Gaming Accessories Market Size:

Gaming Accessories Market size is estimated to reach over USD 18,276.54 Million by 2031 from a value of USD 8,558.77 Million in 2023 and is projected to grow by USD 9,257.68 Million in 2024, growing at a CAGR of 9.9% from 2024 to 2031.

Gaming Accessories Market Scope & Overview:

Gaming accessories are peripheral devices designed to enhance and optimize gaming experience. They include gaming mice, keyboards, controllers, headsets, and others to make gaming a more comfortable, immersive, and intense experience. Moreover, these accessories offer an enhanced gaming experience by providing better control, faster response times, and more immersive gameplay. The aforementioned benefits are major determinants for increasing their adoption in gaming, content creation, and others.

Gaming Accessories Market Insights:

Gaming Accessories Market Dynamics - (DRO) :

Key Drivers:

Rising Popularity of Online Games Propels Market Expansion

Online games frequently require extended gaming sessions and social interactions, resulting in an increased need for comfortable and high-quality accessories including headsets, microphones, mice, and controllers. The expansion of streaming and content creation in the online games space requires these accessories. Additionally, many online games receive frequent updates and expansions, leading gamers to seek the latest accessories to stay competitive and experience new functionalities.

- In September 2023, Logitech G, introduced the PRO Series line, the Logitech G PRO X TKL LIGHTSPEED Gaming Keyboard and Logitech G PRO X SUPERLIGHT 2 Gaming Mouse deliver high performance and quality in gaming sessions, enhancing experience.

Thus, the rising popularity of online games is collectively driving the gaming accessories market expansion, as gamers seek high performance, quality, speed, and reliability in gaming.

Key Restraints :

High Cost is Restraining the Market

Gamers with limited budgets may prioritize essential items over high-end or specialized accessories, reducing overall market demand. Additionally, advanced features and cutting-edge technology increase production costs making high-performance accessories less affordable.

- For instance, the HP Omen X Emperium 65 monitor, Audeze LCD-GX headset, Wooting Two HE keyboards, and the Mad Catz R.A.T Pro X3 Supreme mouse represent some of the most expensive gaming accessories available. These products provide high-tech advancements, outstanding efficiency, and elegant design elements.

However, the steep prices of these products reduce affordability for a large number of consumers, limiting access to only the most committed and financially able gamers, which hampers the expansion of the gaming accessories market.

Future Opportunities :

Incorporation of Artificial Intelligence (AI) and Virtual Reality Builds Potential Opportunities

Integrating accessories with emerging technologies including AI, VR, and augmented reality (AR) environments, significantly enhances gaming experiences and functionality. These emerging technologies create more responsive peripherals including adaptive controllers and intelligent headsets that enhance gameplay through personalized settings.

- In February 2023, Sony Interactive Entertainment launched a virtual reality headset PlayStation VR2 headset, and included a PlayStation VR2 Sense controller with haptic feedback, featuring high-fidelity visuals, enhanced tracking, and enabling users to experience a heightened range of sensations in gaming sessions.

Thus, the integration of these accessories with virtual reality and artificial intelligence enhances the immersive gaming experience by providing control and haptic feedback, which is expected to promote Gaming Accessories Market opportunities during the forecast period.

Gaming Accessories Market Segmental Analysis :

By Product:

Based on the product, the market is segmented into Gaming Mouse, Gaming Keyboard, Gaming Headsets, Gaming Monitors , Controllers, Gaming Console and Others.

Trends in the product:

- Development of accessories optimized for cloud gaming platforms, including controllers and streaming devices, to provide a seamless gaming involvement across multiple devices.

- Increasing availability of accessories compatible with VR and AR such as motion controllers and haptic feedback devices, to enhance the immersive gaming experience.

The gaming monitors accounted for the largest revenue share in 2023.

- Gaming monitors play a crucial role in enhancing visual performance with high refresh rates and high-resolution display.

- The demand for immersive and visually appealing gameplay drives the popularity of gaming monitors.

- Additionally, advancements including curved screens, HDR support, and adaptive sync technologies further boost their appeal catering to gamers seeking the best visual performance and immersive experience.

- In December 2022, LG Electronics, launched UltraGear OLED Gaming Monitors, featuring support for variable refresh rate (VRR), NVIDIA G-SYNC Compatible, FreeSync Premium, and VESA Adaptive Sync for a seamless gaming experience with outstanding contrast, vibrant colors, and high response time.

- Thus, analysis shows that the aforementioned features of gaming monitors are driving the proliferation of the gaming accessories market demand.

The gaming headset segment is anticipated to emerge as the fastest-growing segment during the forecast period.

- A gaming headset enhances the gaming experience by offering precise and clear audio, making it more engaging.

- Features including surround sound, noise cancellation, and high-fidelity audio quality, which enhances gameplay and communication in gaming sessions.

- As per the analysis, the adoption of VR headsets in gaming sessions provides ultra-high-resolution display and control over the virtual environment with advanced haptic feedback technology.

- In June 2023, Apple launched Apple Vision Pro VR headset, with a high-resolution display system of 23 million pixels spread across two screens, and specialized Apple chips in a dual-chip setup to provide a realistic and immersive gaming experience.

- Hence, a gaming headset is expected to expand the global gaming accessories market trend.

By Connectivity:

Based on the connection, the market is bifurcated into wired and wireless.

Trends in the connectivity:

- Enhanced Bluetooth and Wi-Fi technology enables seamless pairing and connectivity across multiple devices, including consoles, PCs, and mobile devices .

The wireless segment accounted for the largest revenue share in the year 2023 and is anticipated to register the fastest CAGR growth during the forecast period.

- The increasing preference of gamers for wireless accessories including mice, keyboards, and headsets for clutter-free and flexible gaming setups is propelling the gaming accessories market trend.

- Moreover, as per the analysis, advancements in wireless technology including low-latency and high bandwidth connections with minimal lagging in gaming sessions, offer gamers the freedom from cables without compromising performance.

- In July 2022, Logitech , introduced the Aurora Collection, featuring the G735 Wireless Gaming Headset, G715 Wireless Gaming Keyboard, G713 Gaming Keyboard, G705 Wireless Gaming Mouse, and eight custom accessories, incorporated with LIGHTSPEED high-performance wireless technology and Blue VO!CE microphone technology ensures minimal lag in wireless accessories.

- Hence, rising innovations the wireless technology with minimal lag in gaming sessions are boosting the global gaming accessories industry.

By Sales Channel:

Based on the sales channel, the market is segmented into Online, Specialty Stores, Retail Stores, Enterprises, and Others.

Trends in the sales channel:

- Continued importance of physical retail stores for providing hands-on experience with accessories, offering customer support and demonstration.

- Adoption of omnichannel retail strategies where brands integrate digital and offline sales channels seamlessly, providing customers with flexible purchasing options and consistent brand experience.

The specialty stores accounted for the largest revenue share in the year 2023.

- Specialty stores offer a comprehensive range of the latest and most innovative gaming accessories.

- These stores focus on providing an engaging shopping experience by setting up demo stations where consumers can test out these accessories and experience the features.

- According to the analysis of the Census Bureau of the Department of Commerce, U.S. retail e-commerce sales for the first quarter of 2024 were estimated at USD 289.2 billion, representing a 2.1 percent increase from the fourth quarter of 2023, after adjusting for seasonal variation but not for price changes.

- Hence, the specialty stores segment is boosting the gaming accessories market.

The online segment is anticipated to register the fastest CAGR growth during the forecast period.

- Online shopping offers a seamless and convenient experience, allowing customers to browse and buy flexibly.

- Expanding e-commerce platforms, due to increased investments, provide access to a broad range of products, including specialized and latest gaming accessories.

- For instance, Flipkart, the leading e-commerce company owned by Walmart, secured USD 1 billion in upcoming funding, with an investment of USD 600 million expected from Walmart.

- Therefore, with the rising investments in e-commerce companies, the online segment is expected to grow the gaming accessories market trend during the forecast period.

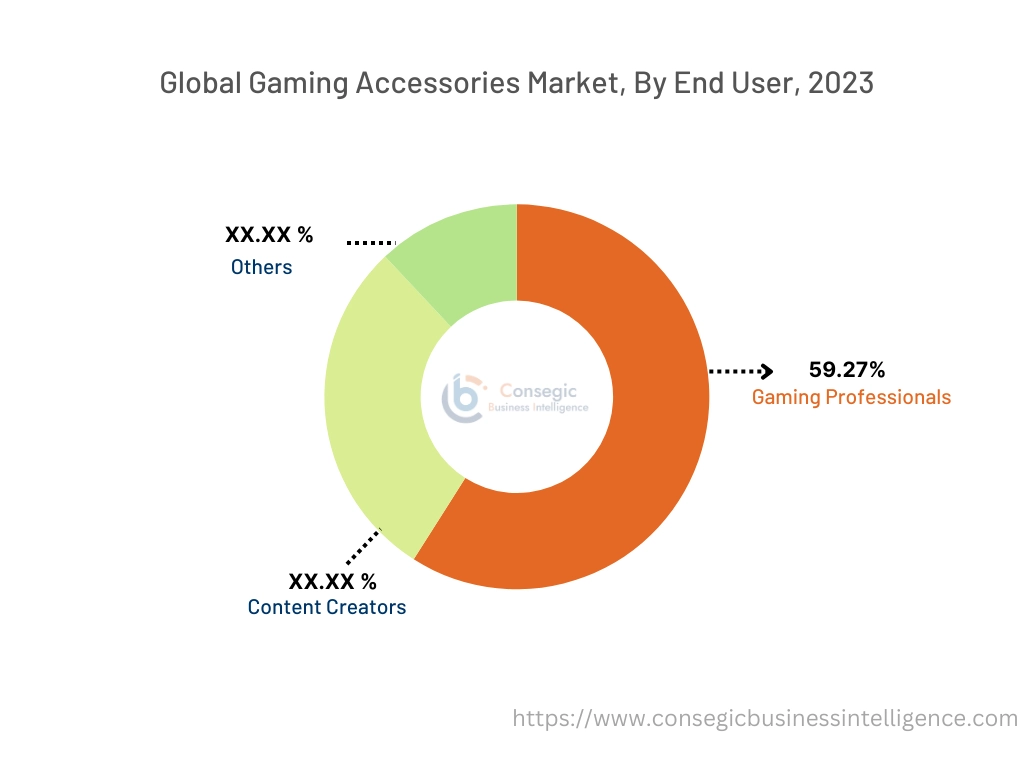

By End-User:

Based on the end user, the market is segmented into Gaming Professionals, Content Creators, and Others.

Trends in the end user:

- Adoption of accessories that enhance collaboration and communication including high-quality webcams and multi-channel audio systems, particularly among gaming professionals and content creators, depicts a growing trend.

The gaming professionals segment accounted for the largest revenue share of 59.27% in 2023 and is anticipated to register the fastest CAGR growth during the forecast period.

- Determinants including increasing demand for immersive gaming experiences, advancements in online game development with high-quality graphics, the latest sensory features, enhanced tracking, and the growing popularity of e-sports and virtual reality competitions are key aspects driving the segment.

- In October 2021, Capcom partnered with Oculus Studios and Armature Studio to release the survival horror game "Resident Evil 4" exclusively for Oculus Quest 2 in a VR headset, where users engage and explore the game world using both teleportation and room-scale movement, enhancing the immersive experience

- Consequently, segment analysis depicts that the releases of the latest online games necessitate high-performance gaming accessories boosting the market share.

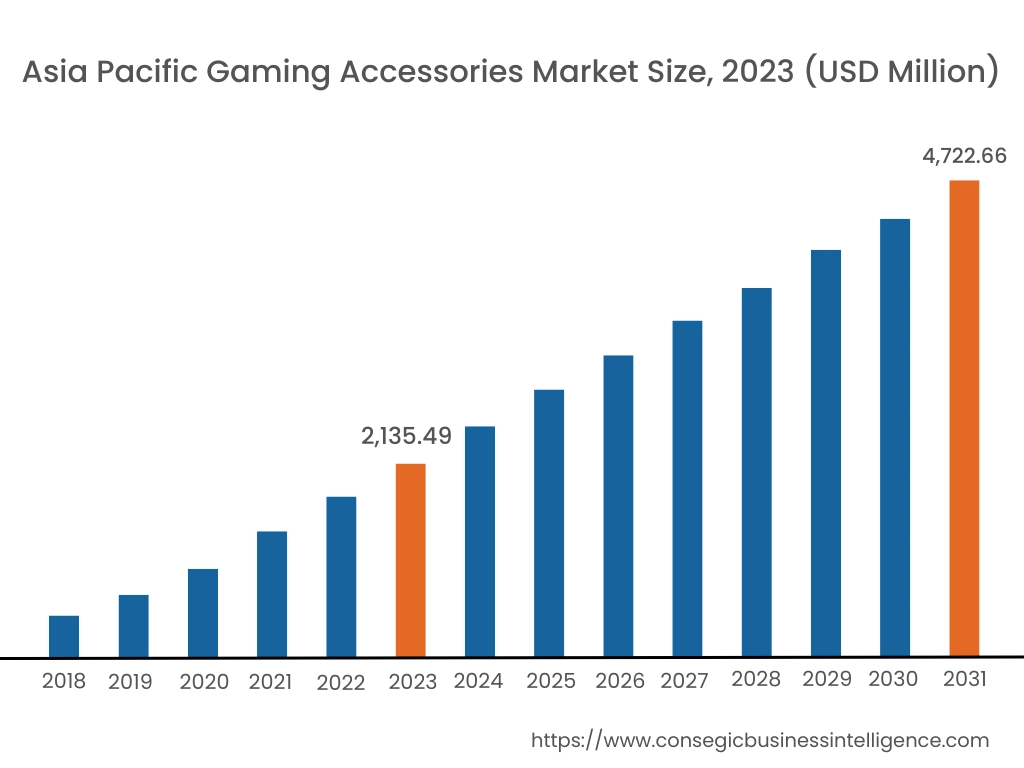

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 6,223.16 Million by 2031 from a value of USD 2,913.48 Million in 2023 and is projected to grow by USD 3,151.46 Million in 2024. The market growth for gaming accessories is mainly driven due to a large base of gamers, high disposable incomes, and a well-established gaming culture.

- In November 2021, ArborXR partnered with Axon, enabling Axon to remotely deploy software updates and add new public safety training content to agencies HTC VIVE Focus 3 headsets powered by ArborXR across North America.

Moreover, technological advancements including high-resolution displays, 3D audio controllers, and a thriving gaming industry are expected to fuel the market in North America in the coming forecast period.

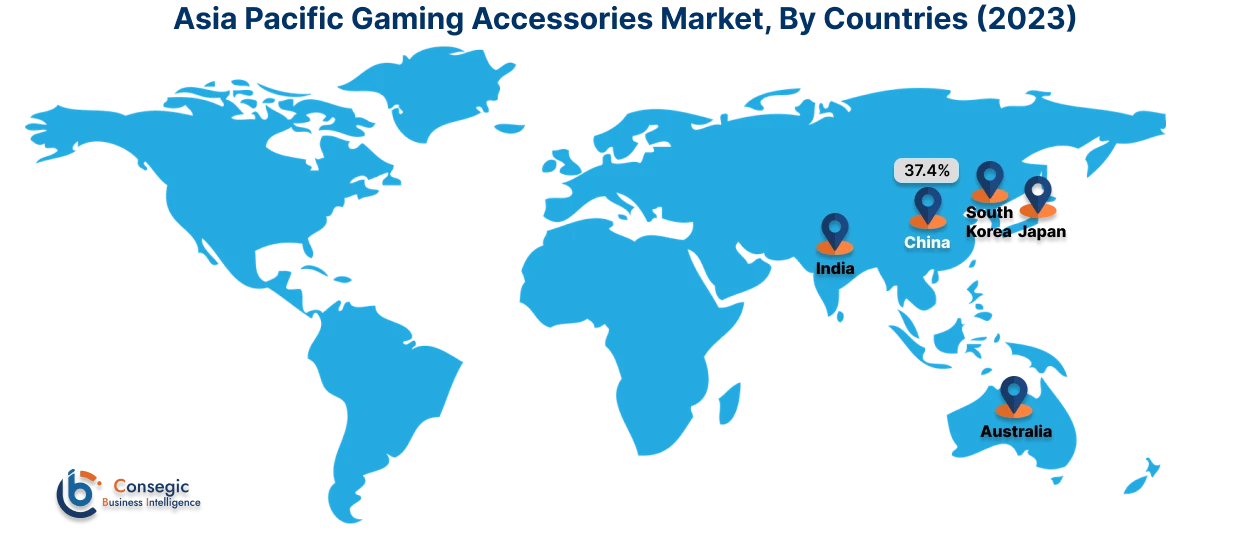

Asia-Pacific region was valued at USD 2,135.49 Million in 2023. Moreover, it is projected to grow by USD 2,316.73 Million in 2024 and reach over USD 4,722.66 Million by 2031. Out of this, China accounted for the maximum revenue share of 37.4%.

The Asia-Pacific region's growing interest in gaming culture and development offers lucrative growth prospects for the market. Additionally, the growth of online gaming culture, high-performance accessories penetration, and a large consumer base are driving the gaming accessories market growth.

- In January 2024, Sony Corporation (Tokyo, Japan) launched an immersive spatial content creation system with a 4K OLED XR head-mounted display and intuitive 3D object controllers, designed to empower creators in producing intricate and high-quality content.

As per the Gaming Accessories Market analysis, Europe is anticipated to witness substantial growth that is backed by the electronic industry. Companies invest in innovative gaming accessories to cater to the surging demand for gaming accessories across the region.

The Middle East, Africa, and Latin America are expected to grow at a considerable rate owing to the rising adoption of gaming accessories in the expanding entertainment sector across Brazil, UAE, Mexico, and others.

Top Key Players & Market Share Insights:

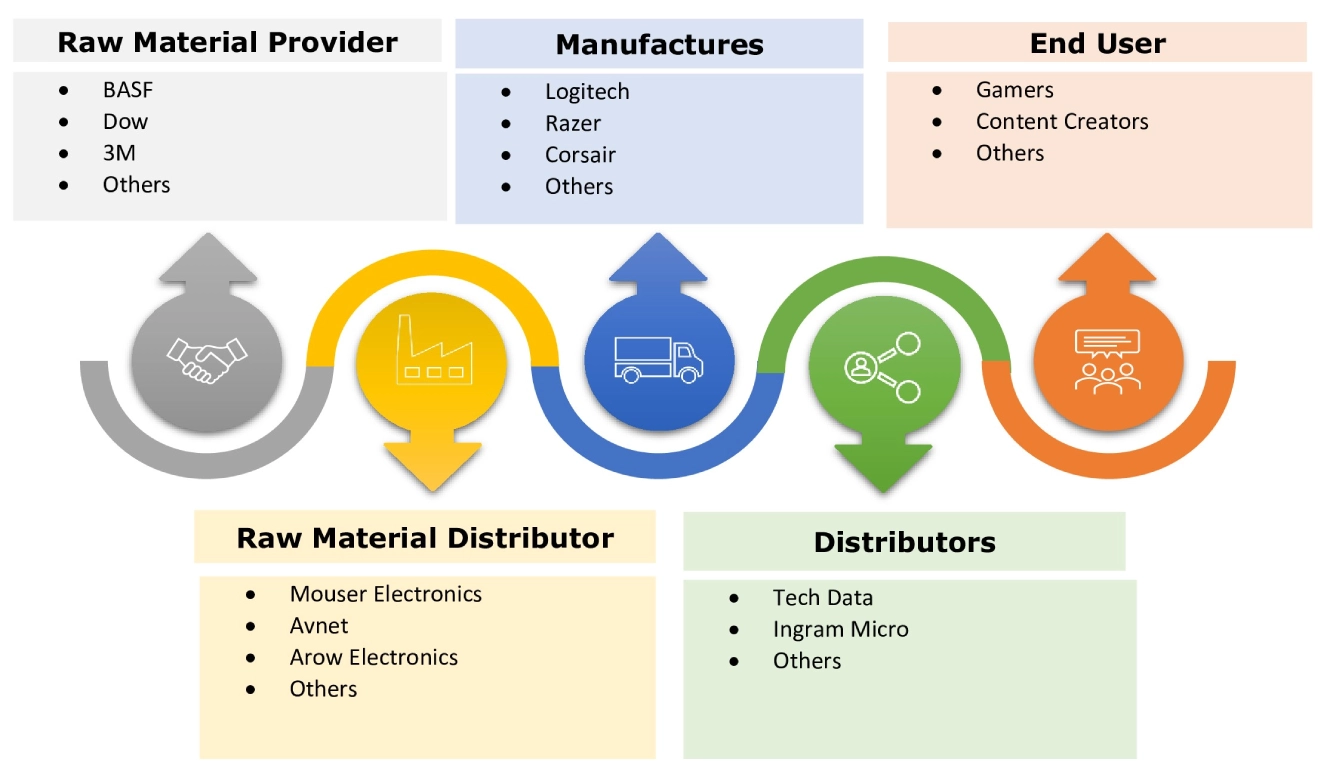

The Gaming accessories market is highly competitive with major players providing immersive and comfortable gaming experiences to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the Gaming accessories market. Key players in the Gaming accessories market include-

- Logitech G (Switzerland)

- Razer Inc (US)

- HyperX (US)

- Thrustmaster (US)

- Turtle Beach (US)

- ASUS (Taiwan)

- Xbox (US)

- Corsair (U.S)

- Steel Series(Denmark)

- Samsung Electronics (South Korea)

- Alienware(Dell) (US)

- Sony Corporation (Japan)

- Sennheiser Electronics (Germany)

Recent Industry Developments :

Product Launche

- In July 2024, CORSAIR, launched the CORSAIR 3500X Series Mid-Tower PC Case designed with a blend of style, compatibility, and cooling efficiency. The 3500X offers impressive views of the PC's internal components through its wraparound tempered glass panels.

- In February 2024, LG Electronics introduced the LG MyView Smart Monitor, with Full HD IPS displays, webOS23 streaming platform, and built-in Wi-Fi and Bluetooth, these monitors let you enjoy games, movies, shows, and work tasks without the need for a PC.

- In May 2023, Lenovo launched the ThinkReality VRX headset in a compact form factor offering mixed reality (MR) features for immersive training, collaboration, and 3D design, providing enterprise solutions, supported by cloud software, security features, and services to enhance operations and provide immersive gaming sessions.

Enhancement in Existing Product

- In July 2023, PlayStation5 system software was designed to enhance the gaming experience, allowing users to activate haptic feedback effects when using the DualSense Controller, DualSense Edge Controller, or PS VR2 Sense controller while navigating the PS5.

Gaming Accessories Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 18,276.54 Million |

| CAGR (2024-2031) | 9.9% |

| By Product |

|

| By Connectivity |

|

| By Sales Channel |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Gaming Accessories market? +

The Global Gaming Accessories Market size is estimated to reach over USD 18,276.54 Million by 2031 from a value of USD 8,558.77 Million in 2023 and is projected to grow by USD 9,257.68 Million in 2024, growing at a CAGR of 9.9% from 2024 to 2031.

What is the key market trend? +

Integration of Artificial Intelligence (AI), virtual reality (VR), and Augmented reality (AR) into gaming accessories enables more immersive gaming environments.

Who are the major players in the gaming accessories market? +

The Key players in the gaming accessories market include Logitech G (Switzerland), Razer Inc (US), Corsair (US), Steel Series (Denmark), HyperX (US), Thrustmaster (US), Turtle Beach (US), ASUS (Taiwan), Xbox (US), Samsung Electronics (South Korea), Alienware(Dell) (US), Sony Corporation (Japan), Sennheiser Electronics (Germany) and others.