends, and the shift toward transparency in beverage formulations, which requires emulsions to meet both performance and regulatory expectations.

Latin America is emerging as a promising region, with countries such as Brazil, Mexico, and Argentina leading the adoption curve. Market analysis suggests increasing incorporation of emulsions in fruit-based drinks, sports beverages, and flavored dairy alternatives. Brands are seeking emulsions that maintain sensory attributes and freshness across a variety of climatic conditions. The beverage emulsion market opportunity in Latin America is supported by growing need for value-added beverages that offer functional health benefits, as well as increasing investment by multinational beverage companies expanding their regional manufacturing capabilities.

The Middle East and Africa are gradually adopting beverage emulsions, particularly in the UAE, Saudi Arabia, and South Africa, where premium beverage consumption is on the rise. Market analysis indicates a preference for emulsions that can stabilize flavors and colors in fortified waters, isotonic drinks, and luxury non-alcoholic beverages. Expansion in this region is further stimulated by health and wellness trends, as consumers show greater interest in beverages offering hydration, immunity, and energy-boosting properties. Manufacturers are seeking emulsions capable of maintaining quality in extreme temperature environments, enhancing the appeal of shelf-stable beverages.

Top Key Players and Market Share Insights:

The beverage emulsion market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global beverage emulsion market. Key players in the beverage emulsion industry include -

- Kerry Group plc (Ireland)

- Tate & Lyle PLC (United Kingdom)

- Riken Vitamin Co., Ltd. (Japan)

- Kancor Ingredients Ltd. (India)

- Hangzhou Fuchun Food Additive Co., Ltd. (China)

- Givaudan SA (Switzerland)

- Döhler GmbH (Germany)

- Hansen Holdings A/S (Denmark)

- Corbion N.V. (Netherlands)

- Palsgaard A/S (Denmark)

Recent Industry Developments :

Product Launches:

- In October 2024, the Flora Growth Corp. launched its first THC-infused beverage, Melo, in four different flavors- grapefruit, half & half lemonade iced tea, strawberry mango and wild berries. The premium THC-infused drink was developed in collaboration with Peak, a renowned provider of advanced cannabis-based products. This product launch aligns with the growing consumer trends towards meaningful alternatives to alcohol.

Acquisitions:

- In October 2023, the private investment firm specializing in materials, ingredients and the life sciences sector, SK Capital Partners, LP, acquired J&K Ingredients, Inc., a market-leading manufacturer and supplier of food and beverage ingredients that are natural, organic, and clean label products.

Partnerships:

- In September 2021, Vertosa collaborated with State B Cannabis Beverage Co. by Brujera Elixirs Inc. to become its exclusive United States emulsions partner. This partnership enables the companies to develop proprietary formulations for the CBD and THC-infused beverages.

Beverage Emulsion Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.97 Billion |

| CAGR (2025-2032) | 8.6% |

| By Source |

|

| By Application |

|

| By Emulsion Type |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Beverage Emulsion Market? +

Beverage Emulsion Market size is estimated to reach over USD 2.97 Billion by 2032 from a value of USD 1.54 Billion in 2024 and is projected to grow by USD 1.64 Billion in 2025, growing at a CAGR of 8.6% from 2025 to 2032.

What specific segmentation details are covered in the Beverage Emulsion Market report? +

The Beverage Emulsion market report includes specific segmentation details for source, application, emulsion type and end-use industry.

What are the end-use industries of the Beverage Emulsion Market? +

The end-use industries of the Beverage Emulsion Market are food & beverage, pharmaceuticals, personal care, nutraceuticals, and others.

Who are the major players in the Beverage Emulsion Market? +

The key participants in the Beverage Emulsion market are Kerry Group plc (Ireland), Tate & Lyle PLC (United Kingdom), Givaudan SA (Switzerland), Döhler GmbH (Germany), Chr. Hansen Holdings A/S (Denmark), Corbion N.V. (Netherlands), Palsgaard A/S (Denmark), Riken Vitamin Co., Ltd. (Japan), Kancor Ingredients Ltd. (India) and Hangzhou Fuchun Food Additive Co., Ltd. (China).