Redispersible Polymer Powder Market Size:

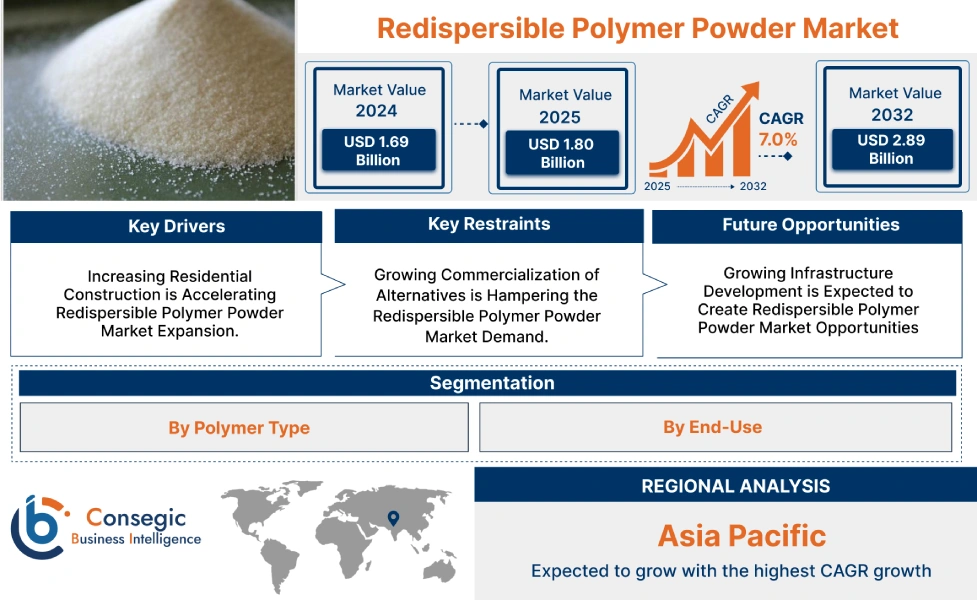

Redispersible Polymer Powder Market size is growing with a CAGR of 7.0% during the forecast period (2025-2032), and the market is projected to be valued at USD 2.89 Billion by 2032 from USD 1.69 Billion in 2024. Additionally, the market value for the 2025 attributes to USD 1.80 Billion.

Redispersible Polymer Powder Market Scope & Overview:

Redispersible polymer powder (RDP) is a free-flowing, white powder derived from a liquid polymer emulsion. When mixed with water, it redisperses back into a stable emulsion, essentially behaving like the original liquid polymer. It is primarily produced by spray-drying polymer emulsion. The liquid emulsion, containing polymers such as VAE, acrylics, SB and protective colloids to prevent clumping, is atomized into fine droplets. These droplets are then rapidly dried in a hot air stream, transforming them into fine, solid powder. This powder is then cooled and treated with anti-caking agents for storage stability. This powder significantly enhances dry-mix construction materials by improving adhesion, flexibility, water resistance, workability, and durability.

How is AI Impacting the Redispersible Polymer Powder Market?

AI is significantly impacting the redispersible polymer powder (RDP) market by enhancing manufacturing efficiency, quality control, and product innovation. AI-driven systems monitor polymerization processes in real-time, ensuring consistent particle size distribution and optimal film integrity. This leads to higher-quality RDPs with improved performance characteristics for various applications. Furthermore, AI-powered predictive analytics can anticipate equipment failures, enable proactive maintenance, and reduce costly downtime in RDP production facilities. In the future, AI could accelerate the development of novel RDP formulations by analyzing vast chemical datasets and simulating new material properties, catering to the increasing demand for sustainable and high-performance building materials. This intelligent approach optimizes production, reduces waste, and fosters innovation across the RDP value chain.

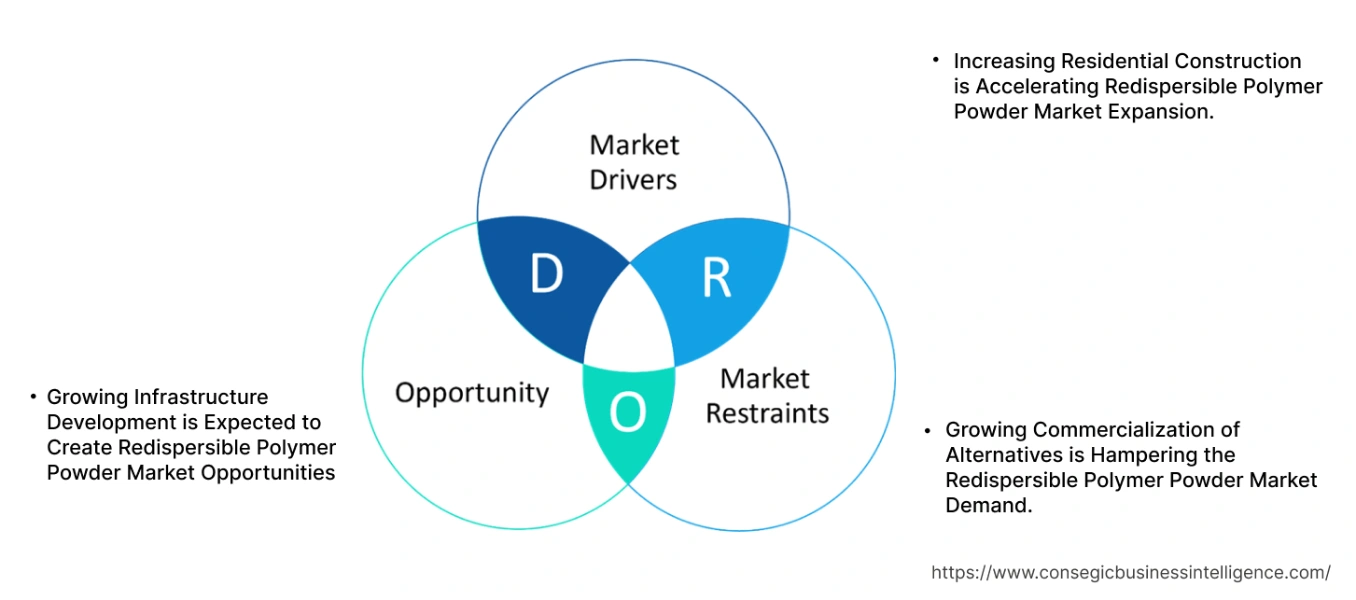

Redispersible Polymer Powder Market Dynamics - (DRO) :

Key Drivers:

Increasing Residential Construction is Accelerating Redispersible Polymer Powder Market Expansion.

In residential construction, redispersible polymer powder is widely used to enhance the performance of dry-mix mortars such as tile adhesives, plasters, and self-leveling compounds. Its benefits include significantly improving bond strength and flexibility, and preventing cracks from thermal expansion and structural movement. It also boosts water resistance in areas such as bathrooms and kitchens, while improving workability, making application easier for contractors. Ultimately, it leads to more durable, aesthetically pleasing, and longer-lasting homes. Population growth and urbanization are leading to increased residential construction, hence requiring these polymer powders for multiple applications.

For instance,

- According to Real Estate Japan, Japan’s new housing construction increased by 6.6% in the year 2021 when compared to 2020, thus positively impacting redispersible polymer powder market trends.

Overall, increasing residential construction is significantly boosting the redispersible polymer powder market expansion.

Key Restraints:

Growing Commercialization of Alternatives is Hampering the Redispersible Polymer Powder Market Demand.

The market faces hurdles from the substitutes available in the market. For instance, cellulose ethers are water-soluble polymers derived from cellulose, commonly used in dry-mix mortars as thickeners, water retention agents, and rheology modifiers. They are excellent for water retention, preventing rapid drying, and improving open time and workability. They are crucial for consistency and anti-sag properties, particularly in plasters and tile adhesives. Moreover, starch and starch ethers are modified natural polymers used as thickening agents to improve workability and anti-sag properties in cement and gypsum-based mortars. They offer good rheology modification and workability, often at a lower cost. They contribute to the consistency and initial stickiness of the wet mortar, making it easier to apply. Hence, the growing commercialization of substitutes is hampering the redispersible polymer powder market demand.

Future Opportunities :

Growing Infrastructure Development is Expected to Create Redispersible Polymer Powder Market Opportunities

In infrastructure projects such as roads, bridges, and tunnels, redispersible polymer powder enhances the performance of critical concrete and mortar applications. It significantly improves flexibility and crack resistance in repair mortars and overlays, crucial for resisting thermal cycles and traffic stress. It also boosts adhesion to existing substrates, ensuring long-lasting repairs and stronger bonds for new constructions. Furthermore, it increases water resistance and durability against harsh environmental conditions, ultimately prolonging the lifespan and reducing maintenance costs of vital infrastructure. The growing investment in infrastructure development is positively influencing redispersible polymer powder market trends.

For instance,

- According to GGI Global Alliance AG, in 2025, the Malaysian government allocated USD 20 billion to critical infrastructure improvements, creating the potential for the market.

Overall, growing infrastructure development is expected to increase the redispersible polymer powder market opportunities.

Redispersible Polymer Powder Market Segmental Analysis :

By Polymer Type:

Based on polymer type, the market is categorized into vinyl acetate ethylene (VAE), vinyl ester of versatic acid (VeoVa), styrene butadiene (SB), acrylics, and others.

Trends in Polymer Type:

- There is a growing trend of using acrylics polymer type due to their superior UV and weather resistance, making them ideal for high-quality exterior applications.

- The usage of VeoVa in high-performance formulations such as waterproofing and decorative plasters is also a rising trend.

The vinyl acetate ethylene (VAE) segment accounted for the largest market share in 2024

- VAE is the workhorse of the market due to its balanced and versatile properties. It significantly improves the bond strength of mortars to diverse substrates such as concrete, masonry, wood, and tiles, ensuring long-lasting construction.

- Its ethylene content makes it highly flexible, allowing materials to withstand thermal pressure, structural movements, and vibrations without cracking.

- The growing presence of VAE discussions on online platforms such as blogs and social media is enhancing its market awareness, hence driving segmental share.

- For instance, in 2022, Hebei Chemical published an article, stating what is VAE, its manufacturing process, its properties, and its applications.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the market.

The acrylics segment is expected to grow at the fastest CAGR over the forecast period.

- Acrylic polymer powders are gaining prominence for their high-performance characteristics, particularly in challenging applications.

- They offer superior resistance to degradation from sunlight (UV radiation) and harsh weather conditions.

- This makes them ideal for exterior applications where long-term color stability and integrity are crucial.

- They provide high impermeability and low water absorption, making them suitable for waterproofing mortars, exterior coatings, and areas exposed to significant moisture.

- Many acrylic formulations have lower VOC (volatile organic compound) emissions, aligning with increasing demand for greener building materials. All these benefits are driving its increased usage.

- Overall, as per the market analysis, the aforementioned factors will drive the segment in the redispersible polymer powder market growth.

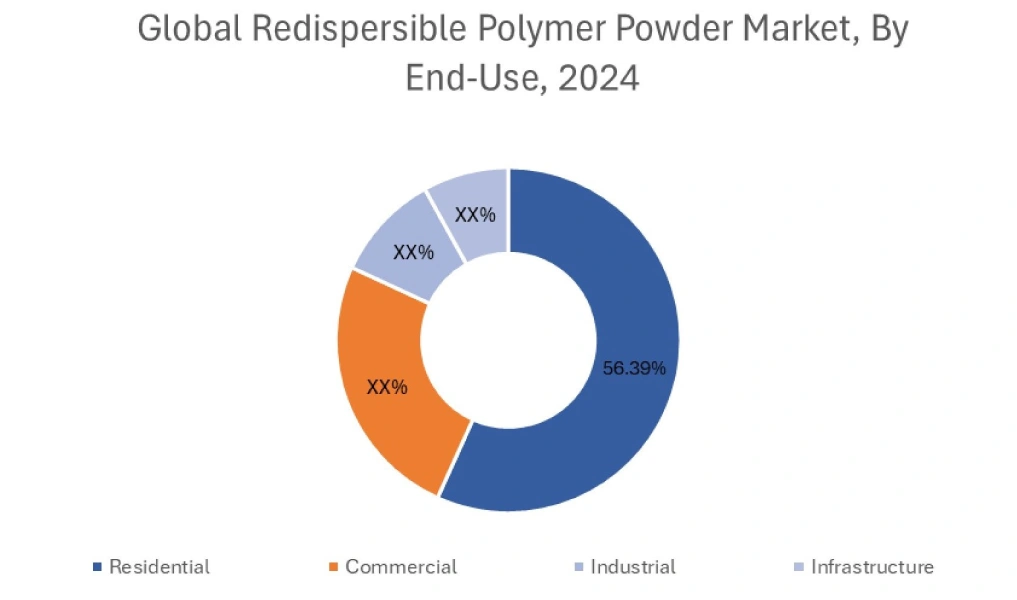

By End Use:

Based on end-use, the market is categorized into residential, commercial, industrial, and infrastructure.

Trends in the End-Use

- There is a growing trend of using RDP in modern housing for better finish and durability in products such as tile adhesives and skim coats among others.

- There is a growing trend towards green building certifications and sustainable materials, favoring RDP for its contribution to durable, energy-efficient (via ETICS), and sometimes lower VOC-emitting construction products.

The residential accounted for the largest market share of 56.39% in 2024.

- RDP significantly improves the bonding strength and flexibility of tile adhesives, ensuring tiles adhere strongly to surfaces and resist cracking.

- It enhances the workability, adhesion, and flexibility of mortars and plasters, making them suitable for interior and exterior wall coatings, as well as repair and renovation projects.

- In flooring applications, it improves the flow properties and adhesion of self-leveling compounds, resulting in smooth and durable floors.

- The segment growth is fueled by a consistent rise in new housing starts and home renovation projects. Additionally, the government’s support for home renovation is supporting the market.

- In March 2023, the Government of the UK announced financial assistance schemes, providing property owners with up to USD 44.34 Mn for major home improvements in Lancashire for the second phase of the Home Upgrade Grant.

- Overall, as per the market analysis, the aforementioned factors are driving the segment in the redispersible polymer powder industry.

The infrastructure segment is expected to grow at the fastest CAGR over the forecast period.

- RDP improves the bonding strength between different construction materials, crucial for structural integrity.

- It makes materials more resistant to cracking and movement, especially important in areas with temperature fluctuations or vibrations.

- It helps prevent water damage, which leads to corrosion and deterioration of infrastructure.

- Improving these properties, contributes to the overall longevity and performance of infrastructure, reducing the need for frequent repairs.

- Also, it strengthens the bond between bricks and blocks, enhancing the stability of masonry structures. Increasing infrastructure projects by governments is driving the segment.

- Thus, according to market analysis, the aforementioned factors will drive the segment in the redispersible polymer powder market growth.

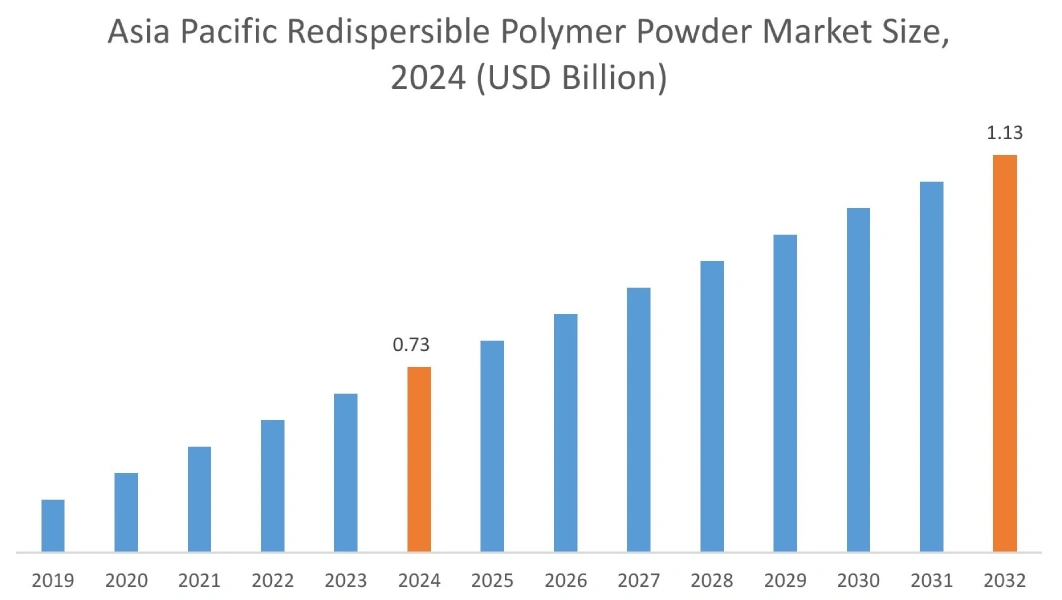

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

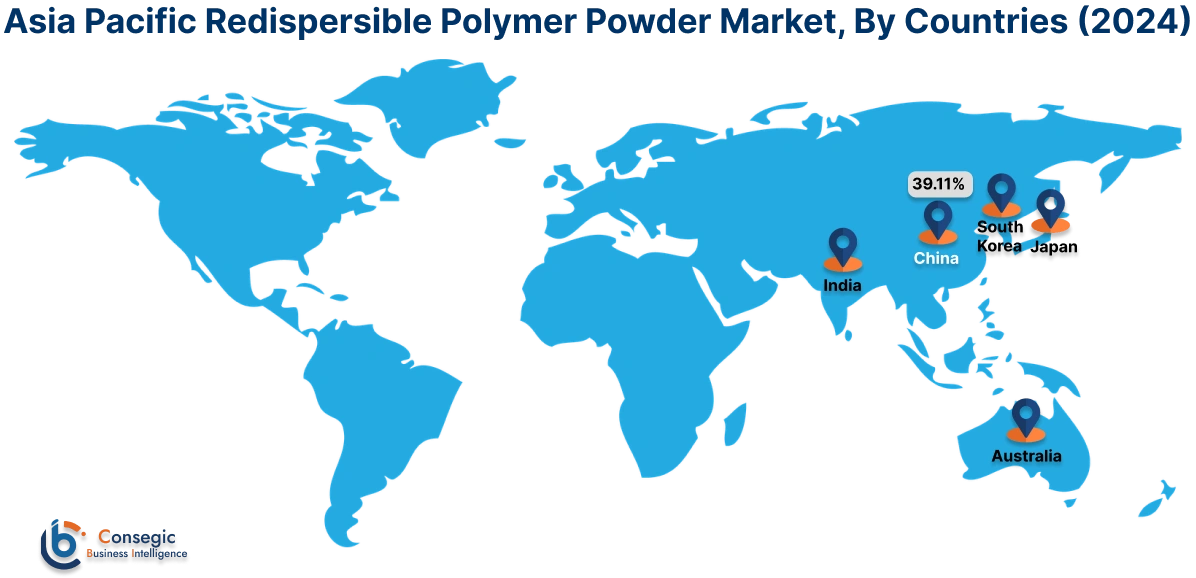

In 2024, Asia Pacific accounted for the highest redispersible polymer powder market share at 43.22% and was valued at USD 0.73 Billion and is expected to reach USD 1.13 Billion in 2032. In Asia Pacific, the China accounted for the redispersible polymer powder market share of 39.11% during the base year of 2024. The Asia-Pacific region is experiencing a substantial surge in residential construction projects, mainly fueled by rapid urbanization, increasing disposable incomes, and supportive government initiatives that are aimed at addressing growing housing demands. Countries such as Japan, India, China, and South Korea lead the market.

For instance,

- According China government, in 2022, China saw an increase of 18.4% in the residential areas for sale.

Redispersible polymer powder is integral to creating durable, high-quality homes. It acts as a high performance additive and significantly enhances key materials such as tile adhesives, wall putties, plasters, and self-leveling compounds. Overall, growing residential construction is driving the market in the region.

In Europe, the redispersible polymer powder market is experiencing the fastest growth with a CAGR of 9.3% over the forecast period. Europe is a leader in sustainable building practices, driven by ambitious climate goals such as the EU's Green Deal and stringent regulations aimed at achieving carbon neutrality. This strong emphasis on energy efficiency, reduced environmental footprint, and sustainable materials directly boost the demand for redispersible polymer powder. They play a crucial role in external thermal insulation composite systems, enhancing the adhesion, flexibility, and durability of insulation materials, thereby reducing energy consumption in buildings. It also enables the development of low VOC dry-mix mortars, aligning with sustainability. Countries such as Germany, France, and the UK lead the market.

North America’s redispersible polymer powder market analysis indicates that several key trends are contributing to its growth in the region. The market is significantly propelled by ongoing technological advancements in polymer chemistry. This includes the development of new polymer powder grades with enhanced functionalities such as improved hydrophobic properties, better adhesion to challenging substrates, and superior chemical resistance. Innovations focus on creating tailor-made powders for specific applications, optimizing performance for challenging conditions such as extreme temperatures or heavy loads. These advancements enable manufacturers to offer high-value, specialized products that meet evolving industry standards and expand application possibilities, fostering market growth in the various construction segments. Expanding the e-commerce industry is further supporting the market.

The Middle East and Africa (MEA) redispersible polymer powder market analysis indicates that the region is experiencing a surge in demand for high-performance building materials, driven by large-scale construction projects and a push for modern, durable infrastructure, and these polymer powders play a crucial role by significantly improving the properties of mortars, plasters, and concrete. It enhances adhesion, flexibility, water resistance, and overall durability, which are critical in MEA's harsh climatic conditions. The focus on creating resilient and long-lasting structures, from iconic skyscrapers to extensive urban developments, directly fuels the increasing adoption of these polymers. Countries such as UAE and Saudi Arabia lead the market.

Latin America's region creates potential for the market. There is a growing shift towards prefabricated and modular construction methods, driven by the demand for faster, more cost-effective, and standardized housing and infrastructure solutions. Redispersible polymer powder is integral to this shift. It enables the creation of high-quality, factory-produced dry-mix elements and panels by ensuring excellent bond strength, flexibility, and dimensional stability. It also facilitates rapid assembly on-site by providing reliable performance in adhesives and grouts for joining prefabricated components. This adoption contributes to reduced construction time, improved quality control, and less on-site waste, making these polymers a key enabler for modern construction techniques in the region. Countries such as Brazil, Argentina, and Chile leads the market.

Top Key Players and Market Share Insights:

The Redispersible Polymer Powder market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Redispersible Polymer Powder market. Key players in The Redispersible Polymer Powder industry include-

- Celanese Corporation (United States)

- WOTAIchem (China)

- Shandong Kundu Chemical Co., Ltd. (China)

- Sakshi Chem Sciences Private (India)

- Anxin Cellulose Co., Ltd. (China)

- Kaimaoxing Cellulose Co., Ltd. (China)

- Shijiazhuang Honglai Cellulose Co., Ltd. (China)

- Tengda Materials Co., Ltd. (China)

- Kima Chemical Co., Ltd. (China)

- Madhu Hydrocolloids Pvt. Ltd. (India)

Redispersible Polymer Powder Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.89 Billion |

| CAGR (2025-2032) | 7.0% |

| By Polymer Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Redispersible Polymer Powder market? +

In 2024, the Redispersible Polymer Powder market is USD 1.69 Billion.

Which is the fastest-growing region in the Redispersible Polymer Powder market? +

Europe is the fastest-growing region in the Redispersible Polymer Powder market.

What specific segmentation details are covered in the Redispersible Polymer Powder market? +

Polymer Type and End-Use segmentation details are covered in the Redispersible Polymer Powder market.

Who are the major players in the Redispersible Polymer Powder market? +

Celanese Corporation (United States), WOTAIchem (China), Kaimaoxing Cellulose Co., Ltd. (China), Shijiazhuang Honglai Cellulose Co., Ltd. (China), and Dezhou Tengda Construction New Materials Co., Ltd. (China) are some major players in the market.