Detergents Market Size :

Consegic Business Intelligence analyzes that the Detergents market size is growing with a CAGR of 3.8% during the forecast period (2023-2031). The market accounted for USD 131.80 billion in 2023 and the market is projected to be valued at USD 178.16 Billion by 2031.

Detergents Market Scope & Overview :

Detergents are compounds containing polar or charged hydrophilic (water-attracting) or hydrophobic (water-repelling) groups. The molecules are characterized as surfactants because they reduce the surface tension of water. Because of their structural formation, they stabilize the interaction between greasy and oily substances posing as a molecular bridge.

In the household, these ingredients are used for cleaning the laundry, as they are surfactant molecules that combine with dirt and impurities to make clothes soluble in water. They surge the softness of water, which helps them to absorb oil spills and dirt on the floor making them useful for cleaning the tiles and floor. In the agriculture sector, they are used to kill weeds and mosses. Moreover, they are used as biological reagents in the fields of biochemistry, cell and molecular biology, and molecular diagnostics. They are used for stabilization, isolation, denaturation, and separation, and in methods such as cell lysis, permeabilization of cells, extraction of DNA and RNA, chromatographic techniques, and various protein assays.

How is AI Transforming the Detergents Market?

AI is being utilized in the detergents market, specifically to improve product development, optimize manufacturing, and enhance sustainability. AI-powered systems are helping manufacturers formulate detergents with better cleaning power and environmental friendliness, optimize supply chains, and automate production processes. Moreover, AI-powered machines can adapt to varying raw material characteristics while ensuring consistent product quality and optimizing resource consumption.

Further, the integration of AI-driven automation systems in production enhances the precision of chemical blending, thereby improving product uniformity and reducing resource usage. Therefore, the above factors are expected to create lucrative prospects for market growth in the upcoming years.

Detergents Market Insights :

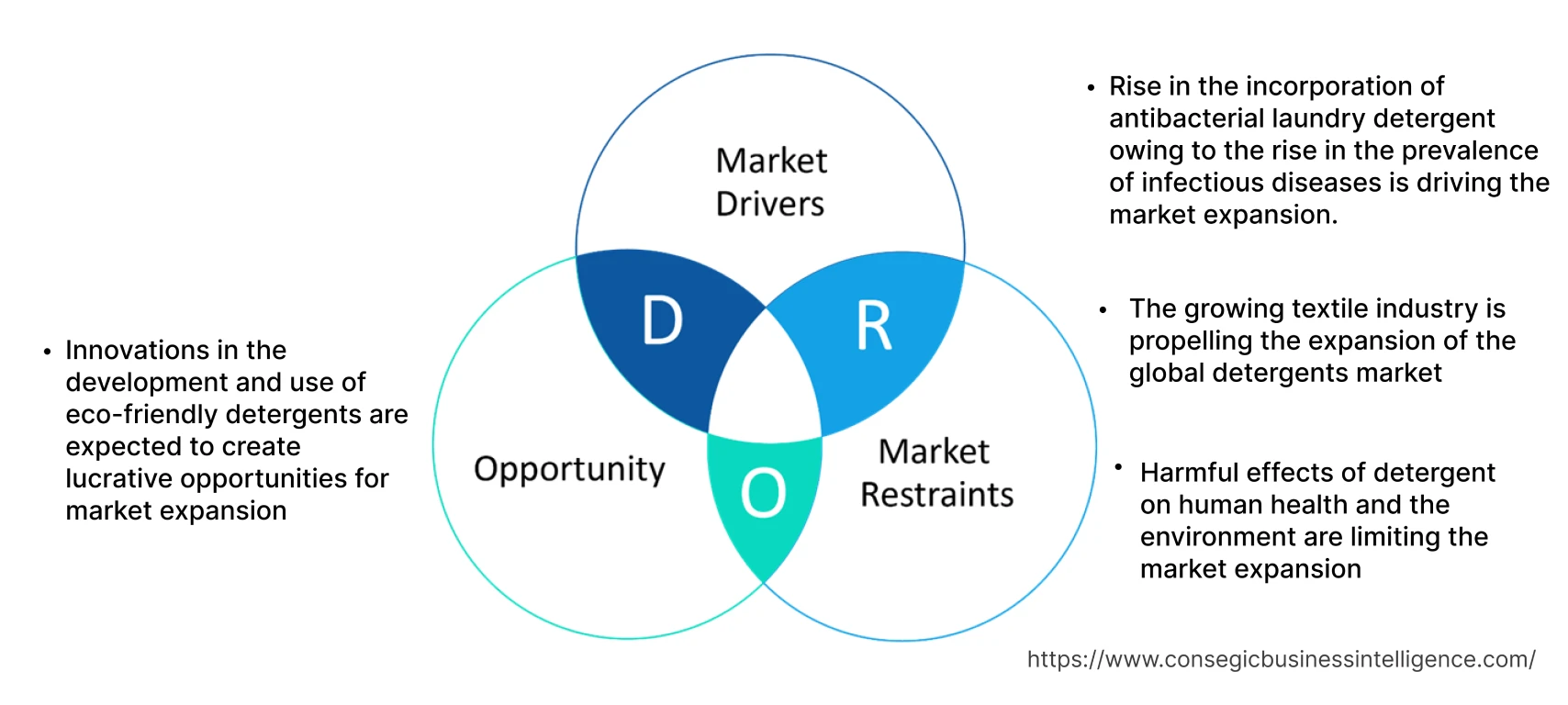

Detergents Market Dynamics - (DRO) :

Key Drivers :

Rise in the incorporation of antibacterial laundry detergent owing to the rise in the prevalence of infectious diseases is driving the market expansion

Individuals are becoming more aware of cleanliness and hygiene maintenance because of the rise in infectious diseases. The appearance of illnesses such as covid 19, influenza, and multiple infections resistant to antibiotics have raised awareness regarding hygiene issues. The demand for cleaning products that provide efficient disinfection and protection is been driven by consumers increased awareness regarding various viruses and their potential contaminations.

Demand for antibacterial and disinfecting detergent is rising especially for application in laundry and home cleaning. As per the analysis, individuals look for products that not only get rid of dirt and stains but also lessen or completely eradicate dangerous bacteria and viruses. Owing to this new antibacterial laundry detergents are being launched in the market.

For instance, In May 2021, Ama detergent launched Morocco's first antibacterial laundry detergent. The launch aims to offer an efficient product that eliminates bacteria from clothes regardless of the temperature and the duration of the washing cycle.

Thus, the increase in awareness regarding hygiene and the rise of infectious diseases along with the launches of new antibacterial detergents are boosting the expansion of the market.

The growing textile industry is propelling the expansion of the global detergents market

The growing detergents market is driven by the expanding textile sector. The expansion of the textile sector demands effective cleaning solutions. The production of fabrics and clothing as well as gathering of raw material are all included in the variety of procedures that make up the textile sector. Numerous impurities including oils, dyes, and other residues build up on the fabrics during different phases. A systematic cleaning schedule is necessary to guarantee the creation of fabrics that are aesthetically pleasing and of the finest quality.

In textile processing, they play a crucial role due to their ability to disperse, emulsify, and solubilize various stains and dirt. The compound helps to remove stains from raw materials such as cotton and synthetic fibers in the initial stages. They are essential in removing residues from machinery during the manufacturing stage, which ensures a productive and efficient production process. Moreover, the textile sector is wide, including clothing, industrial fabrics, and textiles for homes. Various cleaning solutions are required to meet the specific needs of each section. Based on the analysis, manufacturers and the textile sector mostly rely on these materials and cleaning agents to maintain quality and standards, to meet the requirements of the customer. The investment and expansion of the textile sector is increasing the use of these compounds.

For instance, According to Indian Brand Equity Foundation (IBEF), reported that the government has approved research and development projects worth USD 7.4 billion in the textile sector.

Thus, the rise in the textile sector and the use of these compounds in the cleaning process is boosting the trends of the market.

Key Restraints :

Harmful effects of detergent on human health and the environment are limiting the market expansion

Detergent are harmful to the environment as well as people's health because of the presence of phosphates in them. They contain harsh chemicals that after regular use, may irritate skin, trigger allergies, or cause various respiratory issues. The compound with fragrance and color influences more severe skin conditions. Furthermore, using these compounds exposes people with pre-existing conditions to respiratory risks due to inhaled fumes and dust particles.

Moreover, water pollution is a consequence of these compounds which is released in the water bodies. Excessive growth of algae caused because of phosphates and surfactants in these compounds causes eutrophication and disturbs the ecosystem. As per the analysis, these compounds have a long-term effect on the environment because of a few nonbiodegradable factors. Thus the harmful effects of these compounds on humans as well as the environment are restraining the expansion of the market.

Future Opportunities :

Innovations in the development and use of eco-friendly detergents are expected to create lucrative opportunities for market expansion

Innovations and advancements in the development and use of eco-friendly compounds are driven by the rise in the use of sustainable and eco-friendly compounds and are creating lucrative detergents market trends and opportunities. Sustainable and eco-friendly detergents aim to reduce the environmental effects and impact and promote a more sustainable approach towards cleaning. Sustainable detergents use biodegradable material, which breaks down more conveniently and is not harmful to the ecosystem. Most of the sustainable detergents contain plant-based material instead of synthetic material, which reduces the carbon footprint.

For instance, In July 2023, Unilever launched its most sustainable laundry capsule. This capsule is designed to perform in cold conditions and short cycles and can save up to 60% of energy.

Thus, the development of sustainable detergent is creating lucrative detergents market opportunities in the market.

Detergents Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 178.16 Billion |

| CAGR (2024-2031) | 3.8% |

| By Type | Anionic, Cationic, Nonionic, Ionic, Zwitterionic, and Others. |

| By Form | Bar, Powder, Liquid/Gel, and Others |

| By Application | Online and Offline( Hypermarkets and Supermarkets, Convenience Stores and Others) |

| By Distribution Channel | Household (Laundry cleaning, Dishwashing, Personal cleaning, and Others) Industries (Biological reagents, Fuel additives, and Others) and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | Henkel Corporation, Unilever, Procter and Gamble, Kao, Novozymes, Evonik, Clariant, Ecolab, DeLaval, La Corona Soap Factory SA de CV, Reckitt Benckiser, Xtra, Seventh Generation Inc, and Eastern Valley Chemicals. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Detergents Market Segmental Analysis :

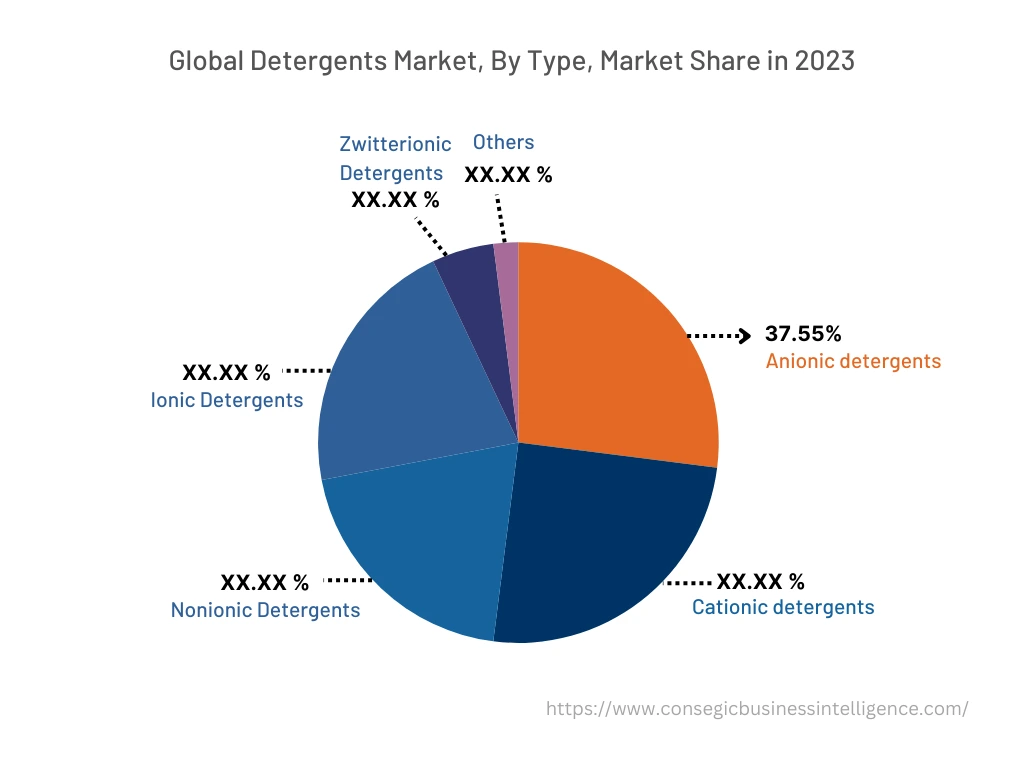

By Type :

The type is categorized into anionic, cationic, nonionic, ionic, zwitterionic, and others. In 2023, the anionic segment accounted for the highest detergents market share of 27.34% in the detergents market and is expected to hold the highest CAGR over the forecast period in the detergents market, because of their negatively charged hydrophilic group, cationic works well for cleaning products. These compounds are usually affordable and have adaptable formulas that produce a lot of foam which is good for products like body washes and dishwashing liquids. The widespread use of anionic s is attributed to their adaptability to different components and their ability to differentiate to their lipophilic-hydrophilic balance (HLB). As per the analysis, these anionic compounds are perfect for a variety of cleaning products such as body washes, shampoos, dishwashing liquids, and laundry.

Dishwasher liquids usually contain these compounds for efficient dish cleaning. Phosphates are termed as builders as they improve cleaning by softening the water. Anionic surfactants such as sodium lauryl sulfate break down grease and oils while enzymes such as protease, amylase, and lipase target specific stains. Anionic detergent present in the dishwashing liquid ensures the proper cleaning of dishes. For instance, Lifebuoy by Unilever launches its first-ever dishwashing liquid in Indonesia. The aim of the launch is to offer a superior cleaning product at an affordable price. Thus, the aforementioned factors are propelling the trends of the segment.

By Form :

The form is categorized into bar, powder, liquid/gel, and others. In 2023, the powder segment accounted for the highest market share in the market. Powder forms are laundry care essential because of their exceptional cleaning power. These compounds contain anionic surfactants like sodium lauryl sulfate, which are excellent at removing and dissolving stains and dirt from textiles and apparel. Components that soften water, like sodium carbonate, increase the efficiency of these compounds. Enzymes or oxygen bleaches are added to remove stains and brighten the area. Their enduring popularity is attributed to their affordability extended shelf life, and compatibility with a variety of washing machines. For instance, in November 2023, Unilever launched its first laundry powder pilot using near-zero emission ingredients. Thus, the extensive use of laundry powder is driving the trends of the segment.

Furthermore, the liquid segment is expected to hold the highest CAGR over the forecast period in the market. The common type of detergent is liquid, which is convenient and efficient for cleaning fabrics. These liquids are multipurpose and readily dissolve in water. Because of their liquid form, they work well as pre-treatment for stains. Enzymes optical brighteners, and fragrances are generally added to liquid to improve cleaning and leave clothing smelling great. As they are pourable, precise dosing is possible, lowering the possibility of product waste and cost. For instance, Godrej Consumer Products Limited introduced Godrej-Fab, a high-performance liquid. The product is mostly launched in the Southern part of India at half the price. Thus, the advancements and high use of these compounds are boosting the trends of the segment.

By Application :

The application is categorized into household, industrial, and others. In 2023, the household segment accounted for the highest market share in the market and is expected to hold the highest CAGR over the forecast period in the detergents market. The household segment is further bifurcated into laundry cleaning, dishwashing, personal cleaning, and others. The use of these compounds in the home is essential for preserving hygienic conditions. They are primarily used in the laundry because they contain surfactants, which ensure efficient stain and oil removal during cleaning.

This ability extends to dishwashing, the compounds help to sanitize dishes by removing the grease. By dissolving dirt and bacteria, the compound helps to create an environment free of germs. Sustainable detergents are environment-friendly alternatives that are designed to minimize the impact of these compounds that pose a threat to the environment. For instance, all Free Clear brand launched its eco-friendly and sustainable laundry detergent. This product is in an eco ultra-concentrated liquid laundry detergent. It is a biobased formula that is stored in an eco bottle. Thus, The extensive use of a liquid form of these compounds in households is driving the expansion of the segment.

By Distribution Channel :

The distribution channel segment is categorized into online and offline. The offline segment is further bifurcated into hypermarkets and supermarkets, convenience stores, and others. In 2023, the offline segment accounted for the highest detergents market share in the overall market. Offline purchasing of products through stores enables customers to perform the quality check of products before buying them. Additionally, offline stores offer several advantages for customers like the variety of goods in one place, discounts on products, convenience or extended shopping hours, and multiple options for the same product. Moreover, they also have a larger selection of products and food producers to choose from. As a result, the convenience and benefits associated with the offline distribution of these compounds are propelling the detergents market growth.

Moreover, the online segment is expected to grow at the fastest CAGR over the forecast period. Online distribution channels such as e-commerce websites and company websites provide a platform for customers to purchase detergent products online, allowing the customer to purchase them in the comfort of their homes within a short time. The increasing adoption of e-services is expected to propel the detergents market demand for segments in the upcoming years. Additionally, the rising e-commerce sector is expected to contribute to this growth trajectory. For instance, according to the data published by the National Investment Promotion and Facilitation Agency in 2023, the e-commerce market in India is expected to touch USD 350 billion in gross merchandise value by 2030 and online shoppers in India are expected to reach 500 billion in 2030 from 150 billion 2020. Thus, the rising use of online sites is boosting the growth of the segment.

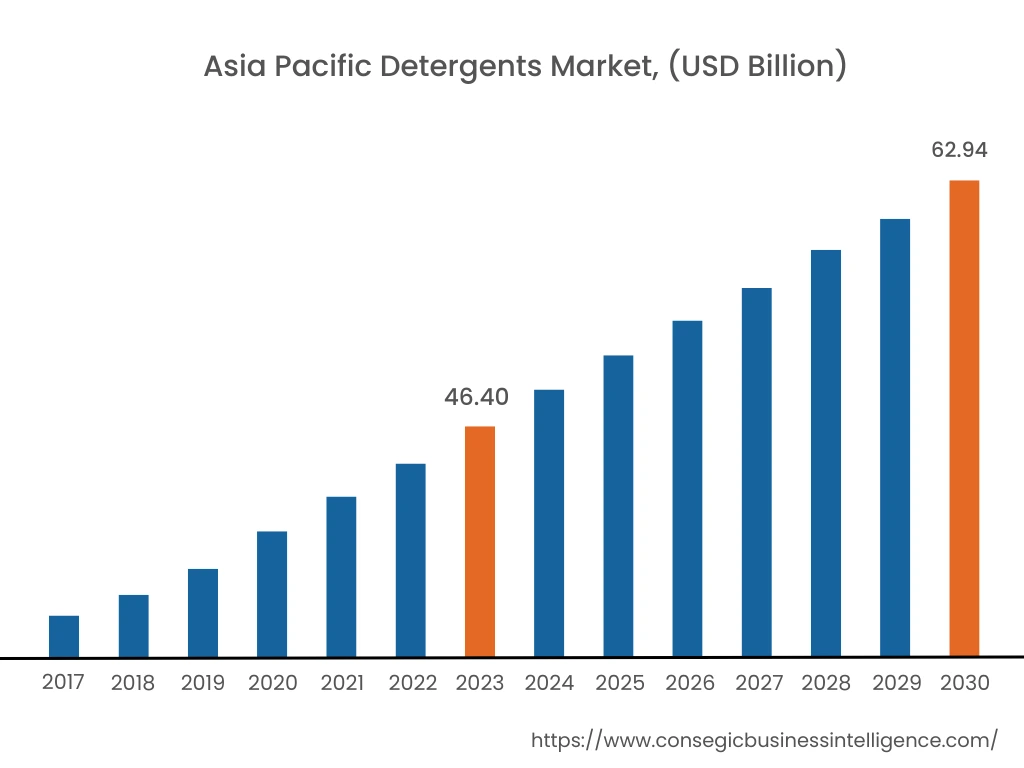

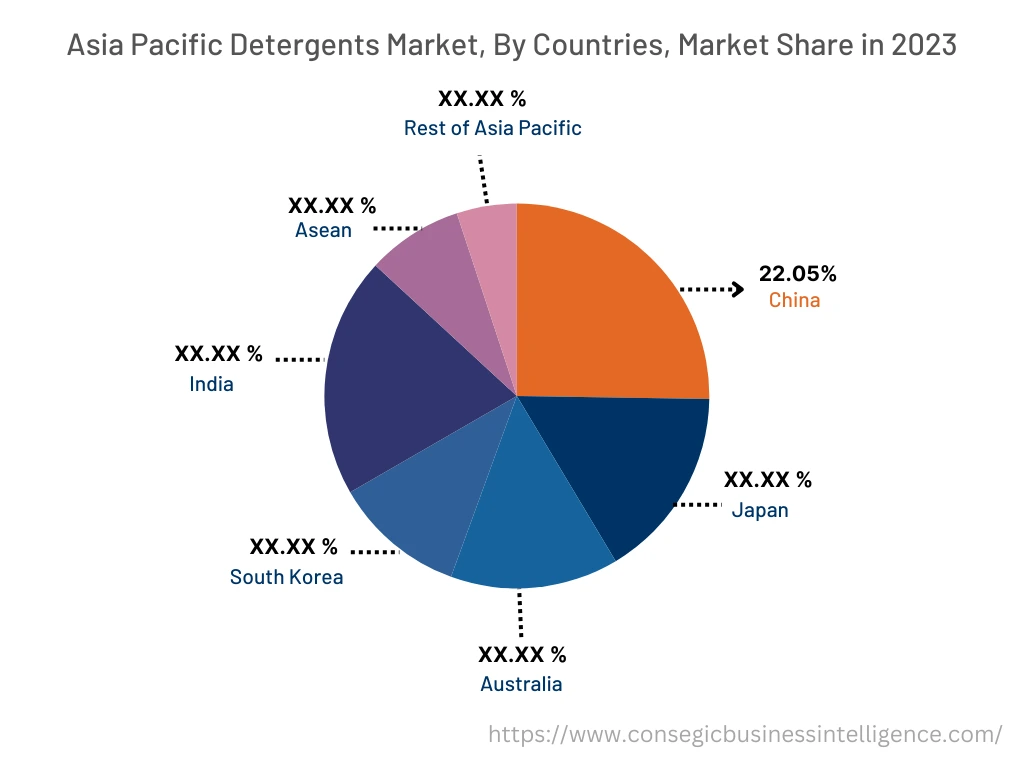

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, Asia Pacific accounted for the highest market share at 35.20% valued at USD 46.40 Billion in 2023, it is expected to reach USD 62.94 Billion in 2031. In Asia Pacific, China accounted for the highest market share of 22.05% during the base year of 2023. The compounds are used for the cleaning of various surfaces. Based on the detergents market analysis, significant growth in these industries across the Asia Pacific is driving the market in the region. They are used in the pharmaceutical sector for sanitizing and keeping the surfaces clean. Significant growth of pharmaceutical industry is booting the adoption of the compound across the region.

For instance, According to the report by the Indian Brand Equity Foundation in August 2023, the market size of the Indian pharmaceuticals industry is expected to reach USD 65 billion by 2024, and USD 130 billion by 2030. Thus, these factors are boosting the trends of the segment.

Furthermore, the North America region is expected to witness significant growth over the forecast period, growing at a CAGR of 4.3% during 2024-2031. The increasing population and urbanization led to the use of cleaning products, which include these compounds, for households as well as industries. Moreover, customers' growing awareness about hygiene and cleanliness is boosting the growth and trends of the market in the region.

Top Key Players & Market Share Insights :

The global detergents market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The detergent industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market through mergers, acquisitions, and partnerships. The key players in the market include-

The key players in the market include-

Recent Industry Developments :

- In July 2023, Unilever launched its most sustainable laundry capsule. This capsule is designed to perform in cold conditions and short cycles and can save up to 60% of energy.

- In November 2023, Unilever launched its first laundry powder pilot using near-zero emission ingredients. Thus, the extensive use of laundry powder is driving the trends of the segment.

Key Questions Answered in the Report

What is the market size of the detergents industry in 2023? +

In 2023, the market size of detergents market is USD 131.80 billion.

What will be the potential market valuation for the detergents market industry by 2031? +

In 2031, the market size of detergents market will be expected to reach USD 178.16 billion.

What are the key factors restraining the growth of the detergents market market? +

Harmful effects of detergent on human health and the environment.

What is the dominating segment in the detergents market market by form? +

In 2023, the powder segment accounted for the highest market share in the overall detergents market market.

Based on current market trends and future predictions, which geographical region is growing at the fastest CAGR over the forecast period in the detergents market market? +

North America region accounted for the highest CAGR in the overall detergents market market.