LIB Cathode Conductive Auxiliary Agents Market Size:

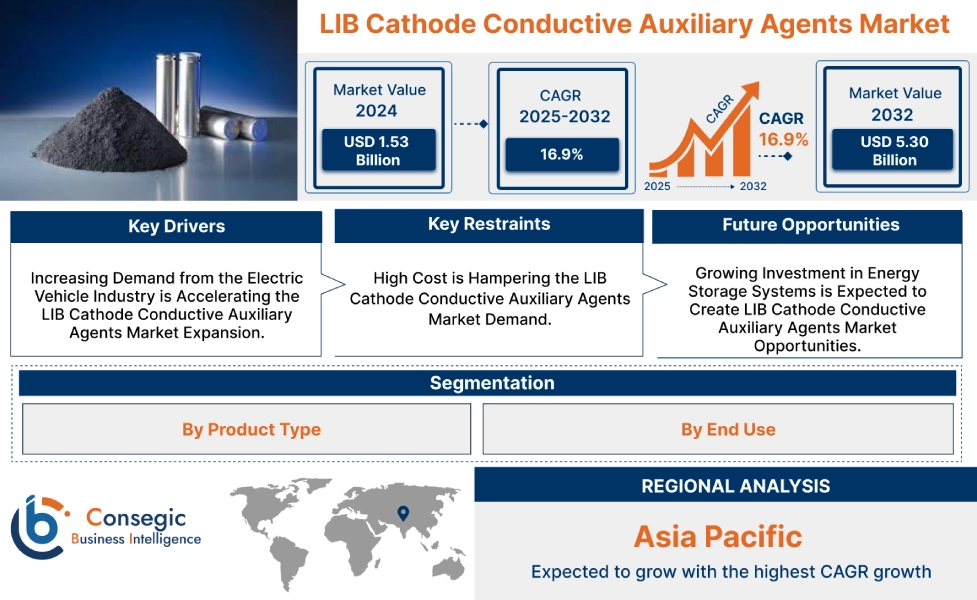

LIB Cathode Conductive Auxiliary Agents Market size is growing with a CAGR of 16.9% during the forecast period (2025-2032), and the market is projected to be valued at USD 5.30 Billion by 2032 from USD 1.53 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 1.78 Billion.

LIB Cathode Conductive Auxiliary Agents Market Scope & Overview:

LIB cathode conductive auxiliary agents are materials added to the cathode active material in lithium-ion batteries (LIBs) to significantly improve their electrical conductivity. Cathode active materials have poor intrinsic conductivity, which hinders efficient electron flow during charge and discharge cycles. These auxiliary agents form a conductive network within the cathode, facilitating rapid electron transfer. Common types include carbon black, carbon nanotubes, and graphene, among others. These agents possess high electrical conductivity, large surface areas, and good mechanical strength. Their benefits include reducing internal resistance, enhancing energy density, improving power capability, extending cycle life, and increasing overall safety by preventing overheating.

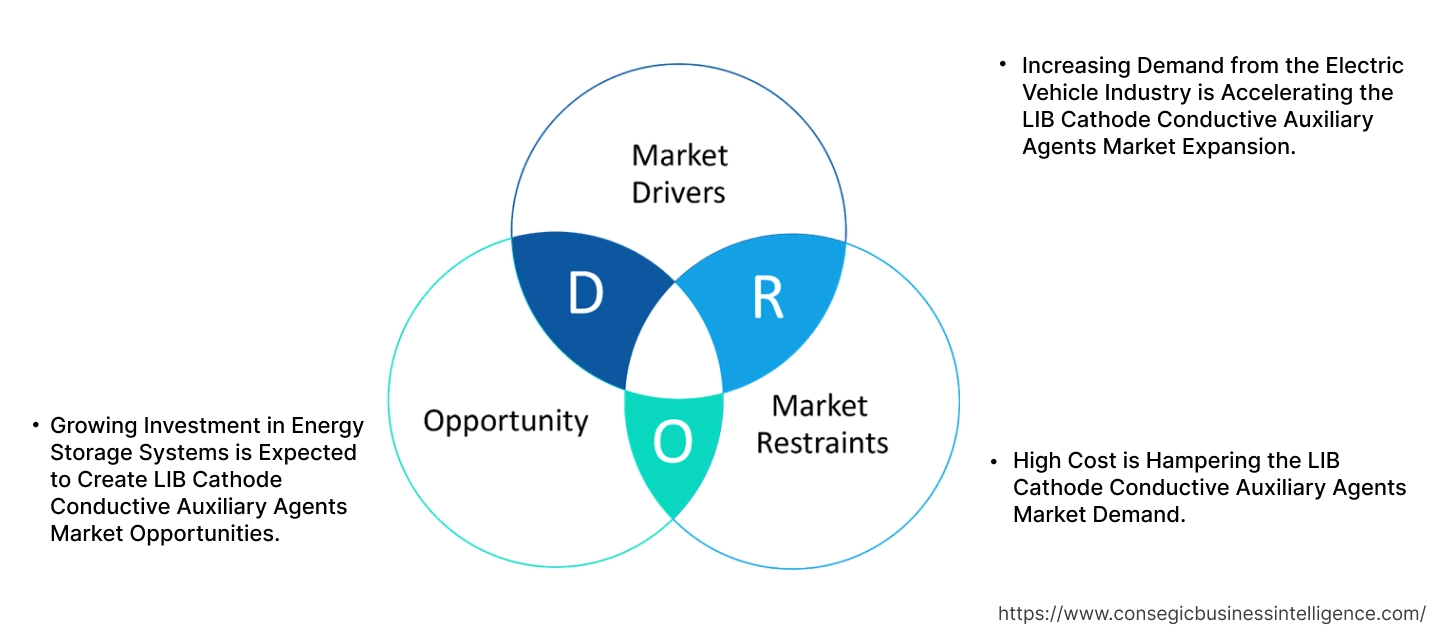

LIB Cathode Conductive Auxiliary Agents Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand from the Electric Vehicle Industry is Accelerating the LIB Cathode Conductive Auxiliary Agents Market Expansion.

LIB cathode conductive auxiliary agents are vital for enhancing electric vehicles (EVs). They significantly boost battery energy density, leading to longer driving ranges. By reducing internal resistance, these agents enable faster charging capabilities, a critical factor for EV adoption. They also improve power output for quicker acceleration and regenerative breaking. Furthermore, they contribute to extended battery lifespan and enhanced safety by facilitating efficient electron flow and thermal management, ultimately making EVs more practical and reliable for consumers. A combination of environmental concerns and government incentives has led to growth in the EV sector, hence driving the need for these agents.

For instance,

- According to the International Energy Agency, global electric car sales surged by 35% in 2023, exceeding 2022 figures by 3.5 million units, thus positively impacting the LIB cathode conductive auxiliary agents market trends.

Overall, the increasing need from the electric vehicle sector is significantly boosting the LIB cathode conductive auxiliary agents market expansion.

Key Restraints:

High Cost is Hampering the LIB Cathode Conductive Auxiliary Agents Market Demand.

While carbon black is relatively inexpensive, it involves processes that generate emissions and potentially hazardous byproducts. Stricter environmental regulations increase production costs and complexity. Moreover, next-generation materials such as carbon nanotubes (CNTs) and graphene offer superior conductivity and performance benefits (e.g., higher energy density, faster charging). However, their production processes are complex and energy-intensive, involving specialized equipment and purification steps, which drive up their manufacturing costs significantly compared to conventional carbon black. For instance, CNTs are over 30 times more expensive than carbon black. This cost disparity makes it challenging for battery manufacturers to integrate these advanced materials into mainstream LIB production, especially for price-sensitive markets such as consumer electronics and entry-level electric vehicles, limiting their market penetration despite their superior technical advantages. Hence, the high cost is hampering the LIB cathode conductive auxiliary agents market demand.

Future Opportunities :

Growing Investment in Energy Storage Systems is Expected to Create LIB Cathode Conductive Auxiliary Agents Market Opportunities.

In energy storage systems (ESS), particularly grid-scale applications, LIB cathode conductive auxiliary agents are crucial for maximizing efficiency and longevity. They enhance power capability, allowing faster charge and discharge rates to quickly respond to grid fluctuations from renewable energy sources such as solar and wind. By reducing internal resistance, these agents minimize energy loss during storage and retrieval, improving overall system efficiency. Furthermore, they contribute to extended cycle life and thermal stability, ensuring the long-term reliability and safety of large battery installations vital for grid balancing and renewable energy integration. The need for grid stability and supportive government policies is leading to increased investment in the energy storage sector, positively influencing the LIB cathode conductive auxiliary agents market trends.

For instance,

- According to Utility Dive, the U.S. energy storage sector has made a significant pledge to invest USD 100 billion by 2030, creating the potential for the market.

Overall, growing investment in energy storage systems is expected to increase the LIB cathode conductive auxiliary agents market opportunities.

LIB Cathode Conductive Auxiliary Agents Market Segmental Analysis :

By product Type:

- There is a growing trend of using carbon due to its cost-effectiveness, scalability, and reliable performance.

- Usage of graphene for applications requiring superior electrical conductivity and mechanical flexibility is also a rising trend.

The carbon black segment accounted for the largest market share in 2024

- Carbon Black, particularly grades such as Super P and acetylene black, is currently the dominant product type in the market.

- Its widespread use is primarily attributed to its cost-effectiveness, established manufacturing processes, and good overall performance as a conductive additive.

- It offers a balance of electrical conductivity and ease of dispersion, making it a reliable and economical choice for a vast majority of lithium-ion battery applications, especially in consumer electronics and various EV segments where cost optimization is crucial. Growth in these sectors is driving segmental share,

- For instance, according to Canalys, the PC market, with combined shipments of desktops, notebooks, and workstations, increased by 5.0% in 2024 when compared to the previous year.

- Overall, as per the market analysis, the aforementioned factors are driving a segment in the market.

The carbon nanotubes segment is expected to grow at the fastest CAGR over the forecast period.

- Carbon nanotubes are revolutionizing LIB cathode performance. Beyond their exceptionally high electrical conductivity, large aspect ratios, and excellent mechanical strength, they offer unique advantages.

- CNTs form a highly efficient 3D conductive network at very low loadings, meaning only a small amount is needed to dramatically improve electron flow.

- This leads to higher energy density, enabling longer driving ranges for EVs and significantly improved power capability for faster charging and discharge rates.

- Their remarkable mechanical flexibility helps mitigate structural degradation within the cathode during repeated charge/discharge cycles, resulting in extended battery cycle life and enhanced long-term stability. All these factors are driving their increased usage.

- Overall, as per the market analysis, the aforementioned factors will drive a segment in the LIB cathode conductive auxiliary agents market growth.

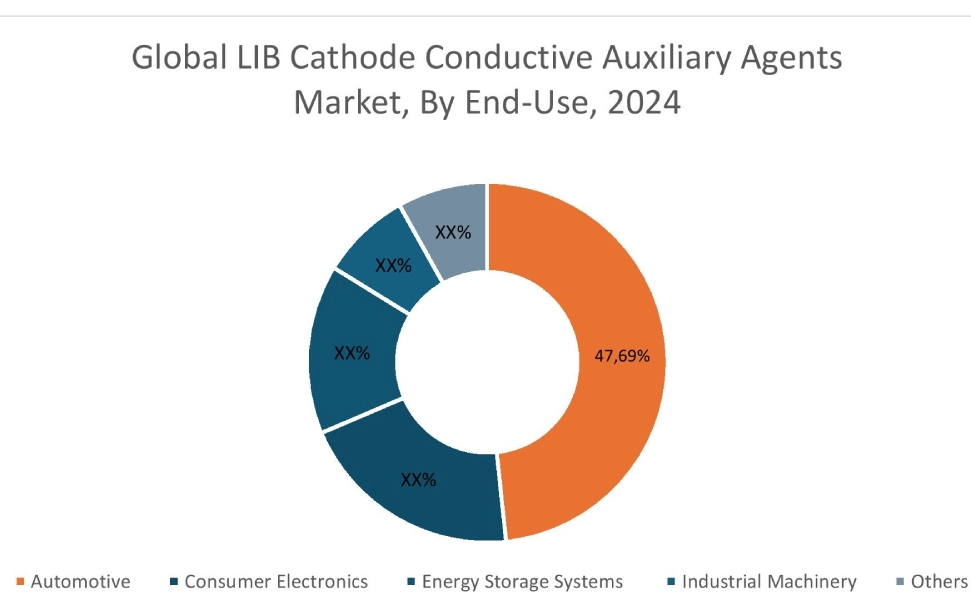

By End-Use :

Based on end-use, the market is categorized into automotive, consumer electronics, energy storage systems, industrial machinery, and others.

Trends in the End-Use

- The ongoing trend of miniaturization and the need for higher energy density in devices such as smartphones and wearables maintains a steady demand for efficient, compact battery solutions.

- Niche sectors such as drones, urban air mobility and advanced medical devices are creating demand for ultra-high-performance and customized conductive solutions.

The automotive segment accounted for the largest market share of 47.69% in 2024.

- The automotive sector currently dominates the market, and this dominance is driven by the global electric vehicle (EV) revolution, fueled by stringent emission regulations and government incentives.

- EVs require high-performance lithium-ion batteries that deliver long driving ranges, rapid charging capabilities, and extended lifespans, all of which are directly enhanced by efficient conductive auxiliary agents.

- These agents are crucial for optimizing electron flow within the cathode, enabling the energy density and power output required for EV performance.

- As major automakers worldwide commit substantial investments to EV production, the demand for high-quality conductive agents continues to surge.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the LIB cathode conductive auxiliary agents industry.

The energy storage systems segment is expected to grow at the fastest CAGR over the forecast period.

- The energy storage systems segment is a rapidly emerging and high-growth application area for these auxiliary agents.

- This growth is intrinsically linked to the global push for renewable energy integration and grid modernization.

- As solar and wind power generation become more prevalent, the need for robust and efficient battery storage to manage intermittency and stabilize electricity grids becomes paramount.

- Conductive auxiliary agents enhance the performance of these large-scale LIBs by enabling faster charge/discharge cycles for grid balancing, improving overall system efficiency, and extending the operational lifespan of the batteries. The growing energy storage sector is creating potential for the market.

- For instance, according to Energy Storage News, the global energy storage market is expected to grow at a CAGR of 23% by 2030 from 2022.

- Thus, according to market analysis, the aforementioned factors will drive the segment in the LIB cathode conductive auxiliary agents market growth.

By Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest LIB cathode conductive auxiliary agents market share at 40.23% and was valued at USD 0.62 Billion and is expected to reach USD 1.94 Billion in 2032. In Asia Pacific, China accounted for the LIB cathode conductive auxiliary agents market share of 39.15% during the base year of 2024. There is an evolving automotive sector in the region. This is driven by a rising focus on electric vehicles. Countries such as China, South Korea, and Japan are key players in EV manufacturing and adoption.

- For instance, according to the IEA, China maintained its position as the global electric car manufacturing hub in 2024, producing over 70% of the world's electric vehicles. This production dominance was increasingly driven by domestic manufacturers, with Chinese OEMs accounting for more than 80% of the country's electric car output in 2024, a notable increase from approximately two-thirds in 2021.

This large scale of EV production directly fuels the need for high-performance LIBs, which in turn necessitates a continuous supply of advanced cathode conductive auxiliary agents. These agents are crucial for enhancing battery energy density, enabling faster charging capabilities, extending battery lifespan, and improving overall safety. Collectively, the aforementioned factors are driving the market in the region.

In Europe, the LIB cathode conductive auxiliary agents market is experiencing the fastest growth with a CAGR of 19.5% over the forecast period. There is development in renewable energy and grid storage solutions in the region. Europe is committed to a rapid transition away from fossil fuels, with ambitious targets for renewable energy integration. This is leading to a surge in the deployment of large-scale battery energy storage systems to manage the intermittency of solar and wind power, ensure grid stability, and enhance energy security. These grid-scale and even residential battery storage installations require high-performance lithium-ion batteries, which in turn necessitate efficient conductive auxiliary agents for their cathodes. The benefits of these agents are vital for the reliability and economic viability of Europe's burgeoning renewable energy infrastructure.

North America’s LIB cathode conductive auxiliary agents market analysis indicates that several key trends are contributing to its growth in the region. There is a growing focus on miniaturization and higher power in consumer electronics. As consumers need thinner, lighter, and more powerful devices such as smartphones, laptops, wearables, and portable medical equipment, the need for compact yet high-performing lithium-ion batteries intensifies. LIB cathode conductive auxiliary agents are crucial in achieving this, as they enhance the electrical conductivity of cathode materials, allowing for higher energy density and power output within a smaller battery footprint. This enables faster charging, longer battery life, and superior performance for smaller electronic gadgets, directly contributing to the market's expansion in the region.

Middle East and Africa (MEA) LIB cathode conductive auxiliary agents market analysis indicates that there is a growing government investment in diversifying economies and promoting sustainable technologies. Countries such as the UAE and Saudi Arabia are actively investing in new sectors beyond traditional oil and gas, including renewable energy projects and the nascent electric vehicle industry. There's a push towards establishing battery manufacturing capabilities and EV adoption targets. Similarly, nations in Africa are seeing government-backed initiatives to develop critical mineral mining and processing, and even early-stage battery component manufacturing. These strategic investments are indirectly stimulating the need for high-performance LIBs, and consequently, for the crucial conductive auxiliary agents needed to power these emerging industries.

Latin America creates potential for the market due to rapid evolving nature of the industrial machinery sector in the region. As industries across the region modernize and automate, there's an increasing need for robust and efficient power solutions for a wide range of industrial equipment, including robotics, material handling machinery, and automated guided vehicles. Lithium-ion batteries are increasingly favored for these applications due to their superior energy density, longer cycle life, and lower maintenance requirements compared to traditional lead-acid batteries. The benefits derived from the use of LIBs in industrial machinery, such as enhanced productivity, reduced downtime, and improved operational efficiency, directly drive the demand for the high-performance cathode conductive auxiliary agents essential for optimizing these batteries' performance.

Top Key Players and Market Share Insights:

The baked savory snacks industry is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global Cardiac Medical Device Market. Key players in the baked savory snacks industry include

- Birla Carbon (India)

- Orion S.A. (Luxembourg)

- Imerys (France)

- LG Chem (South Korea)

- Resonac Holdings Corporation (Japan)

- BTR New Material Group Co., L

- Zeon Corporation (Japan)

- Adeka Corporation (Japan)

- Shenzhen Dynanonic Co., Ltd. (China)

- Cabot Corporation (United States)

- OCSiAl (Luxembourg)

LIB Cathode Conductive Auxiliary Agents Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 5.30 Billion |

| CAGR (2025-2032) | 16.9% |

| By Product Type |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the LIB Cathode Conductive Auxiliary Agents market? +

In 2024, the LIB Cathode Conductive Auxiliary Agents market is USD 1.53 Billion.

Which is the fastest-growing region in the LIB Cathode Conductive Auxiliary Agents market? +

Europe is the fastest-growing region in the LIB Cathode Conductive Auxiliary Agents market.

What specific segmentation details are covered in the LIB Cathode Conductive Auxiliary Agents market? +

Product Type and End-Use segmentation details are covered in the LIB Cathode Conductive Auxiliary Agents market.

Who are the major players in the LIB Cathode Conductive Auxiliary Agents market? +

Birla Carbon (India), Orion S.A. (Luxembourg), Imerys (France), LG Chem (South Korea), and Resonac Holdings Corporation (Japan) are some major players in the market.