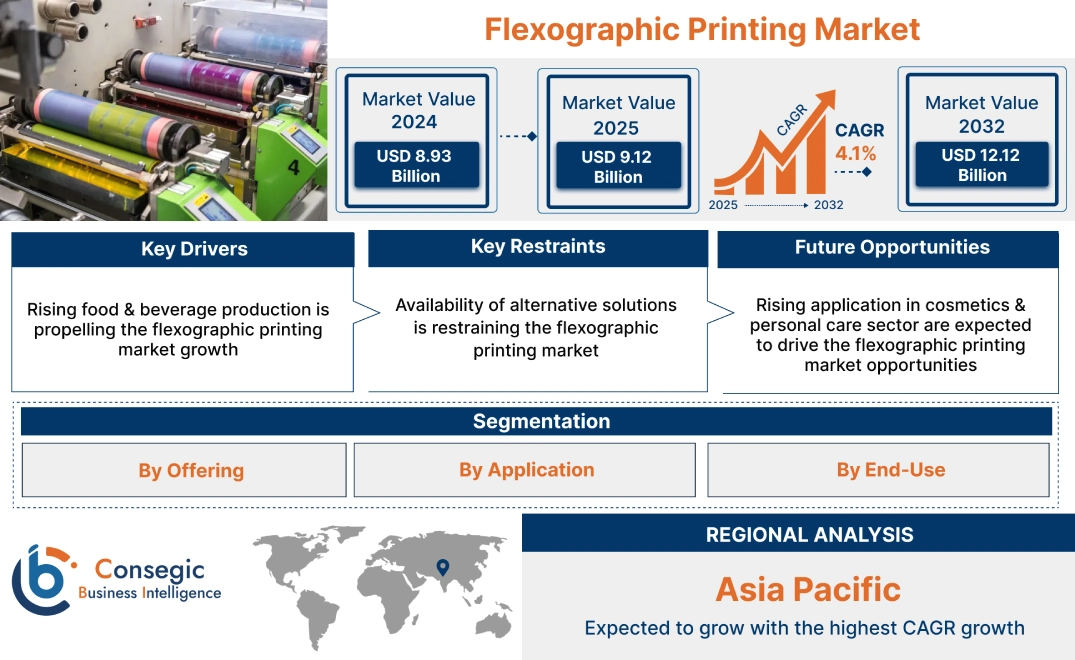

Flexographic Printing Market Size:

Flexographic Printing Market size is estimated to reach over USD 12.12 Billion by 2032 from a value of USD 8.93 Billion in 2024 and is projected to grow by USD 9.12 Billion in 2025, growing at a CAGR of 4.1% from 2025 to 2032.

Flexographic Printing Market Scope & Overview:

Flexographic printing, also known as flexography, refers to a high-speed printing method that utilizes flexible, raised-image plates for transferring ink onto several materials. It is commonly used as a roll-to-roll printing type and is ideal for continuous printing applications, particularly on substrates including plastic, foil, and paper. Moreover, flexography offers a range of benefits including high printing speed, compatibility with wide range of substrates, high quality print, in-line converting flexibility, and others. The above benefits of flexography are primary determinants for increasing its utilization in printing high volume of flexible packaging, corrugated packaging, and labels & tags among others.

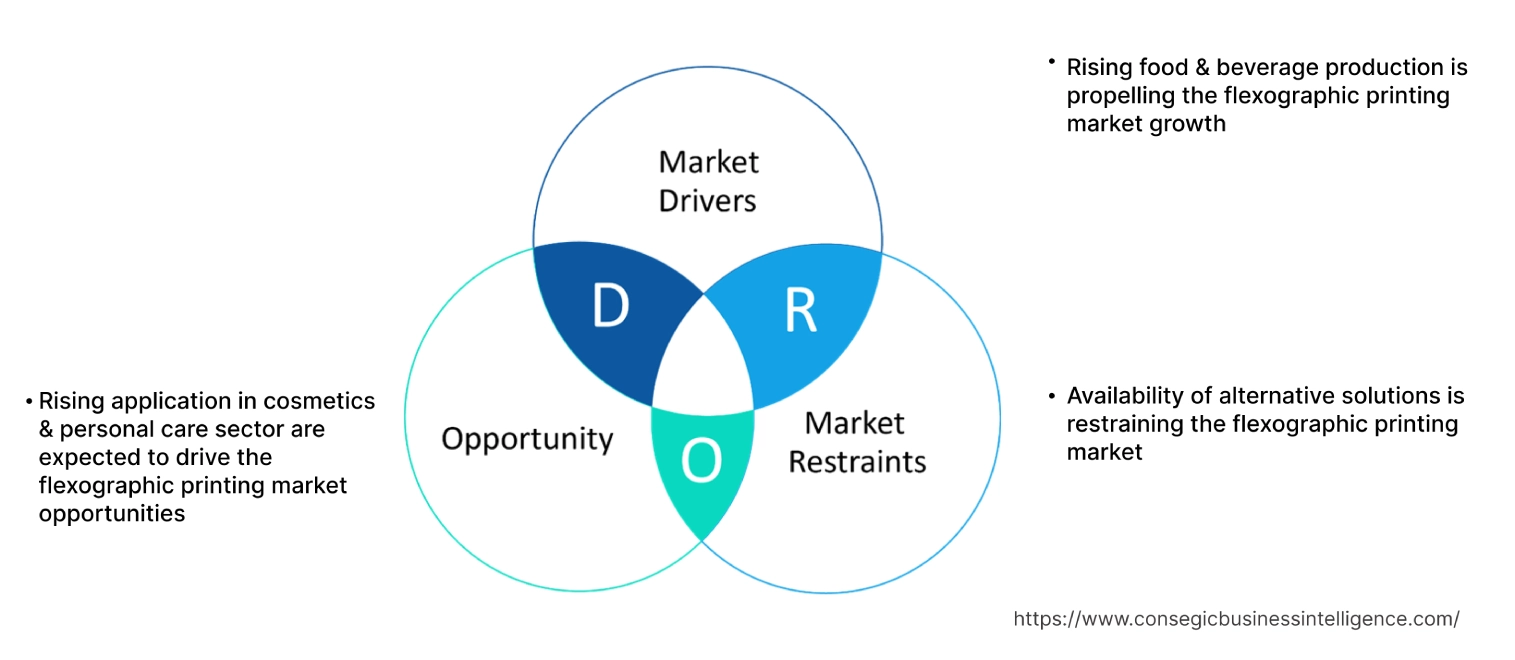

Key Drivers:

Rising food & beverage production is propelling the flexographic printing market growth

Flexographic printing is primarily used in food & beverage sector for printing packaging, tags, and labels used in food & beverage products. Flexography is commonly used for printing packaging materials such as bags, pouches, cartons, and others that hold several food & beverage products. Moreover, flexography is also used for printing labels that are often used for branding and providing product information. Additionally, flexography utilizes a quick-drying ink, which is not harmful to food products. The versatility, efficiency, and ability to produce high-quality prints on various substrates makes flexography ideal for utilization in food & beverage packaging.

- For instance, according to Food Drink Europe, the European Union food and beverage sector was valued at EUR 1,121 billion (USD 1,196.7 billion) in 2022, demonstrating an incline of 2.6% in comparison to EUR 1,093 billion (USD 1,166.8 billion) in 2021.

Hence, the rising food & beverage production is increasing the adoption of flexography for application in food & beverage packaging, in turn proliferating the flexographic printing market size.

Key Restraints:

Availability of alternative solutions is restraining the flexographic printing market

There are several alternative solutions to flexographic printing including lithographic printing, digital printing, and others. Moreover, the alternative solutions have similar benefits and applications in comparison to flexography, which is a key factor restricting the market.

For instance, lithographic printing is often used for printing paper products, brochures, and packaging materials such as cartons. Moreover, lithographic printing can deliver high-quality and detailed prints. Meanwhile, digital printing can be used for printing labels, packaging, and other materials. Digital printing offers several benefits such as quick and agile low-volume printing, short run times, fast setup, and others. Thus, the availability of several alternative solutions to flexography is hindering the flexographic printing market expansion.

Future Opportunities :

Rising application in cosmetics & personal care sector are expected to drive the flexographic printing market opportunities

Flexography is commonly used in cosmetics & personal care sector for printing various types of packaging used in cosmetics and personal care products. Flexography offers high-speed production capabilities, which makes it suitable for fulfilling the high production demand of the cosmetics & personal care sector. Moreover, flexography’s improved adaptability, efficiency, and ability to produce high-quality graphics on both flexible and rigid packaging materials are key aspects for increasing its utilization in packaging application in the cosmetics and personal care sector.

- For instance, according to Cosmetics Europe (Personal Care Association), the largest markets for cosmetics and personal care products within Europe include Germany with retail sales value of USD 17.5 billion in 2023, followed by France with USD 15.1 billion, Italy with USD 13.8 billion, UK with USD 12.1 billion, Spain with USD 11.5 billion, and Poland with USD 5.7 billion among others.

Hence, as per the analysis, the growing cosmetics & personal care sector is projected to increase the adoption of flexography, in turn boost the flexographic printing market opportunities during the forecast period.

Flexographic Printing Market Segmental Analysis :

By Offering:

Based on offering, the market is segmented into flexographic printing machine and flexographic ink.

Trends in the offering:

- Increasing technological advancements associated with flexography machines for improved performance, high quality print, and enhanced operational efficiency.

- There is a rising trend towards utilization of flexographic inks due to its several benefits including high adhesion, quick drying, and improved versatility in applications among others.

The flexographic printing machine segment accounted for a largest revenue share in the total flexographic printing market share in 2024.

- A flexographic printing machine refers to a printing press that utilizes flexible relief plates for transferring ink onto a variety of substrates, such as paper, plastic, films, and others.

- Flexographic machines are used for printing labels, flexible packaging, cartons, and newspapers among others.

- Moreover, flexographic machines offer several benefits such as high speed, improved versatility, quick change-over time, cost-efficiency, and others.

- For instance, in June 2024, Expert, an Italian manufacturer, introduced its new Expert Active 908-X model of CI flexo printing press. The flexo printing machine includes a zero-waste system and provides high-quality, and precise prints.

- According to the flexographic printing market analysis, the rising innovations associated with flexographic machines are driving the flexographic printing market trends.

The flexographic ink segment is anticipated to register a significant CAGR growth during the forecast period.

- Flexographic ink refers to a specifically formulated ink that is utilized in flexography process.

- Flexographic ink can adhere to several substrates and dry quickly for maintaining printing speed.

- Additionally, flexographic ink offers a range of benefits including quick drying, high adhesion, vibrant colors, improved versatility in applications, and others.

- For instance, DIC India offers flexographic inks in its product offerings. The company’s flexographic inks are specifically designed for application in label and packaging sectors.

- Thus, rising advancements related to flexographic inks are anticipated to boost the flexographic printing market trends during the forecast period.

By Application:

Based on application, the market is segmented into flexible packaging, corrugated packaging, labels & tags, and others.

Trends in the application:

- Rising trend towards adoption of flexible packaging in food & beverages, cosmetics & personal care, consumer goods, and other industries is driving the market.

- Increasing trend adoption of flexography in producing high volumes of labels and packaging, attributing to its faster printing speed, high efficiency, and multiple substrate compatibility.

The flexible packaging segment accounted for the largest revenue in the overall market in 2024, and it is anticipated to register a substantial CAGR growth during the forecast period.

- Flexography is typically used in flexible packaging sector, attributing to its ability to produce high-quality prints on a broad range of materials and substrates.

- Flexography is often used for printing flexible packaging such as bags, pouches, wrappers, and films, which are widely used in several industries such as food & beverages, cosmetics & personal care, consumer goods, and others.

- For instance, according to the Flexible Packaging Association, the flexible packaging sector in the United States reached up to 41.5 billion in sales in 2022.

- Therefore, rising adoption of flexible packaging is driving the flexographic printing market growth.

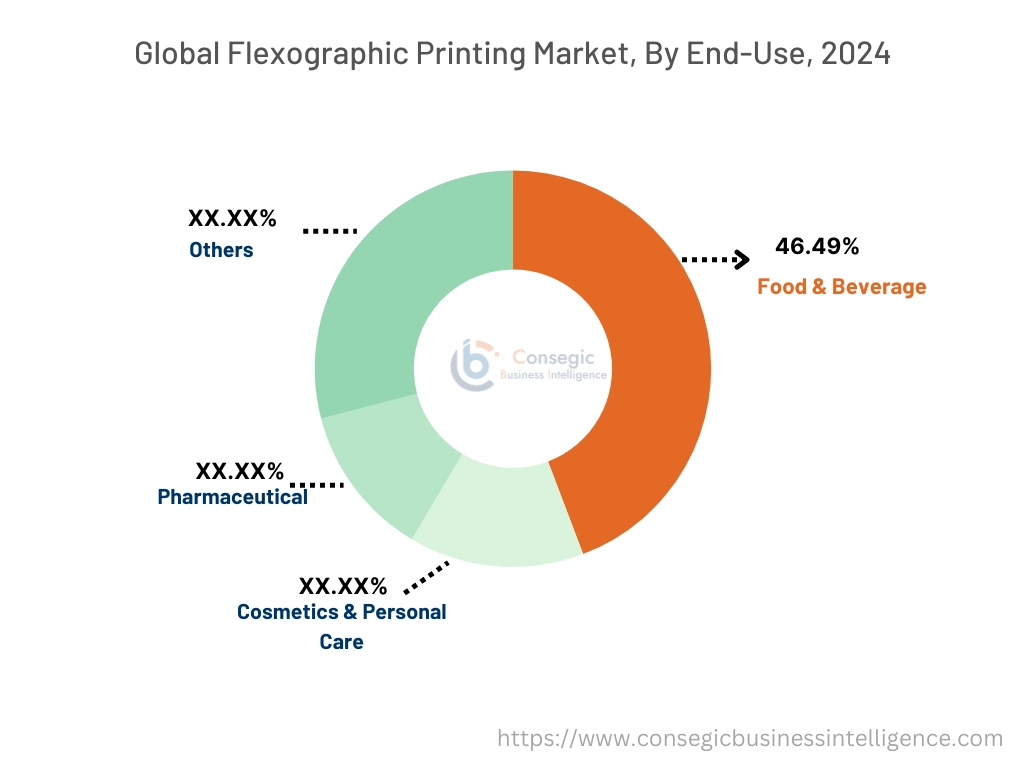

By End-Use:

Based on the end-use, the market is segmented into food & beverage, cosmetics & personal care, pharmaceutical, and others.

Trends in the end-use:

- Factors including significant investments in food & beverage sector, rising consumer demand for packaged and processed food products, along with increasing hygiene standards in food & beverage sector are primary aspects driving the growth of the food & beverage segment.

- Rising trend in adoption of flexography for printing labels and packaging for food & beverage, pharmaceuticals, and cosmetic & personal care products.

Food & beverage segment accounted for the largest revenue share of 46.49% in the overall flexographic printing market share in 2024.

- Flexography is primarily used in food & beverage sector for printing packaging, tags, and labels used in food & beverage products.

- Additionally, the versatility, efficiency, and ability to produce high-quality prints on various substrates makes flexography ideal for utilization in food & beverage packaging.

- For instance, Kerry Group, a food and beverage company, announced the launch of its new food manufacturing facility in Georgia, United States in 2022. The food manufacturing facility was developed to meet the rising consumer demand in seafood, poultry, and alternative protein markets across the United States and Canada.

- According to the analysis, the increasing food & beverage production is driving the adoption of flexography for application in food & beverage packaging, thereby, propelling the flexographic printing market size.

Cosmetics & personal care segment is anticipated to register a substantial CAGR growth during the forecast period.

- Flexography is commonly used in cosmetics & personal care sector for printing various types of packaging used in cosmetics and personal care products.

- Moreover, flexography offers numerous benefits including improved adaptability, efficiency, and ability to produce high-quality graphics on both flexible and rigid packaging materials, which are primary aspects for driving its utilization in packaging application in cosmetics & personal care sector.

- For instance, according to Japan Cosmetic Industry Association (JCIA), cosmetic shipments in Japan reached approximately USD 9.23 billion in 2023, witnessing an increase of 2.9% increase as compared to 2022.

- Therefore, the growing cosmetics & personal care sector is projected to drive the market demand during the forecast period.

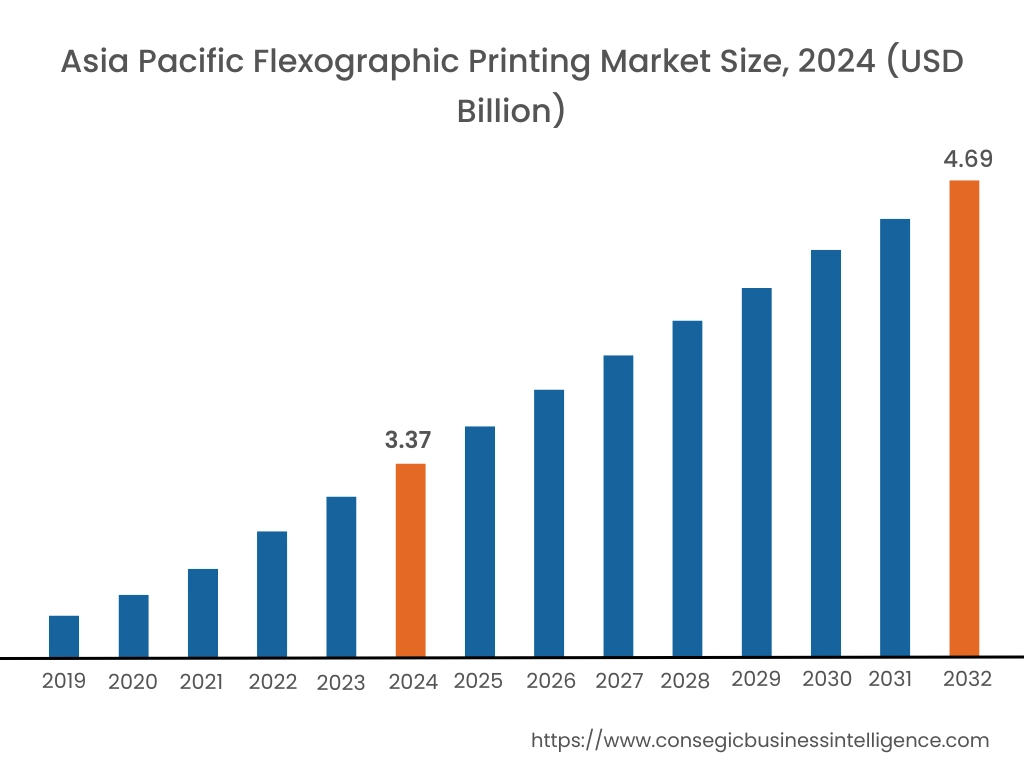

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

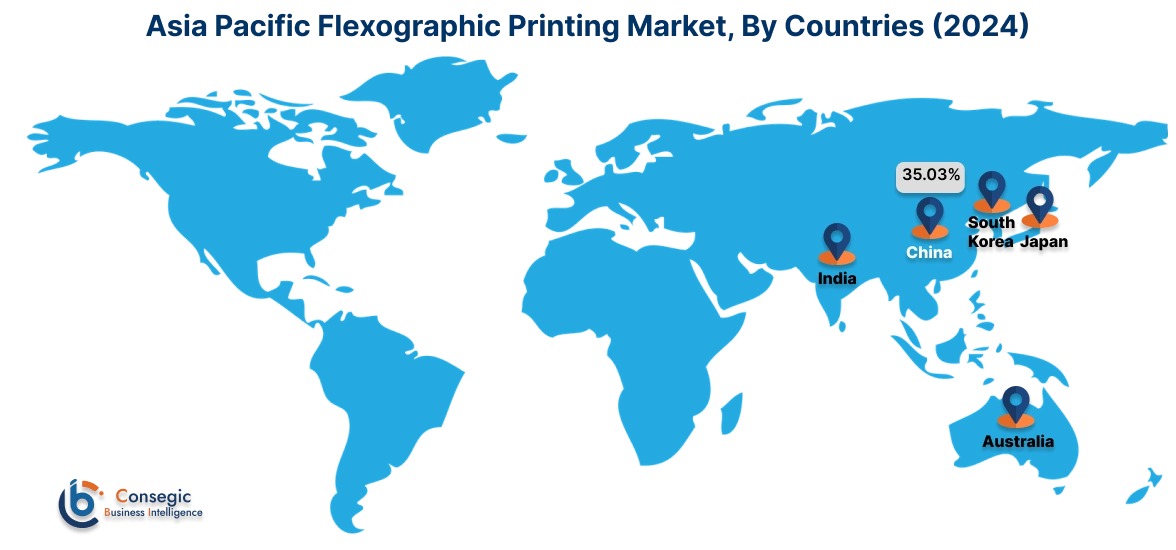

Asia Pacific region was valued at USD 3.37 Billion in 2024. Moreover, it is projected to grow by USD 3.45 Billion in 2025 and reach over USD 4.69 Billion by 2032. Out of this, China accounted for the maximum revenue share of 35.03%. As per the flexographic printing market analysis, the adoption of flexography in the Asia-Pacific region is primarily driven by growing pharmaceutical, cosmetics & personal care, and other sectors. Additionally, the rising packaging production and increasing adoption of flexible and corrugated packaging in several industries are further accelerating the flexographic printing market expansion.

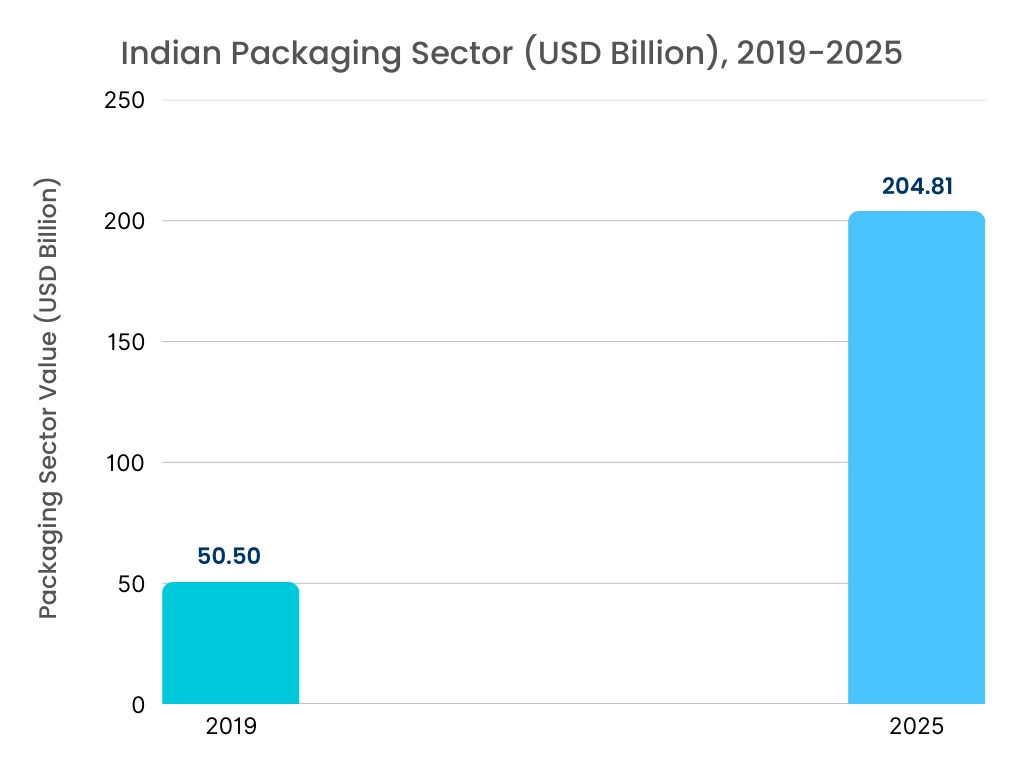

- For instance, according to Packaging Industry Association of India (PIAI), the packaging sector in India was valued at USD 50.5 billion in 2019, and it is projected to reach up to USD 204.81 billion by 2025, witnessing an annual growth rate of 26.7% during the period of 2020-2025. Thus, the above factors are expected to boost the market in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 3.23 Billion by 2032 from a value of USD 2.40 Billion in 2024 and is projected to grow by USD 2.45 Billion in 2025. In North America, the growth of flexographic printing industry is driven by rising investments in food & beverage, cosmetics, and pharmaceutical production among others. Similarly, rising adoption of medical flexible packaging solutions are further contributing to the flexographic printing market demand.

- For instance, according to the Flexible Packaging Association, the flexible packaging sector was the second largest packaging segment in the United States in 2022, accounting for 21% of the overall USD 180.3 billion U.S packaging sector. The above factors are driving the market in the North American region.

Additionally, the regional analysis depicts that the rising investments in cosmetics & personal care sector and increasing pharmaceutical production are driving the flexographic printing market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as substantial investments in food & beverage and pharmaceutical sectors along with increasing adoption of flexography for food & beverage and pharmaceutical packaging among others.

Top Key Players and Market Share Insights:

The global flexographic printing market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the flexographic printing market. Key players in the flexographic printing industry include-

- Bobst (Switzerland)

- Mark Andy Inc. (U.S)

- Windmoller & Holscher (Germany)

- Heidelberger Druckmaschinen AG (Germany)

- MPS Systems B.V. (Netherlands)

- Nilpeter A/S (Denmark)

- Aim Machinetechnik Pvt. Ltd (India)

- Koenig & Bauer AG (Germany)

- Comexi (Spain)

- Soma Engineering (Czech Republic)

Recent Industry Developments :

Product Launch:

- In January 2025, Komori India announced the launch of its automatic printing machine at PrintPack India 2025. The machine is developed to cater to flexo printing of paper bags, packaging, and paper cups among others.

Flexographic Printing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 12.12 Billion |

| CAGR (2025-2032) | 4.1% |

| By Offering |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the flexographic printing market? +

The flexographic printing market was valued at USD 8.93 Billion in 2024 and is projected to grow to USD 12.12 Billion by 2032.

Which is the fastest-growing region in the flexographic printing market? +

Asia-Pacific is the region experiencing the most rapid growth in the flexographic printing market.

What specific segmentation details are covered in the flexographic printing solutions report? +

The flexographic printing solutions report includes specific segmentation details for offering, application, end-use, and region.

Who are the major players in the flexographic printing market? +

The key participants in the flexographic printing market are Bobst (Switzerland), Mark Andy Inc. (U.S), Windmoller & Holscher (Germany), Heidelberger Druckmaschinen AG (Germany), MPS Systems B.V. (Netherlands), Nilpeter A/S (Denmark), Aim Machinetechnik Pvt. Ltd (India), Koenig & Bauer AG (Germany), Comexi (Spain), Soma Engineering (Czech Republic), and others.