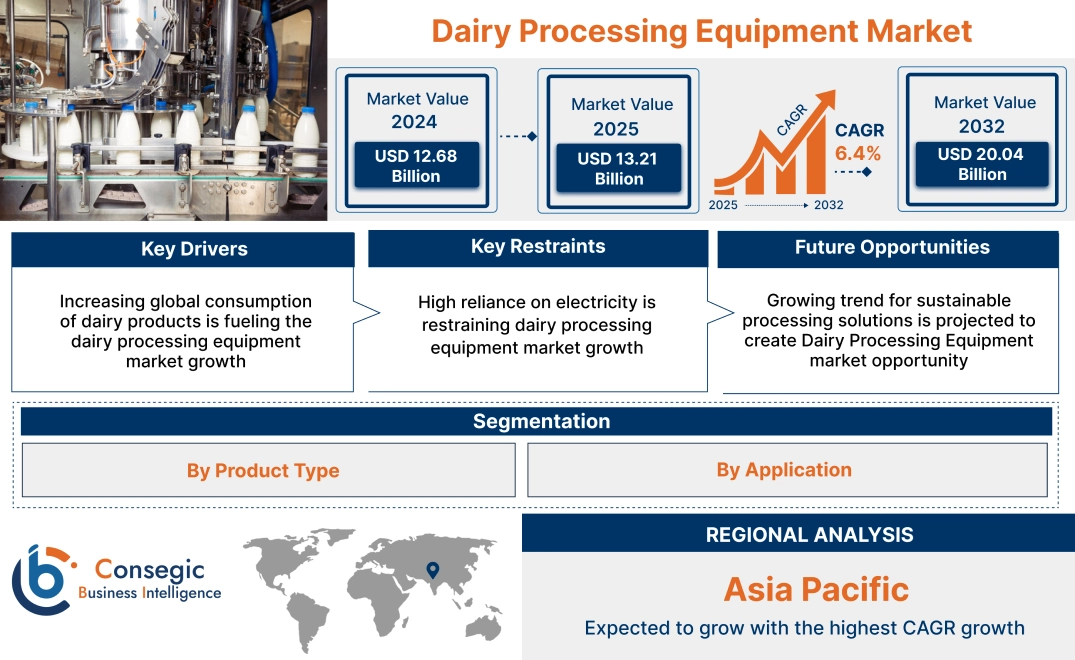

Dairy Processing Equipment Market Size:

Dairy Processing Equipment Market Size is estimated to reach over USD 20.04 Billion by 2032 from a value of USD 12.68 Billion in 2024 and is projected to grow by USD 13.21 Billion in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

Dairy Processing Equipment Market Scope & Overview:

Dairy processing equipment encompasses a wide range of machinery used to transform raw milk into various consumable dairy products. This equipment is essential for processes like pasteurization, homogenization, separation, and packaging, which are crucial for ensuring product safety, extending shelf life, and creating diverse dairy products such as milk, cheese, butter, yogurt, and milk powder. Additionally, these machines facilitate the efficient and hygienic handling of milk, meeting stringent quality and safety standards within the dairy sector.

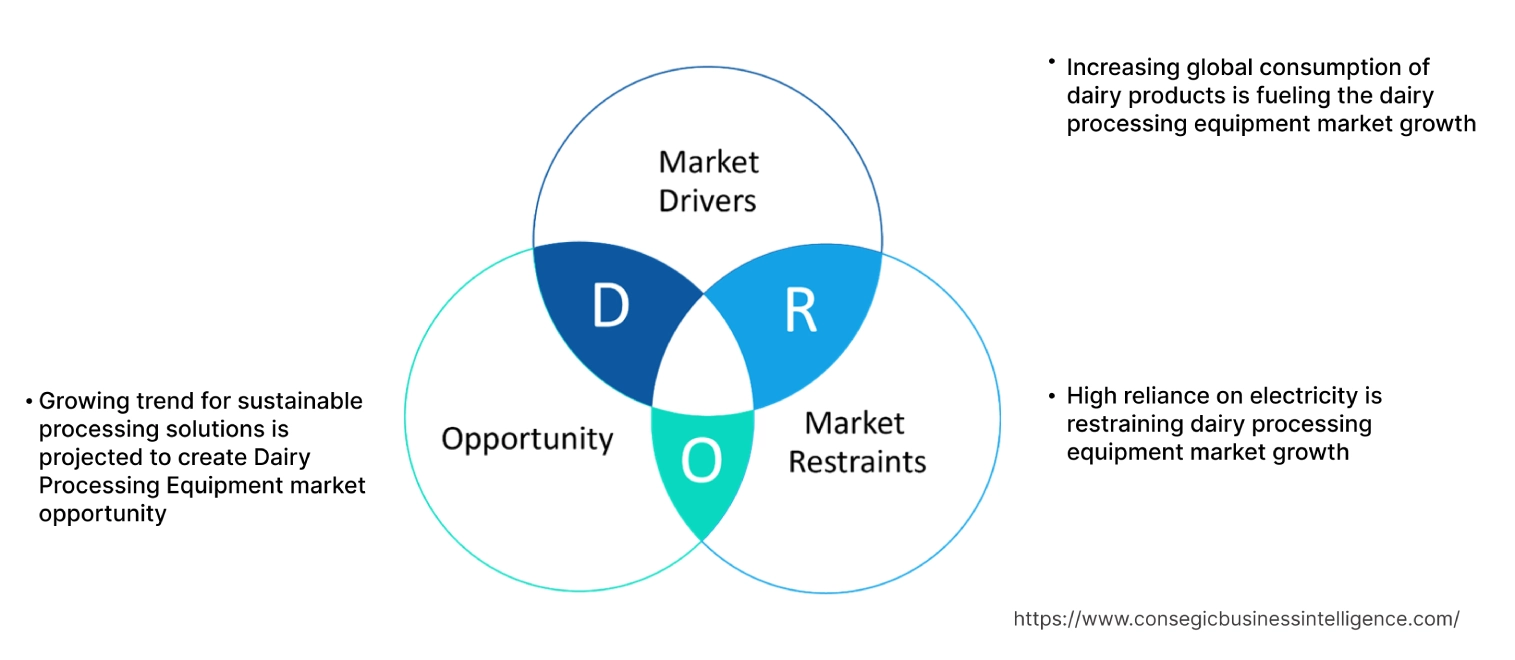

Key Drivers:

Increasing global consumption of dairy products is fueling the dairy processing equipment market growth

The increasing global consumption of dairy products is a primary driver for the market, as rising populations and changing dietary habits boost demand for milk and its derivatives. This surge in consumption necessitates increased production capacity, pushing dairy processors to adopt advanced equipment for efficient handling, processing, and packaging of larger volumes. Furthermore, the diversification of dairy products, coupled with stringent quality and safety standards, requires specialized machinery, leading to extension of processing facilities and thereby driving the dairy processing equipment market size.

- For instance, according to European Union, in 2023, dairies processed 149.3 million tonnes of milk, primarily cow's milk (145 million tonnes), while only 11.6 million tonnes were used on farms for personal consumption, direct sales, feed, or on-farm processing.

Consequently, increasing global consumption of dairy products is driving the dairy processing equipment market expansion.

Key Restraints:

High reliance on electricity is restraining dairy processing equipment market growth

Dairy processing equipment’s heavy dependence on electricity presents significant restraints, primarily due to the industry's energy-intensive nature, leading to increased operational costs susceptible to fluctuating electricity prices. This reliance also exposes dairies to vulnerabilities from power outages, risking product spoilage and production delays.

Furthermore, environmental concerns associated with traditional electricity generation and infrastructure limitations in developing regions compound these issues, while the industry's growing focus on energy efficiency necessitates costly equipment upgrades, potentially slowing market expansion. Therefore, as per the analysis, these combined factors are significantly hindering dairy processing equipment market share.

Future Opportunities :

Growing trend for sustainable processing solutions is projected to create Dairy Processing Equipment market opportunity

Governments worldwide are implementing stricter environmental regulations, compelling dairy processors to invest in equipment that minimizes water and energy consumption, reduces waste, and lowers emissions. Simultaneously, consumers are increasingly prioritizing environmentally conscious food choices, pushing dairy companies to align with these values and creating a market for sustainable processing technologies. Furthermore, the long-term cost savings achieved through reduced resource usage and optimized operational efficiency further incentivize the adoption of these solutions, benefiting both environmental sustainability and the profitability of dairy businesses, thus significantly boosting dairy processing equipment market demand.

- For instance, in Oct 2024, John Deere and DeLaval have introduced the Milk Sustainability Center, a digital platform that combines crop and animal data to help dairy farms improve efficiency and meet increasing sustainability standards and regulations. This integrated system aims to provide a unified solution for managing and optimizing dairy farming operations.

Hence, based on the analysis, growing trend for sustainable processing solutions is expected to create dairy processing equipment market opportunities.

Dairy Processing Equipment Market Segmental Analysis :

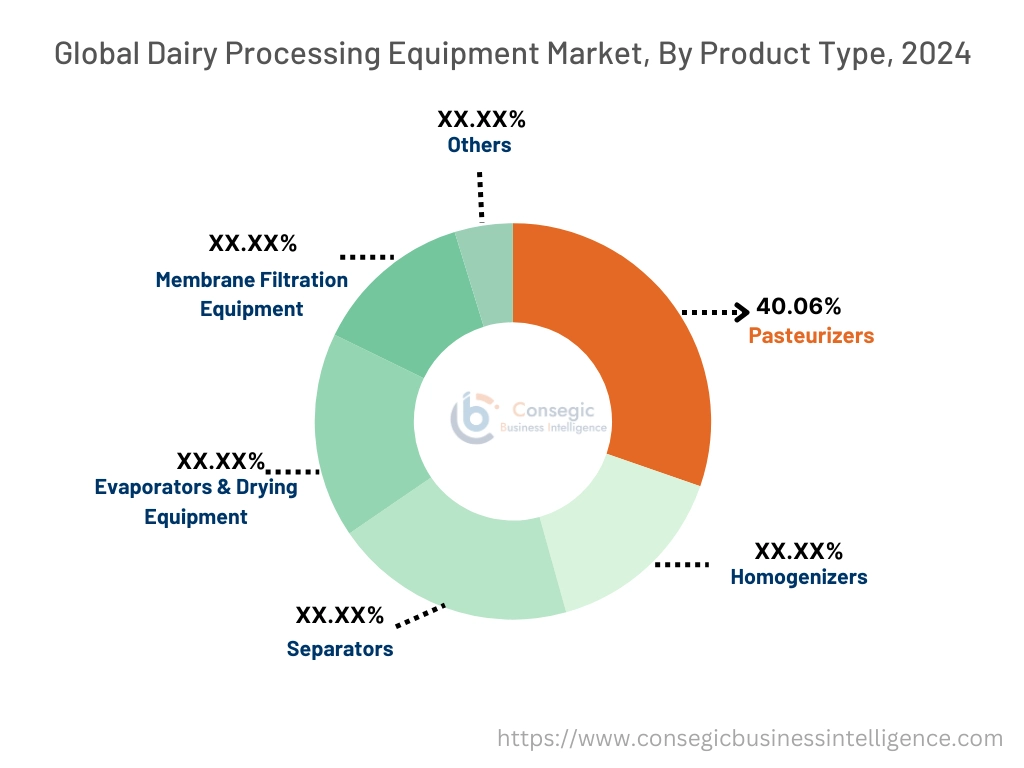

By Product Type:

- Advancements in centrifugal separation technology for efficient cream separation and milk clarification.

- Growing trend for the adoption of energy-efficient evaporators and spray dryers for milk powder production, driven by the increasing global trade of dairy ingredients.

Pasteurizers accounted for the largest revenue share of 40.06% in the market in 2024.

- Emphasis on energy-efficient pasteurization systems, like High-Temperature Short-Time (HTST) and Ultra-High Temperature (UHT) pasteurization, to reduce operational costs and environmental impact, thus driving dairy processing equipment market share.

- Integration of automation and smart technologies, such as IoT-enabled systems, for real-time monitoring and control of pasteurization processes is also boosting industry.

- Growing trend towards the development of non-thermal pasteurization methods, that preserve the nutritional value and taste of products, hence spurring the dairy processing equipment market size.

- For instance, in July 2024, American Society for Microbiology confirmed that pasteurization effectively inactivates highly infectious H5N1 avian flu in milk. While raw milk samples showed the presence of the virus, testing revealed no infectious virus in pasteurized milk products. However, non-infectious viral genetic material was detected in 20% of pasteurized samples, demonstrating the effectiveness of pasteurization in eliminating the infectious risk.

- Thus, as per the dairy processing equipment market analysis, the aforementioned factors are driving the pasteurizers segment.

Homogenizers are predicted to register the fastest growth during the forecast period.

- High-pressure homogenizers are crucial, particularly in specialized products like ultra-high temperature (UHT) milk, cream, and dairy-based desserts.

- Dairy processors are seeking energy-efficient homogenizers to reduce operational costs and environmental impact, including innovations in motor technology and hydraulic systems to minimize energy consumption.

- Integrating sensor technology and digital control systems allows for precise monitoring and adjustment of homogenization parameters, ensuring consistent product quality and reducing process variability, thus driving dairy processing equipment market demand.

- For instance, in May 2024, Tetra Pak introduced a new line of homogenizers using Circle Green stainless steel, which significantly reduces the carbon footprint compared to traditional steel. This innovation addresses the steel industry's substantial contribution to global CO2 emissions and supports the food and beverage sector's efforts to lower its environmental impact during homogenization processes.

- In conclusion, the above-mentioned factors are contributing significantly in spurring the market trend.

By Application:

Based on the application, the market is classified into processed milk, cream, milk powder, cheese, protein ingredient, and others.

Trends in the Application:

- Growing interest in reduced-fat and lactose-free cream variants, driving the adoption of membrane filtration and separation technologies.

- Expanding global trade of milk powder, fuelling the need for efficient evaporators and spray dryers.

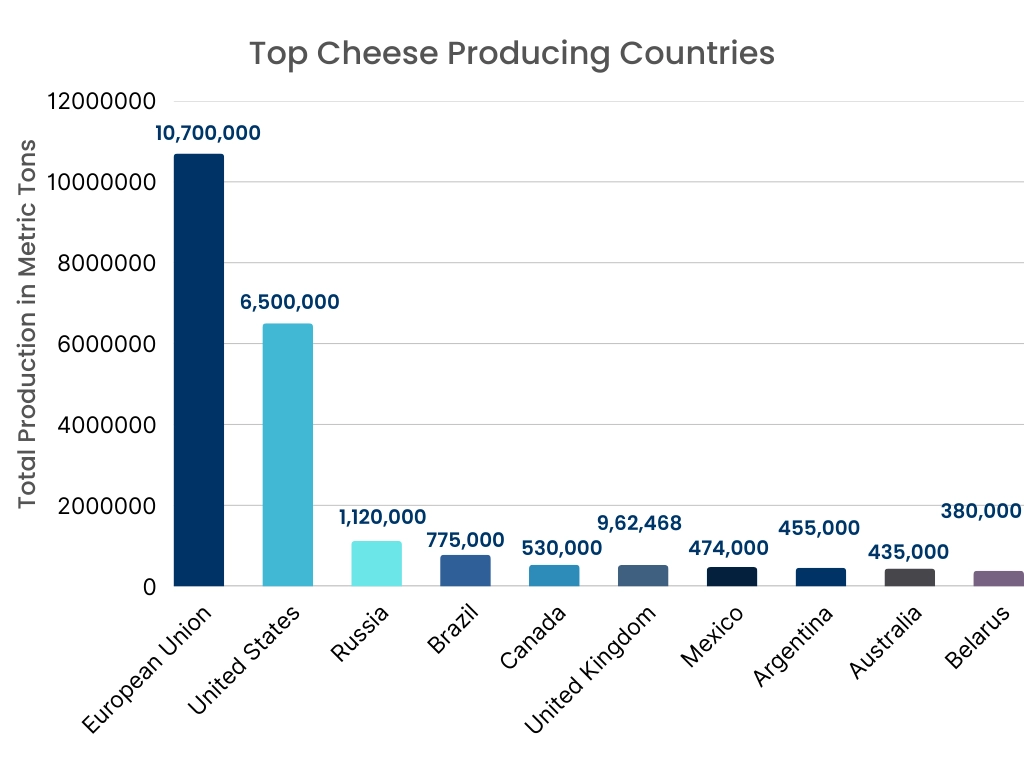

Cheese accounted for the largest revenue share in the market in 2024.

- Diversification of cheese varieties and production methods, driving the need for specialized cheese-making equipment, including curdling, pressing, and ripening systems.

- Moreover, growing need for processed cheese and cheese analogs, requiring advanced blending and emulsification equipment, further driving the dairy processing equipment market demand.

- Additionally, development of equipment for producing unique cheese textures and flavors through controlled fermentation and ripening processes.

- Increased use of membrane filtration technologies (ultrafiltration, reverse osmosis) for whey processing in cheese production, enabling the recovery of valuable protein and lactose.

- Thus, as per the dairy processing equipment market analysis, the aforementioned factors are driving cheese segment.

Processed Milk is predicted to register the fastest growth during the forecast period.

- Increased need for extended shelf-life milk products, driving the adoption of advanced pasteurization and UHT processing technologies.

- Growing popularity of flavoured and fortified milk, requiring specialized homogenizers and blending equipment is driving the adoption of processed milk.

- Additionally, the increasing government initiatives for the establishment of processed milk plants is also driving the dairy processing equipment market.

- For instance, in Jan 2025, the Chief Minister of Himachal Pradesh inaugurated the construction of a new milk processing plant in Dhagwar, Kangra, with an initial capacity of 1.50 lakh litres per day, expandable to 3 LLPD. This plant aims to boost the economy of over 35,000 dairy farmers across five districts by providing them with enhanced processing capabilities.

- Consequently, as per the analysis, the above-mentioned factors are contributing significantly in driving the market trend.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

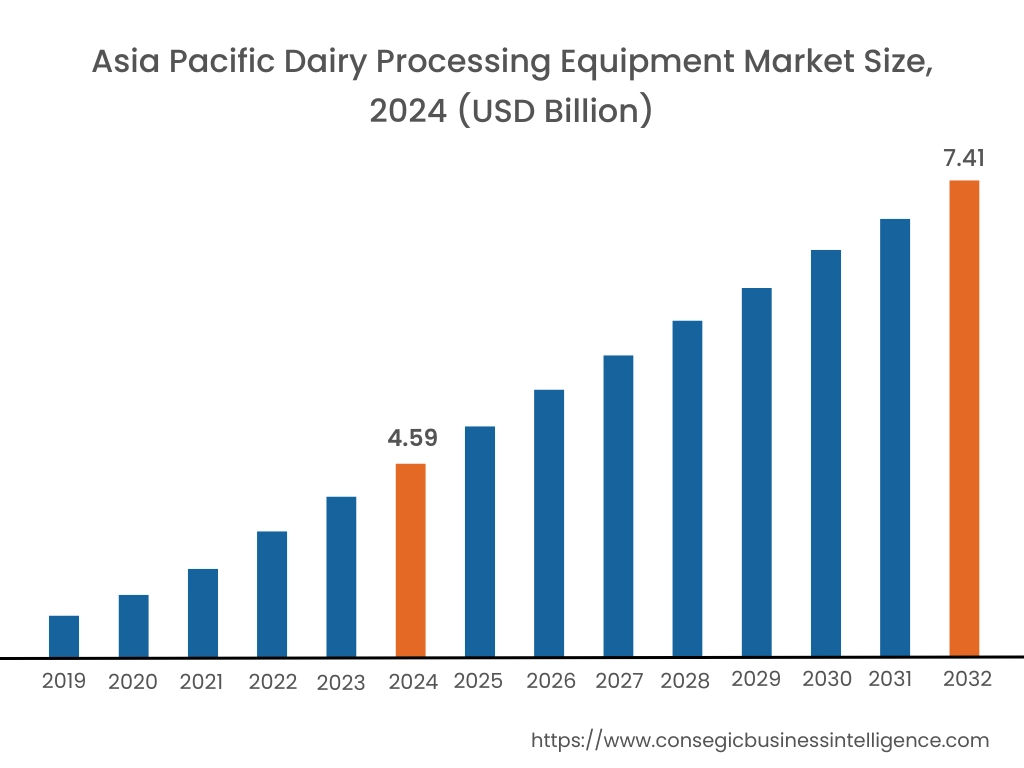

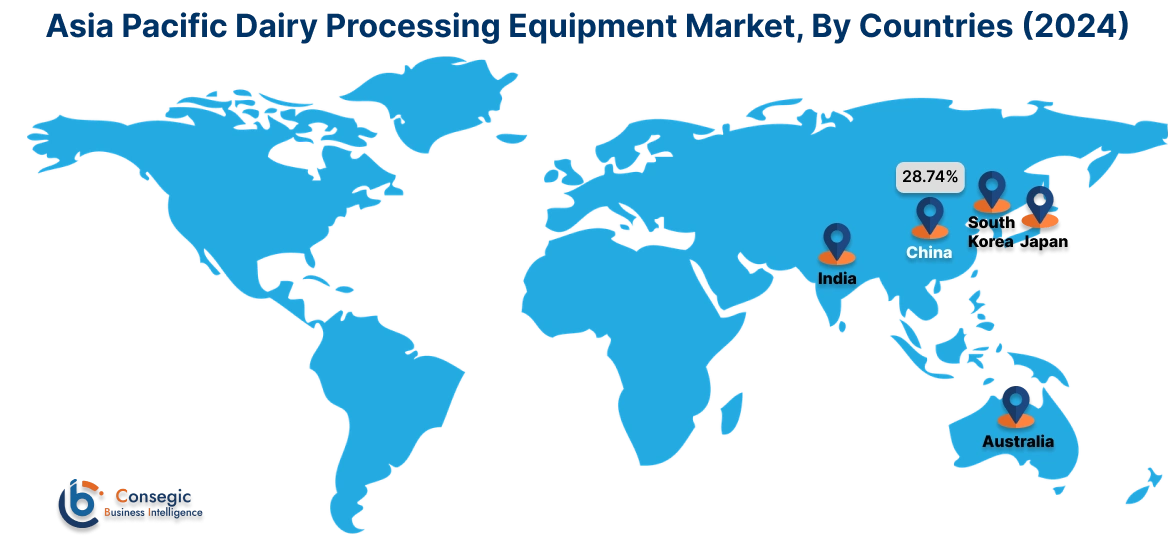

Asia Pacific was valued at USD 4.59 Billion in 2024. Moreover, it is projected to grow by USD 4.79 Billion in 2025 and reach over USD 7.41 Billion by 2032. Out of these, China accounted for the largest revenue share of 28.74% in 2024. Countries like China, India, and Southeast Asian nations are witnessing a significant increase in dairy consumption, necessitating the expansion and modernization of processing facilities. Stringent food safety regulations, coupled with a rising awareness of product quality, are compelling dairy processors to invest in advanced equipment, including pasteurizers, homogenizers, and membrane filtration systems. Additionally, the region's diverse agricultural landscape and growing dairy farming sectors are contributing to the market's expansion.

- For instance, India leads global milk production, accounting for 24.64% of the world's total, with a 5.85% annual growth rate over the last nine years, reaching 230.58 million tons in 2022-23. In contrast, global milk production grew only 0.51% in 2022. India's per capita milk availability is also significantly higher at 459 grams per day, compared to the global average of 322 grams.

Europe region was valued at USD 3.76 Billion in 2024. Moreover, it is projected to grow by USD 3.92 Billion in 2025 and reach over USD 5.98 Billion by 2032. Strict European Union regulations regarding food safety and environmental sustainability drive the demand for advanced and efficient processing equipment. Also, a strong tradition of diverse dairy products, including specialty cheeses, yogurts, and fermented milk products, fuels the need for specialized equipment in European countries is accelerating the market growth. Moreover, the presence of key players in the region is also contributing significantly in driving the dairy processing market share.

- For instance, in January 2025, GEA introduced the Dairy Evaporator eZero, a new energy-efficient system designed to significantly reduce the dairy’s carbon footprint. This evaporator can cut energy consumption by up to 60% and potentially eliminate CO2 emissions completely when powered by green electricity, compared to traditional evaporators. It aligns with GEA's goal of promoting sustainable production by transitioning to renewable energy sources.

As per the dairy processing equipment market analysis, a robust and well-established dairy sector, particularly in the United States and Canada, drives consistent demand for advanced processing equipment. Additionally, increasing consumer demand for high-quality, safe, and diverse dairy products, including specialty cheeses, yogurt, and plant-based alternatives. Expanding dairy production in countries like Brazil and Argentina, coupled with investments in modern processing facilities, fuels market development in Latin America countries. Further, government initiatives to enhance food security and promote local dairy production in Middle East countries are driving investments in modern processing infrastructure, thereby driving the market growth.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing dairy processing equipment to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the dairy processing equipment industry include-

- Christakis Agathangelou Ltd. (Cyprus)

- GEA Group Aktiengesellschaft (Germany)

- Harvest Hi-tech Equipments Pvt. Ltd. (India)

- HOMMAK (Turkey)

- IDMC Limited (India)

- INOXPA (India)

- IWAI Kikai Kogyo Co., Ltd. (Japan)

- Izumi Food Machinery (Japan)

- John Bean Technologies Corporation (U.S.)

- Krones AG (Germany)

- Paul Mueller Company, Inc. (U.S.)

- SPX FLOW (U.S.)

- SUNRISE INDUSTRIES (India)

- Tetra Laval S.A. (Switzerland)

Recent Industry Developments :

Innovation:

- In March 2024, GEA presented innovative separator solutions at Anuga FoodTec 2024, prioritizing water and energy conservation to address challenges like escalating costs and labor scarcity.

Dairy Processing Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 20.04 Billion |

| CAGR (2025-2032) | 6.4% |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the dairy processing equipment market? +

The dairy processing equipment market size is estimated to reach over USD 20.04 Billion by 2032 from a value of USD 12.68 Billion in 2024 and is projected to grow by USD 13.21 Billion in 2025, growing at a CAGR of 6.4% from 2025 to 2032.

What specific segmentation details are covered in the dairy processing equipment report? +

The dairy processing equipment report includes specific segmentation details for product type, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the dairy processing equipment market, homogenizer is the fastest-growing segment during the forecast period.

Who are the major players in the dairy processing equipment market?q +

The key participants in the dairy processing equipment market are Buhler Group (Switzerland), Christakis Agathangelou Ltd. (Cyprus), GEA Group Aktiengesellschaft (Germany), Harvest Hi-tech Equipments (India) Pvt. Ltd. (India), HOMMAK (Turkey), IDMC Limited (India), INOXPA (India), IWAI Kikai Kogyo Co., Ltd. (Japan), Izumi Food Machinery (Japan), John Bean Technologies Corporation (U.S.), Krones AG (Germany), Paul Mueller Company, Inc. (U.S.), SPX FLOW (U.S.), SUNRISE INDUSTRIES (India), Tetra Laval S.A. (Switzerland) and Others.