Camping Cooler Boxes Market Size :

Camping Cooler Boxes Market is estimated to reach over USD 1,500.91 Million by 2030 from a value of USD 857.79 Million in 2022, growing at a CAGR of 7.5% from 2023 to 2030.

Camping Cooler Boxes Industry Definition & Overview:

Camping cooler boxes refer to insulated boxes that are designed for storing and cooling food and beverages with the use of ice packs. Cooler boxes offer several benefits including excellent portability, ease of maintaining constant temperature, availability in various patterns, colors, and dimensions along with an economical approach for storing and cooling food and beverages. The aforementioned benefits of cooler boxes are key determinants for increasing the utilization of coolers in camping applications.

Camping Cooler Boxes Market Insights :

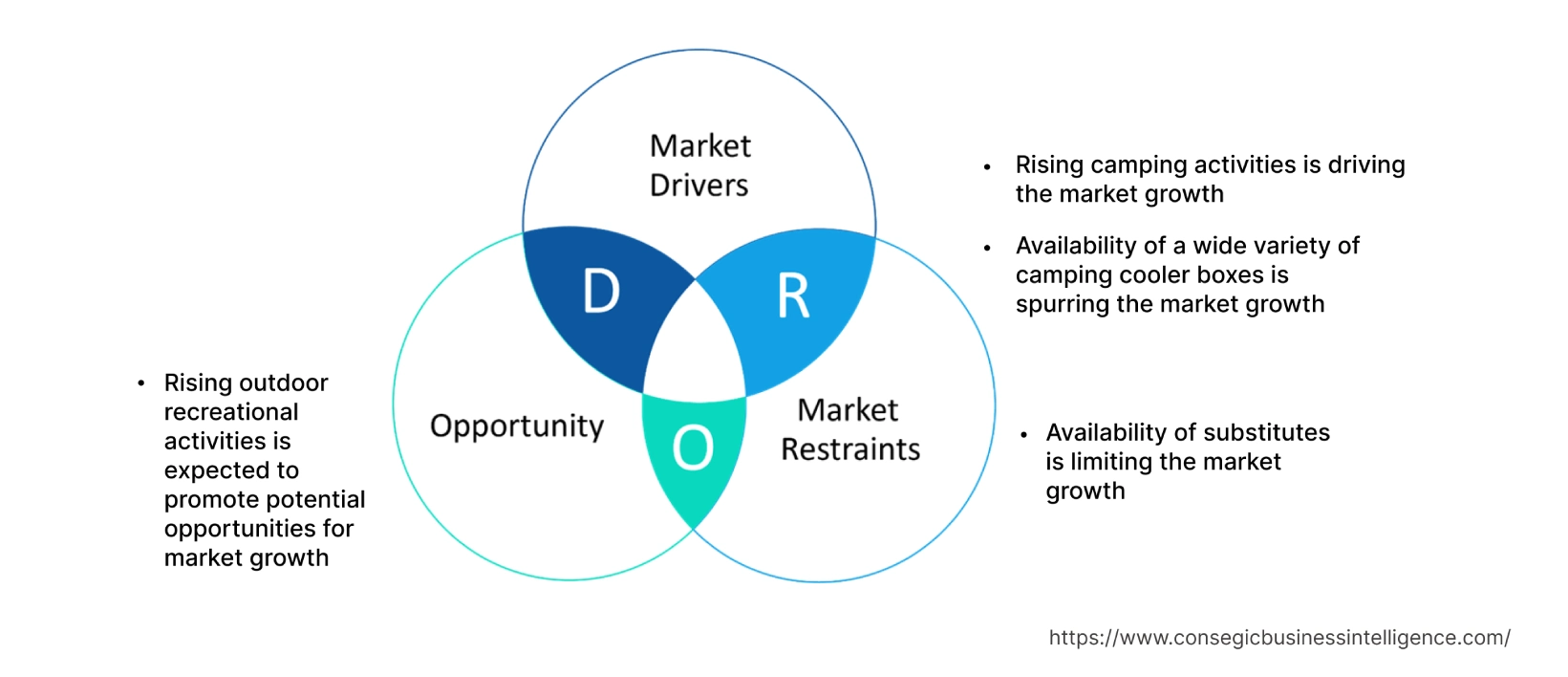

Camping Cooler Boxes Market Dynamics - (DRO) :

Key Drivers :

Rising camping activities are driving the market growth.

Camping has become a popular outdoor recreation activity in recent years, with more individuals selecting camping for adventure and leisure activities. Moreover, camping cooler boxes are designed for storing and cooling food and beverages intended for consumption during camping activities. Factors including the growing number of campers, the rising trend towards outdoor recreation, and the increasing need for portable food and beverage storage solutions are among the key prospects driving the adoption of cooler boxes.

- For instance, according to the KOA (Kampgrounds of America Inc.) North American Camping Report 2022, around 57 million households in North America took at least one camping trip in 2021, depicting an increase of 18.2% in comparison to 48.2 million in 2020.

Hence, camping cooler boxes market analysis shows that the rise in camping activities is driving the adoption of cooler boxes for storage and cooling of food & beverages, in turn proliferating the camping cooler boxes market growth.

Availability of a wide variety of camping cooler boxes is spurring the market growth.

Camping cooler box manufacturers are constantly investing in the development of various types of coolers with new features to ensure efficient utilization during camping activities. For instance, Yeti Coolers offers various types of camping cooler boxes including hard coolers, wheeled coolers, and others. Similarly, Bison Coolers offers a wide range of cooler boxes that are available in multiple colors and sizes. Moreover, camping cooler manufacturers are continuously launching new products with updated features and advancements.

- For instance, in May 2023, AO Coolers launched its new Canvas Series Tie-Dye coolers. The coolers are distinct, functional, and feature an aesthetic design. The coolers are integrated with an insulated interior to ensure that snacks and beverages stay fresh and cold for a long duration of time, making them ideal for camping trips. Moreover, the newly launched coolers are composed of high-quality materials including a leakage-proof TPU liner and a robust polyester exterior, which enhances the ability to withstand any adventure.

Thus, the analysis of market trends shows that the availability of a wide range of cooler boxes and continuous advancement are driving the camping cooler boxes market demand.

Key Restraints :

Availability of substitutes is limiting the market growth.

Camping cooler boxes have various substitutes including portable refrigerators, cooler bags, and others. The cooler box substitutes have similar features, performance, and applications, which act as a key factor in restricting the market. For instance, portable refrigerators act as an ideal alternative to cooler boxes for storing and cooling food & beverages during camping applications. Moreover, portable refrigerators are capable of keeping food & beverages cold and fresh for a longer period of time by storing them at relatively colder temperatures as compared to cooler boxes. Additionally, portable refrigerators offer several benefits including the availability of multiple food compartments, precise and adjustable temperature, automatic seals, and others. Therefore, market analysis depicts that the availability of various substitutes for cooler boxes is limiting the camping cooler boxes market demand.

Future Opportunities :

Rising outdoor recreational activities are expected to promote potential opportunities.

The rising outdoor recreational activities are expected to present potential opportunities for the camping cooler boxes market. Outdoor recreational activities include camping, hiking, and skiing, among others. They play a vital role in outdoor recreational activities involving camping for storing and cooling food and beverages to ensure that they stay fresh for consumption for a longer duration of time. Factors including an increase in discretionary time and the rising trend of outdoor recreation activities are expected to promote lucrative growth aspects for the market.

- For instance, according to the Outdoor Industry Association, the outdoor recreation participant base in the United States reached up to 164.2 million in 2021, representing a growth of 2.2% in comparison to 160.7 million in 2020.

Therefore, analysis portrays that the rise in outdoor recreational activities involving camping is projected to increase the adoption of cooler boxes, in turn promoting camping cooler boxes market opportunities during the forecast period.

Camping Cooler Boxes Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 1,500.91 Million |

| CAGR (2023-2030) | 7.5% |

| By Material | Plastic, Metal, and Others |

| By Distribution Channel | Online and Offline |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | YETI COOLERS LLC, Bison Coolers, Engel Coolers, Grizzly Coolers LLC, AO Coolers, Igloo Products Corp., Pelican Products Inc., POLAR BEAR COOLERS, The Coleman Company Inc., Koolatron, Cordova Outdoors, and K2 Coolers |

Camping Cooler Boxes Market Segmental Analysis :

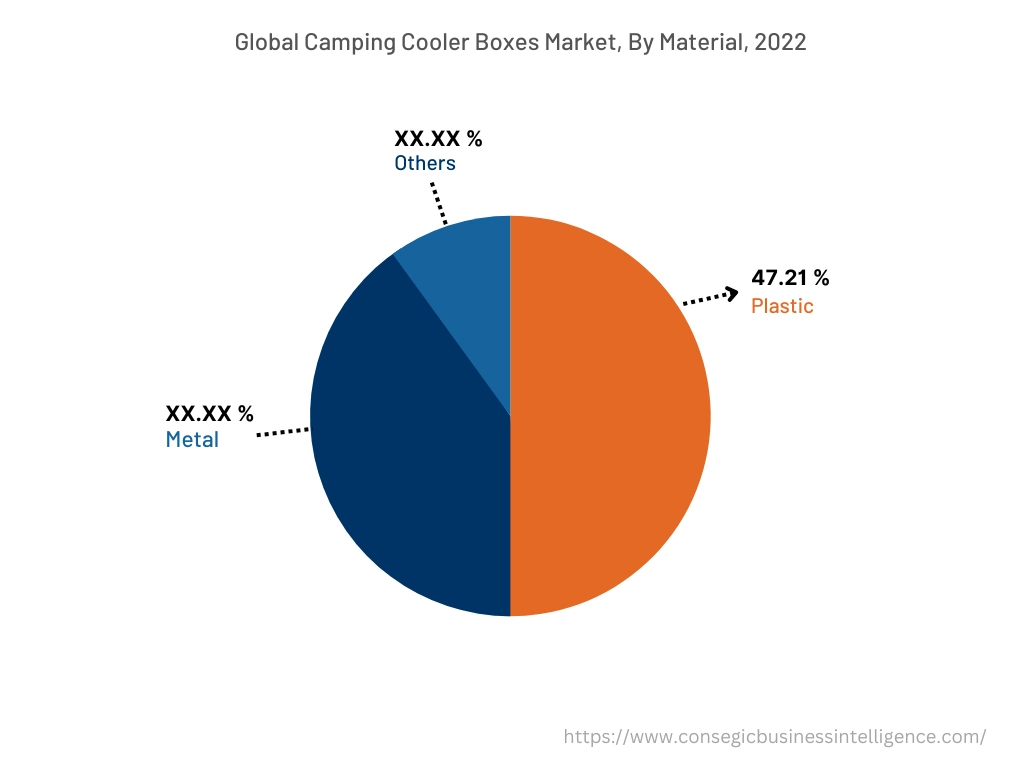

Based on the Material :

Based on the material, the camping cooler boxes market is bifurcated into plastic, metal, and others.

The plastic segment accounted for the largest revenue share of 47.21% in the year 2022. Camping cooler boxes made of plastic are lightweight and easy to move in comparison to metal cooler boxes. Moreover, plastic cooler boxes are relatively less expensive and offer several features including water resistance, durability, and rust resistance, making it ideal for utilization in camping applications.

- For instance, in April 2021, Igloo Products Corp. launched the ECOCOOL collection of hard coolers that are composed of recycled plastic. The cooler is ideal for utilization in outdoor activities including camping.

Hence, segmental trends analysis depicts that rising innovation associated with plastic cooler boxes is among the key factors contributing to the camping cooler boxes market growth.

The metal segment is anticipated to register a significant CAGR during the forecast period. Camping cooler boxes composed of metal offer higher durability, and strength, and are less prone to damage. Moreover, the ability of metal cooler boxes to keep food and beverages fresh for a longer duration of time makes them ideal for deployment in camping activities.

- For instance, according to the Eurostat (Statistical Office of the European Union), France witnessed the highest number of overnight stays by tourist campers on campsites in Europe in 2020, reaching up to 128.6 million, followed by the UK and Italy with 59.5 million and 54.6 million, respectively.

Thus, the analysis concludes that rising popularity of camping is fostering the demand for metal cooler boxes which in turn drives the camping cooler boxes market trends during the forecast period.

Based on the Distribution Channel :

Based on the distribution channel, the camping cooler boxes market is segregated into online and offline.

The online segment accounted for the largest revenue share of the total camping cooler boxes market share in the year 2022. Online distribution channel offers a method of distribution in which the manufacturers sell products through the company websites or any other third-party e-commerce websites. Online distribution channels offer several benefits including easy access to the products, quicker comparison of multiple products and prices, faster buying process, and higher flexibility.

- For instance, Bison Cooler is among the few camping cooler box manufacturers that provide various types of camping cooler boxes for online purchase through the company website along with multiple e-commerce websites including Amazon, eBay, and others.

Therefore, analysis of segmental trends shows that the increasing availability of cooler boxes in online distribution channels is a key factor fostering the camping cooler boxes market share.

The offline segment is expected to witness the fastest CAGR during the forecast period. Offline distribution channel involves the distribution of cooler boxes from manufacturers to the end-users directly or indirectly through offline distributors including supermarkets/hypermarkets, specialty stores, and others. The growth of the offline segment is attributed to several factors including a strong customer base, higher credibility, and ease of customization as per the target market.

- In March 2022, LuLu Group launched its new hypermarkets in Dubai City Mall, as a part of the company's expansion strategy. Additionally, the LuLu Group further launched two new hypermarkets in Shamkha Mall in Abu Dhabi, and Dubai Investment Park.

Therefore, the rising development of hypermarkets is anticipated to drive the distribution of cooler boxes from offline stores, in turn fostering camping cooler boxes market trends during the forecast period.

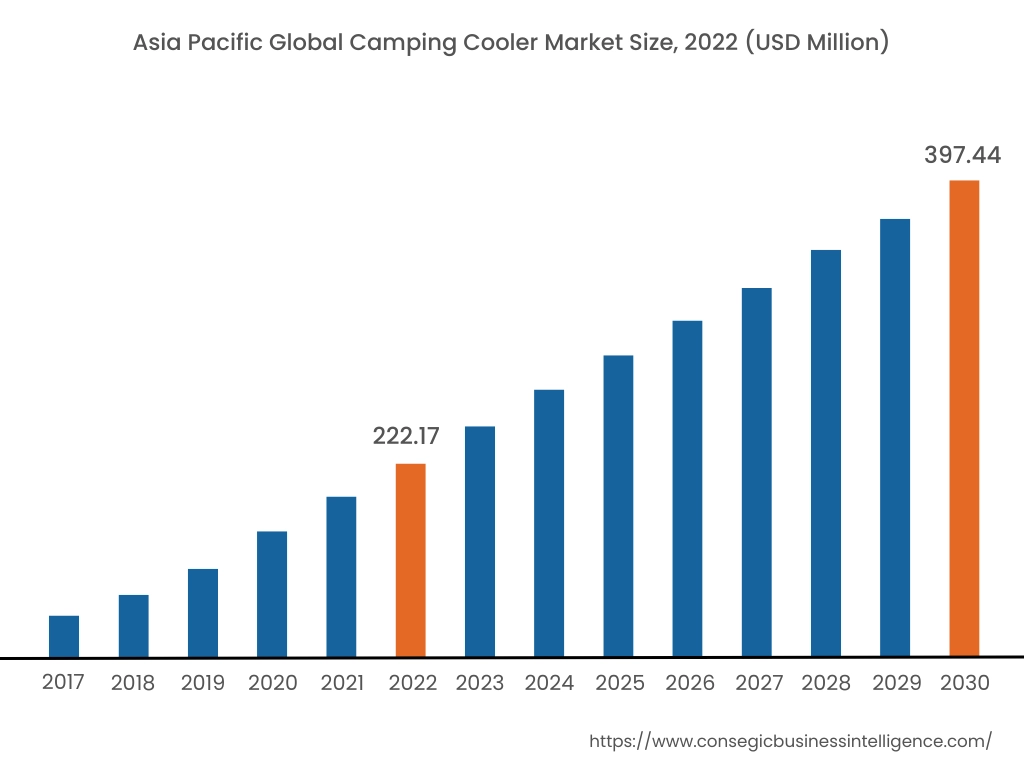

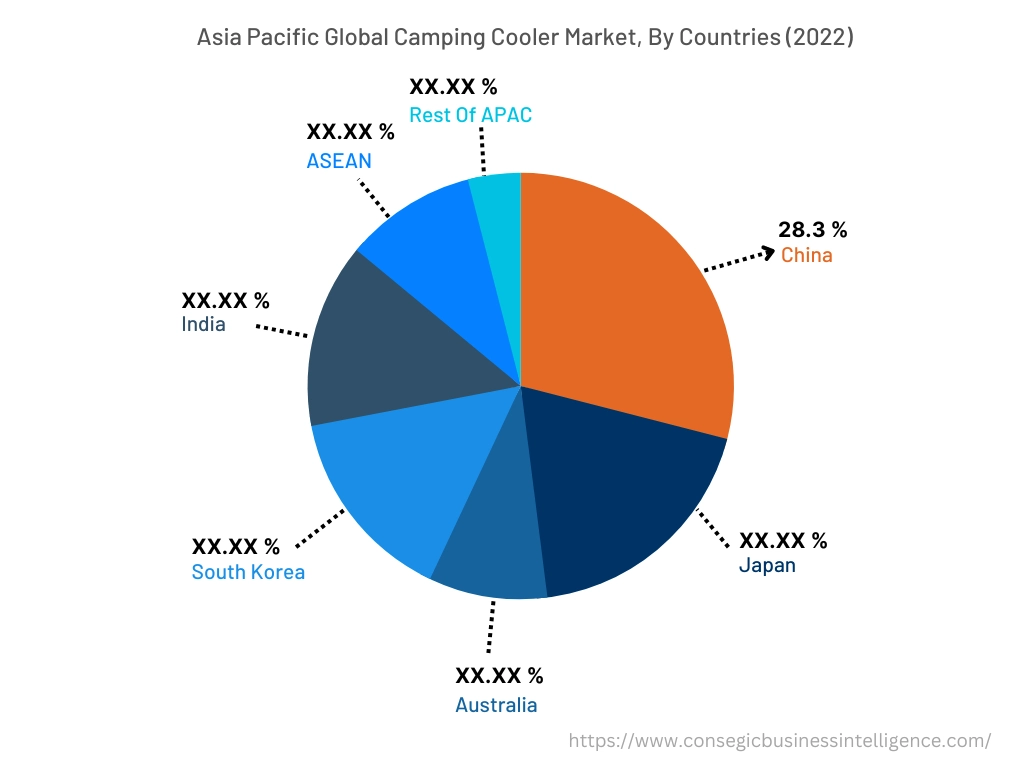

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

North America accounted for the largest revenue share of USD 307.78 Million in 2022 and is expected to reach USD 543.93 Million by 2030, registering a CAGR of 7.6% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share during the same year. The adoption of camping cooler boxes in North America is primarily driven by multiple factors including the rising trend of outdoor recreation, the increasing number of campers, and rising government initiatives and funding to promote camping in the region.

- For instance, according to the Outdoor Industry Association, camping ranked among the top five outdoor activities in the U.S., reaching 45.9 million participants between 2015 to 2021.

- Additionally, in July 2022, the U.S. Government launched an initiative called the Federal Interagency Council on Outdoor Recreation (FICOR) that aims at creating safer, affordable, and equal opportunities for Americans to encourage outdoor activities. FICOR aims at strengthening investments in resilient recreation infrastructure including camping grounds.

Thus, the regional analysis shows that above factors are anticipated to drive the demand for cooler boxes, in turn proliferating camping cooler boxes market expansion in North America during the forecast period.

Asia-Pacific is expected to register the fastest CAGR of 7.8% during the forecast period. Factors including the increasing popularity of camping activities and rising government initiatives to promote camping are among the key aspects driving the market in the Asia-Pacific region.

- For instance, according to the Caravan Industry Association of Australia, the caravan and camping visitor economy generated 12.6 million trips in 2022, depicting a growth of 19% as compared to 2021.

Thus, the growing camping culture is driving the demand for cooler boxes, in turn boosting the camping cooler boxes market opportunities in the Asia-Pacific region.

Top Key Players & Market Share Insights :

The camping cooler boxes market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in the global camping cooler boxes market. Key players in the camping cooler boxes industry include-

- YETI COOLERS LLC

- Bison Coolers

- The Coleman Company Inc.

- Koolatron

- Cordova Outdoors

- K2 Coolers

- Engel Coolers

- Grizzly Coolers LLC

- AO Coolers

- Igloo Products Corp.

- Pelican Products Inc.

- POLAR BEAR COOLERS

Recent Industry Developments :

- In March 2023, AO Coolers launched its new hybrid cooler, AO Hybrid. The hybrid cooler is lightweight and offers high strength and performance. The cooler is designed for utilization in adventure activities camping, fishing, hiking, and others.

Key Questions Answered in the Report

What is camping cooler box? +

Camping cooler boxes refer to insulated boxes that are designed for storing and cooling food and beverages intended for camping activities with the use of ice packs.

What specific segmentation details are covered in the camping cooler box report, and how is the dominating segment impacting the market growth? +

By material segment has witnessed plastic as the dominating segment in the year 2022, owing to its increasing utilization of camping cooler boxes due to the advantages including lightweight, durability, and cost-effectiveness.

What specific segmentation details are covered in the camping cooler box market report, and how is the fastest segment anticipated to impact the market growth? +

By distribution channel segment has witnessed offline as the fastest-growing segment during the forecast period due to rising development of hypermarkets/supermarkets, specialist stores, and other offline stores for distribution of cooler boxes.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to increasing popularity of camping activities and rising government initiatives to promote camping in the region.